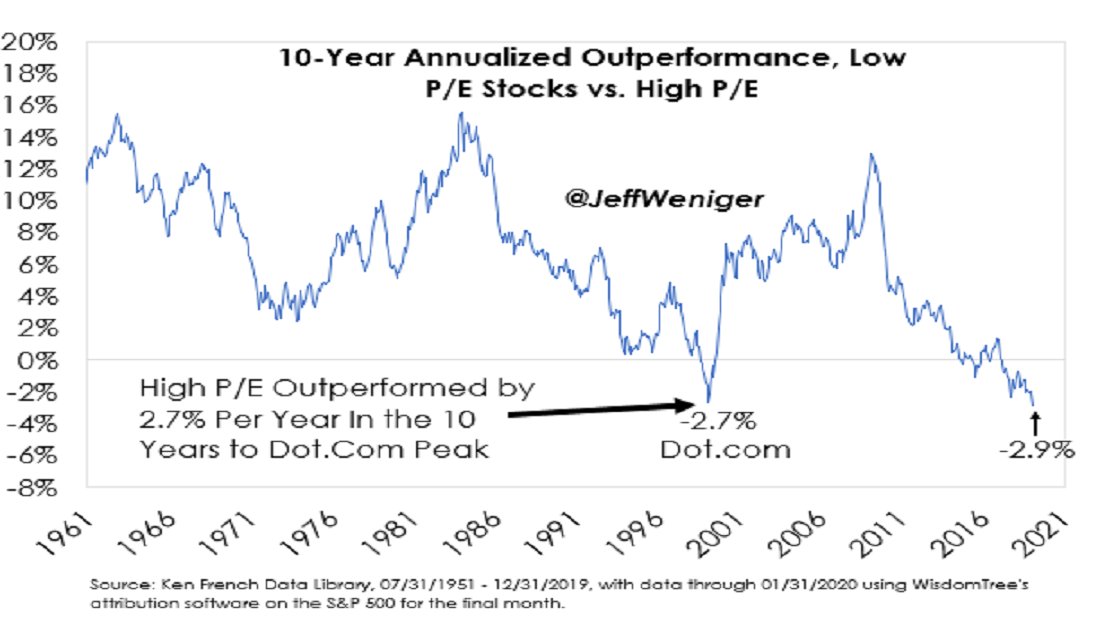

High P/E stocks beat Low P/E more in the last 10 years than they did in the 10 years to the Dot.Com peak.

Never thought I'd see such a thing.

-

But the studies by Prof. Siegel & my colleague @JeremyDSchwartz, 1957-2019, show this is anomalous.

-

Only one other time: the 1990s Tech bubble, which gave way, hard, to Value stocks, 2000-2007.