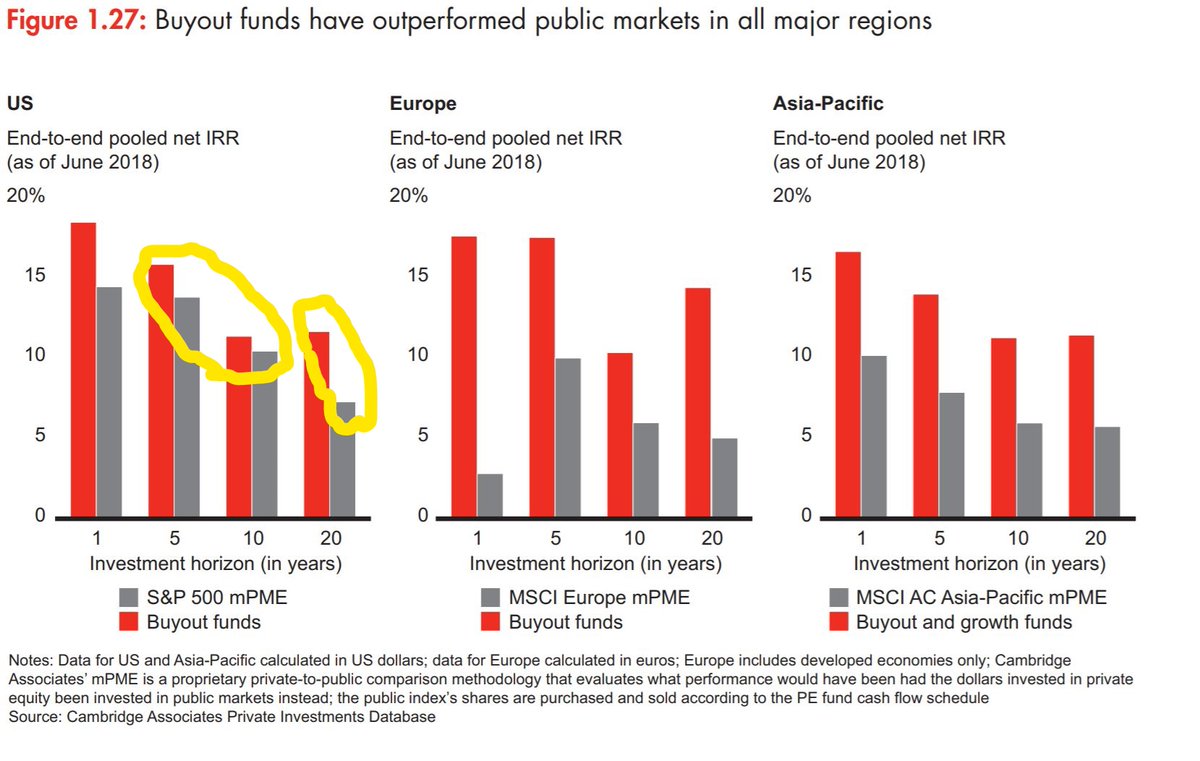

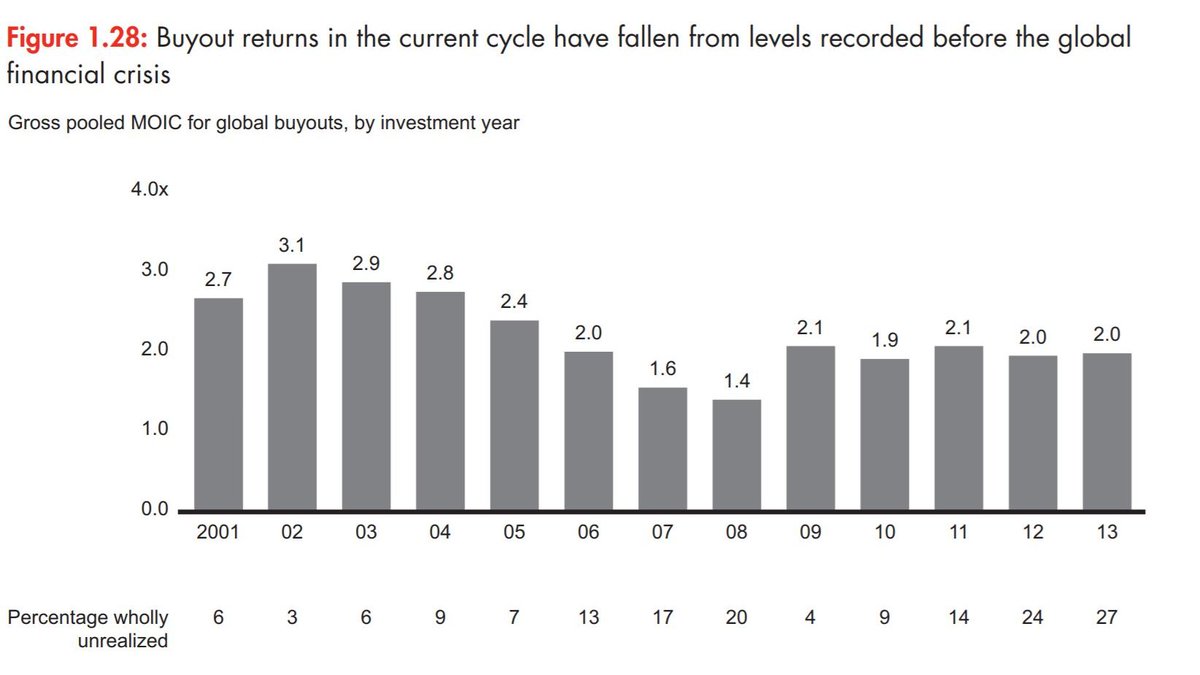

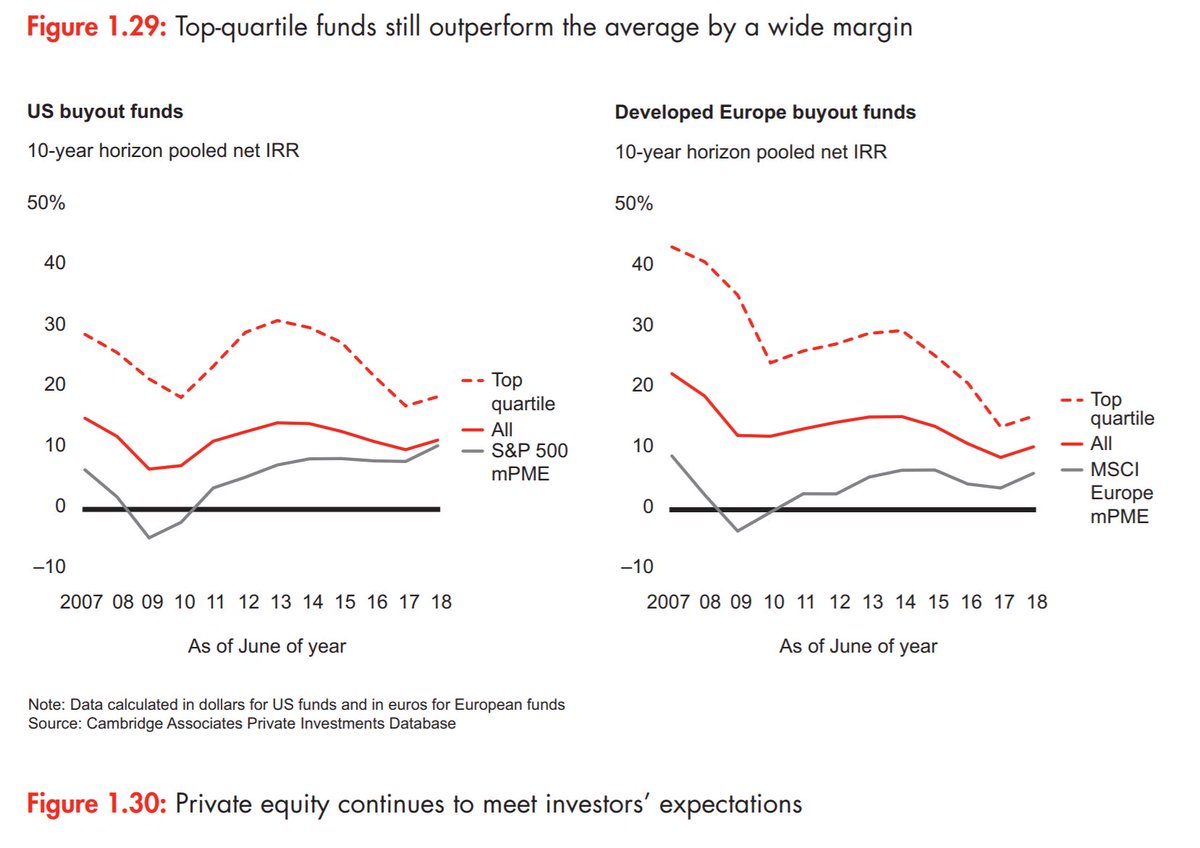

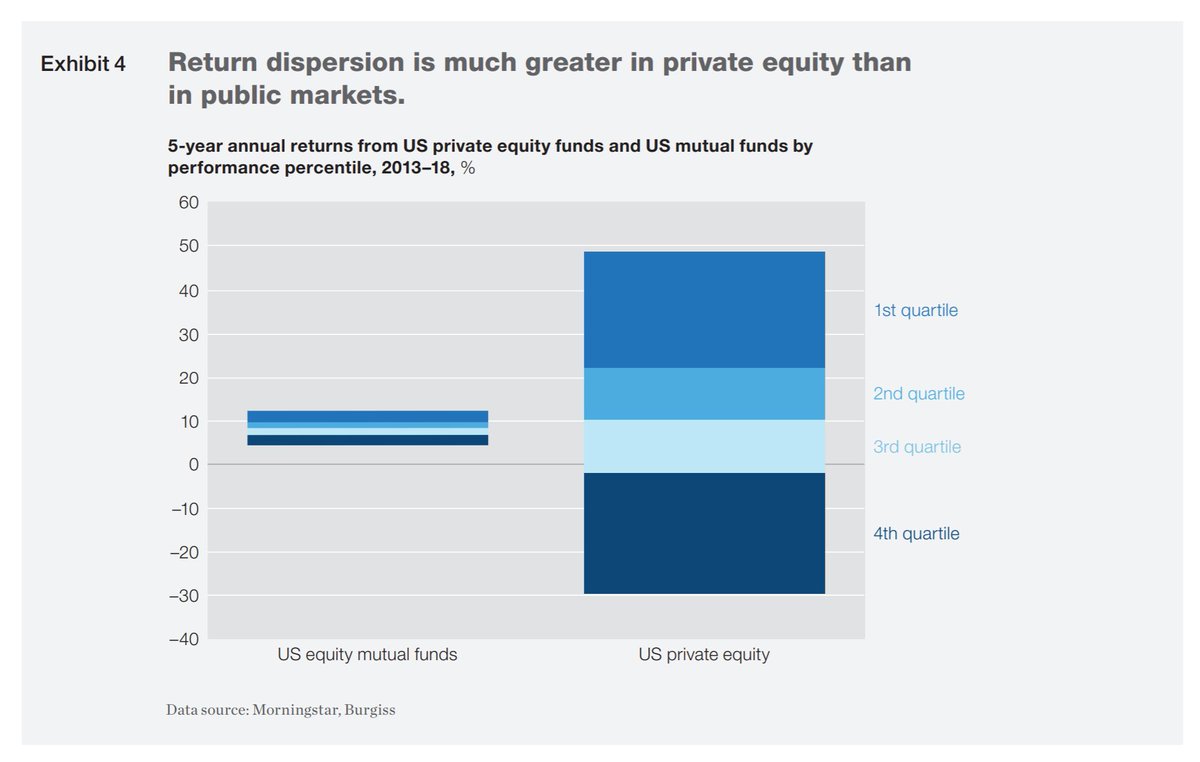

TL;DR: Returns vs. SP500 are compressing, there is a greater skill gap in PE vs. public equity which is wild and I suspect allocators stay focused on PE vs. public equities.

bain.com/insights/topic…

threader.app/thread/1109093…

Even so, looks like there is a larger skill gap in private equity vs. public equity. Really surprising.