New iOS in #Markets

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

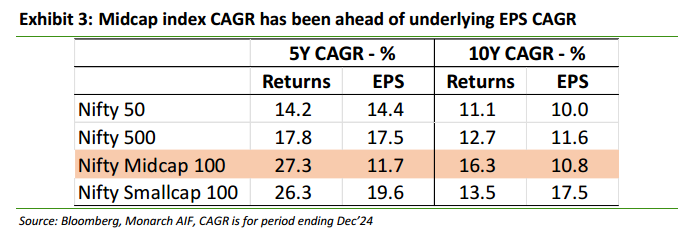

1) #Retail Participation went through the roof in 2021

Some Moderation now in 2022-2023

#Retail in Cash Market From 3 cr in Jan 20 to 11.7 cr in 2021.

#Retail at 3.2 cr participants March 23.

3x jump in all participation from Jan 20 !!

Some Moderation now in 2022-2023

#Retail in Cash Market From 3 cr in Jan 20 to 11.7 cr in 2021.

#Retail at 3.2 cr participants March 23.

3x jump in all participation from Jan 20 !!

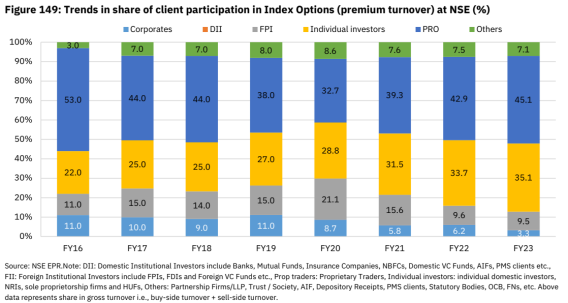

2) Everyone is an #Option Trader

#FIIs are just 9.5% of #IndexOptions Premium Turnover !!! From 21% in Fy20.

45% is #Domestic Prop ( #Broker trading on its own behalf )

35% is #Retail.

Retail + pro = 80%

#Retail is almost 4x of #FIIs.

Btw #FIIs own 20% of India.

#FIIs are just 9.5% of #IndexOptions Premium Turnover !!! From 21% in Fy20.

45% is #Domestic Prop ( #Broker trading on its own behalf )

35% is #Retail.

Retail + pro = 80%

#Retail is almost 4x of #FIIs.

Btw #FIIs own 20% of India.

3) #Pro are propping up the #Trading Volumes in #EquityDerivatives .

On a notional turnover, 53% of the #Volumes is #PRO accounts.

#Brokers are now #Traders or #Traders have turned #Brokers ?

#FIIS are just 7.4%

#Retail at 27%

On a notional turnover, 53% of the #Volumes is #PRO accounts.

#Brokers are now #Traders or #Traders have turned #Brokers ?

#FIIS are just 7.4%

#Retail at 27%

4) The #Indian #Options #Speculator is an Indexer

For all the talk about #IndexFunds & #ETFs the data suggests #Retail is all in on #Index Futures instead.

31.7% of #Index Futures is #Retail and 34% is #PRO

#FIIs at 11.8%

For all the talk about #IndexFunds & #ETFs the data suggests #Retail is all in on #Index Futures instead.

31.7% of #Index Futures is #Retail and 34% is #PRO

#FIIs at 11.8%

5) #Retail is shifting from #Futures to #Options

#StockFutures sees a major cut in #Retail participation.

From 31% of Volumes in 2018 to just 15.6% in 2023.

#FIIs continue to be at 23-25%

#DIIs at 8.5% thanks to the #ArbitrageFunds and #TaxBenefit.

#StockFutures sees a major cut in #Retail participation.

From 31% of Volumes in 2018 to just 15.6% in 2023.

#FIIs continue to be at 23-25%

#DIIs at 8.5% thanks to the #ArbitrageFunds and #TaxBenefit.

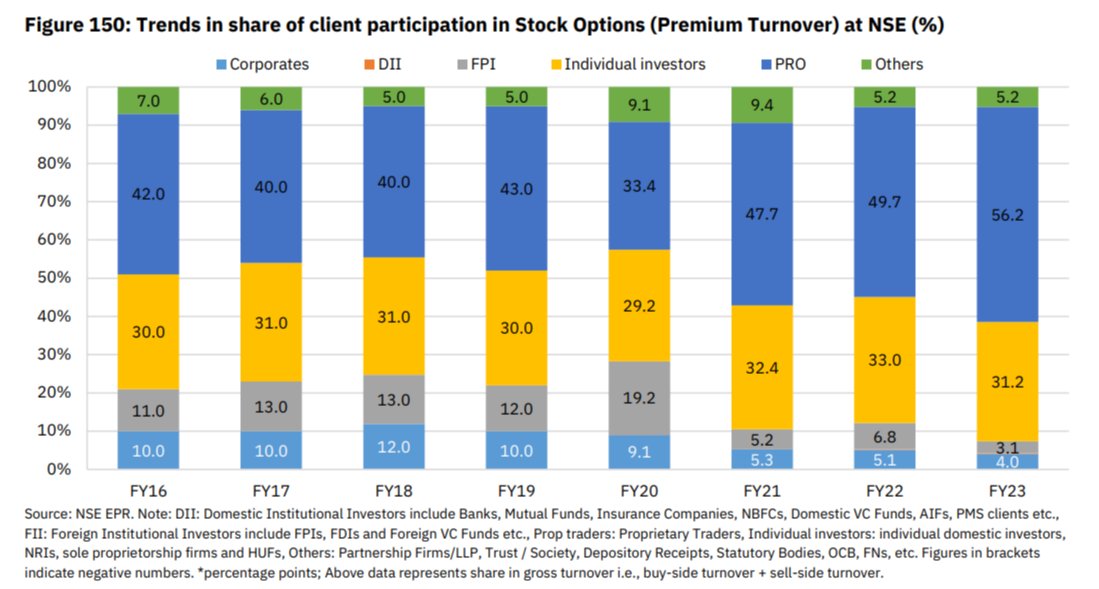

6) #StockOptions is all about the #PRO and #Retail

56% of Volumes by #PRO and 31% by #Retail.

#FIIs are just 3.1 % .

Repeating

#FIIs are just 3.1% of Stock Options ( Premium Turnover )

56% of Volumes by #PRO and 31% by #Retail.

#FIIs are just 3.1 % .

Repeating

#FIIs are just 3.1% of Stock Options ( Premium Turnover )

7) The #Machines are fighting it out.

51.5% of #Volumes of Equity Derivatives and 33% of #CashMarket is via Co-Location.

17% of trades via a Mobile in cash Market. It peaked at 25% in 2021 !!

51.5% of #Volumes of Equity Derivatives and 33% of #CashMarket is via Co-Location.

17% of trades via a Mobile in cash Market. It peaked at 25% in 2021 !!

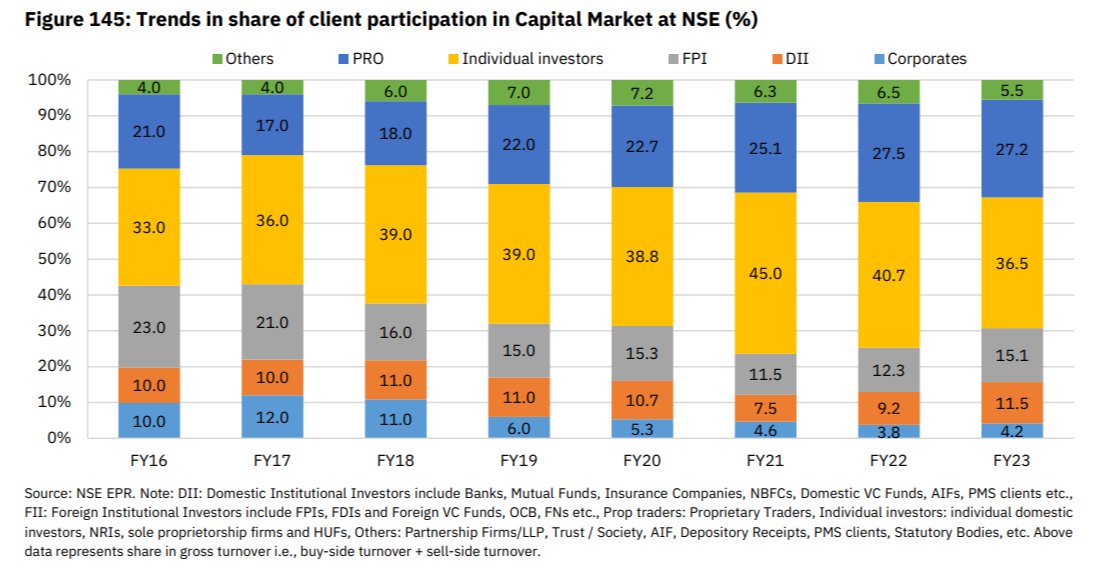

8) #CapitalMarket still has #FIIs #DIIs and #Retail slugging it out.

#PRO is 27%

#Retail is 36.5% from a peak of 45% in FY21.

#FIIs at 15%

#PRO is 27%

#Retail is 36.5% from a peak of 45% in FY21.

#FIIs at 15%

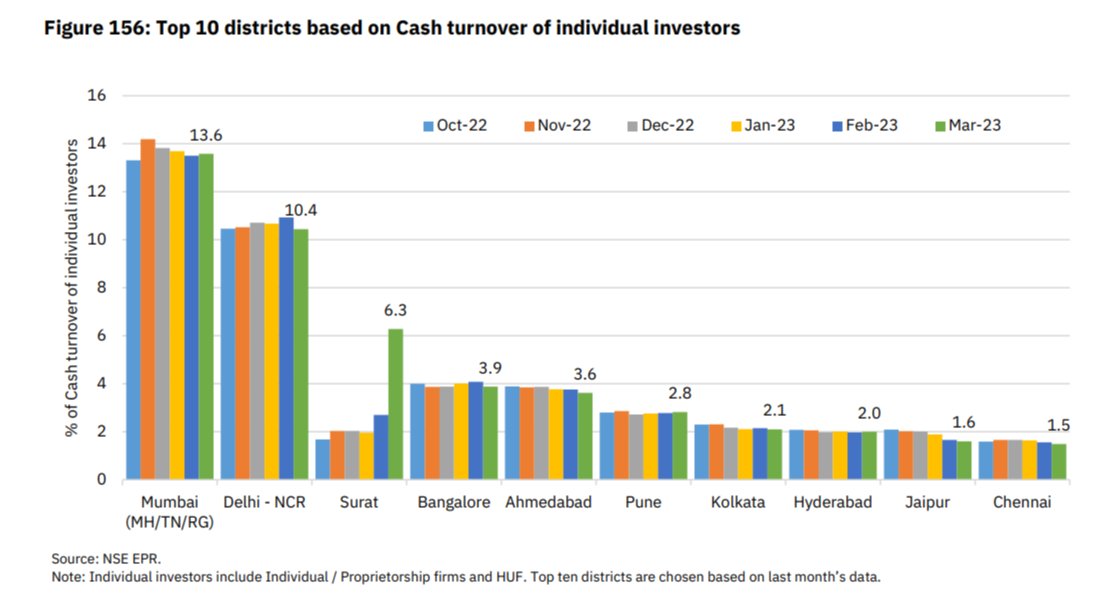

Couple of odd ones

#SURAT just beat the Rest of India in terms of Cash turnover of #Individuals in March 23 with 6.3% of Volumes !!! .

Mumbai continues to be the largest.

#EquityMarket AUM crosses #DebtMarket in #MutualFunds

#SURAT just beat the Rest of India in terms of Cash turnover of #Individuals in March 23 with 6.3% of Volumes !!! .

Mumbai continues to be the largest.

#EquityMarket AUM crosses #DebtMarket in #MutualFunds

10) #Retail participation is increasing in a big way. More in #OptionSelling

Mind you #Leverage is the toughest way to make money and the easiest to Lose it All.

I just hope a lot of #Retail does not have to learn this lesson in a tough way with #Volatility going berserk.

Mind you #Leverage is the toughest way to make money and the easiest to Lose it All.

I just hope a lot of #Retail does not have to learn this lesson in a tough way with #Volatility going berserk.

A lot of things are not in your Control.

Outages can be everywhere.

#Broker

#Exchange

#Bank

#War a lot can create volatility.

Remember a 15 min Lower circuit in 2012 due to a Freak order by a Broker.

Control your Size and Leverage. Be conservative.

Outages can be everywhere.

#Broker

#Exchange

#Bank

#War a lot can create volatility.

Remember a 15 min Lower circuit in 2012 due to a Freak order by a Broker.

Control your Size and Leverage. Be conservative.

• • •

Missing some Tweet in this thread? You can try to

force a refresh