1/ HEY CRYPTO LAWYERS: buckle in bc a big piece of US #crypto regulatory puzzle fell in place yesterday. Culminates >2yr process, coordinating w/ SEC & other regulators, to clarify "#qualifiedcustodian." #NoActionLetter by #Wyoming Banking Division🤠here:

docs.google.com/viewer?a=v&pid…

docs.google.com/viewer?a=v&pid…

2/ Here's an article from @ForbesCrypto's @AndreaTinianow & a post from McDermott Will & Emery, the attorneys who obtained the letter for @TwoOceanTrust of #Wyoming.

So...WHAT DOES IT REALLY MEAN??? 🤔

mwe.com/media/mcdermot…

forbes.com/sites/andreati…

So...WHAT DOES IT REALLY MEAN??? 🤔

mwe.com/media/mcdermot…

forbes.com/sites/andreati…

3/ Follow along! Under SEC Custody Rule & SEC Customer Protection Rule, #RIAs (Registered Investment Advisers) & investment managers must hire a #qualifiedcustodian to store customers' assets.

But traditional custody banks can't/won't touch #bitcoin & other #crypto right now.

But traditional custody banks can't/won't touch #bitcoin & other #crypto right now.

4/ So, how can RIAs & asset managers offer #crypto to their clients, if custody banks won't provide the service? Until v recently the ONLY option was to use a trust company as custodian. But #Wyoming for the save! It started chartering banks & gave a trust co a #NoActionLetter.🤠

5/ Key point: liability for an #RIA or asset manager is HUGE if something goes wrong & a court finds their custodian *WASN'T ACTUALLY* a #qualifiedcustodian. How can an #RIA/asset mgr manage this liability risk? Hire a bank as custodian, or hire a trust co w/ #NoActionLetter.

6/ AGAIN, I can't stress enuf how #Wyoming has helped pave way for US institutional investors to invest in #bitcoin & #crypto. (This liability issue was big, bc many fiduciaries have personal liab for their decisions--esp in pensions--so they just can't take legal uncertainty.)

7/ So, #RIAs/asset mgrs will likely gravitate to custodians that give more legal certainty that they are indeed #qualifiedcustodians.

Which custodians can give that?

* banks can

* #Wyoming #SPDI banks can🤠(Kraken+hopefully Avanti soon!🤞)

* @TwoOceanTrust can (see its letter).

Which custodians can give that?

* banks can

* #Wyoming #SPDI banks can🤠(Kraken+hopefully Avanti soon!🤞)

* @TwoOceanTrust can (see its letter).

8/ But what about all the other trust companies in #crypto? 🤔

Read the details in the #NoActionLetter--most prob aren't #qualifiedcustodians. To be clear that letter applies only in #Wyoming, but you'd be crazy if you think it won't have broad reach beyond Wyoming, bc it is...

Read the details in the #NoActionLetter--most prob aren't #qualifiedcustodians. To be clear that letter applies only in #Wyoming, but you'd be crazy if you think it won't have broad reach beyond Wyoming, bc it is...

9/ ...literally the roadmap for attorneys advising #RIAs & asset mgrs to use in determining if their custodian is actually a #qualifiedcustodian. Big law firm (McDermott Will & Emery) obtained it. Yep, other key regulators were consulted. Its reach will go far beyond #Wyoming.

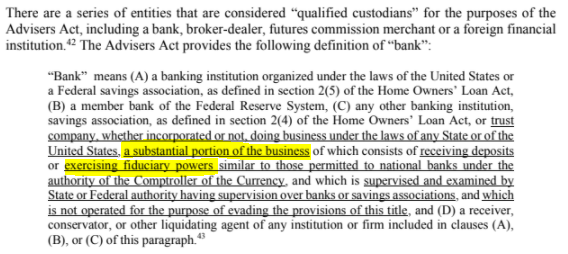

10/ What it DOESN'T mean, tho, is that all trust cos fail to qualify. Here's the standard--a trust co is a #qualifiedcustodian as long as "a substantial portion" of its biz involves "exercising fiduciary powers similar to those permitted to national banks" as defined by the OCC.

11/ So a "substantial portion" of a trust co's biz must involve exercising fiduciary powers (which means exercising discretion over customer assets). The OCC takes position that custody isn't a fiduciary activity bc custody doesn't involve exercise of discretion (see the letter).

12/ So that means a trust co likely must PROVE to #RIAs/asset mgrs that a "substantial portion" of its biz involves activity other than custody where it exercises discretion.

Here's the rub tho. In the fine print, most trust cos EXPRESSLY SAY THEY ARE NOT FIDUCIARIES (!!!)

Here's the rub tho. In the fine print, most trust cos EXPRESSLY SAY THEY ARE NOT FIDUCIARIES (!!!)

13/ And if a trust co isn't a fiduciary for a "substantial portion" of its biz, then it's not a #qualifiedcustodian & the #RIAs or asset mgrs will probably need to find a different custodian that is.

Next, what does "substantial" mean? The letter goes into detail.

Next, what does "substantial" mean? The letter goes into detail.

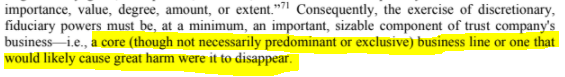

14/ "Substantial" isn't "necessarily predominant or exclusive"...but the trust co's fiduciary activity must be a "core" business of the trust co that "...would likely cause great harm were it to disappear."

Confusing?? In the next tweet, I'll summarize.

Confusing?? In the next tweet, I'll summarize.

15/ SUMMARY:

* if a trust co doesn't act as a fiduciary at all, then it's not a #qualifiedcustodian. Period.

* if a trust co does have some fiduciary activities in addition to #crypto custody, then the test is whether those fiduciary activities are "substantial" to the trust co.

* if a trust co doesn't act as a fiduciary at all, then it's not a #qualifiedcustodian. Period.

* if a trust co does have some fiduciary activities in addition to #crypto custody, then the test is whether those fiduciary activities are "substantial" to the trust co.

16/ I've long suspected most of the trust cos formed in #crypto in past ~5+ yrs wouldn't pass the #qualifiedcustodian test, bc they aren't acting as fiduciaries in a "substantial" portion of their biz. @TwoOceanTrust is, tho, as the letter makes clear. It has a "golden ticket..."

17/ ...in the form of that #NoActionLetter. For all other trust cos, the test will be fact-specific & the burden is on the trust cos to prove they qualify. #RIAs/asset managers will start asking trust cos to provide disclosure on how "substantial" their fiduciary activities are.

18/ Now that banks are in the #crypto custody biz + one trust co has a #NoActionLetter, many #RIAs & asset mgrs just won't take legal risk of using a trust co that doesn't have such a letter.

A "gold standard" in #crypto custody used to be a trust charter. But the puck moved.

A "gold standard" in #crypto custody used to be a trust charter. But the puck moved.

19/ Now, banks are in #crypto custody (#SPDIs are already here; OCC-chartered banks are on the way too (when the OCC is ready to supervise #digitalassets).

Next, ponder this: why do you think the big custodians in securities markets are banks, not trust cos? I think 4 reasons:

Next, ponder this: why do you think the big custodians in securities markets are banks, not trust cos? I think 4 reasons:

20/

i. banks are #qualifiedcustodians by def'n,

ii. banks can access Fed liquidity,

iii. banks are much better capitalized, audited & subject to much more frequent supervisory exams, &

iv. banks offer customers clearer asset segregation protection in bankruptcy than trust cos.

i. banks are #qualifiedcustodians by def'n,

ii. banks can access Fed liquidity,

iii. banks are much better capitalized, audited & subject to much more frequent supervisory exams, &

iv. banks offer customers clearer asset segregation protection in bankruptcy than trust cos.

21/ TO SUM UP, an unclear area of US #crypto regulation (#qualifiedcustodian) just got much-needed clarification, just in time for the wave of #RIAs & other institutional investors now buying #bitcoin for their customers. That's awesome for #crypto!

22/ NONE OF THIS IS LEGAL ADVICE! Talk to your own attorneys. Read the #NoActionLetter. Call #Wyoming (note its #SPDI charter has been open to applicants for 1yr).

And be sure to thank WY for this clarification, which will help bring more institutional investors into #crypto!🤠

And be sure to thank WY for this clarification, which will help bring more institutional investors into #crypto!🤠

• • •

Missing some Tweet in this thread? You can try to

force a refresh