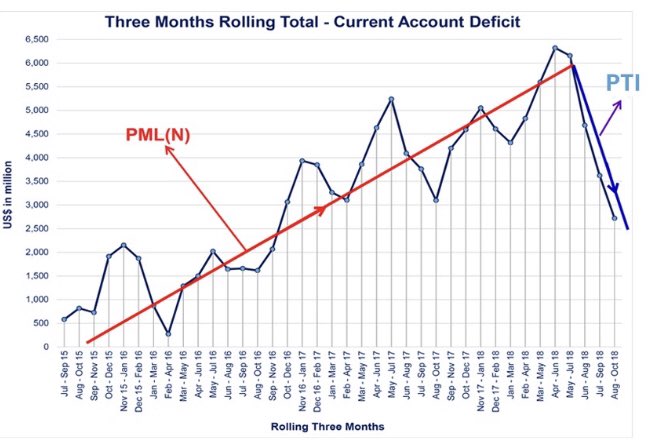

The result of the above mentioned fiscal and monetary policies was not surprising for any economist.

So what has the new government done about this? And what does it plan to do in order to make sure that the repeat of the above does not take place?

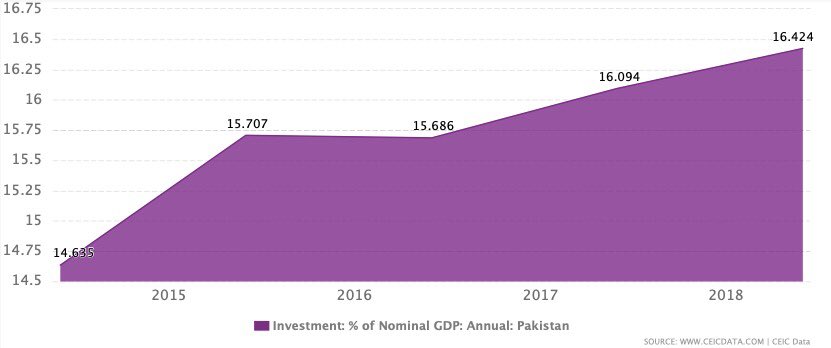

Studies point out that apart from restrictive economic policies that were hindering savings and investment in Pakistan, there are two additional features in play.

‘Change’ is always accompanied by a certain degree apprehension and uncertainty. We indeed see that in our economy now and it is understandable.

The general paradigm of fiscal&monetary policies has been realigned towards exports, investment & productivity growth.