A Thread on Pension 1/

The current NIS deduction rate is 2.5% for employee & 2.5% for employer up to a maximum of $1.5 Million

2/

3/

5/

gillianajackson.com/is-your-saving…

So why do you need a pension plan? ...

6/

This is the monthly amount you would have for the extra years

Years Monthly Amt

10 = $45,000

20 = $22,500

30 = $15,000

11/

gillianajackson.com/why-pensions-a…

14/

jamaicaobserver.com/news/increase-…

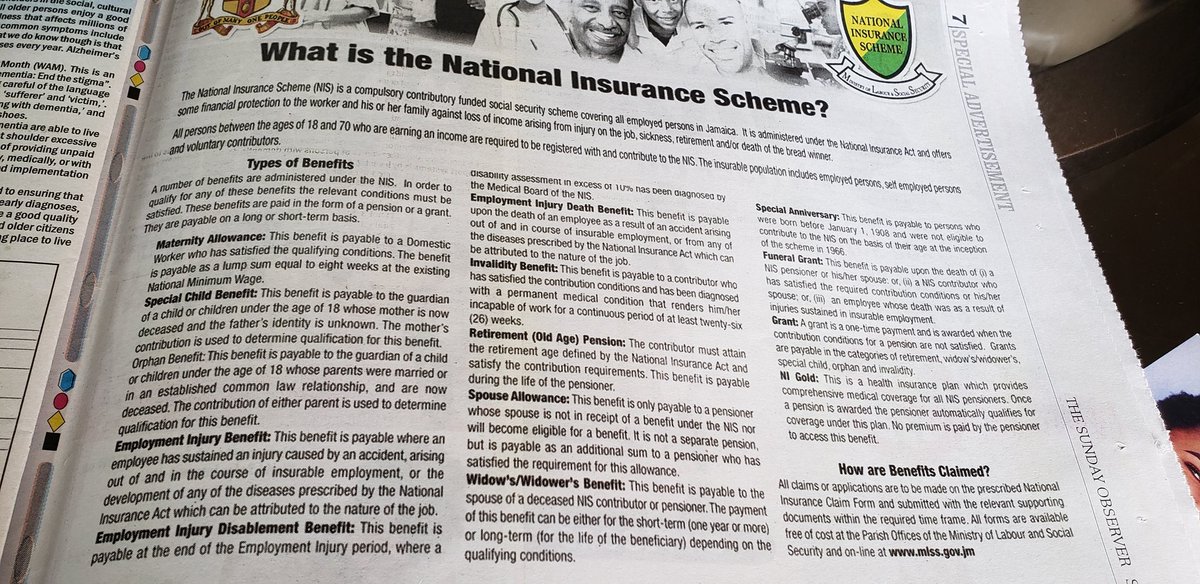

-Maternity

-Special Child Benefit

-Employment Injury

-Funeral Grant

-Invalidity Benefit

-Spouse Allowance

-Widows Benefit

Check it out. #FinanceTwitterJa