So a decade ago @Gautam_Adani invested $1bn in a HALE thermal #coal deposit 400km from anywhere in the Galilee.

At the same time Mr Adani invested $40m in a 40MW #solar project.

So fast forward to 2020: which investment is doing better?

At the same time Mr Adani invested $40m in a 40MW #solar project.

So fast forward to 2020: which investment is doing better?

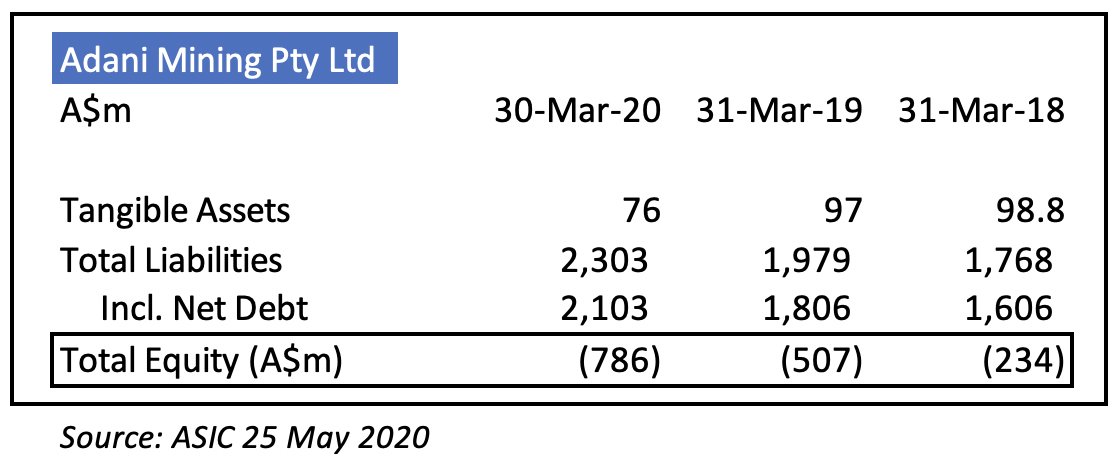

So @AdaniAustralia's Carmichael coal remains a stranded HALE coal deposit with zero revenues, nets debts of A$2.1bn and negative A$786m shareholders "equity" (plus a royalty holiday for the rest of this decade, thanks to @AnnastaciaMP & @glencore's @mattjcan).

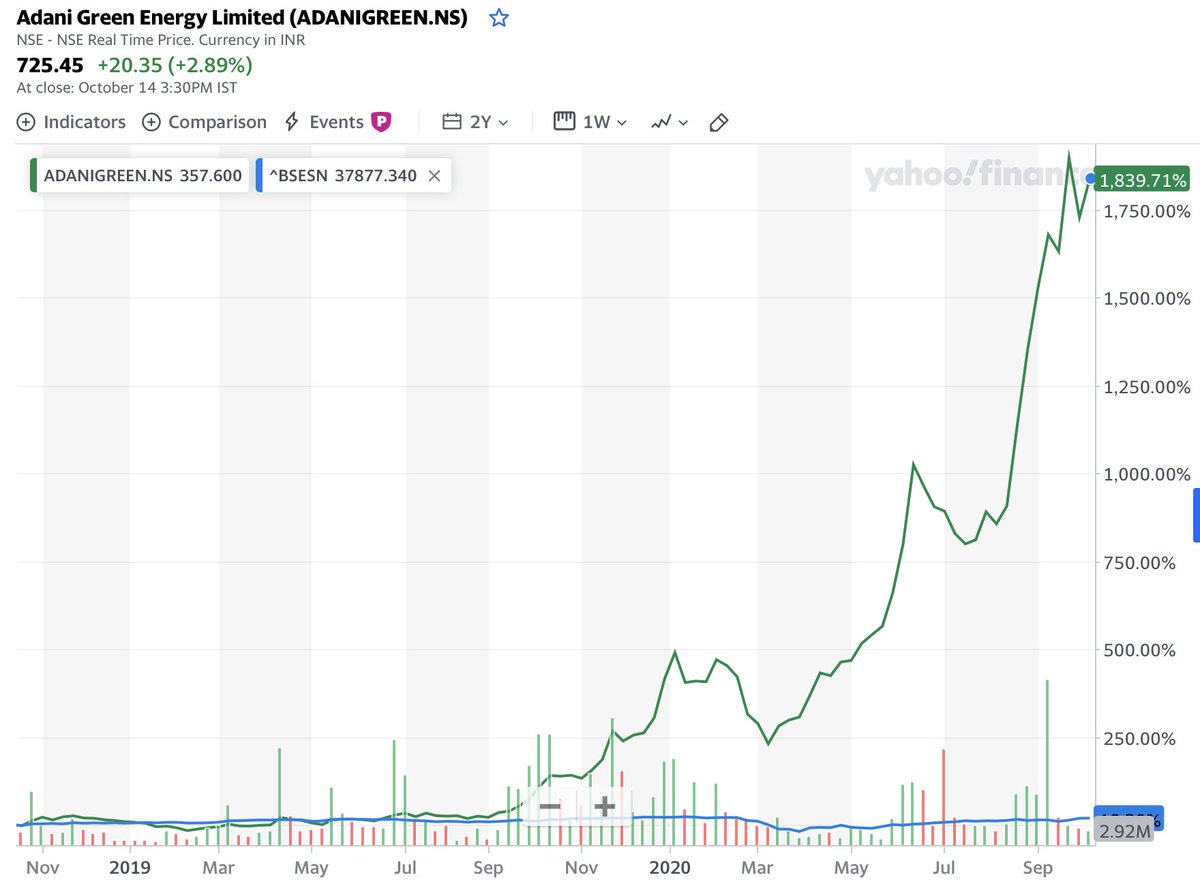

In contrast, #Adani Green Energy - with a US$15bn market capitalisation - is by value now the largest energy firm in India, by a mile (having overtaken the 65GW @ntpclimited giant last month)! 🇮🇳✅

Mr Adani owns 75% worth US$11bn!

And zero subsidies, emissions or pollution.

Mr Adani owns 75% worth US$11bn!

And zero subsidies, emissions or pollution.

I wonder if Mr Adani regrets any of his investment decisions of a decade ago?!

Overdue time to pivot, and not sink more good money trying to salvage an irreparable error.

Time for #Adani to ignore @mattjcan, look after #1 & double down on the future: "Growth with Goodness".

Overdue time to pivot, and not sink more good money trying to salvage an irreparable error.

Time for #Adani to ignore @mattjcan, look after #1 & double down on the future: "Growth with Goodness".

• • •

Missing some Tweet in this thread? You can try to

force a refresh