Hull City’s 2019/20 financial results covered a season when they finished 24th in the Championship, so were relegated to League One under head coach Grant McCann. COVID-19 had a substantial impact on the club’s operations. Some thoughts in the following thread #hcafc

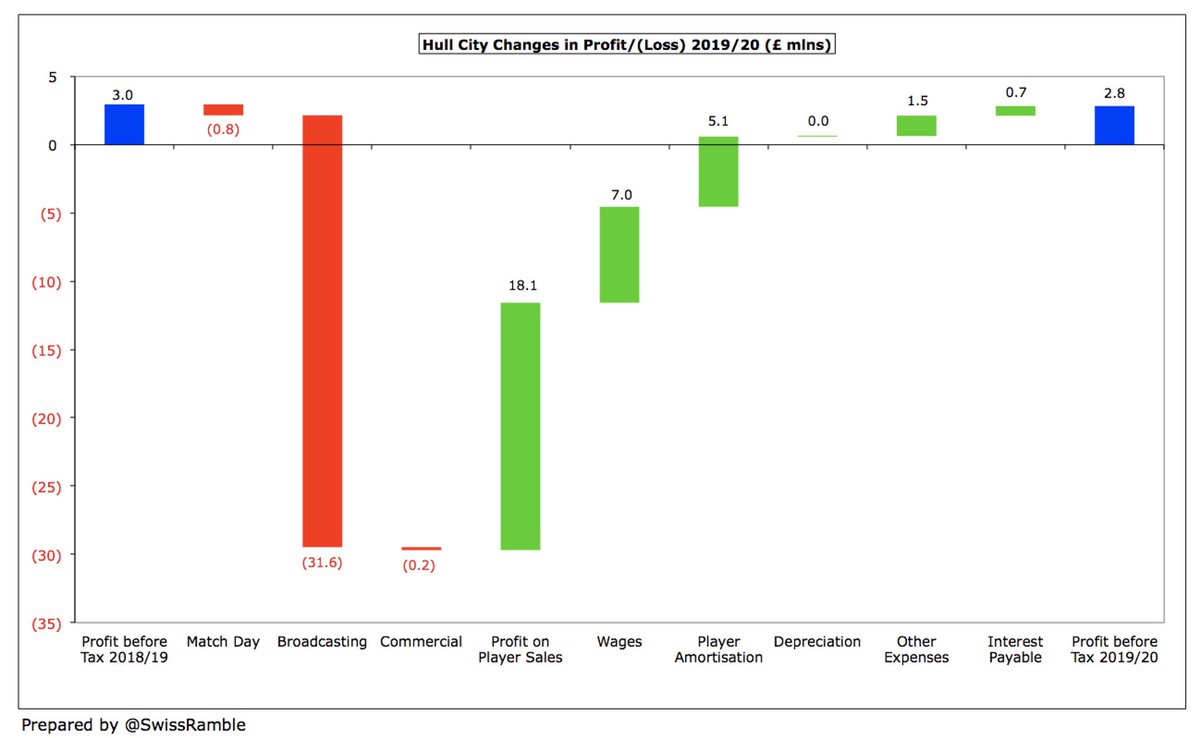

Despite the impact of the pandemic, #hcafc still managed to post a pre-tax profit of around £3m, mainly due to profit on player sales rising £18m to £23m. Revenue fell £32m (67%) from £48m to £16m, as parachute payments stopped. Partly compensated by expenses being cut by £14m.

The main driver of the revenue reduction was broadcasting, which fell £32m (79%) after parachute payments from the Premier League stopped, but the other revenue streams also declined: match day was down £0.8m (13%) to £5.3m, while commercial was £0.2m (10%) lower at £2.1m.

The revenue reduction was partly offset by further cost-cutting at #hcafc with wages slashed £7m (28%) to £18m, as more expensive players were released, and player amortisation was down £5m (40%) to £8m. Other expenses fell £1.5m (15%) to £8.5m, while interest was £0.7m lower.

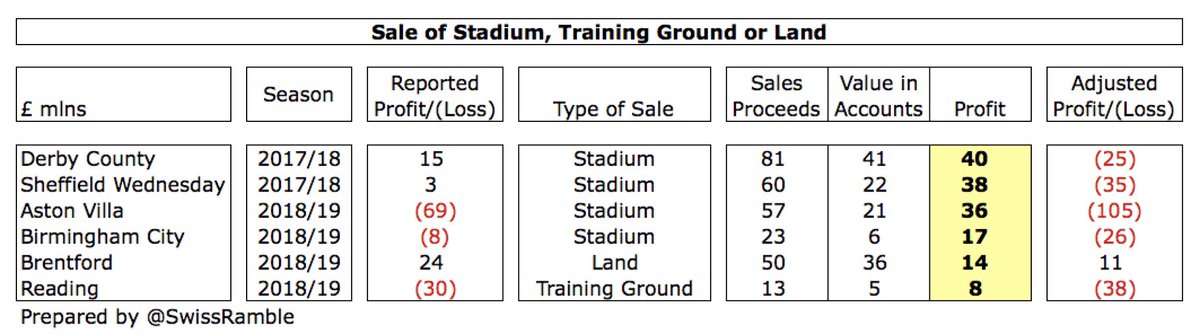

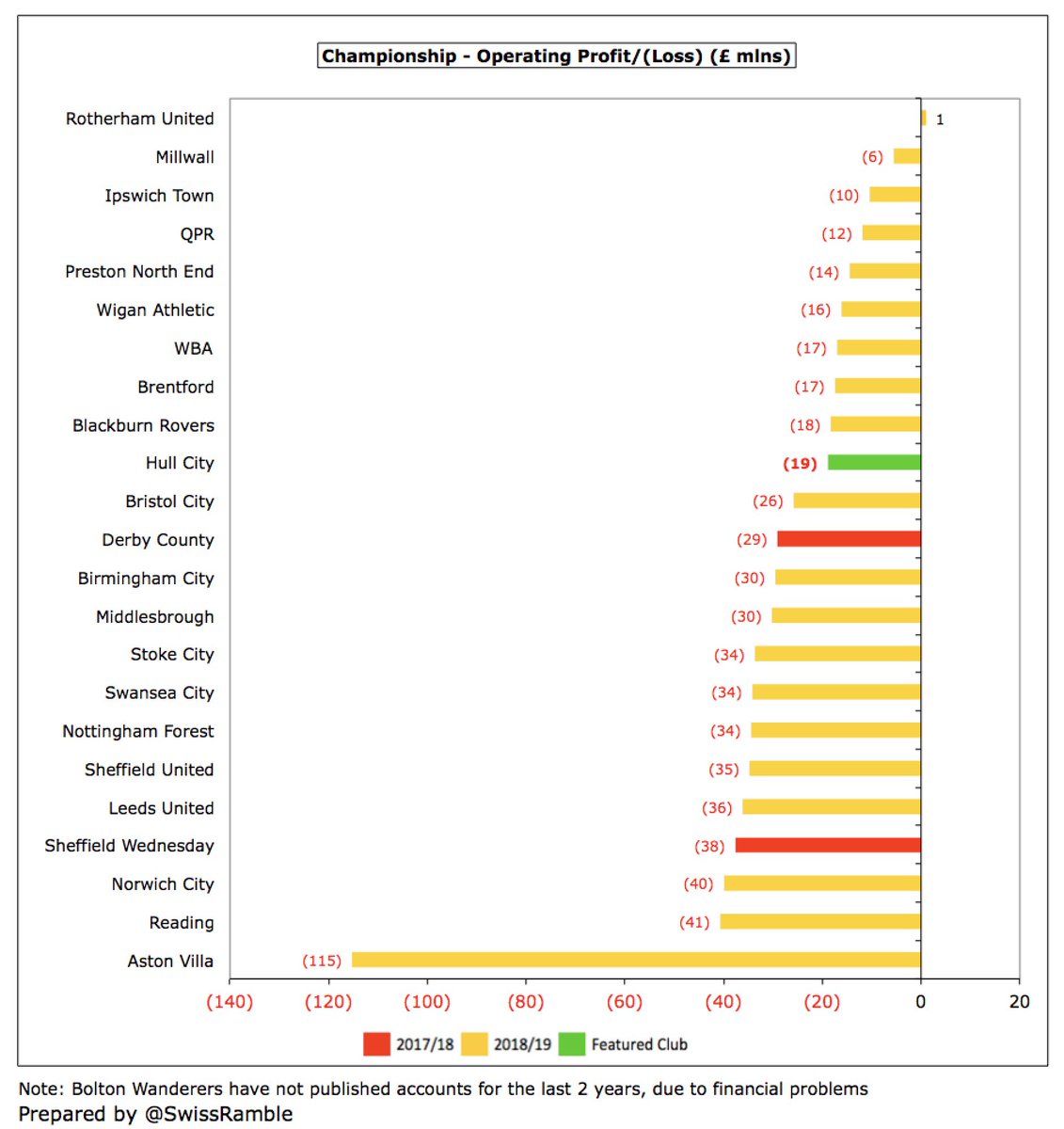

Most clubs in the Championship lose money, so #hcafc £3m profit has to be considered a good achievement – from a purely financial perspective. The largest losses in 2018/19 were reported by the promoted clubs, #AVFC £69m and #NCFC £39m, partly due to hefty promotion bonuses.

It is also worth noting that some clubs’ figures were inflated by once-off accounting profits from the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so the underlying figures were even worse.

Excluding these property sales, only 5 Championship clubs were profitable in 2018/19 with the highest profits of £11m at Bristol City and Brentford. On this basis, #hcafc £3m profit was actually 3rd best in the division – in stark contrast to their bottom place in the league.

However, #hcafc figures benefited from £23m profit on player sales, much higher than previous season’s £5m, mainly from the departures of their leading scorers, Jarrod Bowen to #WHUFC and Kamil Grosicki to #WBA. This was much higher than the £12m average in the Championship.

That said, #hcafc have been profitable in six of the last seven years, making £65m profit in the last four seasons alone. The one loss, £21m in 2016, was impacted by sizeable promotion bonuses.

Worth noting that stadium management activities, including KCOM lease, is handled by Superstadium Management Company Ltd, another company in the Allamhouse Group, which is run at a loss (£2m last year). This needs to be taken into consideration for a fuller picture of #hcafc.

Much of the #hcafc profitability has been due to player sales, averaging £18m a year from 2015. This year included money from a 15% sell-on clause for Harry Maguire. The owner commented, “Our player trading has been really good and that’s offset the loss of the parachutes.”

Excluding player sales, #hcafc went from breaking-even at an operating level to a £19m loss, the worst since £30m in 2016 (though that included promotion payments). When Hull City were in the Premier League or had parachute payments, they usually made an operating profit.

In fairness, only one other Championship club (Rotherham United) posted an operating profit in 2018/19, so #hcafc £19m loss can be considered one of the better results. Most clubs operate at a significant loss, due to high wages to turnover ratios, as they compete for promotion.

In the three years since relegation, #hcafc revenue has dropped £101m (87%) from £117m to £16m, the lowest since 2008. Decrease is mainly broadcasting £86m, but also match day £11m and commercial £5m. Parachute payments, which accounted for 77% of total revenue, have now ended.

Following the revenue decrease, #hcafc revenue of £16m was one of the lowest in the Championship. This was miles behind the three clubs relegated from the Premier League the previous season: WBA £71m, Stoke City £71m and Swansea City £68m. Average for the division is £32m.

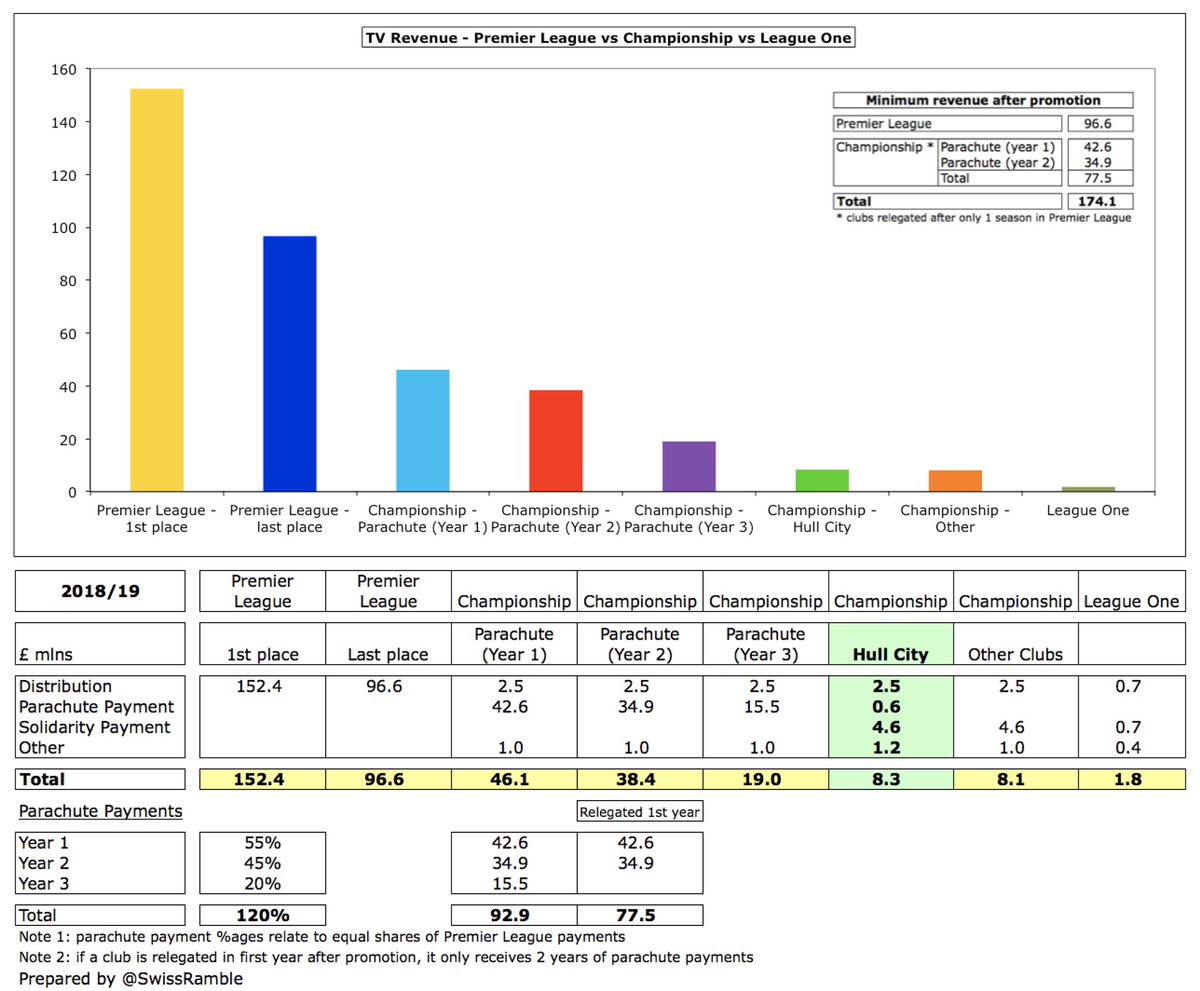

Championship revenue is hugely influenced by Premier League parachute payments with 8 clubs benefiting in 2018/19, led by Stoke, Swansea and WBA £43m. #hcafc said they received £37.2m that season, but estimates based on PL regulations were £35m.

Even if parachute payments were excluded, #hcafc would still have one of the lowest revenues in the Championship, though the gap to the top club’s revenue would fall from £55m to £34m. That said, #LUFC £49m revenue was still around three times as much as Hull City.

#hcafc only had two years parachute payments, as they were relegated after one season in the top flight. Last season their £8m included a Premier League solidarity payment £4.6m and EFL central distribution £2.5m. This year will drop to less than £2m in League One.

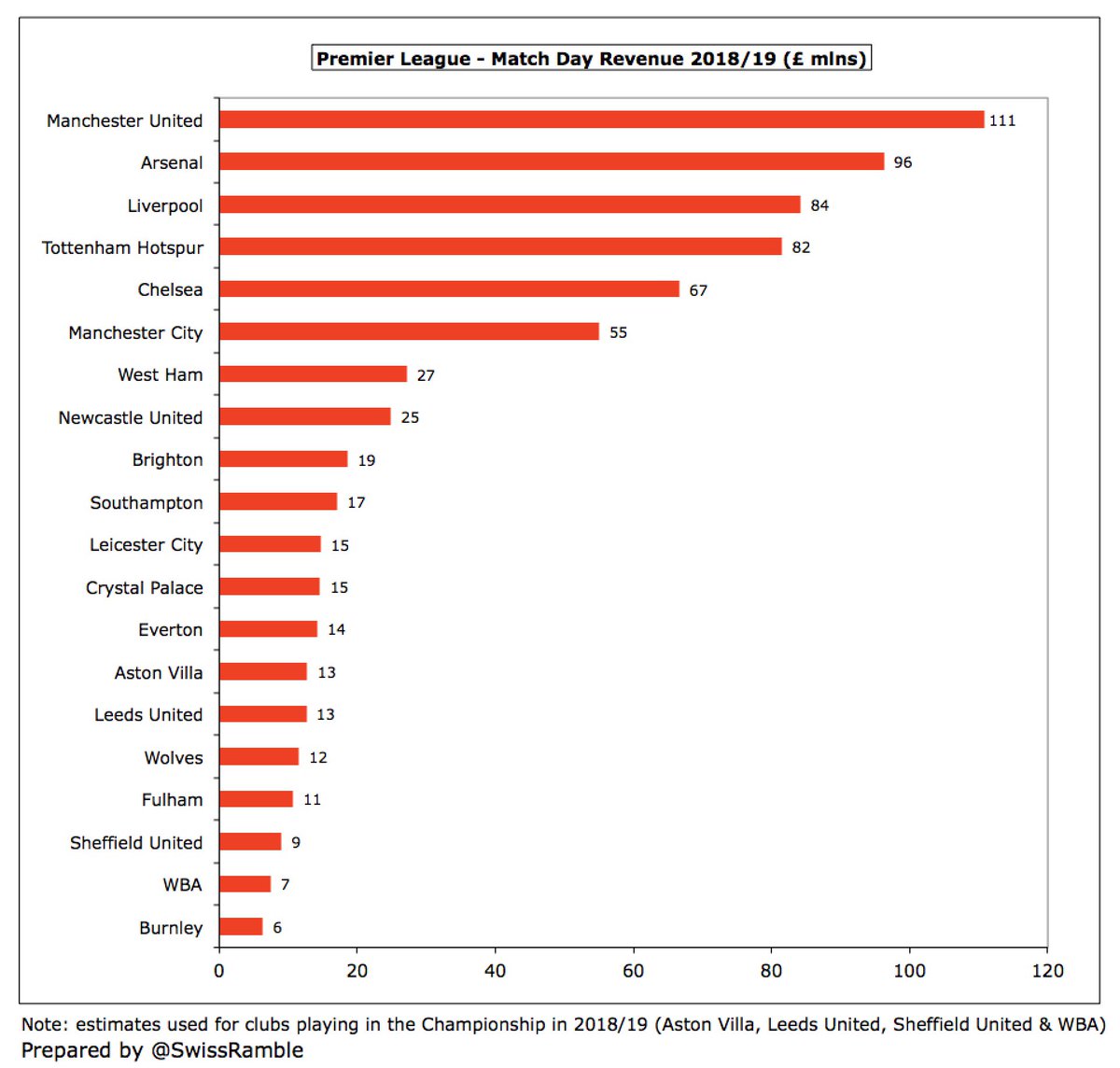

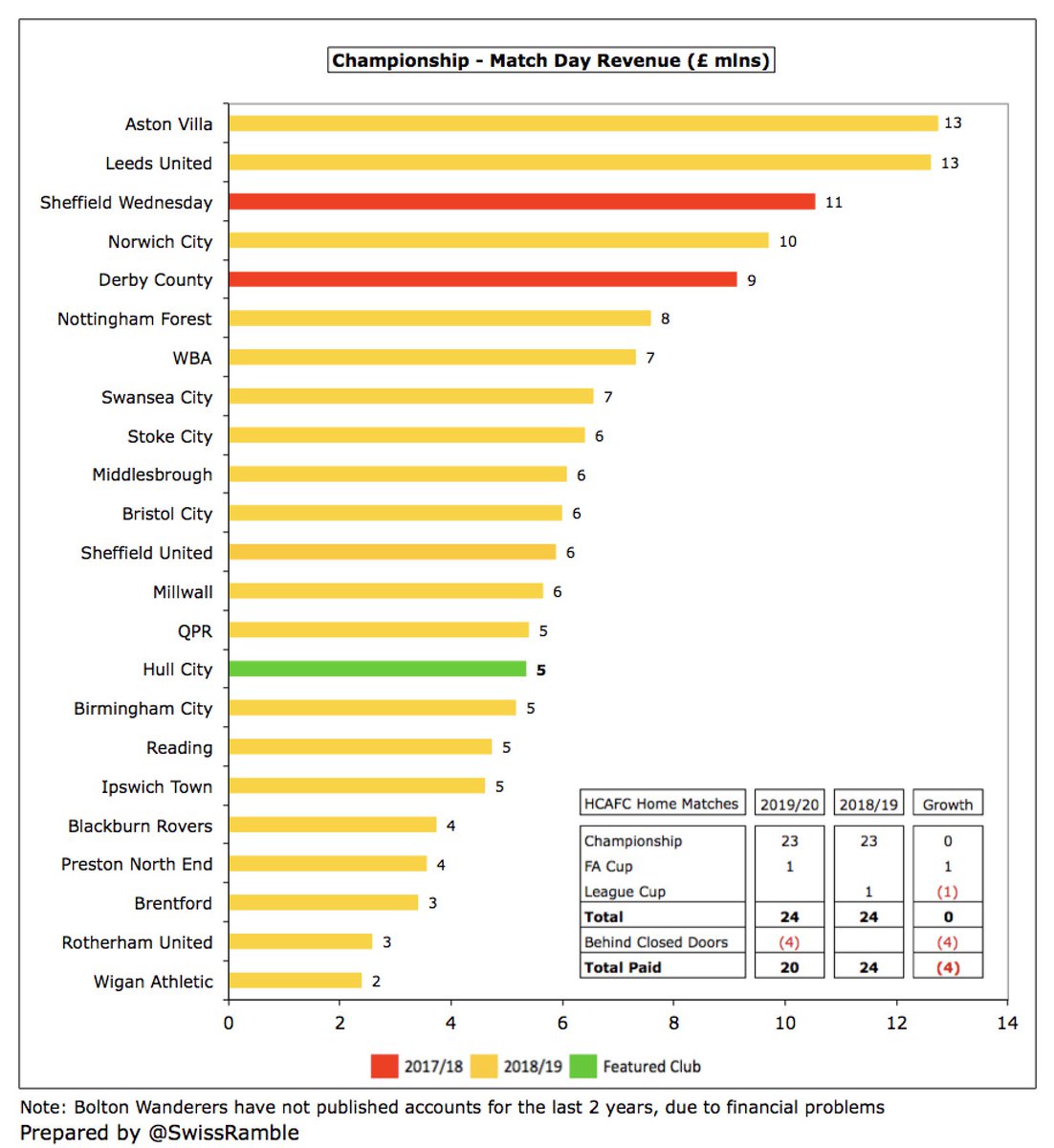

#hcafc match day income fell £0.8m (13%) to £5.3m, partly due to playing 4 home games behind closed doors because of the pandemic. This is around £11m (67%) lower than the £16m they generated in the Premier League. This was firmly in the bottom half of the Championship.

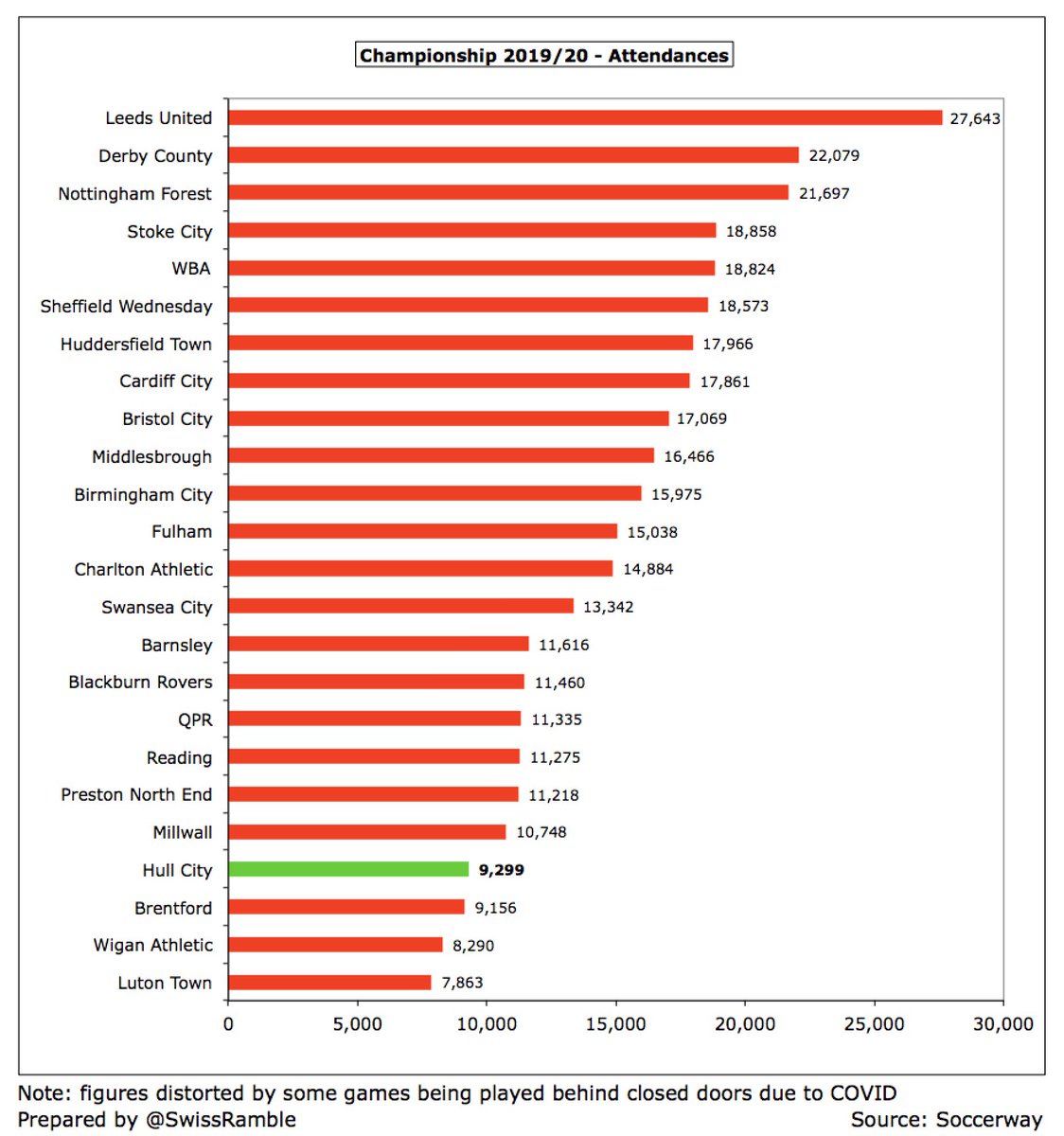

#hcafc attendances have slumped from around 24,000 in the Premier League in 2013/14 to just 9,300, partly due to fans’ unhappiness with the owners. This was exacerbated by implementing a controversial membership scheme, though concession prices have now been reintroduced.

#hcafc average attendance of 9,299 was one of the smallest in the Championship in 2019/20, only above Brentford, Wigan Athletic and Luton Town. This was around a third of Leeds United 27,643. Obviously all clubs’ crowds hit by COVID-19.

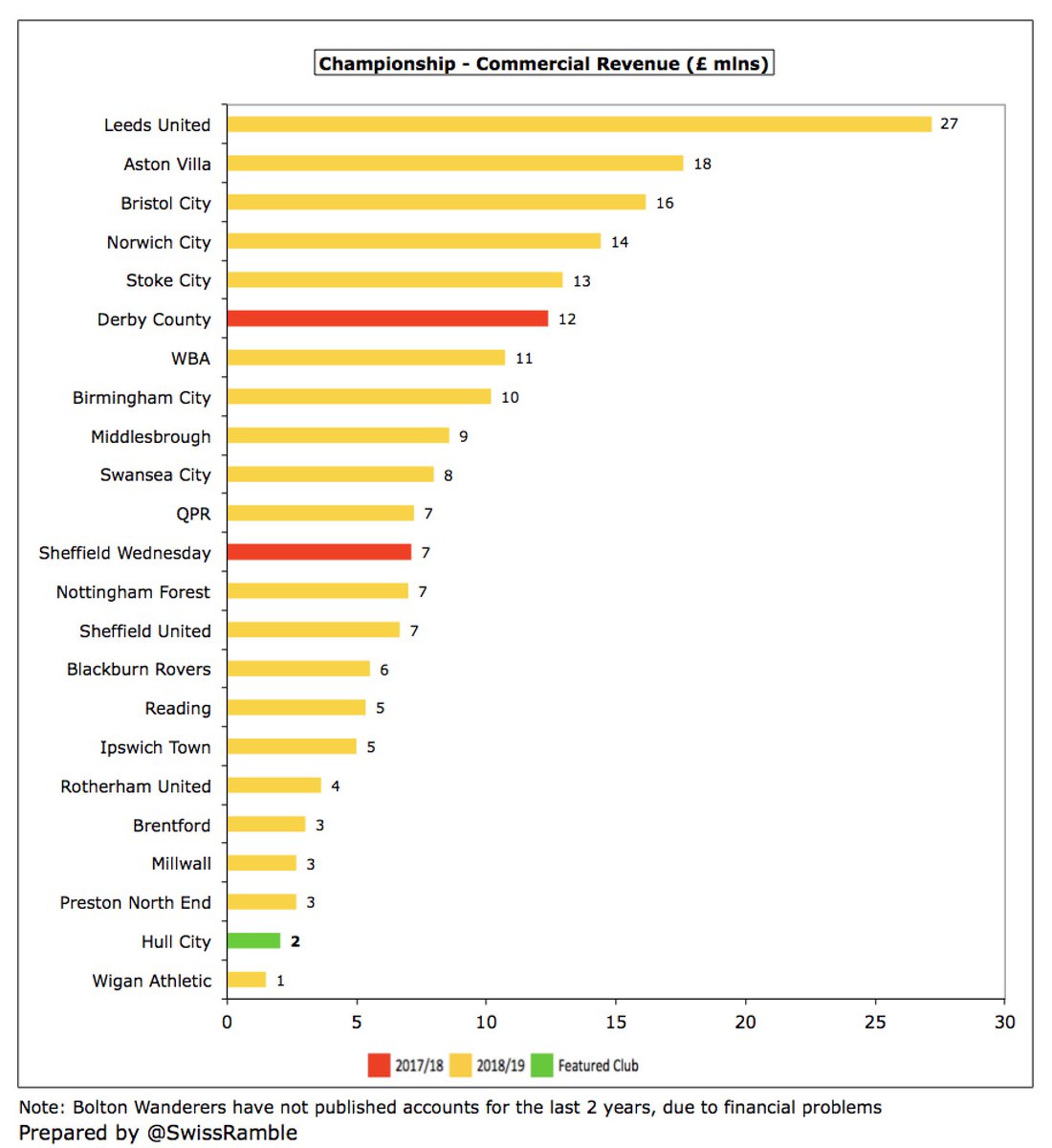

#hcafc commercial income fell 10% to £2.1m, comprising commercial £1.3m and retail £0.8m. Down from £7.1m in the Premier League. Would have been 2nd lowest in the 2018/19 Championship season, which is poor for a team that’s been in the top flight 3 of last 7 years.

After four years with SportPesa, #hcafc have a new shirt sponsor for the 2020/21 season with local business Giacom. Umbro has been the club’s kit supplier since 2014/15. Also have a back-of-shirt deal with another local business On Line.

#hcafc wage bill decreased for the third year in a row, by £7m (28%) from £25m to £18m in 2019/20. This means that wages have been cut by £43m (71%) from £61m following relegation from the Premier League. Will fall further in League One, due to departures and relegation clauses.

As a result, #hcafc £18m wage bill was one of the lowest in the Championship, only ahead of Millwall and Rotherham United. In fact, 12 clubs had wages more than twice as much as Hull City, including #AVFC £83m and Stoke City £56m.

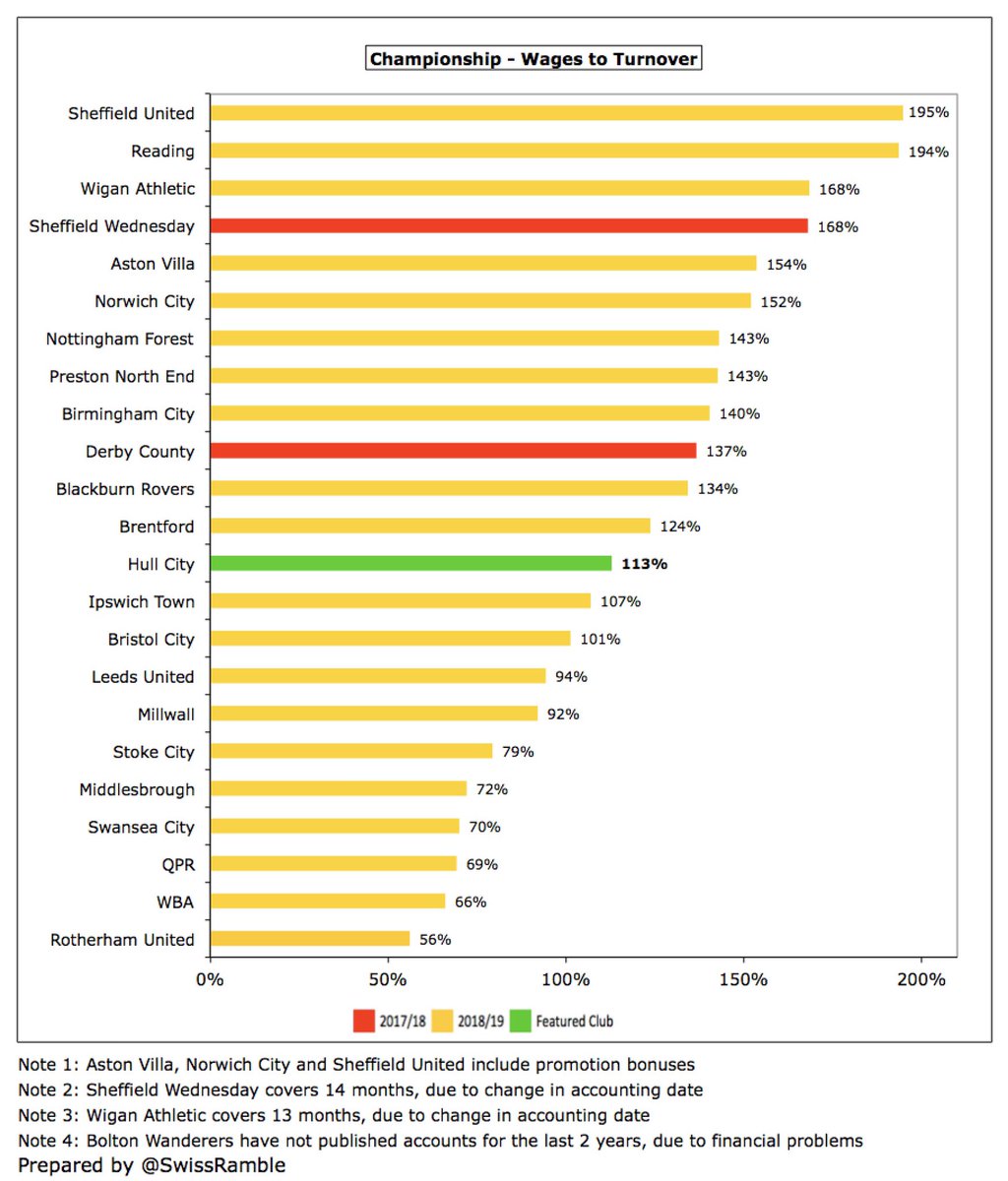

#hcafc wages to turnover ratio more than doubled from 51%, when they benefited from parachute payments, to 113%, the highest since 2103. However, this is pretty much the norm in this division, where 15 clubs are above 100%, much worse than UEFA’s recommended 70% upper limit.

Assem Allam said, “Do you know that Ehab and I have not made £1 in salary, wages or directors’ fees? Absolutely nothing.” This appears to be true, but #hcafc fans will point to the payments received in interest on their loans and dividends from the parent company, Allamhouse Ltd.

After many years of growth, #hcafc administrative expenses have now fallen two years in a row from a £9.4m peak to £6.0m. Looked at another way, excluding wages, player amortisation and depreciation, Hull’s other expenses dropped by £1.5m (15%) from £10.0m to £8.5m in 2019/20.

#hcafc player amortisation, the annual charge for writing-off transfer fees over the length of a player’s contract, fell £5m (40%) from £13m to £8m. This expense is now only around a third of the £23m booked in the Premier League.

Despite the decrease, #hcafc £8m player amortisation is still around mid-table in the Championship, though a long way behind big-spending Stoke City £29m, Swansea City £28m, Middlesbrough £26m, Aston Villa £26m and WBA £23m.

#hcafc only spent £3m on players in 2019/2. Although higher than prior year’s £2m, still represents a huge decrease on previous seasons: £17m in 17/18 and £32m in 16/17. This is in the bottom 6 clubs in the Championship, massively outspent by Stoke £67m, #AVFC £31m & #NFFC £23m.

In the last 5 years, #hcafc have averaged annual net sales of £7m, compared to net spend of £22m in the preceding 3 years, a decline of £29m. As gross spend has nearly halved from £25m to £13m, sales have shot up from £3m to £20m. Very little expenditure or sales in 2020/21.

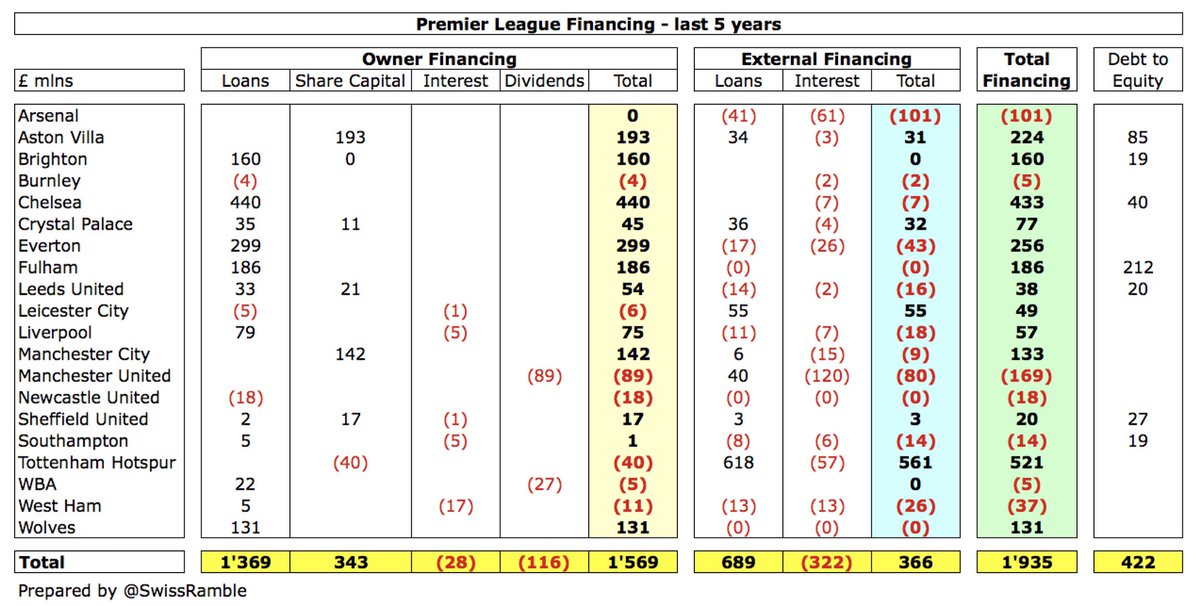

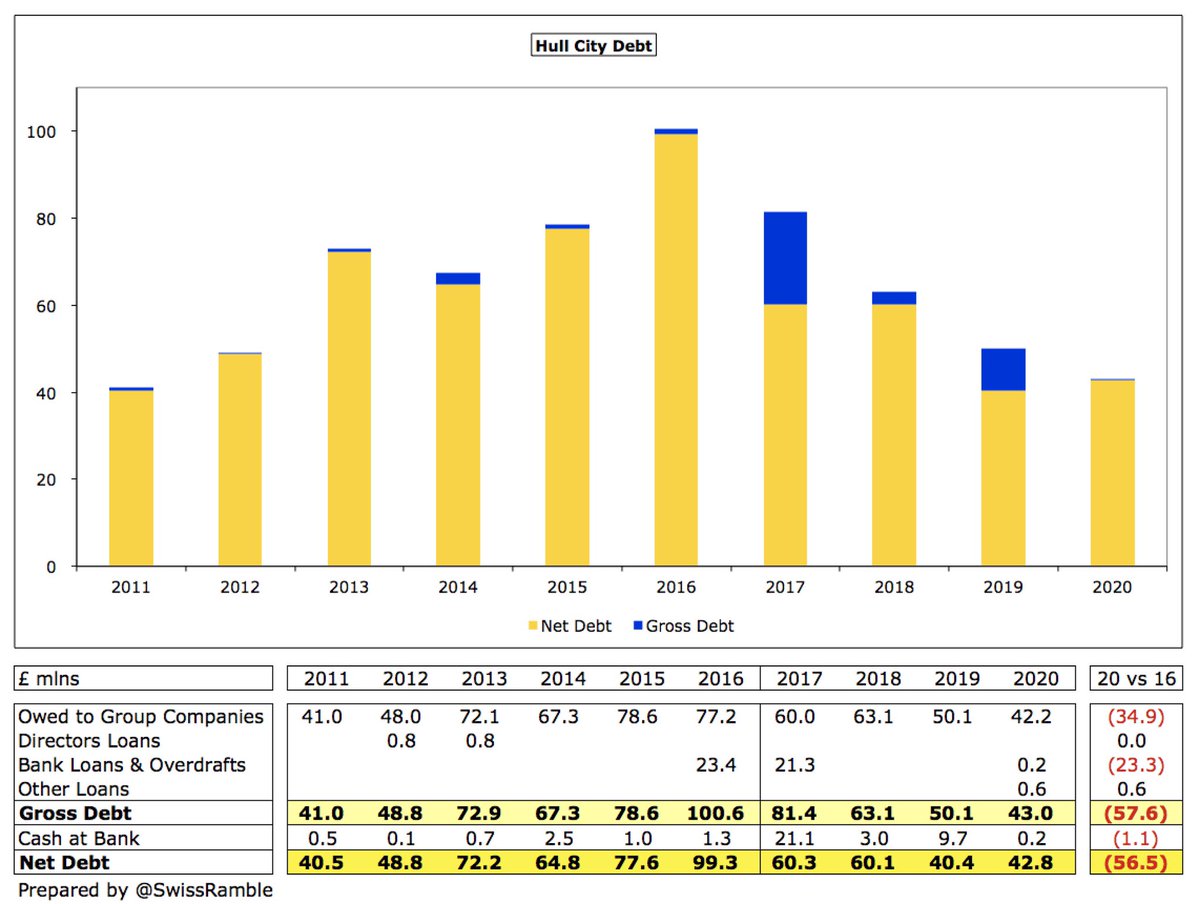

#hcafc gross debt was cut by £7m from £50m to £43m, almost entirely £42m owed to the Allams, which means that this has fallen by £58m in last 3 years from a high of £101m. In that period, the club has repaid £35m to the owners (including £8m last season) and £23m to the bank.

#hcafc £43m debt is mid-table in the Championship, around a third of Blackburn Rovers £142m and Stoke City £141m. It could be argued that the money from player sales has essentially been used to reduce the owners’ debt.

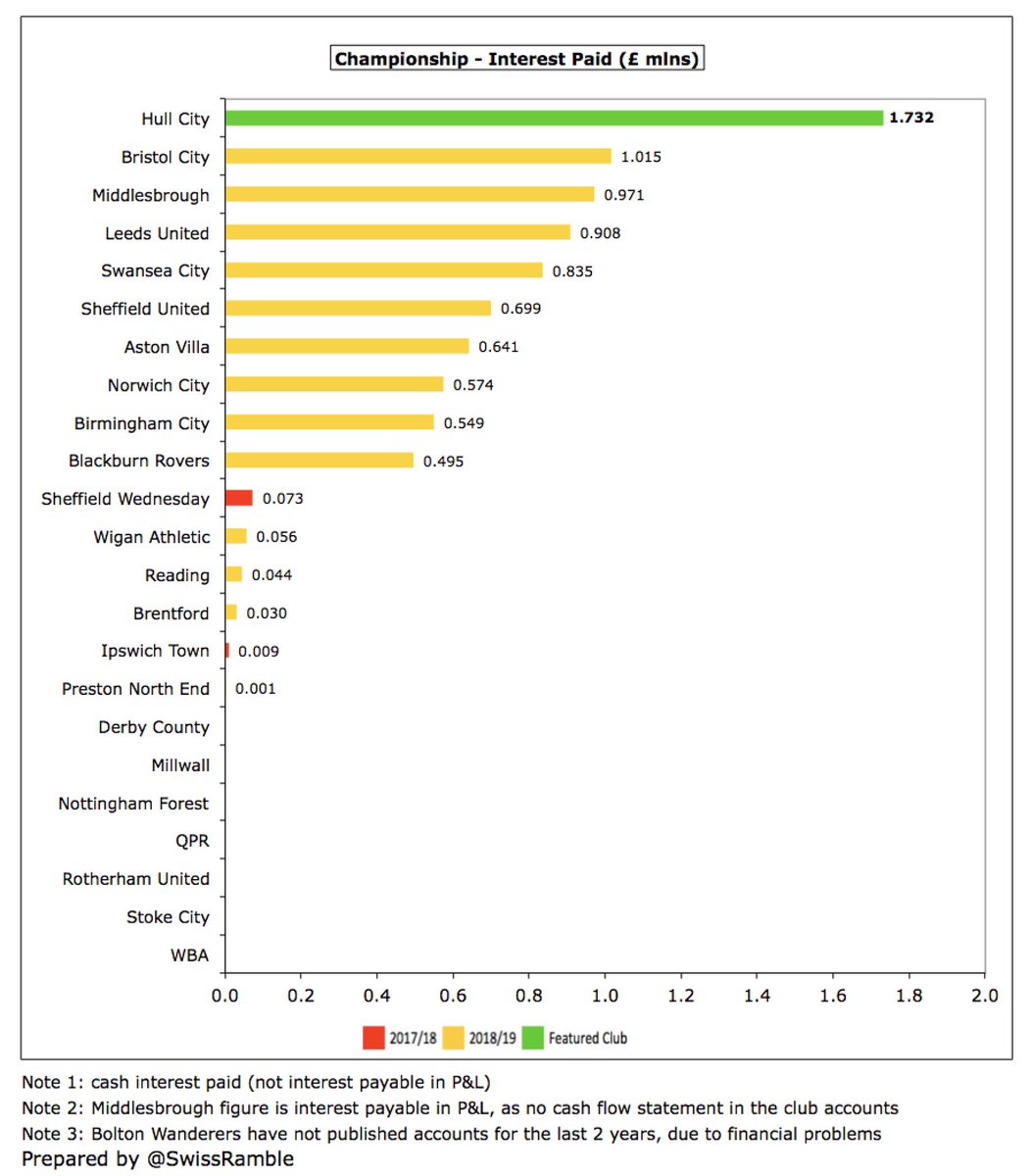

Although debt is high in the Championship, most of it is provided by owners who charge little or no interest. However, #hcafc are an exception to the rule, as their £1.7m interest (at a reported 4%) was the highest in the division, though down from £2.4m the previous year.

#hcafc only have £0.6m transfer debt, while they are owed £11.7m from other clubs, giving a net receivable of £11.1m. This has been the position in four of the last five years, due to the slowdown in player purchases and increase in sales.

#hcafc £22m cash shortfall from operations, partly due to a steep rise in debtors, was compensated by £22m net player sales. However, the club then paid £9m to the Allams (£8m loan repayment and £1m interest), leading to a £10m net cash outflow.

As a result, #hcafc cash balance dropped from £9.7m to just £0.2m, which was the second lowest in the Championship. In fairness, 15 clubs in this division had less than £2m cash in the bank, so this was not exceptional (though not a great buffer in the current climate).

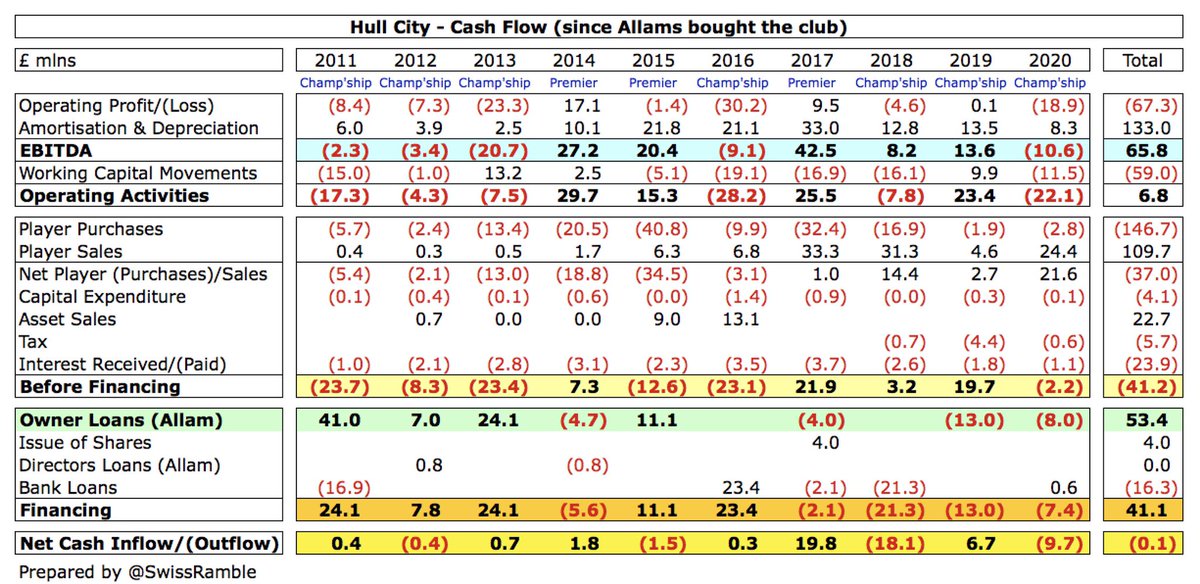

Since the Allams bought #hcafc they have put in £57m (net of loan repayments), while £23m has come from asset sales and £7m from operations. Most £37m has gone on net player purchases, then £24m interest, £16m bank loan repayments and £6m tax. Only £4m invested in infrastructure.

In the last decade I estimate that the Allams have received £36m from the club: £22m interest on their loans plus £14m dividends and £2m directors fees. The latter two payments are made from the parent company, but driven by profits made by the football club (and exclude 2020).

#hcafc have no FFP concerns, as they are profitable over the 3-year monitoring period). As Allam noted with a fair bit of understatement, “We have the biggest amount of head room, in terms of financial fair play – more than any other club in the division.”

The Allam family has been looking to sell #hcafc since 2014. They have made it clear that they want to recoup the money they have invested, so would need at least £42m, i.e. the current level of debt. As Allam said, “The lower the loan, the lower the asking price.”

Like all other football clubs, COVID-19 has impacted #hcafc finances, so they asked their players to take a 20% pay cut, though it has been reported that this was rejected, and furloughed some other staff.

After initially saving the club from going bust, the Allams have managed a steady decline, going from Premier League to League One in the past 4 years. Although their finances look better than most in the basket case that is the Championship, the lack of investment has cost them.

• • •

Missing some Tweet in this thread? You can try to

force a refresh