Is #Polkadot $DOT still alive?

Is the “Ethereum Killer” narrative still valid?

What's new with the protocol that was supposed to replace #Ethereum?

Thread 🧵👇

Is the “Ethereum Killer” narrative still valid?

What's new with the protocol that was supposed to replace #Ethereum?

Thread 🧵👇

1/46

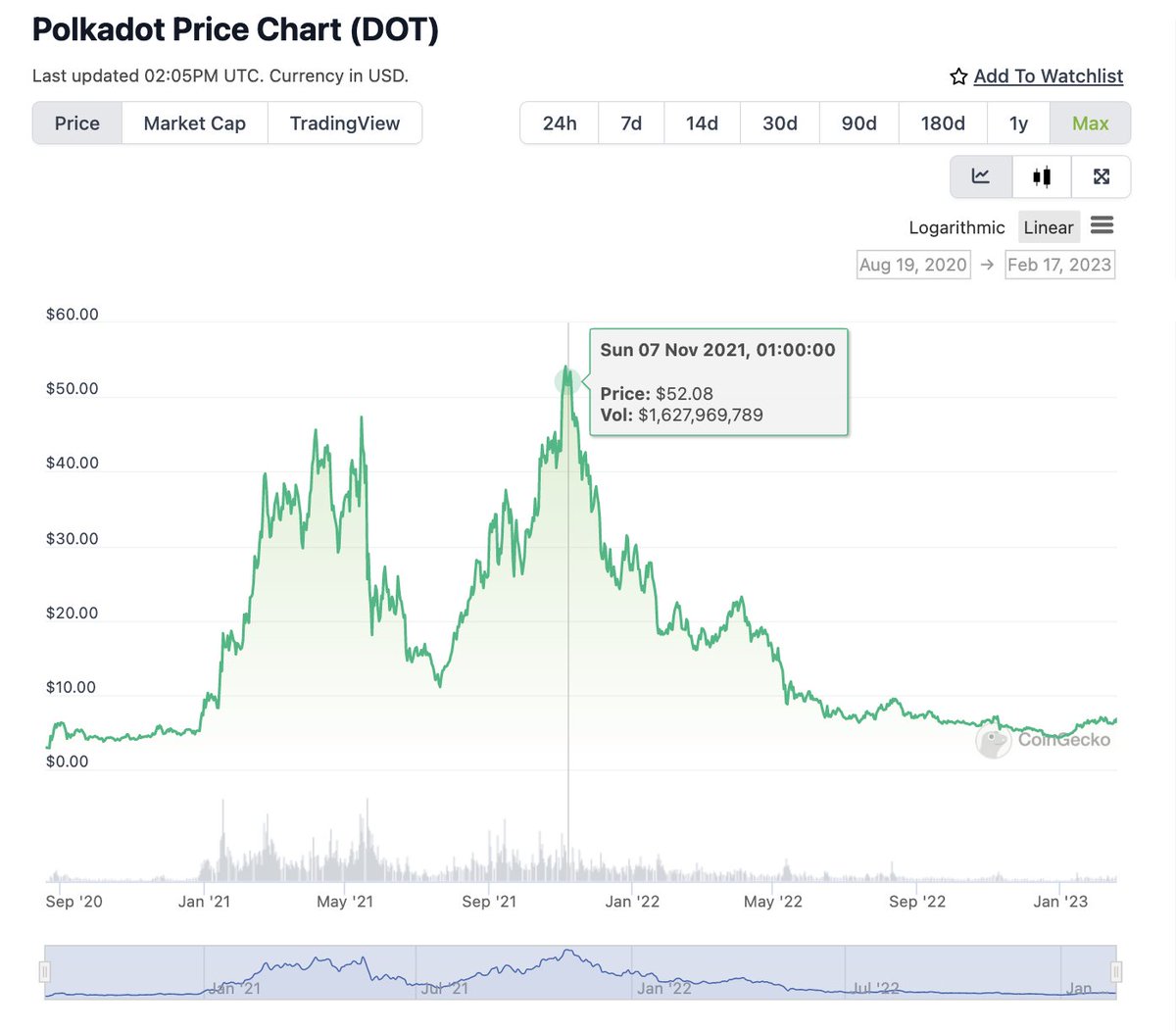

When #Polkadot launched in the second half of 2020, you could hear that we are dealing with the real successor to #Ethereum.

medium.com/coinmonks/polk…

When #Polkadot launched in the second half of 2020, you could hear that we are dealing with the real successor to #Ethereum.

medium.com/coinmonks/polk…

2/46

The #Polkadot $DOT narrative was so strong that there was a temporary trend of pumping and getting excited about all projects that had anything to do with Polkadot.

The #Polkadot $DOT narrative was so strong that there was a temporary trend of pumping and getting excited about all projects that had anything to do with Polkadot.

3/46

PolkaCity, PolkaFoundry, PolkaStarter... are ERC20 tokens, however, the name referring to #Polkadot caused huge increases. Madness 🤯

👇

coingecko.com/en/categories/…

PolkaCity, PolkaFoundry, PolkaStarter... are ERC20 tokens, however, the name referring to #Polkadot caused huge increases. Madness 🤯

👇

coingecko.com/en/categories/…

4/46

This trend lasted for several months. At the same time, Polkadot $DOT was one of the strongest tokens.

This trend lasted for several months. At the same time, Polkadot $DOT was one of the strongest tokens.

5/46

However, at some point, the narrative died very quickly and it looked like most investors suddenly forgot about #Polkadot. So what happened?

However, at some point, the narrative died very quickly and it looked like most investors suddenly forgot about #Polkadot. So what happened?

6/46

I will try to answer this question, but at this point it is worth briefly summarizing the development of #Polkadot $DOT since then.

I will try to answer this question, but at this point it is worth briefly summarizing the development of #Polkadot $DOT since then.

10/46

The first two paid over 30m $DOT for a parachain slot. At that time, these amounts exceeded $1b!

coindesk.com/tech/2021/11/1…

The first two paid over 30m $DOT for a parachain slot. At that time, these amounts exceeded $1b!

coindesk.com/tech/2021/11/1…

11/46

A year later, at the end of 2022, the @DarwiniaNetwork paid 9.9k DOT or approximately $45k for a parachain slot.

A year later, at the end of 2022, the @DarwiniaNetwork paid 9.9k DOT or approximately $45k for a parachain slot.

12/46

This situation perfectly illustrates how much the bear market has changed the rules. Not only have there been huge drops in valuations, but also in engagement.

This situation perfectly illustrates how much the bear market has changed the rules. Not only have there been huge drops in valuations, but also in engagement.

13/46

Such situations can be a great investment opportunity. A small capital commitment results in much larger prizes from the auctions. But that’s the story for another time. Let's move on.

Such situations can be a great investment opportunity. A small capital commitment results in much larger prizes from the auctions. But that’s the story for another time. Let's move on.

14/46

Another big event for the #Polkadot ecosystem took place in May 2022 and it was the launch of the first version of the #XCM protocol that allows communication between parachains.

cryptobriefing.com/polkadot-ecosy…

Another big event for the #Polkadot ecosystem took place in May 2022 and it was the launch of the first version of the #XCM protocol that allows communication between parachains.

cryptobriefing.com/polkadot-ecosy…

15/46

In January this year, @gavofyork announced the release of version 3 of the #XCM protocol.

This cross consensus message format enables parachains to ‘communicate’ without the need for bridges.

In January this year, @gavofyork announced the release of version 3 of the #XCM protocol.

This cross consensus message format enables parachains to ‘communicate’ without the need for bridges.

https://twitter.com/gavofyork/status/1615363662801428486?s=20

16/46

Thanks to the #XCM protocol, by the end of 2022, 160k transactions were carried out between various parachains with a total value of $605m.

Source: dotinsights.subwallet.app/polkadot-repor…

Thanks to the #XCM protocol, by the end of 2022, 160k transactions were carried out between various parachains with a total value of $605m.

Source: dotinsights.subwallet.app/polkadot-repor…

17/46

Is that a lot? It depends.

For example, #Cosmos ecosystem, thanks to #IBC, carries out almost a million transactions per week with a value exceeding $300m.

mapofzones.com/zones?columnKe…

Is that a lot? It depends.

For example, #Cosmos ecosystem, thanks to #IBC, carries out almost a million transactions per week with a value exceeding $300m.

mapofzones.com/zones?columnKe…

18/46

With the launch of version 3, there will probably be a faster increase in the popularity of this type of communication between parachains. However, the way to reach the #IBC level is a long way off.

With the launch of version 3, there will probably be a faster increase in the popularity of this type of communication between parachains. However, the way to reach the #IBC level is a long way off.

19/46

Undoubtedly, one of the most interesting information related to #Polkadot $DOT appeared along with the annual @ElectricCapital report.

Undoubtedly, one of the most interesting information related to #Polkadot $DOT appeared along with the annual @ElectricCapital report.

https://twitter.com/MariaShen/status/1615394281837178882?s=20

20/46

It turns out that #Polkadot $DOT is definitely ahead of the competition in terms of the number of active developers.

It turns out that #Polkadot $DOT is definitely ahead of the competition in terms of the number of active developers.

21/46

If we compare the development dynamics of #Polkadot and #Ethereum, it turns out that @gavofyork's child is developing faster than #Ethereum.

If we compare the development dynamics of #Polkadot and #Ethereum, it turns out that @gavofyork's child is developing faster than #Ethereum.

22/46

Active developers motivated to create a decentralized future is the most important fundamental indicator of any protocol. In this case, #Polkadot $DOT comes out great.

Active developers motivated to create a decentralized future is the most important fundamental indicator of any protocol. In this case, #Polkadot $DOT comes out great.

23/46

However, 2022 has not been kind to the Polkadot ecosystem. The two largest parachains, #Moonbeam $GLMR and #Acala $ACA, have been hacked.

However, 2022 has not been kind to the Polkadot ecosystem. The two largest parachains, #Moonbeam $GLMR and #Acala $ACA, have been hacked.

24/46

#Moonbeam $GLMR suffered from the Nomad Bridge hack in August. Although most of the stolen funds have been returned, TVL on the chain has dropped dramatically.

#Moonbeam $GLMR suffered from the Nomad Bridge hack in August. Although most of the stolen funds have been returned, TVL on the chain has dropped dramatically.

25/46

#Acala $ACA was also hit in August. These two events led to the destruction of trust in Polkadot-based protocols.

#Acala $ACA was also hit in August. These two events led to the destruction of trust in Polkadot-based protocols.

26/46

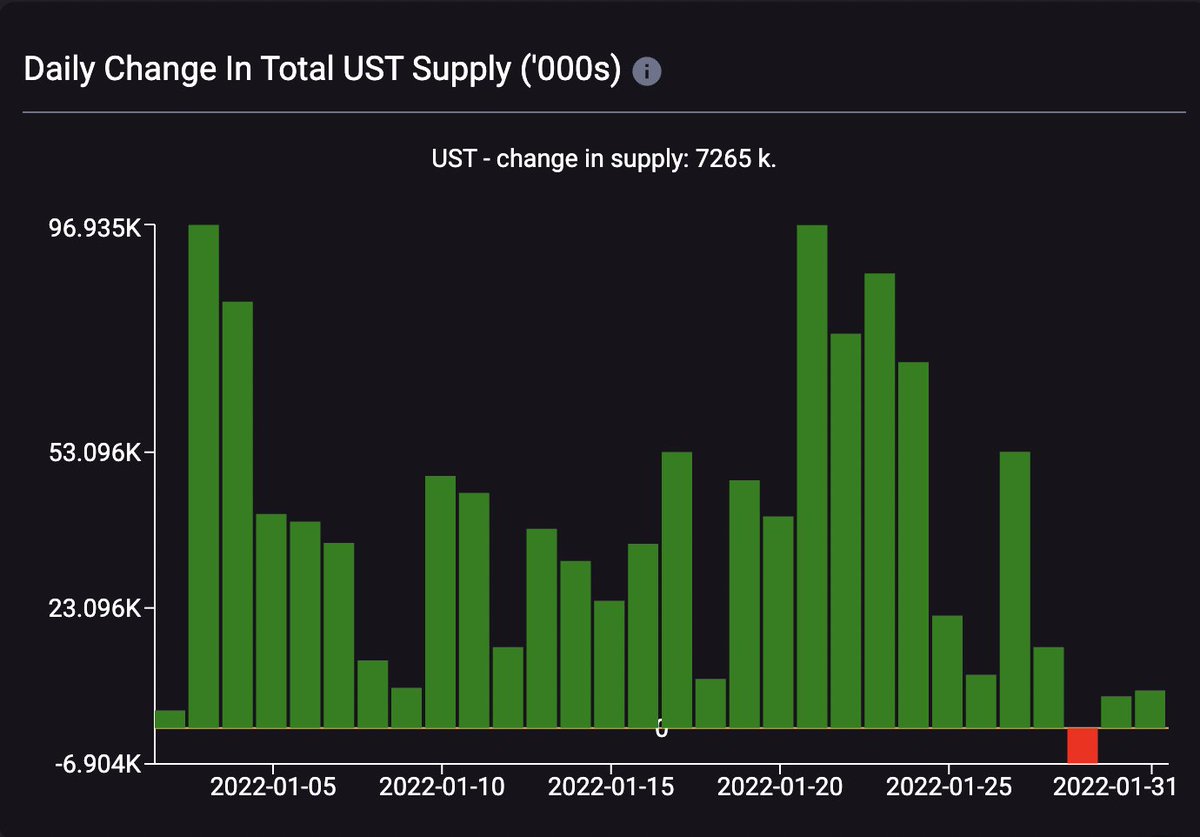

I noticed that one of the problems of $DOT is the lack of liquidity in the entire ecosystem.

Liquidity, stablecoins, activity = network effect.

#Polkadot still doesn't have it. Which makes the chain boring. Could this change in the near future?

I noticed that one of the problems of $DOT is the lack of liquidity in the entire ecosystem.

Liquidity, stablecoins, activity = network effect.

#Polkadot still doesn't have it. Which makes the chain boring. Could this change in the near future?

27/46

The fuel for the growth of TVL may turn out to be the release of the long-awaited trustless bridge, which will connect #Polkadot with #Ethereum.

👇

snowfork.com

The fuel for the growth of TVL may turn out to be the release of the long-awaited trustless bridge, which will connect #Polkadot with #Ethereum.

👇

snowfork.com

28/46

Of course, with the development of XCM v3, much newer and more interesting applications will be created. Adding well-thought-out liquidity programs will probably speed up the adoption process.

Of course, with the development of XCM v3, much newer and more interesting applications will be created. Adding well-thought-out liquidity programs will probably speed up the adoption process.

29/46

Already at this point you can notice the accelerated development of some parachains. In my opinion, Astar Network $ASTR is the dark horse of the #Polkadot ecosystem.

Already at this point you can notice the accelerated development of some parachains. In my opinion, Astar Network $ASTR is the dark horse of the #Polkadot ecosystem.

30/46

The development of $ASTAR requires a description in a separate thread. However, I encourage you to read:

👇

The development of $ASTAR requires a description in a separate thread. However, I encourage you to read:

👇

https://twitter.com/JSquare_co/status/1623694764619997184

31/46

Another project worth mentioning is #Centrifuge $CFG.

One of the few protocols that fits into the #RWA (Real World Asset) narrative recently mentioned by Delphi Digital.

members.delphidigital.io/reports/real-w…

Another project worth mentioning is #Centrifuge $CFG.

One of the few protocols that fits into the #RWA (Real World Asset) narrative recently mentioned by Delphi Digital.

members.delphidigital.io/reports/real-w…

32/46

#Polkadot $DOT has one more problem, which is very often mentioned in the comments as "an insurmountable barrier for some"

#Polkadot $DOT has one more problem, which is very often mentioned in the comments as "an insurmountable barrier for some"

33/46

The problem is UX, so how complicated it is to use the @Polkadot ecosystem. Despite quite a lot of knowledge, I had problems with the wallet myself.

It has been noticed and there are more and more better solutions.

The problem is UX, so how complicated it is to use the @Polkadot ecosystem. Despite quite a lot of knowledge, I had problems with the wallet myself.

It has been noticed and there are more and more better solutions.

36/46

The infrastructure is definitely developing in the right direction. These types of facilities will convince new people joining the #Polkadot ecosystem.

Source: dotinsights.subwallet.app/polkadot-repor…

The infrastructure is definitely developing in the right direction. These types of facilities will convince new people joining the #Polkadot ecosystem.

Source: dotinsights.subwallet.app/polkadot-repor…

37/46

However, I left the most interesting and bullish information about #Polkadot $DOT for the very end.

However, I left the most interesting and bullish information about #Polkadot $DOT for the very end.

38/46

After the collapse of @FTX_Official , we entered a period of closer scrutiny of the regulator on the crypto market. The effects of this are plain to see.

After the collapse of @FTX_Official , we entered a period of closer scrutiny of the regulator on the crypto market. The effects of this are plain to see.

39/46

Kraken receiving a penalty for staking, BUSD loses Paxos support. Everything indicates that this is not the end.

Kraken receiving a penalty for staking, BUSD loses Paxos support. Everything indicates that this is not the end.

40/46

One of the most important questions every crypto investor should ask himself is whether his tokens can be considered as a “security”.

One of the most important questions every crypto investor should ask himself is whether his tokens can be considered as a “security”.

41/46

At this point, it's extremely difficult to answer this question, because we don't really know any guidelines. It looks like Gessler is shooting blindly at various projects.

At this point, it's extremely difficult to answer this question, because we don't really know any guidelines. It looks like Gessler is shooting blindly at various projects.

42/46

It turns out, however, that the Web3 foundation has been in constant contact with the SEC for several years to finally avoid defining $DOT as security.

It turns out, however, that the Web3 foundation has been in constant contact with the SEC for several years to finally avoid defining $DOT as security.

43/46

The Web3 Foundation talks about the $DOT token as software. So far, of course, we can't count on any confirmation from the SEC about the validity of this thesis.

👇

cointelegraph.com/news/polkadot-…

The Web3 Foundation talks about the $DOT token as software. So far, of course, we can't count on any confirmation from the SEC about the validity of this thesis.

👇

cointelegraph.com/news/polkadot-…

44/46

However, several years of work by Web3 lawyers directly with the SEC gives a good chance of success. In that case, $DOT would be given rocket fuel for growth.

However, several years of work by Web3 lawyers directly with the SEC gives a good chance of success. In that case, $DOT would be given rocket fuel for growth.

https://twitter.com/Web3foundation/status/1618550186166620161?s=20

45/46

With increasing regulatory pressure, I predict a trend towards “non-security” tokens 🐂

With increasing regulatory pressure, I predict a trend towards “non-security” tokens 🐂

46/46

It is difficult to fit all the news and changes in such a huge ecosystem as #Polkadot in one thread.

I'll probably do another part of this thread soon.

If you liked today's part, then please follow my account and retweet the post. Thank you!

👇❤️

It is difficult to fit all the news and changes in such a huge ecosystem as #Polkadot in one thread.

I'll probably do another part of this thread soon.

If you liked today's part, then please follow my account and retweet the post. Thank you!

👇❤️

https://twitter.com/jarzoombek/status/1627684879197433857?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh