This is really rather astonishing. Below, I'll go through one common response to the Copenhagen experiment.

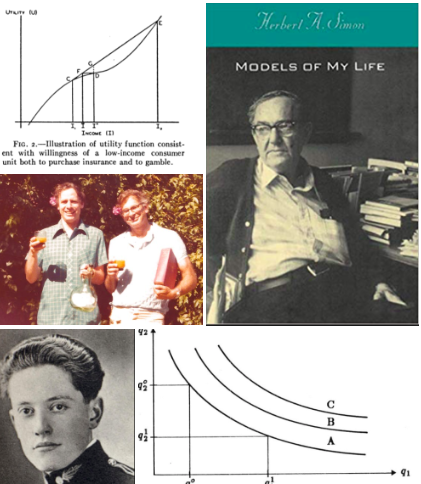

Much of economics is based on expected-utility theory (EUT).

That theory says "we don't know what people do, we just know each person behaves consistently."

Formally, this means each person's behavior can be represented by a utility function.

Specifically, they found that our approach, ergodicity economics, predicts pretty well what people do: in one setting they'll behave as if they had one utility function; in another setting it will be another function.

We predict the form of both functions correctly.

So no, each person does not behave consistently in the economics sense of that word.

The Copenhagen group now receives various comments from economists who feel that the old way of thinking (EUT) is worth defending because so much work has gone into it (~300 years).

Here is their most common defense of EUT:

They agree that expected utility theory predicts, or assumes, that the choices an individual makes are consistent.

This is something von Neumann and Morgenstern pointed out in 1944, and it's become part of the economics canon.

But, so goes the defense, consistency among choices only applies to a moment in time. The next second, preferences may have changed, and a person would make a different set of choices, possibly inconsistent with what he did just before, but consistent in themselves.

Of course, it's not actually possible to make several choices at once (not in the relevant sense). So in practice this means EUT only says "you do something now, and later you also do something but the two actions are not related, nor is anything known about either of them."

In other words, expected-utility theory cannot say anything -- absolutely nothing -- about human behavior.

A priori, it doesn't know what you'll do, and after observing what you've just done, it still has no predictive power for what you'll do next.

That's the best defense of EUT so far.

Let me summarize. It says: your experiment does not falsify our theory because our theory predicts nothing. So whatever you find, our theory is untouched by it.

In Popper's thinking about the Demarcation Problem (distinguishing science from non-science), this is key: a theory is scientific if it makes predictions that allow us to see if the theory is wrong. A theory that makes no such predictions is non-scientific.

These are not value judgements. It's just about demarcation, i.e. drawing a line between science and non-science.

For example, religious beliefs are not scientific.

Let's say a religious theory is that God exists. There is no experiment we can carry out, not even in principle, that would prove the non-existence of God, and therefore this theory is not scientific.

Feynman said there's nothing wrong with love, but love's no science.

I think people should know this about mainstream economics. Fundamentally, it has not yet fully entered the scientific age.

Like Geoff West said recently, economics hasn't had an Einstein because it hasn't had a Galileo yet.