💸"Potential Benefits of Prepaying Loans: Adani Group Recently Paid 7000+ Cr Share-Backed Loan"

[THREAD🧵]👇

Mainly 2 Reasons:

1) Adani can avoid the possibility of margin calls on pledged shares and mitigate additional selling pressure in the market.

#AdaniGroups #Adani

[THREAD🧵]👇

Mainly 2 Reasons:

1) Adani can avoid the possibility of margin calls on pledged shares and mitigate additional selling pressure in the market.

#AdaniGroups #Adani

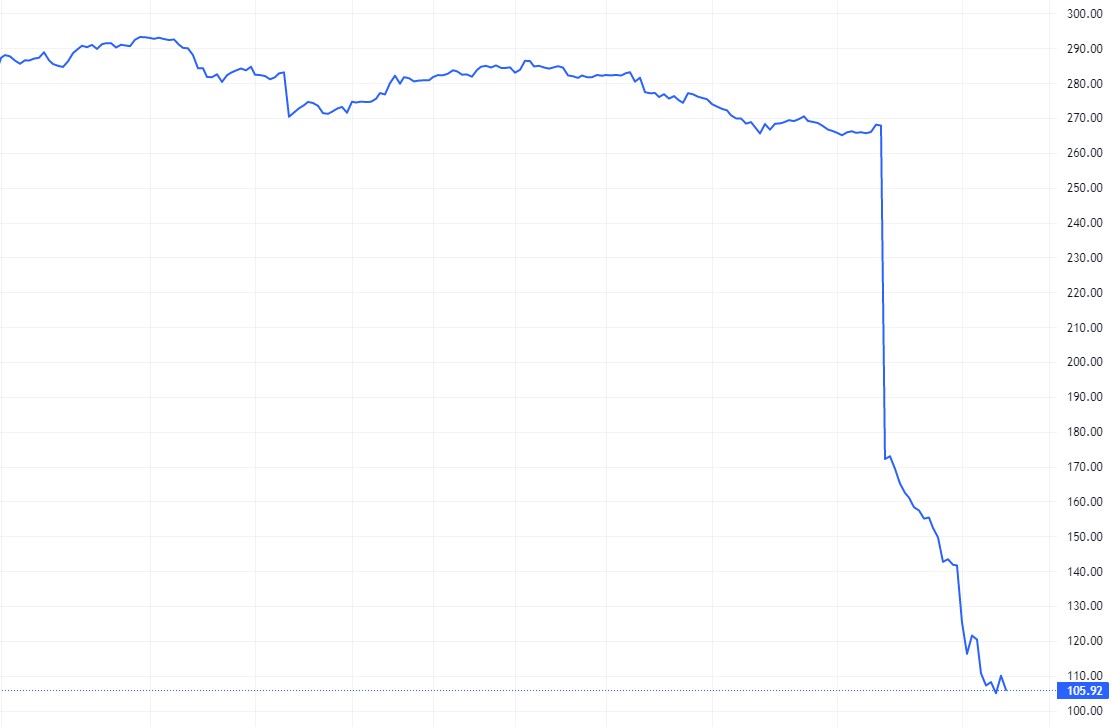

Margin Call: When a company's shares go down below a preset value that can cover the bank's loan value, the bank will ask for more money or shares as a guarantee that the loan will be paid back.

If the business owner is unable to meet the bank's request for additional funds or collateral, the bank has the authority to sell the pledged shares on the stock market to secure repayment of the loan.

This can create a cycle of more selling.

This can create a cycle of more selling.

In case Adani has repaid the loans secured by the pledged shares, all of those shares would have been returned to the promoters.

Consequently, there would be no further possibility of margin calls, which means there would be no pressure to sell due to that reason.

Consequently, there would be no further possibility of margin calls, which means there would be no pressure to sell due to that reason.

2) Improved Market Sentiment and Credit rating

By demonstrating that Adani is able to repay its debt obligations early, Adani can enhance its reputation with investors and lenders.

By demonstrating that Adani is able to repay its debt obligations early, Adani can enhance its reputation with investors and lenders.

• • •

Missing some Tweet in this thread? You can try to

force a refresh