"The SEN handled 68,361 transactions in the quarter, a 70% sequential increase from the 2020 second quarter and a 455% increase as compared to the 2019 third quarter"

https://twitter.com/ValuewaCatalyst/status/1321122022911582208

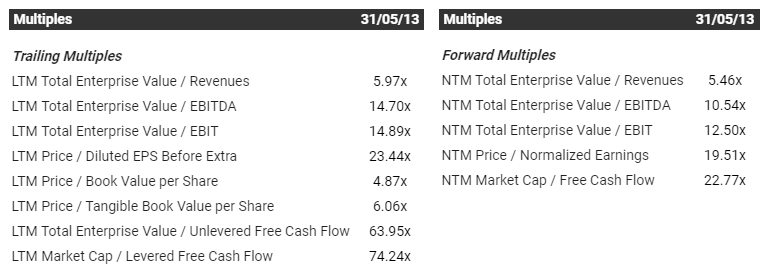

So the chart below is the one above but if you didn't like the crypto aspect of that then this is another one to pass by - however, whilst there's a little more of the same this has an additional angle: this is kind of a bank proxy for what #GAN is (was?) meant to be to gambling.

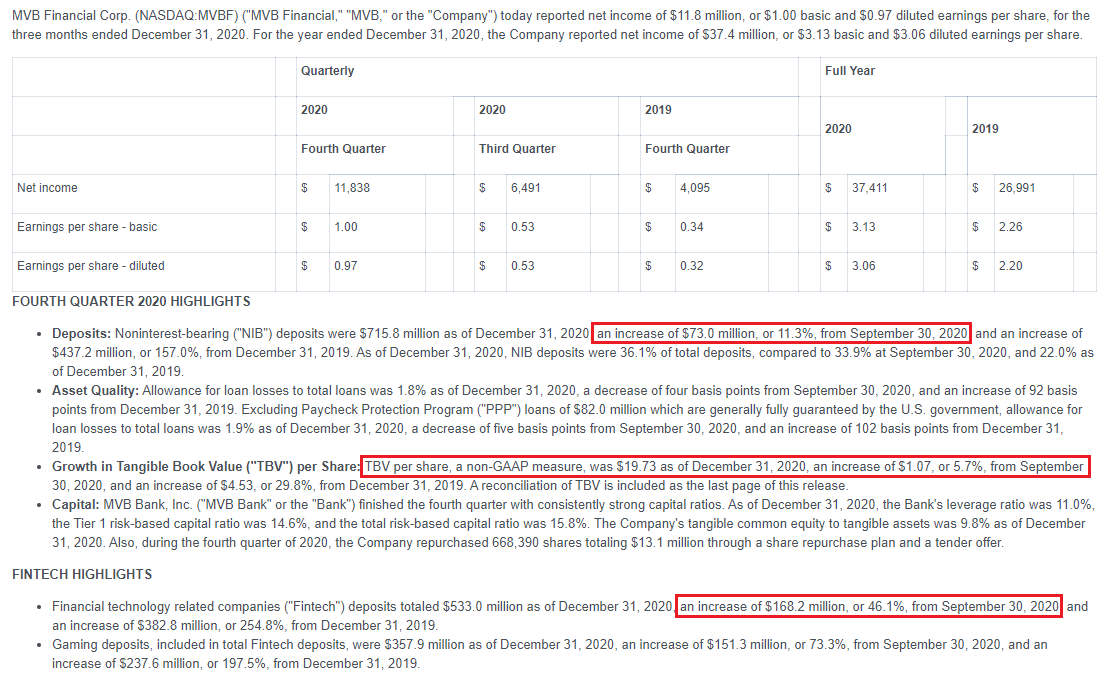

Here it is, selling for just under a whisker of TBV - this bank, MBV Financial, $MBVF is growing like a weed not only to a small crypto side of things but in large part thanks to the fact that they're directly linked to deposit taking for the likes of Draft Kings etc

Along with $SI above, this is another bank that instead of quietly stagnating, is attempting to adapt.

As correctly pointed out by @relativevalue00, the name is MVB Financial $MVBF rather than MBV Financial $MBVF They are indeed illiquid and have the advantage over MBV of actually existing. Many thanks for the heads up!

https://twitter.com/relativevalue00/status/1324798346373009409?s=20

A couple of interesting bits on $SI - thanks to

@dopamine_uptake for flagging them up

Podcast with CEO - excellent to understand the company and what APIs mean for banking. You can see why some trade below book and others don't

podcasts.google.com/feed/aHR0cHM6L…

Cathie hard on it

@dopamine_uptake for flagging them up

Podcast with CEO - excellent to understand the company and what APIs mean for banking. You can see why some trade below book and others don't

podcasts.google.com/feed/aHR0cHM6L…

Cathie hard on it

I was thinking about mentioning this bank yesterday: $EBC, a recent demutualisation but decided on the whole it was too boring and too little to say. Good deposit growth ex-ppp; cost of deposits practically nil and non-interest income exposure of ⅓ of the total.

Shortly after not tweeting about it, they then announced a merger - the interesting thing here is the price: 1.75 TBV of the target. It seems a bit on the high side but I don't know the target.

businesswire.com/news/home/2021…

businesswire.com/news/home/2021…

Here's another bank trading perhaps by now, a little under that 1.75x - it's the pipsqueak in the previous few tweets and the one just above $20B cap $MTB in 22nd place in terms of number of deposit accounts.

And thanks to @walnutavevalue's sharp eyes, we find that he actually likes it enough to borrow money to exercise as many options as he can - as you'd imagine vs his $700K salary and $2M overall annual comp, a $25M stock position means he has to stretch.

What does his board see to be running a 15% ownership stake with him now at +6% and the 2nd largest holder of stock overall?

My guess is that it's probably similar to the highlighted items in the $EDC statement above. Deposits are growing in the order of a couple of % a week - nice but that only takes you so far; you can only make so much on lending

They're probably also looking non-interest income

They're probably also looking non-interest income

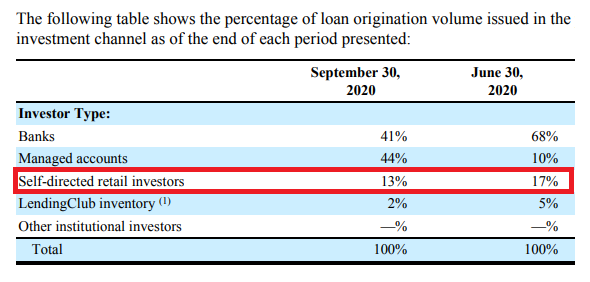

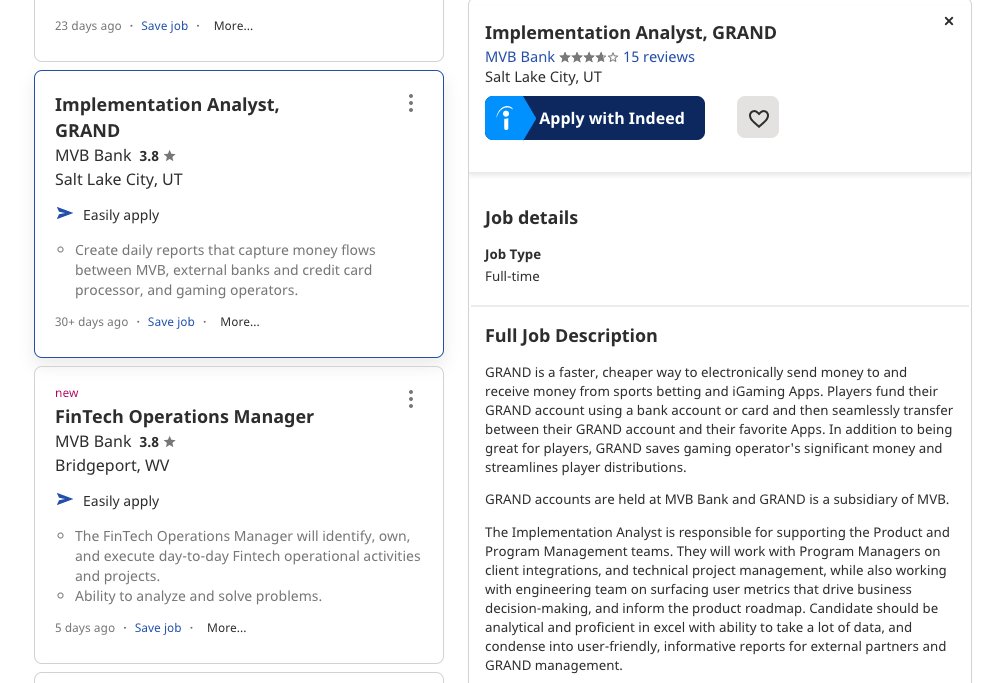

Integrations with BNPL players, card aquiring, gaming wallets - the whole nine yards; things like this below also discovered by @walnutavevalue. Imagine the fervour if such things were available publicly!

$MVBF's latest Q: red with the fintech contribution to NIM at double the level of last year, it's starting to become a material offset to spread pressure. Blue shows some of the cost side benefits from an earlier sale of 4 branches. Green's the next sale, I assume similar to come

I'll bury this here. Above is $CCB. If you look at the kind of premiums the differentiated banks got / are getting whether that was crypto for $SI at the top, gaming for $MVBF or the beginnings of white labelling for $CCB then whilst there's an awful lot not to like about $BMTX..

..then it's not entirely impossible that <1x '21 sales and 20% (extremely) adjusted EBITDA margin may be too cheap.

Results from $BMTX, decent enough I'd think. Operating cashflow apparently $9.5m for the quarter. The line with "other" seems to be whitelabel work for what I assume must either be $GOOG or $TMUS

• • •

Missing some Tweet in this thread? You can try to

force a refresh