1/ New #bitcoin addresses were absolutely off the charts last week.

The backstory is bullish and intriguing — a unique view on a new bull market catalyst.

I’m about to break this down 👇

#BTC

The backstory is bullish and intriguing — a unique view on a new bull market catalyst.

I’m about to break this down 👇

#BTC

2/ First: volume precedes price.

And #bitcoin active address counts are an OG on-chain leading indicator of volume.

And #bitcoin active address counts are an OG on-chain leading indicator of volume.

https://mobile.twitter.com/woonomic/status/1311259900517867520

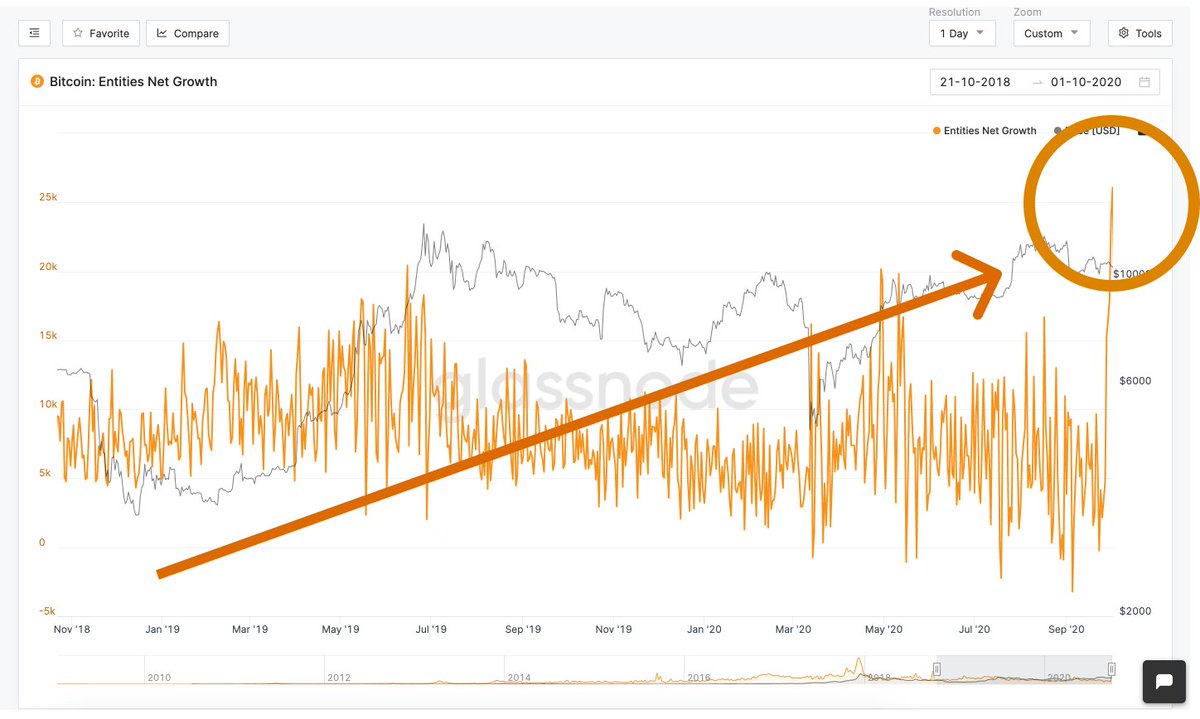

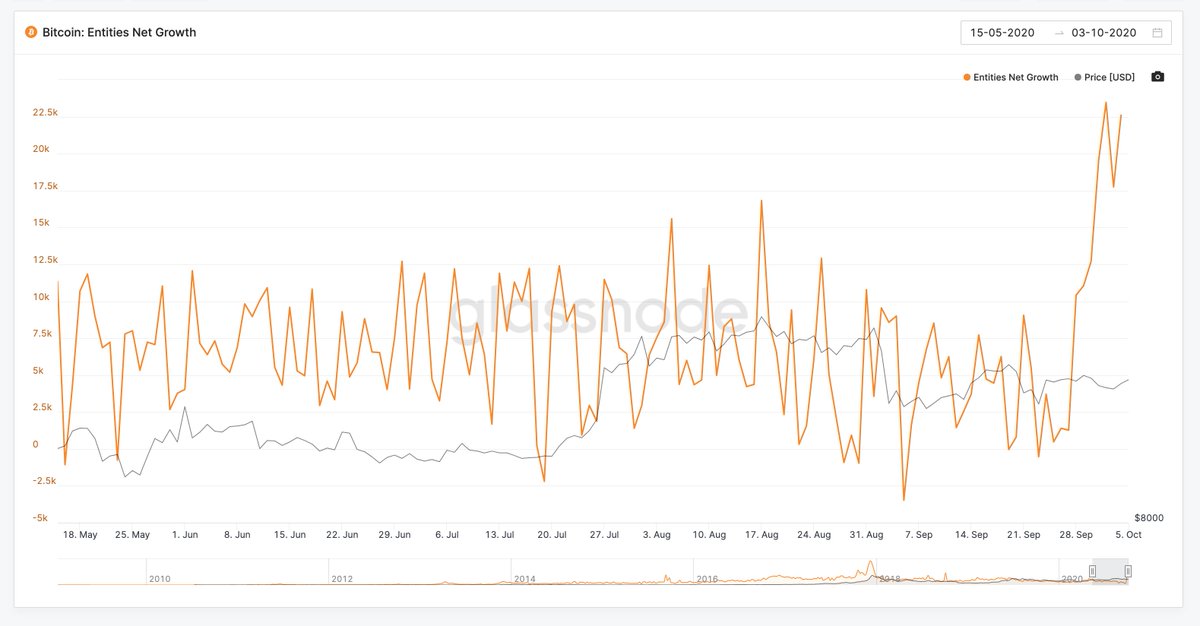

3/ We typically see 5-10k new #bitcoin addresses / day.

That figure grew it its highest level in over two years last week, peaking above 22k.

data // @glassnode // indispensable

That figure grew it its highest level in over two years last week, peaking above 22k.

data // @glassnode // indispensable

4/ Where are these new #bitcoin addresses coming from?

We’ll never know for sure — but here's my suspicion:

It's a story from last week that mostly passed under the radar — despite being the most bullish force I can imagine.

We’ll never know for sure — but here's my suspicion:

It's a story from last week that mostly passed under the radar — despite being the most bullish force I can imagine.

5/ Last week the Chinese government began a coordinated marketing campaign to focus Chinese retail investor psyche on crypto.

Yes, this is really happening.

coindesk.com/china-crypto-b…

Yes, this is really happening.

coindesk.com/china-crypto-b…

7/ The Chinese government seems to want to ignite the bull market.

https://mobile.twitter.com/cz_binance/status/1309373959410864129

8/ But doesn’t China have a long track record of suppressing crypto?

Yes...but the reality is more complex. Simplified:

Chinese leadership promotes whatever narrative benefits their position, at any given time.

Yes...but the reality is more complex. Simplified:

Chinese leadership promotes whatever narrative benefits their position, at any given time.

9/ Why the new narrative? My guess:

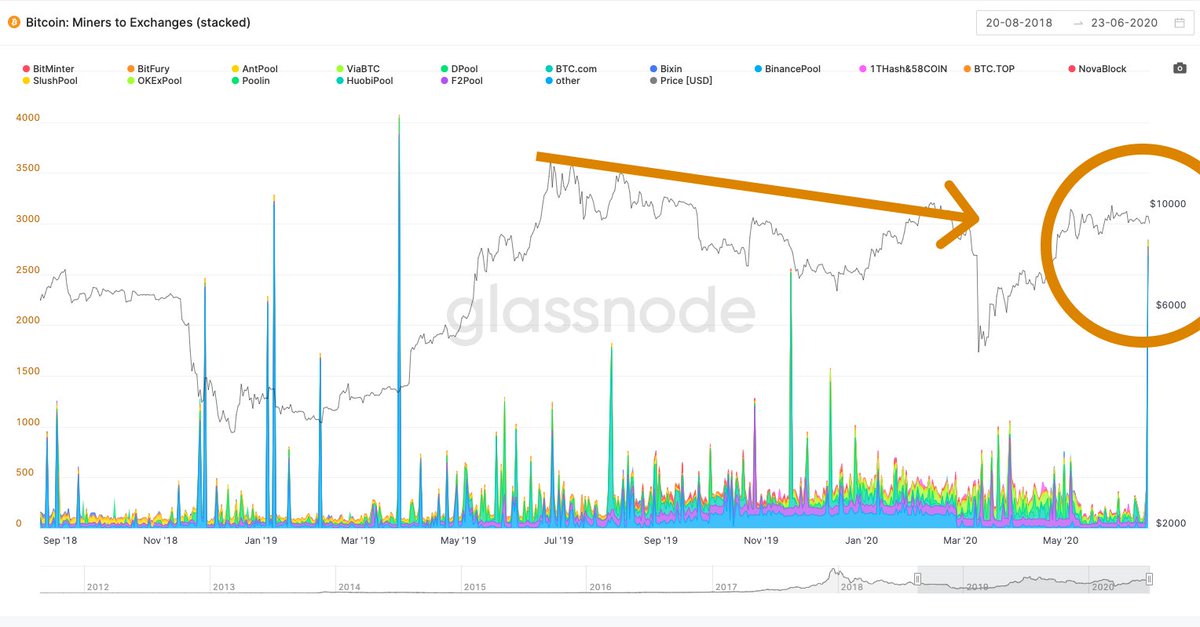

China dominates $BTC mining — and no doubt holds more $BTC than any other country, by a wide margin.

#Bitcoin is China’s national treasure.

Sooner or later, maximizing $BTC's potential becomes an unavoidable economic incentive.

China dominates $BTC mining — and no doubt holds more $BTC than any other country, by a wide margin.

#Bitcoin is China’s national treasure.

Sooner or later, maximizing $BTC's potential becomes an unavoidable economic incentive.

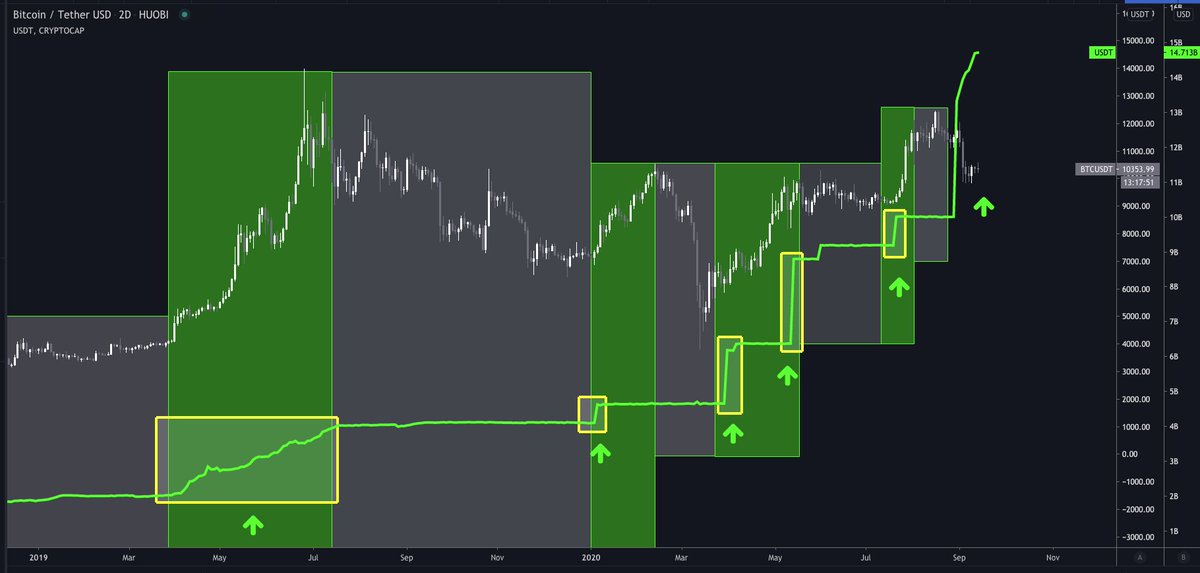

10/ The recent explosion in #Tether printing might have been a leading precursor to China's marketing campaign.

China dominates $USDT volume globally -- and #Tether dominates their fiat onramp liquidity.

China dominates $USDT volume globally -- and #Tether dominates their fiat onramp liquidity.

11/ And of course, #Tether printing has been an effective leading indicator for years.

h/t @BTC_JackSparrow

h/t @BTC_JackSparrow

12/ I suspect Chinese retail buying interest helped #bitcoin absorb last week’s bearish headlines.

https://mobile.twitter.com/iamjosephyoung/status/1311945753909108736

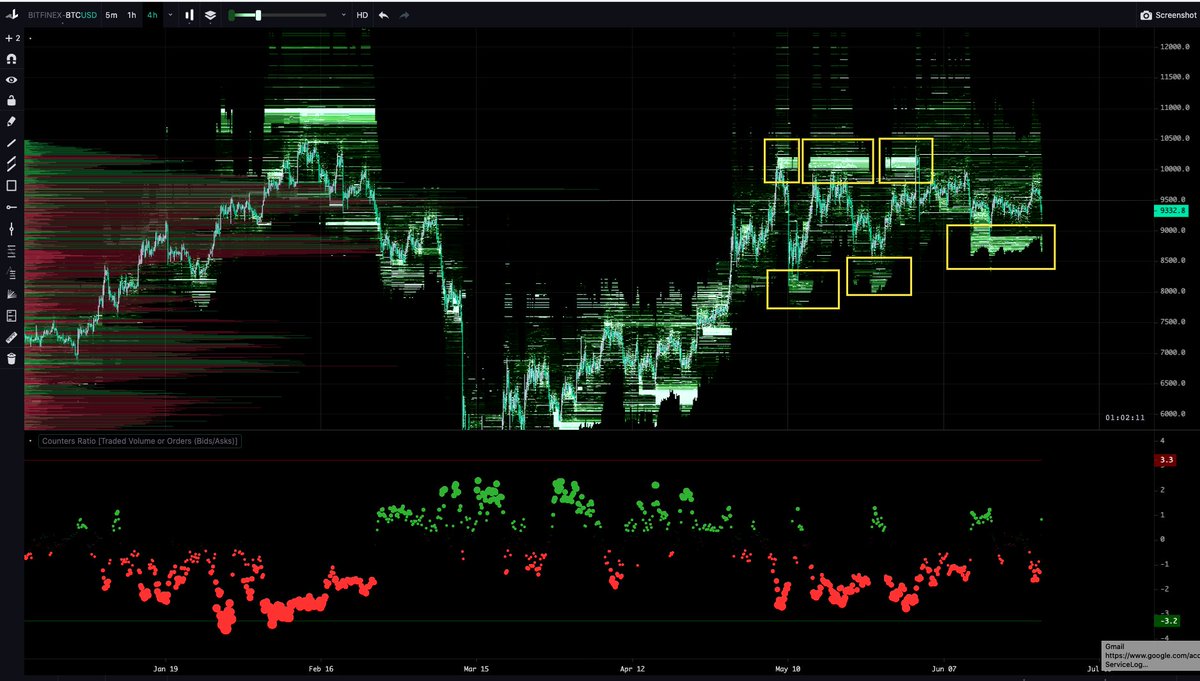

13/ I’d love to validate the overall theory with OkEx, Huobi & Binance volume, but it doesn’t work that way.

New retail buyers won’t make a statistically significant impact on exchange volume that's dominated by much larger players, already in excess of a billion dollars/day.

New retail buyers won’t make a statistically significant impact on exchange volume that's dominated by much larger players, already in excess of a billion dollars/day.

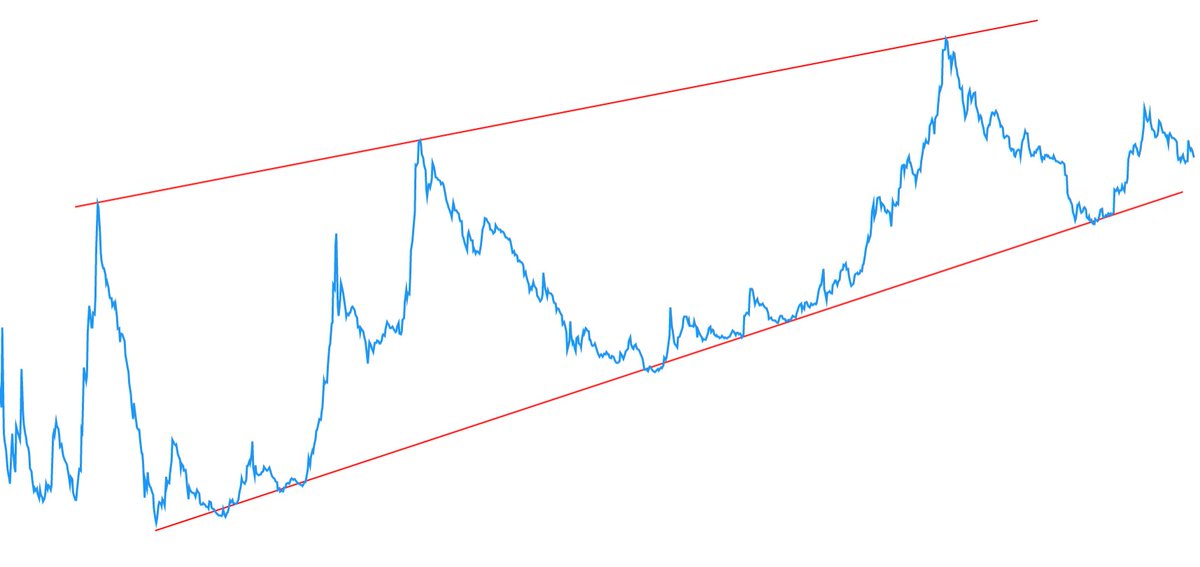

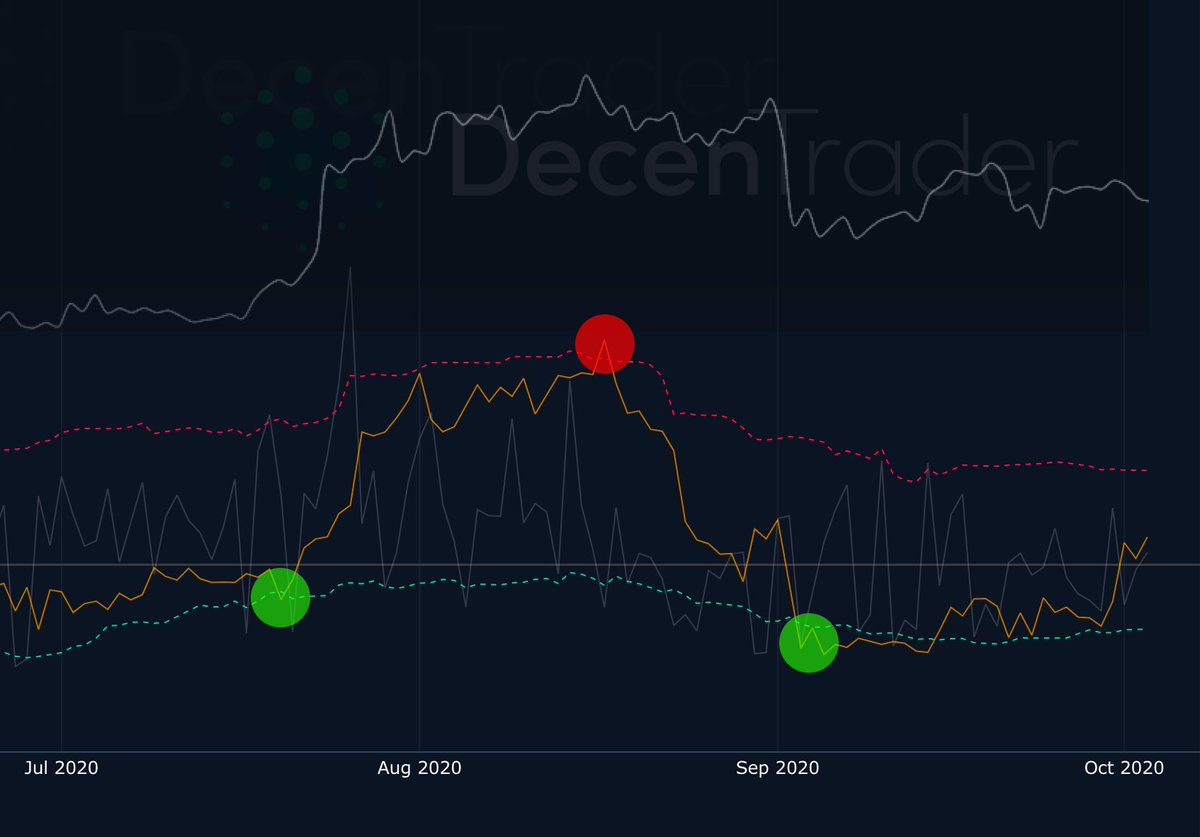

14/ Daily active addresses likely offers advanced signals on big moves throughout this bull market.

A great lens on that is Active Address Sentiment — the brainchild of my friends at @decentrader.

(@filbfilb + @philipswift)

A great lens on that is Active Address Sentiment — the brainchild of my friends at @decentrader.

(@filbfilb + @philipswift)

https://twitter.com/PositiveCrypto/status/1310619218023505923

15/ Active Address Sentiment is a cross-discipline indicator:

It does technical analysis on fundamental data.

It’s a leading indicator with a history of solid bull market signals.

It does technical analysis on fundamental data.

It’s a leading indicator with a history of solid bull market signals.

16/ Bottom line -- this news is incredibly bullish, and appears to have fundamental confirmation.

I definitely I expect more shakeouts and sideways price action moving forward.

But I'm fundamentally bullish on $BTC.

And I think hodlers will be grinning by Christmas.🎄

I definitely I expect more shakeouts and sideways price action moving forward.

But I'm fundamentally bullish on $BTC.

And I think hodlers will be grinning by Christmas.🎄

• • •

Missing some Tweet in this thread? You can try to

force a refresh