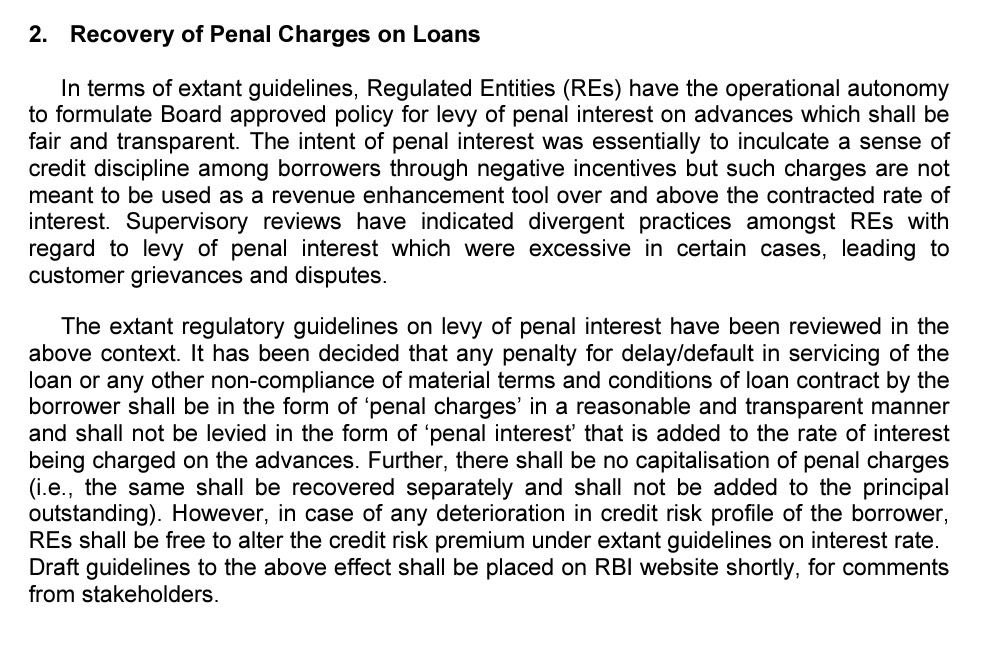

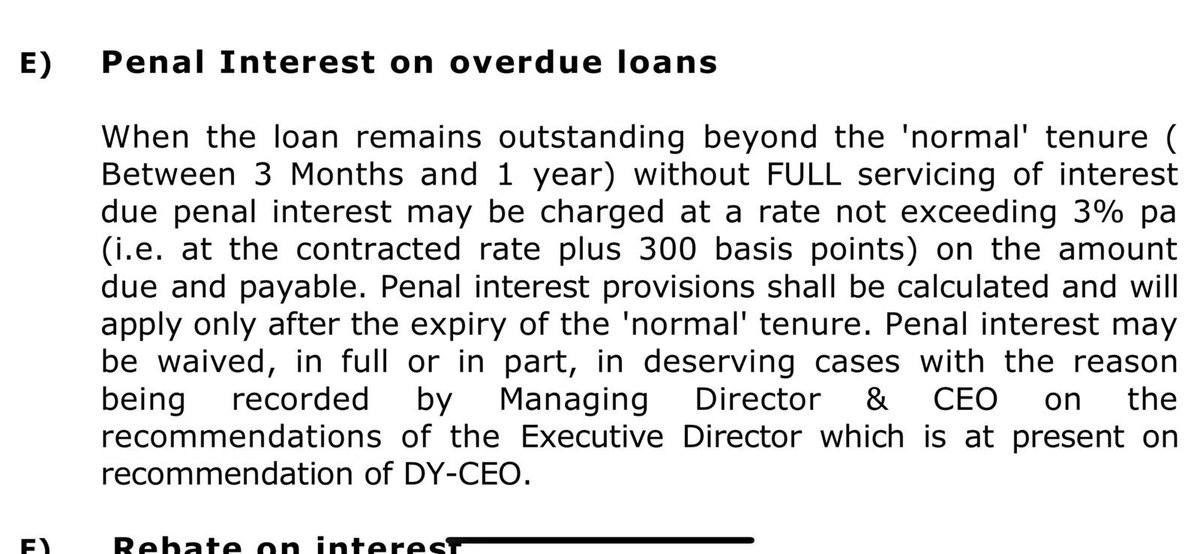

#RBI policy on Recovery of Penal Charges on Loans…. #SBICards #ManappuramGold #MuthootGold #BajajFinance #NBFCs etc

Could be Negative for Credit card Cos, gold loan companies & Likes kd BajajFinance which charge high penal interest….

Could be Negative for Credit card Cos, gold loan companies & Likes kd BajajFinance which charge high penal interest….

#Muthoot charges penal interest of upto 2% on schemes. Recall that their ROA is 6-7% so this Penal Interest is meaningful

#manappuramGold penal Interest Rates

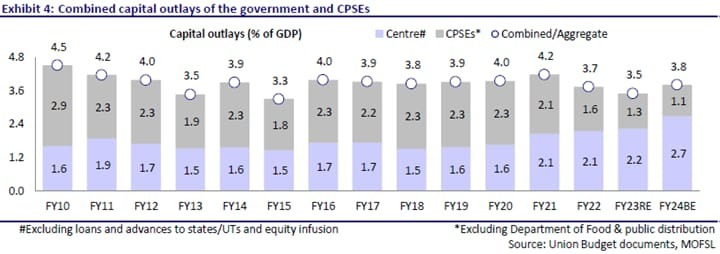

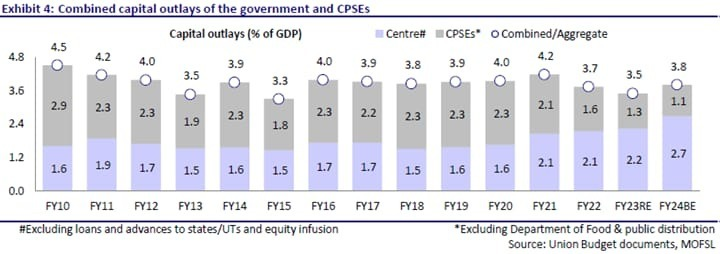

#BajajFinance makes a very high NIM which is far in excess what banks make on similar personal loans. #BajajFinance has best high Penal Interest Charges of 3.5%.

Finally Credit Card Companies like #SBICards charge very high on PENAL INTEREST which partly explains the HIGH profitability of CreditCard companies despite giving free credit period.

So what will Banks/NBFCs do ? They will continue to Charge PENAL Charges but instead of PENAL INTEREST, they will make it PENAL FEES. Now PENAL FEES will attract GST.

SO WHO LOSES & WHO GAINS? If NET PENAL CHARGES remain Same to Financier, CUSTOMER now will pay EXTRA #GST

SO WHO LOSES & WHO GAINS? If NET PENAL CHARGES remain Same to Financier, CUSTOMER now will pay EXTRA #GST

Lots of people who Read the THREAD came back to Clarify that the PENAL INTEREST on a loan was liable to GST. There was a clarification CBIC in June 2019 on this suggesting that charging penal interest was part of the Service (lending) it cannot be charged GST.

If you found this THREAD interesting, please for the Good of the general public #RETWEET it.

People should know that the ONLY thing constant in life is RISING TAXES under #Modinomics

People should know that the ONLY thing constant in life is RISING TAXES under #Modinomics

https://twitter.com/thefactfindr/status/1624811843486367744

• • •

Missing some Tweet in this thread? You can try to

force a refresh