Thread on system trading and conviction to follow them.

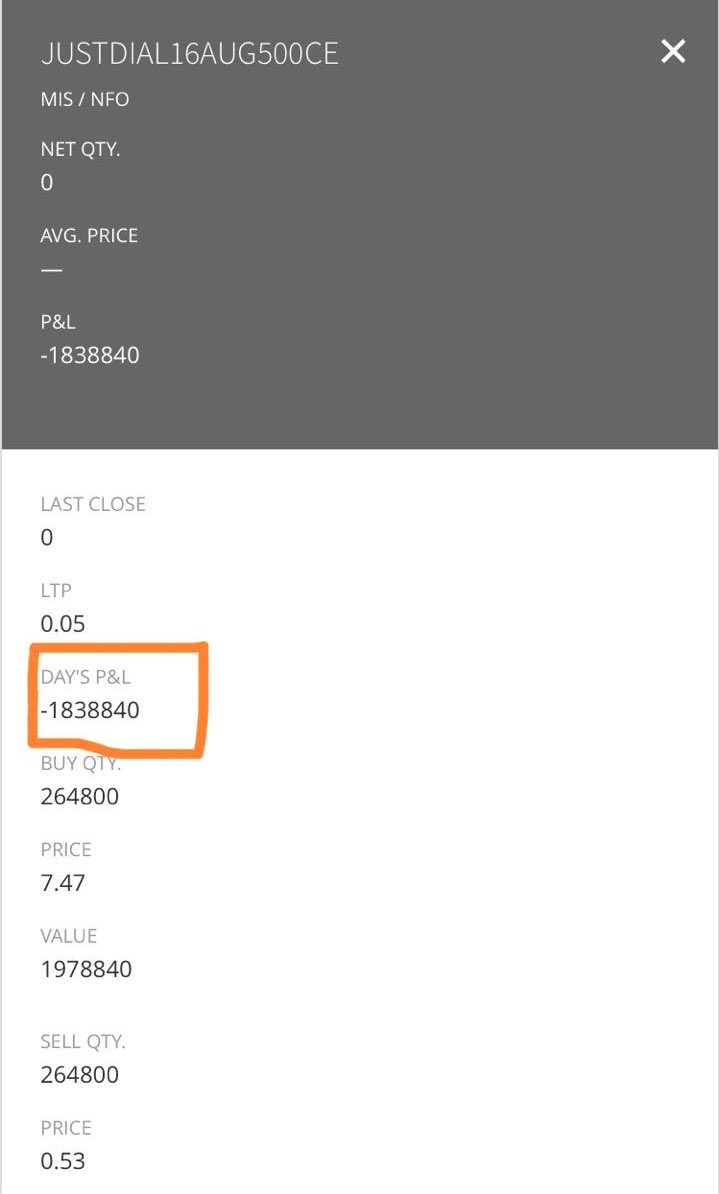

1) On Aug 2016, I had my highest ever loss of 18 L due to illiquidty risk. I had shorted JustDial 500 CE and was in profit at 3.19 pm but at 3.20 pm lost -18 L due to a risk I wasn’t aware at that time.

#trading #risk

1) On Aug 2016, I had my highest ever loss of 18 L due to illiquidty risk. I had shorted JustDial 500 CE and was in profit at 3.19 pm but at 3.20 pm lost -18 L due to a risk I wasn’t aware at that time.

#trading #risk

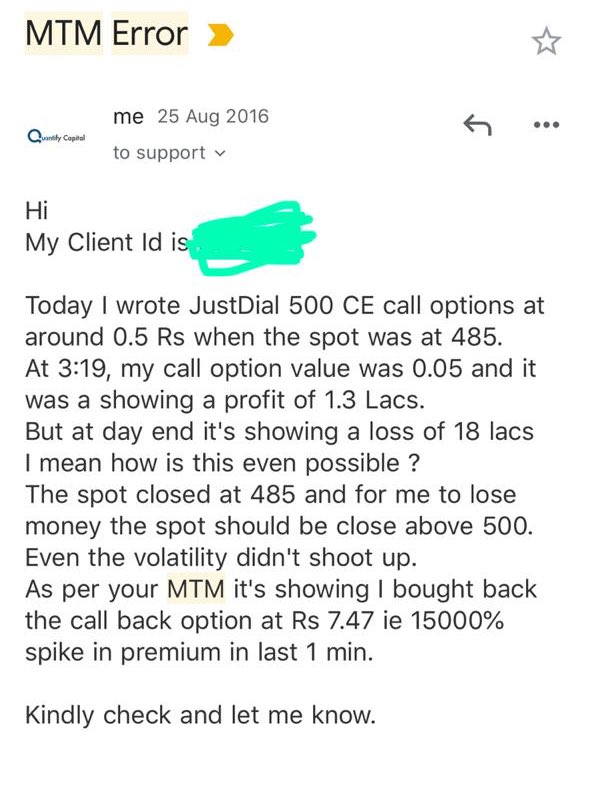

2) I had huge qty in Just Dial CE but as my position was huge and Just Dial being an illiquid script. My position got squared from 0 to 10 Rs. I was in 1.3 L profit at 3.19 & 3:20 -18 L.

Lost almost 20 L in a min

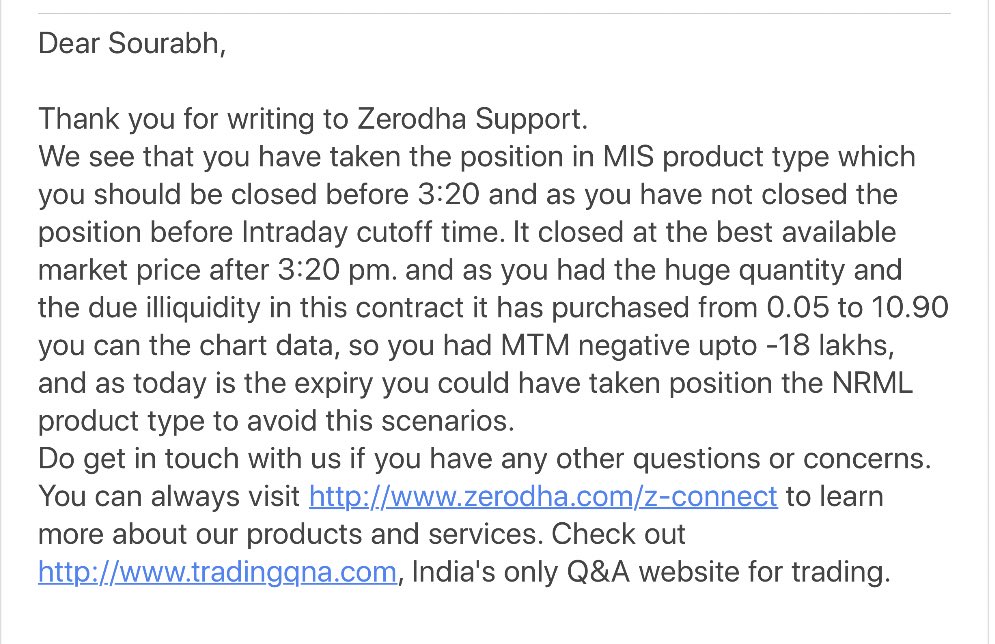

Check my email to Zerodha and their reply to understand more.

Lost almost 20 L in a min

Check my email to Zerodha and their reply to understand more.

3) I was totally upset as I never thought that I could lose so much due to illiquidity.

There was nothing wrong with system or risk management but this was a risk which I was never aware.

This made me believe in risk management ever then before.

There was nothing wrong with system or risk management but this was a risk which I was never aware.

This made me believe in risk management ever then before.

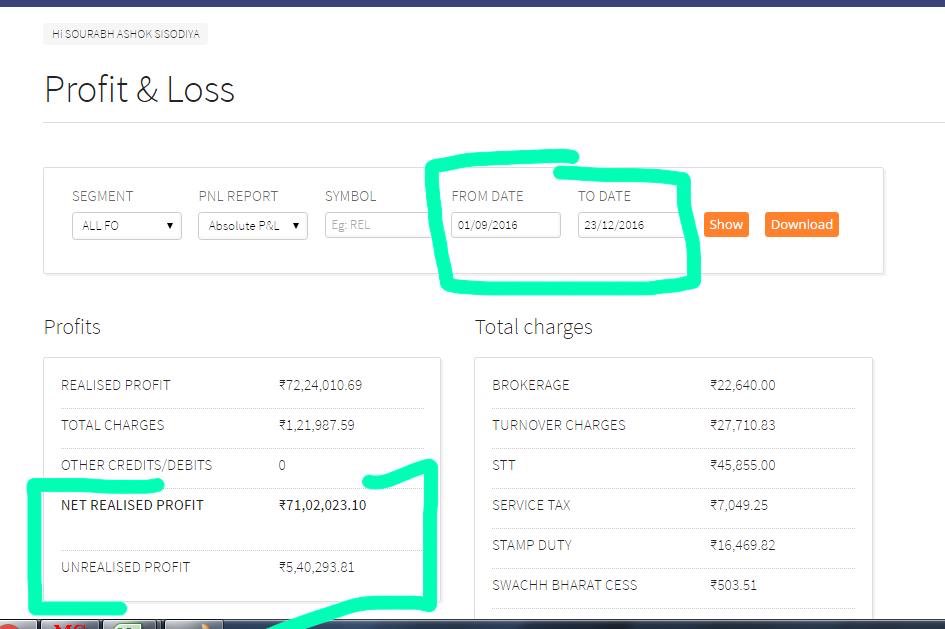

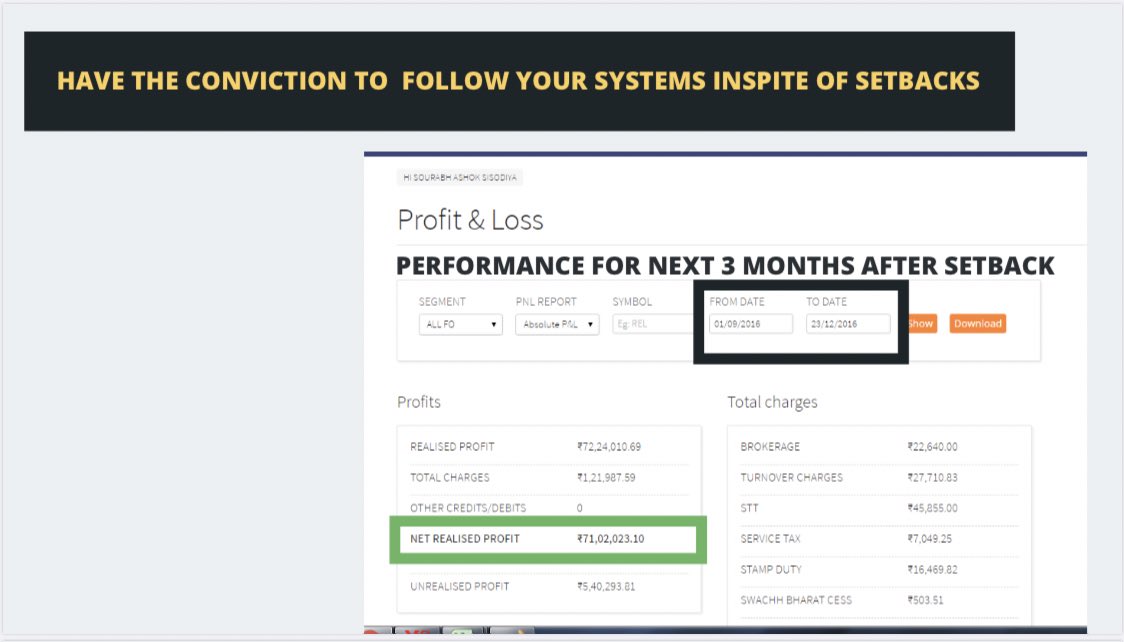

4) Inspite of the huge loss, I kept following my system.

I made the highest ever profit in % term in next 3 months.

Almost 75 L profit in from sept 2016 to Dec 2016.

Have attached the PnL report.

#system

I made the highest ever profit in % term in next 3 months.

Almost 75 L profit in from sept 2016 to Dec 2016.

Have attached the PnL report.

#system

5) I have been in drawdowns several times since then but have never lost the convinction to follow my systems.

Drawdowns are inevitable for a trader.

We can only manage risk & follow our systems.

Never take markets lightly & never make a loss so big that affects you emotionally

Drawdowns are inevitable for a trader.

We can only manage risk & follow our systems.

Never take markets lightly & never make a loss so big that affects you emotionally

6) Last week, I have been on a drawdown but I am sure that will hit new equity soon.

Reason for this thread :

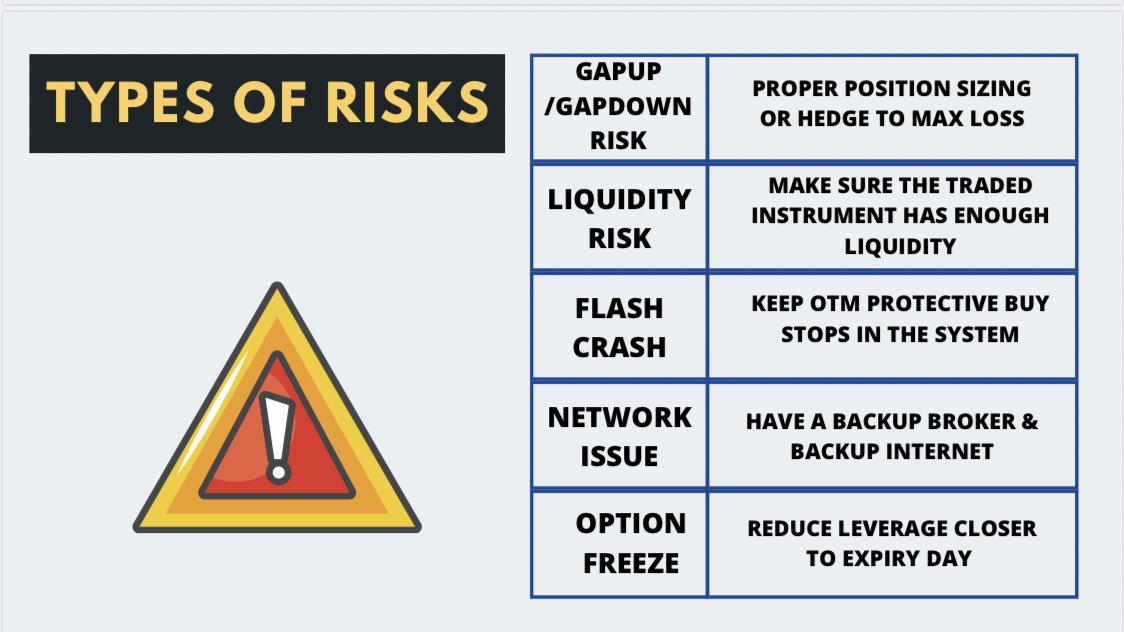

1) Focus on risk management & types of risks

2) Backtest& Follow your systems

3) Don’t be afraid of losses & drawdown as no system can make money all the time

End

Reason for this thread :

1) Focus on risk management & types of risks

2) Backtest& Follow your systems

3) Don’t be afraid of losses & drawdown as no system can make money all the time

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh