Railway Opportunity - Ready to leave station

A Thread.

#indianrailways #capex #highspeedrail #vandebharat #bullettrain #electrification

A Thread.

#indianrailways #capex #highspeedrail #vandebharat #bullettrain #electrification

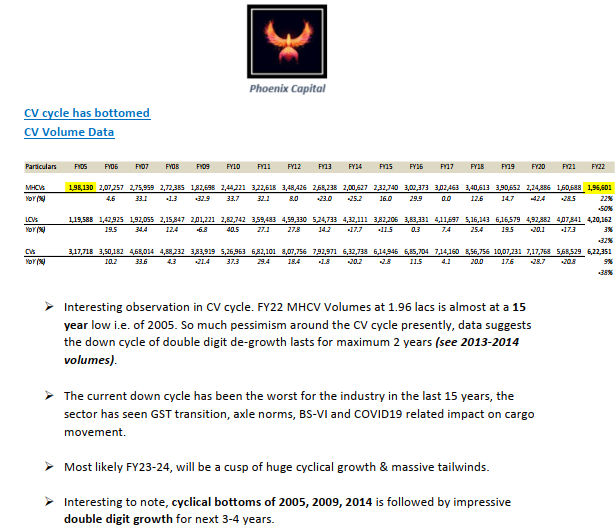

The Railways received the highest-ever allocation of ₹ 2.4 lakh crore for 2023-24 — ₹ 1 lakh crore higher than the previous year.

6x in last 5-6 years, this figure was 25,000 cr in 2013-14.

The consolidated number to reach 30lac crore by 2030.

6x in last 5-6 years, this figure was 25,000 cr in 2013-14.

The consolidated number to reach 30lac crore by 2030.

The railway investments moving towards

> dedicated freight corridors,

> network decongestion,

> bullet train,

> high-speed, and

> semi-high-speed train projects.

The “Atmanirbhar Bharat” initiative for the development of alternative high-tech machines

> dedicated freight corridors,

> network decongestion,

> bullet train,

> high-speed, and

> semi-high-speed train projects.

The “Atmanirbhar Bharat” initiative for the development of alternative high-tech machines

The national rail plan for 2030, Indian railways is expected to reach a future-ready railway system by 2030 to bring down logistics cost and ensure 100% electrification in rail routes by FY23E.

The railway infra investment is expected around 50 lakh cr between 2018 to 2030.

The railway infra investment is expected around 50 lakh cr between 2018 to 2030.

Doubling of Lines and New lines capex is expected around 46% of total railways capex, target is to do 18kms of lines per day in FY24 vs 12 kms per day in FY23.

The same number was a mere 4kms in 2014.

The same number was a mere 4kms in 2014.

"Two to three Vande Bharat trainsets will roll out from the Railways stables every week in next 1 year, produced simultaneously in four factories," Ashwini Vaishnaw said.

400 new-generation Vande Bharat Express trains will be developed and manufactured during the next 3 years.

400 new-generation Vande Bharat Express trains will be developed and manufactured during the next 3 years.

More funds will also be provided for new Vande Bharat trains and Vande Bharat 2.0 with sleeper class.

Cost of railways capex in Vande Bharat is 65,000 cr

Cost of railways capex in Vande Bharat is 65,000 cr

Railways Minister Ashwini Vaishnaw has announced redeveloping 1,275 railway stations across the country under the Amrit Bharat scheme.

Some of the major station under the redevelopment stage are – New Delhi, CSMT, Puri etc.

Some of the major station under the redevelopment stage are – New Delhi, CSMT, Puri etc.

Redevelopment opportunity of 1 lakh cr

Commercial development 68000cr

Station development 28000cr

Awarded Projects at 36 stations worth 13000cr are currently being redeveloped & 14 under tendering stage

Out of proposed 54 projects spanning across 14 zones, 36 has been awarded

Commercial development 68000cr

Station development 28000cr

Awarded Projects at 36 stations worth 13000cr are currently being redeveloped & 14 under tendering stage

Out of proposed 54 projects spanning across 14 zones, 36 has been awarded

Metro investments is expected around 25% share in Urban Infra investments: Investments in urban infrastructure are expected to grow a 18%-22% rise in FY24.

Led by investments in Water supply and sanitation under schemes such as Swachh Bharat Mission, Jal Jeevan mission, AMRUT

Led by investments in Water supply and sanitation under schemes such as Swachh Bharat Mission, Jal Jeevan mission, AMRUT

The urban Infra capex is expected around 6.8 lk cr over next 5 yrs.

The urban infra includes construction intensive mass rapid transit system (MRTS), bus rapid transit system (BRTS), water supply and sanitation (WSS) projects, smart cities, & related infrastructure development

The urban infra includes construction intensive mass rapid transit system (MRTS), bus rapid transit system (BRTS), water supply and sanitation (WSS) projects, smart cities, & related infrastructure development

Indian Railways is moving towards the world's largest electric railway network.

In this process, during 2022-23, electrification of 1,973 Route km (2,647 TKM) has been achieved.

It is 41 percent higher as compared to the corresponding period of 2021-22.

In this process, during 2022-23, electrification of 1,973 Route km (2,647 TKM) has been achieved.

It is 41 percent higher as compared to the corresponding period of 2021-22.

In addition, 1,161 and 296 km of electrification of double lines and sidings respectively have also been completed to date.

Our top idea in railways is RITES Limited, pls find our note on link below

https://twitter.com/phoenixcapindia/status/1329158302291304448?s=20

*********END***************

Follow us for more such insights !!

Follow us for more such insights !!

• • •

Missing some Tweet in this thread? You can try to

force a refresh