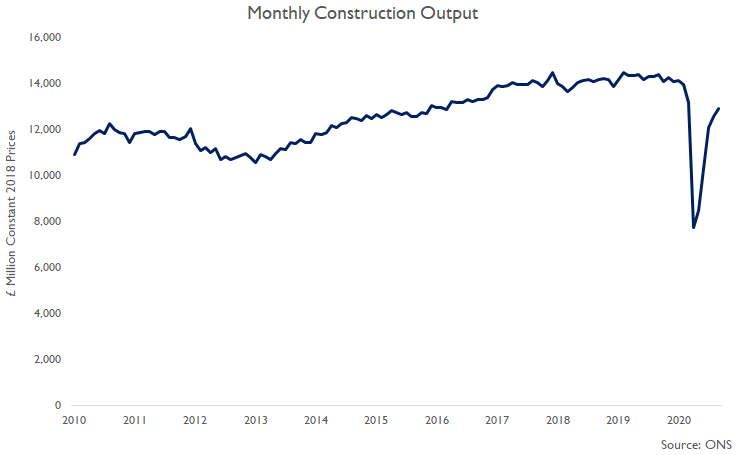

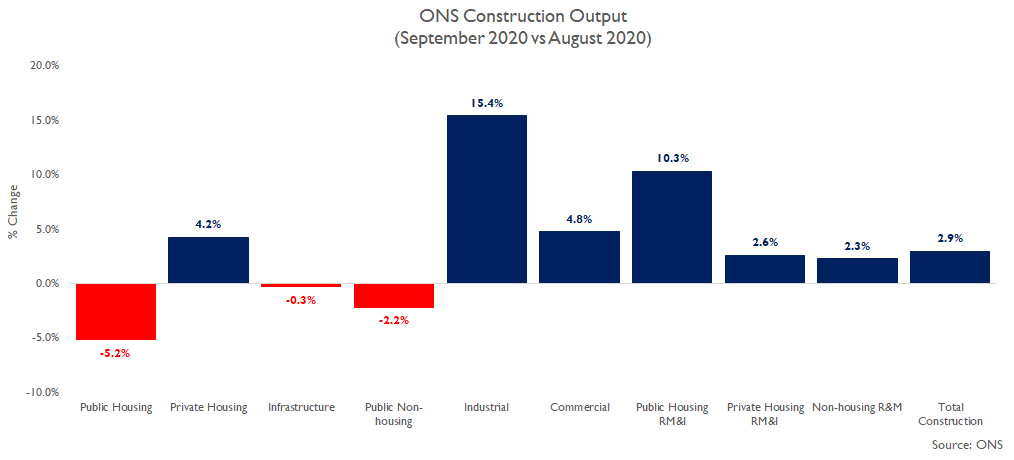

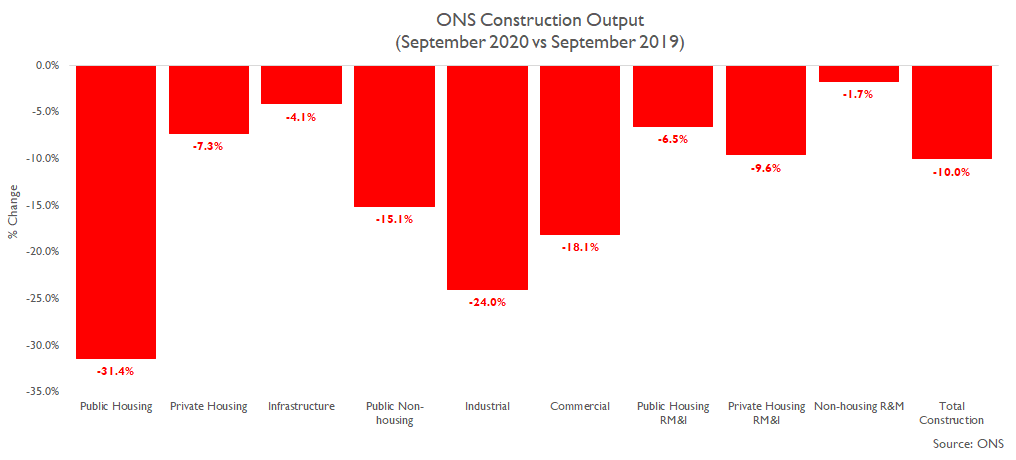

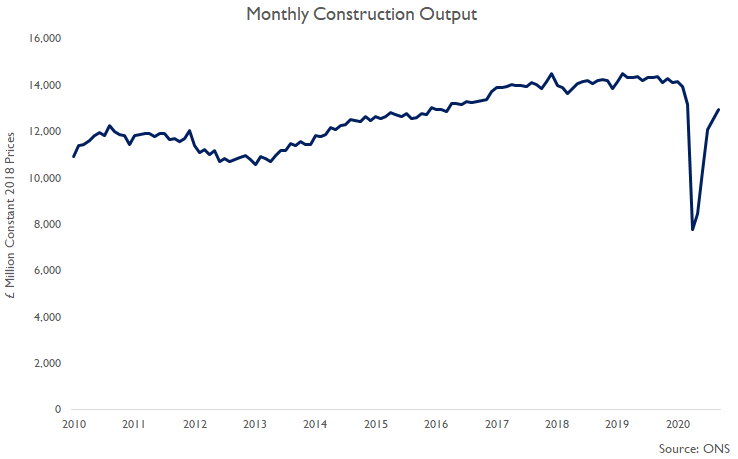

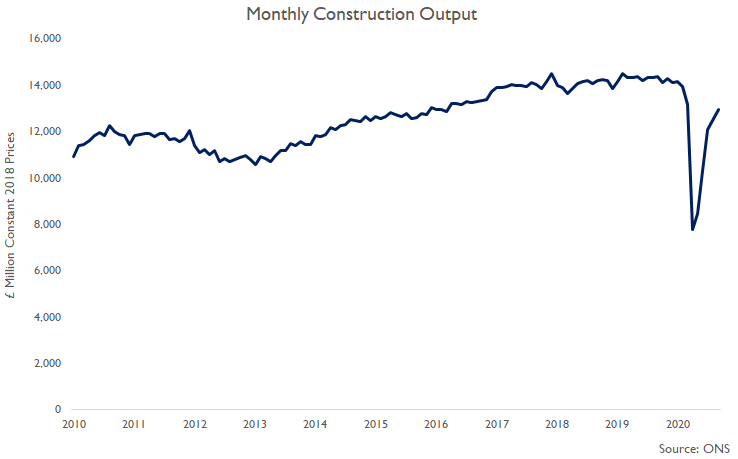

Total construction output in September 2020 was 2.9% higher than in August but still remained 10.0% lower than a year earlier but there were considerable differences across the different construction sectors...

#ukconstruction

ons.gov.uk/businessindust…

#ukconstruction

ons.gov.uk/businessindust…

... & on a quarterly basis, total construction output 2020 Q3 was unsurprisingly 41.7% higher than in (Lockdown 1-affected) Q2 but it remained 12.6% lower than a year earlier...

#ukconstruction

#ukconstruction

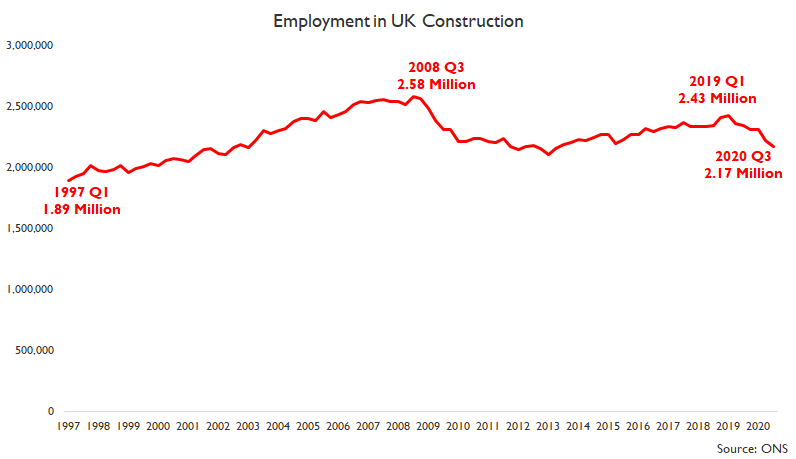

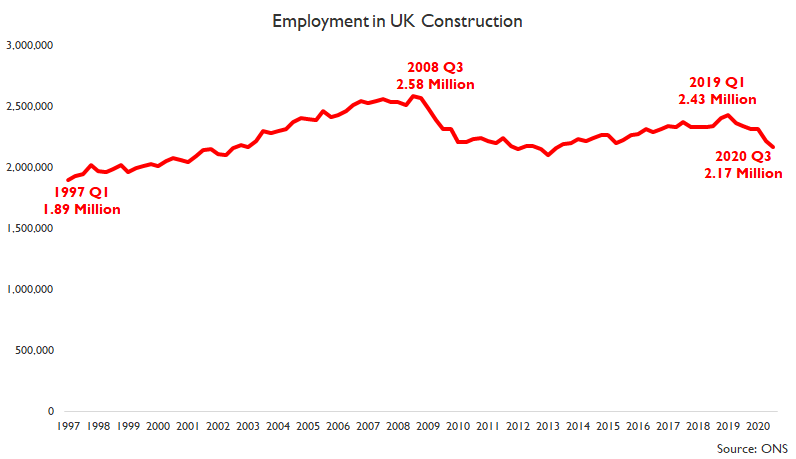

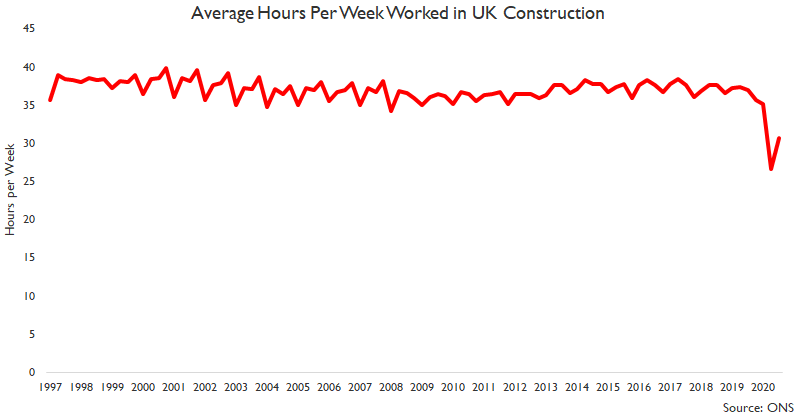

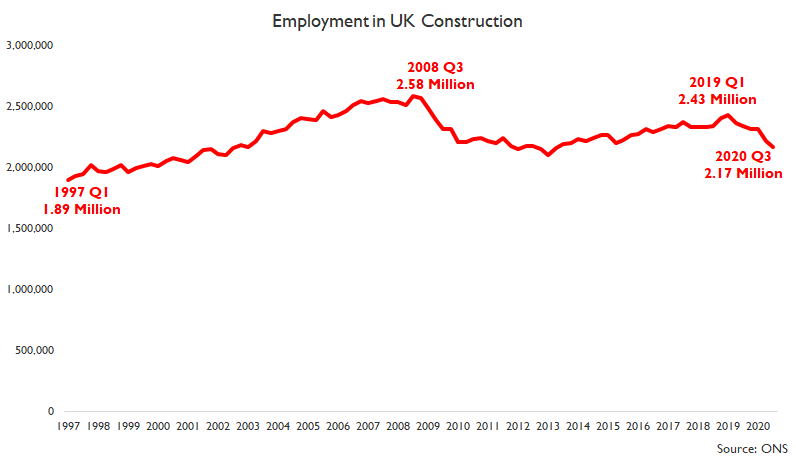

... & note that whilst output in Q3 was 12.6% lower than a year ago, ONS employment data earlier this week shows construction employment in Q3 was 'only' 7.4% lower than a year earlier but hours worked in construction in Q3 were 17.1% lower than a year earlier...

#ukconstruction

#ukconstruction

... Looking at the sector breakdown of the 2.9% growth in output in September 2020, the sharpest rises were in Industrial, public non-housing rm&i (cladding remediation), commercial & private housing (the largest construction sector)...

#ukconstruction

#ukconstruction

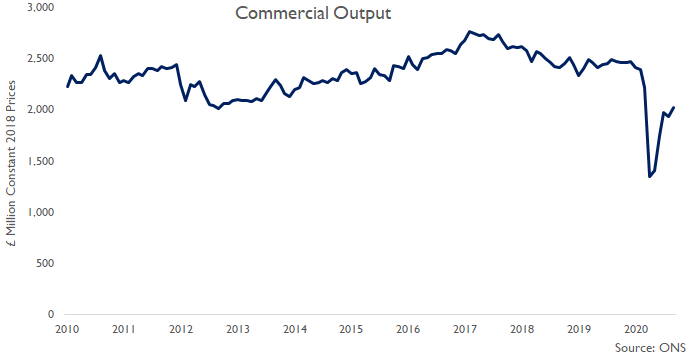

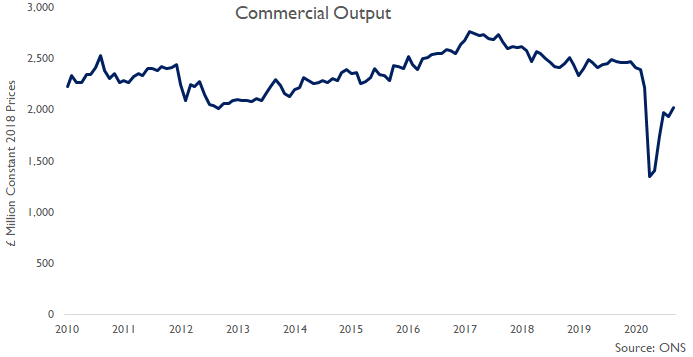

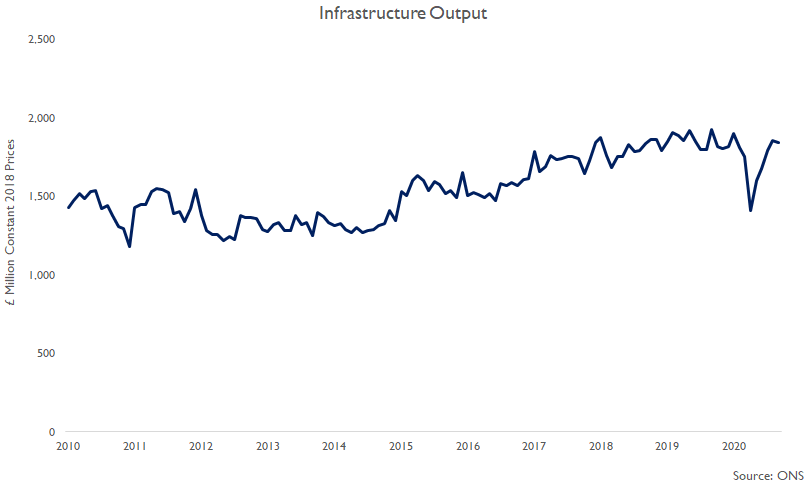

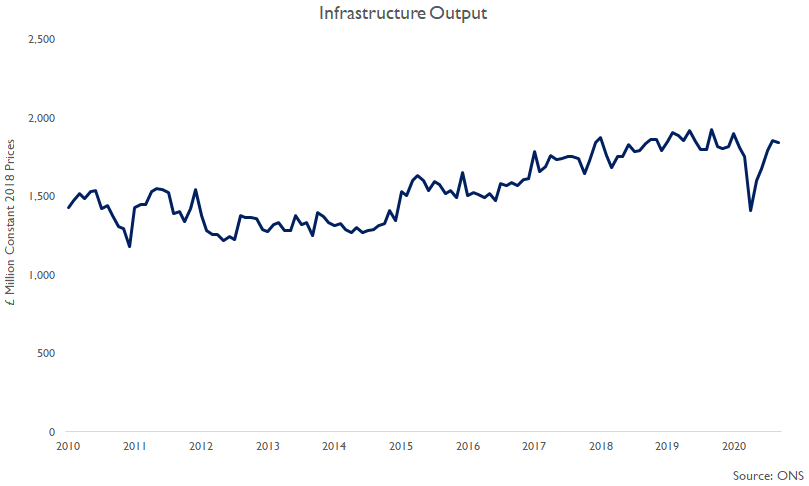

... but construction output in September 2020 was 10.0% lower than a year ago & lower than a year ago in every sector with the sharpest falls in public housing, industrial & commercial sectors whilst the smallest falls were in non-housing r&m & infrastructure...

#ukconstruction

#ukconstruction

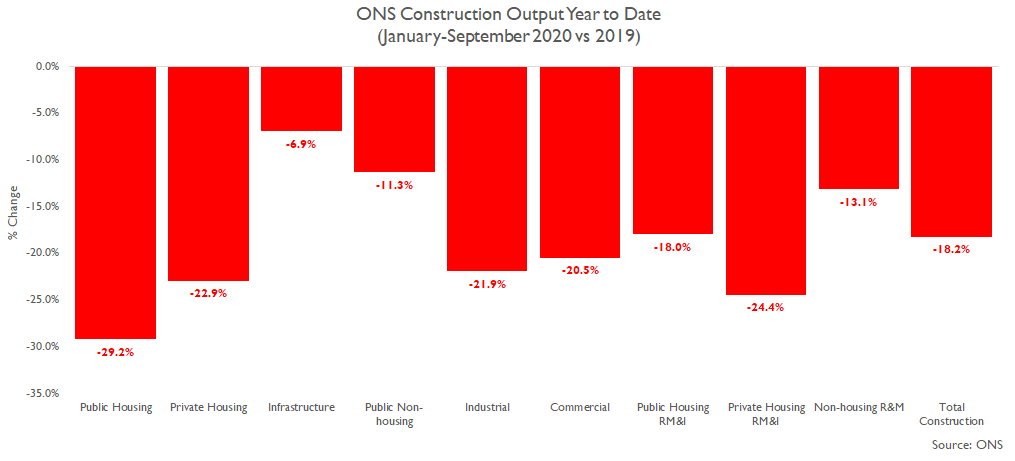

... Year to date, construction output was 18.2% lower than a year earlier with the sharpest falls in sectors most affected by shutting sites in Lockdown 1 (23 March to mid-May); housing new build as well as housing repair, maintenance & improvement (rm&i)...

#ukconstruction

#ukconstruction

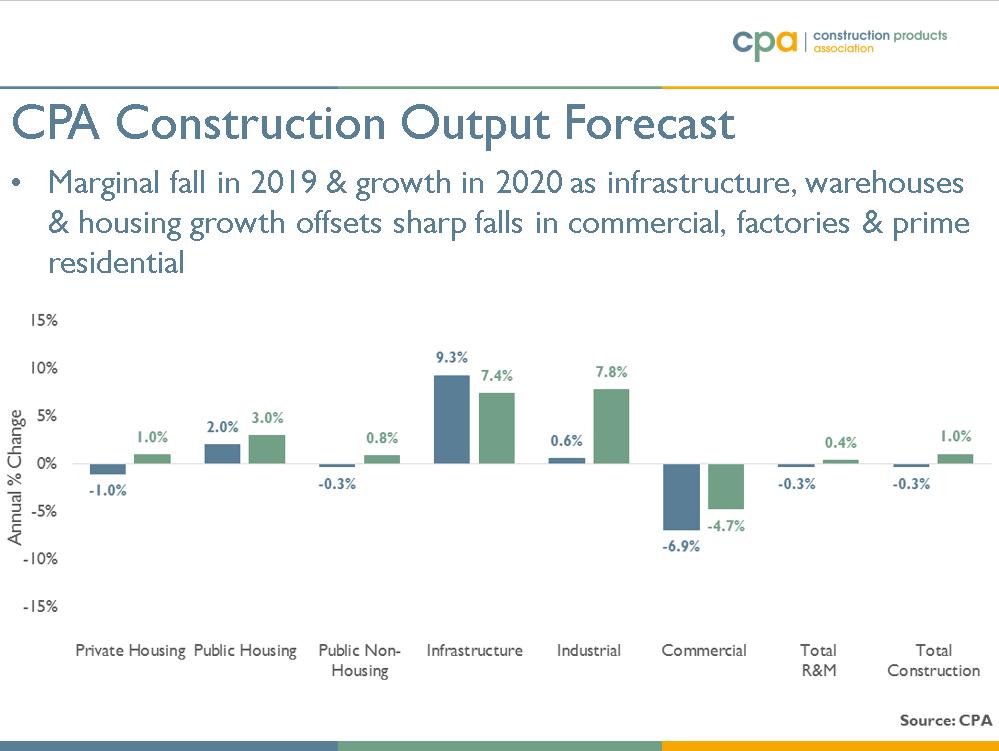

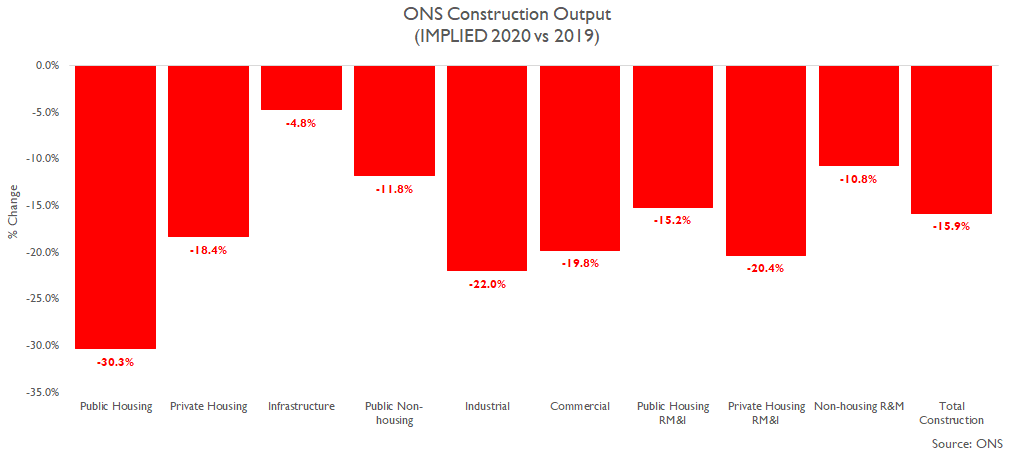

... & as a reference point for the latest construction forecasts, if September's output level is assumed for the remaining 3 months of 2020, which is likely as construction, product manufacturing & builders merchants are continuing throughout lockdown 2, then...

#ukconstruction

#ukconstruction

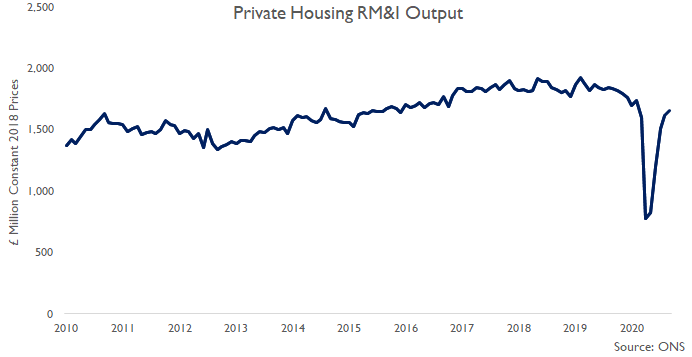

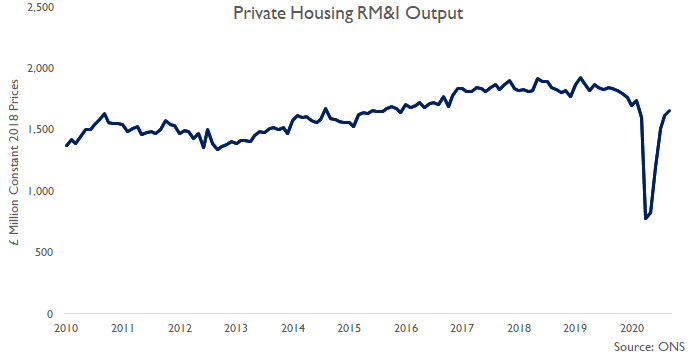

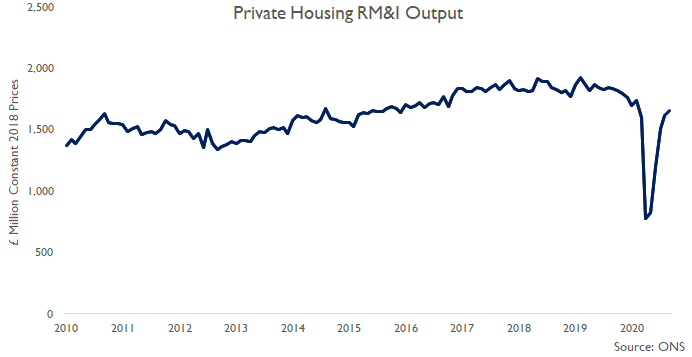

... implied total construction output in 2020 would be 15.9% lower than in 2019 with the largest falls overall in 2020 in new house building as well as private housing rm&i (despite the recovery in activity since the nadir in April) in addition to...

#ukconstruction

#ukconstruction

... implied sharp falls in industrial & commercial output in 2020 if September's construction output levels continue for the rest of the year. The smallest falls in output would be in infrastructure (in which activity largely continued in the initial lockdown)...

#ukconstruction

#ukconstruction

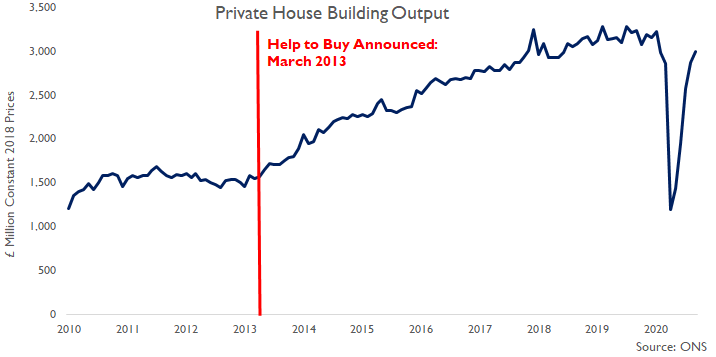

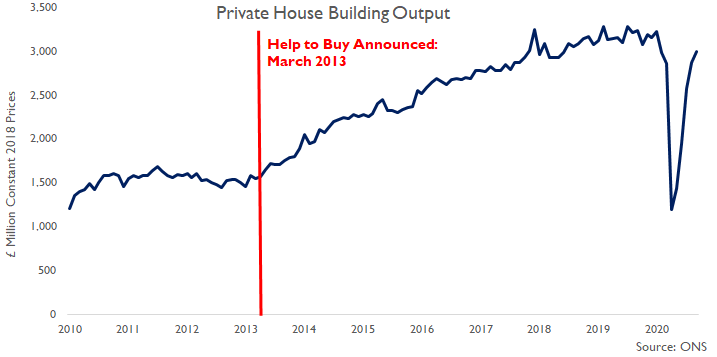

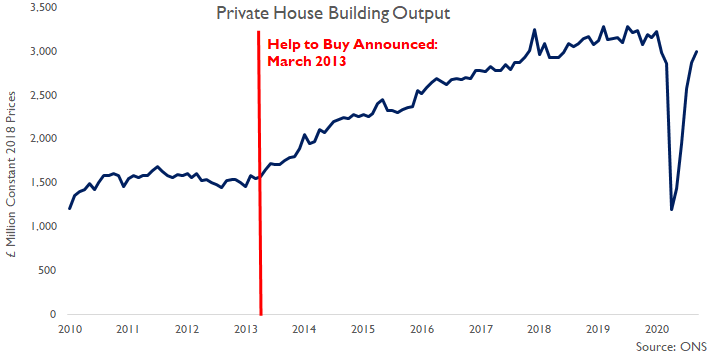

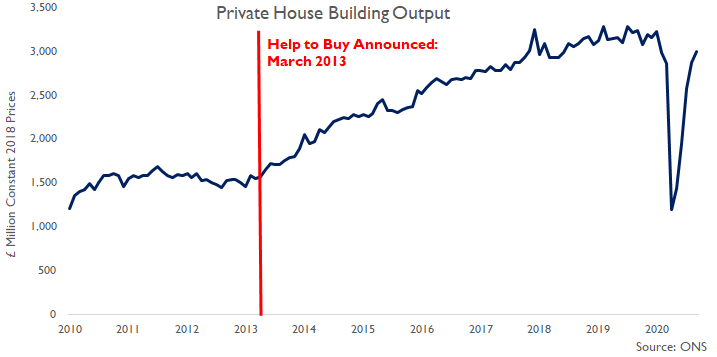

Private housing is the largest construction sector & output in September 2020 rose 4.2% compared to August & although output was 7.3% lower than a year ago, this is a sharp recovery given output in April was more than 60% lower than a year earlier...

#ukconstruction #ukhousing

#ukconstruction #ukhousing

... with house builders benefiting from not only pent-up demand that couldn't be enacted in Lockdown 1 (23 March to mid-May) feeding through in the Summer but also sustained demand after this (highlighted by strong house prices & forward sales) that...

#ukconstruction #ukhousing

#ukconstruction #ukhousing

... has been boosted by government signalling that it will sustain housing demand through the Stamp Duty holiday & Scotland/Wales equivalents) & the completions deadline extension for the current version of Help to Buy plus...

#ukconstruction #ukhousing

#ukconstruction #ukhousing

... there has a strong demand for home purchases that are houses (rather than flats) & particularly outside of London given the impacts of the pandemic (& desire for more space) & shift towards working from home...

#ukconstruction #ukhousing

#ukconstruction #ukhousing

Commercial (offices, retail & leisure) is the second largest construction sector & output in September was 4.8% higher than in August but remained 18.1% lower than a year ago. Activity to finish off projects started pre-Covid-19 is continuing but...

#ukconstruction #commercial

#ukconstruction #commercial

... almost one-third (31%) of commercial construction is in London alone where construction work involves many trades in tight spaces on towers so social distancing & other safety measures are still hindering productivity (time & cost) on site...

#ukconstruction #commercial

#ukconstruction #commercial

Infrastructure output in September 2020 was broadly flat (-0.3%) compared with August & 4.1% lower than a year earlier. Activity remained high on roads, rail, water & energy funded by public & regulated sectors but...

#ukconstruction #ukinfrastructure

#ukconstruction #ukinfrastructure

... infrastructure activity has slowed on airports (unsurprisingly given large Covid-19 impacts on tourism short-term & concerns regarding long-term demand) & as well as local authority infrastructure (due to financially constrained councils)...

#ukconstruction #ukinfrastructure

#ukconstruction #ukinfrastructure

Private housing repair, maintenance & improvement (rm&i) is the 4th largest construction sector & output in September 2020 was 2.6% higher than in August although output was still 9.6% lower than a year earlier, this is still a sharp recovery given that...

#ukconstruction

#ukconstruction

... in the initial lockdown private housing rm&i output was 57.3% lower than a year ago (all improvements in rm&i were postponed whilst repairs & maintenance continued). Output recovered sharply from Spring due to pent-up demand for improvements combined with...

#ukconstruction

#ukconstruction

... many households that are working from home & with fewer work-related costs e.g. commuting actually have more time & money to spend on their improving their home (& increase the value of their asset) especially to increase space...

#ukconstruction

#ukconstruction

Looking to construction output between October & December, it is worth reiterating activity, product manufacturing & builders merchants are continuing in Lockdown 2 (which is not as strong as the initial lockdown) & that firms in the supply chain report that...

#ukconstruction

#ukconstruction

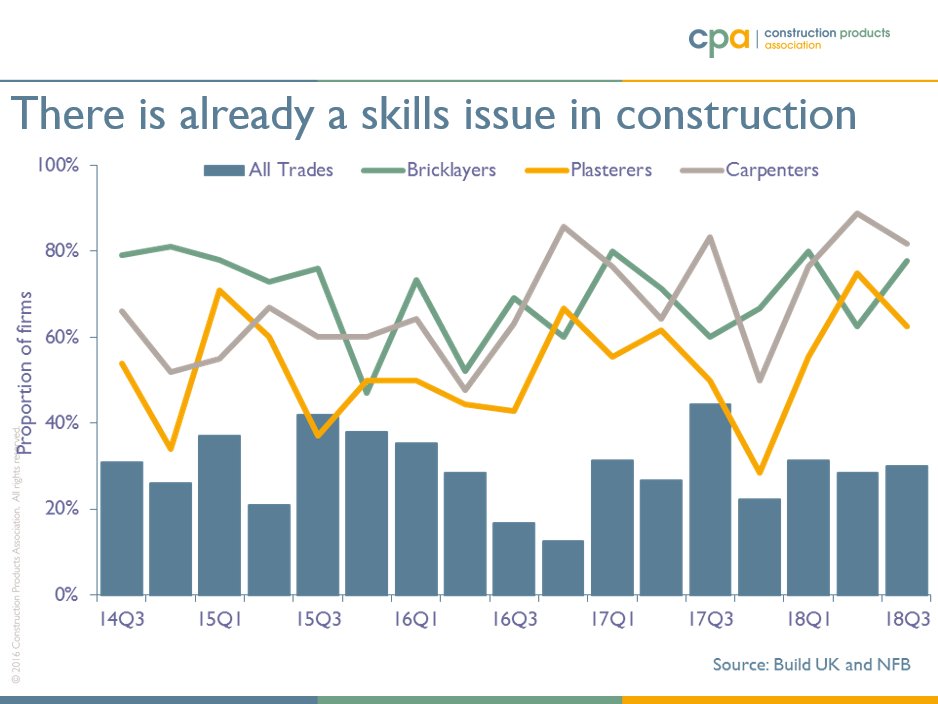

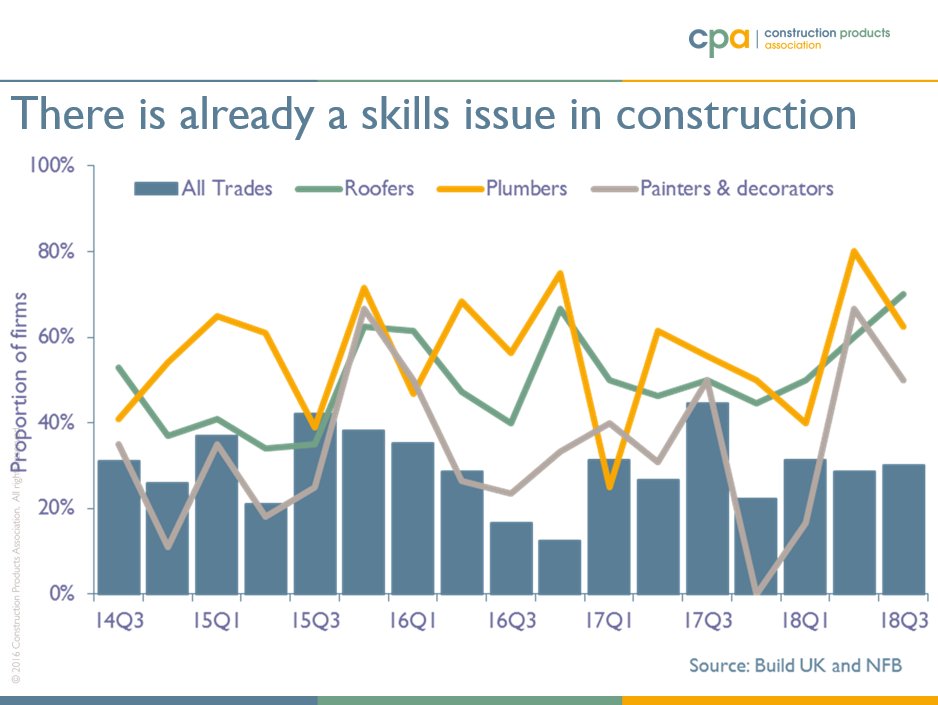

... sectors in which construction demand is high, such as private house building, housing rm&i & infrastructure, will continue to be buoyant for the rest of the year with labour & products supply an issue for some firms whilst...

#ukconstruction

#ukconstruction

... demand is likely to remain subdued in industrial & commercial (double-digit % lower than a year ago) & further job losses are likely, a concern given that construction employment in 2020 Q3 was 258,000 lower than at the recent peak in 2019 Q1. End of Thread.

#ukconstruction

#ukconstruction

• • •

Missing some Tweet in this thread? You can try to

force a refresh