@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod what we are witnessing is akin to what happens when a hacker targets a vulnerability in a system and is able to release malware and it causes havoc to its target.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod There is literally hundreds of zero day attacks in crypto. But rather than addressing bad actors and patching vulnerabilities in the ecosystem. - they were embraced as innovation - literal onramps to the promised land.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod The Signet walled garden is a perfect example - if a bad actor gets into your walled garden as soon as its flagged you excise them and patch the vunerability. If you don't they propagate and destroy your garden. Instead those who could have, should have taken action

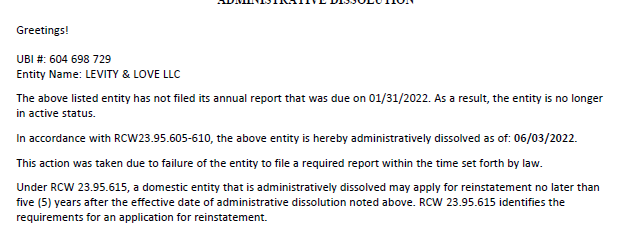

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod did the opposite gave them the keys to the garden and told them to invite their friends some who were maskign their identities worse than this bloke.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod So instead of a slow rot...the garden burnt down.

Now the #muppets are angry with the world blaming everyone but themselves.

Now the #muppets are angry with the world blaming everyone but themselves.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod So here's my #zeroday 1,616 days ago. This #muppet #leader says some really dumb shit. Not only was it dumb then it was later proven to be the worst take of all time (it wasn't redeemed by #tether it was nicked to patch the hole in #bitfinex)

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod @bitfinexed was way ahead of the pack. calling it out way before my zero day. and the warnings continued unabated.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod @Bitfinexed What do the #muppets do....more stupid shit like this.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod @Bitfinexed and never ever take responsibility for the dumb shit they did.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod @Bitfinexed and the #muppets double down claiming they are #victims of a #conspiracy ffs

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod @Bitfinexed unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh