Binance Exchange's Health After the CFTC Lawsuit

CQ's research team assessed the behavior of Binance net-outflows and reserves of $BTC, $ETH, and Stablecoins in three recent stress-test periods.

- Regulatory FUD after FTX Collapse

- Paxos' announcement

- CFTC lawsuit

Thread🧵

CQ's research team assessed the behavior of Binance net-outflows and reserves of $BTC, $ETH, and Stablecoins in three recent stress-test periods.

- Regulatory FUD after FTX Collapse

- Paxos' announcement

- CFTC lawsuit

Thread🧵

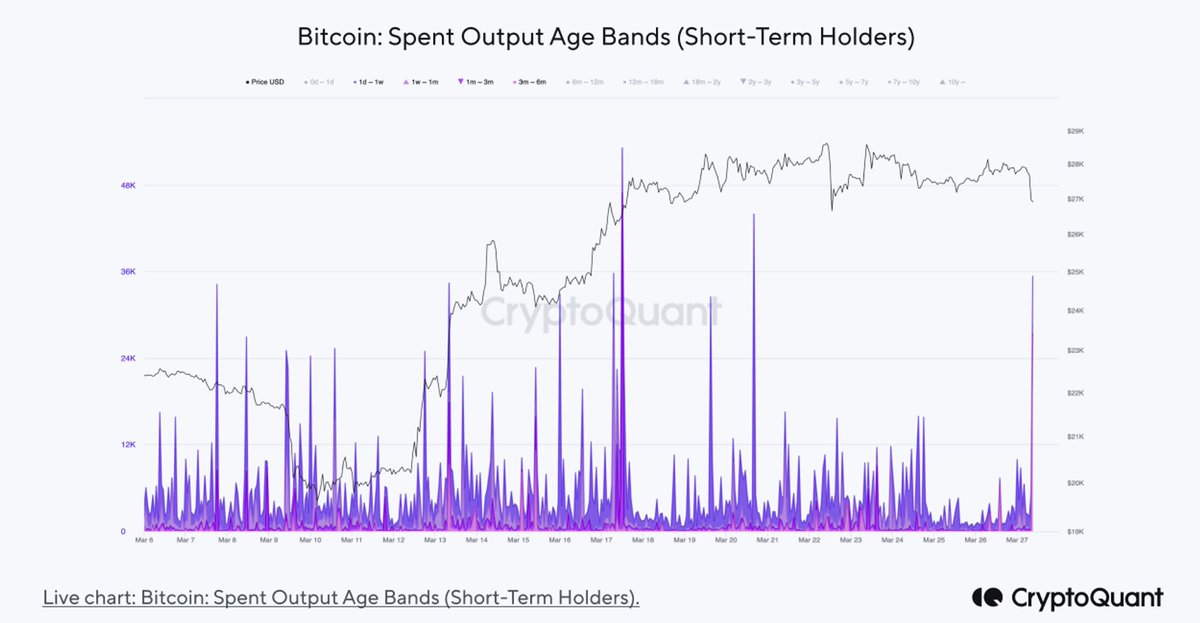

1/ #Bitcoin

Regulatory FUD

A netflow of -40,353 BTC in a day and total netflows of -78,744 BTC in a week.

Paxos' announcement

The largest daily netflow was on Feb 12th for -5,027 BTC.

CFTC lawsuit

A daily netflow of -4,505 BTC.

They have remained inside historical ranges.

Regulatory FUD

A netflow of -40,353 BTC in a day and total netflows of -78,744 BTC in a week.

Paxos' announcement

The largest daily netflow was on Feb 12th for -5,027 BTC.

CFTC lawsuit

A daily netflow of -4,505 BTC.

They have remained inside historical ranges.

2/ #Ethereum

Regulatory FUD

The highest daily netflow was -278k ETH.

Paxos' announcement

The daily netflow was -79,706 ETH

CFTC lawsuit

A daily netflow of -76,146 ETH

They have remained inside historical ranges.

Regulatory FUD

The highest daily netflow was -278k ETH.

Paxos' announcement

The daily netflow was -79,706 ETH

CFTC lawsuit

A daily netflow of -76,146 ETH

They have remained inside historical ranges.

3/ #Stablecoins

In the case of Stablecoins netflows, On-chain data shows netflows of -$871M on Dec 12th, a daily-high outflow of $671M in February (although total netflows during that month were lower than in Dec 2022), and almost -$1B in March since the CFTC lawsuit.

In the case of Stablecoins netflows, On-chain data shows netflows of -$871M on Dec 12th, a daily-high outflow of $671M in February (although total netflows during that month were lower than in Dec 2022), and almost -$1B in March since the CFTC lawsuit.

4/ BTC, ETH #Reserves

$BTC and $ETH reserves have remained at healthy levels even after these periods of high net outflows.

- BTC reserves have grown from 509k in Dec 2022 to 581k currently.

- ETH reserves stand at 4.48M, compared to a low of 4.42M back in Dec 2022.

$BTC and $ETH reserves have remained at healthy levels even after these periods of high net outflows.

- BTC reserves have grown from 509k in Dec 2022 to 581k currently.

- ETH reserves stand at 4.48M, compared to a low of 4.42M back in Dec 2022.

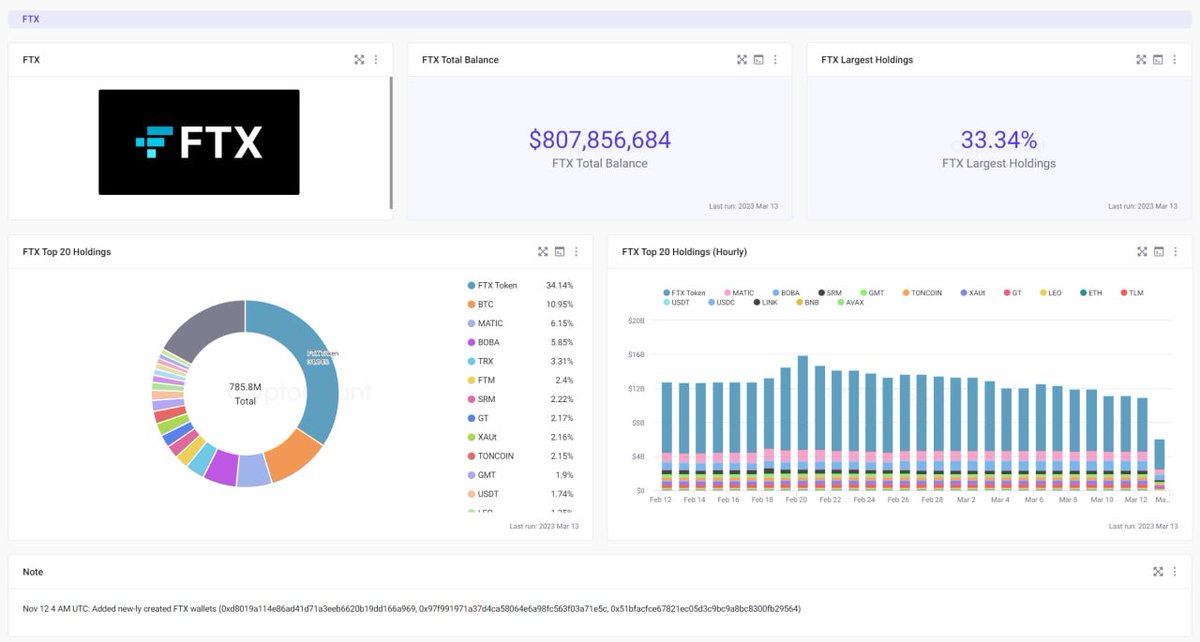

5/ Stablecoins #Reserves

In the case of stablecoins, reserves at Binance have been decreasing significantly, from $24.5 billion in December to $10.7 billion today. This has been mostly the result of a decrease in $BUSD reserves, which accelerated after Paxos' announcement.

In the case of stablecoins, reserves at Binance have been decreasing significantly, from $24.5 billion in December to $10.7 billion today. This has been mostly the result of a decrease in $BUSD reserves, which accelerated after Paxos' announcement.

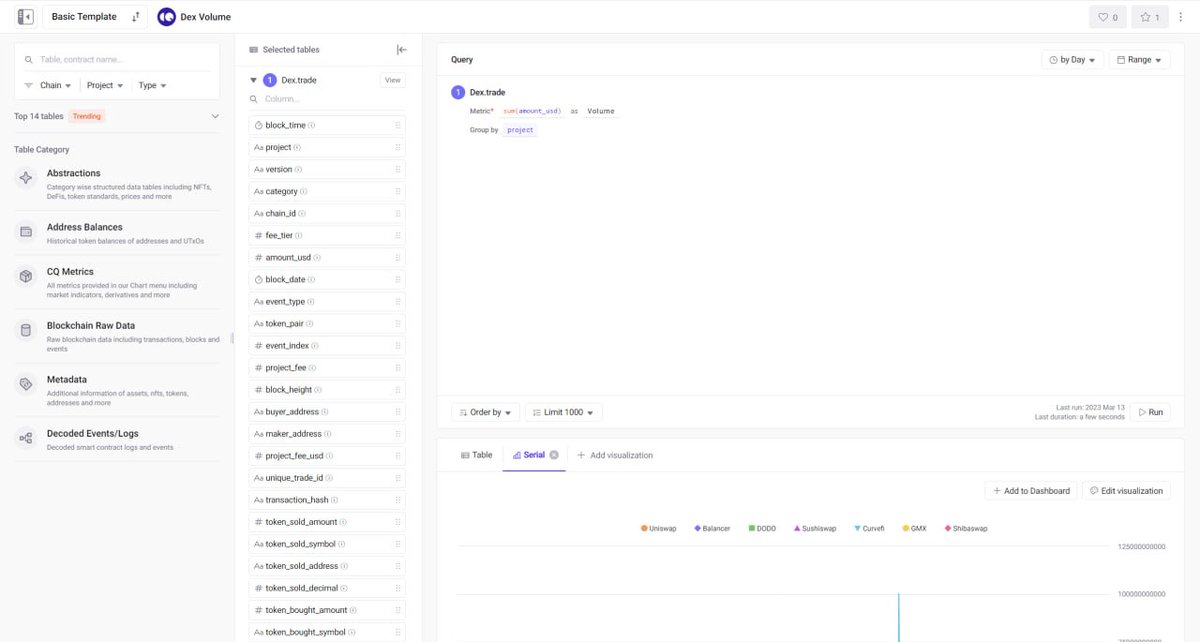

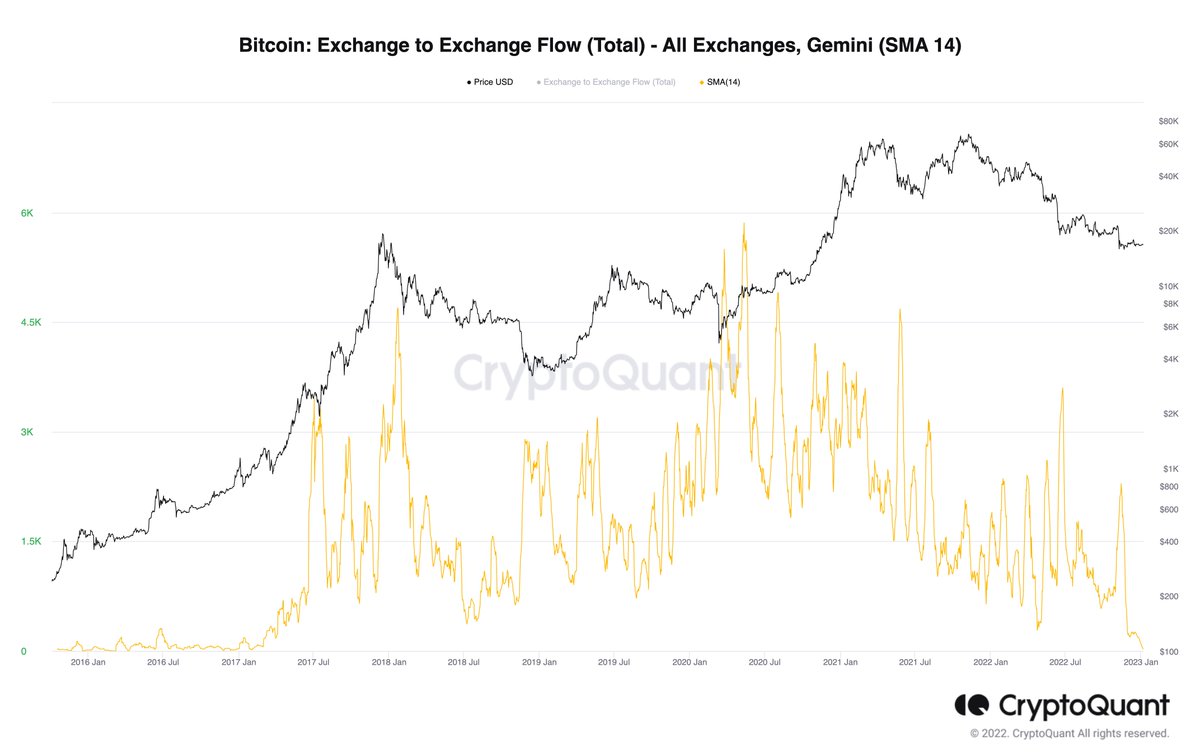

6/ #Exchange #Flows and #Depositing #Transactions

Further assessments on Binance in terms of Exchange-to-Exchange Flows, and User Depositing Transactions are also available on our real-time live dashboards.

@binance @cz_binance

Dashboard👇

cryptoquant.com/analytics/dash…

Further assessments on Binance in terms of Exchange-to-Exchange Flows, and User Depositing Transactions are also available on our real-time live dashboards.

@binance @cz_binance

Dashboard👇

cryptoquant.com/analytics/dash…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter