Entrepreneur, Investor & Hockey Player. #bitcoin & #crypto since '13. Opinions, never investment advice. Yes, I am still a liberal, but I also use my head.

How to get URL link on X (Twitter) App

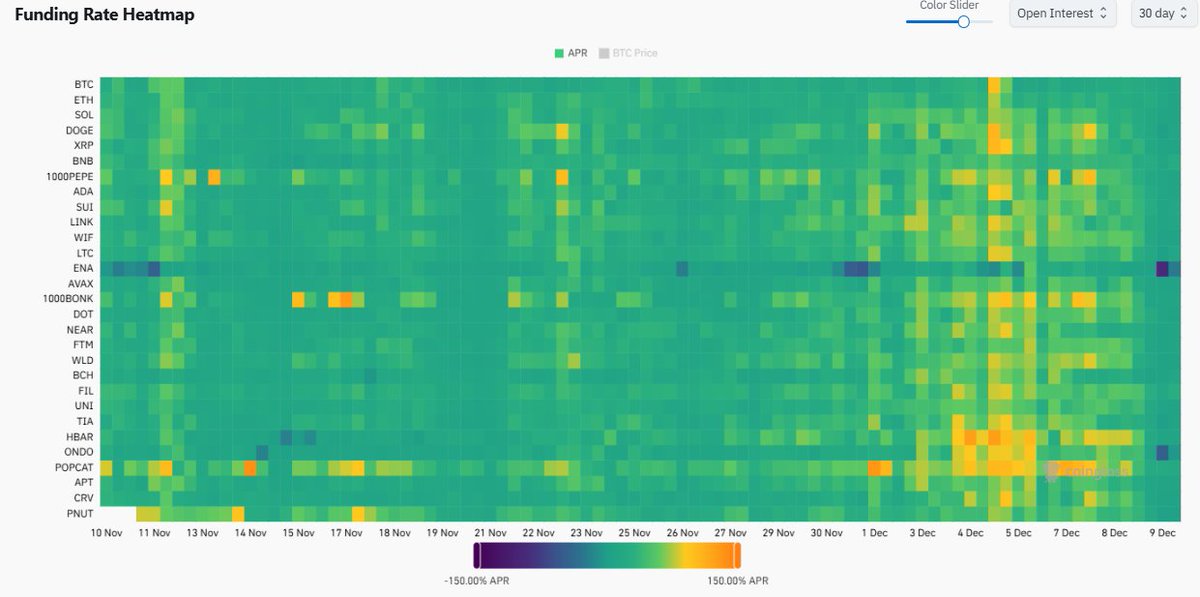

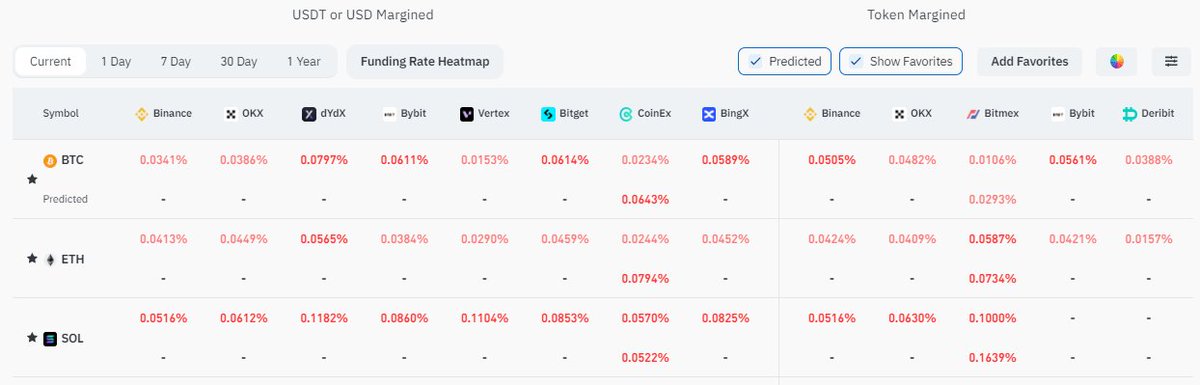

Many alts actually cratered yesterday, some down 50% at the peak. We lost 10% of open Interest across pairs since the 104k top.

Many alts actually cratered yesterday, some down 50% at the peak. We lost 10% of open Interest across pairs since the 104k top.

Charts next (even included the famous Tone-Vays-RightWingRadical count to 9 indicator):

Charts next (even included the famous Tone-Vays-RightWingRadical count to 9 indicator):

Important:

Important:https://x.com/dkcrypto13/status/1736734822754591203

https://twitter.com/dkcrypto13/status/17541145036319376671/ What is $JLP token?

https://twitter.com/dkcrypto13/status/1489431637574262794So far in January I managed to be down just about singe digits in a long-biased mandate, which is still good with markets -25 to 30% in crypto & basically tracking the Nasdaq with a crypto book, but last night I decided against my tweet setup above last minute and kept hedges on.