1/ How do you find bleeding edge leading indicators for crypto markets?

I’ll show you an amazing new platform that I'm loving 👇

#Bitcoin

I’ll show you an amazing new platform that I'm loving 👇

#Bitcoin

2/ Cryptoquant integrates advanced on-chain analytics into Tradingview, for the very first time.

Why this is such a big deal?

To understand that, you have to grok on-chain analytics’s meta game.

Why this is such a big deal?

To understand that, you have to grok on-chain analytics’s meta game.

3/ Analytics on-chain is a cross-discipline science:

It’s an arena where technical analysis works on fundamental data. And fundamental sentiment data.

Your first instinct might be to think that couldn't work.

But it does.

It’s an arena where technical analysis works on fundamental data. And fundamental sentiment data.

Your first instinct might be to think that couldn't work.

But it does.

4/ Why? Because on-chain activity is a catalyst for price.

And if you want an edge in markets, which should you study?

The result? Or the cause?

And if you want an edge in markets, which should you study?

The result? Or the cause?

5/ First principles will likelier give you the most signal.

That’s what on-chain activity is:

The heartbeat, the blood pressure, and the EKG of the network.

But traders never had direct access in tradingview. (Aside from a few basic data points on one chain.)

Until now.

That’s what on-chain activity is:

The heartbeat, the blood pressure, and the EKG of the network.

But traders never had direct access in tradingview. (Aside from a few basic data points on one chain.)

Until now.

6/ I’m just getting started on their platform, but here’s one metric I’ll definitely use:

NVT Goldencross - a fresh take on @woonomic's Network Value to Transaction Value Ratio. (w/ 1wk MA).

Bullish reversals signal a great entry on just about every major #BTC swing.

NVT Goldencross - a fresh take on @woonomic's Network Value to Transaction Value Ratio. (w/ 1wk MA).

Bullish reversals signal a great entry on just about every major #BTC swing.

7/ Cryptoquant also has customizable alerts for all of their on-chain metrics, so you'll never miss anything important.

This is a super high value feature.

This is a super high value feature.

8/ They're currently in closed beta — and just about to open their doors.

I don’t know when exactly, but soon.

👉 cryptoquant.com

I don’t know when exactly, but soon.

👉 cryptoquant.com

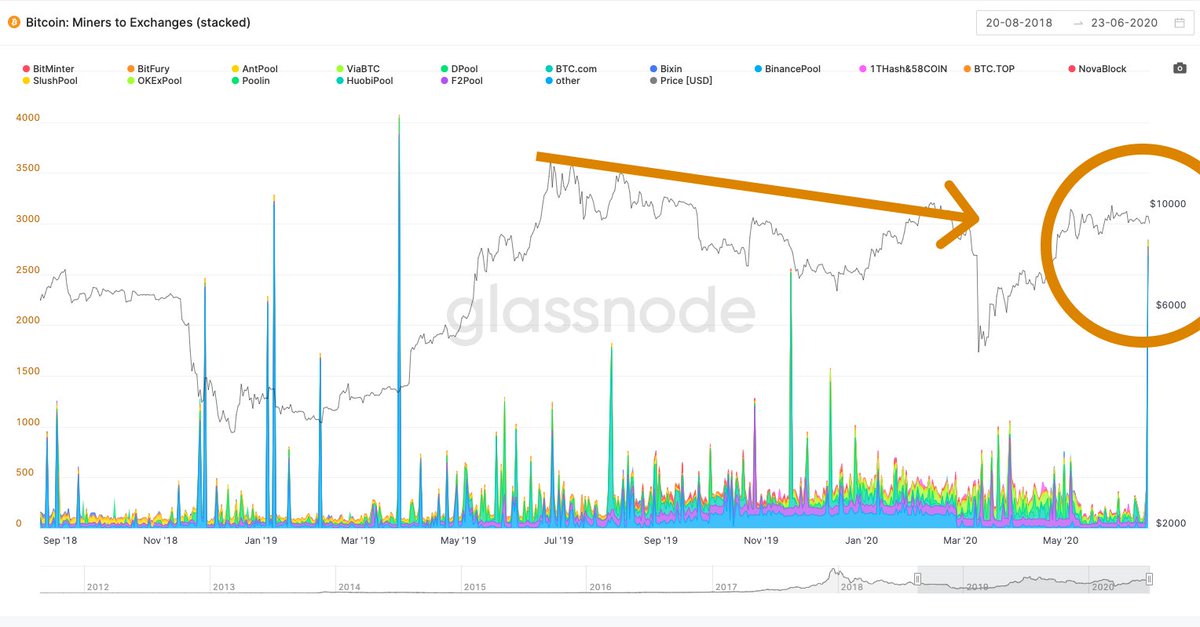

9/ Now I’m gonna pass the mic to @Yodaskk

He's put together an impressive thread of great charts and discoveries:

He's put together an impressive thread of great charts and discoveries:

https://mobile.twitter.com/Yodaskk/status/1317426530444840962

• • •

Missing some Tweet in this thread? You can try to

force a refresh