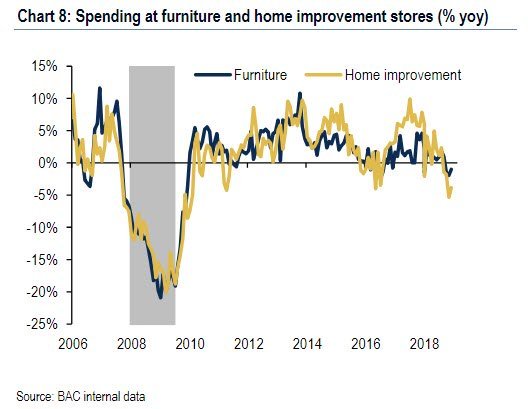

That's why the U.S. housing boom since 2012 is another bubble. It's not identical to the mid-2000s, but it's another bubble variant.

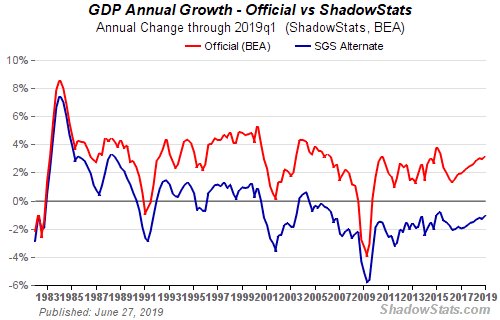

This housing boom would be sustainable if it occurred because wages were booming. Unfortunately, that is not the case.

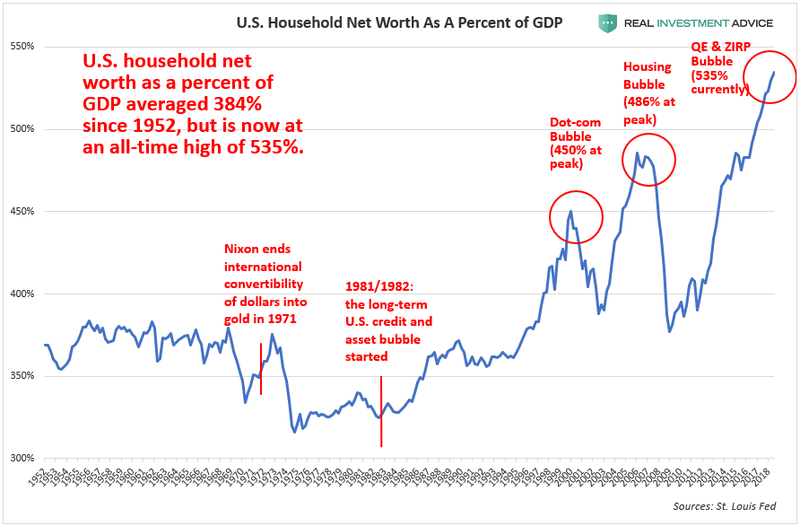

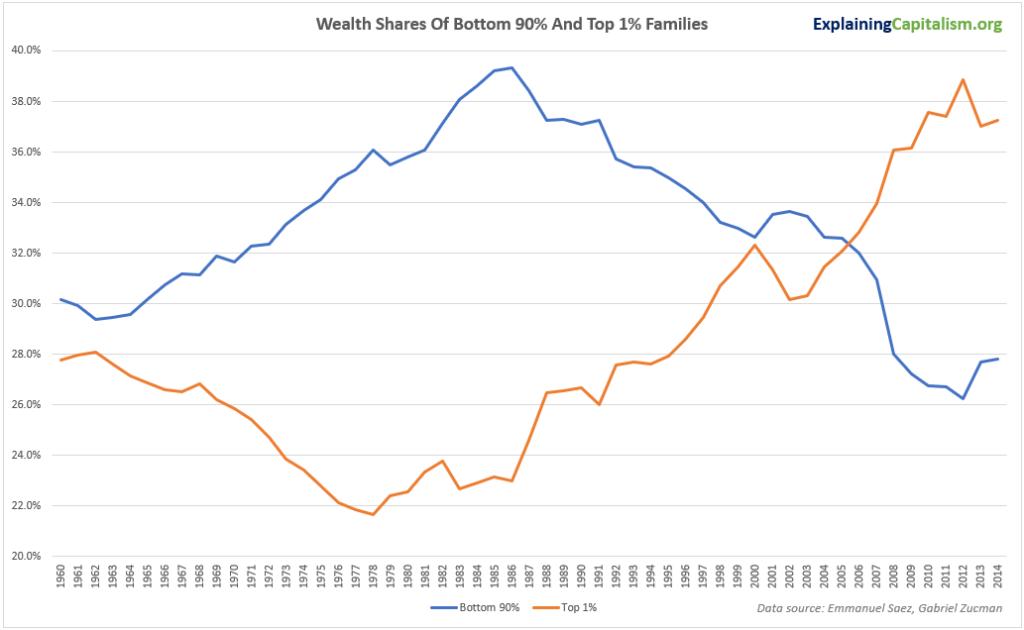

That's why there is now an unprecedented bubble in household wealth.

See my explanation: zerohedge.com/news/2019-06-0…