Wow - the biggest thermal power generator in Japan - JERA commits to net zero emissions by 2050 and as an interim measure, will close all outdated polluting supercritical / subcritical coal-fired power plants by 2030. 🇯🇵✅

energy.economictimes.indiatimes.com/news/coal/japa…

energy.economictimes.indiatimes.com/news/coal/japa…

This follows Mitsui & Co's announcement to exit coal fired power generation in Asia by 2030 earlier this week! 🇯🇵✅

https://twitter.com/TimBuckleyIEEFA/status/1315535519082668033?s=20

And follows Marubeni Corp's landmark pivotal September 2018 announcement to exit coal fired power plant EPC and progressively divest from its existing #coal power.

Which I'm proud to saw @simonjnicholas & I suggested in July 2018. 🇯🇵✅

ieefa.org/ieefa-report-m…

Which I'm proud to saw @simonjnicholas & I suggested in July 2018. 🇯🇵✅

ieefa.org/ieefa-report-m…

Which was followed by the Itochu coal exit policy of February 2019. 🇯🇵✅ itochu.co.jp/en/csr/news/20…

And then in March 2019 Sojitz divested its thermal coal mining operations in Indonesia and then Australia in April 2020. 🇯🇵✅

sojitz.com/en/news/2019/0…

sojitz.com/en/news/2019/0…

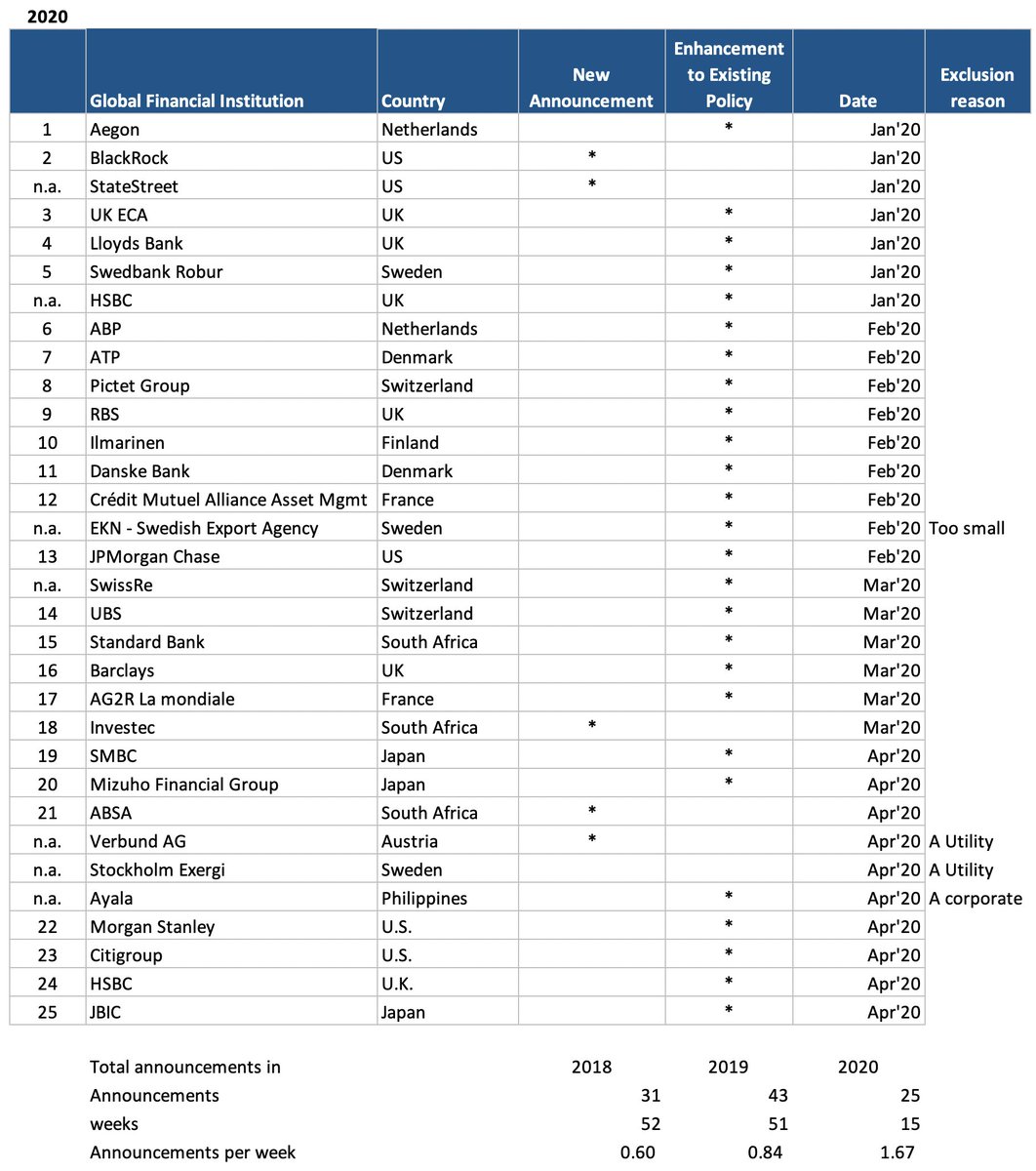

And building on this was the March 2020 announcement by Sumitomo Mitsui Banking Corporation (SMBC) to restrict coal power finance in consideration of building climate and ESG risks. 🇯🇵✅

smbc.co.jp/news_e/e600579…

smbc.co.jp/news_e/e600579…

And then in April 2020 we saw the announcement that Mitsubishi was exiting thermal coal (selling its 11% stake in New Hope Corp.) 🇯🇵✅ reuters.com/article/us-jap…

And April 2020's coal exit announcement by Mizuho Financial Group Inc. 🇯🇵✅

reuters.com/article/us-coa…

reuters.com/article/us-coa…

And the April 2020 commitment by Mr Coal, the Governor of Japanese Bank of International Cooperation (JBIC) to cease funding new coal power plants. 🇯🇵✅

straitstimes.com/asia/east-asia… by Walter Sim

straitstimes.com/asia/east-asia… by Walter Sim

And the August 2020 coal policy announcement by Sumitomo Corp. (Hint: @simonjnicholas has a major new Sumitomo Corp coal report pending, we expect a significant follow up announcement by the company to solidify their coal power exit policy). sumitomocorp.com/ja/jp/ir/finan…

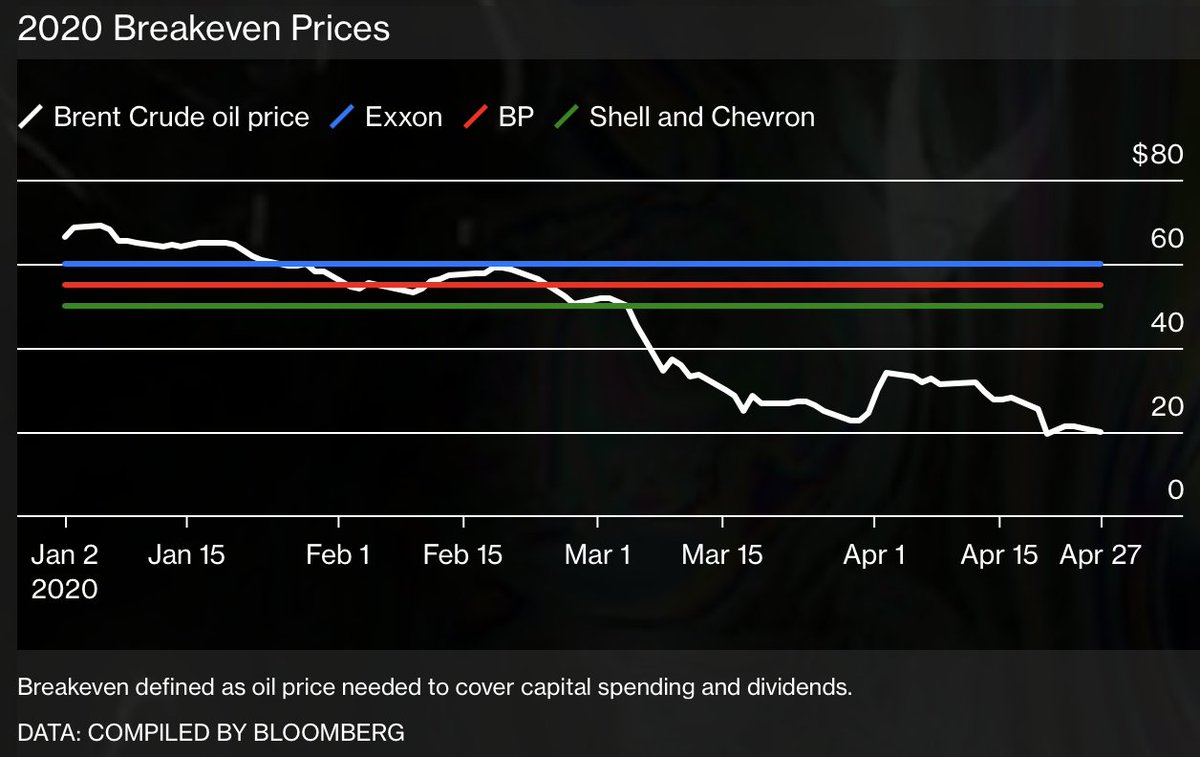

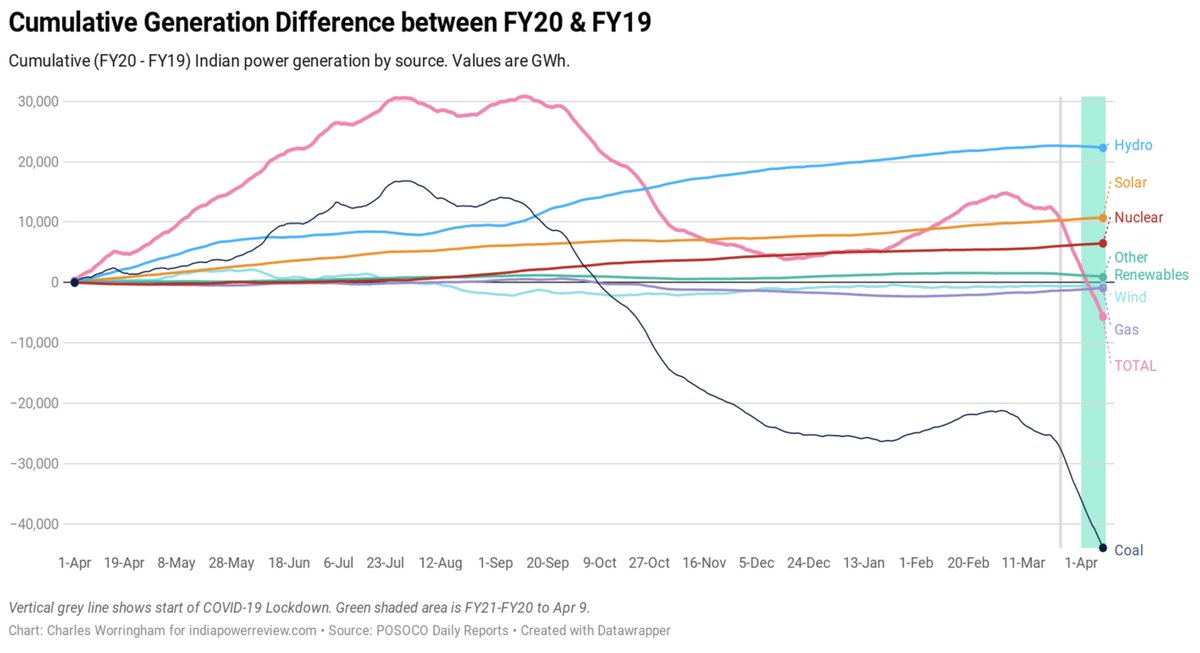

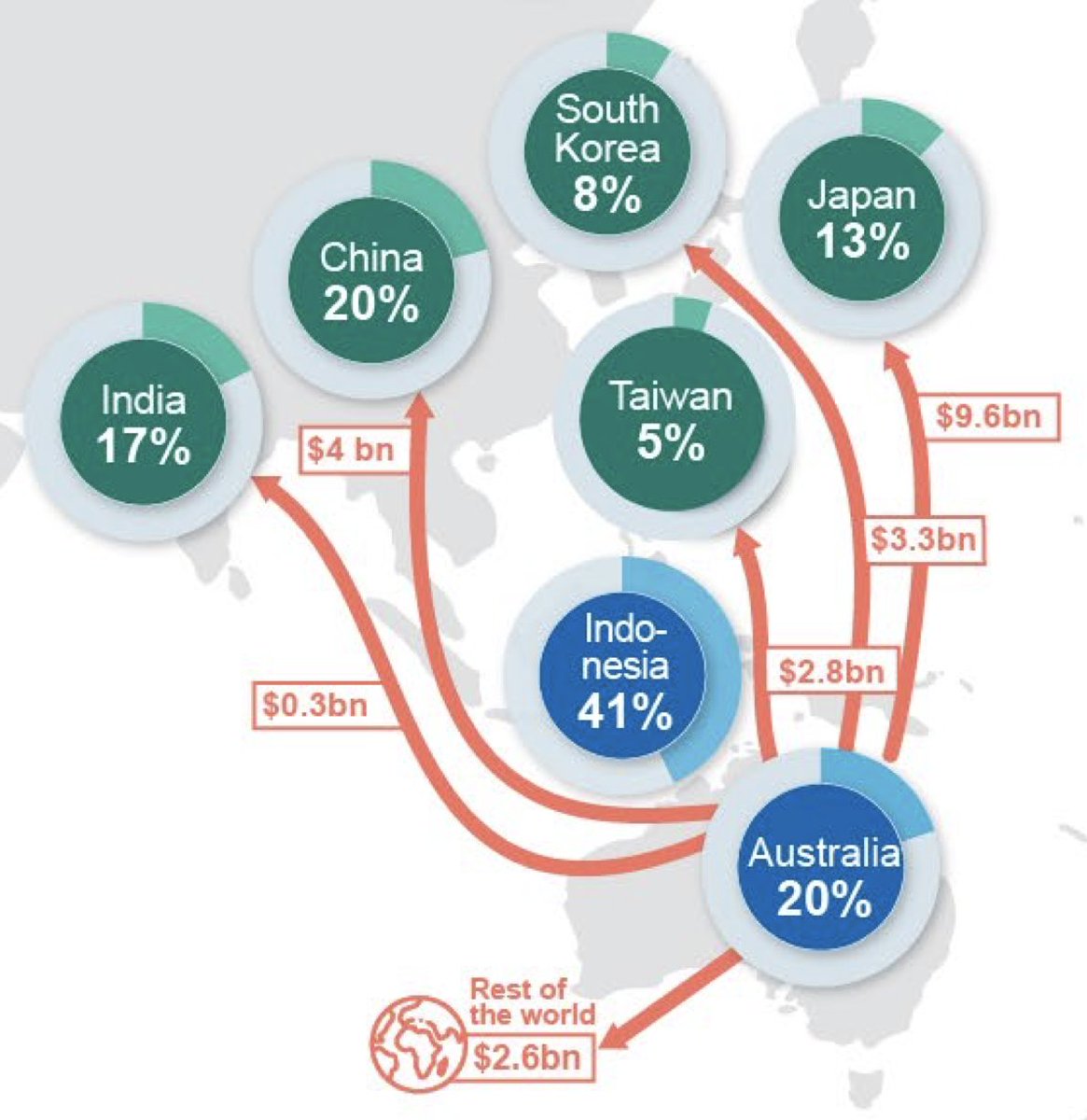

So then a question: Do @AngusTaylorMP @keithjpitt or @ScottMorrisonMP, or @GladysB (she's probably a bit distracted by home front corruption issues) even know Japan is Australia's largest coal export destination?

A$9.6bn annual exports for 🇦🇺, headed to zip according to the @IEA.

A$9.6bn annual exports for 🇦🇺, headed to zip according to the @IEA.

Of course they do. So as Waleed Aly of @theprojecttv said, where is our transition plan?

https://twitter.com/IEEFA_AsiaPac/status/1315947341719896070?s=20

I'd include @mattjcan in this question, except we know where he stands! Besides, Matty is too busy doing @glencore's bidding spruiking a new taxpayer subsidised stranded expensive Collinsville plant using their Shine Energy letterbox plaything. theguardian.com/business/2020/… by @BenSmee

And because this is really a positive story of Japan's pivot from outdated technology to the new, JERA has already announced its pivot into offshore wind in Japan in January 2020, knowing this is the next big thing for 🇯🇵✅

staradvertiser.com/2020/01/16/new…

staradvertiser.com/2020/01/16/new…

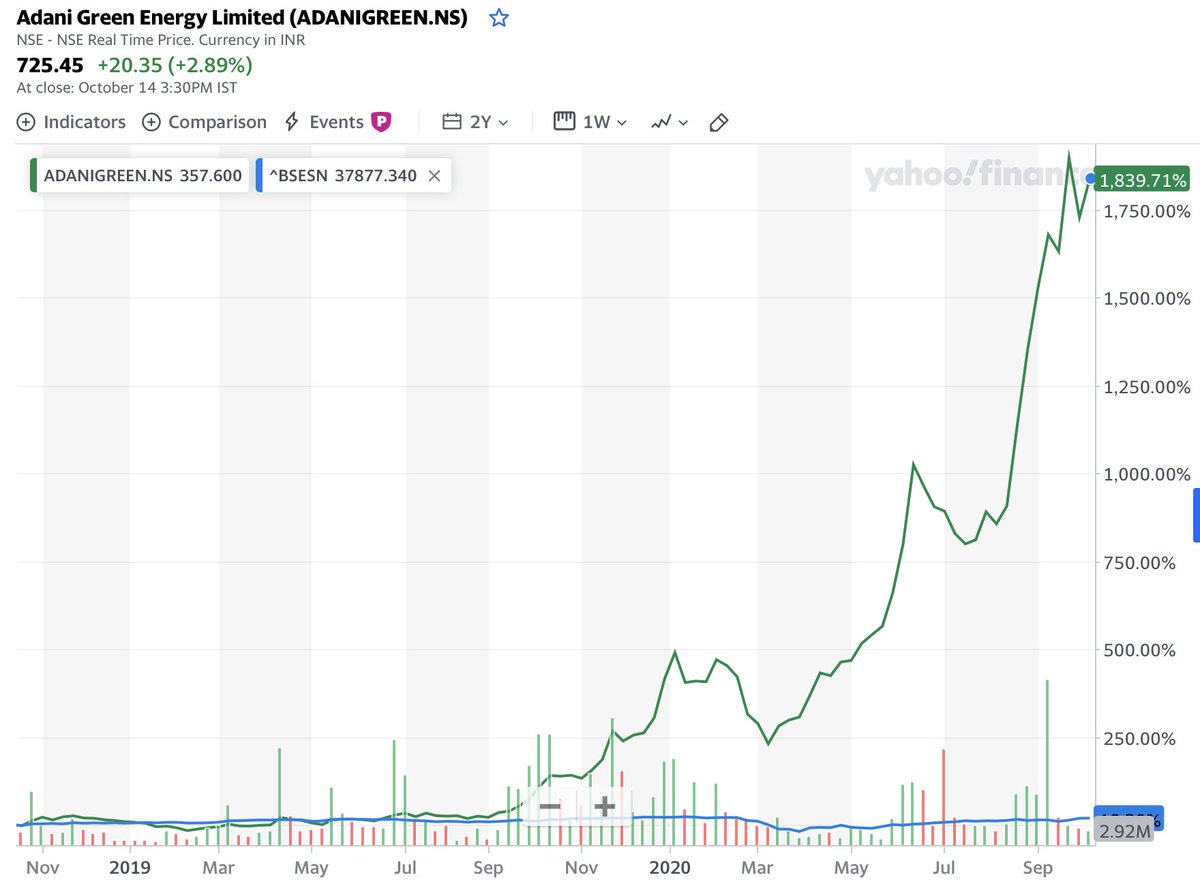

And back in 2017 JERA pivoted into the largest #RenewableEnergy growth market in the world, taking a 10% stake in India's RE leader @ReNew_Power. 🇯🇵🇮🇳✅

livemint.com/Companies/1wn4…

livemint.com/Companies/1wn4…

• • •

Missing some Tweet in this thread? You can try to

force a refresh