Remember Clearly: In markets, there are NO GUARANTEES. Period..

There are probabilities and expectations.

Often Expectations are belied and this can lead to disappointment

Your putting money or handing over money is assumed to be with full appreciation of the risk involved.

Analyse the risk involved.Work out, based on available public records, what can happen..

Whether your existing capital can hold as defence against possible losses?

Don't blame brokers or your Account Managers(If you have entrusted your trading to someone)

Blame yourself for inadequacy of capital

What Capital is needed for Trading?

Answer always is, that depends on what exposure do you undertake while trading.

Many theories are great. Many experts do have excellent strategies. Many traders are brilliant.

Evaluating the risk is your job if the entity which manages the funds are not regulated by regulators like SEBI.

AIF3 which can deal in similar trading activity..

Remember that the illusion of extraordinary returns that traders promise or assure or guarantee based on past performance is purely a Leverage based one.

Really, if you take their NON LEVERAGED Capital into..

Leverage to Trading is like the make up to the actors.

You won't like to see their faces without that make up, will you?

Same case with Traders claiming extraordinary returns

If I had leveraged 10x then I may be doing a 100% returns.

But remember, the more you are leveraged the greater the chance of blowing your a/cs.

Don't fall for tall claims by anyone.. ANYONE

My advice(if one can take it!) is to tell everyone Know Your Risks BEFORE placing money into Leveraged Trades.

Your regrets won't bring money back

After all, he is doing a Professional's job of executing his skills based on his knowledge, expertise and skills.

The more he makes, the greater the share of profits he gets.

But remember the risk is yours, and yours only

Yes, you may call for Arbitration etc. But the issue is dicey

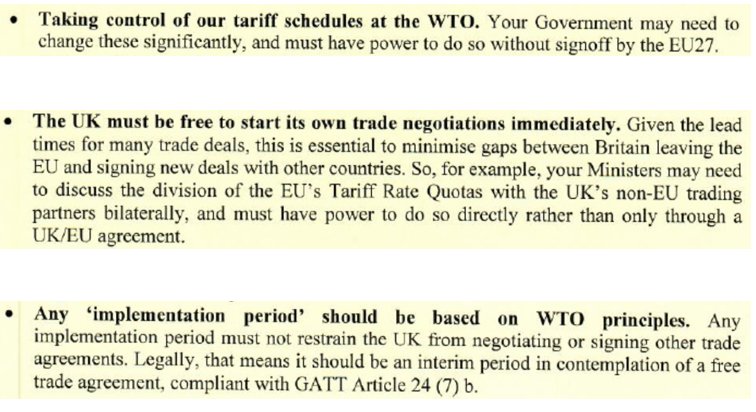

NSE and SEBI, infact doesnot encourage even those kinds of deals

Can there be easy money in this world?

Well, in my 30 years in market, I can tell you all, there is NO easy money available for someone to pick it up. Every paisa comes attached with its own strings

Be clear on where you stand and where the opposite party stands.

DON'T regret after the deal is done. Your money is precious!

Best Wishes