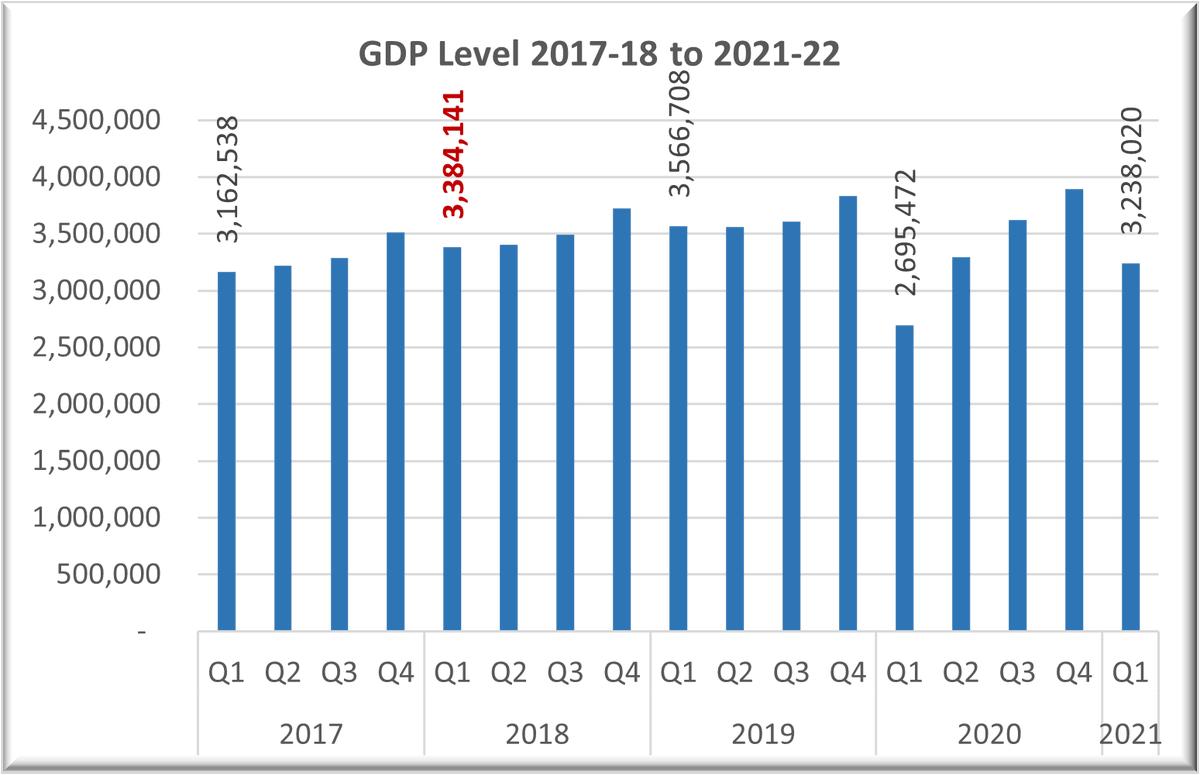

We argue that fiscal consolidation must wait for #India to avoid being trapped in a prolonged slow #economicgrowth trap.

@sunithanatti @NewIndianXpress

newindianexpress.com/web-only/2023/…

@sunithanatti @NewIndianXpress

newindianexpress.com/web-only/2023/…

1. Household earnings drive consumption and investment and the savings provide the required risk-capital for businesses. Unless real earnings and savings rise, GDP growth rate will barely move an inch.

2. The growth in real wages and salaries has either been stagnant or negative for most workers, including entry-level white-collar workers.

3. Likewise, within the rural economy, the level of household earnings itself is low and the pandemic-led reverse migration increased the dependence on agriculture income. The average monthly household income (not per capita) is just above Rs 10,000 pm

4. The primary problem of falling household savings and consumption is topped with another irksome layer of declining government consumption and private investments.

5. Put another way, it's a puncture of the jugular veins -- the crucial blood vessels stretching from head to heart -- and the consequences are well-known.

6. In national economic interest, both the Centre and state governments must slow down on fiscal consolidation and instead invest and consume for growth.

7. On its part, industry must invest ahead of demand to drive value-creation and productivity at the same time.

7. On its part, industry must invest ahead of demand to drive value-creation and productivity at the same time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter