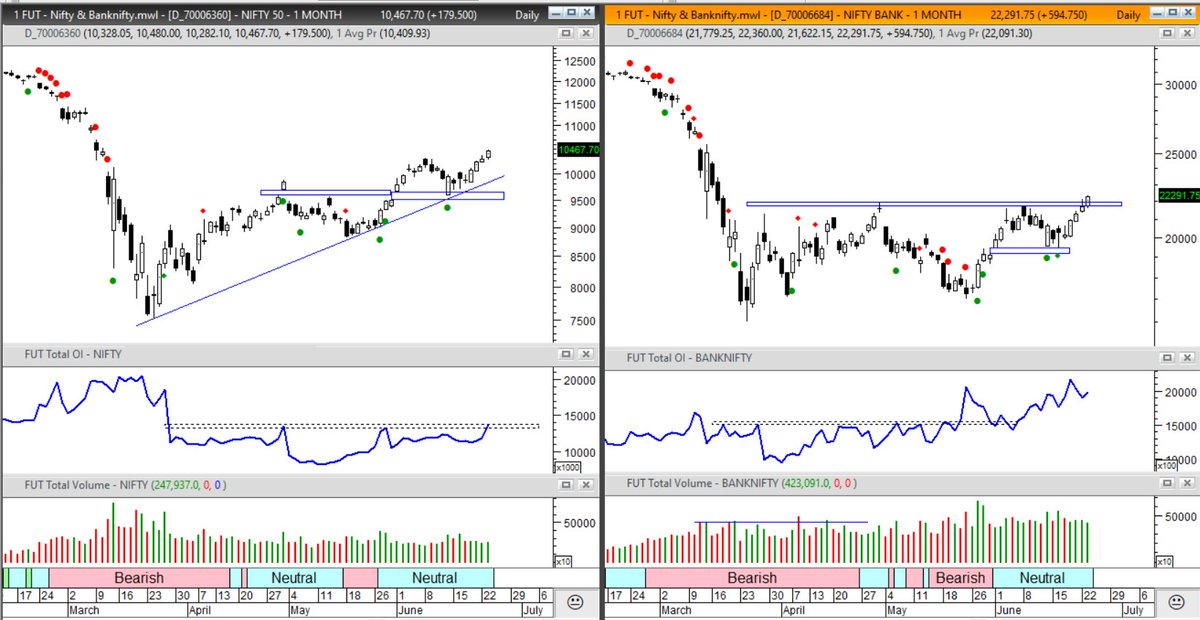

Naa ye girr raha hai.. naa baddh raha hai.. sirf tadap raha hai..

#Bullish view intact in #Gold

SL $1459

#Bullish view intact in #Gold

SL $1459

#GOLD - finally coming out of consolidation.. Maintain #Bullish view for a new 52 week expectation. SL $1465

#GOLD now $1511.. revise SL $1480.. maintain BULLISH view. (after5 day rally, may see 2-5 day pullback/consolidation but thats ok for a strong trend, momentum likely to catch up in mid-jan probably)

• • •

Missing some Tweet in this thread? You can try to

force a refresh