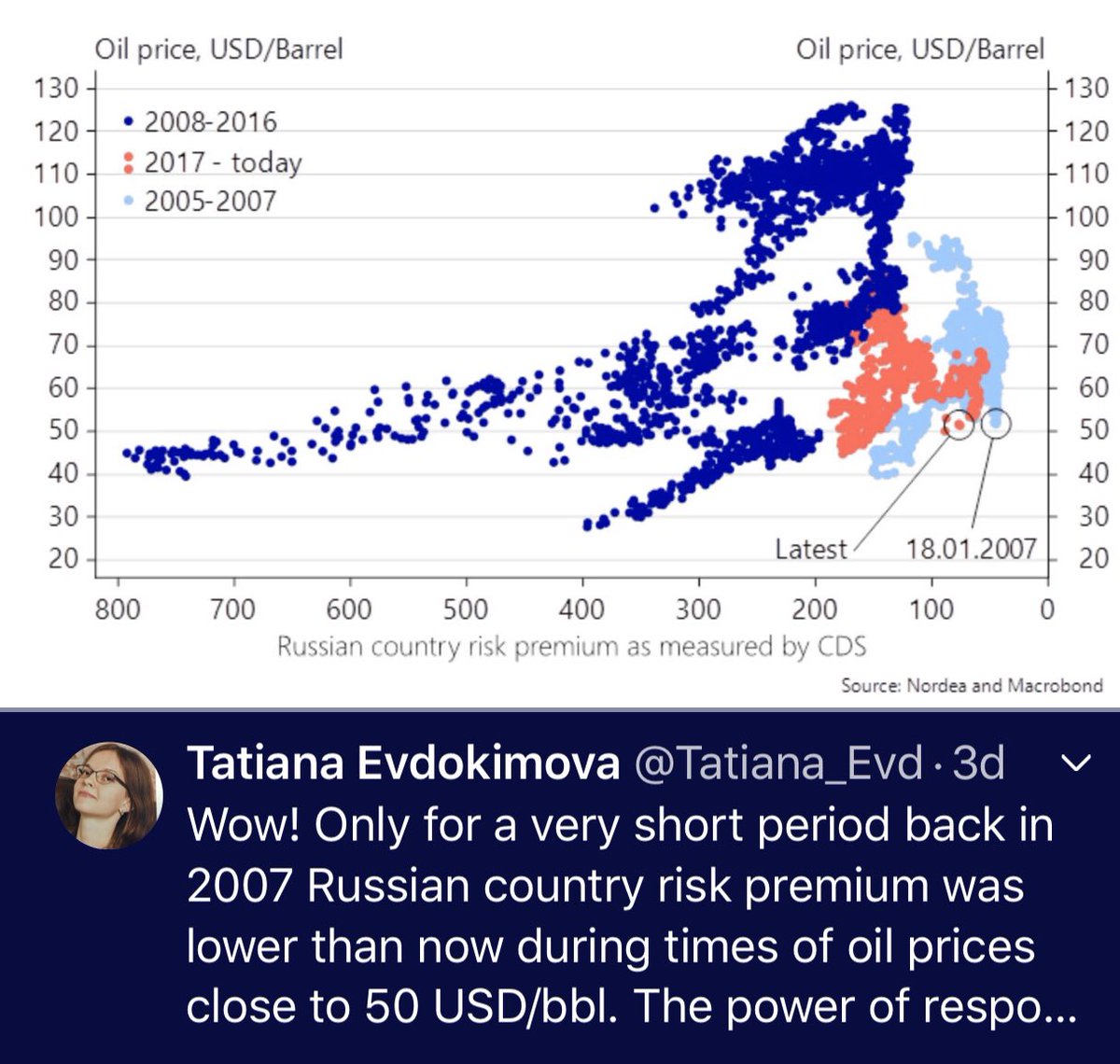

That’s why it is so hard to disentangle the 2014 effect. Both dry up external/budget funding.

A thread on Russia’s macro.

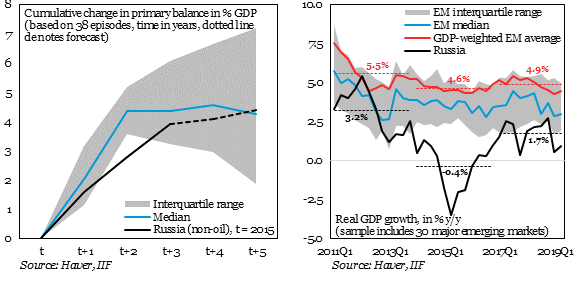

1/ it is one of the few counties with fiscal and current account surpluses.

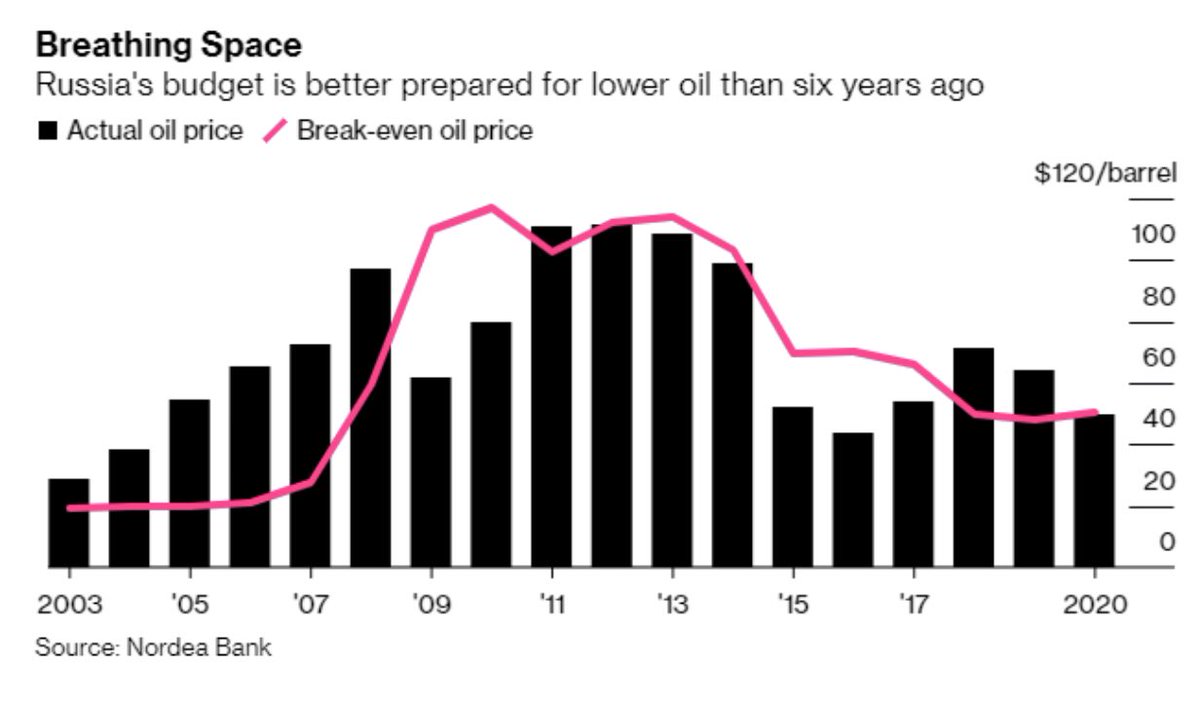

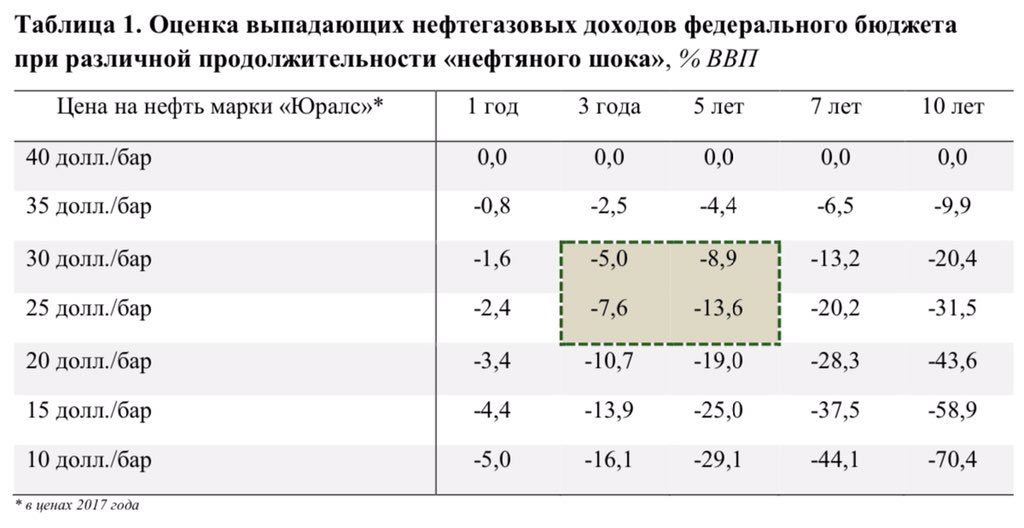

- At #oil $40 zero.

- At oil $25 2.4% of GDP if it lasts 1y.

@ru_minfin

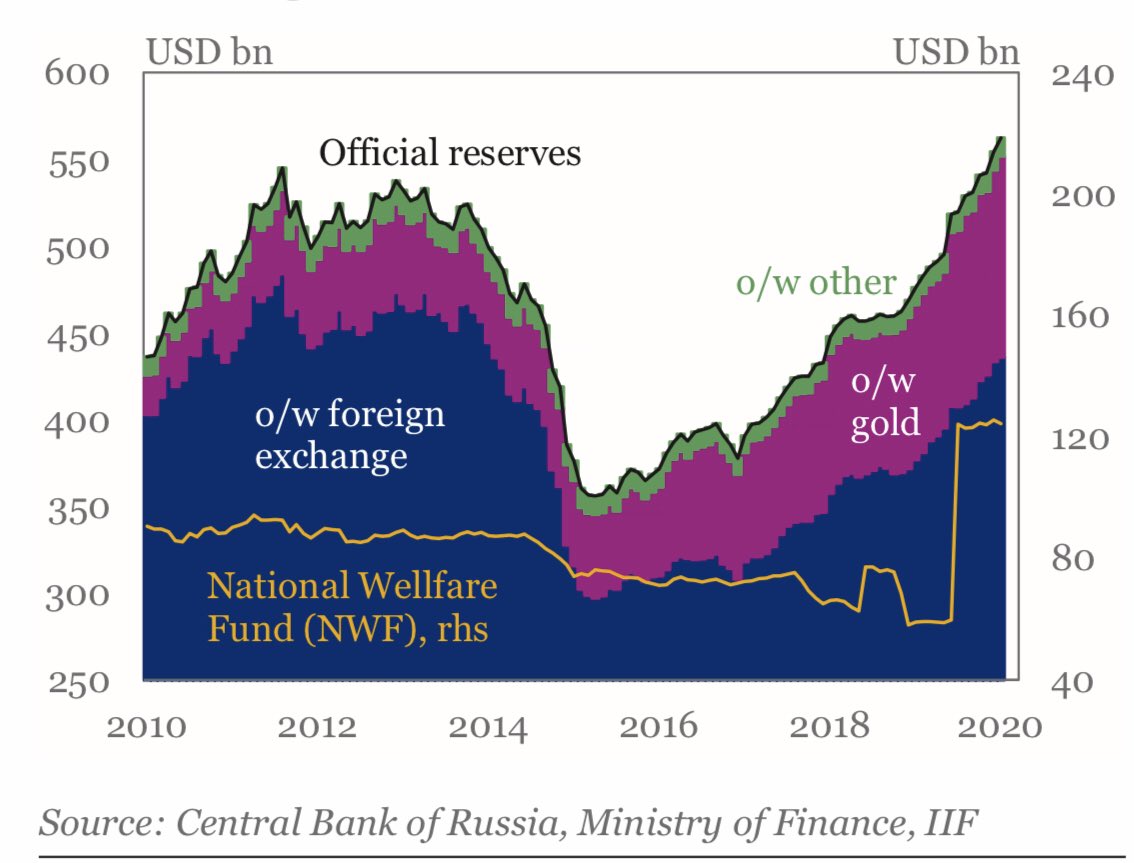

Only the liquid part of Russia’s National Wealth Fund is about 7% of GDP.

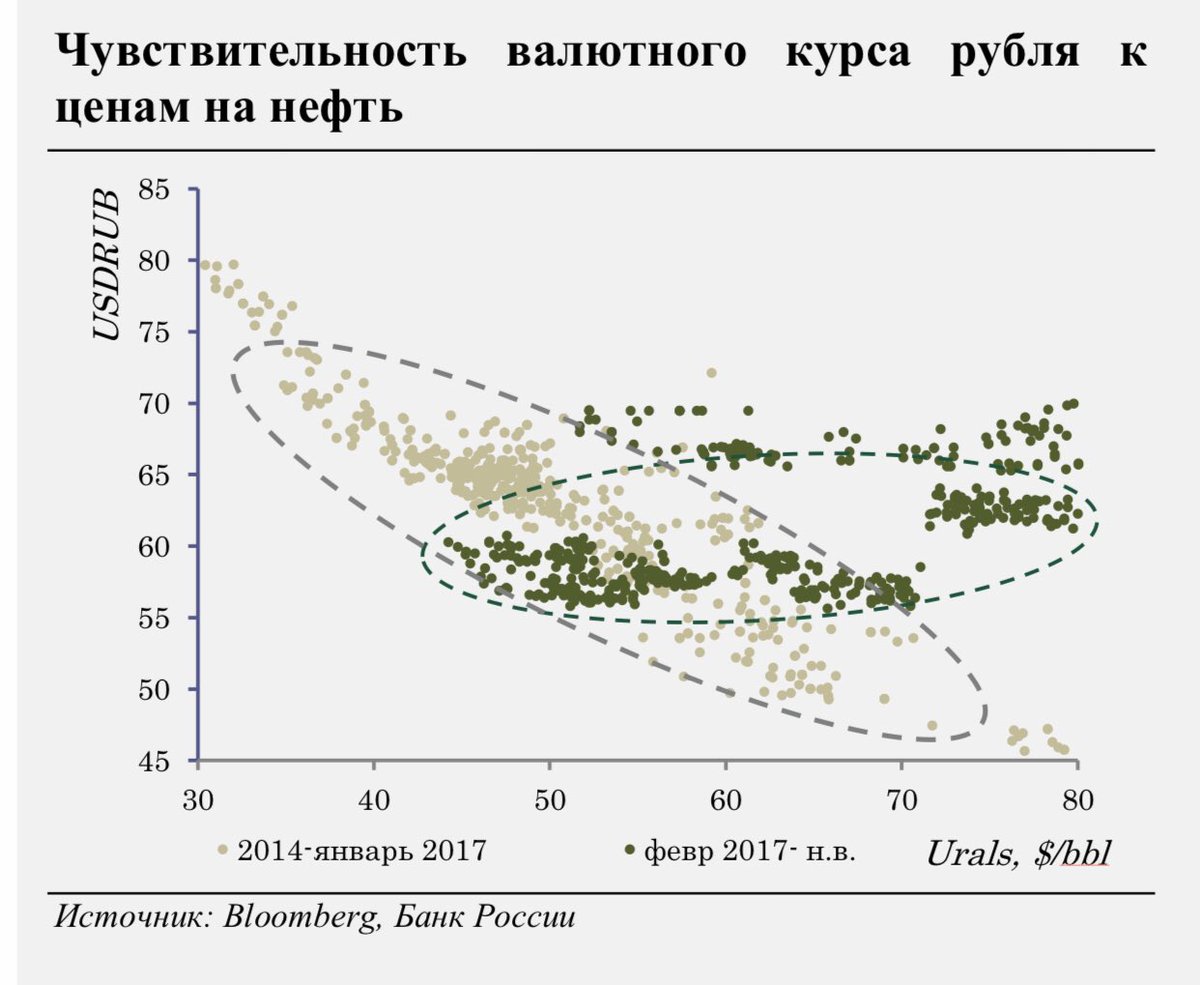

the budget gains automatically from ruble depreciation as 36.7% (6.6% of GDP) of total revenues come from oil and gas and are priced in $.

Ruble/oil 2014-2017 vs 2017-present

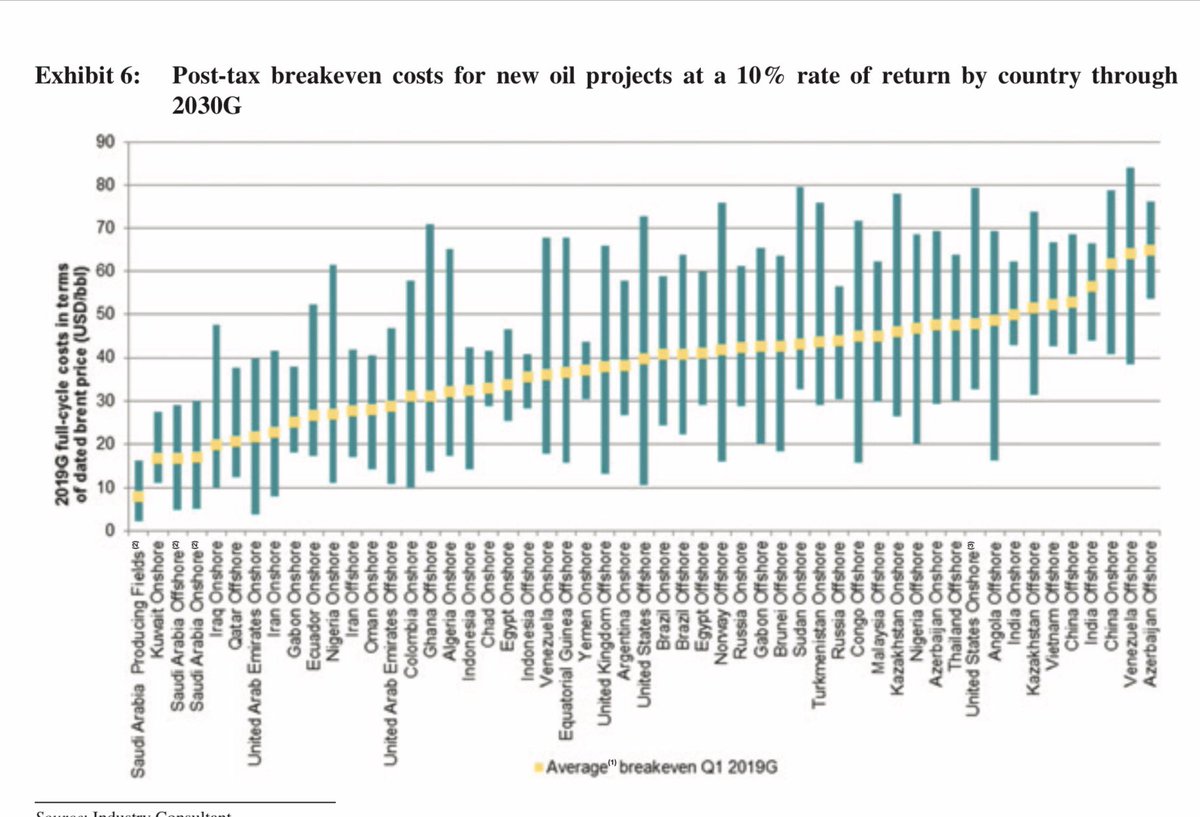

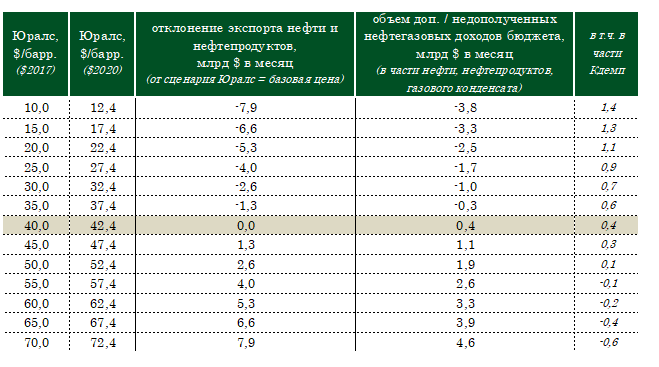

Russia may sell about $1bn per month with oil at $32.4

The rule is the loss of revenues from oil price below 42.4 is compensated from the sovereign wealth fund.

The fund is now $150bn (9% of GDP)

@ru_minfin

minfin.ru/ru/press-cente…

The rule is the loss of revenues from oil price below 42.4 is compensated from the sovereign wealth fund.

The fund is now $150bn (9% of GDP)

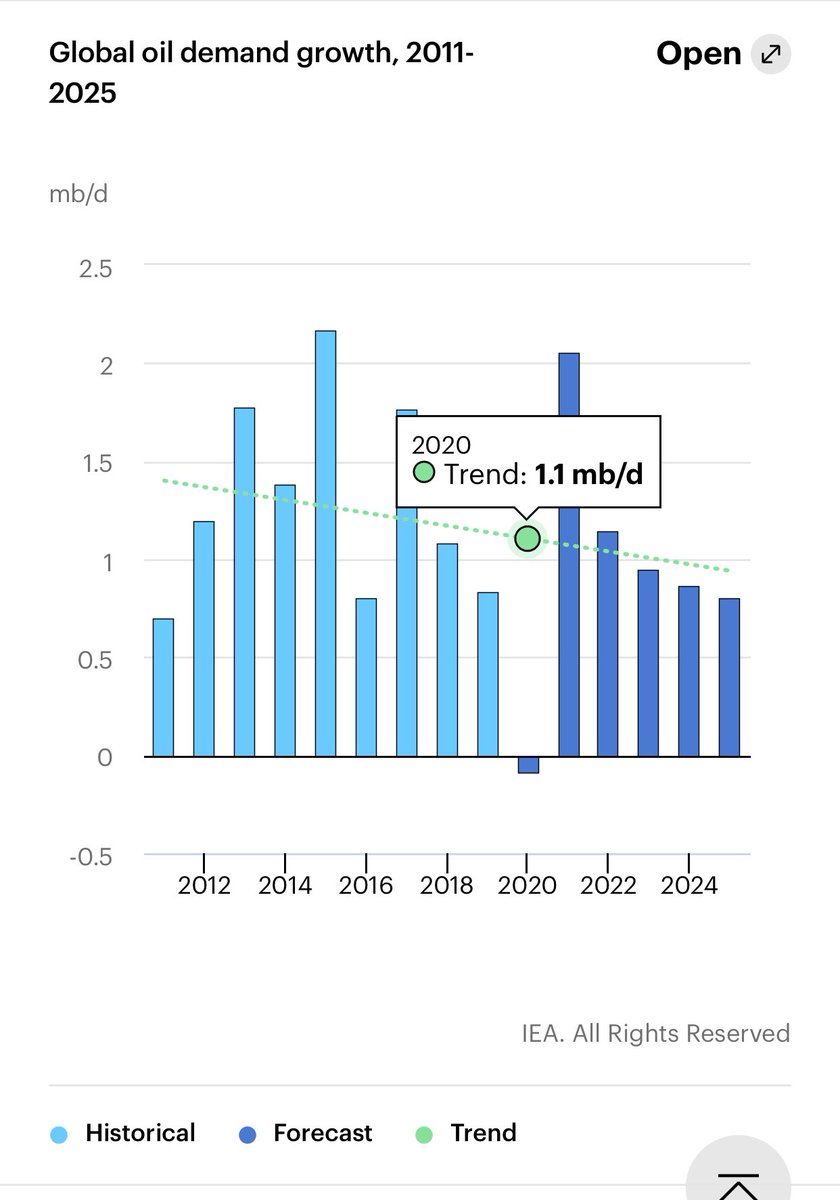

6-10 years at $25-30 maybe is somewhat exaggerated, but makes a point

@ru_minfin