A Phoenix must first burn to rise.Tweets are not investment advice. For detailed notes, pls visit our blog.

2 subscribers

How to get URL link on X (Twitter) App

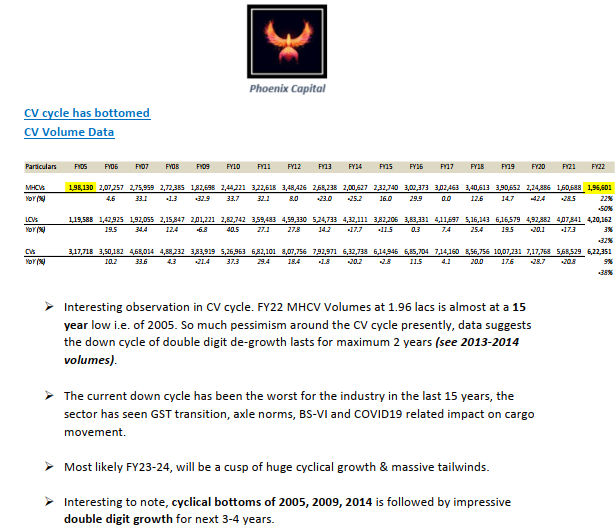

Manufacturing Segment

Manufacturing Segment

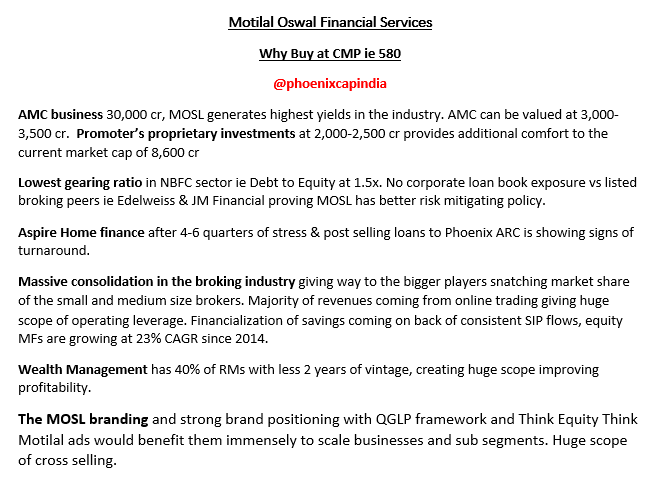

Industry Overview

Industry Overview

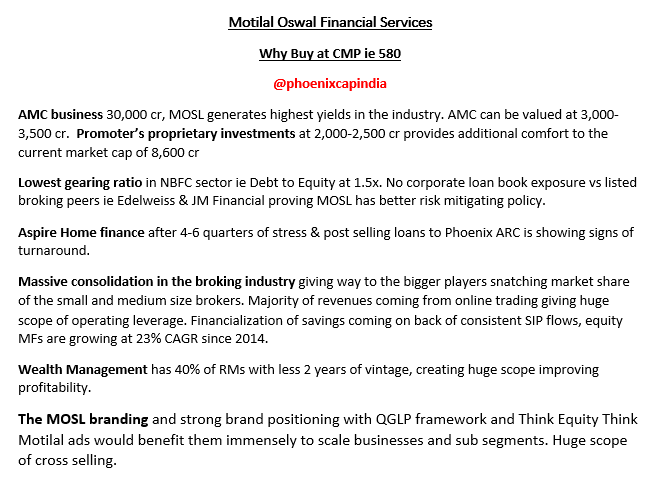

Investment Rationale

Investment Rationale

https://twitter.com/phoenixcapindia/status/1229727825843765248

Impressive #Orderbook growth with Discipline in #Execution

Impressive #Orderbook growth with Discipline in #Execution