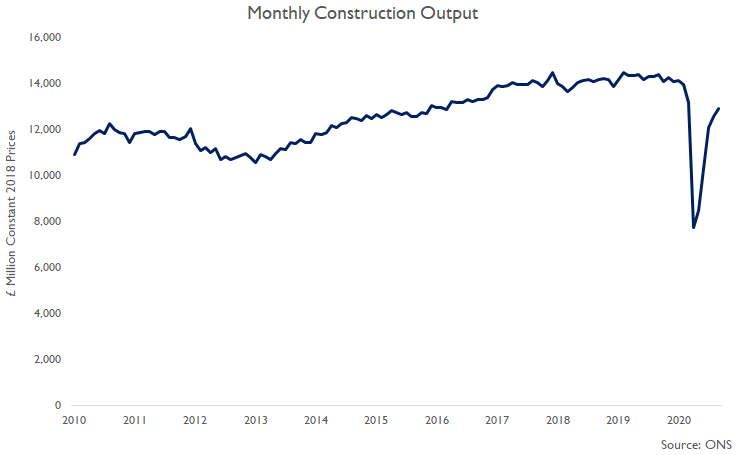

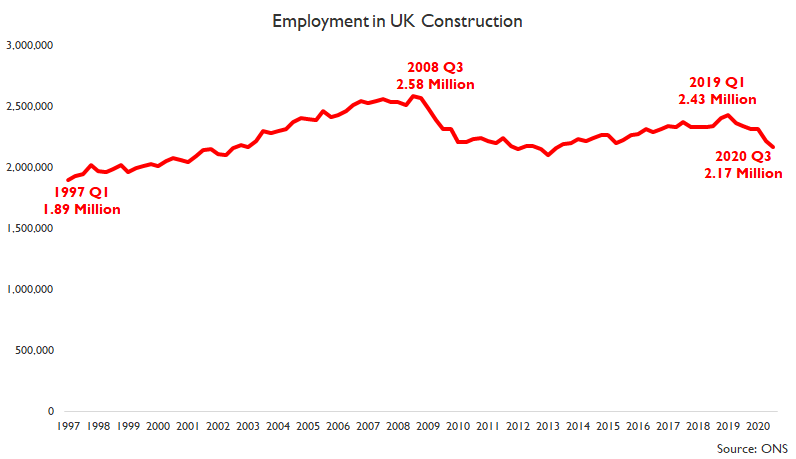

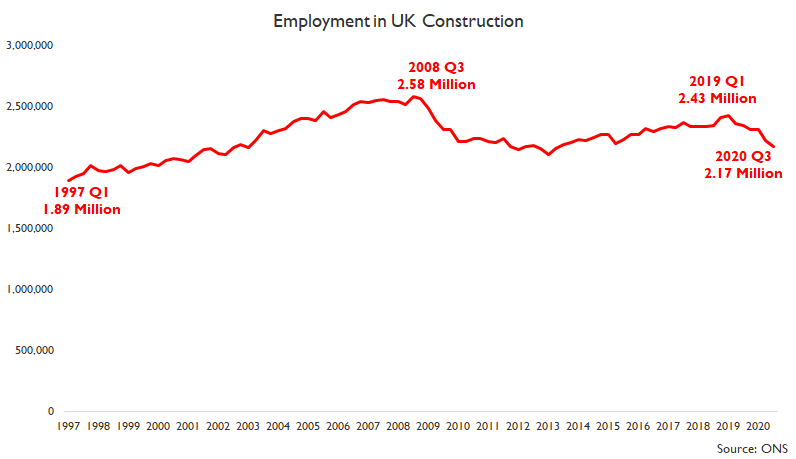

In spite of the recovery in UK construction activity since social distancing restrictions eased, construction has lost 142,000 jobs since 2019 Q4, pre-Covid-19, & lost 258,035 jobs since the recent peak of 2019 Q1 according to @ONS.

#ukconstruction

ons.gov.uk/employmentandl…

#ukconstruction

ons.gov.uk/employmentandl…

UK Construction employment in 2020 Q3 was 7% lower than a year earlier & 11% lower than the recent peak of 2019 Q1, which is broadly in line with activity overall in construction overall at the end of September...

#ukconstruction

#ukconstruction

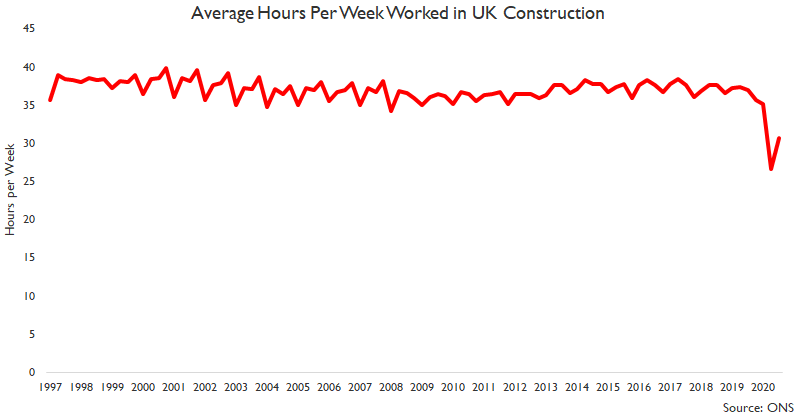

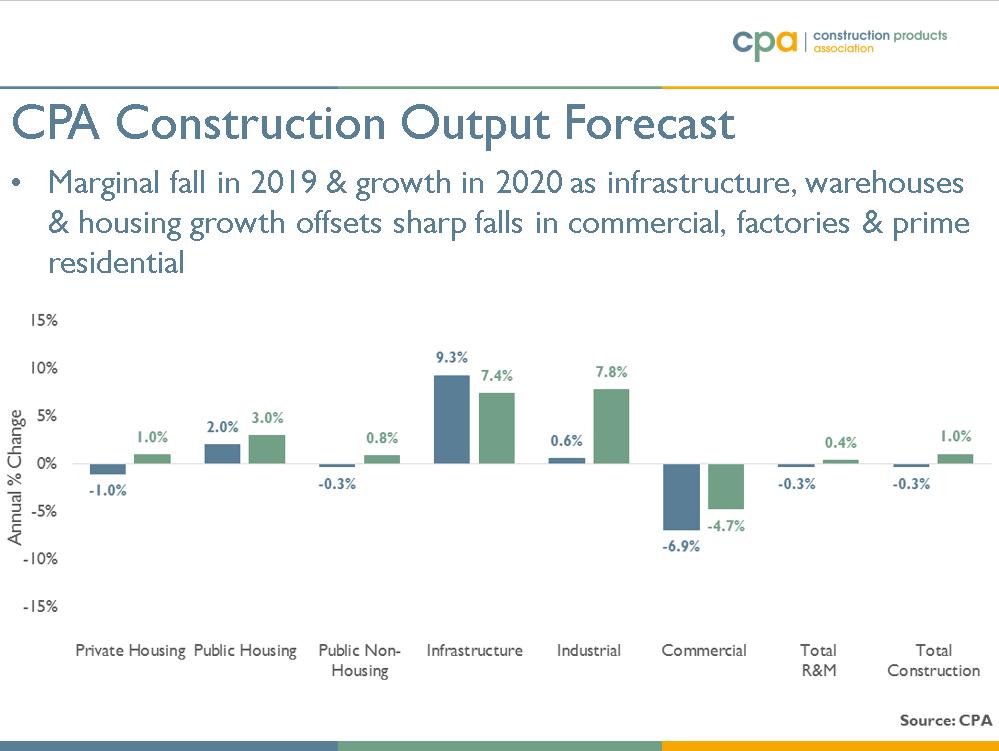

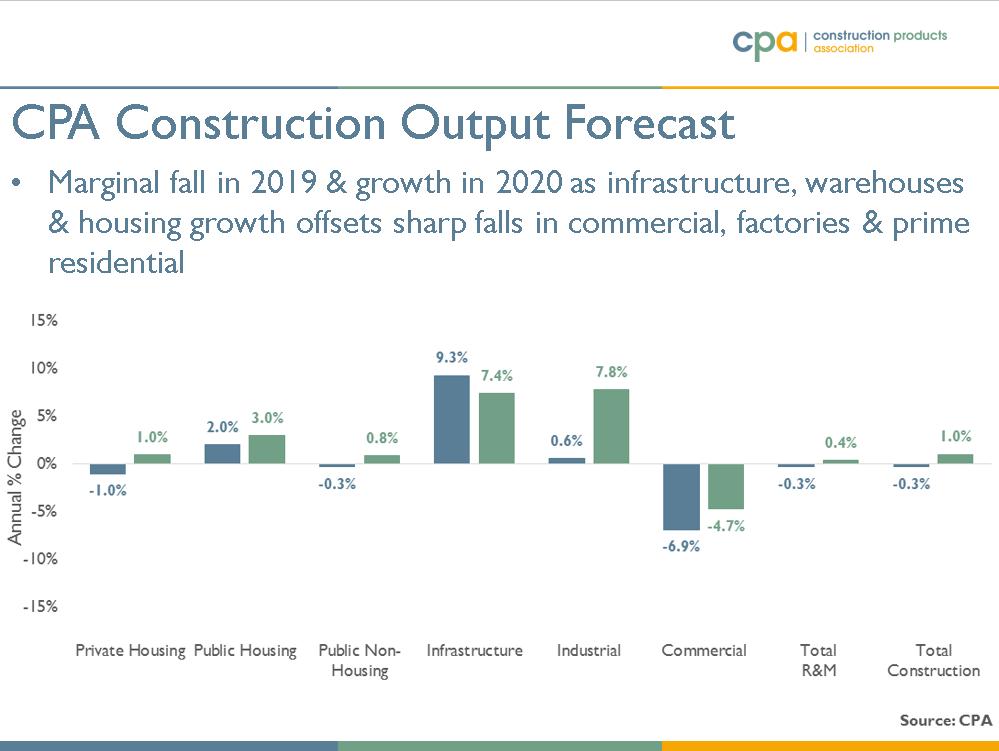

... given that UK construction demand overall has not returned to pre-Covid-19 levels (although it clearly has in some sectors e.g. infrastructure, housing new build & refurb) combined with fewer trades on site simultaneously due to social distancing especially...

#ukconstruction

#ukconstruction

... combined with other safety measures that affects site numbers particularly in sectors such as commercial (towers!) & industrial, in which demand is falling as projects started pre-Covid-19 finish & are not replaced at the same rate.

#ukconstruction

#ukconstruction

• • •

Missing some Tweet in this thread? You can try to

force a refresh