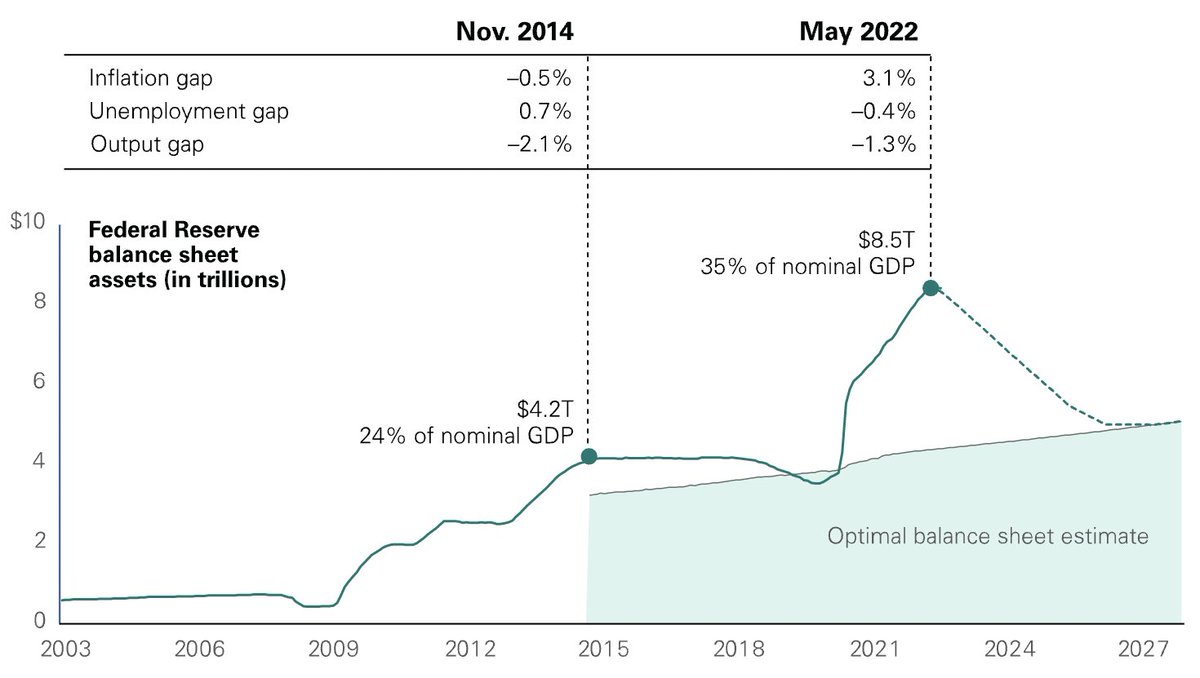

The US #Fed is on an ambitious mission to reduce its balance sheet & hike interest rates

As a result, the financial & tech sectors are experiencing significant disruptions & setbacks

BUT

This creates ONCE IN A GENERATION opportunity for #blockchains like #Cardano

Why?🧵👇

As a result, the financial & tech sectors are experiencing significant disruptions & setbacks

BUT

This creates ONCE IN A GENERATION opportunity for #blockchains like #Cardano

Why?🧵👇

So, what is the balance sheet, and why does it exist?👇

The Federal Reserve employs various tools to regulate the financial system

including manipulating the flow & cost of capital

Typically, the preferred methods of achieving these objectives are through interest rates

BUT

The Federal Reserve employs various tools to regulate the financial system

including manipulating the flow & cost of capital

Typically, the preferred methods of achieving these objectives are through interest rates

BUT

In certain circumstances, the Fed turns to its BALANCE SHEET

another instrument from its monetary policy toolbox to control the money supply

So what is Fed's Balance sheet?

The Fed balance sheet represents the assets & liabilities of the United States Federal Reserve

another instrument from its monetary policy toolbox to control the money supply

So what is Fed's Balance sheet?

The Fed balance sheet represents the assets & liabilities of the United States Federal Reserve

The assets of this balance sheet are

▪️Government securities, mortgage-backed securities & repo rates

Whereas liabilities are

▪️US dollars, money in the reserves & reverse repos

The QT & QE tools help reduce & increase the Fed’s balance sheet, respectively

▪️Government securities, mortgage-backed securities & repo rates

Whereas liabilities are

▪️US dollars, money in the reserves & reverse repos

The QT & QE tools help reduce & increase the Fed’s balance sheet, respectively

QT (tightening) & QE (easing) tools help reduce & increase the Fed’s balance sheet

Amid Pandemic,

Fed expanded its balance sheet by buying securities & increasing the money supply

to stimulate the economy & create jobs

Amid Pandemic,

Fed expanded its balance sheet by buying securities & increasing the money supply

to stimulate the economy & create jobs

The coming back to normalcy after the pandemic

Or during inflation in the economy, it uses QT

How?

by stopping purchases/letting securities mature & exit the balance sheet

Or during inflation in the economy, it uses QT

How?

by stopping purchases/letting securities mature & exit the balance sheet

With inflation at a 40-year high

And as the US economy is on a stronger footing

with a record-low unemployment level & moderate to strong growth over the past three years

#Fed has decided to shrink its balance sheet

And as the US economy is on a stronger footing

with a record-low unemployment level & moderate to strong growth over the past three years

#Fed has decided to shrink its balance sheet

The Fed intends to complete the process of shrinking the balance sheet within 3 years

a rate 3 to 4x faster than the rate at which it was built up

This is expected to have a more significant impact on borrowing costs

than the recent interest rate hikes

a rate 3 to 4x faster than the rate at which it was built up

This is expected to have a more significant impact on borrowing costs

than the recent interest rate hikes

Shrinking the balance sheet reduces the money supply and credit availability in the financial system

↓

Which can drive interest rates higher

↓

Which in turn increases the cost of capital

↓

The increased cost of capital limits funding for businesses/startups

↓

Which can drive interest rates higher

↓

Which in turn increases the cost of capital

↓

The increased cost of capital limits funding for businesses/startups

This reduces funding, particularly for emerging tech startups

Because their market value & financing largely depend on anticipated future potential

rather than their current profit-generating capabilities

This means DEATH to 99% of blockchain-based businesses

Why?

Because their market value & financing largely depend on anticipated future potential

rather than their current profit-generating capabilities

This means DEATH to 99% of blockchain-based businesses

Why?

Blockchain-based startups experienced a surge in investment

due to the low or zero-interest-rate environment

A substantial flow of capital happened into various projects

which was primarily fueled by hype

Most of them were without a clear business case or revenue potential

due to the low or zero-interest-rate environment

A substantial flow of capital happened into various projects

which was primarily fueled by hype

Most of them were without a clear business case or revenue potential

These projects lack the fundamental requirement for any business to be successful

What are those? 👇

What are those? 👇

▪️Scalability

To succeed,

blockchain-based businesses must ensure their platform can scale effectively

However,

current blockchain platforms don't offer the same scalability level as Web 2.0 without compromising decentralization & security

↓

To succeed,

blockchain-based businesses must ensure their platform can scale effectively

However,

current blockchain platforms don't offer the same scalability level as Web 2.0 without compromising decentralization & security

↓

▪️Cost-effectiveness

The absence of scalability in Dapps results in significantly higher costs than Web 2.0 solutions

directly impacting the adoption & profitability of blockchain-based businesses

This forces them to rely on hype-driven marketing to sustain funding

↓

The absence of scalability in Dapps results in significantly higher costs than Web 2.0 solutions

directly impacting the adoption & profitability of blockchain-based businesses

This forces them to rely on hype-driven marketing to sustain funding

↓

▪️ Sustainable business models instead of ponzinomics

Due to the absence of cost-effectiveness & profitability in blockchain-based solutions

The value is primarily based on hype rather than fundamentals

Meaning,

99% of the projects will get wiped out in the coming years

BUT

Due to the absence of cost-effectiveness & profitability in blockchain-based solutions

The value is primarily based on hype rather than fundamentals

Meaning,

99% of the projects will get wiped out in the coming years

BUT

There is hope

This could result in the creation of the most successfully blockchain-based companies ever created

Why?

Because based on the analysis by @socialcapital

High-interest-rate environments have produced the most successful cohort of startups

This could result in the creation of the most successfully blockchain-based companies ever created

Why?

Because based on the analysis by @socialcapital

High-interest-rate environments have produced the most successful cohort of startups

The analysis shows that

The 70s, 80s & 90s produced 27 companies worth more than $5.4 trillion in cumulative market cap

Demonstrating the positive impact of high-interest-rate environments on startups

But why does a high-interest-rate environment produce successful startups

The 70s, 80s & 90s produced 27 companies worth more than $5.4 trillion in cumulative market cap

Demonstrating the positive impact of high-interest-rate environments on startups

But why does a high-interest-rate environment produce successful startups

Especially in a situation where funding is low

in comparison to the past 15 years

Where interest rates were near zero & there was no scarcity of funding

Here's where some exciting influences of a high-interest-rate environment come into play

So let's take a look👇

in comparison to the past 15 years

Where interest rates were near zero & there was no scarcity of funding

Here's where some exciting influences of a high-interest-rate environment come into play

So let's take a look👇

▪️ Low-interest-rate environments can spread capital & talent too thinly

BUT

▪️Higher interest rates concentrate capital & talent more intentionally in ventures that create value

Meaning,

Talent & capital goes to startups that create value rather than hype

BUT

▪️Higher interest rates concentrate capital & talent more intentionally in ventures that create value

Meaning,

Talent & capital goes to startups that create value rather than hype

▪️ Low-Interest-Rate promotes unsustainable growth models

promoting the wrong incentive to grow at any cost

Which is typical for #blockchain-based businesses

BUT

▪️Higher interest rates force sustainable growth models

by giving zero incentive for unsustainable business model

promoting the wrong incentive to grow at any cost

Which is typical for #blockchain-based businesses

BUT

▪️Higher interest rates force sustainable growth models

by giving zero incentive for unsustainable business model

▪️Leading companies founded during high-interest-rate periods

like Microsoft & Google

had significantly higher early margins than those founded during low-interest-rate environments

like Uber & Snapchat

Meaning,

The fundamental structure of a startup focuses on profitability

like Microsoft & Google

had significantly higher early margins than those founded during low-interest-rate environments

like Uber & Snapchat

Meaning,

The fundamental structure of a startup focuses on profitability

In short,

higher rates & an economic downturn could ironically prove beneficial for startups

▪️that can embrace regime change

▪️build sustainable business models

▪️and capitalize on an era that sees competition diminish & talent become available

higher rates & an economic downturn could ironically prove beneficial for startups

▪️that can embrace regime change

▪️build sustainable business models

▪️and capitalize on an era that sees competition diminish & talent become available

If we can overlap this analysis

on the future of blockchain-based startups

We could provide insight into the future direction of the blockchain industry

in any case

99% of the crypto assets will go zero

& 99 of blockchain-based startups will fail in the next 3-5 years

So,

on the future of blockchain-based startups

We could provide insight into the future direction of the blockchain industry

in any case

99% of the crypto assets will go zero

& 99 of blockchain-based startups will fail in the next 3-5 years

So,

There are two possible outcomes for the blockchain startup sector

In the current high-interest rate environment

▪️Outcome 1

Blockchain will make scalability breakthroughs

Making them suitable for hosting competitive DApps which are cheaper & efficient than WeB2 solutions

and

In the current high-interest rate environment

▪️Outcome 1

Blockchain will make scalability breakthroughs

Making them suitable for hosting competitive DApps which are cheaper & efficient than WeB2 solutions

and

Only those blockchain-based businesses with a sustainable business model backing them will survive

In that case

#Cardano could host some of the biggest businesses we have seen

creating a generational opportunity of value creation

or

In that case

#Cardano could host some of the biggest businesses we have seen

creating a generational opportunity of value creation

or

▪️Outcome 2

If blockchain-based startups cant offer any business advantage over web2 solutions

or innovative solutions with new business models

& be profitable in a high-interest-rate environment

The whole blockchain hype will collapse & cease to exist in the next 5 -10 years

If blockchain-based startups cant offer any business advantage over web2 solutions

or innovative solutions with new business models

& be profitable in a high-interest-rate environment

The whole blockchain hype will collapse & cease to exist in the next 5 -10 years

TL;DR

▪️Only blockchain-based businesses with sustainable and healthy business models will survive in the upcoming high-interest rate environment

▪️Any business that cannot figure out such a model will inevitably fail

Meaning

99% of all the current projects are going to fail

▪️Only blockchain-based businesses with sustainable and healthy business models will survive in the upcoming high-interest rate environment

▪️Any business that cannot figure out such a model will inevitably fail

Meaning

99% of all the current projects are going to fail

If you like Tweets like this, you might enjoy our daily newsletter:

This Week In Cardano.

Your weekly dose of updates on the major events happening in the Cardano Ecosystem 💡🤓

Subscribe here👇

thisweekincardanonewsletter.carrd.co

This Week In Cardano.

Your weekly dose of updates on the major events happening in the Cardano Ecosystem 💡🤓

Subscribe here👇

thisweekincardanonewsletter.carrd.co

This eBook is for you 📔🔥

If you like to detect the actual value of Layer1 Blockchains 💎

It's packed with an easy-to-understand assessment framework & examples of 6 major L1s

to help you make metrics-based decisions 💡🤓

#FollowTheMetricsNotTheHype

digitalmoneymindset.gumroad.com/l/vfibi?_gl=1*…

If you like to detect the actual value of Layer1 Blockchains 💎

It's packed with an easy-to-understand assessment framework & examples of 6 major L1s

to help you make metrics-based decisions 💡🤓

#FollowTheMetricsNotTheHype

digitalmoneymindset.gumroad.com/l/vfibi?_gl=1*…

• • •

Missing some Tweet in this thread? You can try to

force a refresh