SME IPO Analysis - Exhicon Events Media Solutions

A market leader in the Exhibitions and Event Management Industry whose IPO is live right now!!

#ExhiconIPO #IPO #SMEIPO #IPOAnalysis

Like and retweet for maximum reach!!

A market leader in the Exhibitions and Event Management Industry whose IPO is live right now!!

#ExhiconIPO #IPO #SMEIPO #IPOAnalysis

Like and retweet for maximum reach!!

1. About the company:

-Exhicon Events Media Solutions Limited is engaged in providing end to end products and services for the Exhibitions, Conferences, and Events Industry.

-Exhicon Events Media Solutions Limited is engaged in providing end to end products and services for the Exhibitions, Conferences, and Events Industry.

-The company provides services to organizers of exhibitions, conferences and events. Services include management and organizing of events, event infrastructure and media and promotional services.

-They also put on their own exhibitions relating to certain industrial niches like Hospital Design and Infra Exhibition and geographical niches like Vasai Industrial Expo or Global Kokan Festival.

-They also have a JV called Messe Global which has the largest convention venue in Pune spread across 15 acres and the largest multipurpose event venue in Punjab.

2. Business Segments:

-The company's business is split in 2 segments - Services that it provides to the organizers or various exhibitions and the exhibitions that it organizes by itself.

-Currently, 80% of the revenues come from services and 20% comes from its own exhibitions.

-The company's business is split in 2 segments - Services that it provides to the organizers or various exhibitions and the exhibitions that it organizes by itself.

-Currently, 80% of the revenues come from services and 20% comes from its own exhibitions.

Under the services segment, the company provides complete end-to-end services like event planning, temporary and permanent event infrastructure and event organization.

Additionally, it provides its clients with additional services like requisite permission and Licenses, large span steel AC structures, octanorm systems, flooring and carpets, modular registration setup, furniture and general lighting, sound light and video,

branding and signage’s CCTV and hardware setup

Under its own exhibition, the company organizes and manages exhibitions for niche industries like Hospital Design Infra Exhibition, Smart Urban Farming Exhibition and an exhibition related to Blockchain.

Under its own exhibition, the company organizes and manages exhibitions for niche industries like Hospital Design Infra Exhibition, Smart Urban Farming Exhibition and an exhibition related to Blockchain.

They also do exhibitions for certain geographies like Vasai Industrial Expo, Tarapur Industrial Expo, Navi Mumbai Industrial Expo or Global Kokan Festival.

The company owns the IP for these exhibitions. It takes time to build a brand in the exhibition space so these exhibitions do not have very high margins currently. But when the event reaches a certain scale, the management expects them to have much better margins.

3. Value Chain:

-Exhicon provides a complete end to end solution for Industrial and Trade Exhibition displaying its presence across the whole value chain.

-Exhicon provides a complete end to end solution for Industrial and Trade Exhibition displaying its presence across the whole value chain.

4. Recent Acquisitions:

-The company recently acquired Worldwide Exhibitions Agency Asia Limited - they are primarily engaged in large-scale international exhibition space selling business.

-This acquisition is expected to help them expand their operations internationally.

-The company recently acquired Worldwide Exhibitions Agency Asia Limited - they are primarily engaged in large-scale international exhibition space selling business.

-This acquisition is expected to help them expand their operations internationally.

5. Exhibition and Events Industry:

-The Indian event and exhibition market was valued at USD 3.6 Billion in CY 21 and it is expected to reach USD 6.7 Billion by CY 26 registering a growth of 12.91% CAGR during the forecasted period.

-The Indian event and exhibition market was valued at USD 3.6 Billion in CY 21 and it is expected to reach USD 6.7 Billion by CY 26 registering a growth of 12.91% CAGR during the forecasted period.

-Exhibitions are considered as a good proxy for the economy as it is a major enabler of B2B trade. Exhibitions are also a very under penetrated form of marketing in India.

-Exhibitions are majorly a B2B business.

-Exhibitions are majorly a B2B business.

-Exhibitions are the best way to get targeted customers for B2B products. So, companies prefer to go to exhibitions when they want to get more customers at a lower marketing budget.

-Management gave an indication that the exhibition industry hardly accounts for 0.1% of the GDP of India whereas it contributes to about 1% of GDP in developed nations. Western nations have exhibitions on 1,000+ subjects whereas India does exhibitions on 100-150 subjects.

-As India’s GDP grows and the penetration of exhibitions into many other industries increases, the industry is expected to grow at a rapid pace.

6. Competition:

-The industry is highly fragmented with organized and unorganized players each making up about half of the industry.

The major plus point for them is that the events are planned months in advance which gives them good visibility on revenues for a year.

-The industry is highly fragmented with organized and unorganized players each making up about half of the industry.

The major plus point for them is that the events are planned months in advance which gives them good visibility on revenues for a year.

-Many exhibition organizers have annual events and client stickiness is high in this business. If an event is successful, the client will come back next year. This creates a barrier to entry as organizers want to feel secure about their event being organized well.

7. Payment terms:

-Payment terms are also good in the business. They get about 20% of the revenue in advance, 30% on the day of the event and 50% on completion. Payment is usually settled within 15-30 days.

-For government exhibitions, 100% of the payment is made post the event.

-Payment terms are also good in the business. They get about 20% of the revenue in advance, 30% on the day of the event and 50% on completion. Payment is usually settled within 15-30 days.

-For government exhibitions, 100% of the payment is made post the event.

8. Future Plans:

-The company has said that they want to grow their presence internationally. Currently, 10-15% of revenue comes from international business and they plan to take it to 30-40% over the next few years.

-The company has said that they want to grow their presence internationally. Currently, 10-15% of revenue comes from international business and they plan to take it to 30-40% over the next few years.

-They currently have a strong foothold in Dubai and are looking to grow in other markets like Qatar, Thailand, Switzerland and Hong Kong.

-The international business will be mostly for services as it may be difficult for the company to build its own IP in these businesses at this stage.

-The domestic business growth will be IP-led. The company is looking to acquire brands in the domestic market. The IP business is relationship based so the promoters of the acquired brands will have to stay with the company for 3-4 years.

The payback period for these brands is expected to be 3-4 years.

-They also plan to expand the geographies that they cater to and will be doing exhibitions in Tier 2 cities as well.

-They also plan to expand the geographies that they cater to and will be doing exhibitions in Tier 2 cities as well.

9. Clients:

-They have many clients like government agencies such as Indian Army, MTDC, Ministry of Rural Development and corporate clients such as Godrej, Tata Motors, Reliance Industries, HDFC Bank, etc. Apart from that, their major clients are event and exhibition organizers.

-They have many clients like government agencies such as Indian Army, MTDC, Ministry of Rural Development and corporate clients such as Godrej, Tata Motors, Reliance Industries, HDFC Bank, etc. Apart from that, their major clients are event and exhibition organizers.

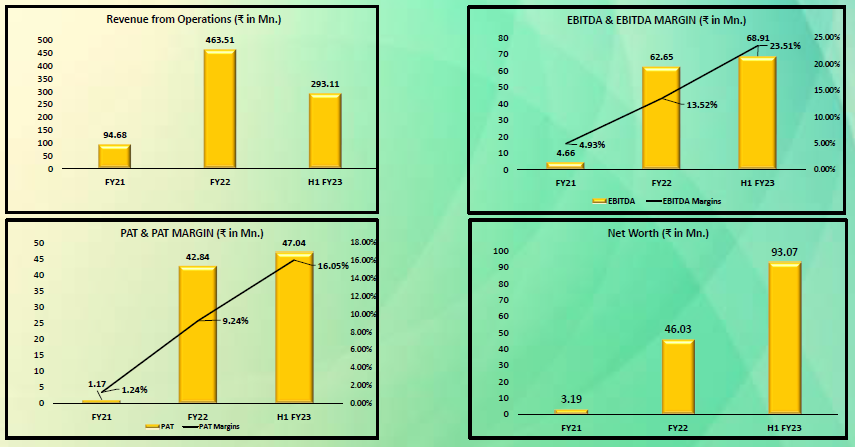

10. Financials:

-The company had ₹46.3 Cr revenue in FY22. EBITDA margin was at 13.52% and PAT margin was at 9.24%.

In H1 FY23, the company had ₹29.3 Cr revenue. EBITDA margins at 23.51% for the first half and PAT margin was at 16.05%.

-The company had ₹46.3 Cr revenue in FY22. EBITDA margin was at 13.52% and PAT margin was at 9.24%.

In H1 FY23, the company had ₹29.3 Cr revenue. EBITDA margins at 23.51% for the first half and PAT margin was at 16.05%.

11. IPO details:

-The IPO opened on 31st March 2023 and is open till 5th April 2023. It will have 33 lakh shares for offer at a rate of ₹61-64 and can be purchased in lots of 2000.

-The IPO opened on 31st March 2023 and is open till 5th April 2023. It will have 33 lakh shares for offer at a rate of ₹61-64 and can be purchased in lots of 2000.

-The company will be raising approx ₹20 Cr which will be used for buying inventory (mainly steel structures used for exhibitions) and for their working capital needs.

We did a Q&A session with the management of the company for the Micro Cap Club Members. To access the recording, join the Micro Cap Club:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter