🏦"Everything You Need to Know About AT1 Bonds"

Bonds are like loans that people can give to companies or governments.

[THREAD🧵]👇

1) What are AT1 Bonds?

AT1 bonds are a type of investment that banks can use to raise money when they need it.

#bonds #Banking #banknifty

Bonds are like loans that people can give to companies or governments.

[THREAD🧵]👇

1) What are AT1 Bonds?

AT1 bonds are a type of investment that banks can use to raise money when they need it.

#bonds #Banking #banknifty

2) How AT1 Bonds are different from traditional Bonds?

a) Higher Risk

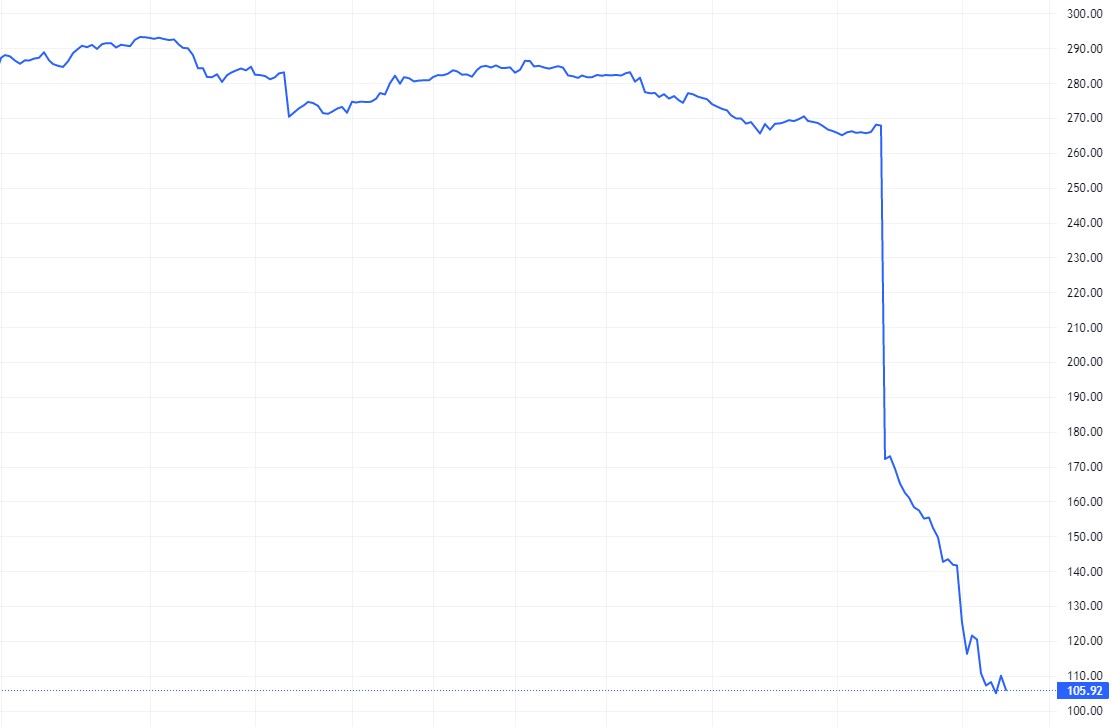

AT1 bonds are considered to be high-risk investments as they are designed to absorb losses in the event of a bank's financial distress.

a) Higher Risk

AT1 bonds are considered to be high-risk investments as they are designed to absorb losses in the event of a bank's financial distress.

Interest Payments in AT1 Bonds

AT1 bonds often have non-cumulative coupons, which means that if the bank misses an interest payment, it is not obligated to make it up in the future.

AT1 bonds often have non-cumulative coupons, which means that if the bank misses an interest payment, it is not obligated to make it up in the future.

3) Why Investors want to buy AT1 bonds even with greater risk?

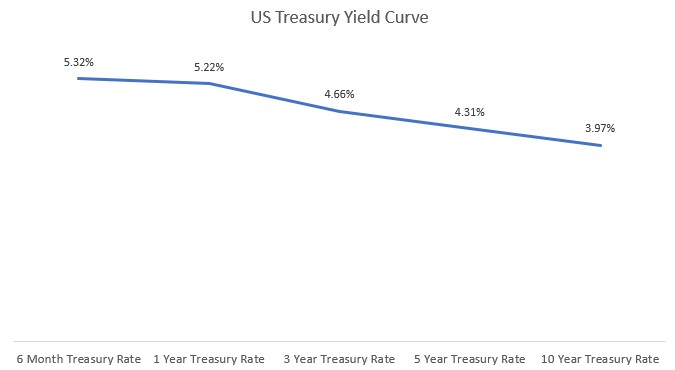

i) AT1 bonds typically offer higher yields compared to other bonds.

ii) AT1 bonds can provide investors with a way to diversify their portfolio

i) AT1 bonds typically offer higher yields compared to other bonds.

ii) AT1 bonds can provide investors with a way to diversify their portfolio

4) Who can issue AT1 Bonds in India?

In India, AT1 bonds can be issued by scheduled commercial banks, small finance banks, and payment banks.

In India, AT1 bonds can be issued by scheduled commercial banks, small finance banks, and payment banks.

5) Why banks wants to issue AT1 bonds?

a) By issuing AT1 bonds, banks can raise additional capital without diluting the ownership of existing shareholders.

b) Diversification

a) By issuing AT1 bonds, banks can raise additional capital without diluting the ownership of existing shareholders.

b) Diversification

c) AT1 bonds typically have lower cost of capital compared to equity.

This is because issuing equity involves giving up ownership in the bank, which can be expensive in terms of the potential dilution of existing shareholders.

This is because issuing equity involves giving up ownership in the bank, which can be expensive in terms of the potential dilution of existing shareholders.

6) Who are allowed to buy AT1 Bonds in India based on RBI guidelines?

As per RBI guidelines, the following entities are allowed to invest in AT1 bonds in India:

- Scheduled Commercial Banks

- All India Financial Institutions (AIFIs)

- Insurance Companies

- Pension Funds

As per RBI guidelines, the following entities are allowed to invest in AT1 bonds in India:

- Scheduled Commercial Banks

- All India Financial Institutions (AIFIs)

- Insurance Companies

- Pension Funds

- National Pension System (NPS) Trust

- Mutual Funds

- Alternate Investment Funds (AIFs)

- Foreign Portfolio Investors (FPIs) within the limits set by SEBI

- NRIs on a non-repatriable basis

- Qualified Foreign Investors (QFIs) within the limits set by SEBI

- Mutual Funds

- Alternate Investment Funds (AIFs)

- Foreign Portfolio Investors (FPIs) within the limits set by SEBI

- NRIs on a non-repatriable basis

- Qualified Foreign Investors (QFIs) within the limits set by SEBI

• • •

Missing some Tweet in this thread? You can try to

force a refresh