Why @reliancejio is more profitable compared to its peers like #vodafoneidea and #Bhartiairtel?

A thread

#investing #investors

A thread

#investing #investors

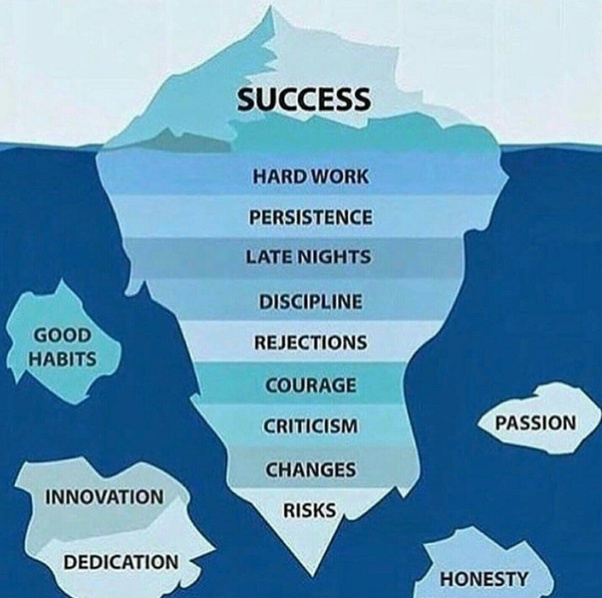

1. This one image aptly describes the way people observe the success of ‘Reliance Jio'.

But, let us delve deep and understand the factors that led to the success of ‘Reliance Jio' rather than just focusing on the tip of the iceberg.

But, let us delve deep and understand the factors that led to the success of ‘Reliance Jio' rather than just focusing on the tip of the iceberg.

2. Many of us might just remember ‘Reliance Jio' for the way it was launched commercially in 2016. Well, there is a solid reason as to why one can not forget the commercial launching of ‘Reliance Jio'.

3. It was Sep. 2016, when the country was already facing the consequences of ‘Demonetization’ and standing in long queues to get the right change was hell of a task! That was the time when Reliance came all guns blazing and announced the launch of its 4G services free of cost!

4. And we Indians love freebies, don’t we? In no time ‘Jio’ became a popular name.

But, let us look at the timeline before this commercial launch of ‘Reliance Jio’.

But, let us look at the timeline before this commercial launch of ‘Reliance Jio’.

5. So, when you and I started enjoying the services of Jio since 2016, there was tremendous money and time spent in capex and making state of art infrastructure for 4G services from 2010 to 2016.

6. And since then, Reliance Jio has been the game changer not just for Reliance Industries Limited but also for the entire telecom sector.

7. Market Penetration of Reliance Jio:

What do customers love?

Quality service at low cost! And this is a universal phenomenon.

That was exactly the market penetration strategy of Reliance Jio.

What do customers love?

Quality service at low cost! And this is a universal phenomenon.

That was exactly the market penetration strategy of Reliance Jio.

8. In September 2016, when Reliance Jio launched its 4G services almost free of cost, it ensured the quality service which helped it gain the market share swiftly from the likes of Vodafone, Idea and Airtel.

9. Jio changed the dynamics of the entire telecom sector. I say this because the ARPU (Average Revenue Per User: It shows how much a user pays a telecom company on an average per month) of the telecom sector fell sharply as Jio was launched.

10. In 2016, as Reliance Jio entered the market, it made quality service available almost free of cost. This led to the ARPU war and other telecom companies like Airtel, Idea, Vodafone, etc were forced to reduce the prices. This led to a sharp fall in ARPUs.

11. Meanwhile, from 2016–2020,

‘Reliance Jio’ managed not just to increase its market share but it eventually became the market leader with more than 30% market share . Also, it managed to breakeven and now it is unlocking the value for its parent company, ‘RIL’.

‘Reliance Jio’ managed not just to increase its market share but it eventually became the market leader with more than 30% market share . Also, it managed to breakeven and now it is unlocking the value for its parent company, ‘RIL’.

12. Idea and Vodafone realized that to stay in the game, they need to shake hands. This marked the the merger of Idea Vodafone on 31st August 2018.

13. Now, if you may ask, how Jio managed to give good services free of cost? Well, that is one sure shot advantage of having a great holding company (Reliance Industries Limited) with deep pockets.

14. The timing of Reliance Jio is one of the primary reasons it is way ahead of its peers.

From 2007 to 2020, the entire telecom sector was consolidating due to the AGR issue. (Read more here: quora.com/What-is-the-en…)

From 2007 to 2020, the entire telecom sector was consolidating due to the AGR issue. (Read more here: quora.com/What-is-the-en…)

15. This led to massive increase in liabilities of almost all the telecom companies except Jio. The reason was the fact that Jio was launched late.

16. Thus,

Cash rich holding company

Great planning and execution

The timing of its launch

are the reasons why Reliance Jio is profitable while is peers are struggling.

Cash rich holding company

Great planning and execution

The timing of its launch

are the reasons why Reliance Jio is profitable while is peers are struggling.

17. The End

• • •

Missing some Tweet in this thread? You can try to

force a refresh