Importance of Risk Management

(Real Life Examples)

1) On 21st Sept 2018, I had sold 330 PE overnight and YesBank opened 10% lower and closed the day at -33%. But I survived as I bought 320 put as protection.

If I had not bought 320 PE then would have lost 10 L

#risk #trading

(Real Life Examples)

1) On 21st Sept 2018, I had sold 330 PE overnight and YesBank opened 10% lower and closed the day at -33%. But I survived as I bought 320 put as protection.

If I had not bought 320 PE then would have lost 10 L

#risk #trading

2) MS. Nirmala Sitaraman Candle

On 21st Sept 2019, BankNifty rallied almost 10% intraday with huge IV spike in calls.

I had 27200 CE sold and booked loss in that at 220. The same option was trading at 2230 few hours later.

Would have lost heavily if I had not exited my calls

On 21st Sept 2019, BankNifty rallied almost 10% intraday with huge IV spike in calls.

I had 27200 CE sold and booked loss in that at 220. The same option was trading at 2230 few hours later.

Would have lost heavily if I had not exited my calls

3)

- Demonetisation

- Flash Crash in March 19

- Lower Circuit on index in March 20

Have survived all these black swans without any major loss.

After making huge losses at the start of my career, I have realised that good trading is all about managing risk.

#risk

- Demonetisation

- Flash Crash in March 19

- Lower Circuit on index in March 20

Have survived all these black swans without any major loss.

After making huge losses at the start of my career, I have realised that good trading is all about managing risk.

#risk

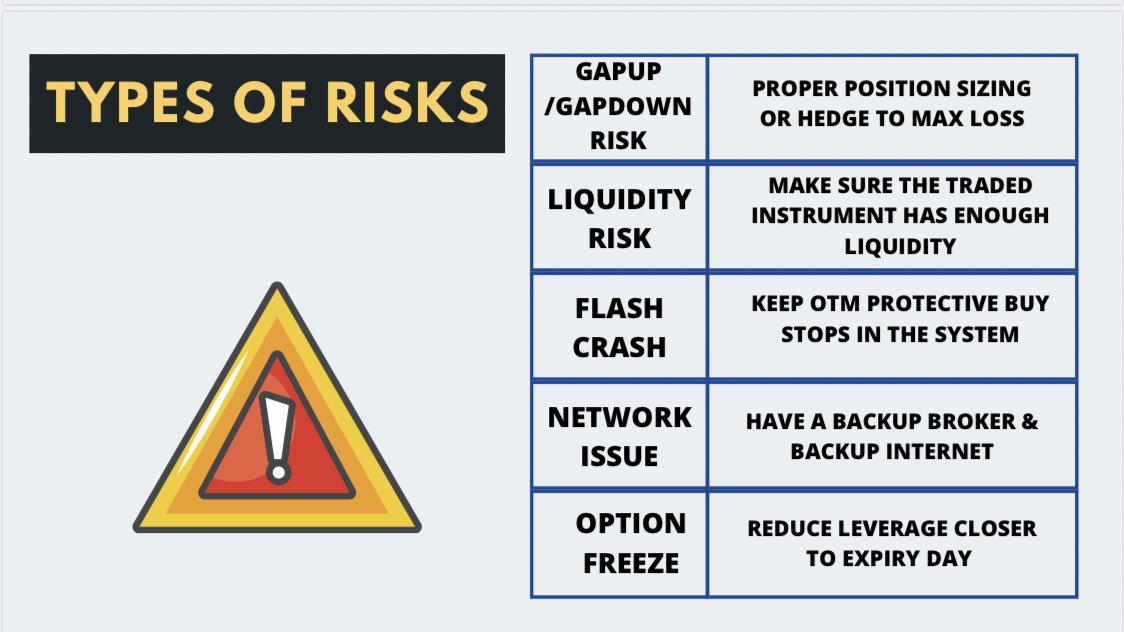

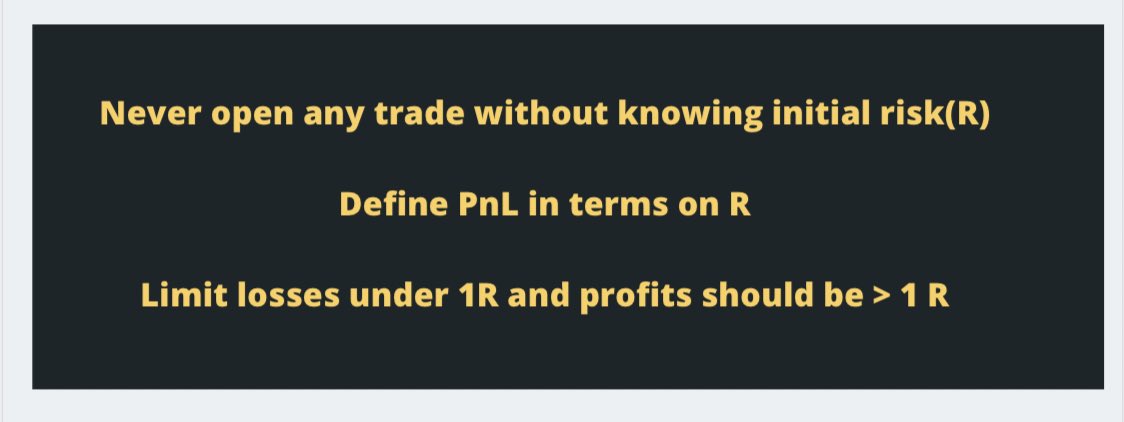

4) Rules I follow to manage Risk

- Never open any trade without knowing the initial risk ( R)

- Define PnL in terms of R

- Limit losses under 1 R and profits should be >1 R

#riskmanagement

- Never open any trade without knowing the initial risk ( R)

- Define PnL in terms of R

- Limit losses under 1 R and profits should be >1 R

#riskmanagement

5) Read this book

Van Tharp’s Definitive guide to position sizing

It’s a great book risk management & position sizing

amazon.com/Definitive-Gui…

(End of thread)

Van Tharp’s Definitive guide to position sizing

It’s a great book risk management & position sizing

amazon.com/Definitive-Gui…

(End of thread)

• • •

Missing some Tweet in this thread? You can try to

force a refresh