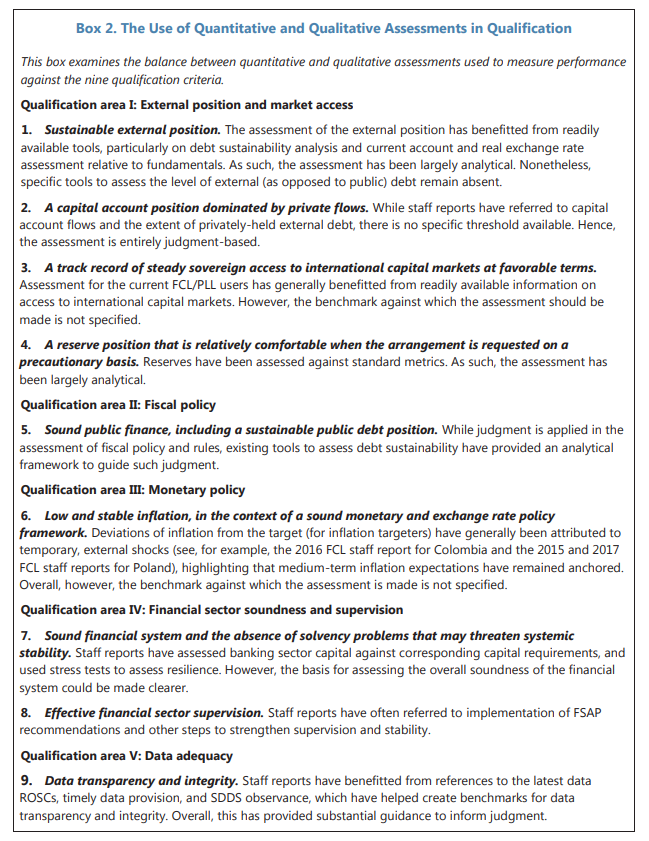

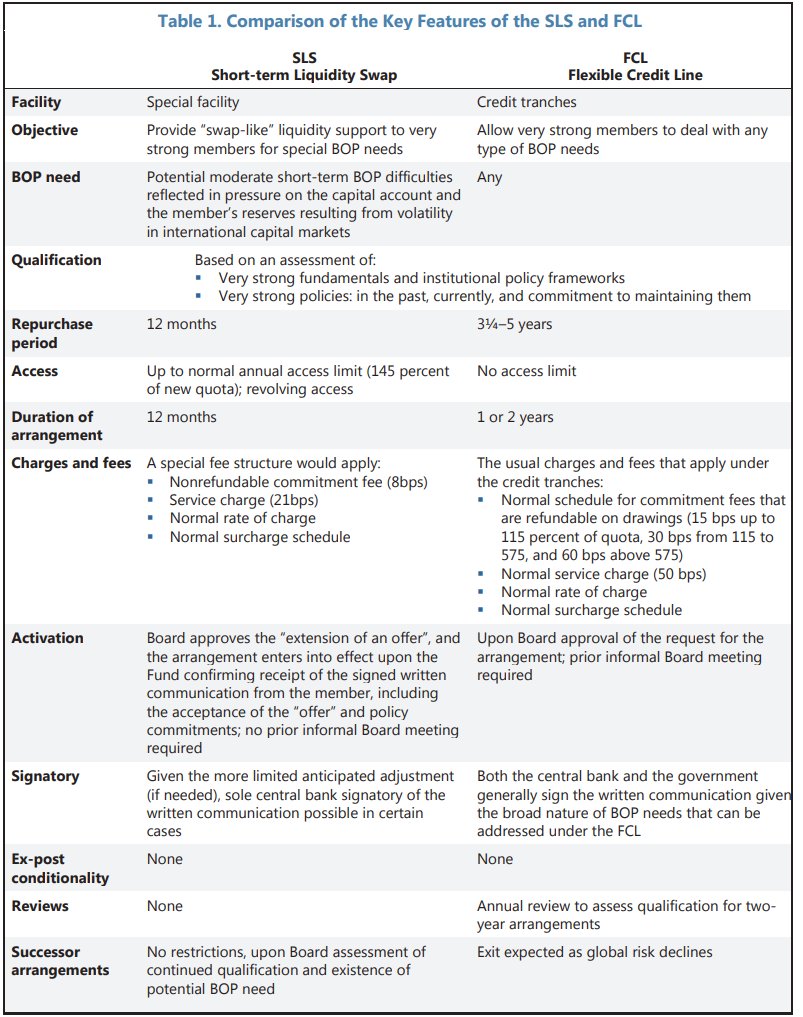

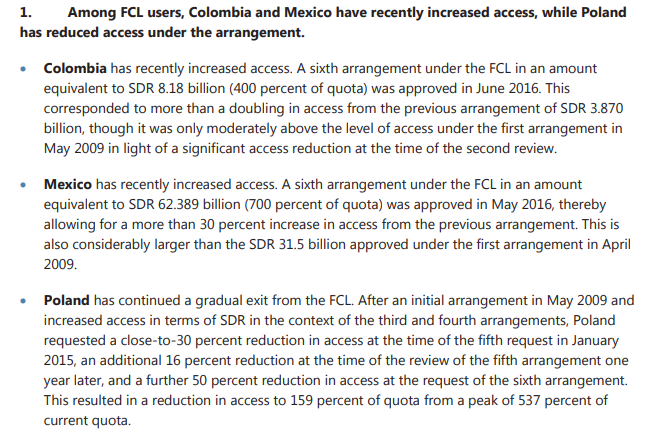

a. Flexible Credit Line, unlimited, but countries need to pre-qualify. So far Mexico, Poland, Colombia (just applied again to re-open) have used it.

Only one country has ever used it -- Morocco.

imf.org/en/Publication…

Looking forward to comments!

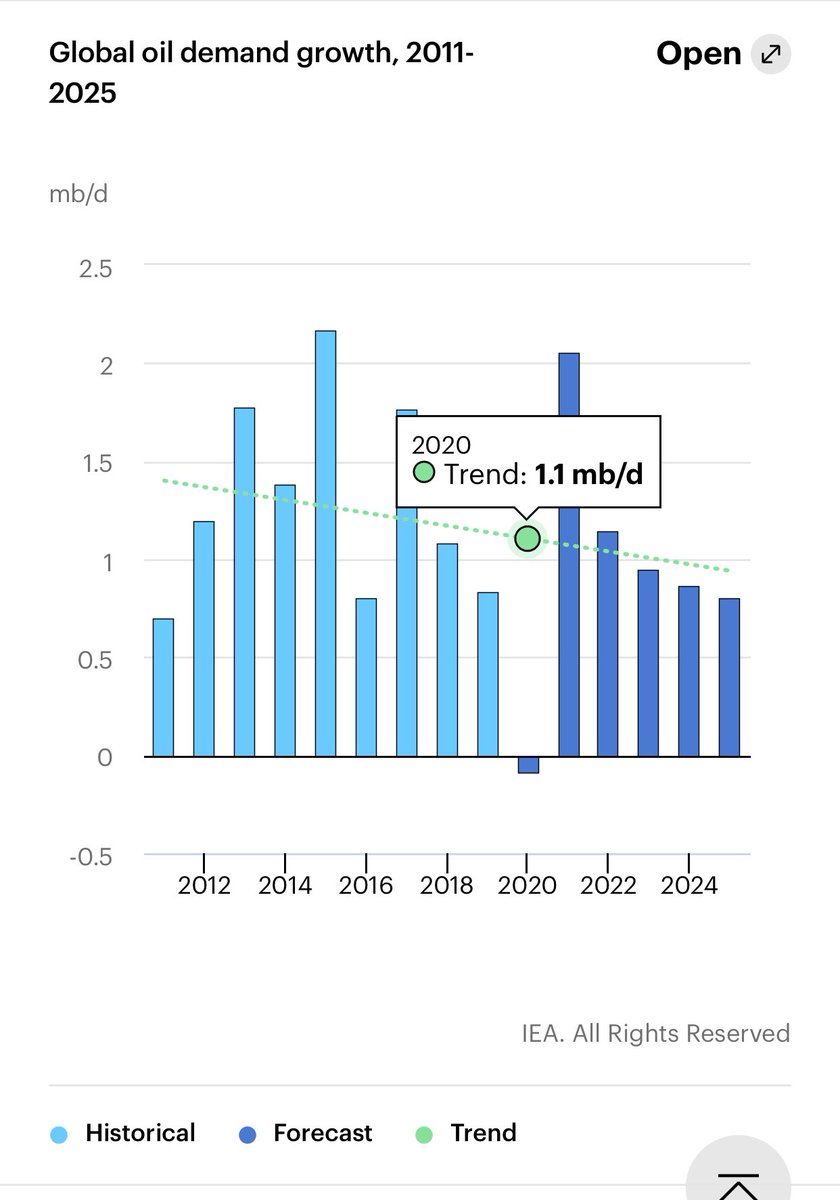

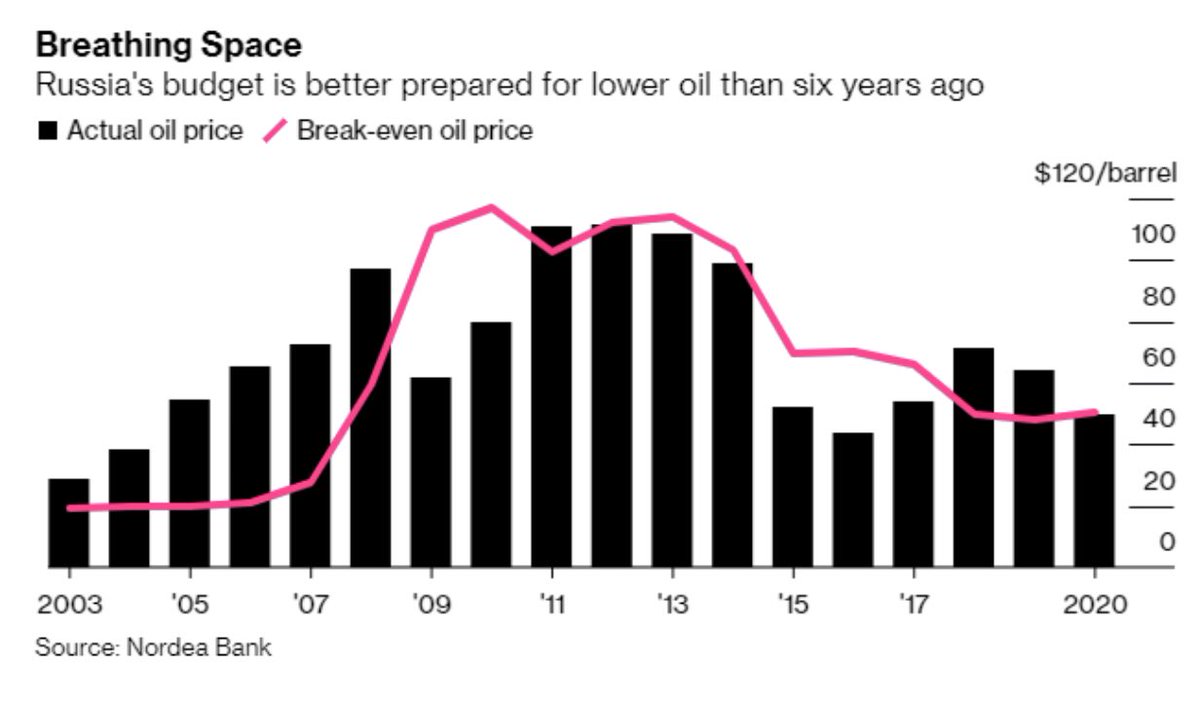

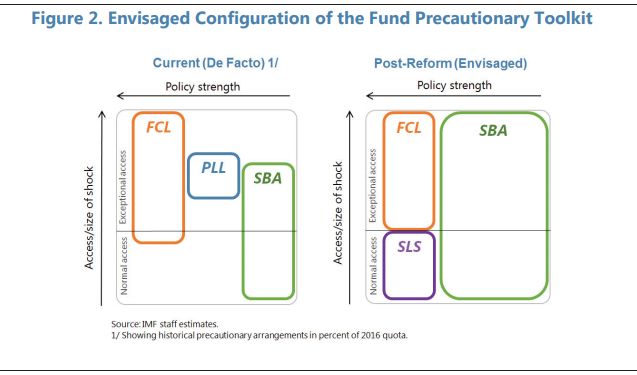

My key concern that many #EmergingMarkets and most FMs don't have reliable liquid CDS, especially in times of stress.

- allocation $100-$200bn.

- CDS spreads as criteria

- best borrowers 250 of quota

siepr.stanford.edu/research/publi…