Long-read #NGS obeys Wright's Law.

For every cumulative doubling in sequence data generated across its install base, @PacBio has been able to lower (consumables) costs by roughly 30%, as shown below.

What could this imply about the future of long-read #sequencing?

For every cumulative doubling in sequence data generated across its install base, @PacBio has been able to lower (consumables) costs by roughly 30%, as shown below.

What could this imply about the future of long-read #sequencing?

First, let's acknowledge a Catch-22. Does PacBio need to (a) derive knowledge from platform utilization to lower sequencing costs or (b) lower costs first in order to unlock greater platform utilization?

At present, we believe it's more of the latter. Why?

At present, we believe it's more of the latter. Why?

PacBio's HiFi chemistry and Sequel II optics are relatively nascent (2019). This suggests a lot of near-term headroom left for optimization in these areas.

It's crucial that all long-read users, not just the top 1%, have access to this innovation.

pacb.com/smrt-science/s…

It's crucial that all long-read users, not just the top 1%, have access to this innovation.

pacb.com/smrt-science/s…

PacBio has a demonstrated history of 'field-upgrading' systems, meaning that labs don't need to shell out $1 million of CapEx to access best-in-class OpEx. Instead, they can pay a 5-10% premium to remain at the forefront of throughput, accuracy, and cost.

pacb.com/products-and-s…

pacb.com/products-and-s…

In our view, this strategy is not only customer-friendly, but also means more capital is spent on generating HiFi data (not buying systems), which should drive consumables costs down even faster in a virtuous cycle.

Granted, consumables are just one part of the total cost-equation. With the Sequel IIe, PacBio collapsed compute time for HiFi by 70% and storage costs by 90%, again suggesting that the next-leg of cost-declines may be chemistry/optics.

pacb.com/wp-content/upl…

pacb.com/wp-content/upl…

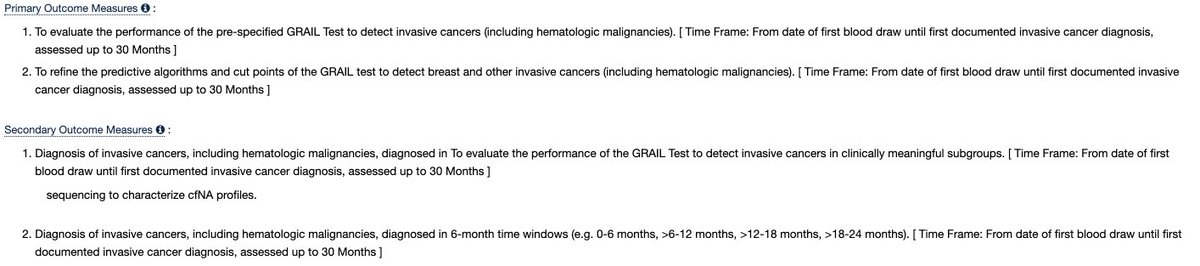

With all of this out of the way, let's flip back to the chart (below) to imagine what demand may look like if, indeed, PacBio is able to scale HiFi like we think they can.

Let's start easy. What happens if PacBio's install base converges to the current Sequel IIe?

Let's start easy. What happens if PacBio's install base converges to the current Sequel IIe?

Presently, it costs ~$3,600 to generate a (Q50*) human genome on Sequel IIe. Using Wright's Law, this implies an immediately-addressable market of ~90K genomes.

What could this mean for consumables revenue?

*Q50 = 99.999% accuracy (AKA Phred Score)

What could this mean for consumables revenue?

*Q50 = 99.999% accuracy (AKA Phred Score)

If we take the definite integral from today's base (16,000 genomes) to 90,000, we get roughly $360 million in consumables sales. But, let's not stop there. What happens if costs fall to $1,000 for a HiFi genome? Then what?

(This forecast runs on units, not time.)

(This forecast runs on units, not time.)

Using the same approach, a $1,000 HiFi genome yields a market for ~1.6 million genomes, or $2.6 billion in consumables sales, as per Wright's Law. Now, where might those genomes be coming from?

(Again, this is a forecast/estimate.)

(Again, this is a forecast/estimate.)

In our view, long-read sequencing is vastly superior to short-read across a large and growing number of clinical applications. We believe large swaths of the clinical market will migrate to long-reads, provided that costs continue to fall.

The beachhead clinical market(s) include: pediatric oncology and rare disease, differential diagnoses of neurological disorders, hereditary disease testing, and carrier screening. We think all of these could immediately benefit from the switch.

HiFi also could improve cancer tissue profiling, provided samples are fresh-frozen and not formalin-fixed. This may require Sequel systems to move close to the point-of-care. Or, someone could come up w/ a clever chemical hack). It's something to think about.

Moreover, many large-scale research applications, such as population sequencing, we think could majorly benefit from the added clarity, again provided that costs continue to fall. Together, these applications (and many others) amount to millions upon millions of genomes.

Final Note:

This is a work in progress and we may change final numbers around before publishing something more comprehensive. Critique/feedback welcome.

This is a work in progress and we may change final numbers around before publishing something more comprehensive. Critique/feedback welcome.

• • •

Missing some Tweet in this thread? You can try to

force a refresh