Football clubs generate most of their cash from revenue they earn from gate receipts, TV deals, prize money, sponsorship and merchandising, but often they need additional financing, either from their owners or the banks. This thread looks at financing in the Premier League.

This analysis will cover the last five years from 2014/15 to 2018/19 (the last season when accounts are available), looking at the 20 clubs currently in the Premier League, i.e. including those promoted last season.

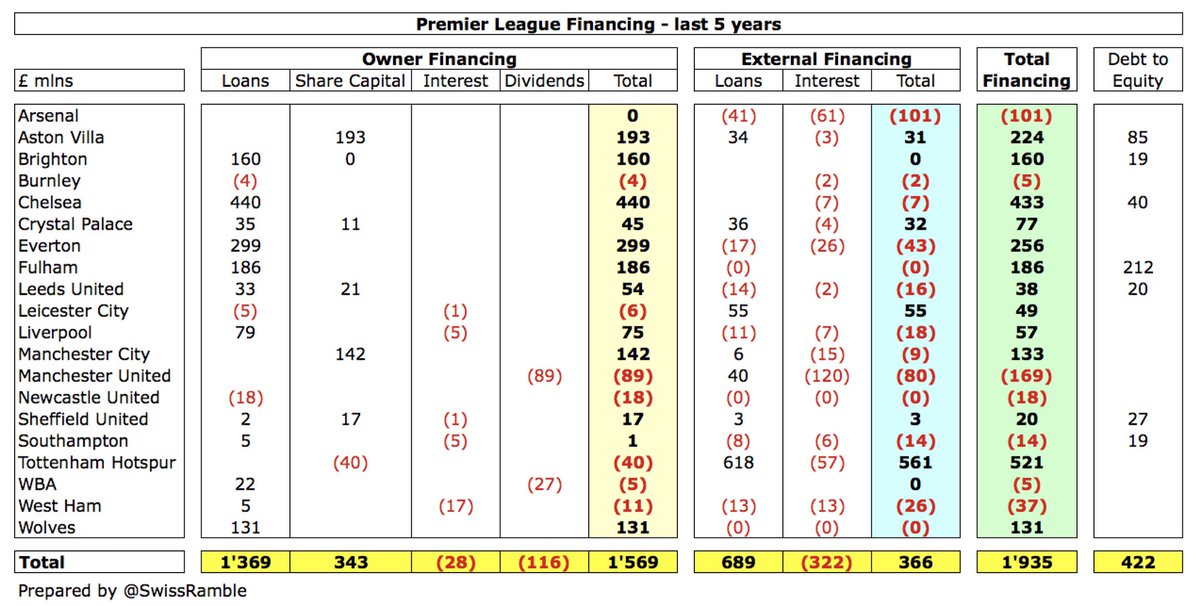

In the last 5 years, the 20 Premier League clubs have benefited from £1.9 bln net financing with most of the money coming from their owners £1,569m (81%) and another £366m (19%) sourced from banks. However, there is a big difference between business models at individual clubs.

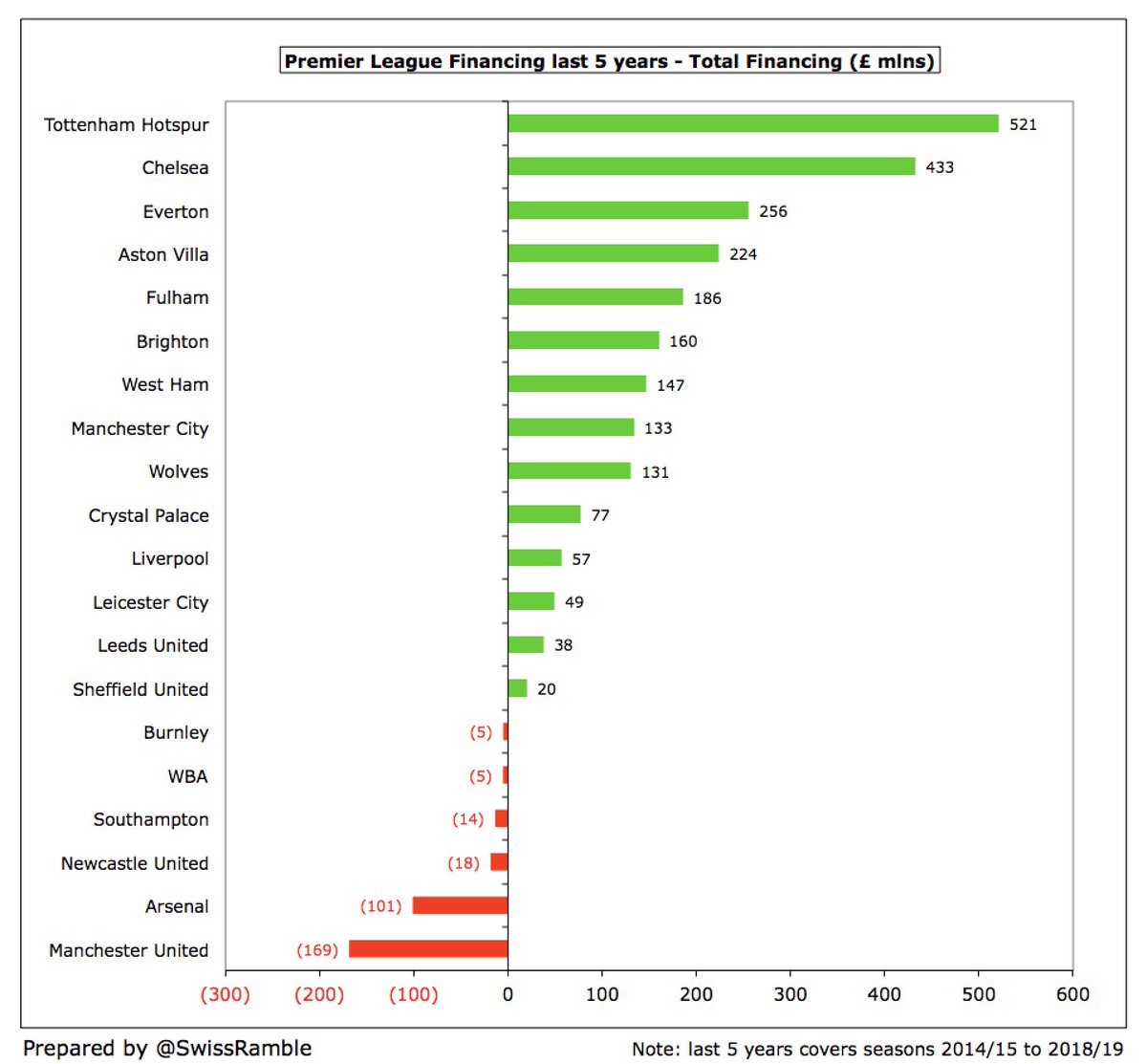

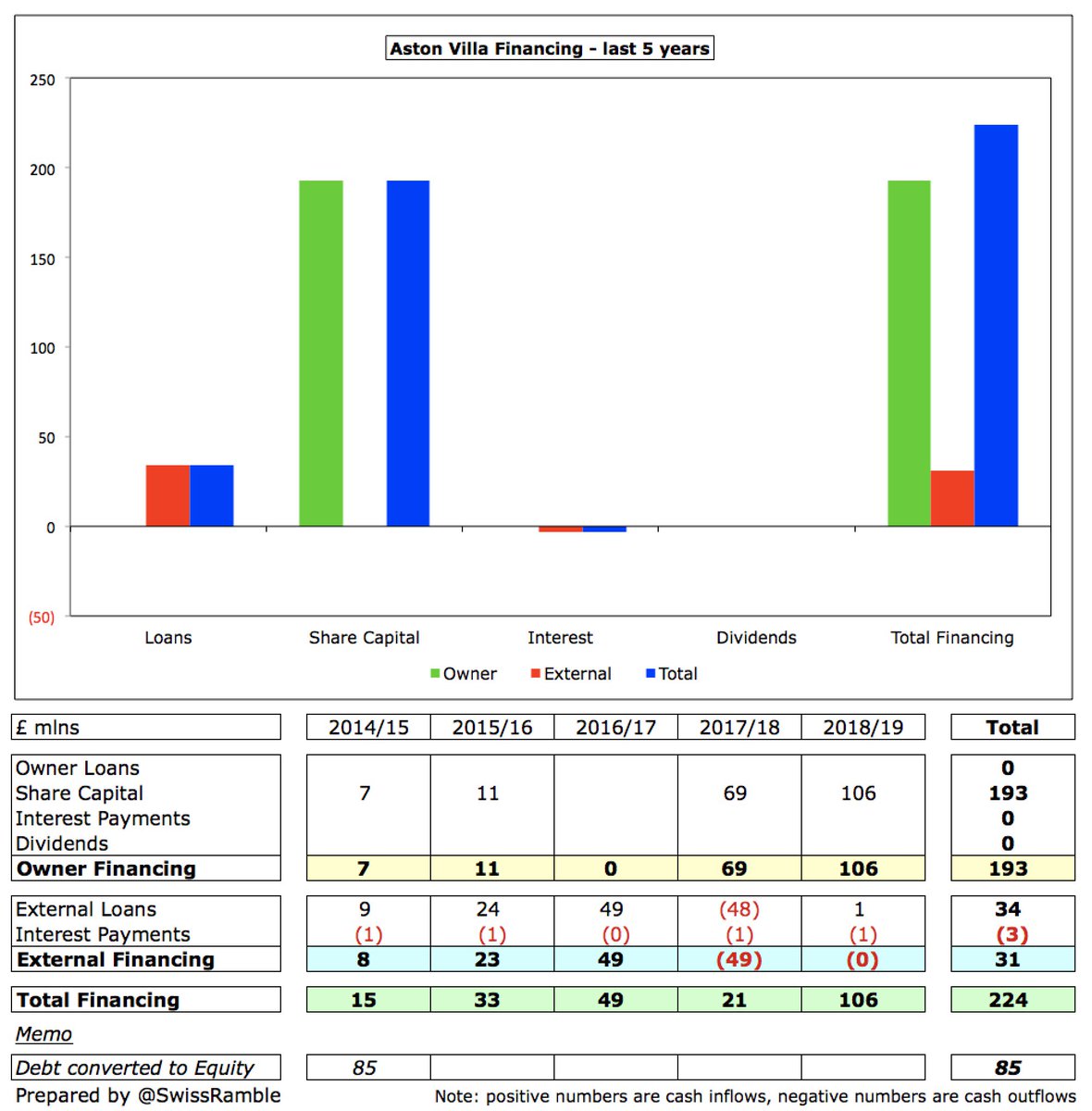

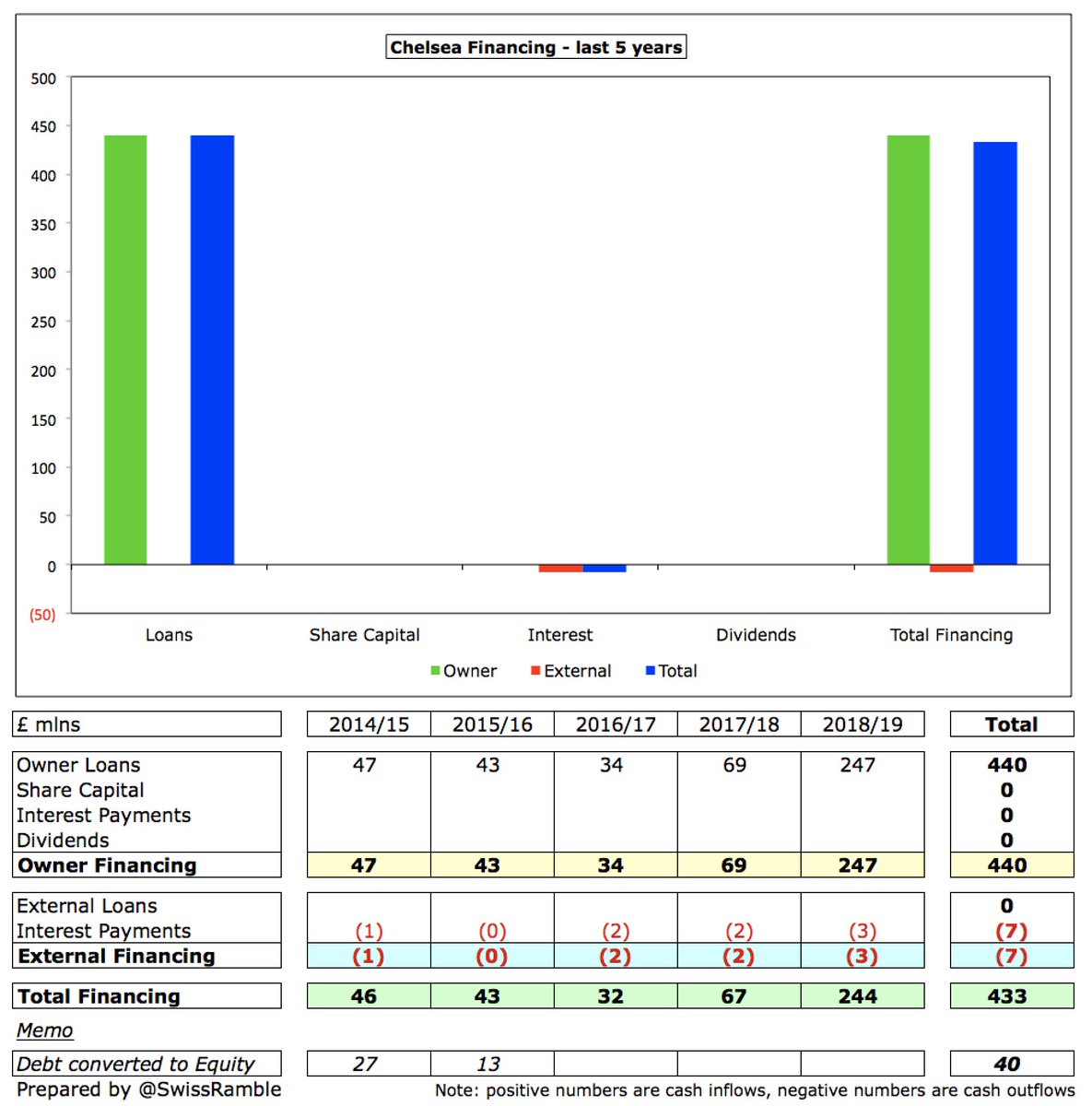

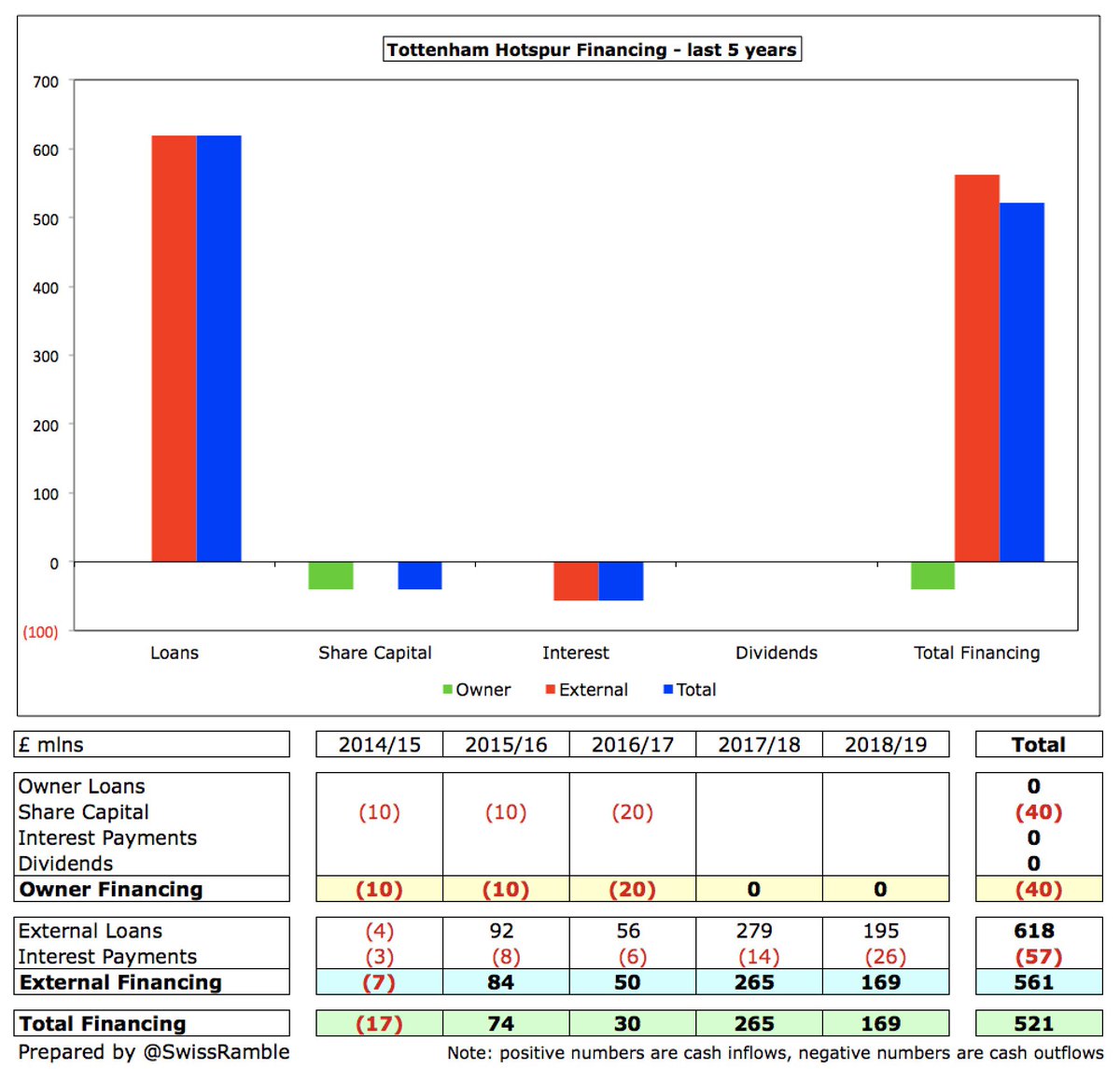

In terms of total financing, two clubs have received by far the most in the last 5 years, namely #THFC £521m and #CFC £433m, followed by #EFC £256m, #AVFC £224m and #FFC £186m. In stark contrast, #MUFC and #AFC had significant net cash outflows with £169m and £101m respectively.

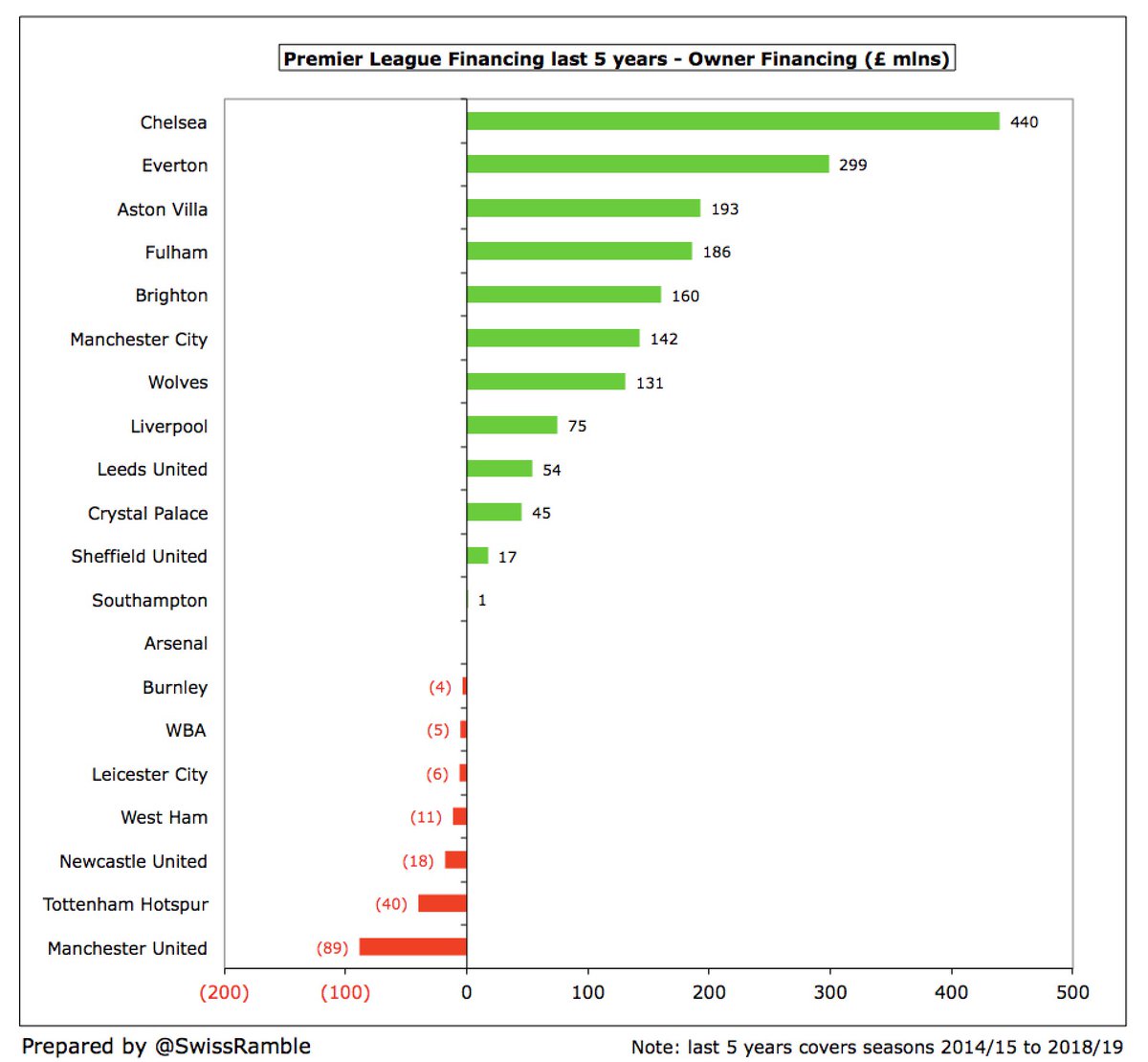

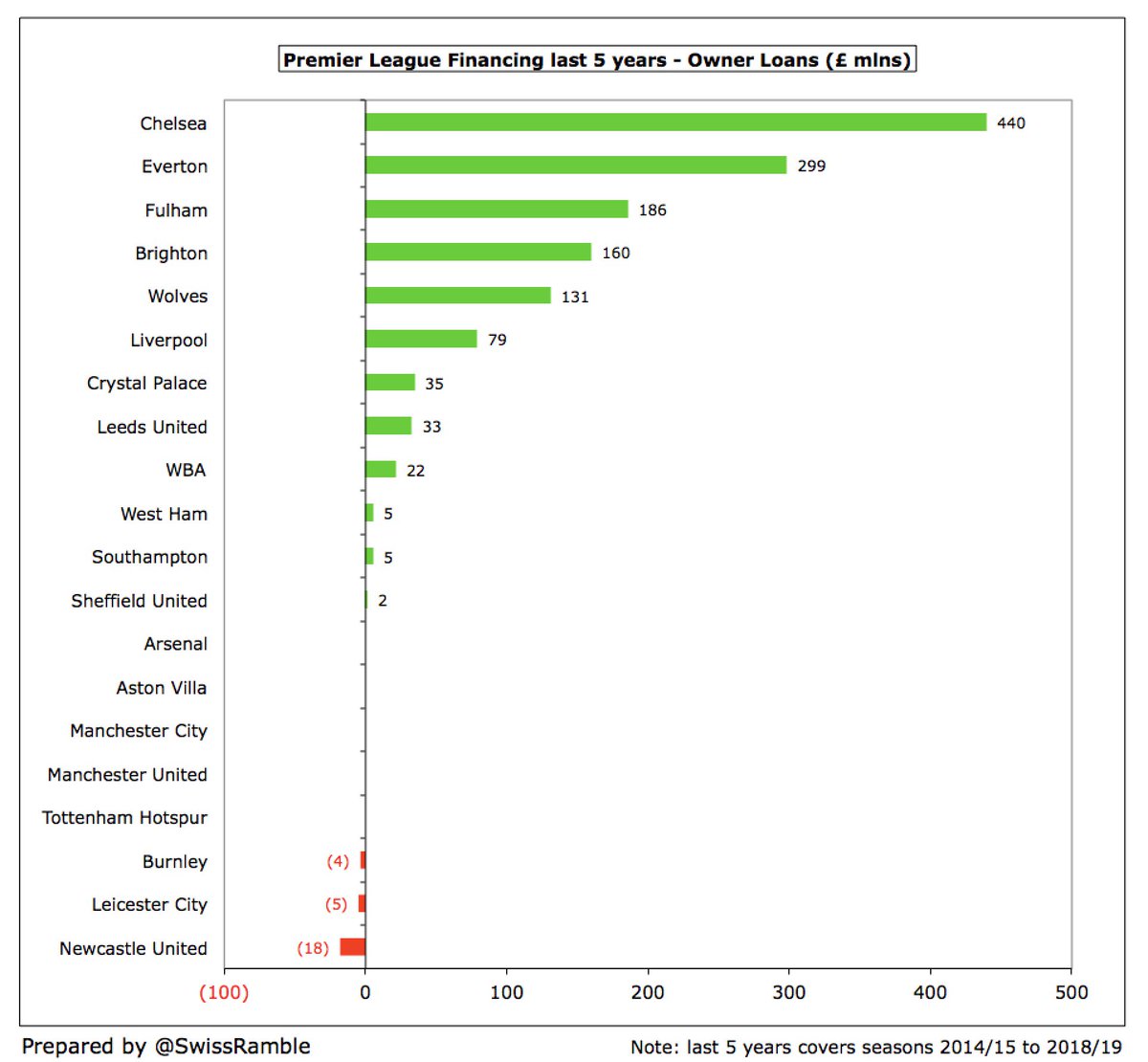

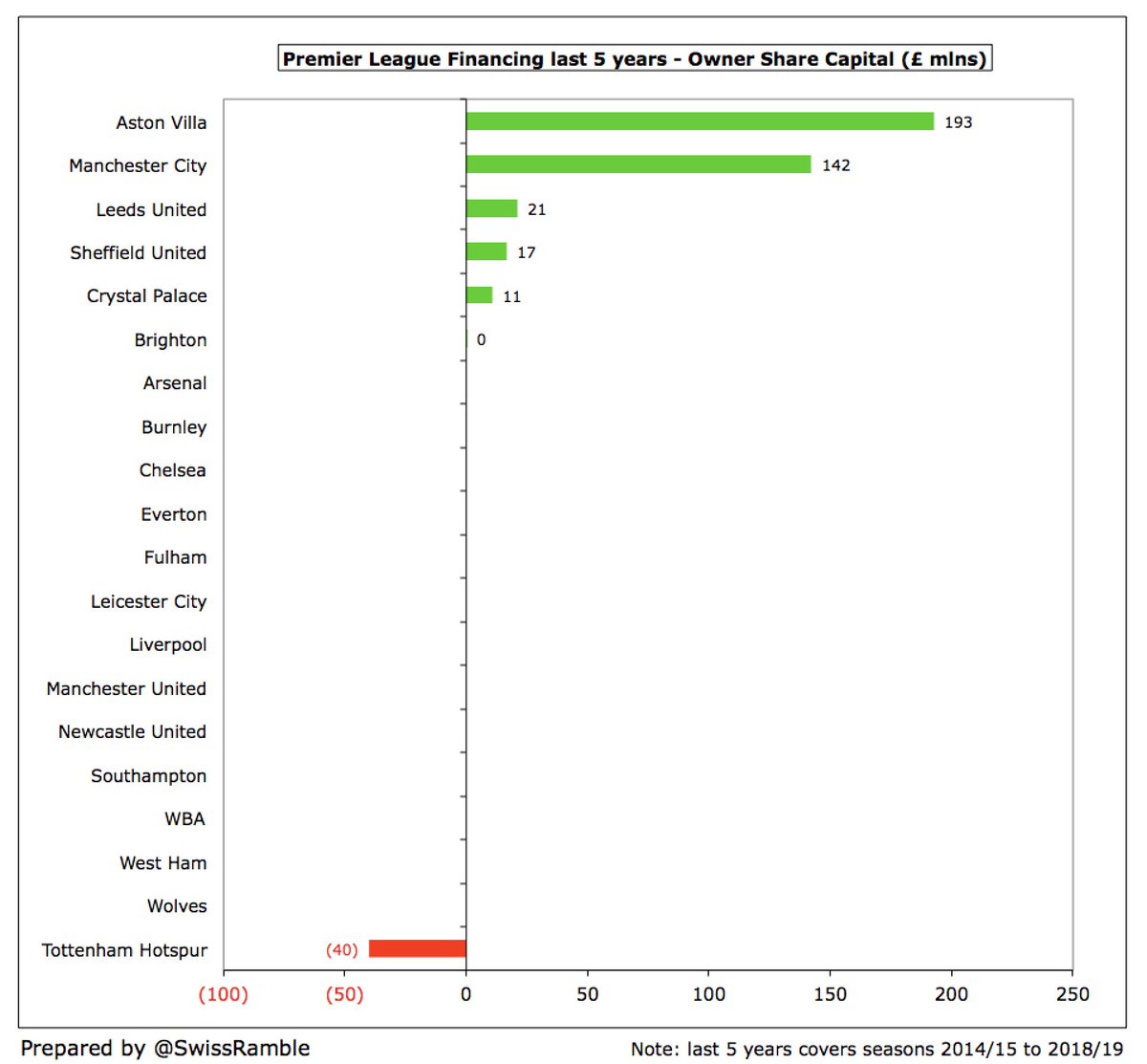

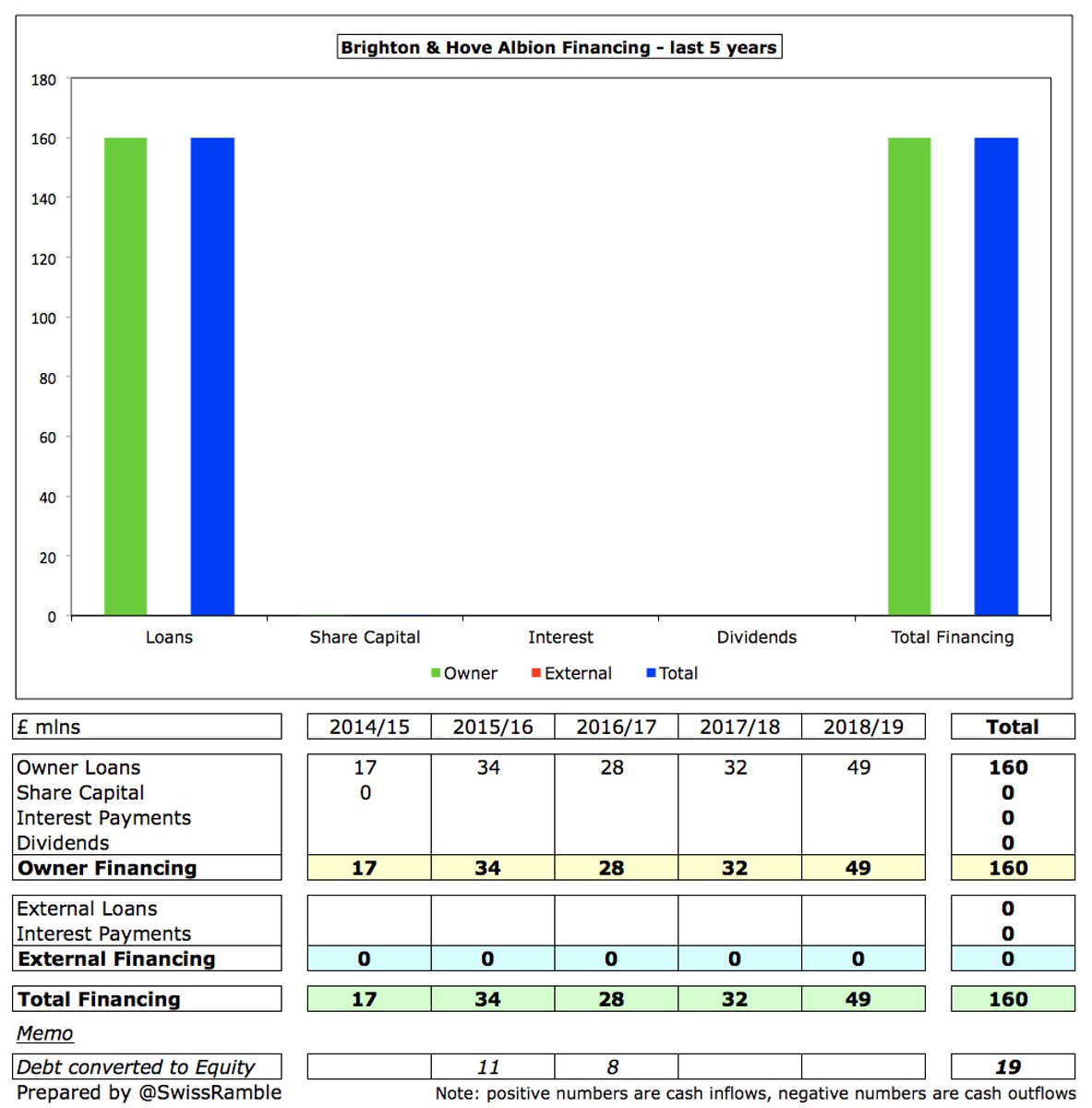

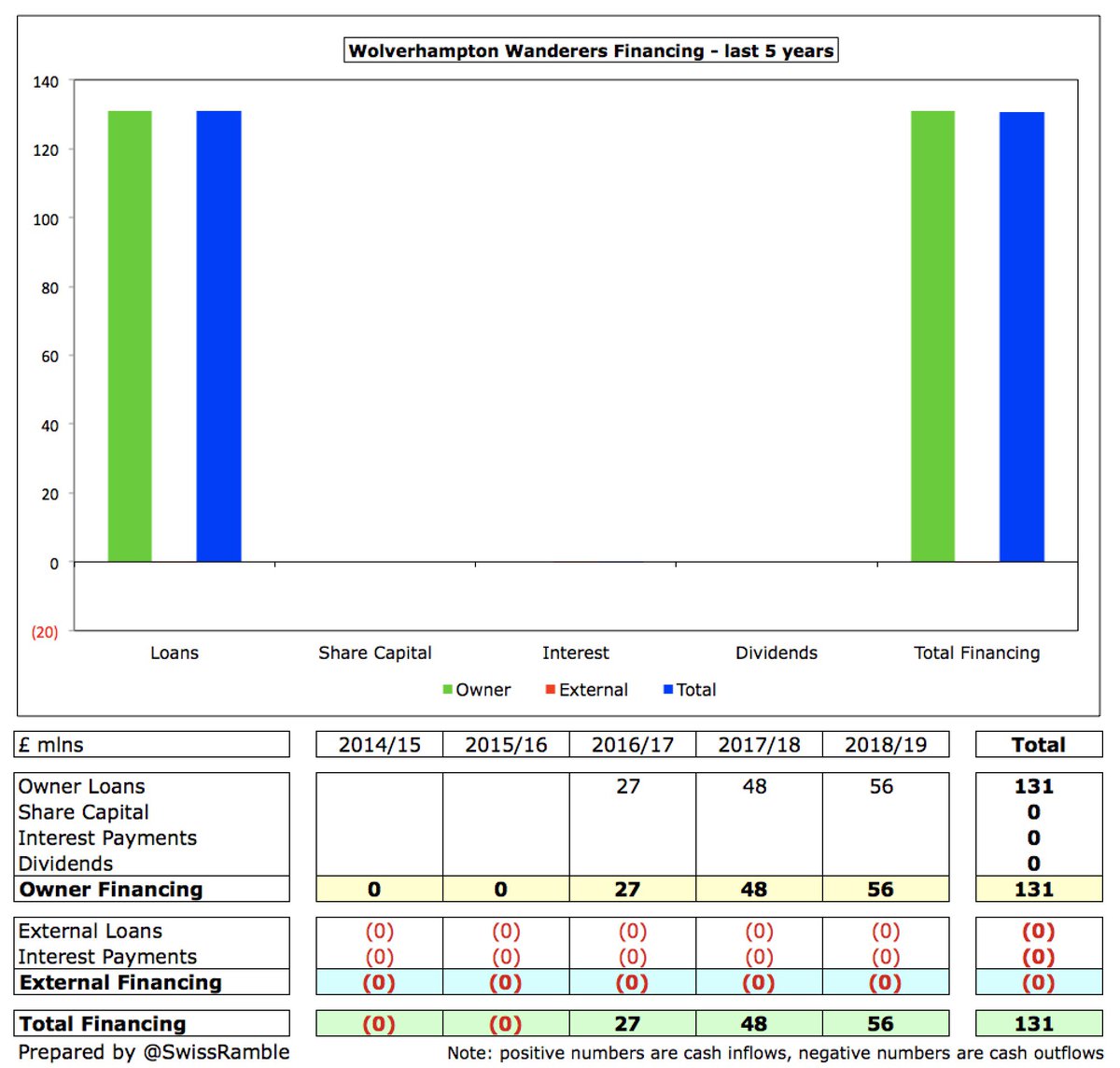

Seven clubs have benefited from more than £100m funding from their owners in the last 5 years. #CFC lead the way with £440m, followed by #EFC £299m, #AVFC £193m, #FFC £186m, #BHAFC £160m, #MCFC £142m and #WWFC £131m. On the other hand, #MUFC have paid £89m to their owners.

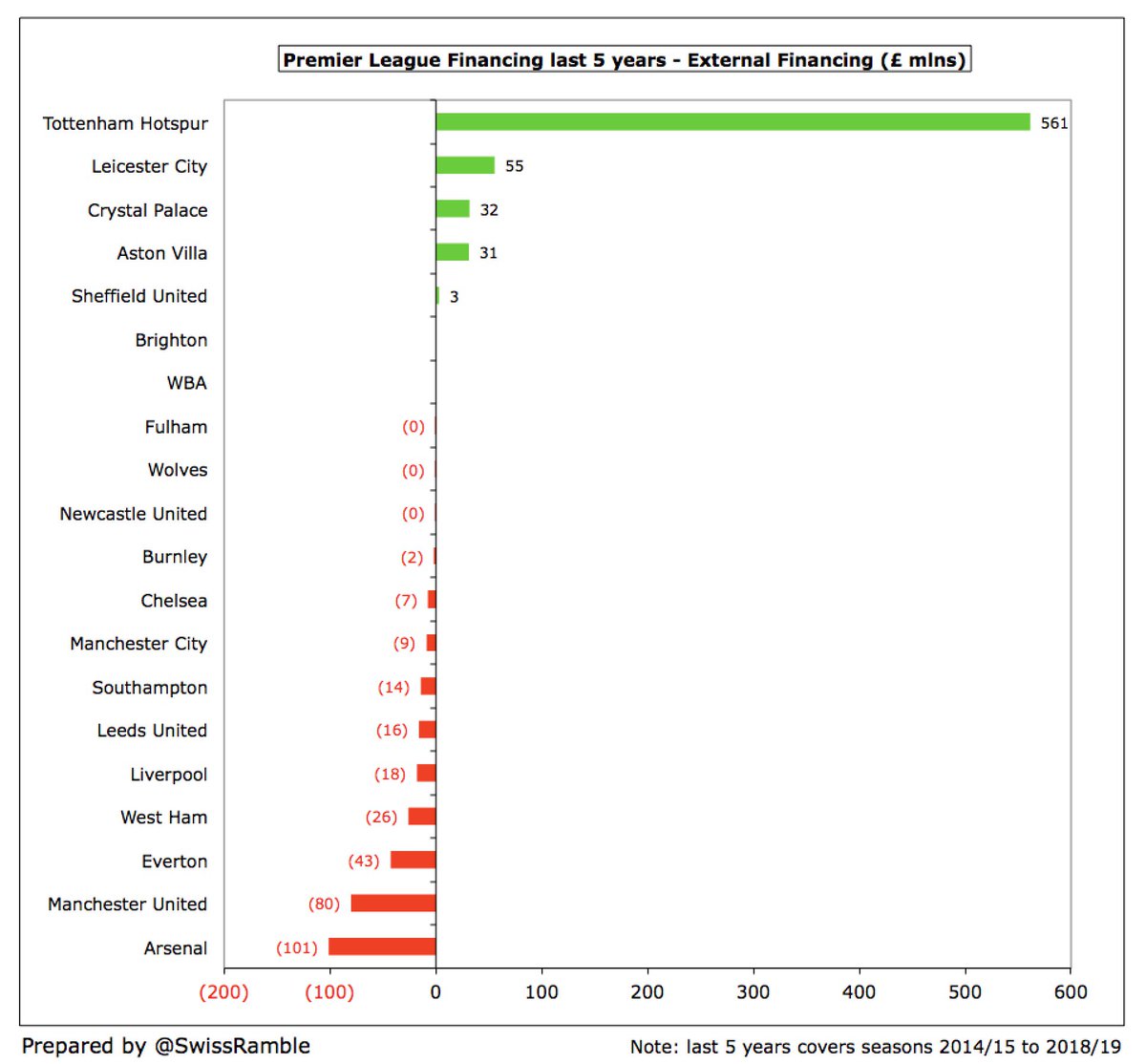

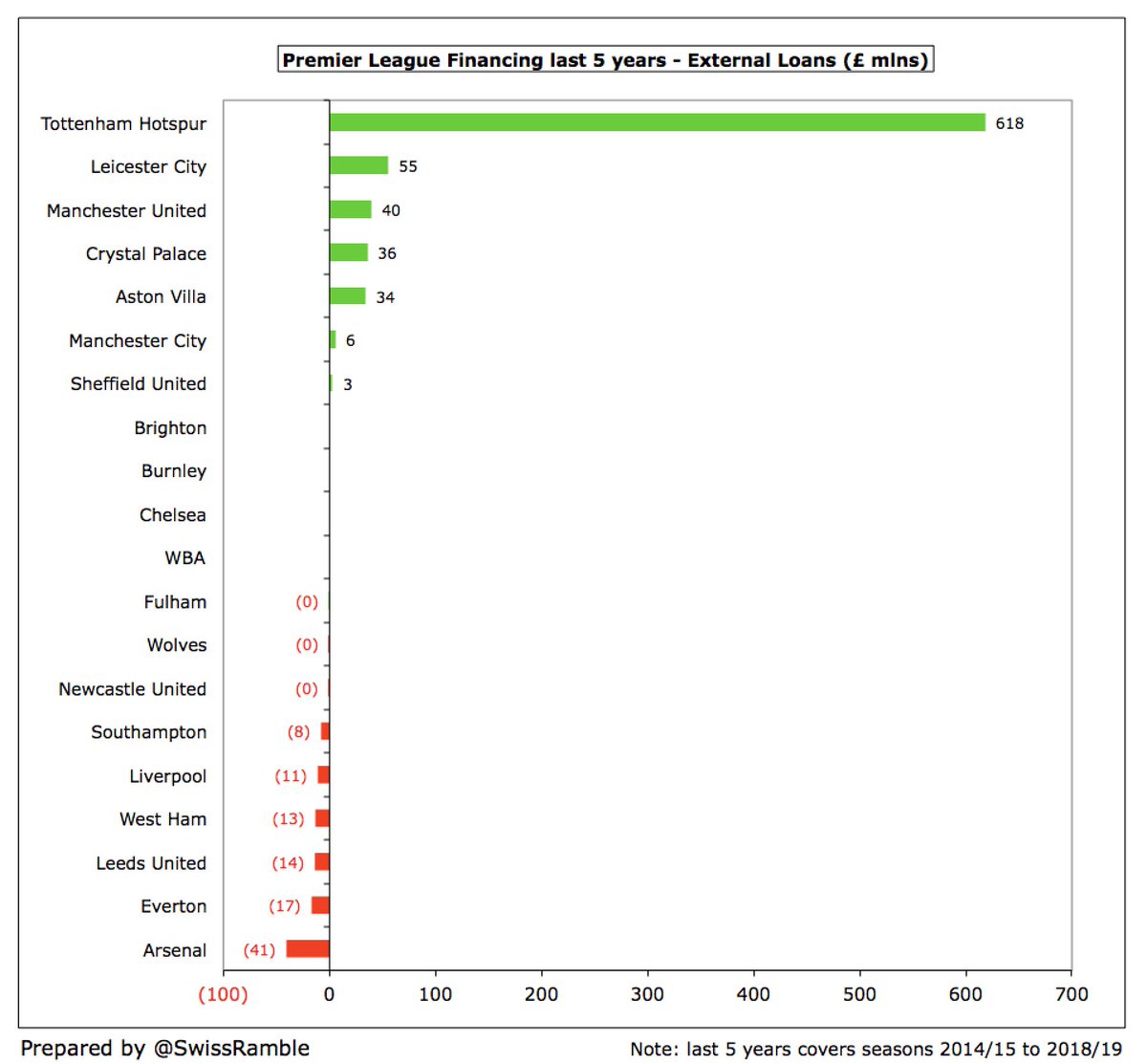

Almost all of the external financing has come at just one club, namely #THFC £561m, who have taken out huge loans to fund the construction of their new stadium. There were large net outflows, either debt repayments or interest payments, at #AFC £101m, #MUFC £80m and #EFC £43m.

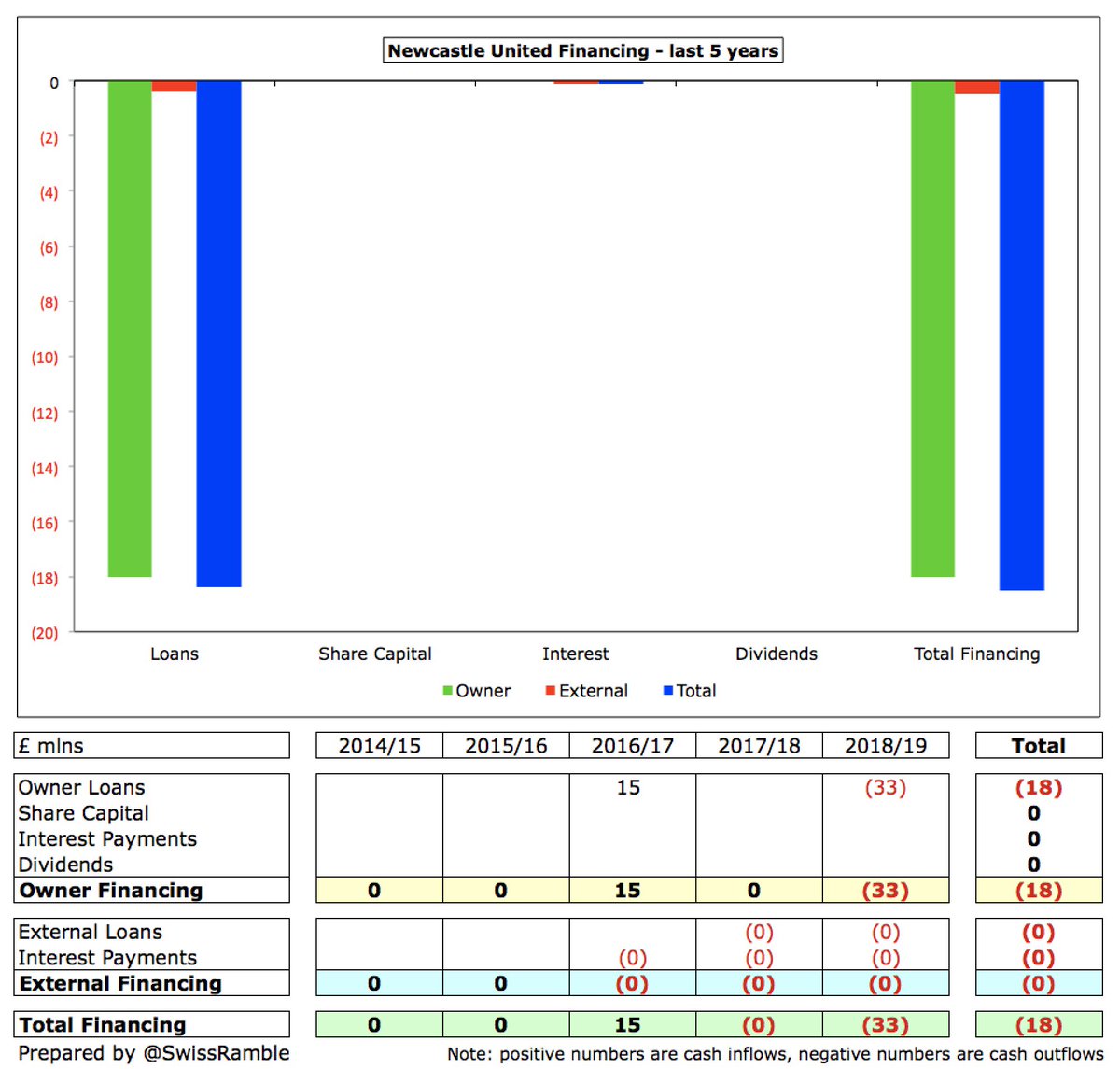

The largest loans provided by football club owners in the last 5 years were #CFC £440m, #EFC £299m, #FFC £186m, #BHAFC £160m, #WWFC £131m and #LFC £79m. These are net of any repayments made during the period. #NUFC repaid a net £18m to Mike Ashley.

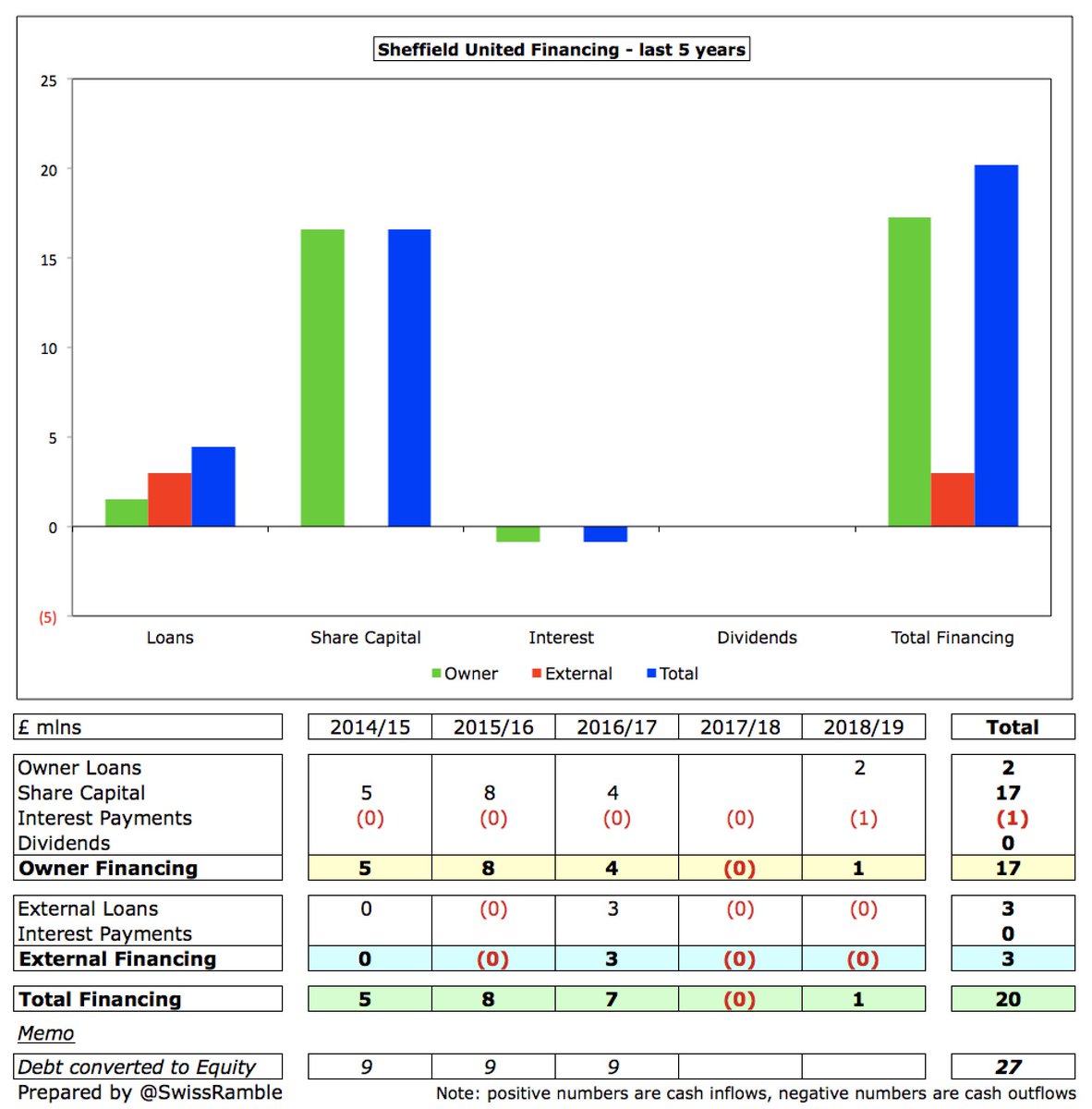

In addition, some owners have provided cash to their clubs in the form of additional share capital, mainly #AVFC £193m and #MCFC £142m, followed by #LUFC £21m, #SUFC £17m and #CPFC £11m. On the other hand, #THFC spent £40m to buy back preference shares between 2015 and 2017.

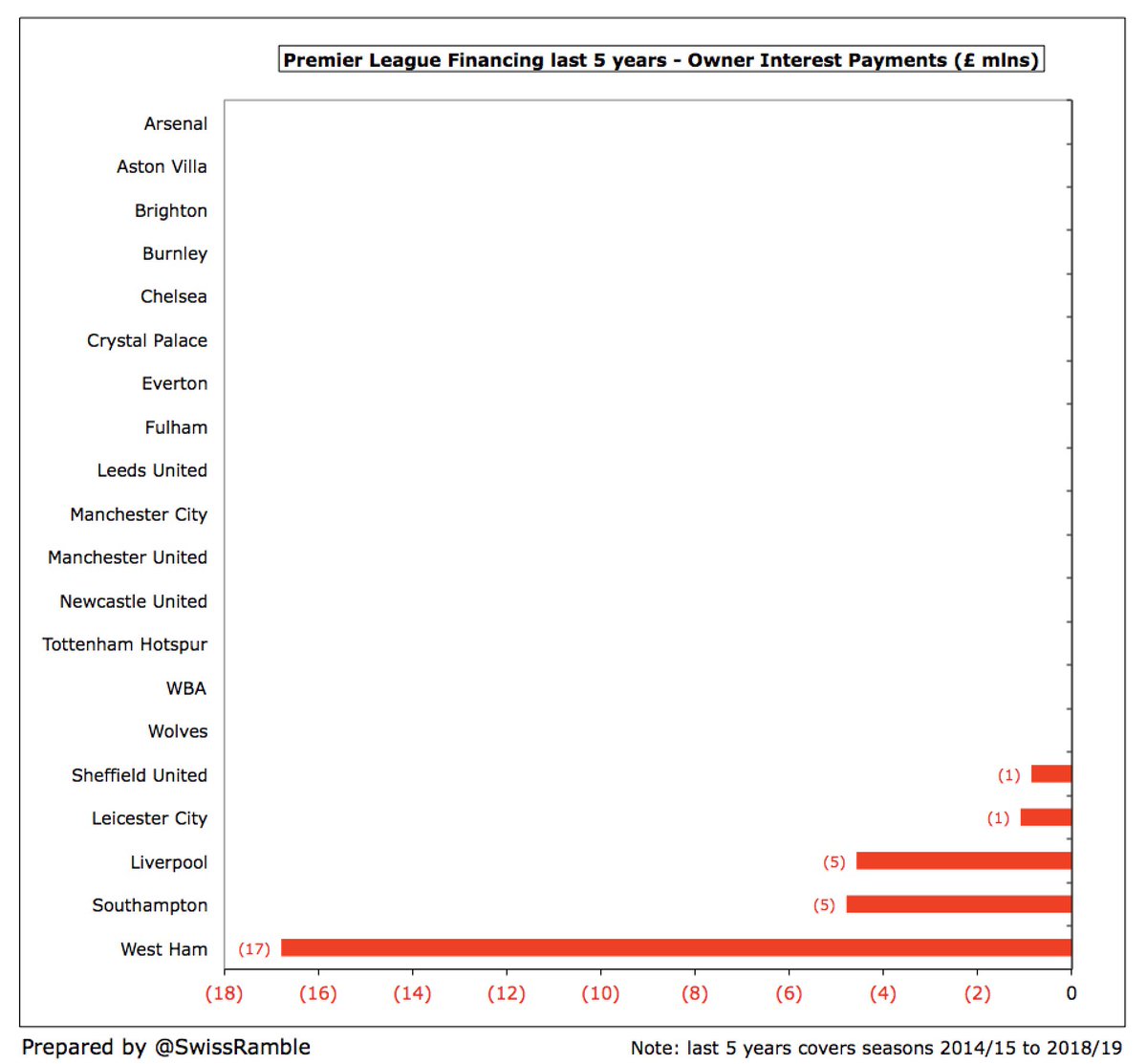

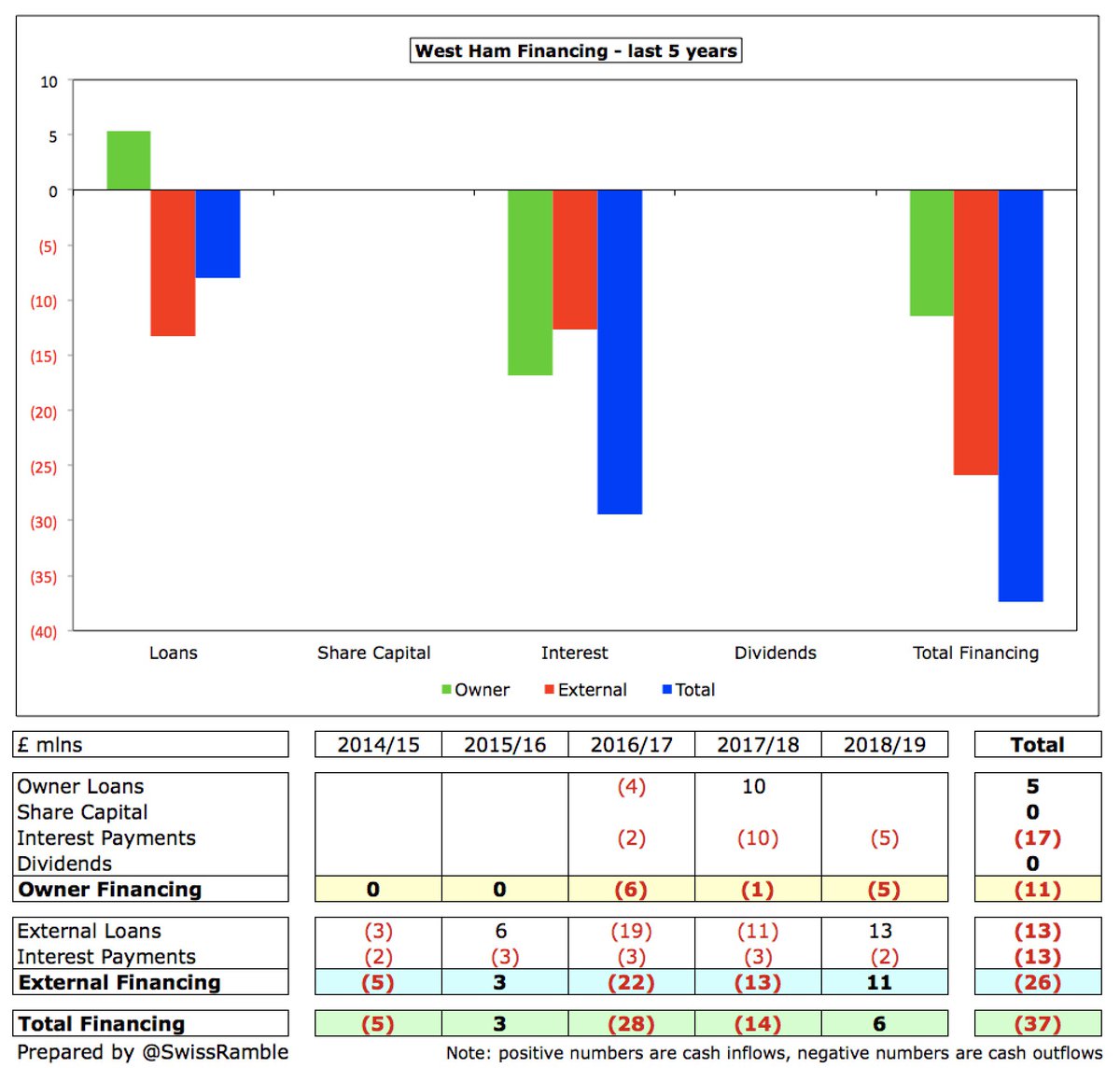

Most owner loans are interest-free, but #WHUFC paid £17m to Sullivan and Gold during this period. Clubs don’t separate interest payments between owners and banks in the accounts, so the other figures are estimates based on the interest rate. #LFC loan charged interest until 2019.

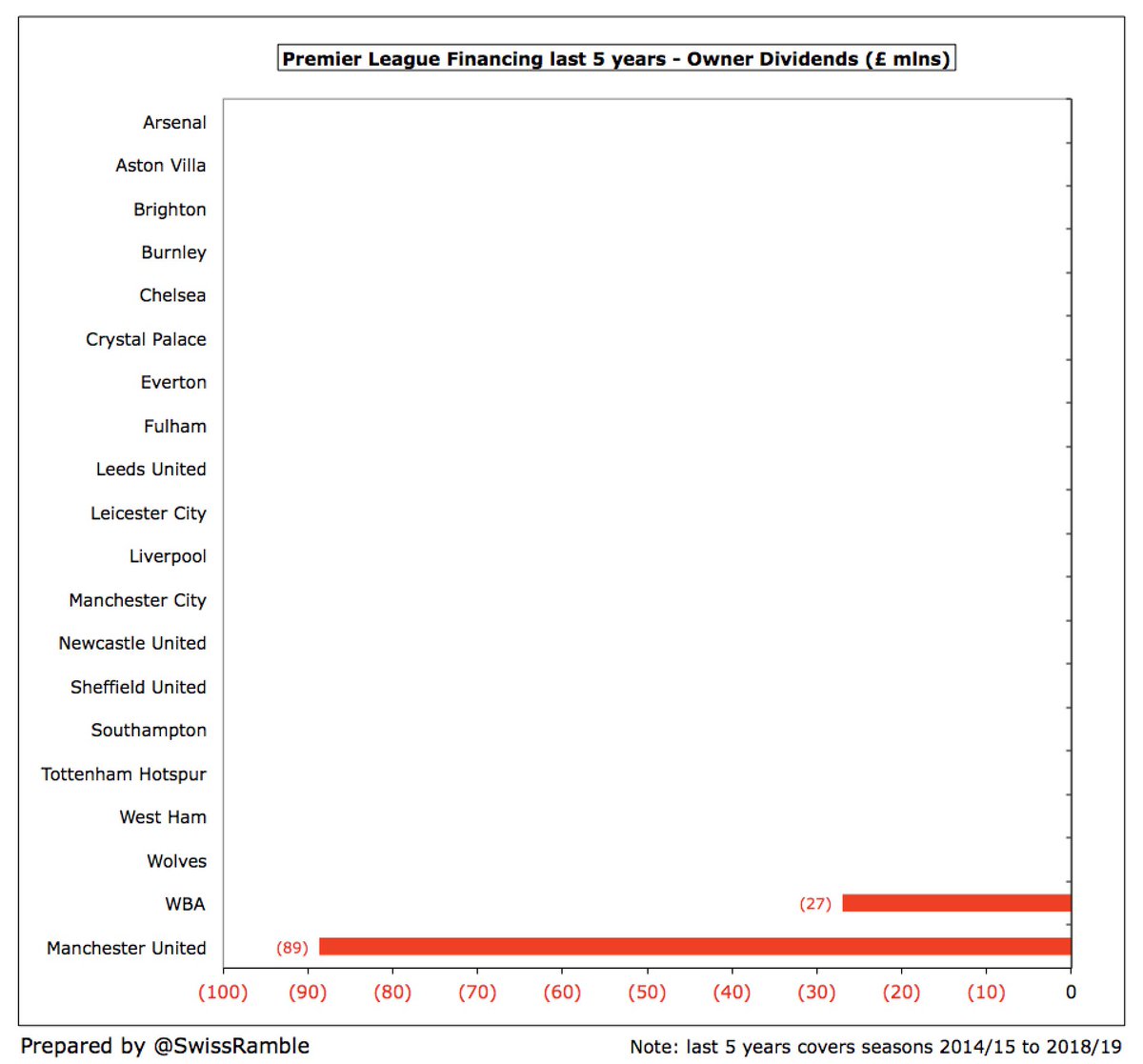

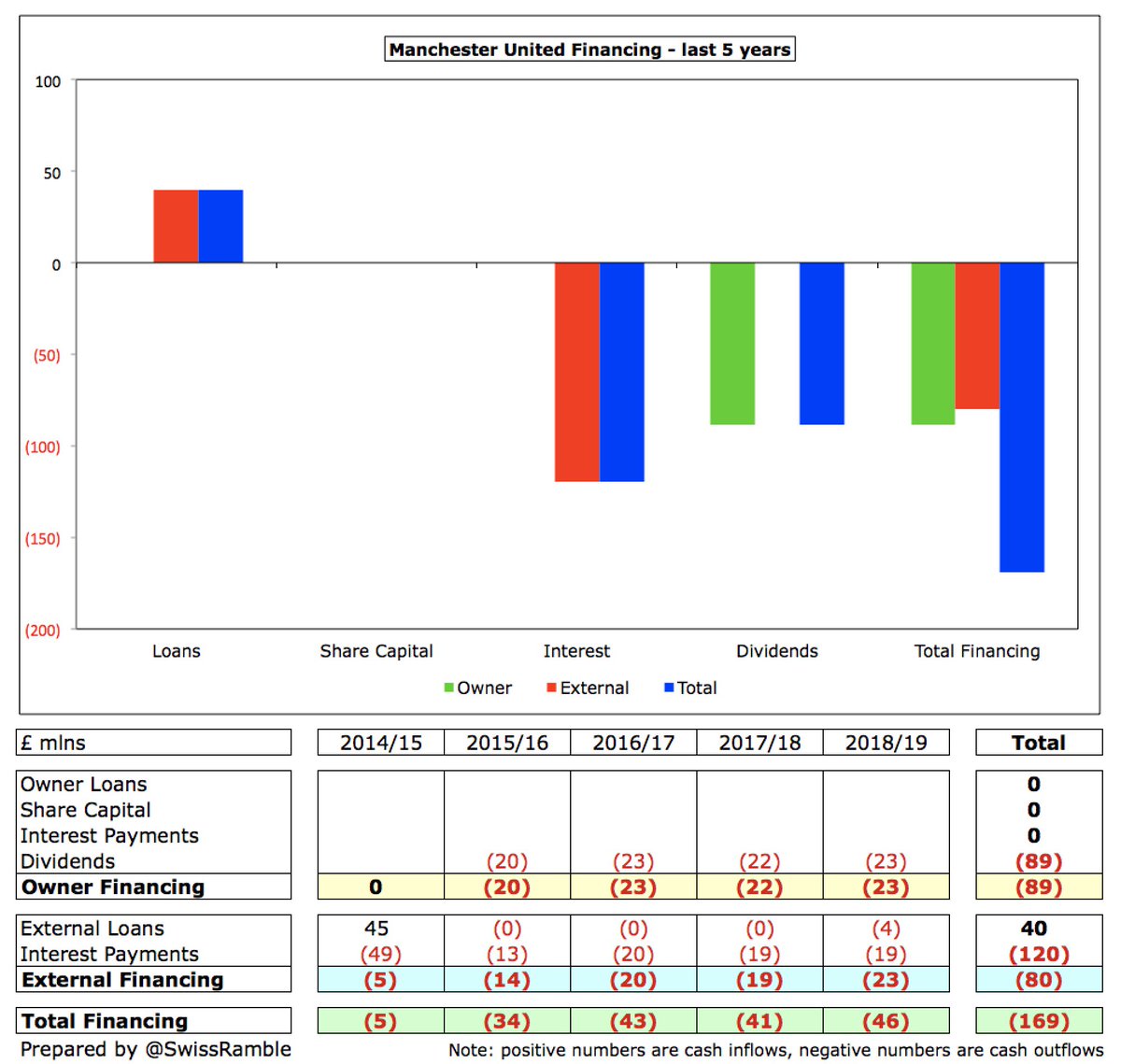

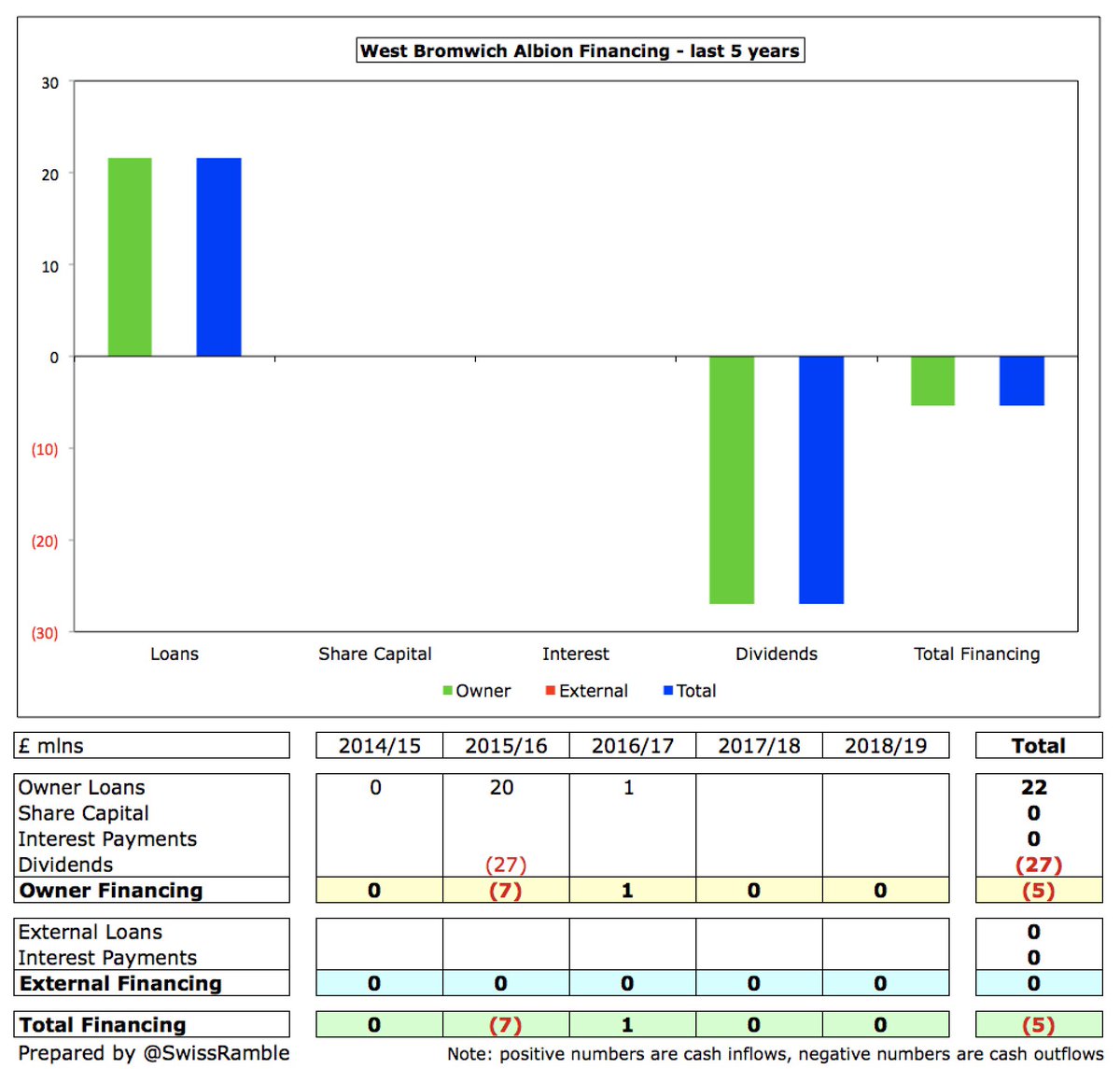

Only two clubs made dividend payments to their owners during the last 5 years, mainly #MUFC who paid £89m to the Glazers. There was another £22m in 2019/20, adding up to £111m. The £27m payment that #WBA made to their holding company in 2015/16 is not explained in the accounts.

#THFC have taken out £618m external loans in the last 5 years to fund their stadium development, while #AFC have made £41m repayments in this period against the debt they took on to fund the construction of the Emirates stadium.

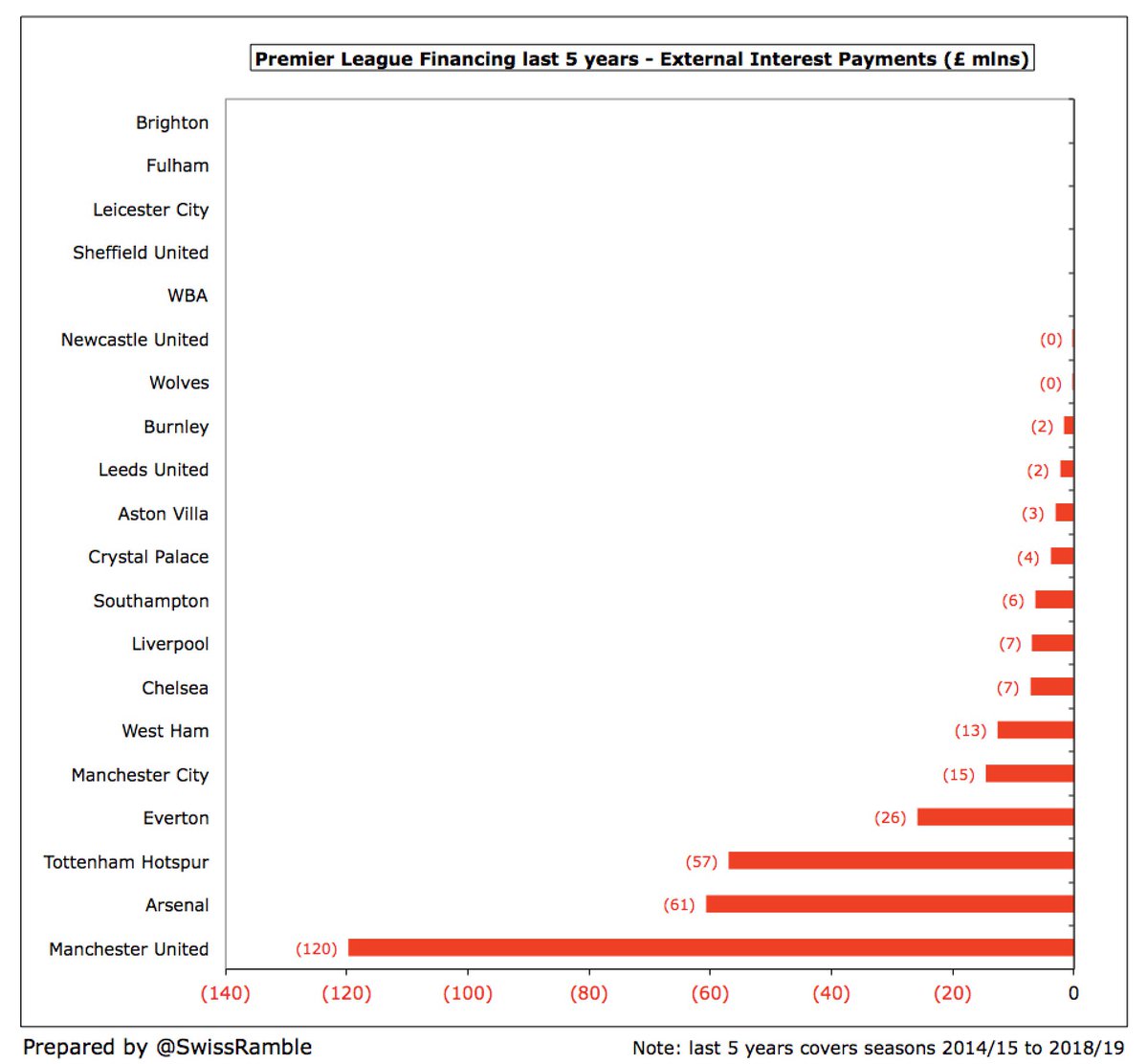

Substantial interest payments to the banks have been made by #MUFC £120m (Glazers’ leveraged buy-out), #AFC £61m (Emirates mortgage) and #THFC £57m (new stadium loan). #EFC £26m includes a £7m payment for early settlement of bank loan, replaced by interest-free owner loan.

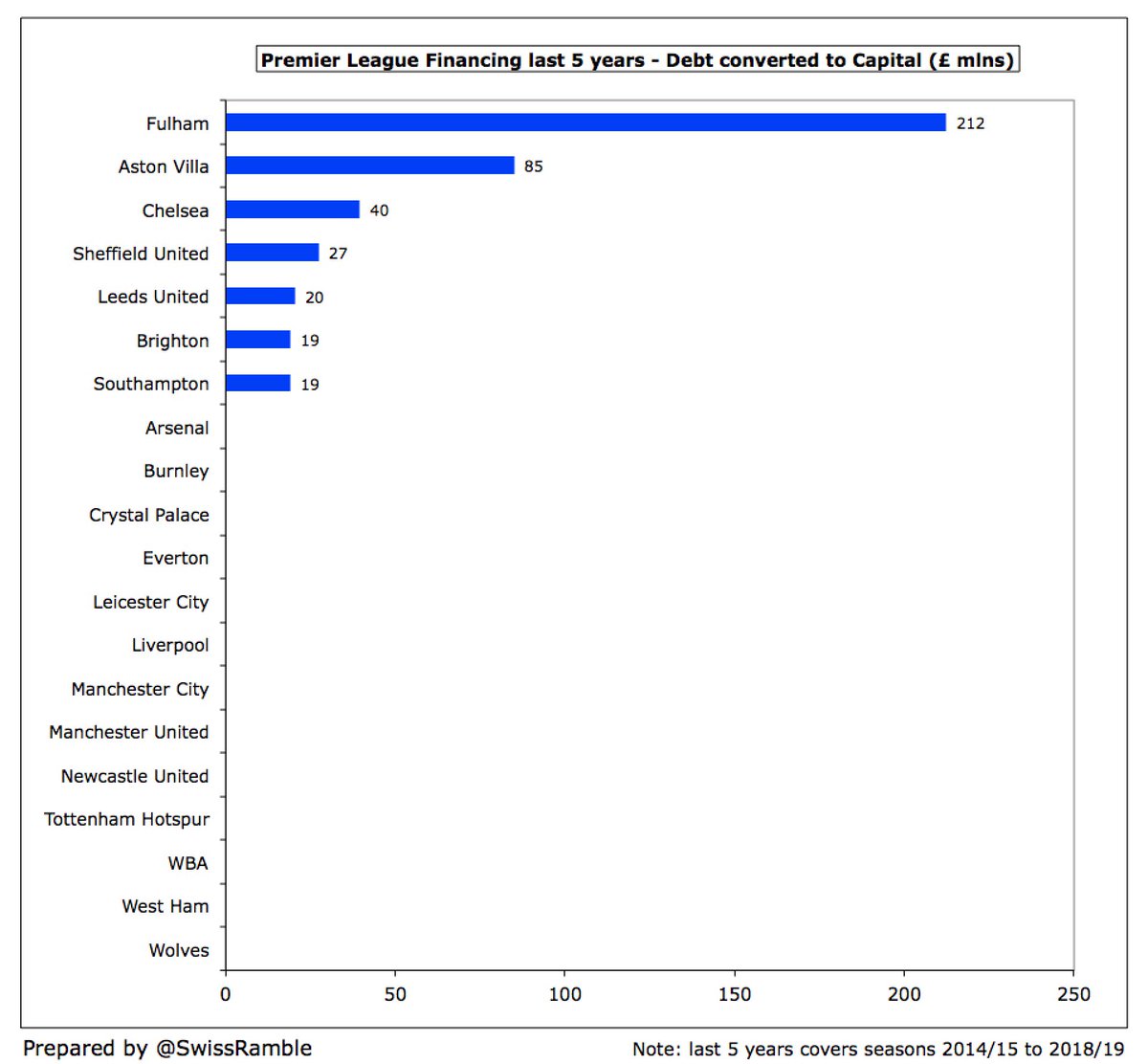

It is worth noting that some owners have also been kind enough to convert their loans into equity, which means they would only get their money back if they sold the club: #FFC £212m, #AVFC £85m, #CFC £40m, #SUFC £27m, #LUFC £20m, #BHAFC £19m and #SaintsFC £19m.

That’s the overall summary of financing in the Premier League in the last 5 years, but we shall now also look at each of the 20 clubs individually, including some of the financing movements reported since the 2018/19 accounts were published.

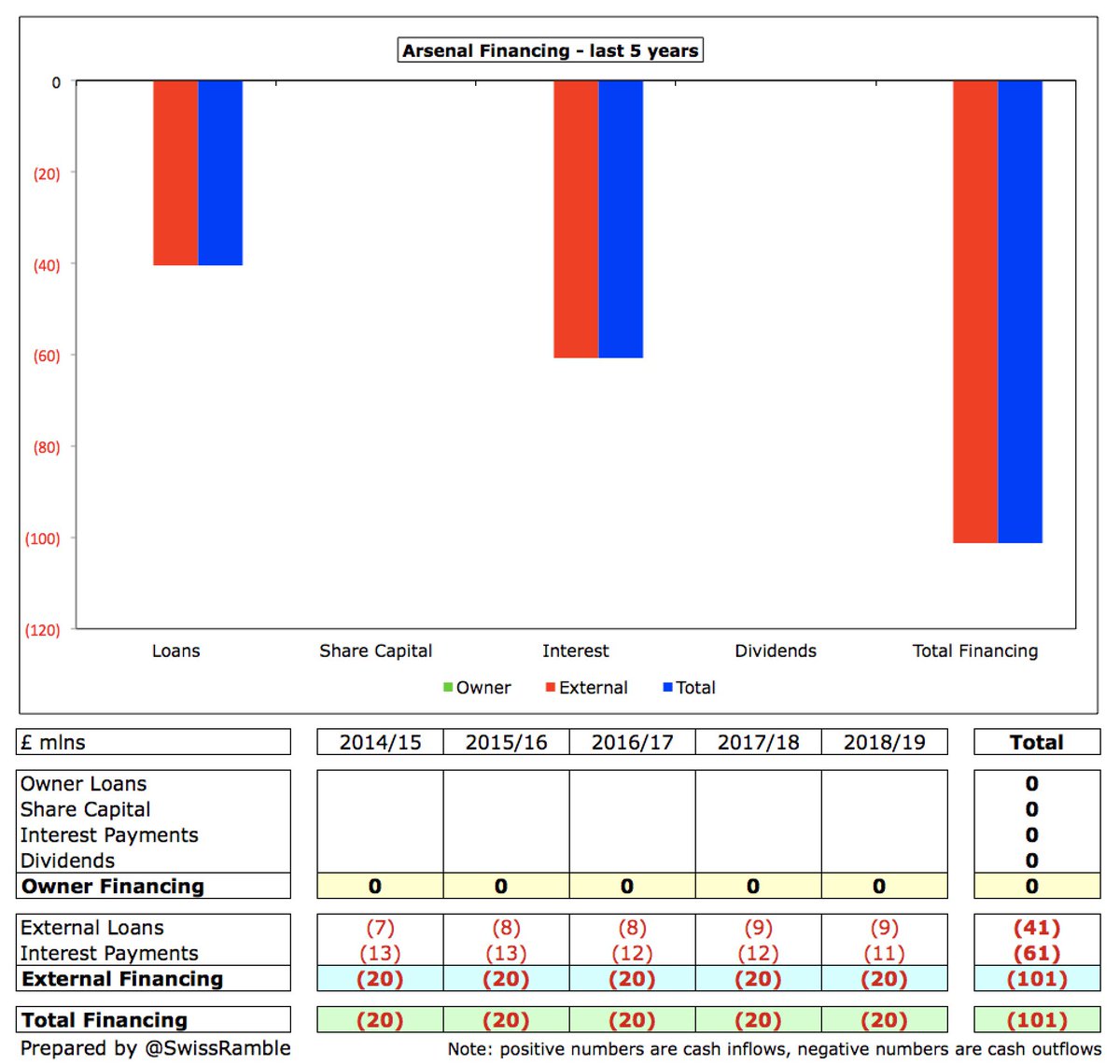

#AFC received no funding in last 5 years, either from Kroenke or the bank. In contrast, they made £101m payments (debt £40m & interest £61m). Also paid KSE £6m for “advisory services”. Recently KSE repaid £160m bonds, replaced with owner loan, presumably at a lower interest rate.

#AVFC have benefited from £193m of share capital from their owners in last 5 years, including £106m from NSWE (Sawiris & Edens) in 2019. This is nothing new for Villa, who have required £333m of funding (share capital £223m plus loans £110m) from various owners in last decade.

#BHAFC owner Tony Bloom provided £160m loans in last 5 years. In fact, he has put in an incredible £360m in total though £272m of loans and £88m of share capital, largely to fund the Amex stadium and new training ground. Subsequent to the year-end, he has added further capital.

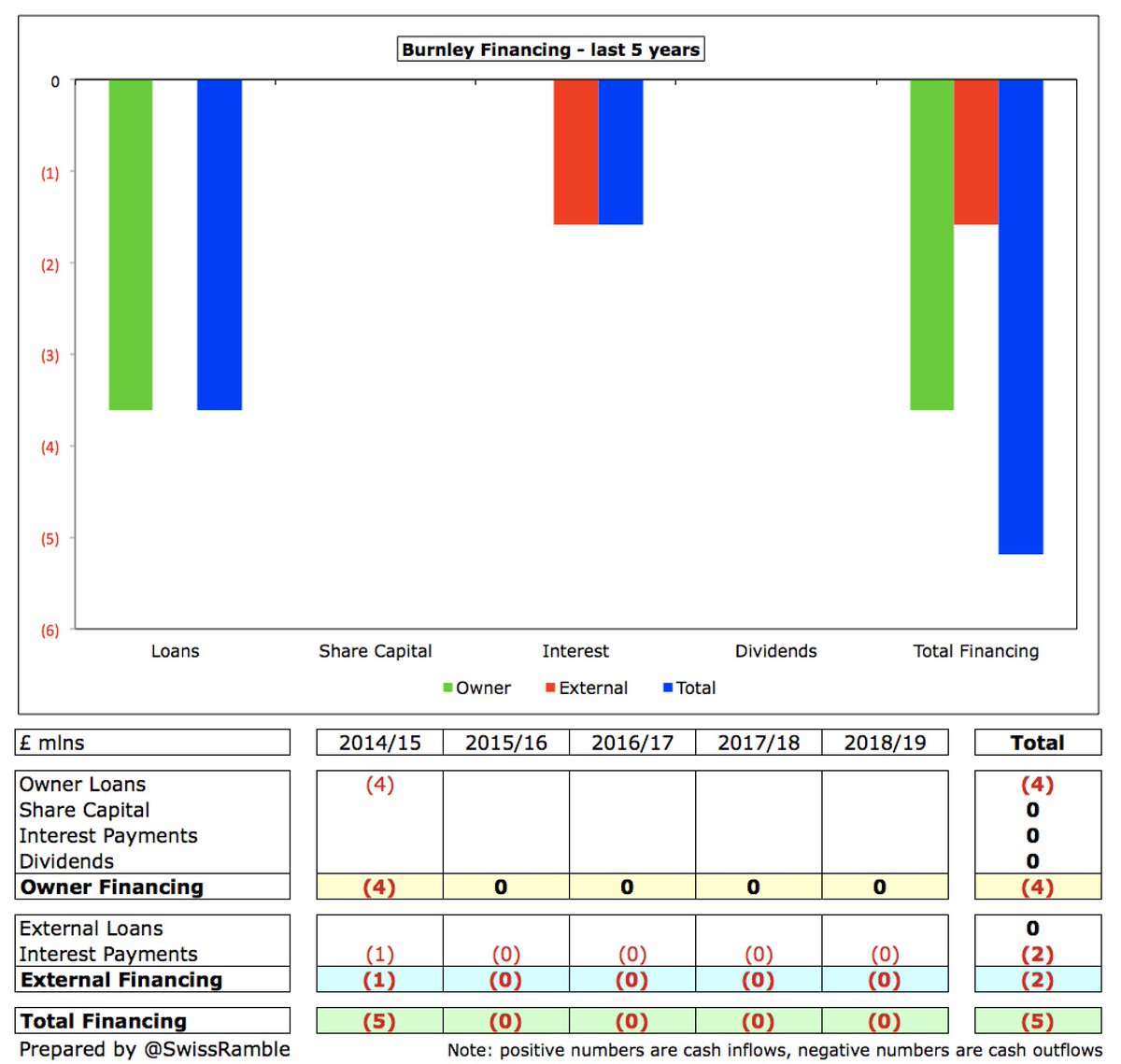

Unlike many clubs, #BurnleyFC pay their own way, so they have not required any funding on top of profits generated from operating activities. In fact, they repaid £4m of owner loans back in 2015, while making less than £2m interest payments.

#CFC have been reliant on funding from Roman Abramovich for many years, so it is no surprise they have the highest owner financing in the PL with £440m loans (reported in the holding company, Fordstam Ltd). Annual funding had been falling, but was back up to £247m in 2019.

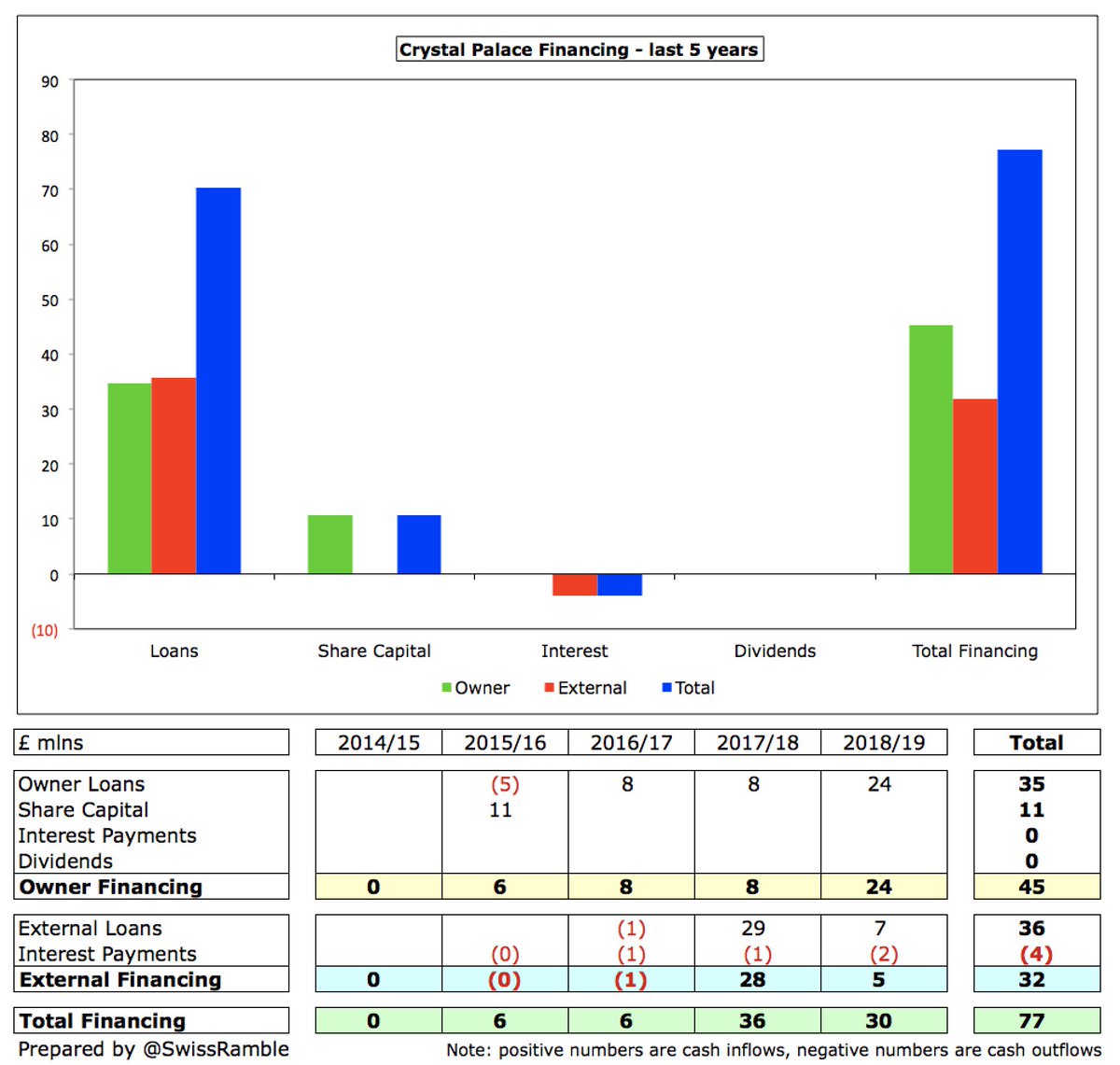

#CPFC £77m financing is split between owners £45m and external £32m. Owner financing was mixture of loans £35m and new share capital £11m. It is worth noting that most of the funding came in the last 2 years: £36m in 2018 and £30m in 2019. Took on additional debt after year-end.

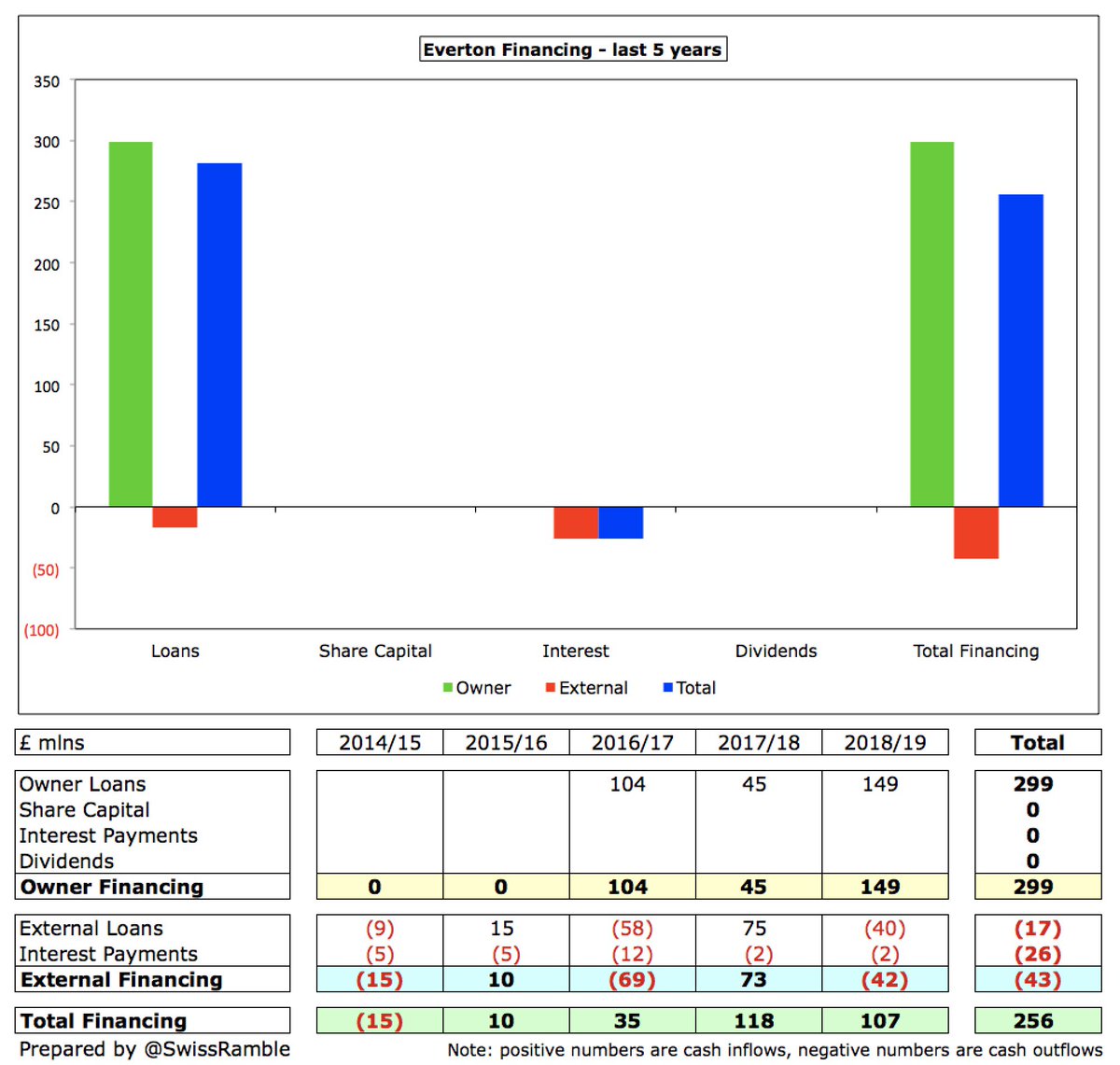

#EFC owner Farhad Moshiri provided £300m interest-free loan (plus another £50m after the accounts), which enabled the club to repay external debt, reducing interest payments. Also paid £24m sponsorship for training complex and £30m for option to buy naming rights for new stadium.

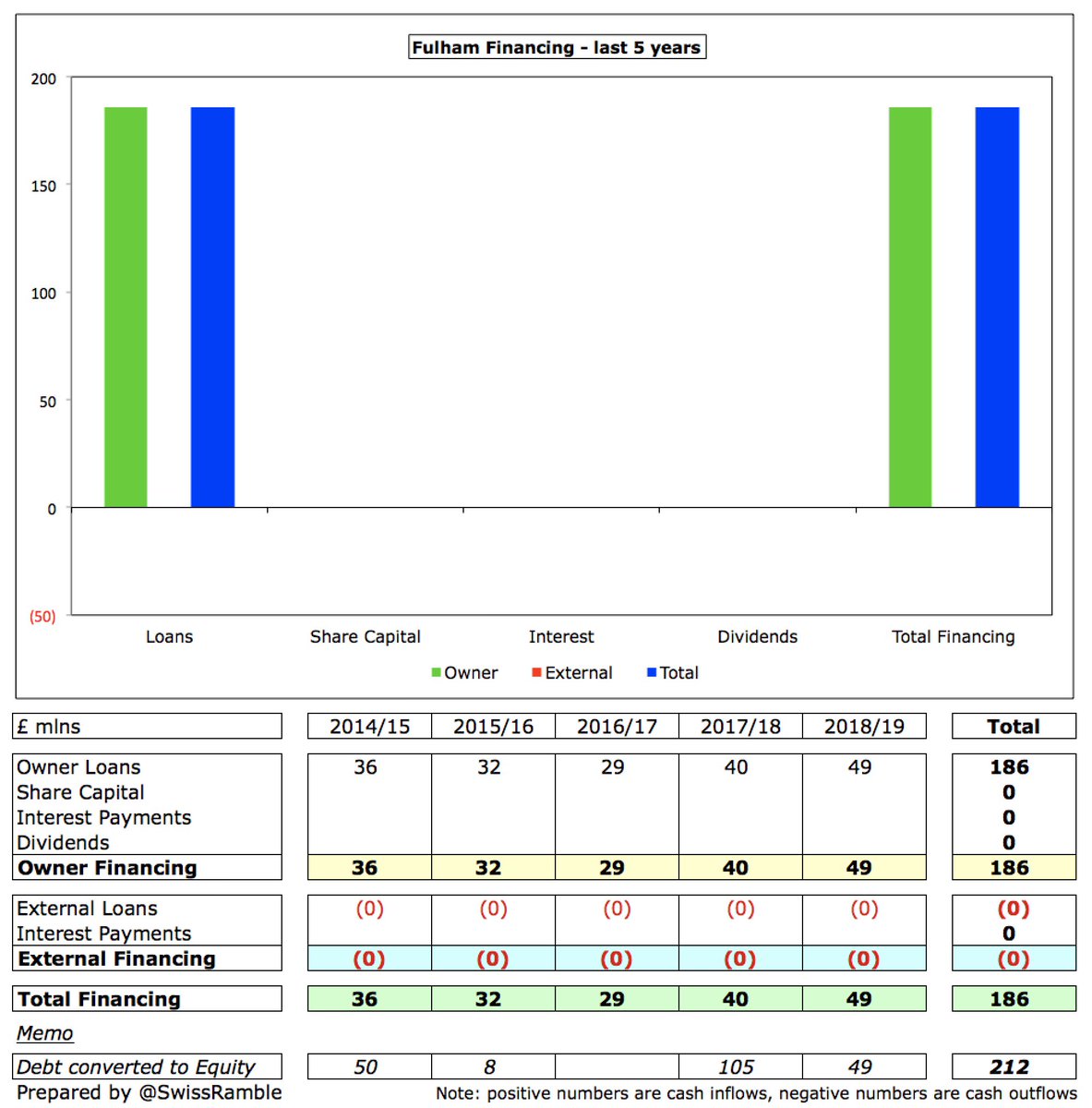

#FFC owner Shahid Khan provided £186m of loans in last 5 years, though he converted all his £212m debt into equity, so the club was debt-free in June 2019. An incredible £424m of debt has now been “written-off” in this way (including £212m from former owner Mohamed Al Fayed).

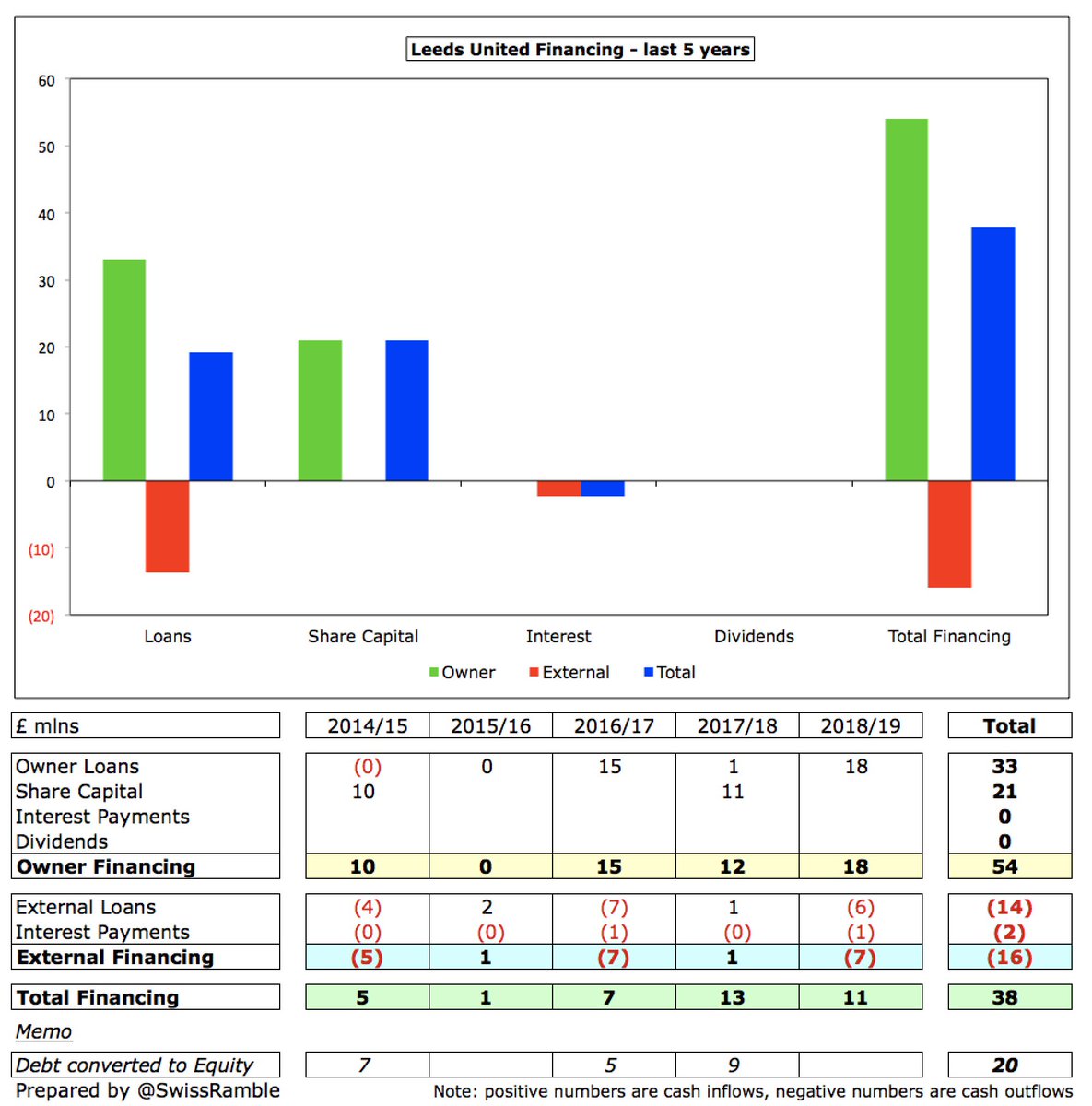

#LUFC have received £54m financing from their owners in the last 5 years, split £34m debt (including £26m from Andrea Radrizzani) and £21m share capital (including £11m for minority stake bought by San Francisco 49ers investment arm). Have also converted £20m of debt into equity.

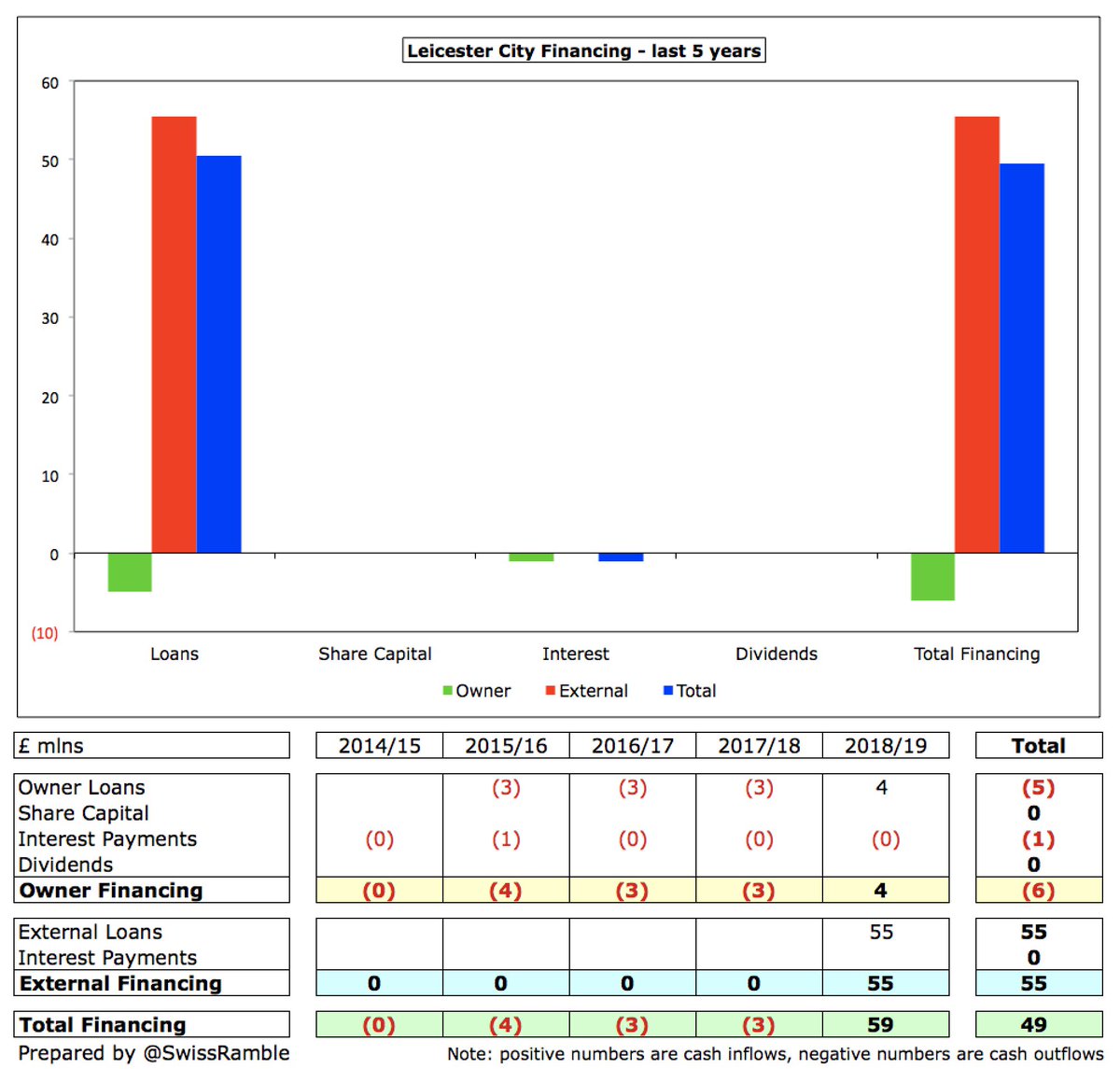

Little owner funding at #LCFC in last 5 years, but received £195m in preceding 4 years (share capital £106m and loans £89m). Also provided £91m loan facility after year-end to fund new training ground construction. King Power additionally sponsor stadium and shirt (£16m in 2019).

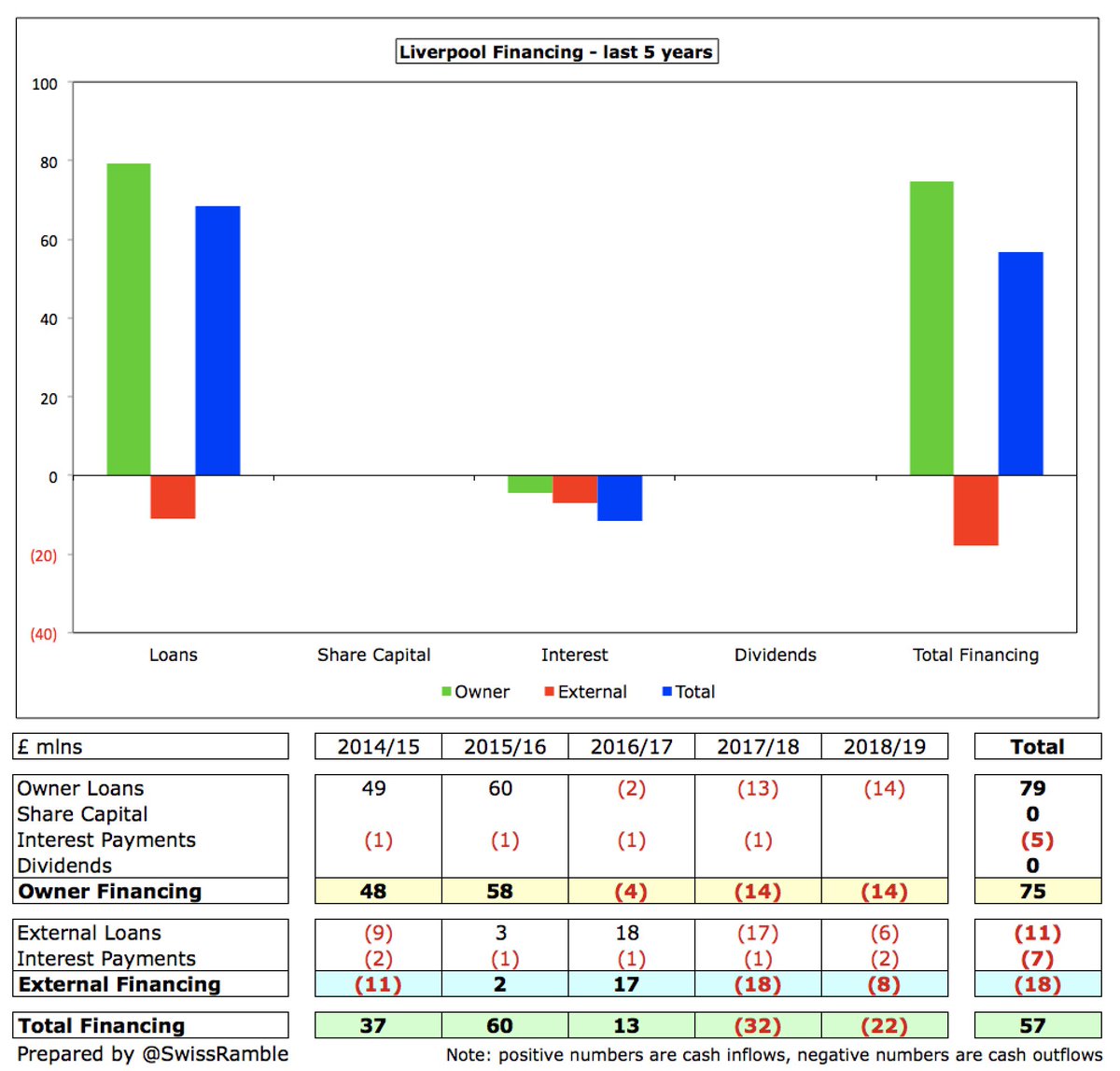

FSG provided £109m loan to fund Anfield Main Stand expansion, but club has since repaid £30m. Loan originally charged interest (estimated as £5m in total), though has been interest-free since 2019. Also made £11m debt repayments and £7m interest payments on bank loans.

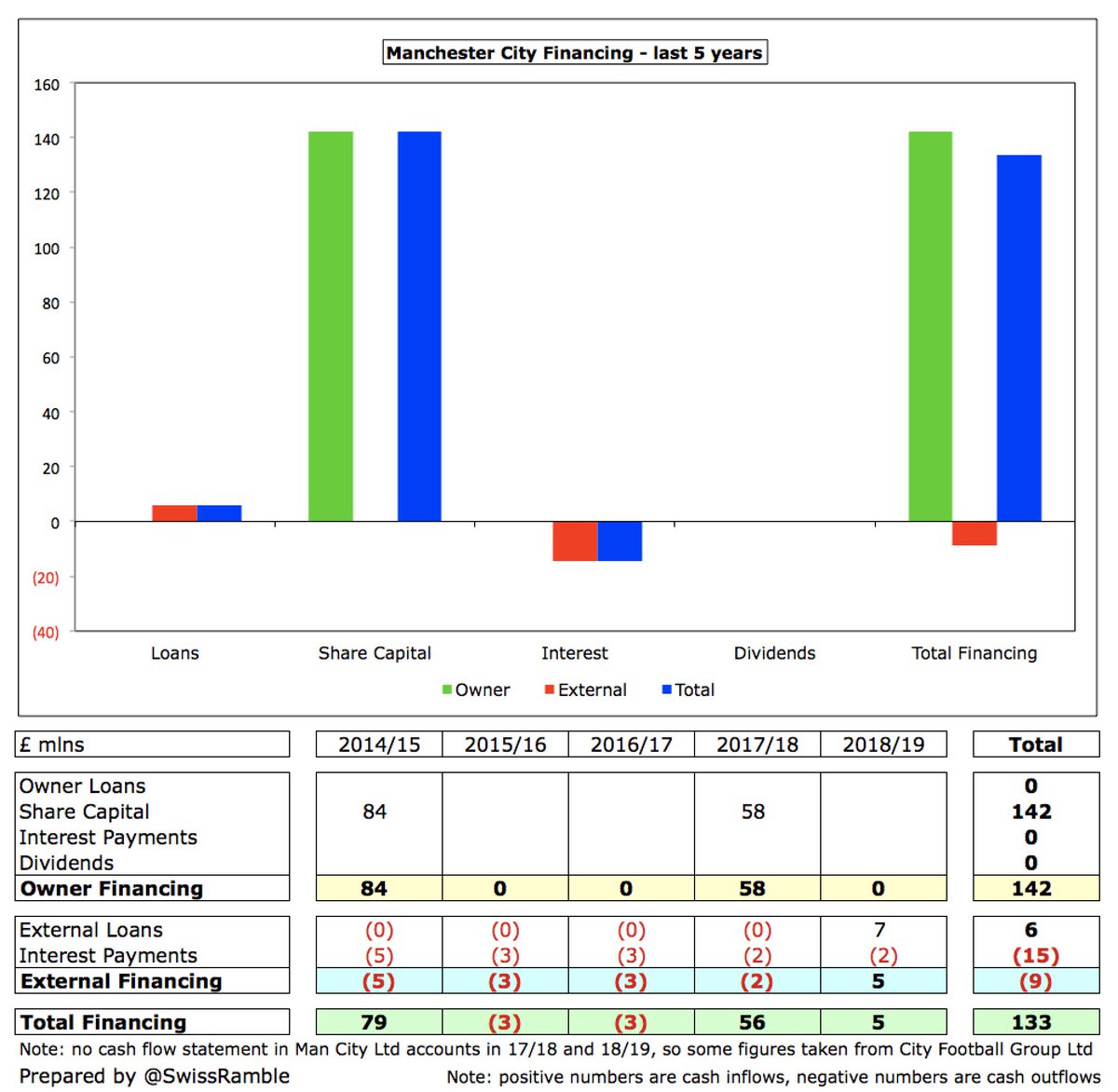

#MCFC owners have provided £142m in share capital in last 5 years, as club has moved to operating profitability. However, in the preceding 6 years, they put in £1,145m, so they have provided a total of £1.3 bln since acquiring the club (all in the form of capital, i.e. no debt).

#MUFC have paid £209m in last 5 years to fund Glazers’ ownership structure: £120m interest plus £89m dividends. In fact, in last 10 years they spent an extraordinary £838m on financing: £488m interest, £251m debt repayments & £99m dividends. Took out £140m loan since year-end.

#NUFC owner Mike Ashley provided £15m loan in 2016/17 to help finance the season in the Championship following relegation, but he was repaid £33m in 2019 to leave his outstanding debt at £111m. The owner’s loans are interest-free, so club paid hardly any interest.

#SUFC received £17m financing from their owners over the last 5 years, mainly in the form of new share capital. Owners converted £27m debt into capital, having also written-off £35m of debt in 2014. After the accounts, took on loans with Macquarie bank against TV money.

No owner funding provided at #SaintsFC for last 4 years, though all outstanding shareholder debt was either repaid or converted to equity in 2016 and 2017 (total £30m). Previous owner Katharina Liebherr charged 5% interest on her loans. Net repayment of external loans in period.

#THFC took on £618m external debt in the last 5 years to finance the construction of the new stadium. Loans refinanced in September 2019 into long-term maturities (average 23 years) at 2.66%. Repaid £40m preference shares. Borrowed £175m at 0.5% from government’s Covid Facility.

For years #WBA have been self-sustaining. Owner Guochuan Lai has not put in any more money since he acquired the club in 2016. There was a mysterious £27m dividend payment made to the holding company that year, which is not fully explained in the accounts.

#WHUFC paid £17m interest to Sullivan and Gold (£19m including payment after year-end), by far highest to Premier League owners in last 5 years. £10m interest-free owner loan in 2018 was from new director J Albert Smith. Raised £30m from shareholders in July 2020 rights issue.

#WWFC owners Fosun International have provided £131m of interest-free loans in the last 3 years, including £56m in 2018/19. In addition, club secured additional financing facilities of £50m from Macquarie Bank after the 2019 accounts closed.

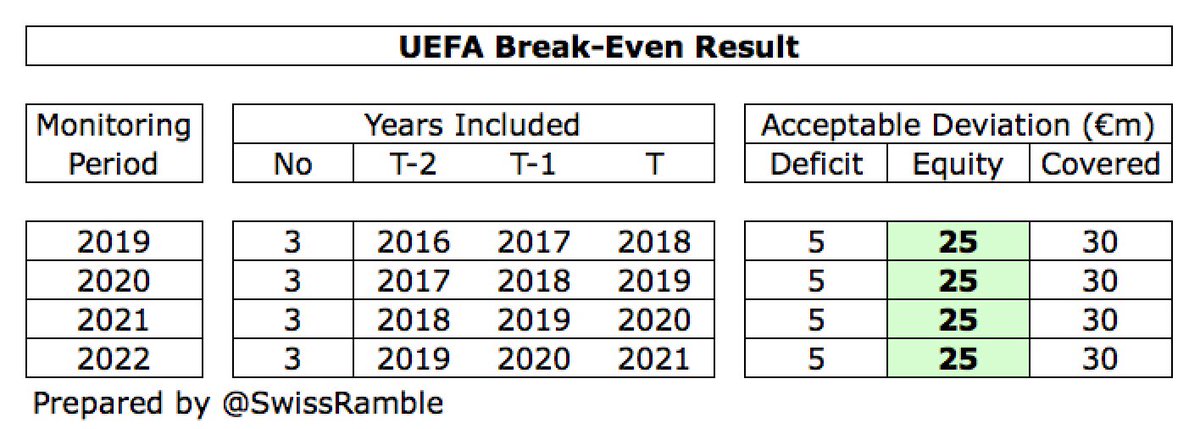

Many will believe that owners cannot put in too much money, due to Financial Fair Play (FFP) regulations, but this is not the case. Owners can provide as much financing as they want. The only restriction is that no more than €25m can be used to offset UEFA’s break-even target.

Each club has its own business model, so there’s no judgement here of what is right or wrong. However, it is evident that in the current pandemic, which has a significant adverse impact on revenue, clubs with generous benefactors are likely to have more money available to spend.

• • •

Missing some Tweet in this thread? You can try to

force a refresh