#SHOCKING #CRICKET

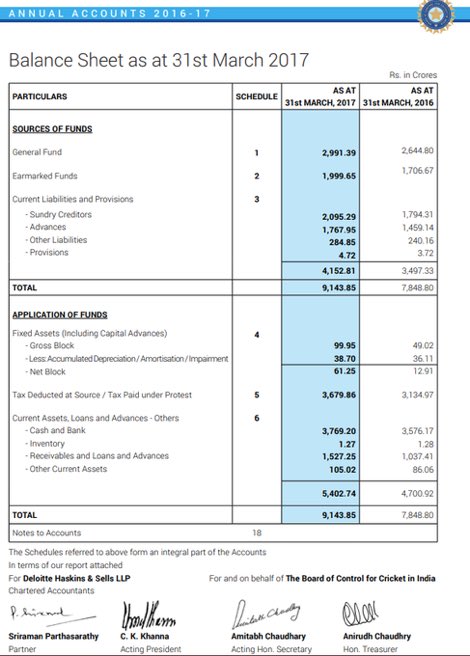

@BCCI is the #WORLDS #RICHEST CRICKET board (Valuation: Rs16500cr, Income: Rs3900cr)

Has NOT PUBLISHED its #ANNUAL #REPORT post FY17.

BUT that is NOT the Shocking Part, Read the #Thread

#CRICKET is a #RELIGION in India & #TRANSPARENCY should be Foremost

@BCCI is the #WORLDS #RICHEST CRICKET board (Valuation: Rs16500cr, Income: Rs3900cr)

Has NOT PUBLISHED its #ANNUAL #REPORT post FY17.

BUT that is NOT the Shocking Part, Read the #Thread

#CRICKET is a #RELIGION in India & #TRANSPARENCY should be Foremost

As per the FY17 Annual Report, @BCCI paid an INTEREST Cost of Rs115 Cr (400% YoY) while it’s INTEREST Income of Rs171 Cr (Fell 2% YoY).

BUT WHY were they paying 171Cr of Interest Costs when they had a CASH BALANCE of 3770 Cr (3560 Cr in FY16) ?

BUT WHY were they paying 171Cr of Interest Costs when they had a CASH BALANCE of 3770 Cr (3560 Cr in FY16) ?

Continuation 👇

https://twitter.com/thefactfindr/status/1662728379169411072

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter