#PiramalPharma’s demerger was one of the most anticipated #specialsituations in FY22. But since listing, the stock has seen a 65% decline. A thread to help you understand some of the reasons for the fall and if they can recover from this

#piramal #pharma #investing #piramalfall

#piramal #pharma #investing #piramalfall

Piramal has seen a massive reduction in margins in FY23. Their 9M FY23 EBITDA margins are at 10%. They have not been this low for a long time.

The reasons for this fall in margins is a mix of macroeconomic factors that are out of their control and some issues that are inherent in their business model.

1. Deferment of demand: Due to current high interest rate scenario, innovators have had to put a lot of molecules in their development pipeline on hold. Over past 2 years when cheap financing was abundant, innovators were pushing as many molecules as they could into development.

But now as debt financing has become more expensive,they have been rationalizing their pipelines & only pushing those molecules into development who have a high chance of commercialization. So, we could see Piramal’s development pipeline shrink considerably in the next few years.

2. Operating deleverage: Due to the deferment of demand, they have a lot of idle capacity which has led to an operating deleverage. The problem is made worse because they have plants in countries like the UK, USA and Canada where the cost to set up plants is higher than in India.

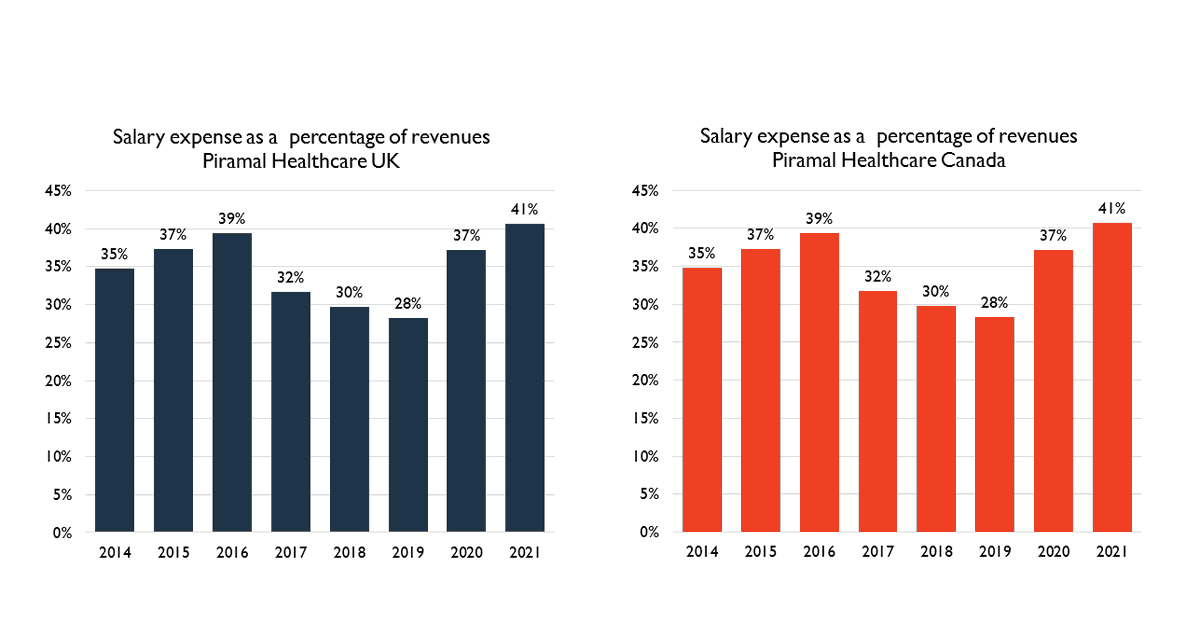

3. High employee costs: Another big, fixed cost which contributed to the operating deleverage is the employee costs. The employee cost for their UK subsidiary and the Canada subsidiary was over 40% in calendar year 2021.

High employee costs: Another big, fixed cost which contributed to the operating deleverage is the employee costs. The employee cost for their UK subsidiary and the Canada subsidiary was over 40% in calendar year 2021.

Salary expenses are much higher in the developed countries compared to India and having plants abroad is essentially a disadvantage for the company compared to its Indian peers.

Even if we compare with Syngene whose main revenues come from research and not manufacturing unlike Piramal, employee costs in Piramal’s foreign subsidiaries are very high.

4. Increase in costs: Their margins have also declined due to the increase in raw material and energy costs which has affected the whole industry.

Moreover, they saw a 24%YoY increase in employee costs which the management has said was due to additional hiring done due to new capex coming online and negative impact of foreign currency fluctuation.

5. Decrease in demand for generics: There has also been a destocking of inventory in generics which has affected the entire industry. Here again, Piramal has been hit worse than its competitors as they are manufacturing generics in high cost plants vs Indian generics players.

Indian players are benefitting from Europe+1 whereas Piramal may suffer because of it in the long term.

6. Provision for bad debt: They also had to provision for bad debts of about ₹30 Cr during the quarter due to one of their biotech customers having an issue with funding. Piramal has a much higher percentage of small biotech's as customers compared to other players like Suven.

7. Supply constraints in CHG business: They did not have an issue related to demand in their complex hospital generics. But they did face some supply constraints with their CMOs during the quarter.

Management has said that this issue has been resolved through debottlenecking and some capacity expansion.

8. ICH is EBITDA neutral: Their Indian Consumer Healthcare business is currently not contributing much to the EBITDA.

The management has said that they will be spending heavily on advertising and promotion till the revenues for this business hit ₹1000 Cr after which we may see some operating leverage play out here.

9. High Debt: The company currently has about ₹4800 Cr of Net Debt which is a problem in a rising interest rate scenario.

Management had said that debt levels would not be over 4-4.5 times EBITDA, but due to contraction in EBITDA, Nebt debt to EBITDA is currently at 5 times on a TTM basis. They are doing a rights issue of about ₹1050 Cr which will cause dilution in equity.

For more such insights, Join the Micro Cap Club:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter