An explanation of how the new format for UEFA competitions will work from next season, including an explanation of the revenue distribution.

The number of clubs in the Champions League will increase from 32 to 36 with the group stage of 8 groups of 4 teams being replaced by a single league of 36 teams, then a new knockout round, before reverting to the traditional last 16.

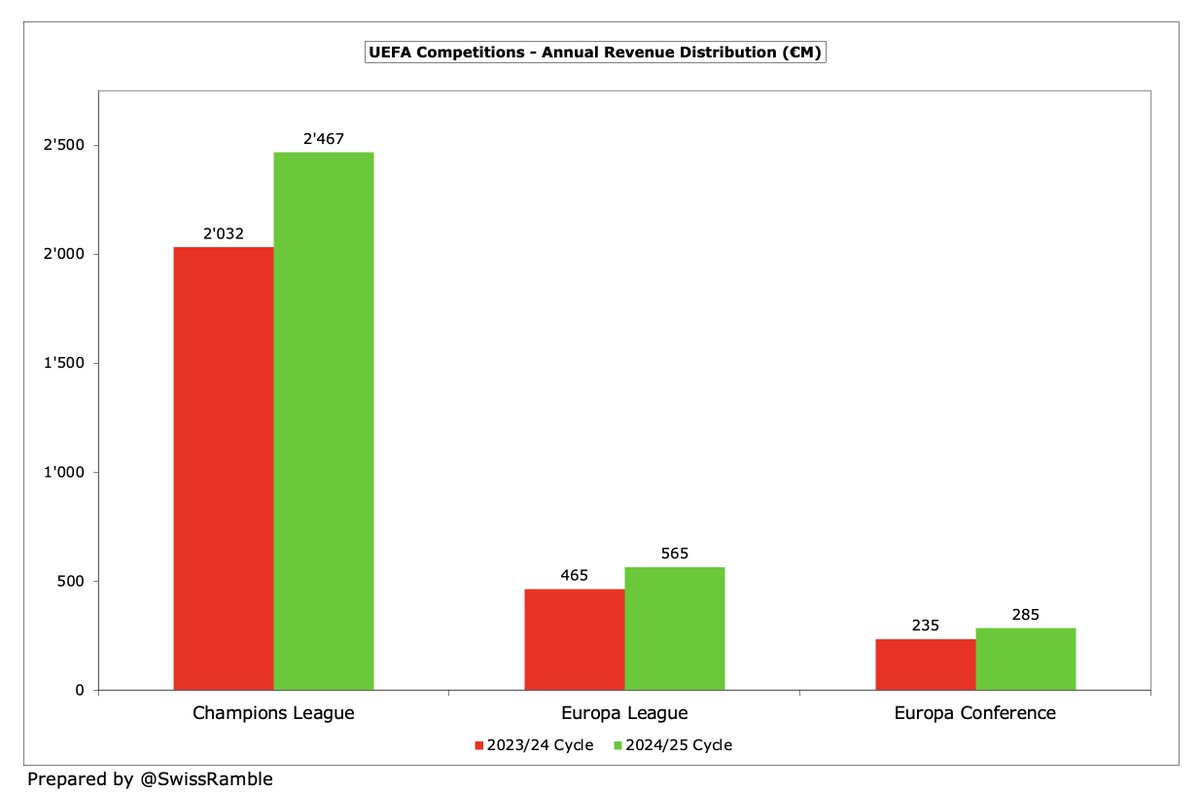

Total revenue distribution will increase by 21% from €2.7 bln to €3.5 bln. Lion's share will go to the Champions League €2.5 bln, followed by Europa League €565m and Europa Conference €285m.

Revenue will be allocated based on three elements:

1. Participation – equal share

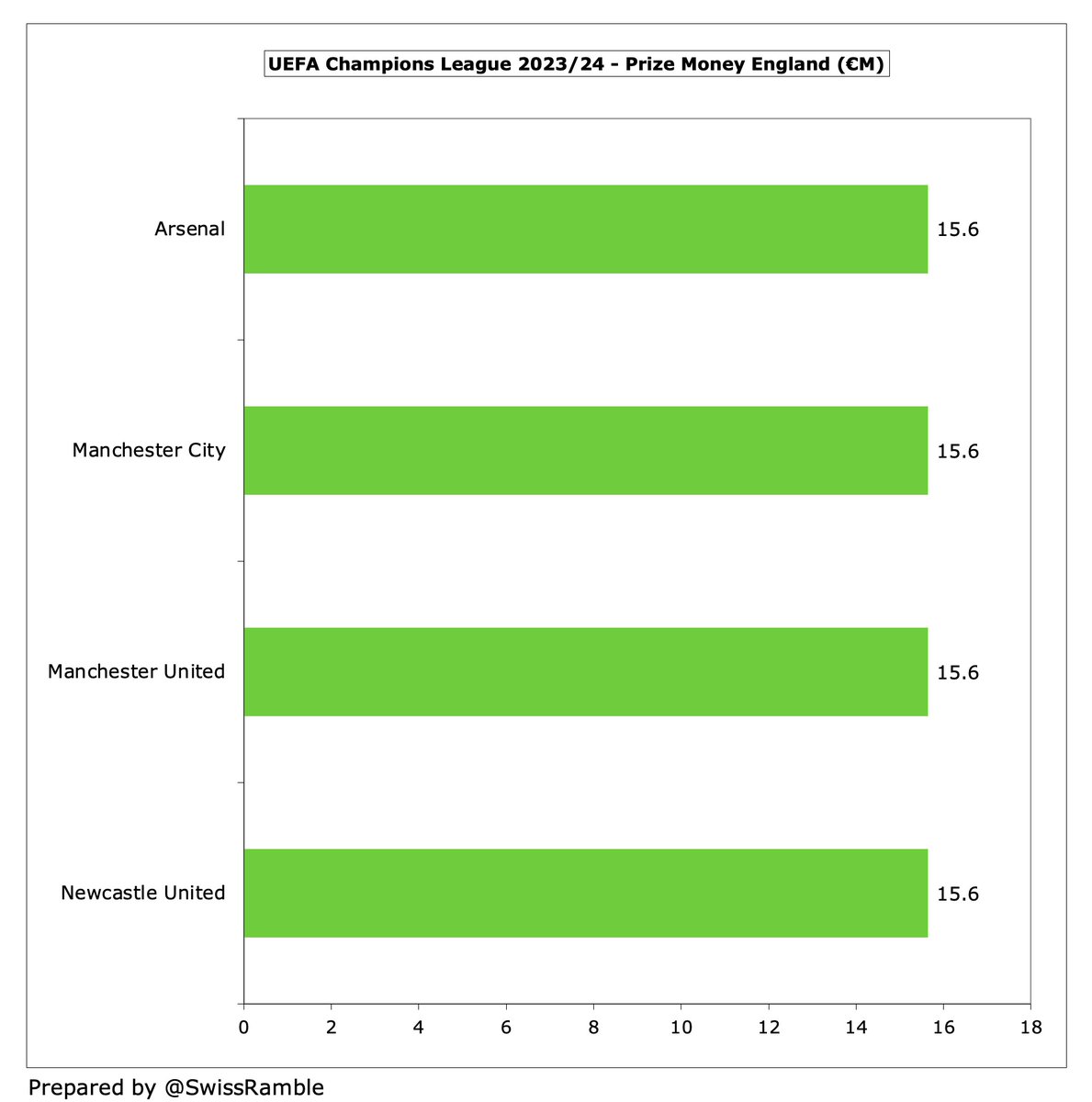

2. Performance – prize money

3. Value pillar – replacing TV pool and UEFA coefficient

1. Participation – equal share

2. Performance – prize money

3. Value pillar – replacing TV pool and UEFA coefficient

Prize money includes two new performance bonuses, one based on a club's finishing position in the league phase, the other based on qualification to the knockout rounds.

The value pillar is a complicated calculation, split into the European part and non-European part. Factors involved in the revenue distribution are size of TV deal, club qualification for group stage in last 5 years and two UEFA coefficients (5 years and 10 years).

Much more detail in today's blog, including an estimate of how much money could be earned.

As an example, Manchester City received £115m for winning the Champions League in 2022/23, which would be worth £134m under the new system #MCFC

swissramble.substack.com/p/uefa-competi…

As an example, Manchester City received £115m for winning the Champions League in 2022/23, which would be worth £134m under the new system #MCFC

swissramble.substack.com/p/uefa-competi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh