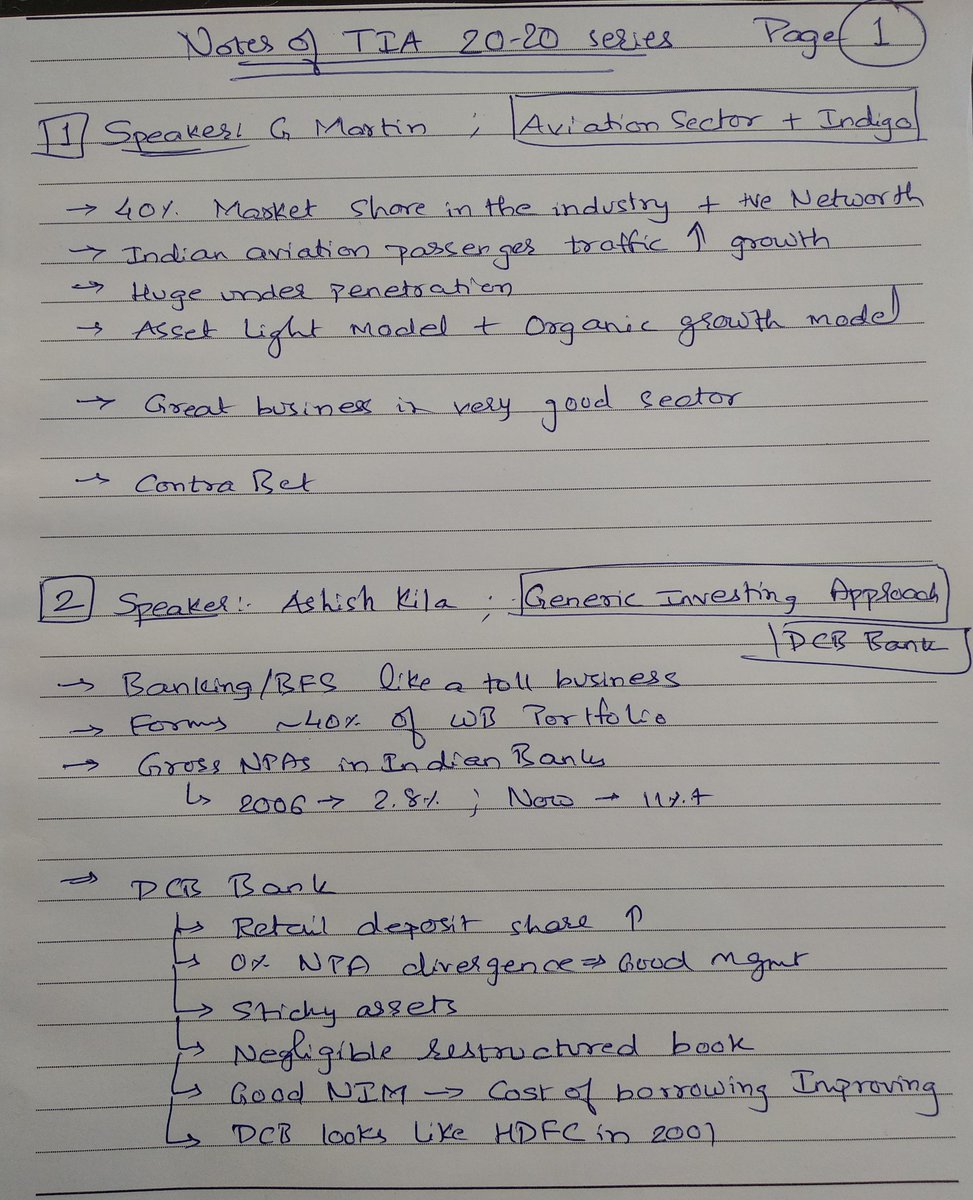

Indigo with 40+% market share is only player with positive net worth !

Surprised !!

It is like toll business.

His idea is Manappuram finance.

FY12. That impacted the business.

Add to it RBI regulations.

Former has 39 PE, latter is 19.

Significant PAT margin. And great growth last few years.

Particularly last 6-7 years.

Now MF AUM is 20% of FD AUM, same as 2008 but vs 12% in 2012

(Interesting )

Also all are well capitalised so bottom line doesn't need to correlate into forward capex.

Could be a long term threat but 10+ years per speaker.

Former has hold on ETFs !

Significant operating leverage is +ve.

-ve is regulatory actions.

In short, a Beta play on capital markets in India.

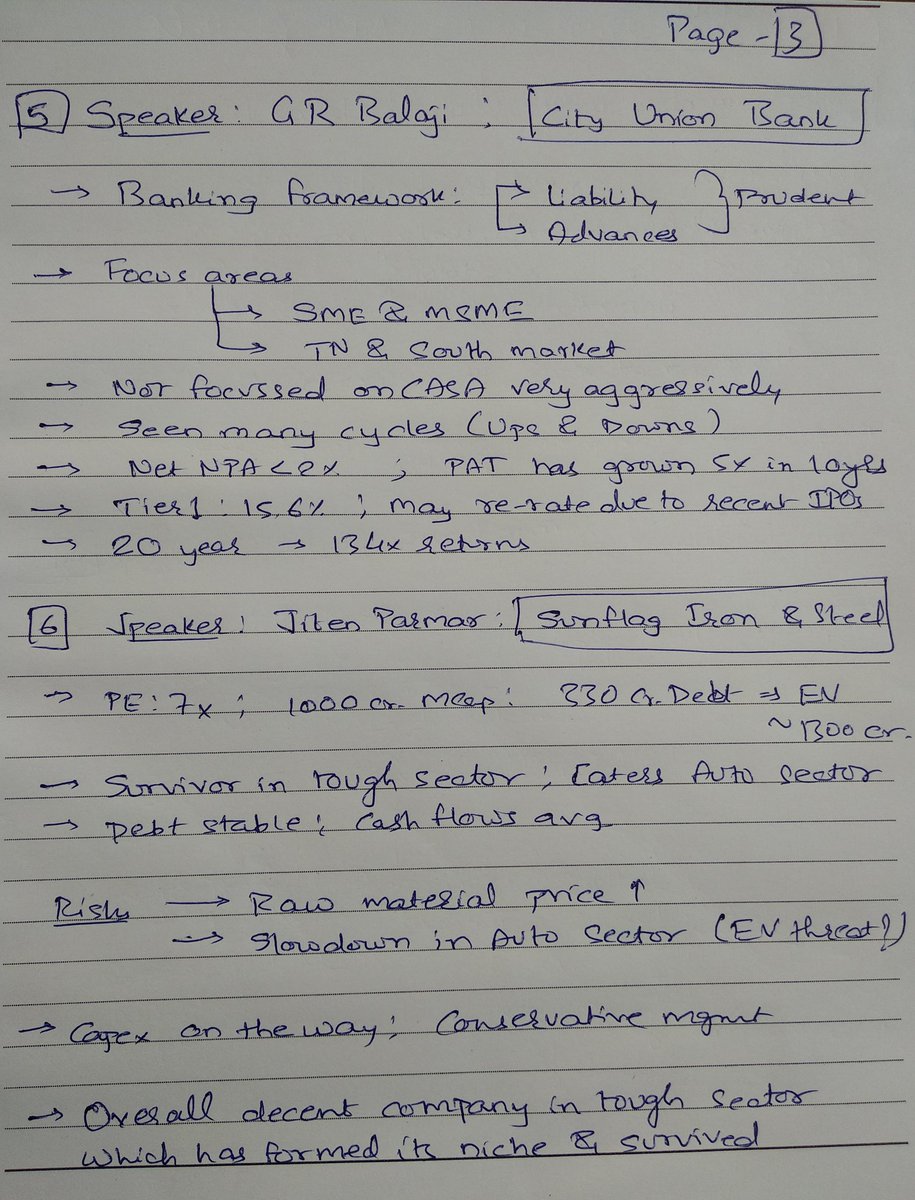

Framework for success in banking :

Build granular liability, grow advances prudently.

PAT 5x in 10 yrs.

Focussed on Trading and MSME segments

Focussed on South India esp TN.

100+ yrs of profit and dividend record 👍👍

Awesome !!

And CUB because of a rare older era private bank that gave 100+x returns in 20 years. If I recall correct HDFC bank 50x in 18 years.

(My view)

His stock idea is Sunflag Iron and steel.

Specialty steel maker.

Survivor among many peers in a tough sector .

Was hedge fund manager in HK.

His stock idea is Cummins India and has a 4-5 yr view on it .

Products are BS6 engines for Trucks, Generators, construction etc.

BS6 is big positive.

After Sales Service also a biz.

No debt.

Now on any growth in power demand will help Cummins.

BS6 deferment may help competition.

Multi location plants.

Logistics prevents any China threat. Bulky product .

Risk : Keyman risk .

Was with Sundaram Fin group.

480 cr MCao, EV 1000+ cr.

Crane rental company , 6th largest in world

Cater to 100+ Metric Tonne segment.

Wind mainly . Then metro, infra, etc

Spot power prices increase in recent times, Renewable power target for 2022 all positive for wind and thus for Sanghvi

Best case yield gives 133% upside in EV.

Worst case yield gives 33% downside from current EV.

Starts with nice disclaimer (Tamil saying)

Is a banker turned broker , distributor. Seen in Tamil Media, regular TIA speaker .

Shares technical view as well.

Investor and mentor at @equitybulls

His investing idea is a apparel retail chain

Debt free, expanding now. Focus on tier 2 and 3.

V2 Retail is the stock.

Businesses learning from past mistakes.

Past history detailed.

Then course corrected, sold units .

Now focus only on fashion retail in tier 2 and 3 cities.

Slower expansion to avoid excess borrowing.

6 store to 49 last 7 yrs

Store presence mostly in small towns . Less competition + less Real estate costs

49 to 70 stores in last many months .

Huge opportunity for it to grow further esp in small towns.

Next speaker is Shagun Jain.

Corporate banker with 14+ yrs experience.

CAGR sales 16%

PAT 21%

Over last 10 yrs

In hottest sector, specialty chemicals.

Then CFO up 30x in 10 yrs.

No debt . Wish invested this in 2009

But not even heard of it .

RPT, Receivable, Group co operations, share pledge, Cash flow from operation etc.

Likewise Commodity chem vs super specialty chemicals . Latter most profitable.

Most of them, mkt share of Vinati is very high !

IBB used in painkillers !!

Lot of fresh capacity on these coming up from Vinati.

+ import substitution angle .

Import substitution => Reduce hedging cost => hi margins!

Risks : Crude oil derivatives but cost is pass thru

Concentrated customer profile. Global biggies like Dow Chemicals etc. Time to market is high.

His idea is JM Financials.

Last 6 yr Sales 2+x, profit 6+x.

Into developer finance mkt. Quite a place today !!

PSU banks 57%, Pvt Banks 25% NBFC 18%

14000 cr loan book today .

Well capitalised NBFC with multiple biz lines. 6000 cr MCap.

Concluding remarks : Well funded, high liquidity NBFC with worst case priced in (shows a table to justify same).

Due to recent guvt measures wrt Sugar and ethanol blending .

Ethanol blending from 0.3% to 4% last 7 years (impressive ) !

Now talks about sugar Industry .

High cyclicality so far.

Sugar is cyclical but Distillery and Power is stable wrt EBIT.

Balrampur forecast ethanol output will be 2x in next 3 yrs.

BCL Industries also mentioned.

Dhampur has debt .

BCL has real estate biz in addition.

Global peers trade at 10-20 PE.

Ends by quoting Warren buffet "No body wants to get rich slow !!"

Speaker and trainer in personal finance .

His investing idea is Tata Elixi.

Into IOT etc.

Gives description of what IOT is.

60% Auto, 30% into Media and broadcast.

More into design side of business.

Working on SW for cutting edge tech. E.g Autonomous driving.

Product could be a middlrware for OEMs.

Debt free company. Consistent dividend. Good ROE

But last few years growth is tepid.

Europe 50% , US 30 % revenues.

Stock has correct last few months (35%)

PE 21, debt free, good to add at CMP.

Speaker concludes with this note.

Columnist in BL, Consultant , writes in Monday edition of Portfolio.

She presented in last year 20-20 session Sun pharma that was when stock bottomed out !

Pharma she focussed on

This year, her pick is Divi Laboratories.

After few years of bad run !

A sector that cannot be ignored .

In CRAMS space.

Focus on differentiated products .

Margins if patented product can be as high as 80%

Generics 57% rest Custom synthesised.

Investment case : RnD capablity. Debt free, cash rich, 500 cr FCF this year , 30% dividend payout !

4x growth in revenues and profits last 5 yrs (approx)

Good promoter holding of 52%, highest after Sun Pharma. "Skin in the Game".

Financials : OPM peaked in 2014. Then dipped. Things now improved. Next 2 yrs ratios must be better.

Only concern can be adverse regulatory development. Management has managed to come out of regulatory issues in past. E.g 2015-17 .

Concludes mentioning currency fluctuation may also be a concern.

He starts by identifying (rightly) that idea of these stock idea sessions is not so much about the stock picks but more about the thought process behind it.

Underlying process must be understood is his view !

His stock idea is Majesco .

IT Service co now turned into a IT product company

Into insurance space .

Illustration of example of how insurance cos using tracking technology to offer differentiated services.

Where rising sales leads to accelerated cash flows .

Majesco has a cloud based subscription service

Last 3 yr PL - Op leverage kicking seen.

Margins will grow with sales

Marquee customers : Allianz, MetLife etc.

Valuation 60-70% of peers. Can catch up with peers

Mentioned about S and J curve in biz.

J Curve - When capex done EPS takes off on sales takeoff.

Latter growing impressively.

Scuttle butt favorable esp on PnC side of biz.

Risk : Keyman risk, Trump /H1B.

Concludes saying : Low analyst coverage is the big opportunity to rerate !!

Starts with disclaimer.

25 year investor in markets. Into full time investing in last few years.

Views on LT winner stocks :

Franchisee, demand supply demography , beneficiary of GDP growth. Or aligns as part of India or Global LT trend.

Example of such trend : Scooter to Motorcycle , Gums to Feviquick stick adhesive.

+ Leverage to improve margins.

His Stock idea is : Zee Learn.

Main biz segment : Kisses,learning kits , school infra biz, flexible staffing etc.

Present in 700+ cities.

Franchisee model .

Structural tailwind.

Only 11% Indians preschooled.

Only 11% market share in pre school market in India

Annual spend on Pvt sector school in India is 3.5 L crore Rs.

Switching costs leads to a moat.

Risks - Guvt fixing fees, high pledge of shares by Zee Group.

Concludes saying it is a must have B2C stock.

Part time investor. Value investor type.

Stock idea is Apollo Hospitals.

Revenues 5x but profits 3.4 x and now down.

Debt up, cash flow up but margins fallen big .

10000 bed chain. Many business within.

CAGR over long period good, last 3 yrs not good.

Regulation, politics , recent policy changes are negatives.

All these have impacted profits but not revenues .

Rising interest rates .

Share of revenue : 2015 to 2018

Pharmacy gaining.. EBIDTA of pharmacy 3x in recent years.

If this trend continues: it may be called as a Pharmacy biz that also owns Hospitals !!

Current pharmacy ROE 15% but older stores have 20+% ROE.

Likewise Hospitals over 5 yrs EBIDTA is better

Half beds are less than 5 yrs !

10% beds still not used falling

Recent expansion has depressed returns!

1600 stores in 2014 vs 3000+ today !

India has 6Lakh pharmacies today.

Fair value per speaker is 1300 around. Mispricing valuation story .

Concludes mentioning risks as debt and regulations and disruption due to predictive machine learning Heath care etc.

His stock idea is Colgate Palmolive.

Terms it as very boring business

Investing process must be simple.

2-3x sales, profit last 9 years.

Calls this business "Rahul Dravid"

Says entry decision can be made based on PE.

Use dips to accumulate the stock.

Concludes recommending having 20% of PF on basket of FMCG stocks. (HUL, Britannia)

Topic of his presentation : Wealth Network

Introduces a company of 8000 cr MCap and 3% dividend yield.

Name's not shared yet !

Now at 40% for India, should cross 50% in next 10 yrs. Share of equity in savings will continue to increase.

Likewise digital infrastructure will also expand . Convergence is the theme.

And stock to ride is : ICICI securities .

Best tech platform.

+ Client base doubling every 5 years

1 cr client in 5 yr possible.

IPO overpriced but selloff over done.

Financial product distribution is also a big LOB.

Private wealth mgmt, estate planning also good.

Next 5-10 yrs broking will become less dominant LOB.

Concludes that ICICI sec

High quality ROE biz at good price .

Special thanks to @TIA_Investors for organizing this great session. Highly informative and highly useful for all investors. Kudos 🙏🙏🙏🙏

Pls take time to read even if u don't agree.

Note - My own views will post soon maybe separate thread.