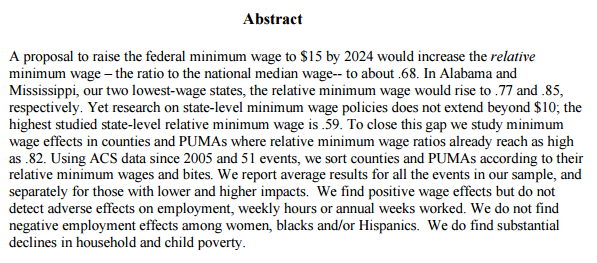

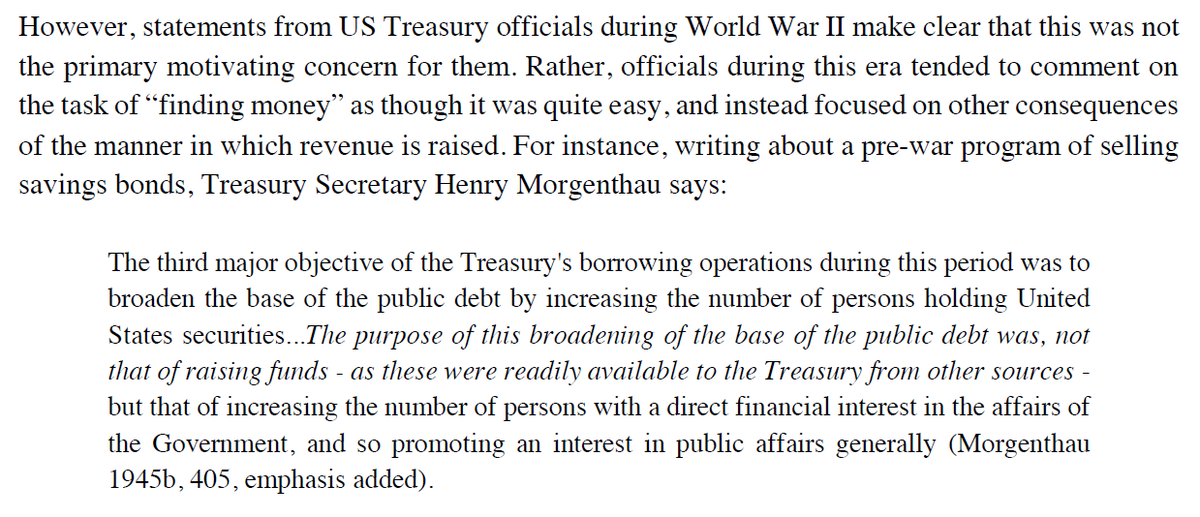

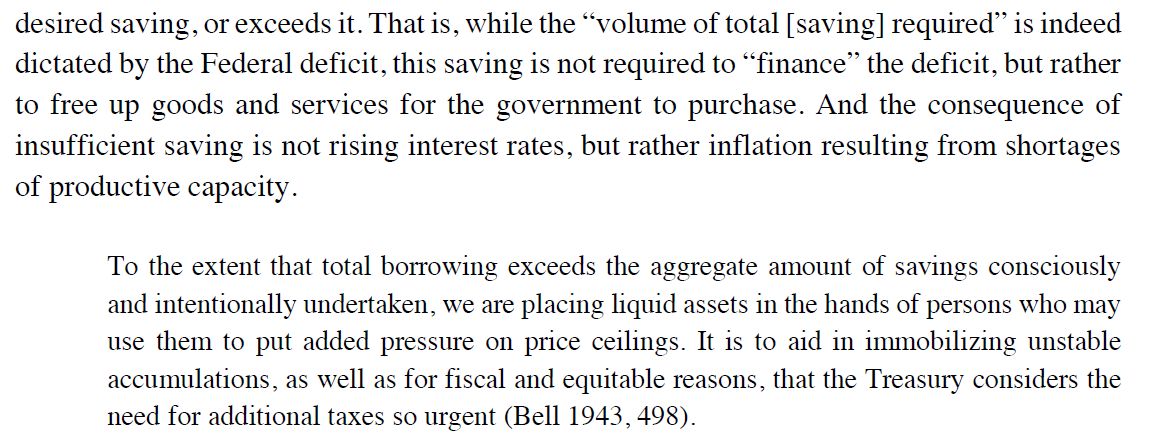

Who once called taxation an "essential anti-inflationary weapon"? Was it one of those Modern Monetary Theory economists? Or was it...the US Government in 1942?

(A thread)

global-isp.org/working-paper-…

Keep Current with Deficit Owls 🦉

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!