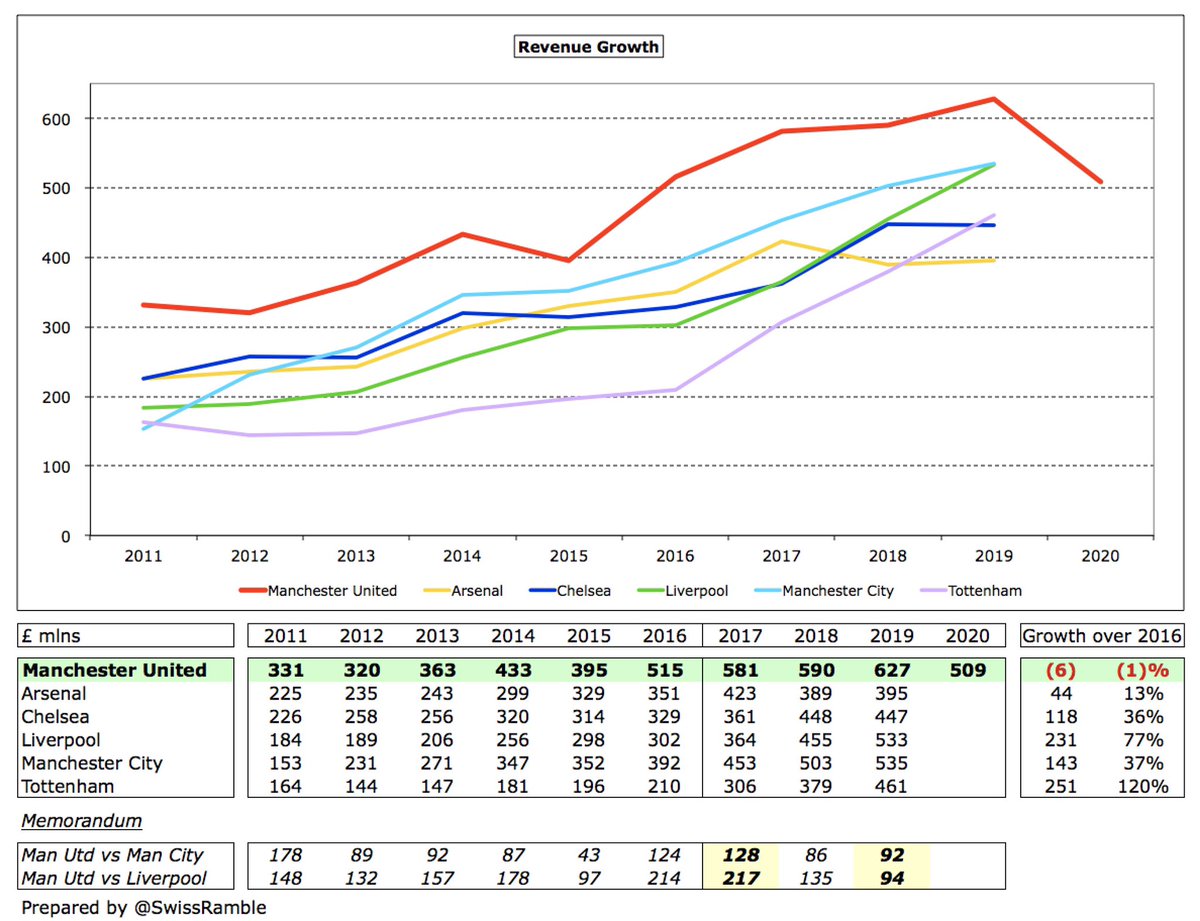

Manchester United are the first Premier League club to publish accounts for the 2019/20 season, when they finished 3rd in the league and reached the semi-finals of 3 cup competitions, including Europa League. Impacted by COVID-19 in last 3 months. Some thoughts follow #MUFC

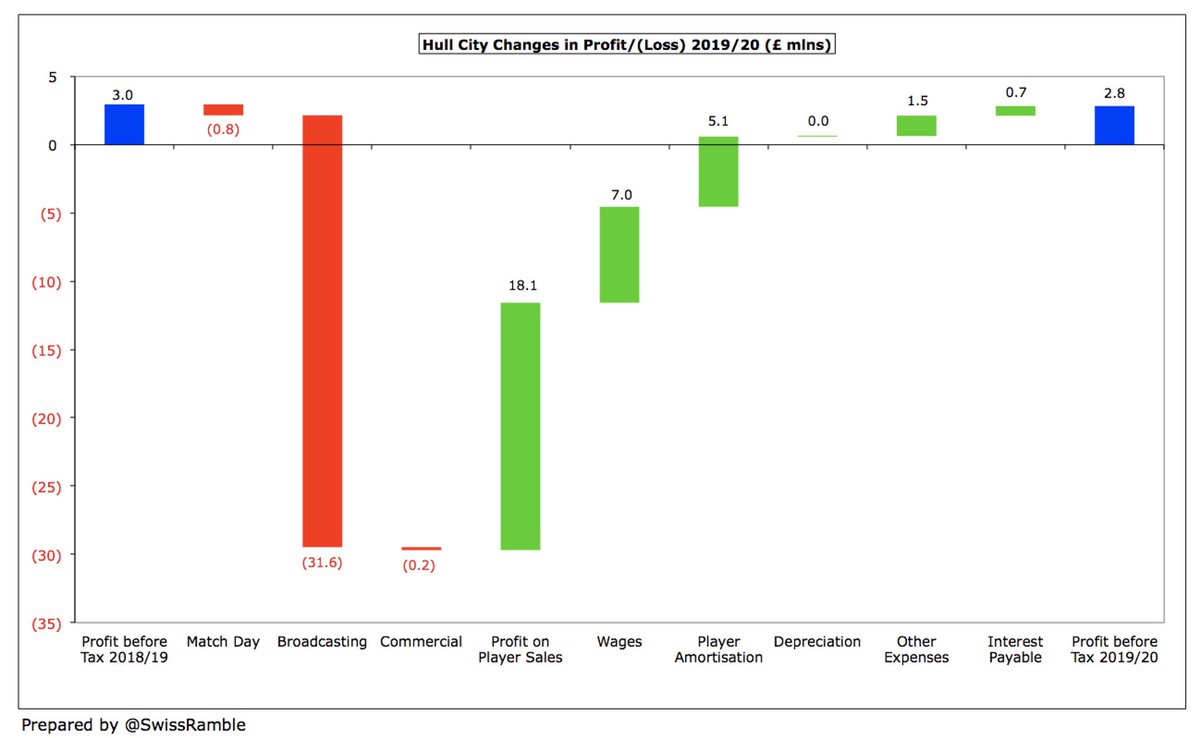

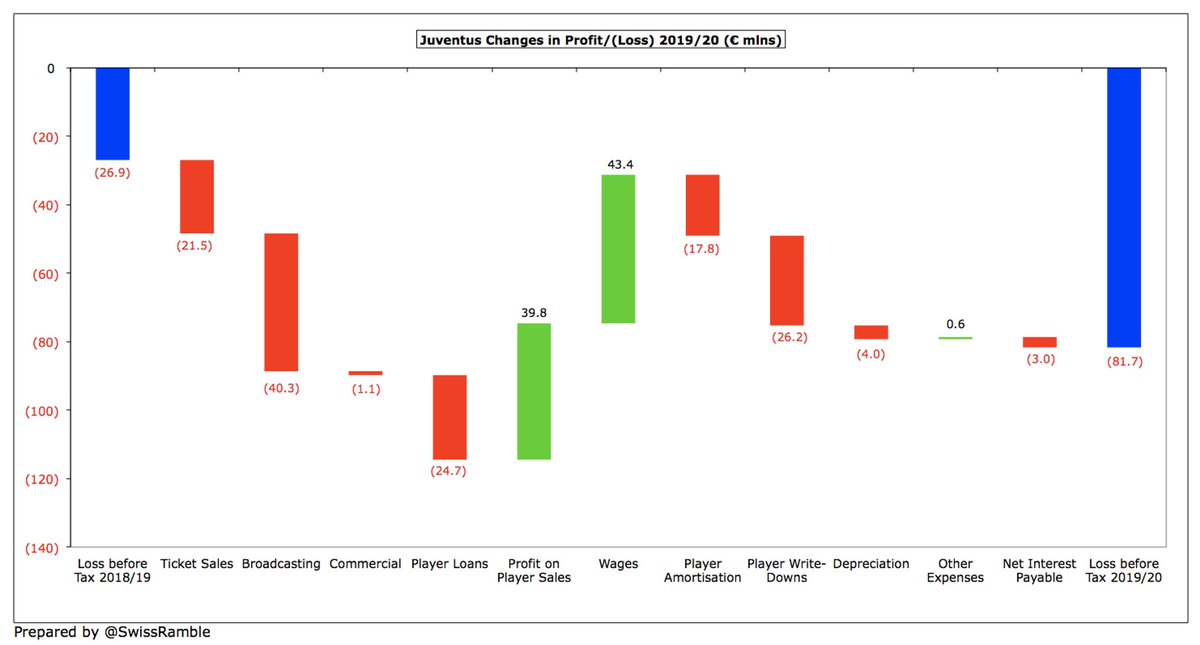

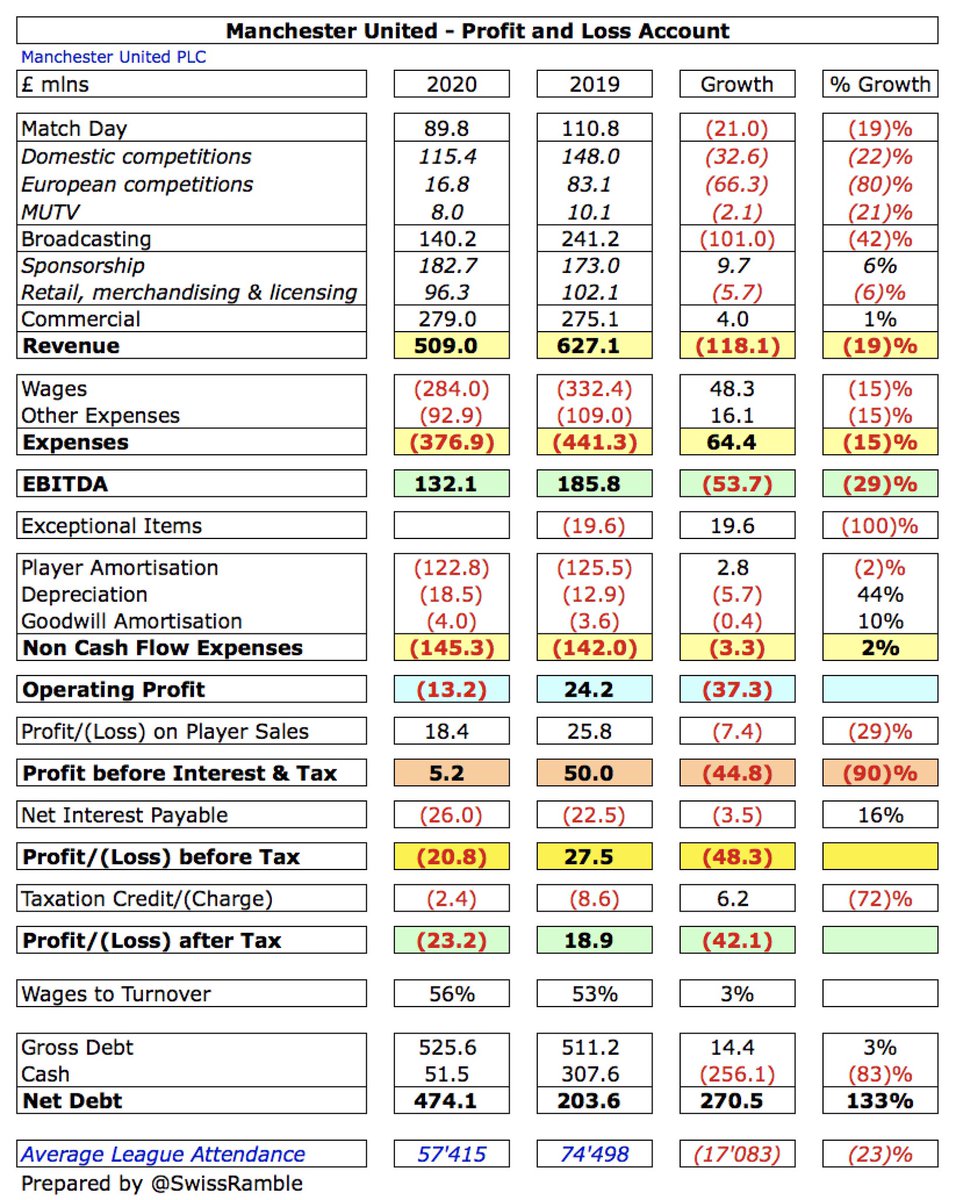

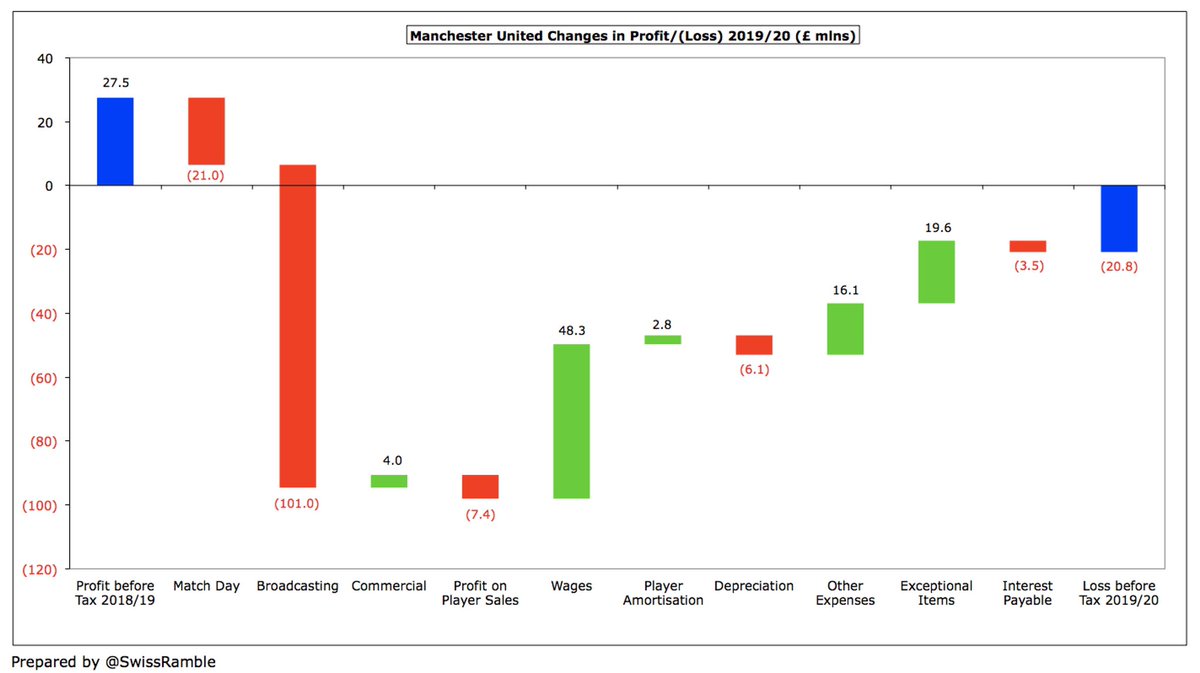

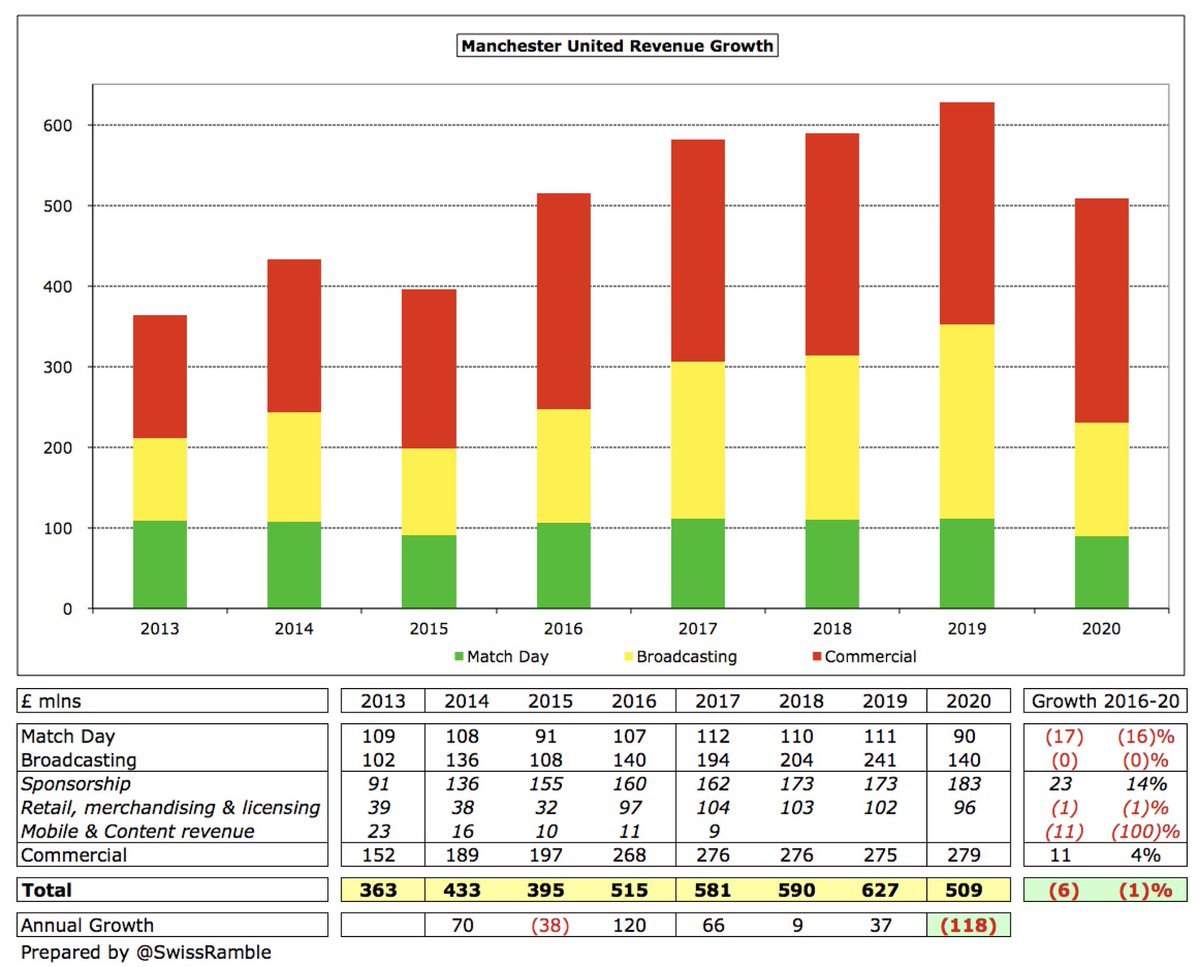

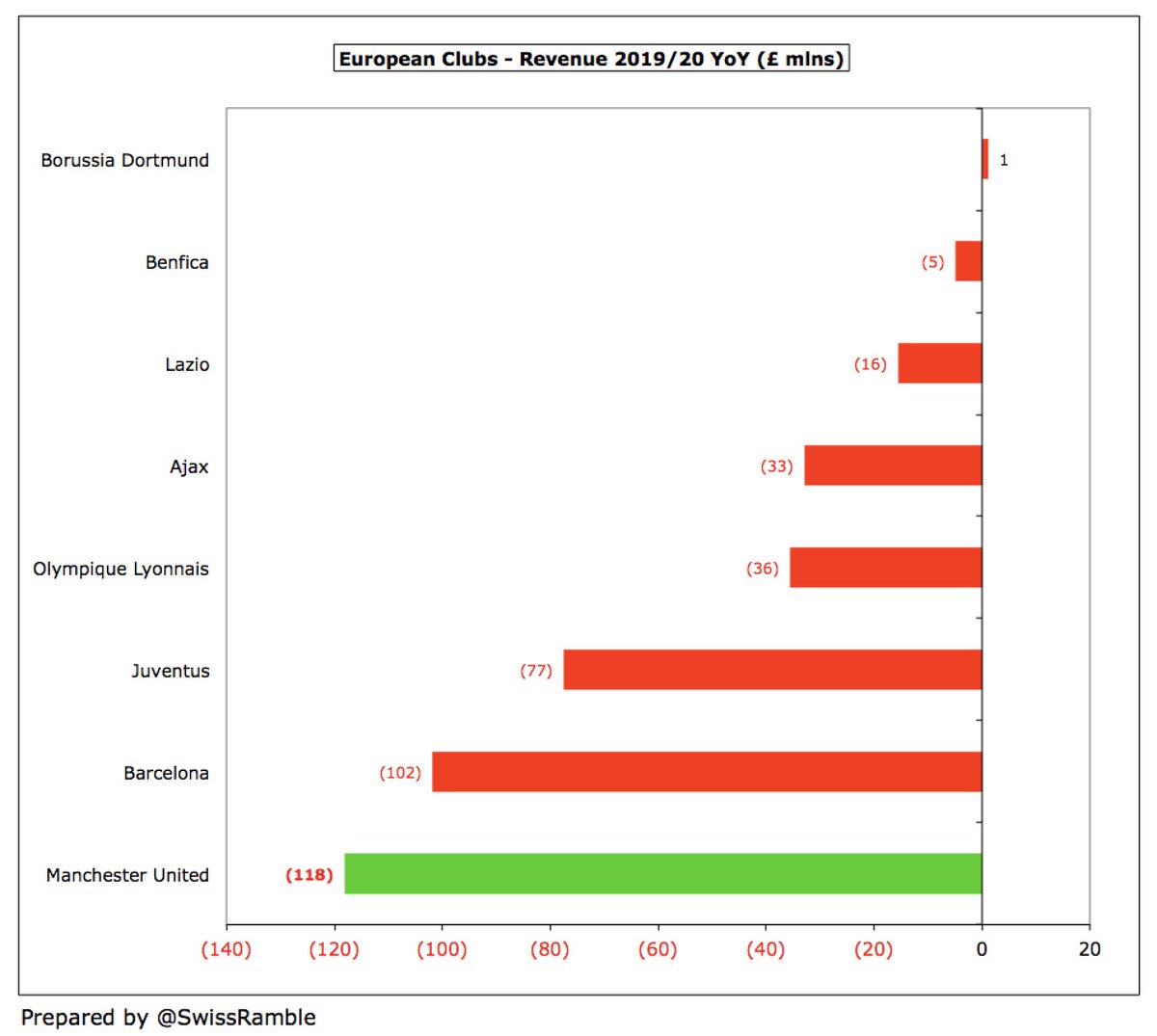

#MUFC swung from £27m profit before tax to £21m loss, a deterioration of £48m. Revenue dropped £118m (19%) from £627m to £509m, while profit on player sales fell £7m to £18m, partly offset by £81m (13%) reduction in operating expenses from £603m to £522m. After tax loss was £23m.

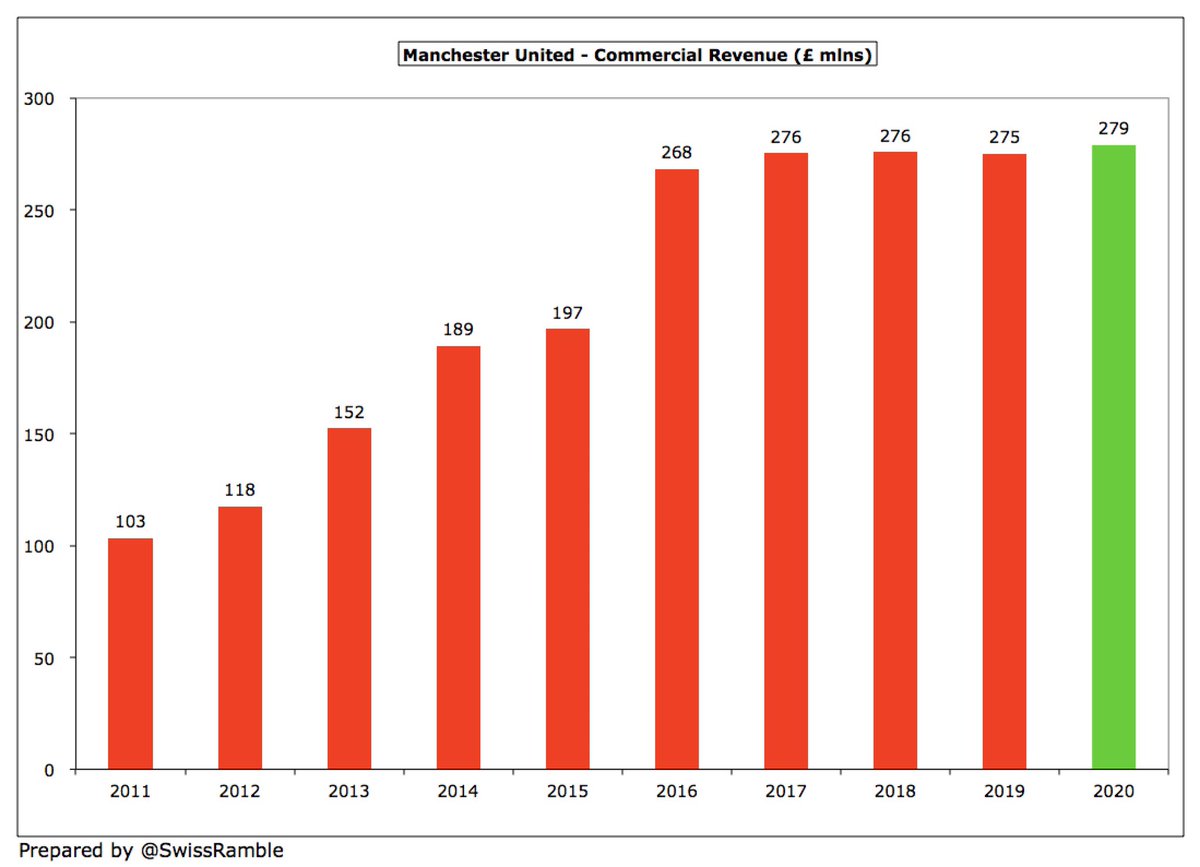

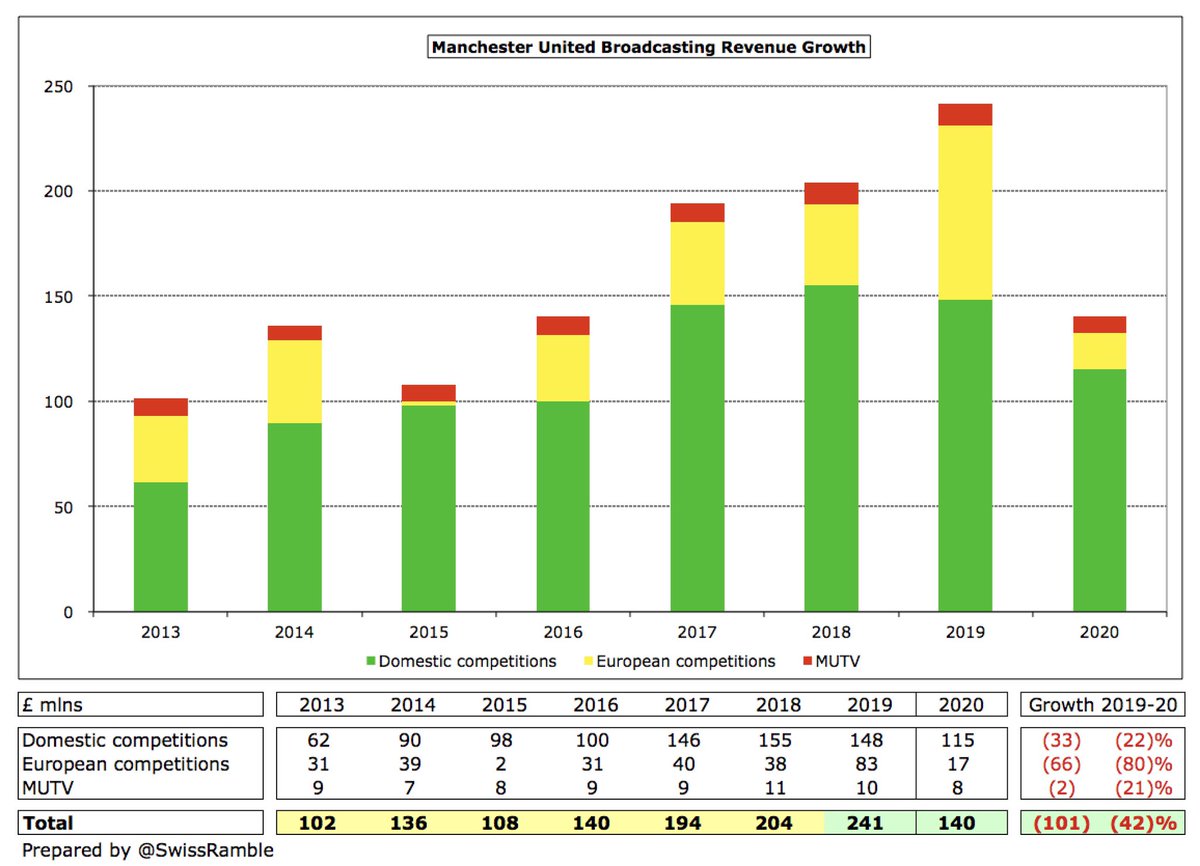

The main driver of #MUFC revenue reduction is broadcasting, down £101m (42%) to £140m, partly due to competing in Europa League instead of Champions League the previous season, while match day also fell £21m (19%) to £90m. Commercial actually rose slightly to £279m.

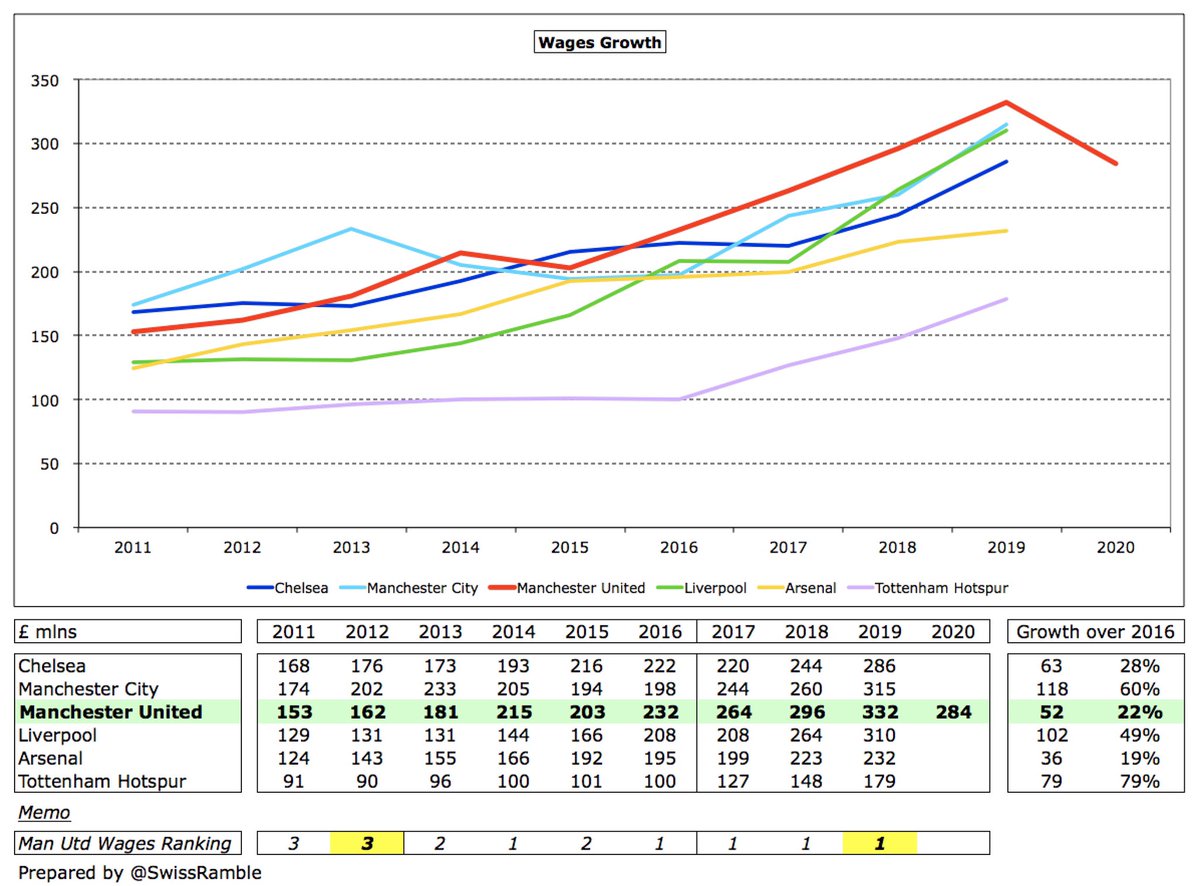

#MUFC wages and other expenses both fell 15%, by £48m from £332m to £284m and £16m from £109m to £93m respectively. £20m exceptional costs in 18/19 for Mourinho’s exit. Depreciation rose £6m to £19m, due to property impairment, while interest was up £4m to £26m (forex losses).

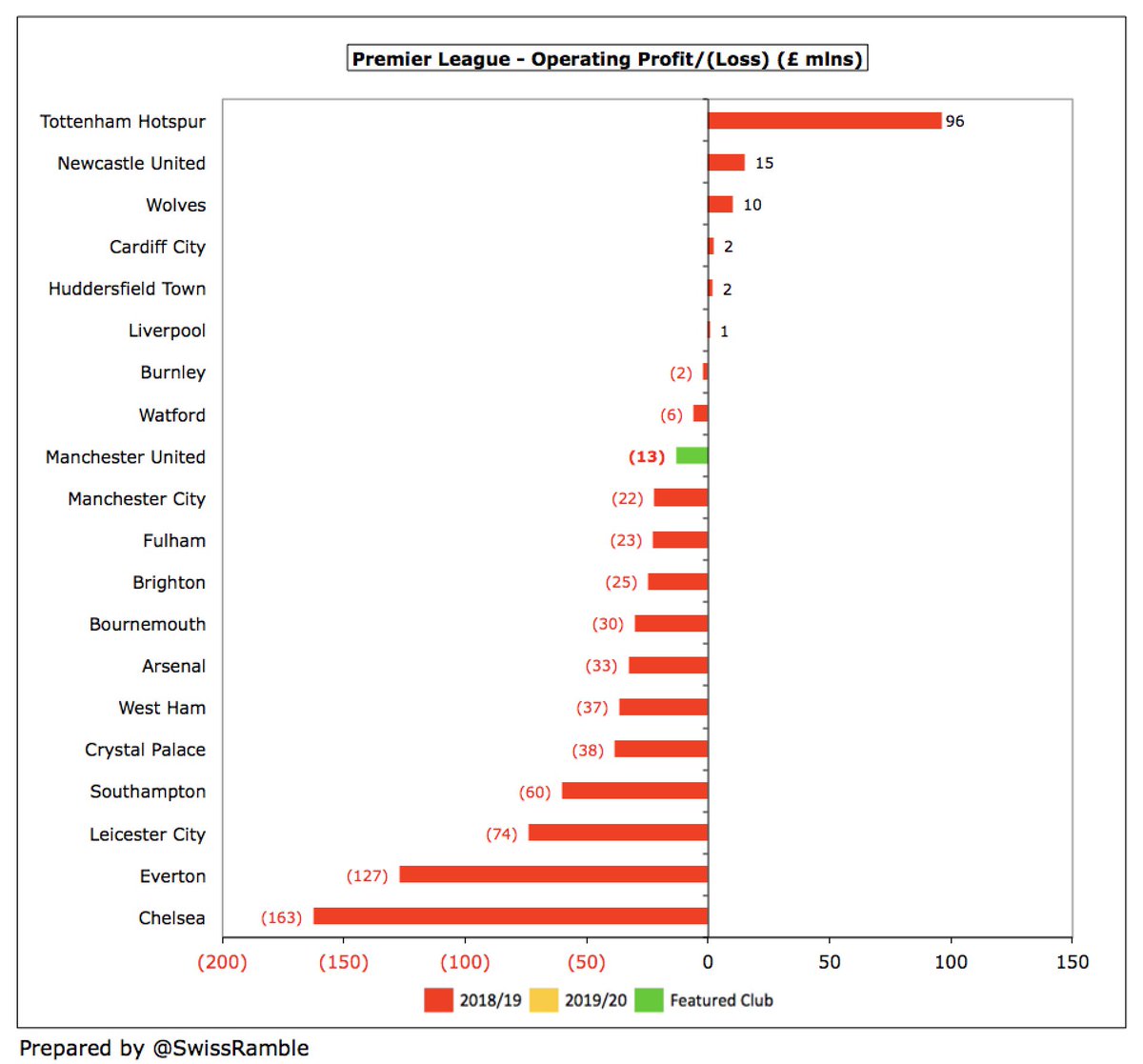

#MUFC £21m loss before tax would have been in the bottom half of the Premier League in 2018/19, though all clubs are likely to see a reduction in profitability in 2019/20 due to impact of the pandemic. #EFC and #CFC losses over £100m even before COVID.

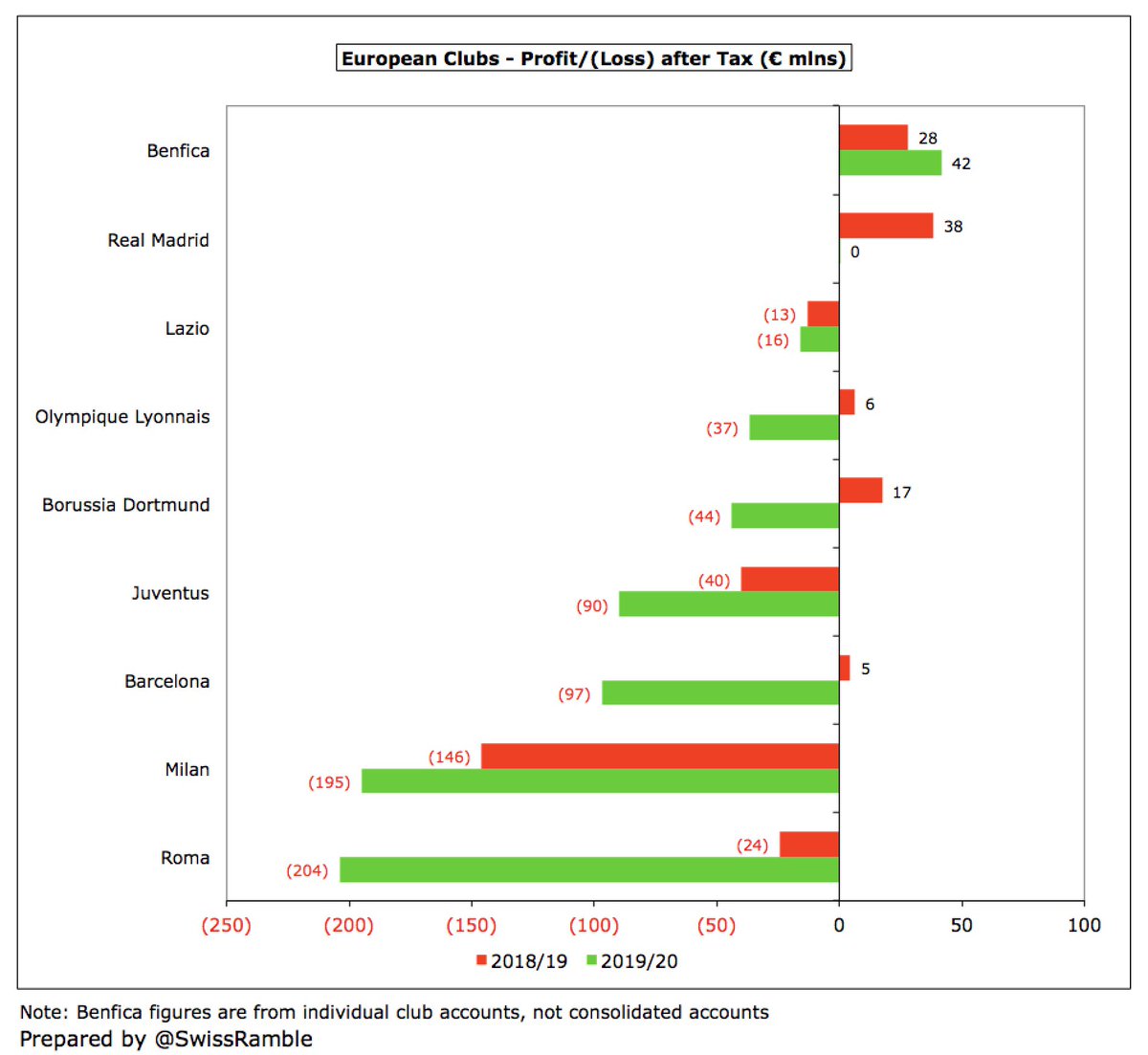

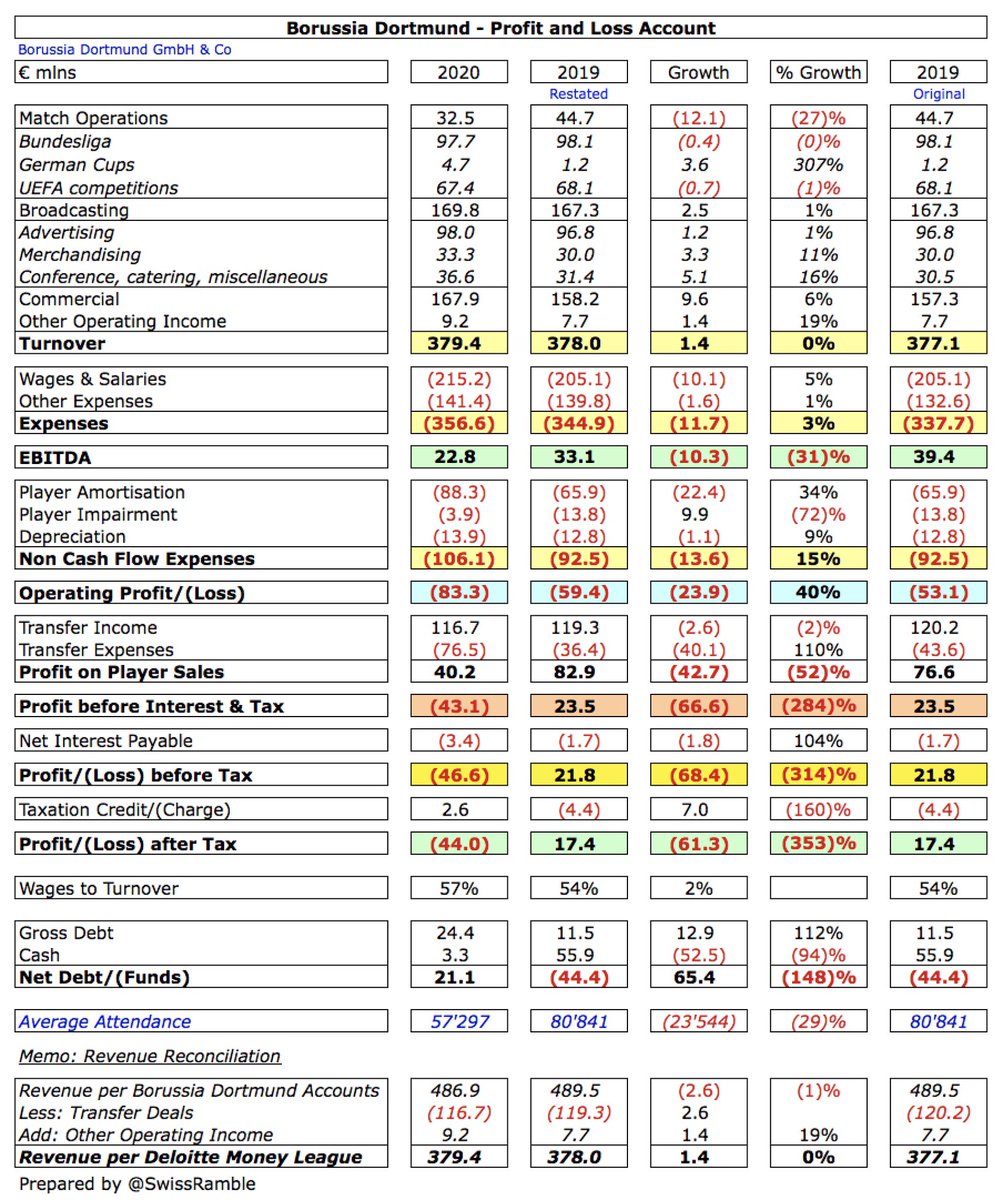

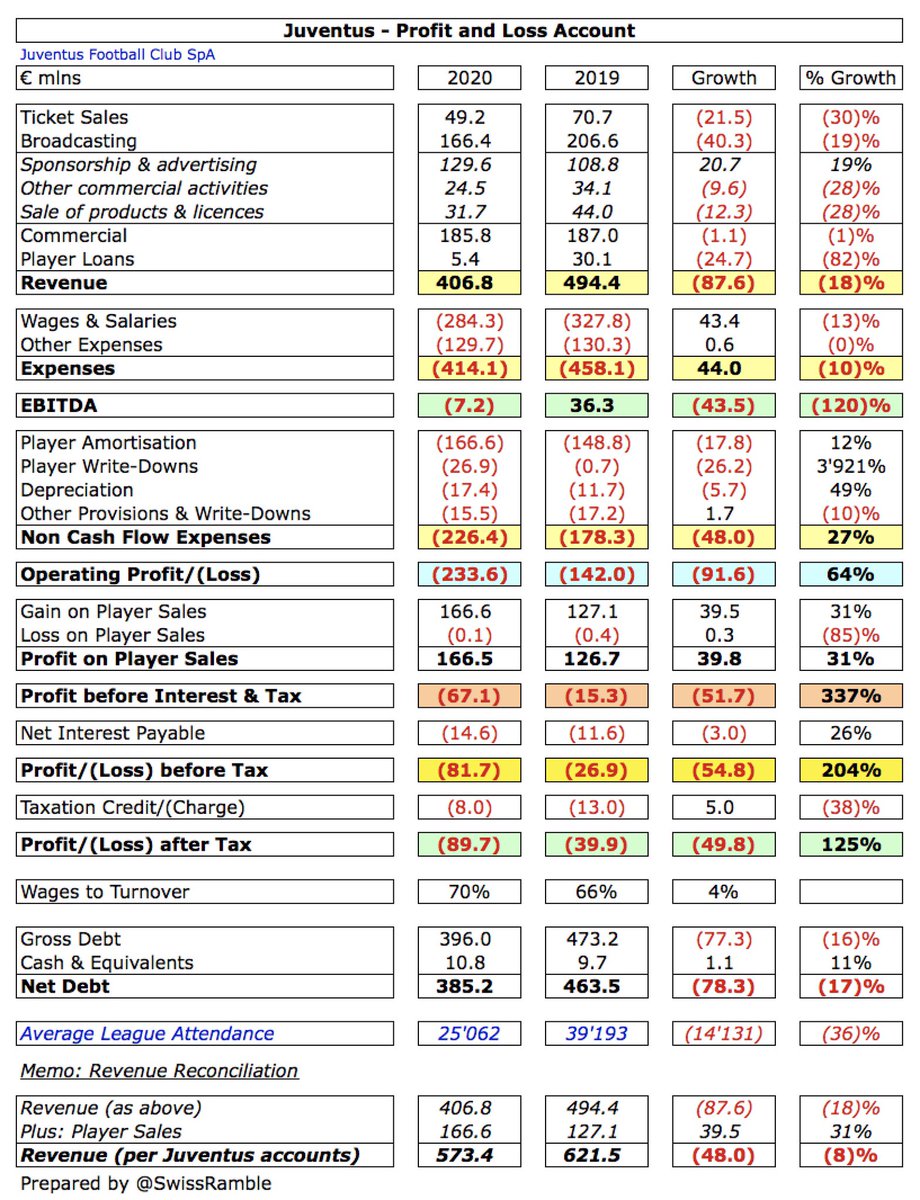

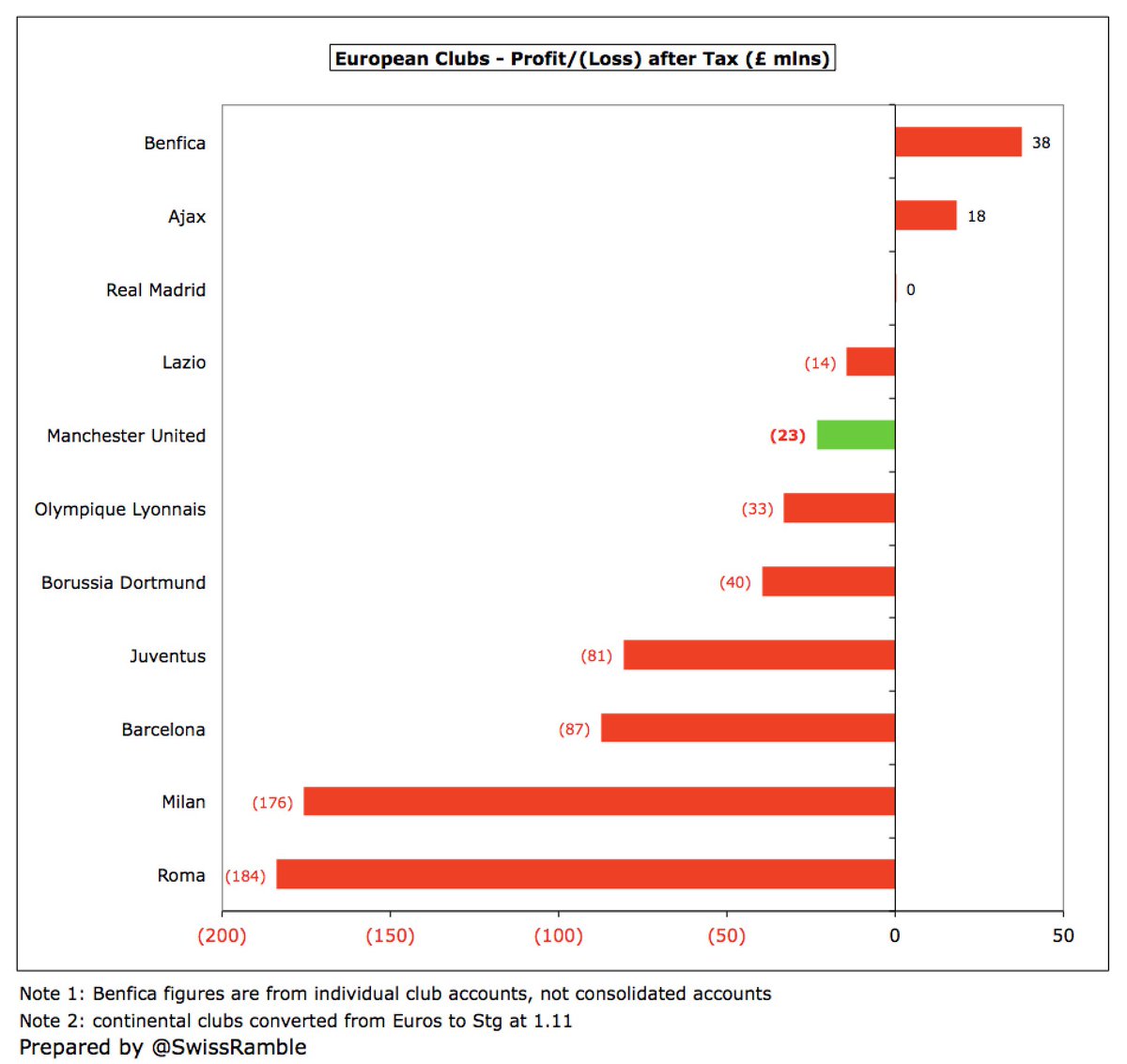

Furthermore, #MUFC £23m loss after tax is much smaller than many announced by European counterparts for 2019/20, e.g. Roma £184m, Milan £176m, Barcelona £87m and Juventus £81m. That said, Real Madrid broke-even, while Benfica and Ajax made good profits, due to high player sales.

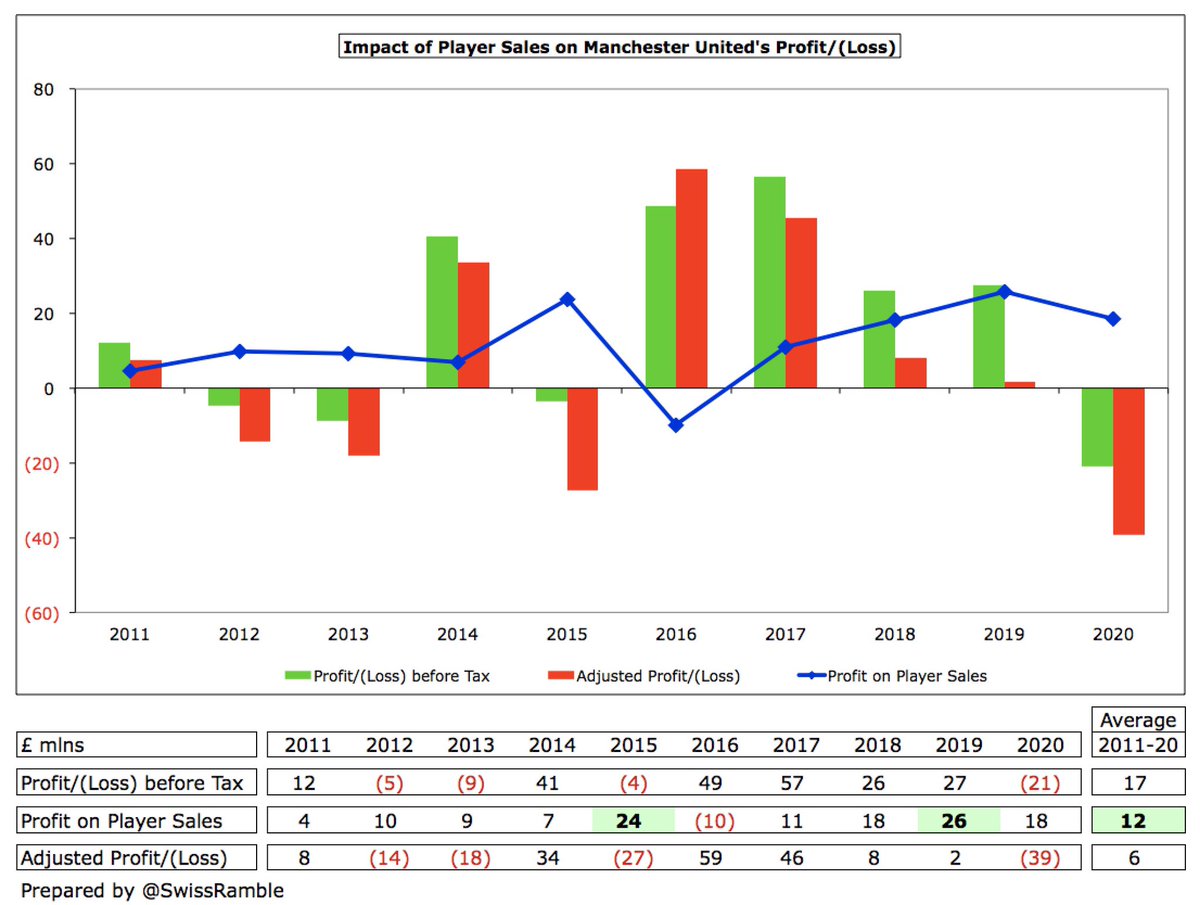

The #MUFC strategy has not been overly reliant on player sales, so their £18m profit from this activity is mid-table in the Premier League. Fell £7m from prior season. Included lucrative sale of Lukaku to Inter, but profit restricted, due to high book value in United’s accounts.

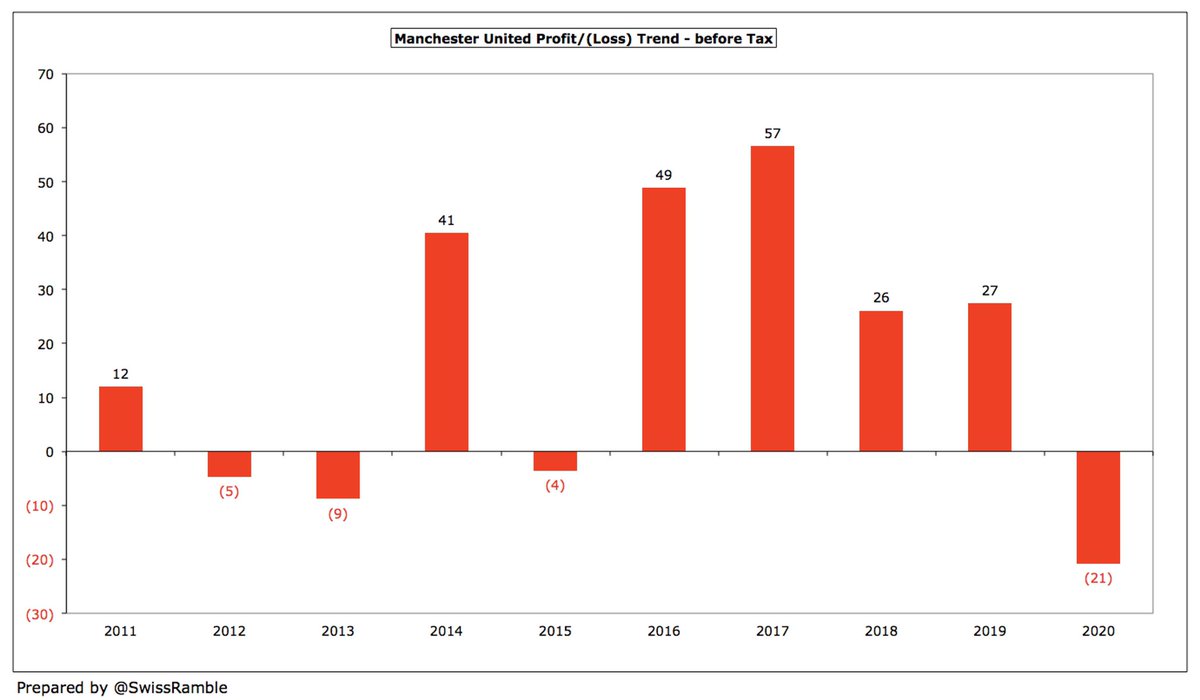

This is the first loss that #MUFC have reported since 2015, when their small £4m deficit was due to the lack of European football. Before 2020, United had aggregated an impressive £159m profit in the last four years, averaging £40m annually in that period.

#MUFC results have rarely been boosted by player sales, only averaging £12m over the last decade. In the 5 years up to 2019, United’s £69m profit from this activity was significantly lower than rest of the Big Six: #CFC £332m, #LFC £306m, #THFC £172m, #AFC £170m and #MCFC £147m.

#MUFC 2019/20 results were not impacted by exceptional items., whereas previous year was hit by £20m compensation paid for a managerial change: £15m to Jose Mourinho with the remainder to his coaching staff. That makes £36m in manager pay-offs since Sir Alex Ferguson retired.

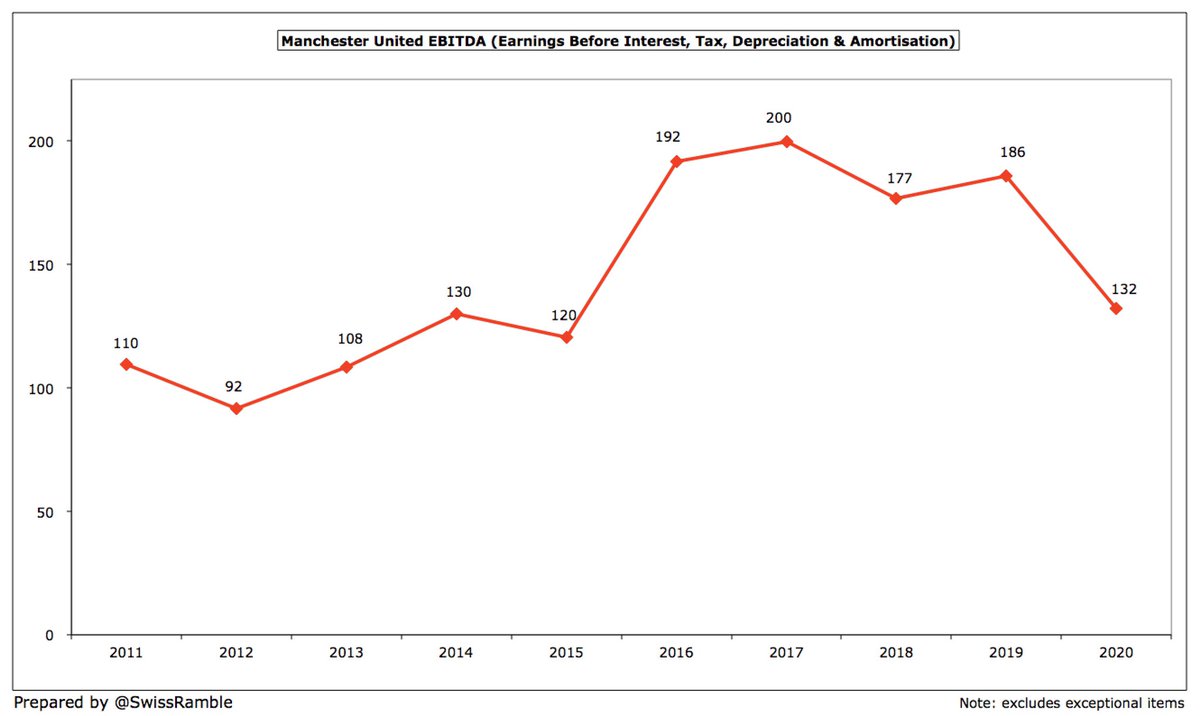

#MUFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for cash operating profit, as it strips out player sales and exceptional items, decreased from £186m to £132m, the lowest for 5 years and a fair way below the £200m peak in 2017.

However, #MUFC lower EBITDA of £132m is still second highest in the Premier League, underlining the club’s incredible ability to generate cash. #THFC are the only club above them with £168m, but that will fall in 2019/20. For some context, 8 clubs had EBITDA below £25m.

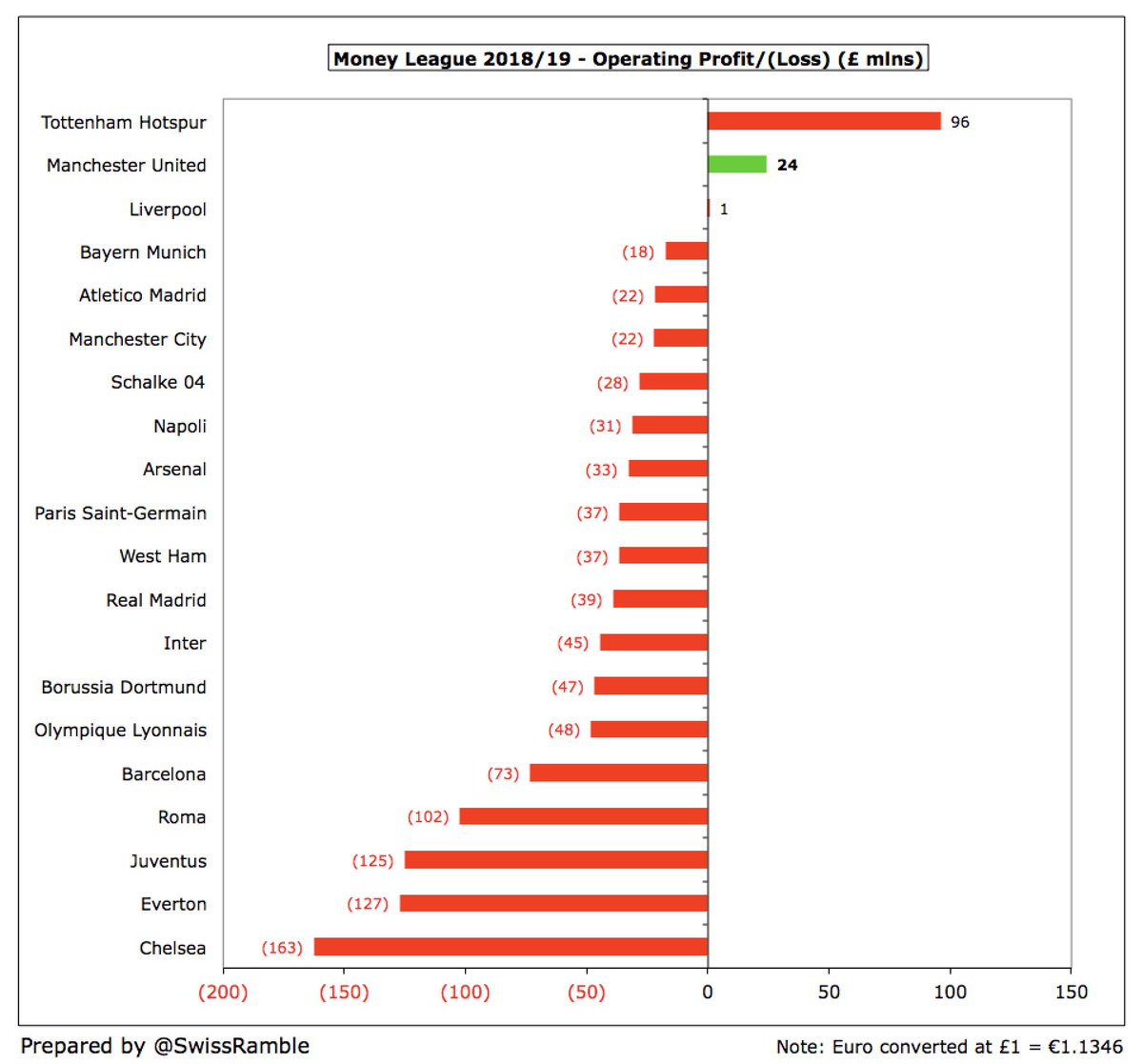

At an operating level (excluding player sales and interest), #MUFC made a £13m loss, the first time they have not posted a profit since 2006. In fairness, very few Premier League clubs were profitable here in 18/19, while United’s £24m profit that year was 2nd highest in Europe.

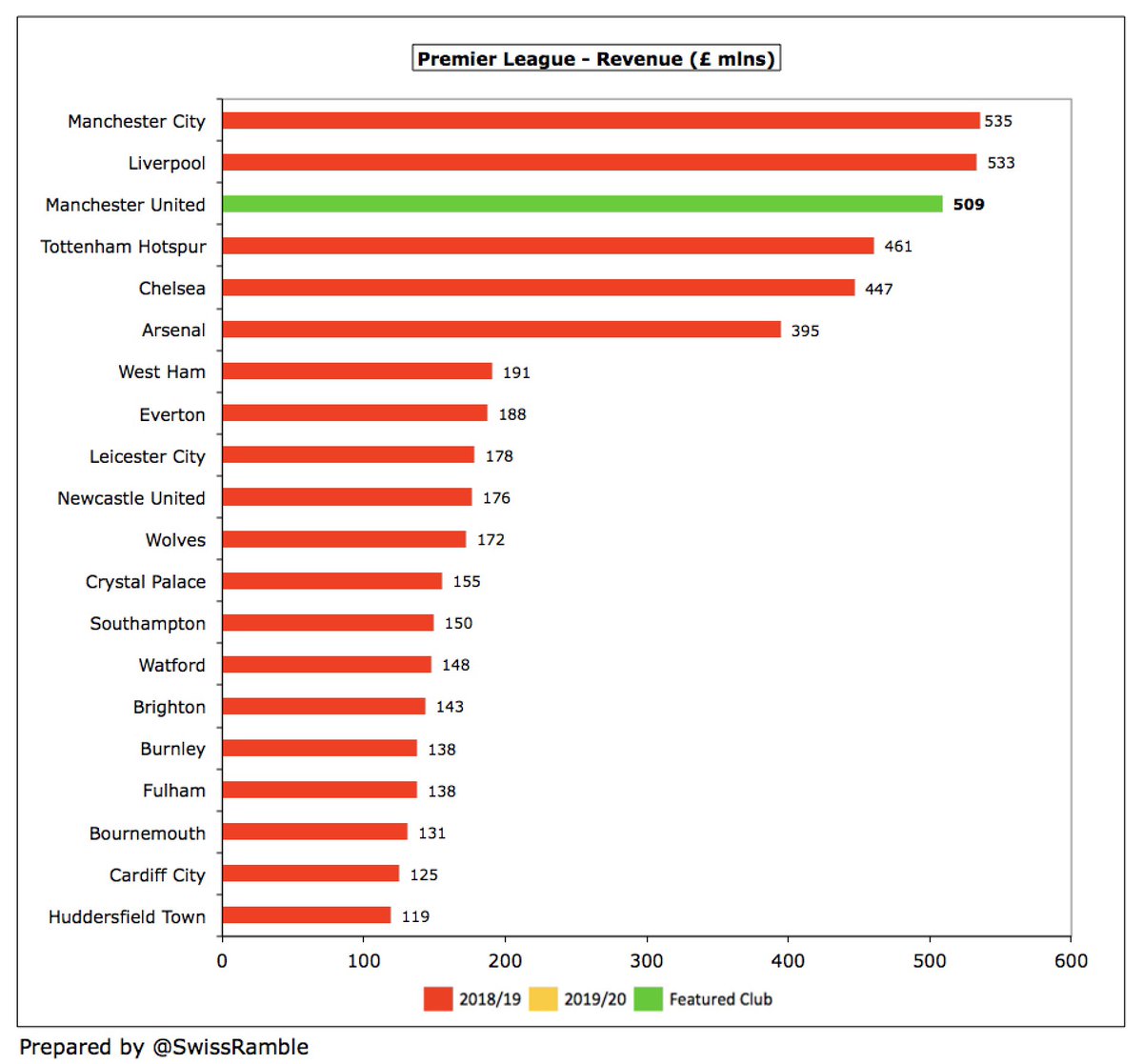

#MUFC £509m revenue is the lowest they have generated for five years (£395m in 2015) and is now back to 2016 levels (£515m in 2016). Before the pandemic struck, the club had projected £560-580m, which implies that the COVID-19 impact was £50-70m.

Following this decrease, #MUFC revenue is no longer the highest in England, falling below #MCFC £535m and #LFC £533m, though these clubs have yet to publish COVID-impacted accounts for 2019/20. That said, other leading clubs have been narrowing the gap to United.

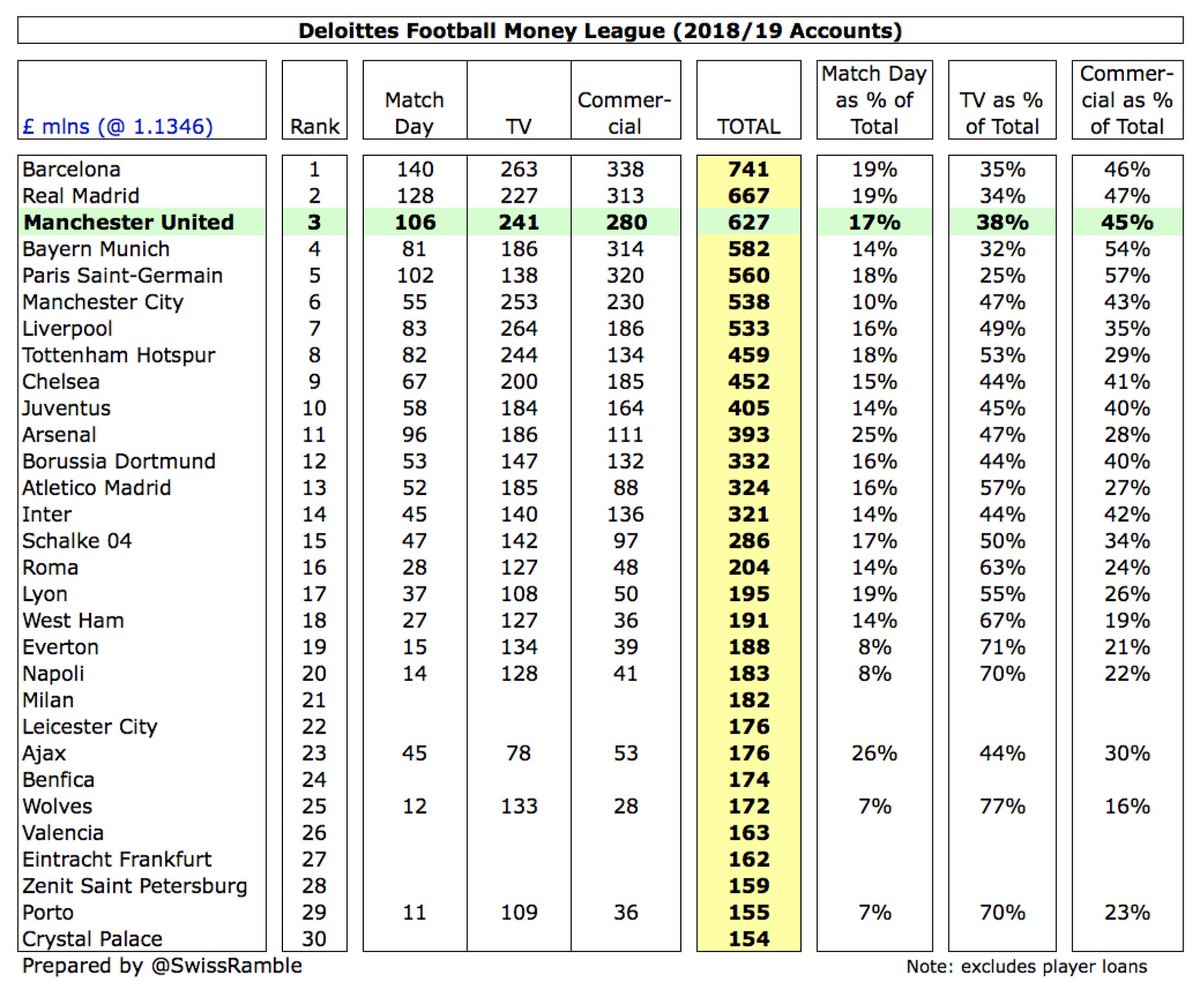

Based on 2018/19 figures, #MUFC £627m revenue was third highest in the Deloitte Money League, but a fair way below Barcelona £741m and Real Madrid £667m. Other leading clubs have seen similar revenue falls to United’s £118m in 2019/20, e.g. Barcelona £102m, Juventus £77m.

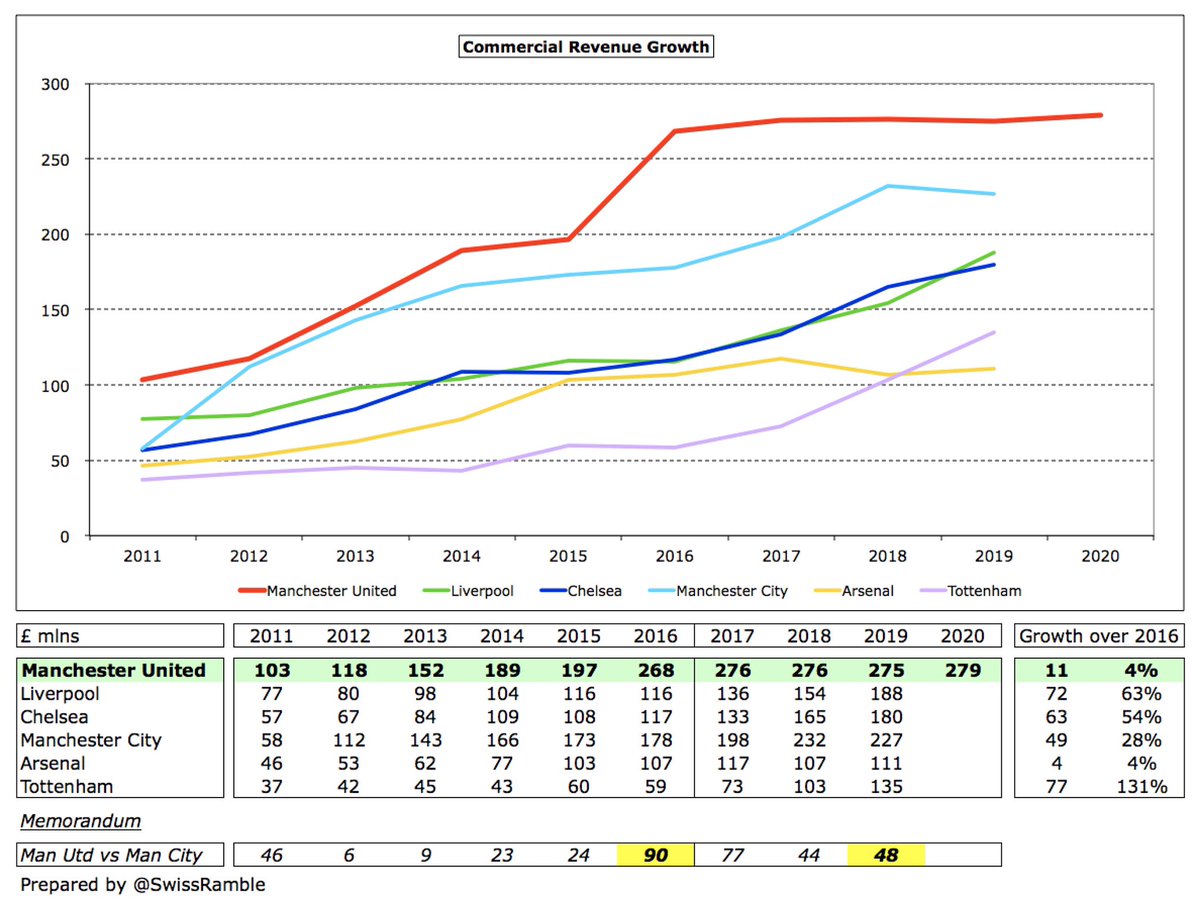

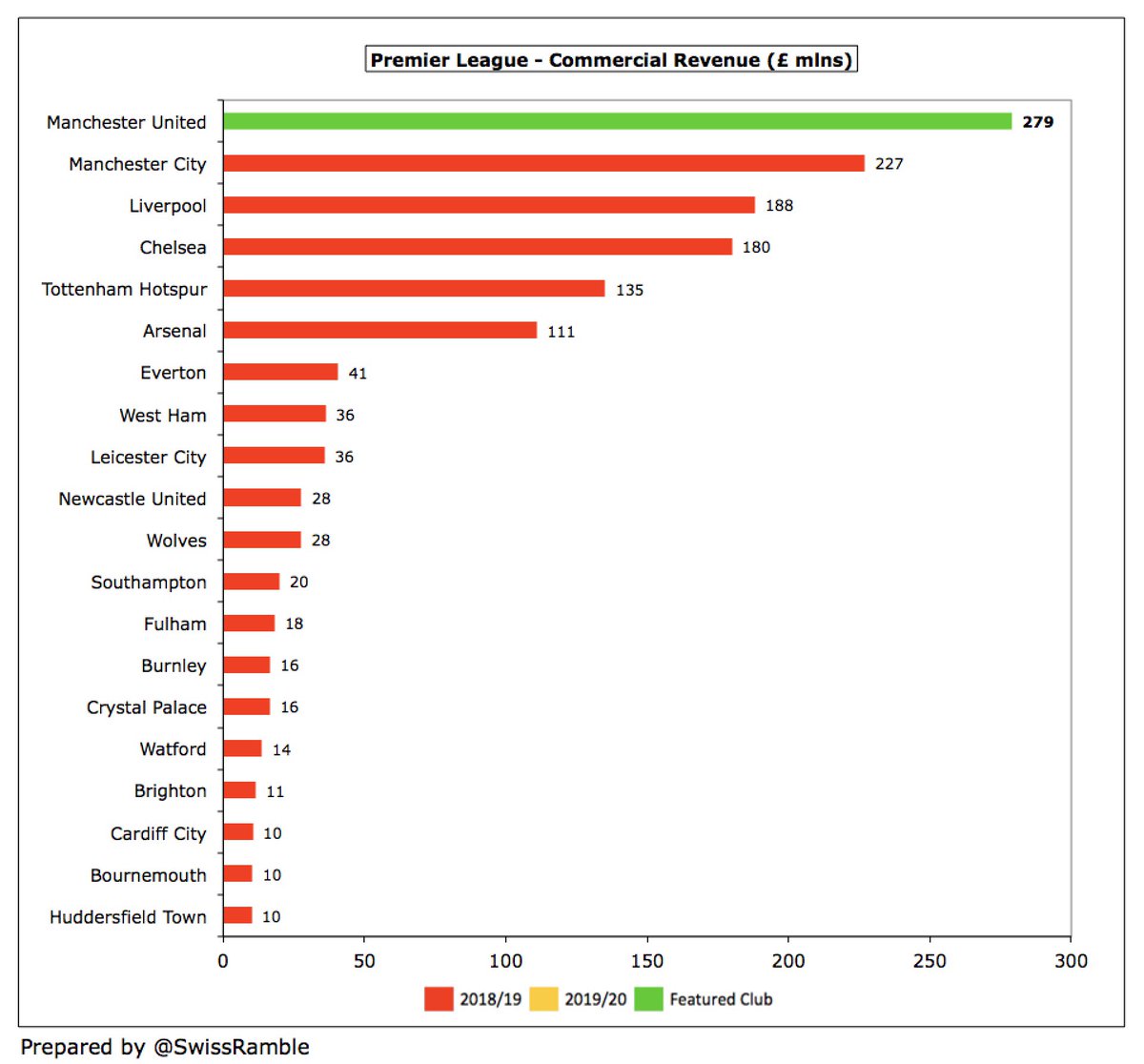

#MUFC commercial income rose £4m (1%) to £279m, as sponsorship increased £10m to £183m, though retail fell £6m to £96m, as Old Trafford Megastore was closed for 3 months. However, this revenue stream has been essentially flat for the last 5 years, while big growth at rival clubs.

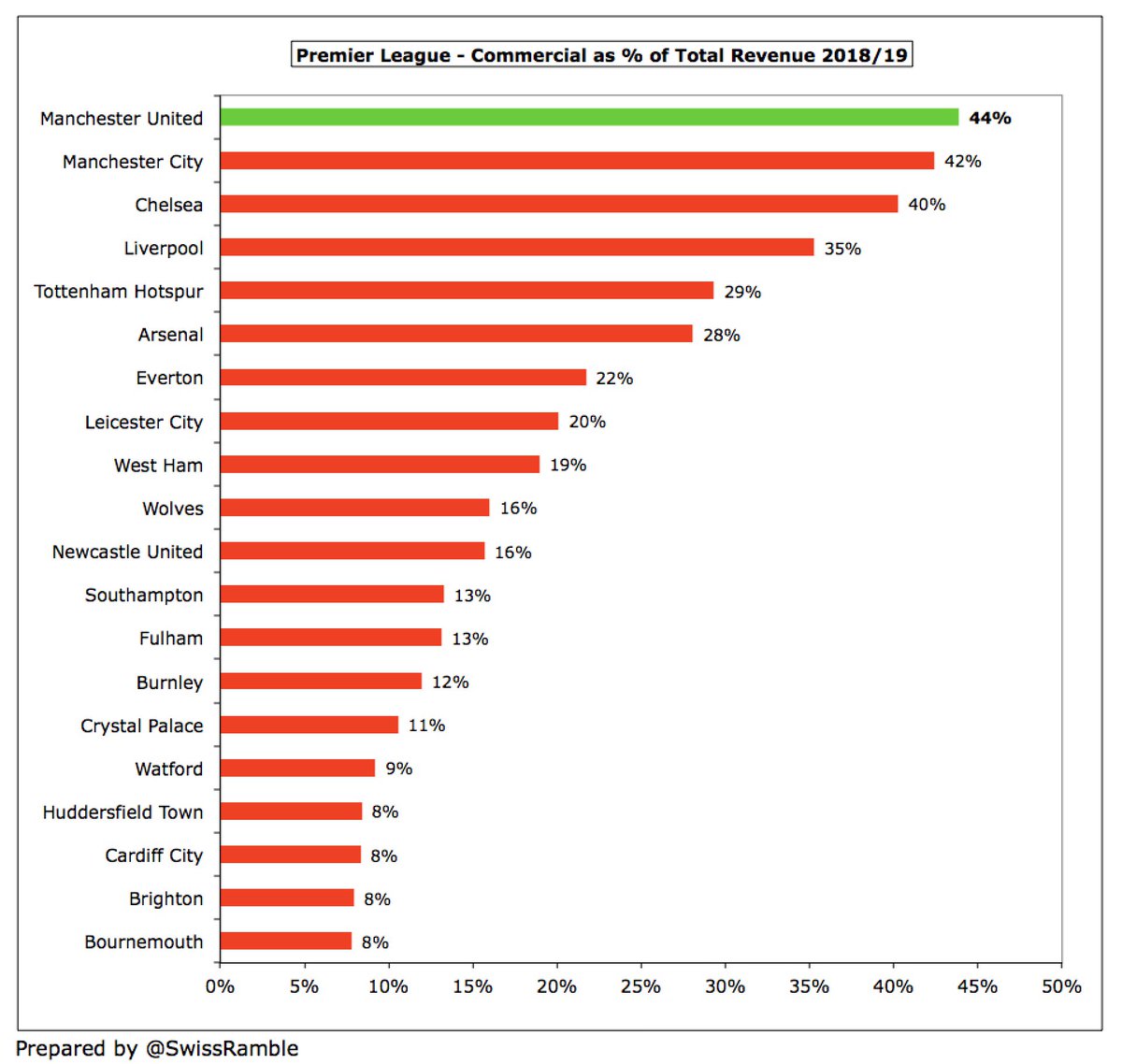

That said, #MUFC £279m commercial income is still over £50m higher than #MCFC £227m. The fact that so much of United’s revenue is from commercial (44% in 2018/19) gives them a degree of protection from the financial impact of the pandemic that others don’t enjoy.

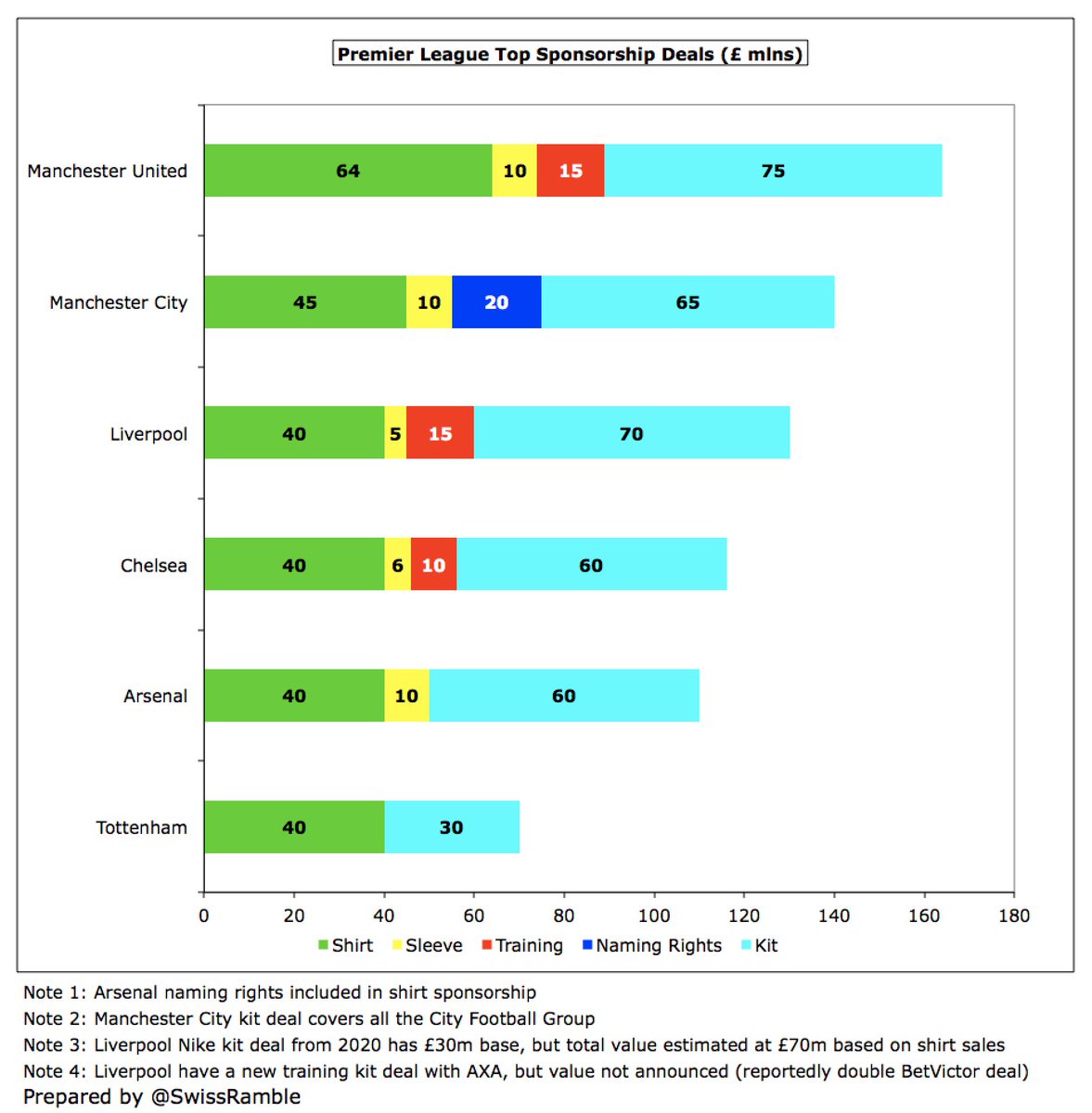

#MUFC Chevrolet shirt sponsorship is £64m a season (extended 6 months to December 2021), while Adidas kit deal is an amazing £75m (cut by 30% if fail to reach Champions League for 2 consecutive seasons). Aon pay £15m for training kit/facilities, Kohler £10m for sleeve sponsor.

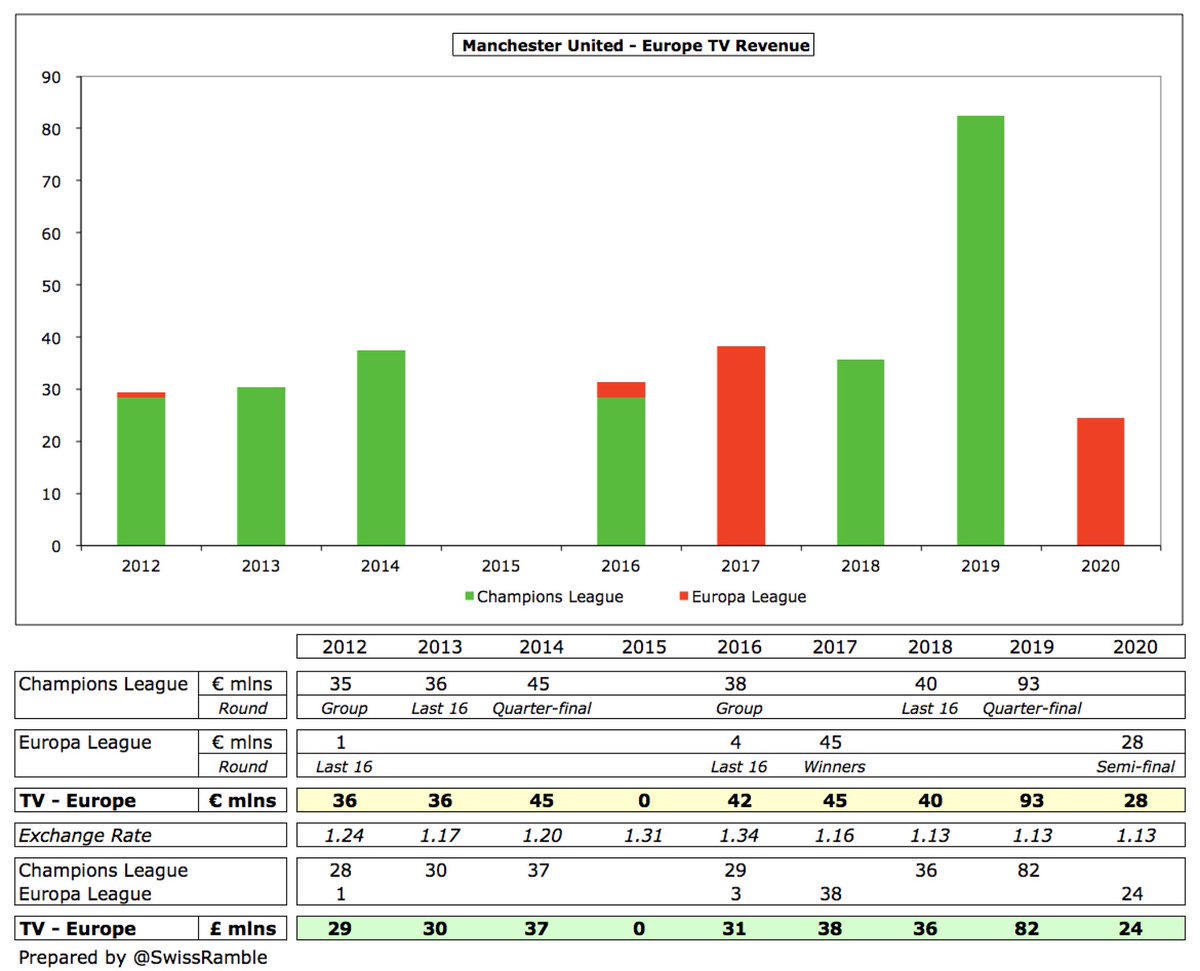

TV money has driven #MUFC revenue growth in recent years, but plunged £101m (42%) from £241m to £140m (domestic £115m, Europe £17m, MUTV £8m), due to revenue from 10 Premier League games slipping to 2020/21 accounts (plus £14m rebate to broadcasters) and no Champions League.

Premier League has not published TV money details, but EPL Handbook has illustrative example based on league place, suggesting gross revenue rose from £143m to £151m (new 19/20 deal) less £16m rebate (£14m per #MUFC accounts), giving net £135m. Some income deferred to 2020/21.

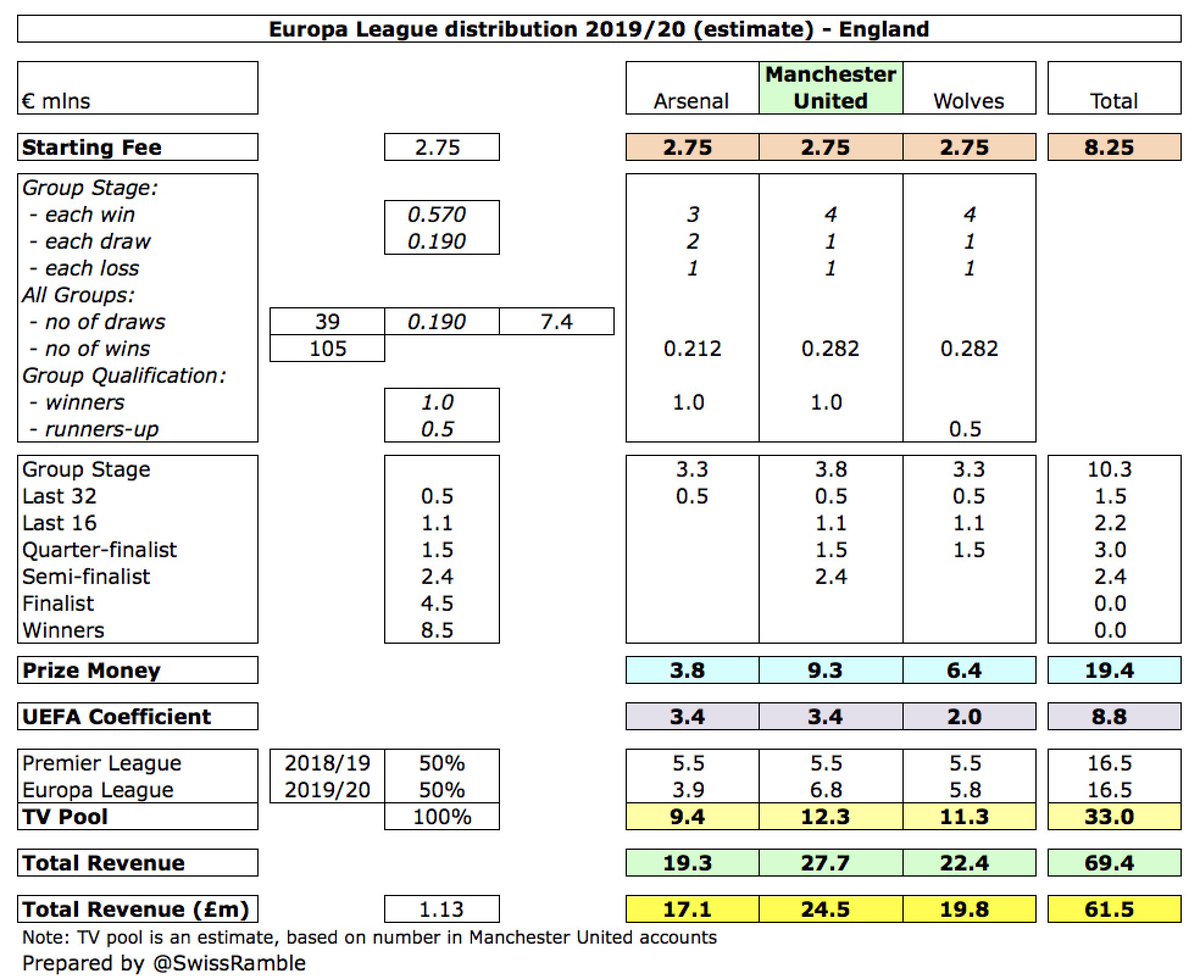

#MUFC earned £25m from Europa League for reaching semi-finals, much less than prior season’s £83m (Champions League quarter-finals), but only booked £17m in 19/20, as revenue from knock-out stages will be in 20/21 accounts. This is before 16% COVID rebate (spread over 5 years).

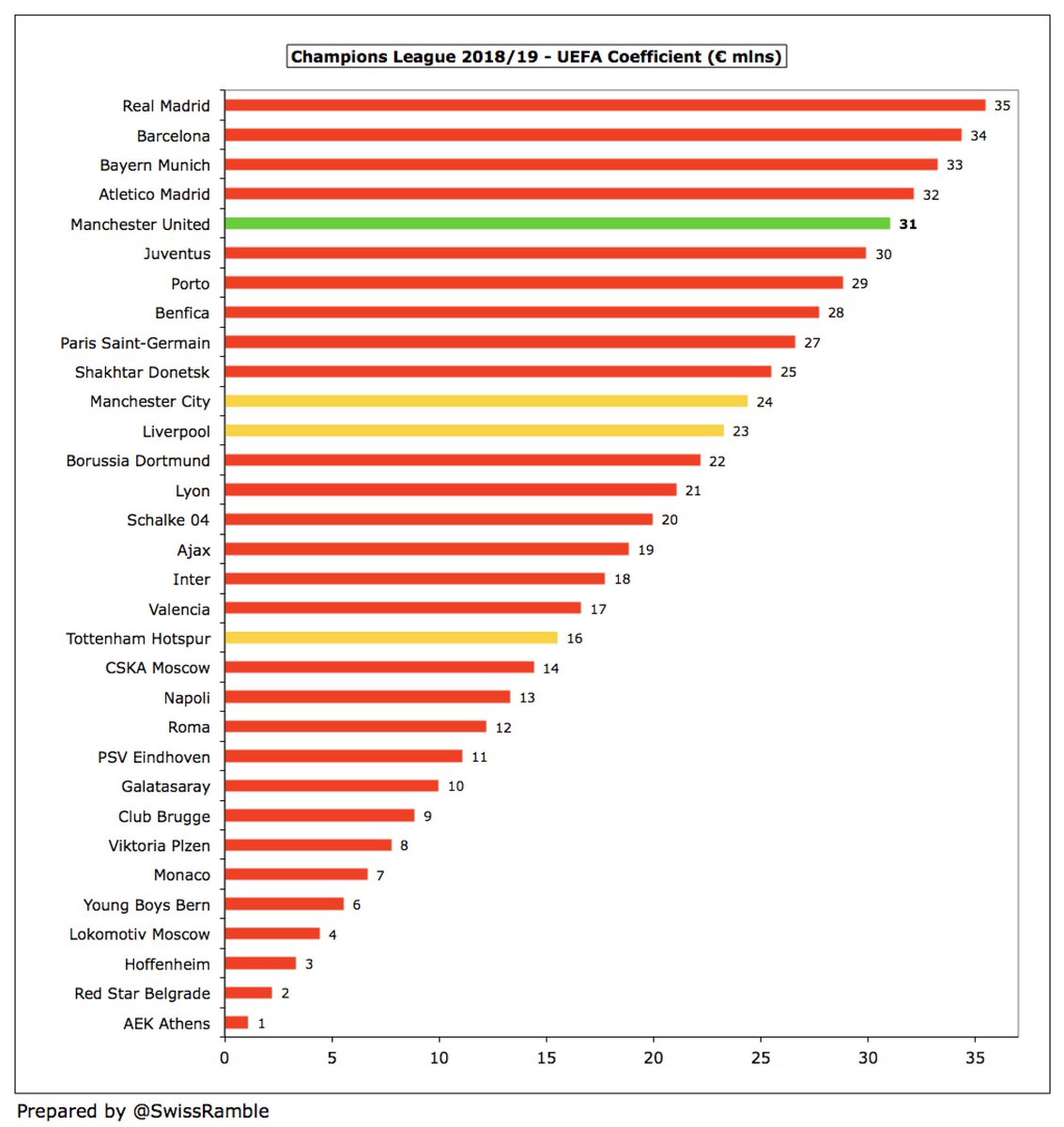

In 2018/19 #MUFC benefited from a new UEFA coefficient payment (based on performances over 10 years), as they received €31m for this element (the 5th highest in the Champions League), but this was much lower in the Europa League in 2019/20 (only around €3.4m).

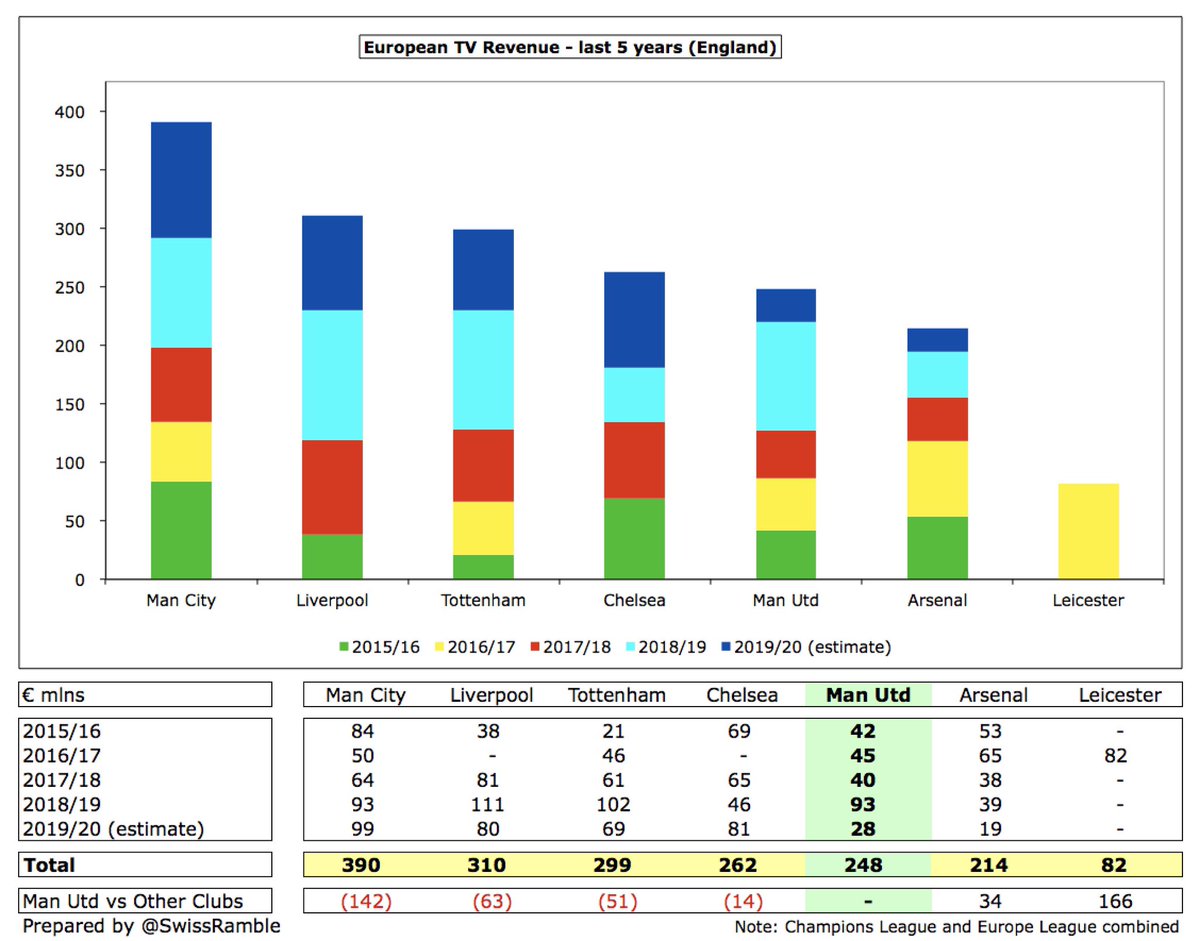

#MUFC relatively poor performance in Europe, including not even qualifying in 2015, means that they have “only” earned €248m in the last 5 years. That’s not too shabby, but it is a hefty €142m less than #MCFC €390m. Also below #LFC €310m, #THFC €299m and #CFC €262m.

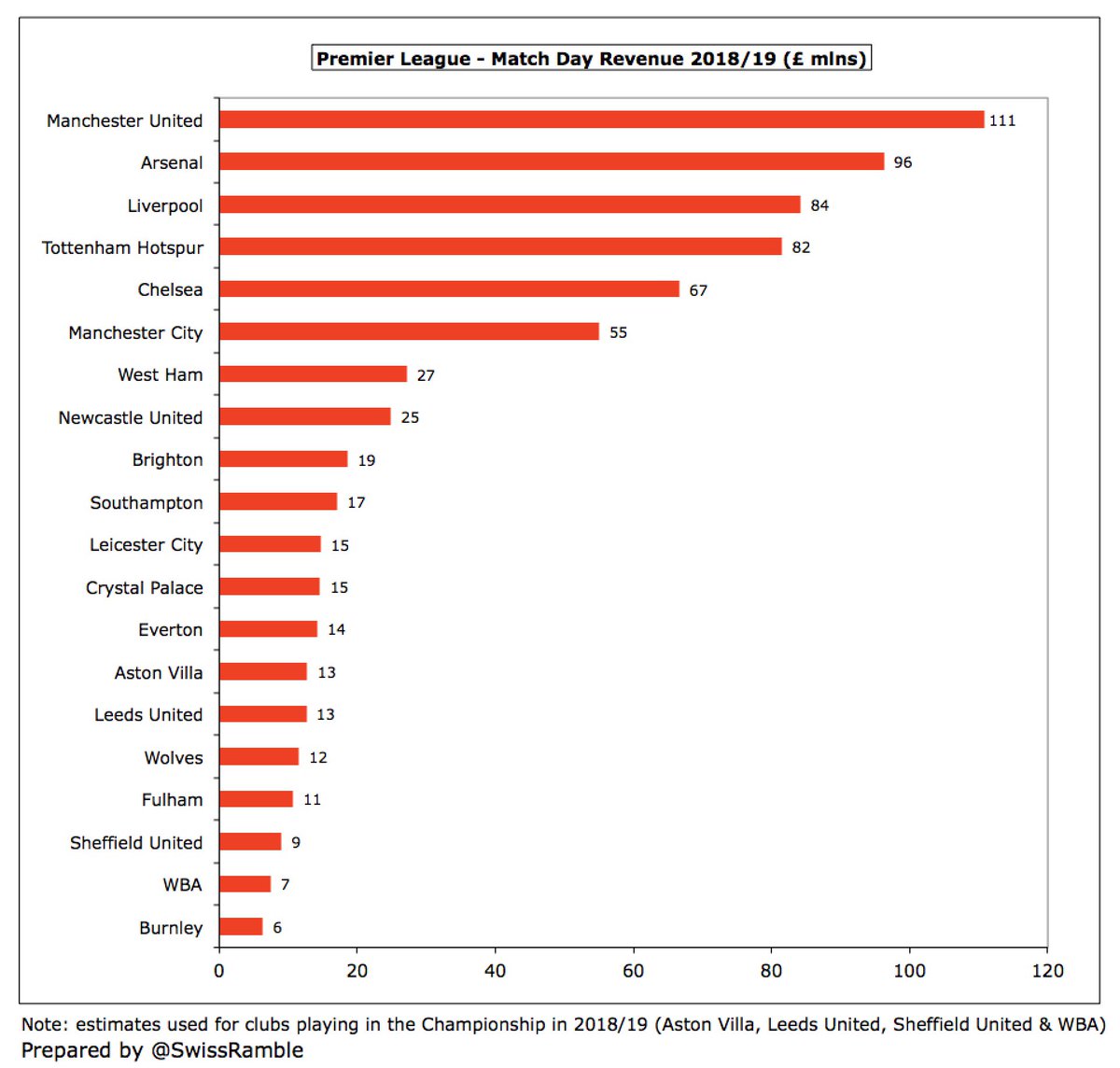

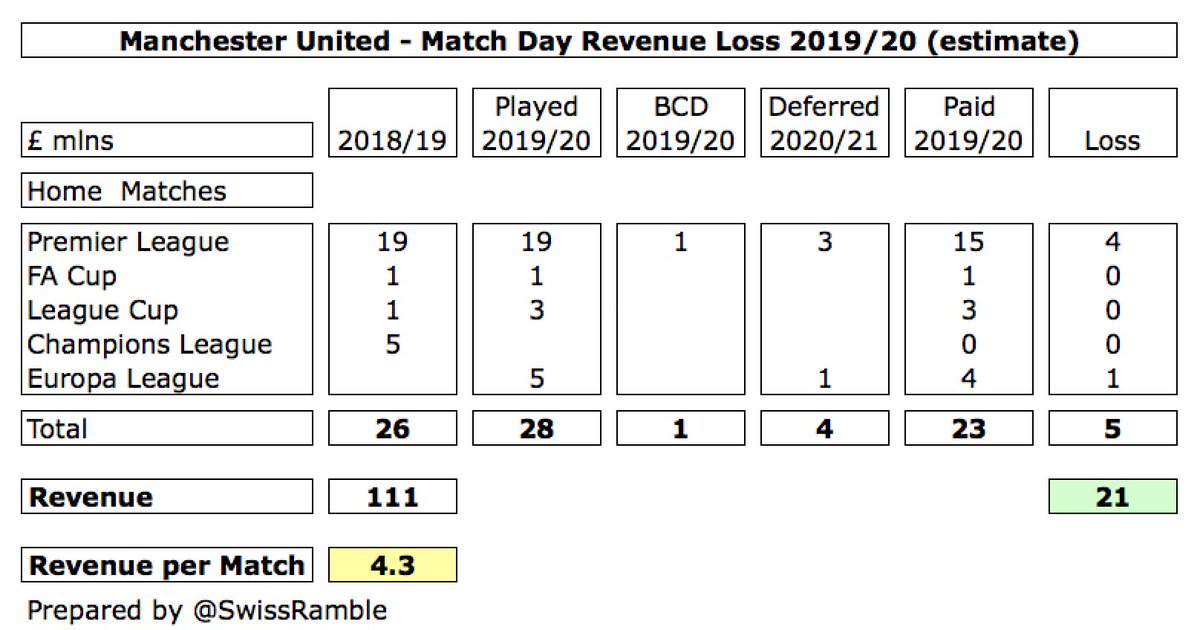

#MUFC match day income fell £21m (19%) from £111m to £90m, as revenue for 4 home games (3 Premier League, 1 Europa League) that were played after 30th June was deferred into 2020/21 accounts, while 1 game in 2019/20 accounts was played behind closed doors.

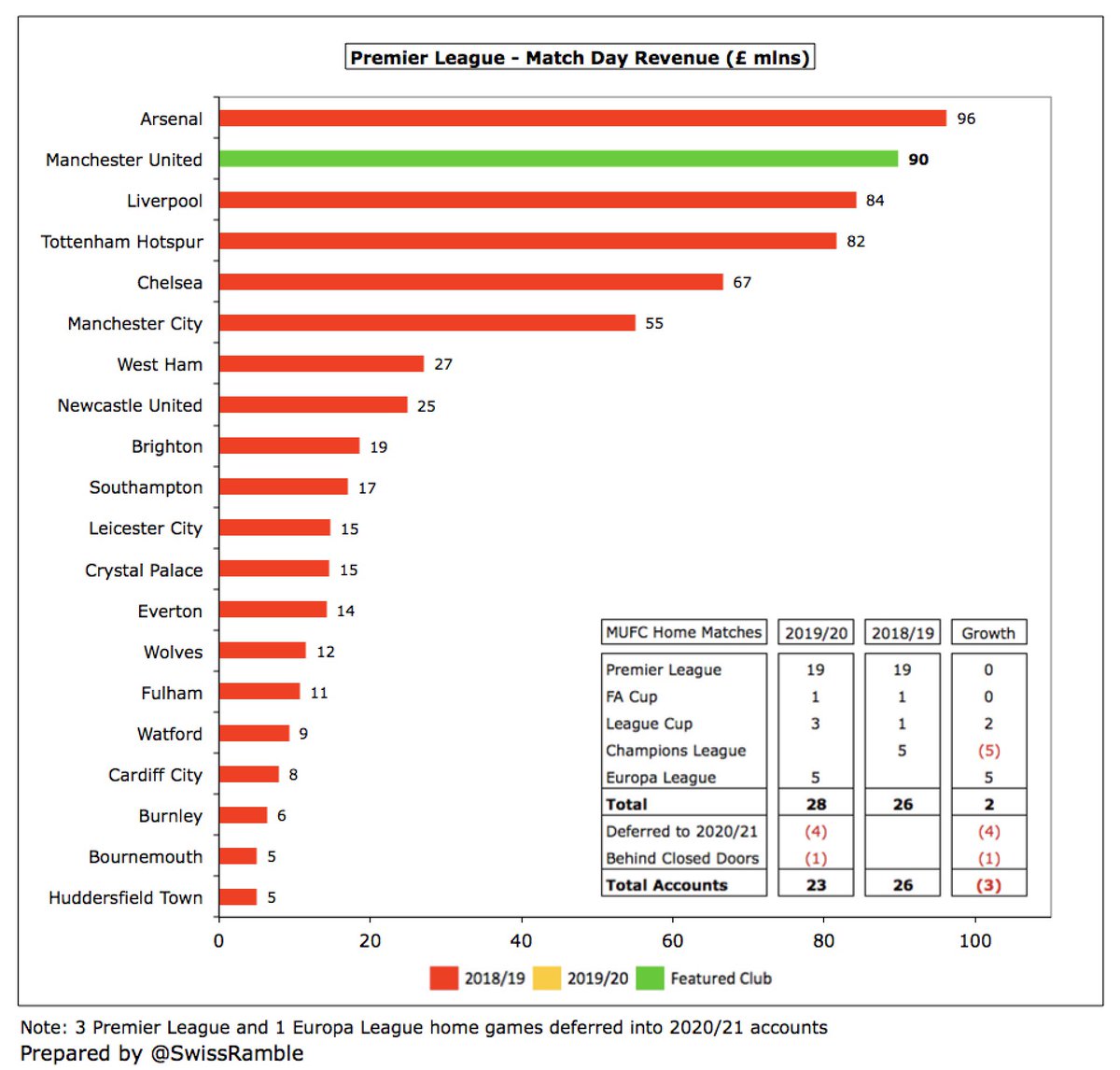

Despite this decrease, #MUFC £90m match day income is likely to still be the highest in the Premier League. #AFC 2018/19 revenue of £96m will fall in 2019/20, due to COVID, though #THFC figure will be interesting after a full season at their new stadium.

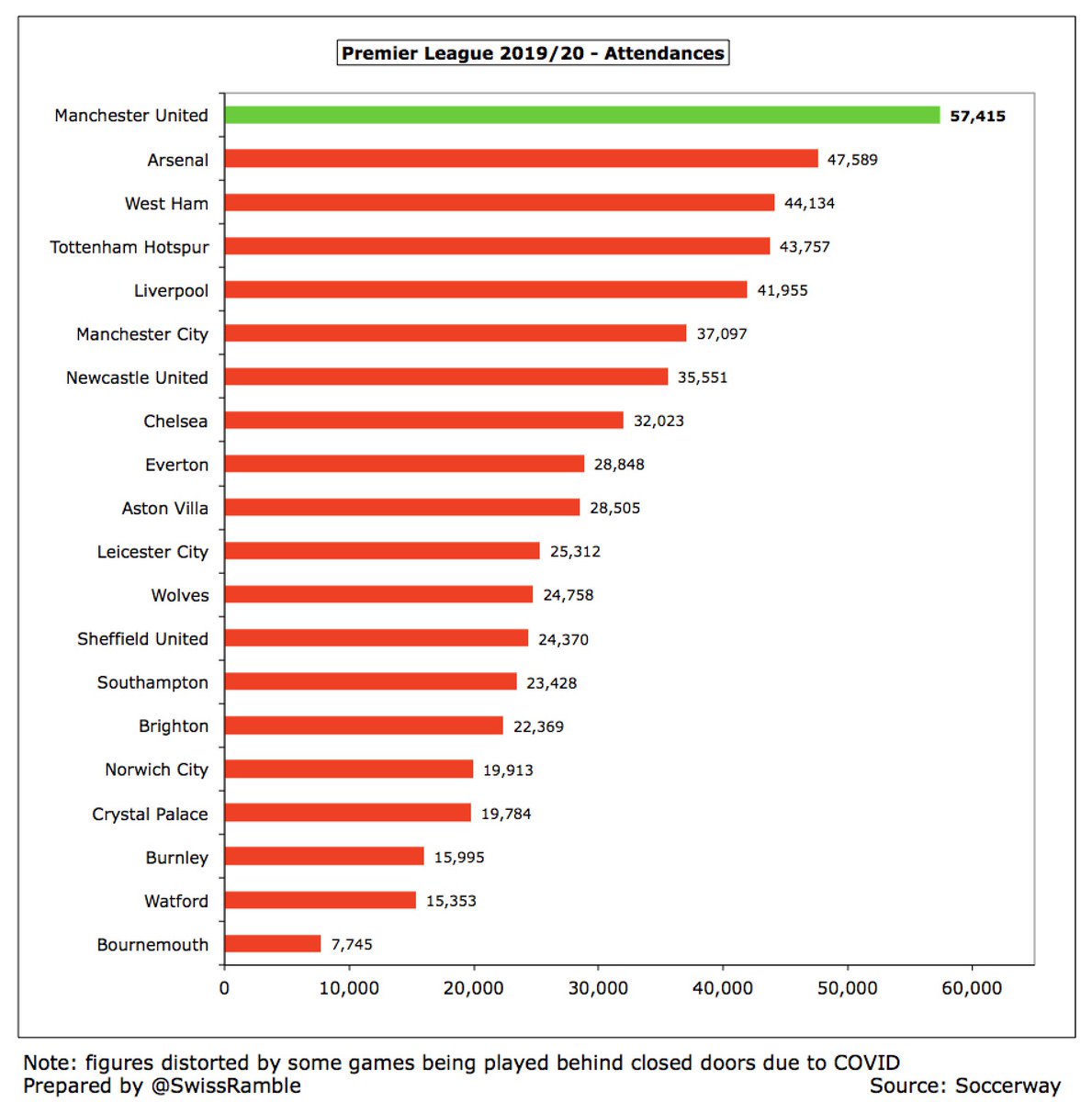

As some games were played without fans, #MUFC average attendance fell from 74,500 to 57,400, though it was once again the highest in the Premier League, around 10,000 more than #AFC. Season ticket prices have been frozen for nine consecutive years.

#MUFC wage bill fell £48m (15%) from £332m to £284m, mainly as a result of player sales, loan deals and lower bonuses from not playing in Champions League. This is United’s lowest since £264m in 2017.

#MUFC £332m wage bill in 2018/19 was highest ever reported in Premier League, but £284m in 2019/20 has fallen below #MCFC £315m, #LFC £310m and #CFC £286m (though picture may well be different with 2019/20 accounts). Last year United only behind Barcelona wages (£442m) in Europe.

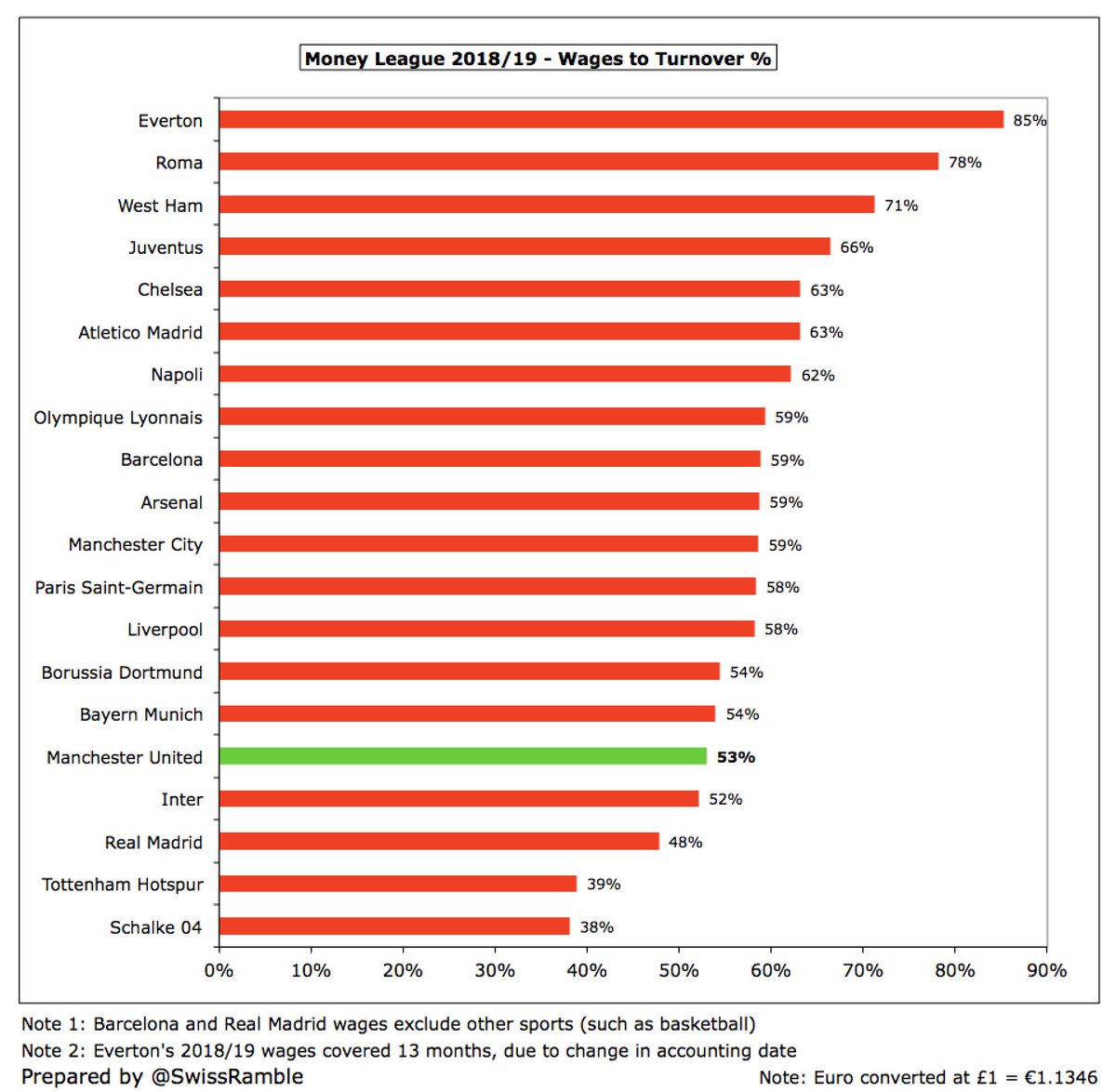

#MUFC wages to turnover ratio increased from 53% to 56%, the highest it has been for many years (it was only 45% 3 years ago). However, it is still one of the lowest in the Premier League. Last year it was also one of the best in Europe, about the same as Bayern Munich.

We will have to wait for another #MUFC company to publish its accounts before we know Ed Woodward’s 2019/20 salary, but United fans will be delighted to see that he trousered £3.2m in 2018/19, only below Daniel Levy’s £7m in the Premier League (including £3m new stadium bonus).

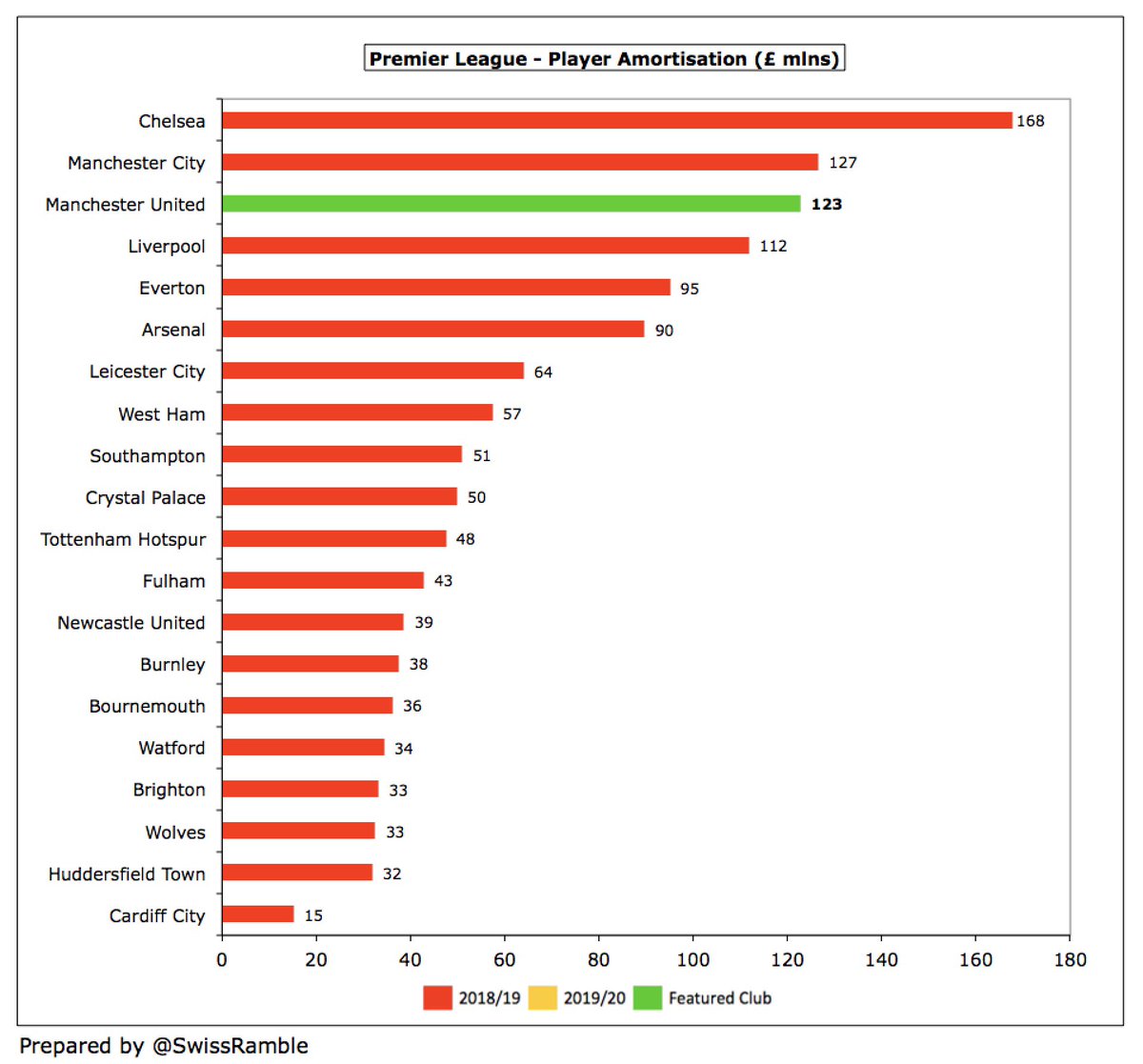

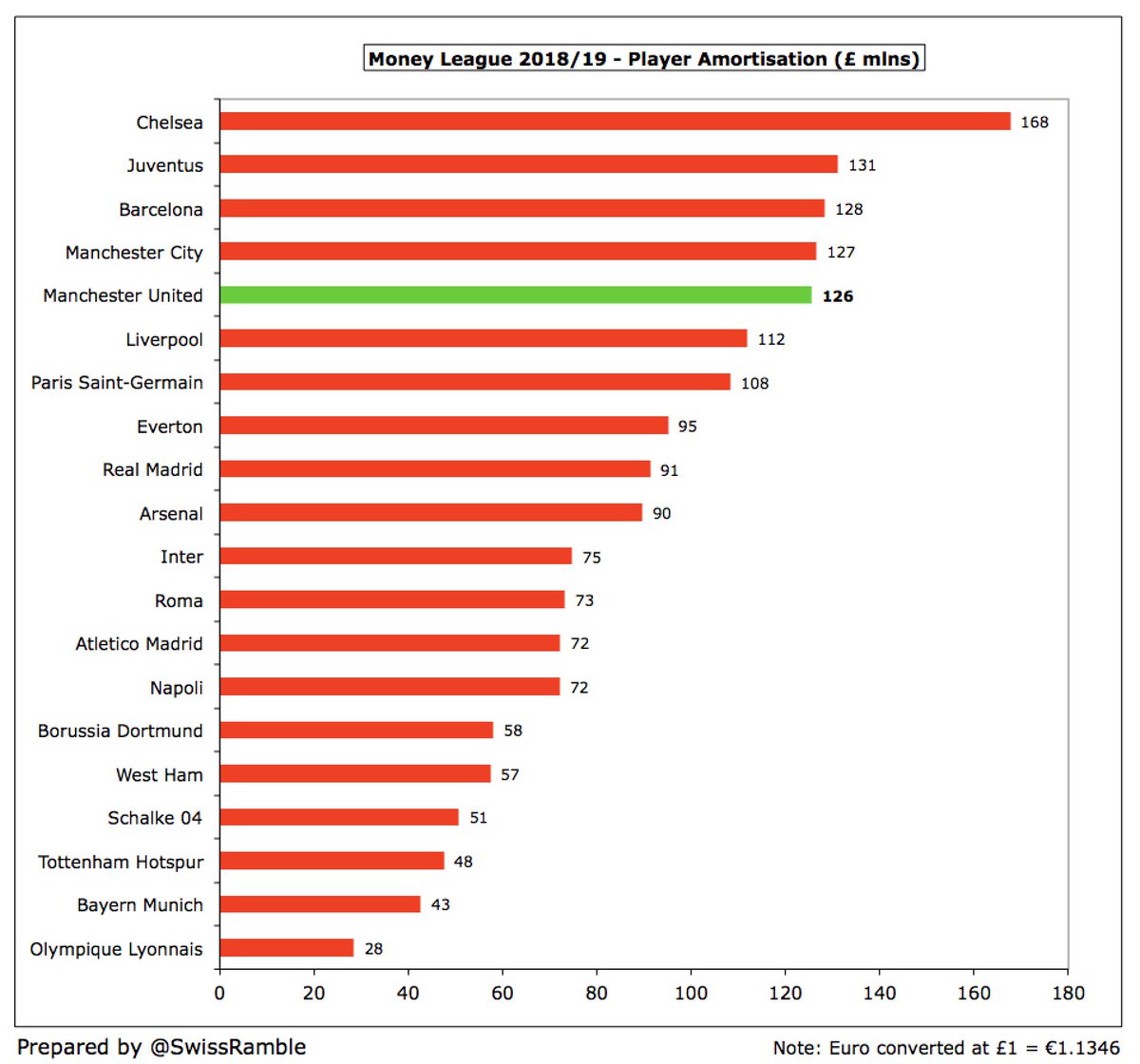

#MUFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, fell £3m (2%) from £126m to £123m, down £14m from the £137m peak two years ago.

As a result of this decrease, #MUFC player amortisation of £123m is now a fair way below #CFC £168m and just behind #MCFC £127m, followed by #LFC £112m, #EFC £95m and #AFC £90m. In Europe, United were also outpaced in 2018/19 by Juventus £131m and Barcelona £128m.

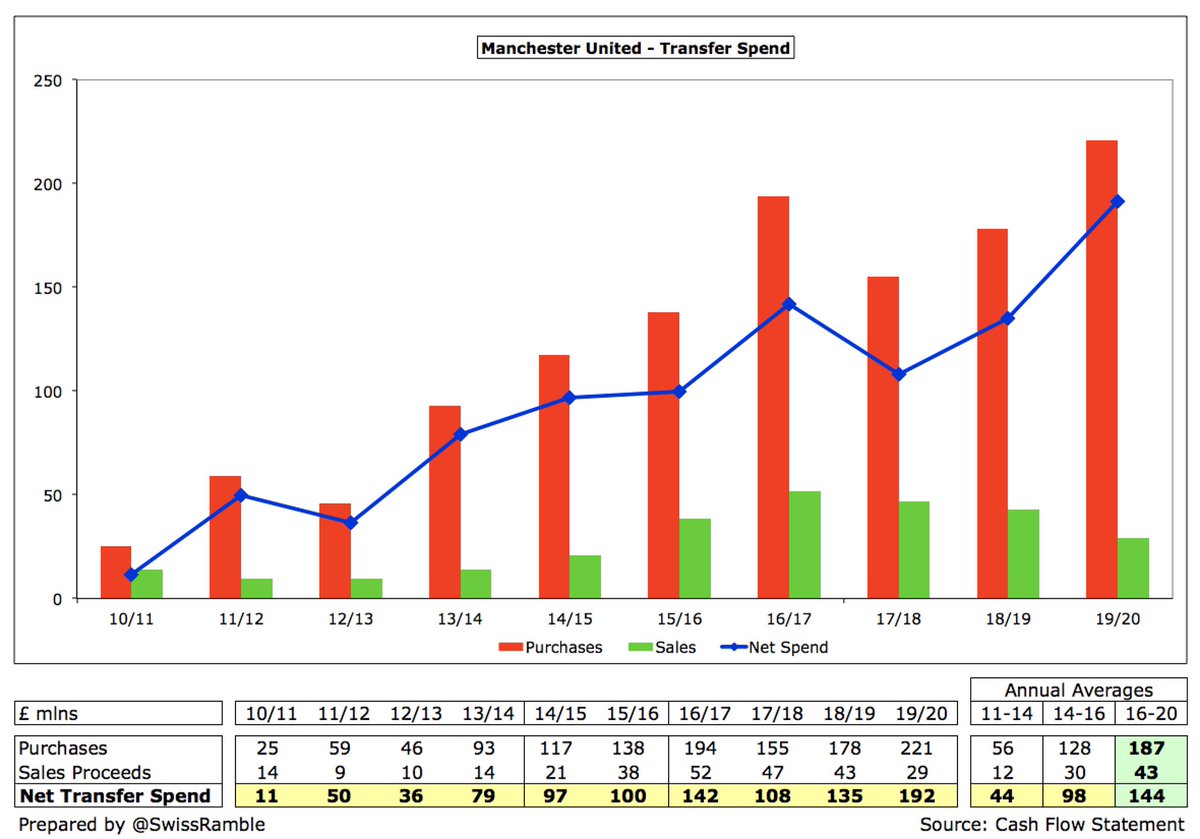

#MUFC player purchases in 2018/19 of £183m were £80m more than the prior season. However, still lower than #CFC £281m and #LFC £223m in 2018/19. That said, United have spent a hefty £735m on new players in the last 4 years, and £1.2 bln in the last 7 years.

In cash terms, #MUFC have averaged £144m net spend in last 4 years (purchases £187m, sales £43m), compared to £98m in preceding 2 years and £55m in 3 years before that. This included £221m player purchases in 2019/20, mainly Maguire, Fernandes, Wan-Bissaka and James.

#MUFC only spent around £75m this summer, mainly van de Beek, Diallo and Telles, with the club explaining that the transfer window was never going to be “business as usual”, as it should be cautious while impacted by COVID to maintain its financial strength.

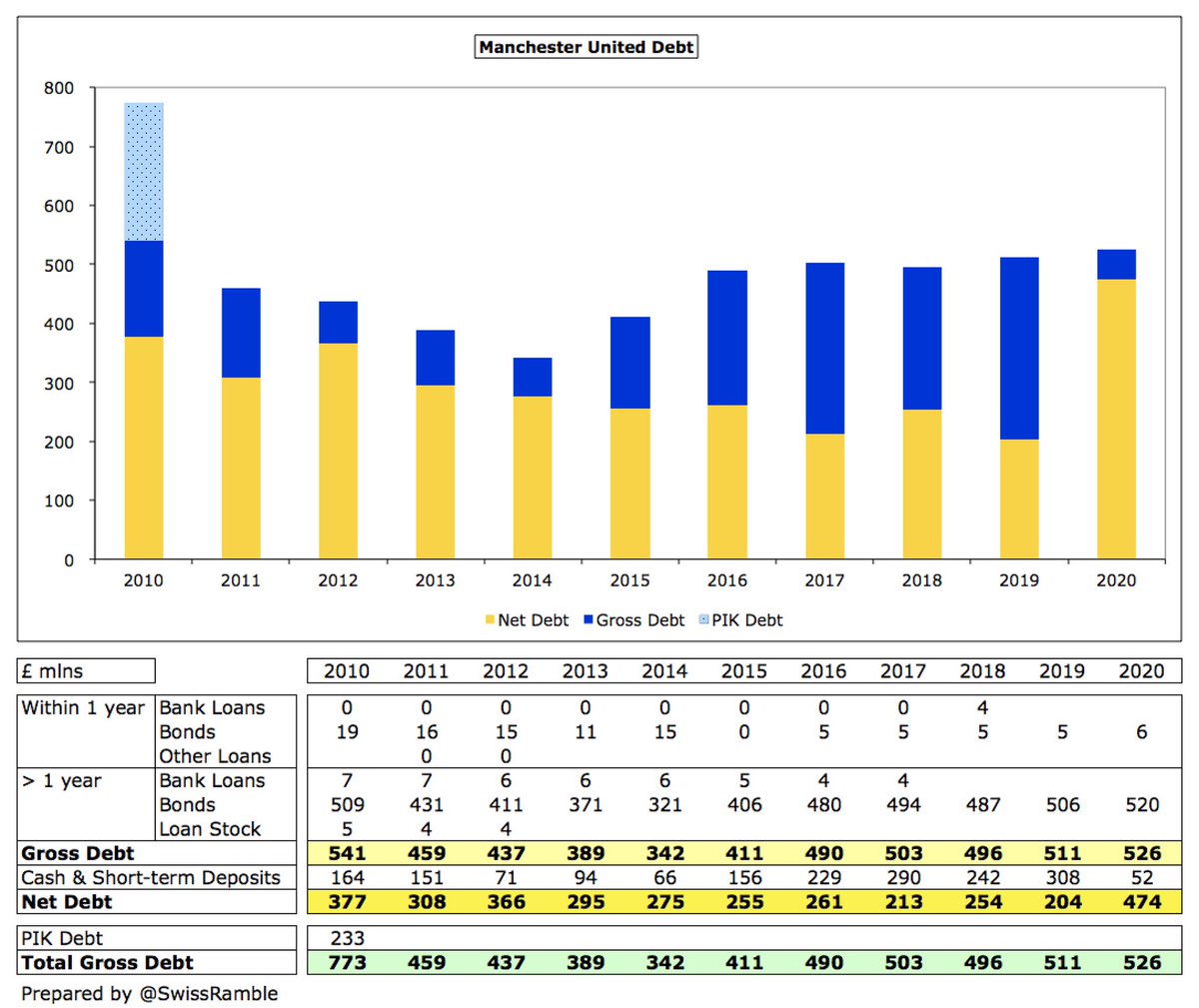

#MUFC net debt more than doubled from £204m to £474m, mainly due to £256m fall in cash from £308m to £52m (deferred sponsor payments £80m, 20/21 season ticket money £50m, player spend up £56m). Gross debt in GBP terms rose £15m from £511m to £526m, though USD debt was unchanged.

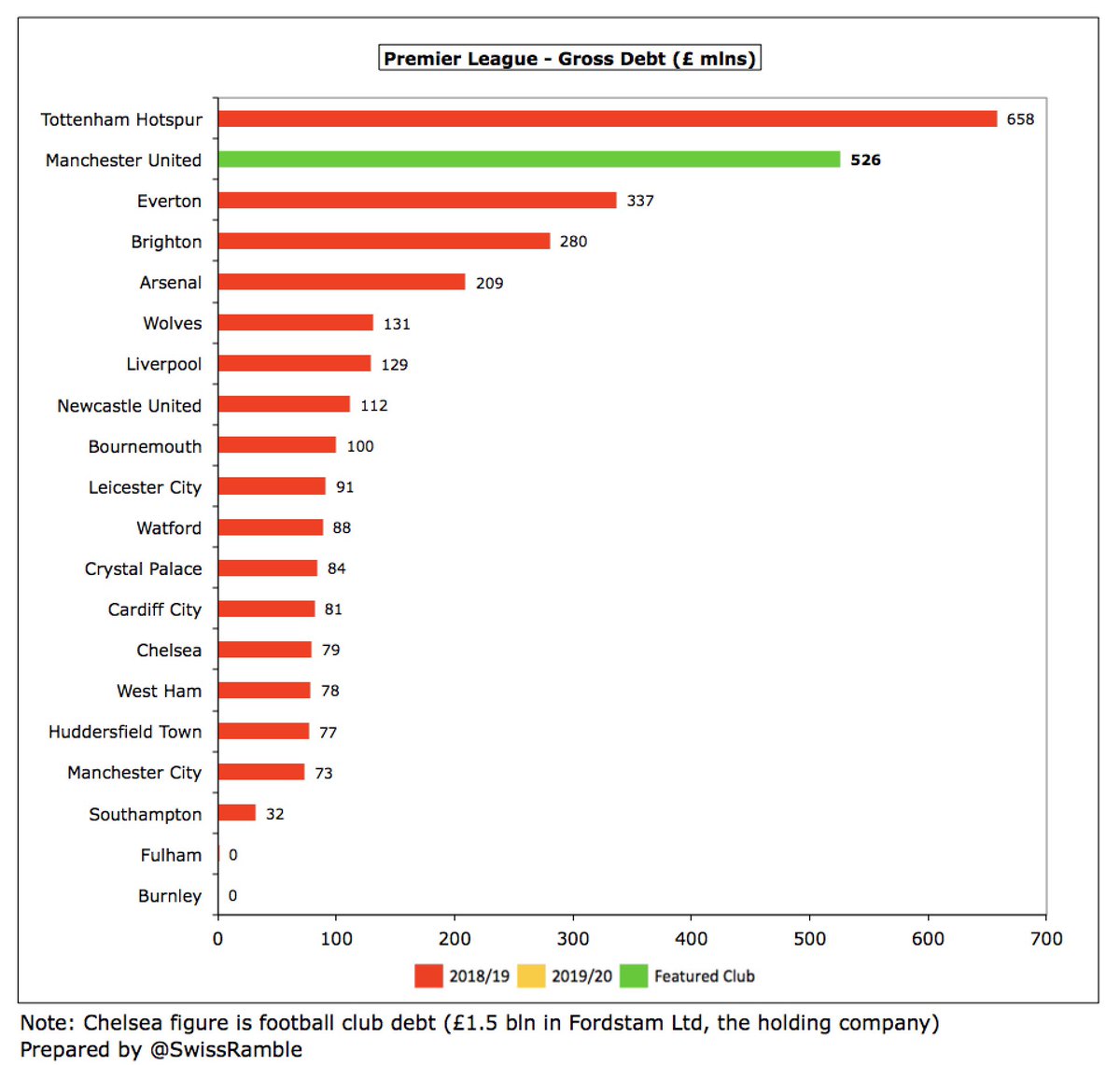

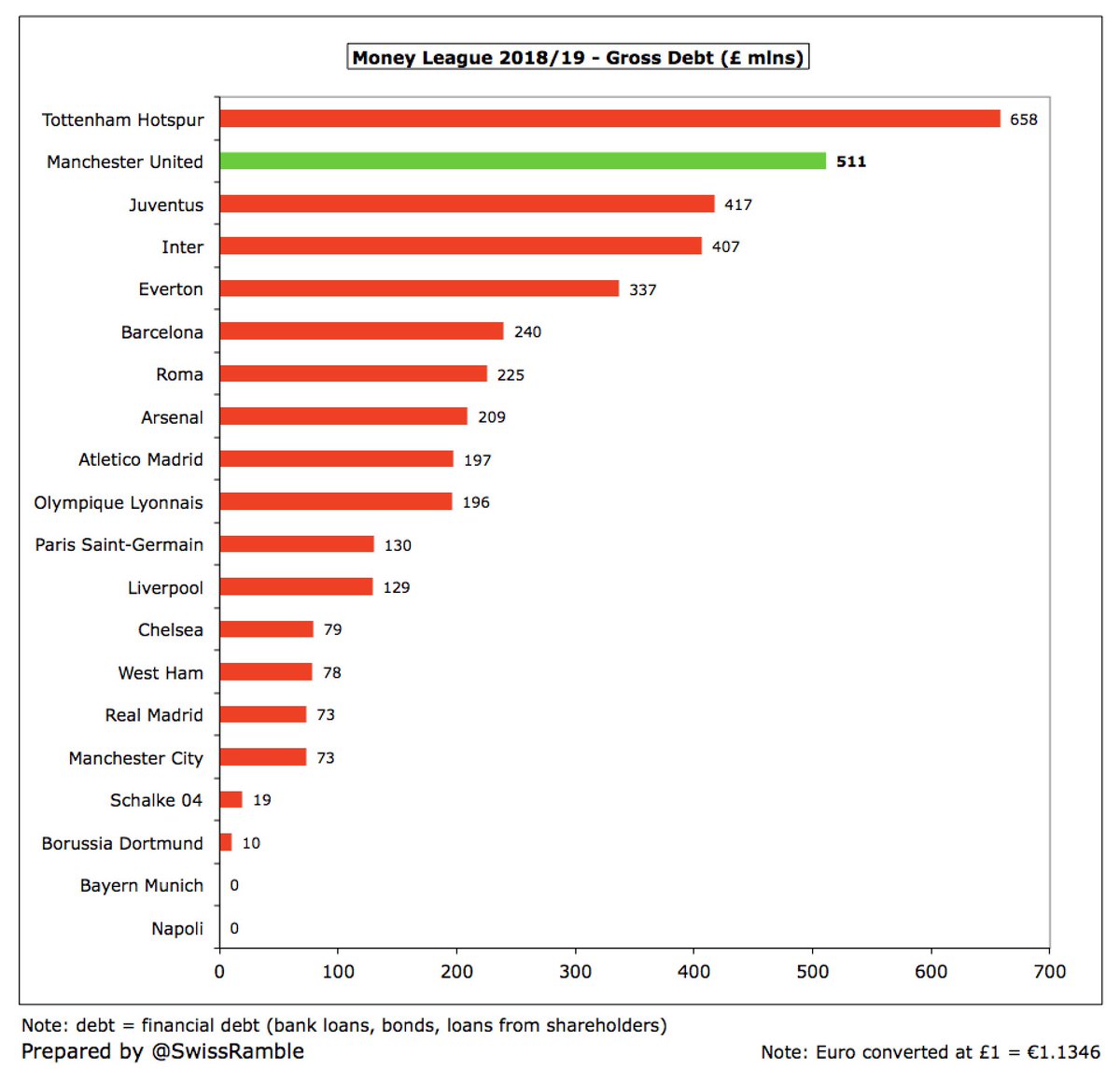

Even after all the Glazers’ refinancings, #MUFC still owe more than half a billion pounds, only behind #THFC £658m (new stadium). Note: #CFC have £1.5 bln debt in their holding company. United also 2nd highest debt in Europe, above Juventus £417m, Inter £407m and Barcelona £240m.

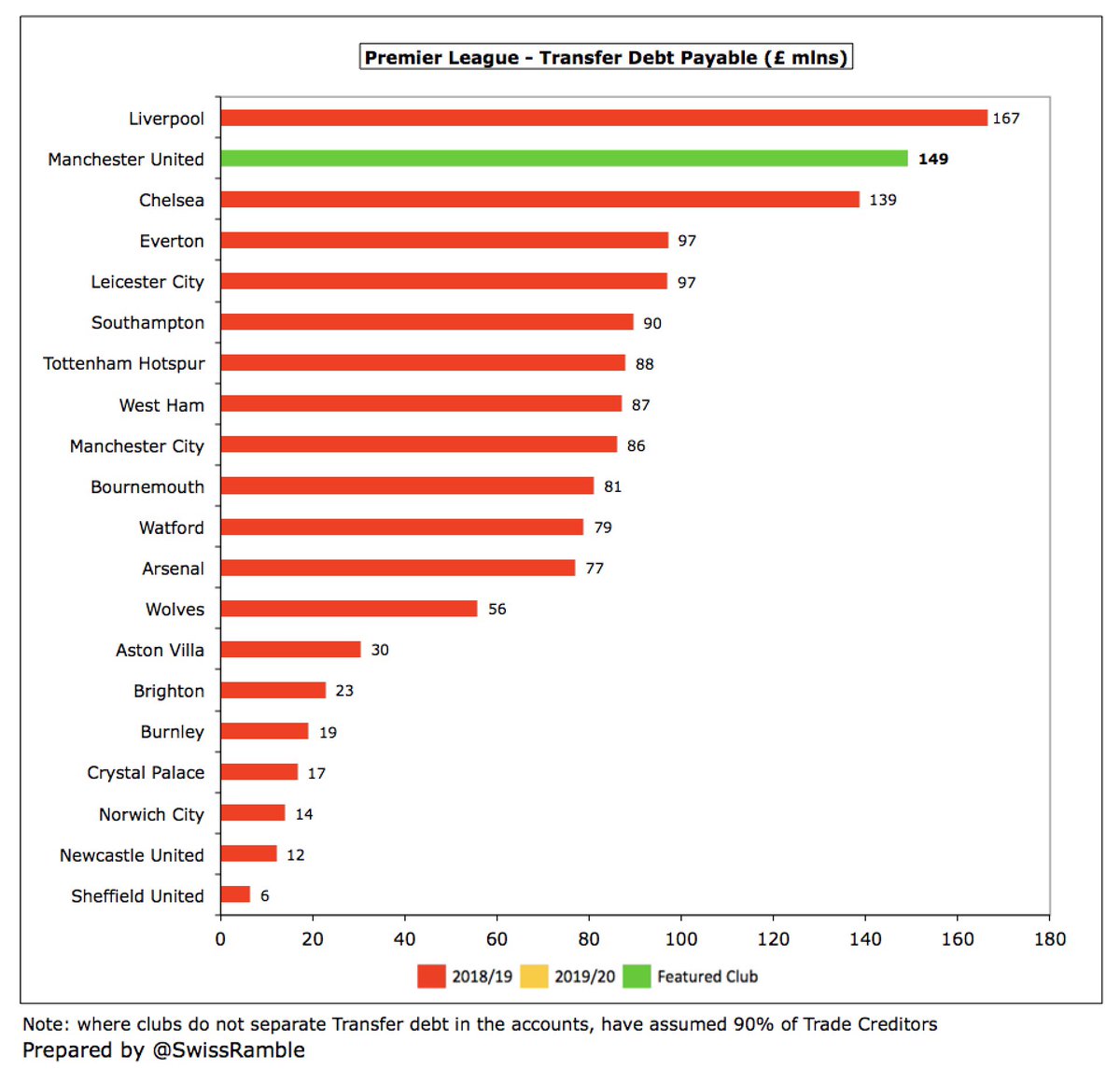

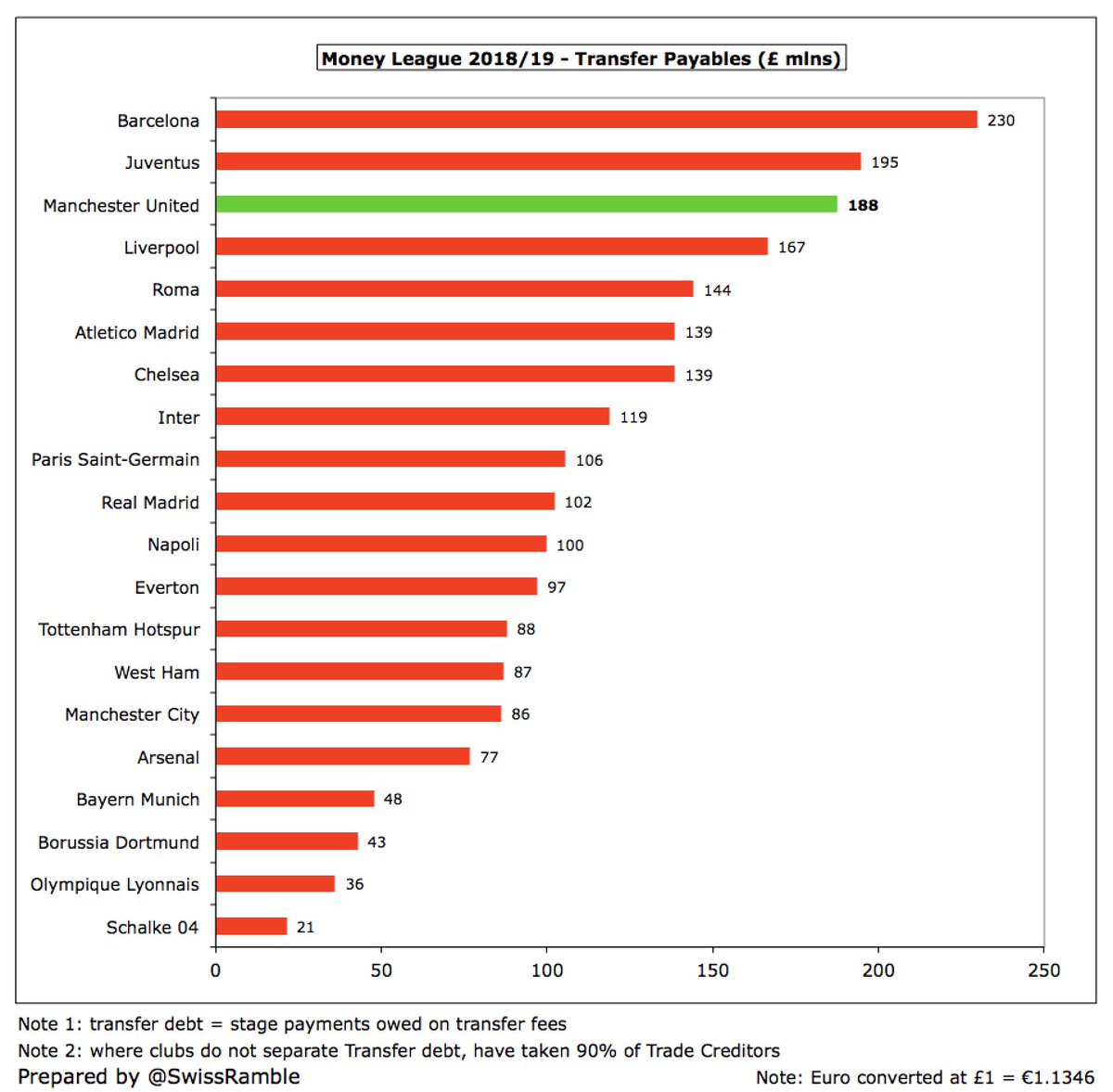

#MUFC transfer payables fell from £188m to £149m, having been as high as £258m two years ago, as stage payments on transfer fees were paid. Transfer receivables up from £18m to £58m, so net transfer debt was down from £169m to £91m.

#MUFC £149m transfer debt is second highest in the Premier League, just behind #LFC £167m. In 2018/19 their £188m was the third highest in Europe, only behind Barcelona £230m and Juventus £195m.

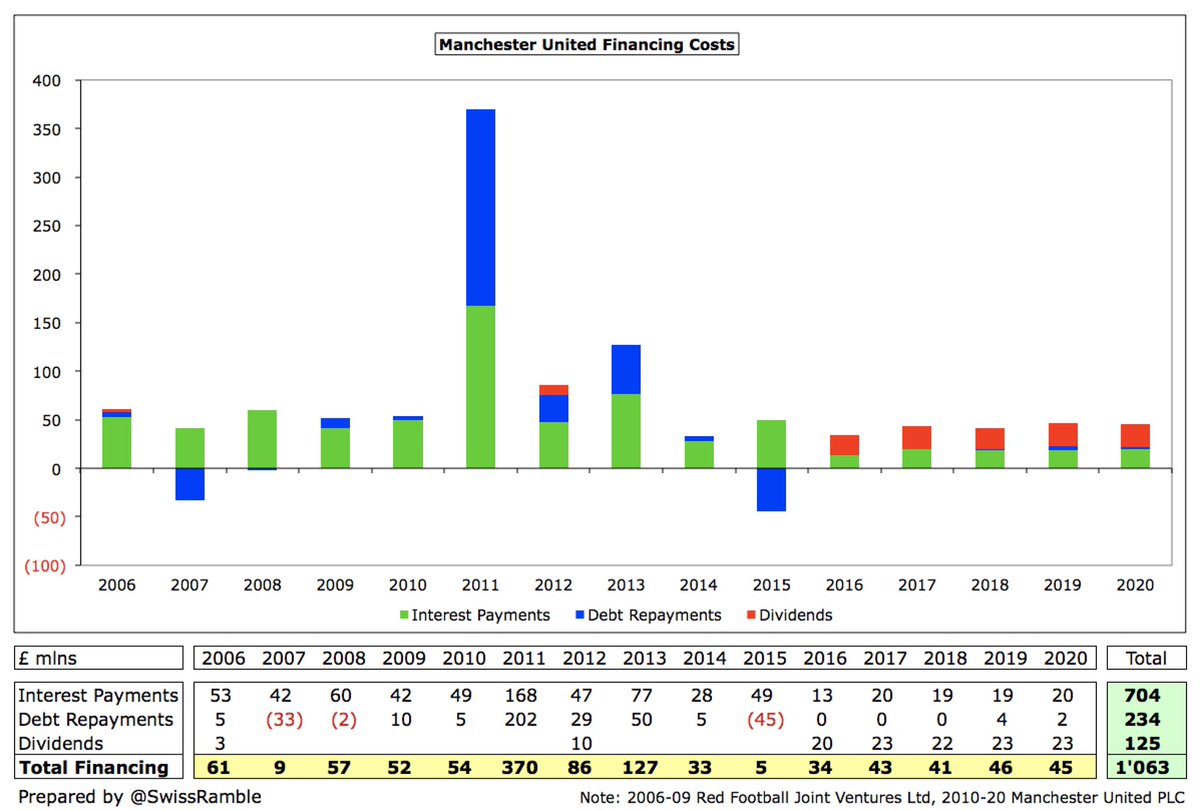

Although it has fallen from its peak, #MUFC annual interest payment of £20m is a lot more than every other Premier League club, except #THFC where stadium debt has recently increased their interest to £26m. More relevantly, #MCFC and #LFC only pay £4m and £2m respectively.

#MUFC only generated £18m cash from operations, compared to average £200m in last 5 years. Spent net £192m on players (purchases £221m, sales £29m), £21m infrastructure, £23m dividends, £19m interest & £21m on shares. All that resulted in a £263m net cash outflow.

As a result, #MUFC cash balance slumped by £256m (including £7m forex gain) from £308m to £52m. This is below 2018/19 cash at #AFC £167m, #MCFC £130m and #THFC £123m, though you would expect these to be much lower in COVID-impacted 2019/20 accounts.

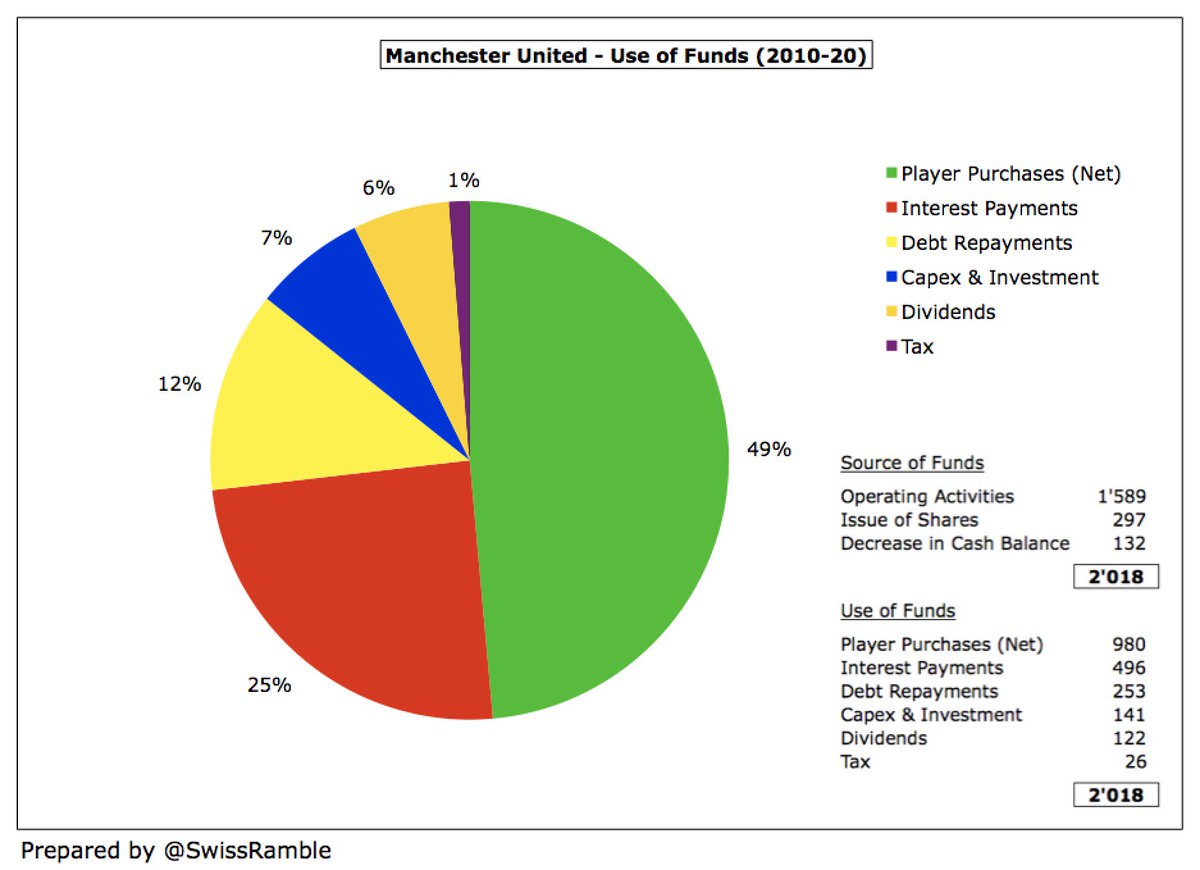

Since 2010 #MUFC have generated nearly £2 bln of cash (£1.6 bln operating activities plus £300m from shares) plus £130m from cash balance. Around £1 bln has been spent on players, but almost the same has gone on financing. Another £141m on infrastructure and £26m on tax.

#MUFC would have had even more money to spend if they did not have to bear the cost of the Glazers’ leveraged buy-out. In fact, since the takeover they have spent over £1 bln on financing: £704m interest, £234m debt repayments and £125m dividends. Averaged £42m in last 5 years.

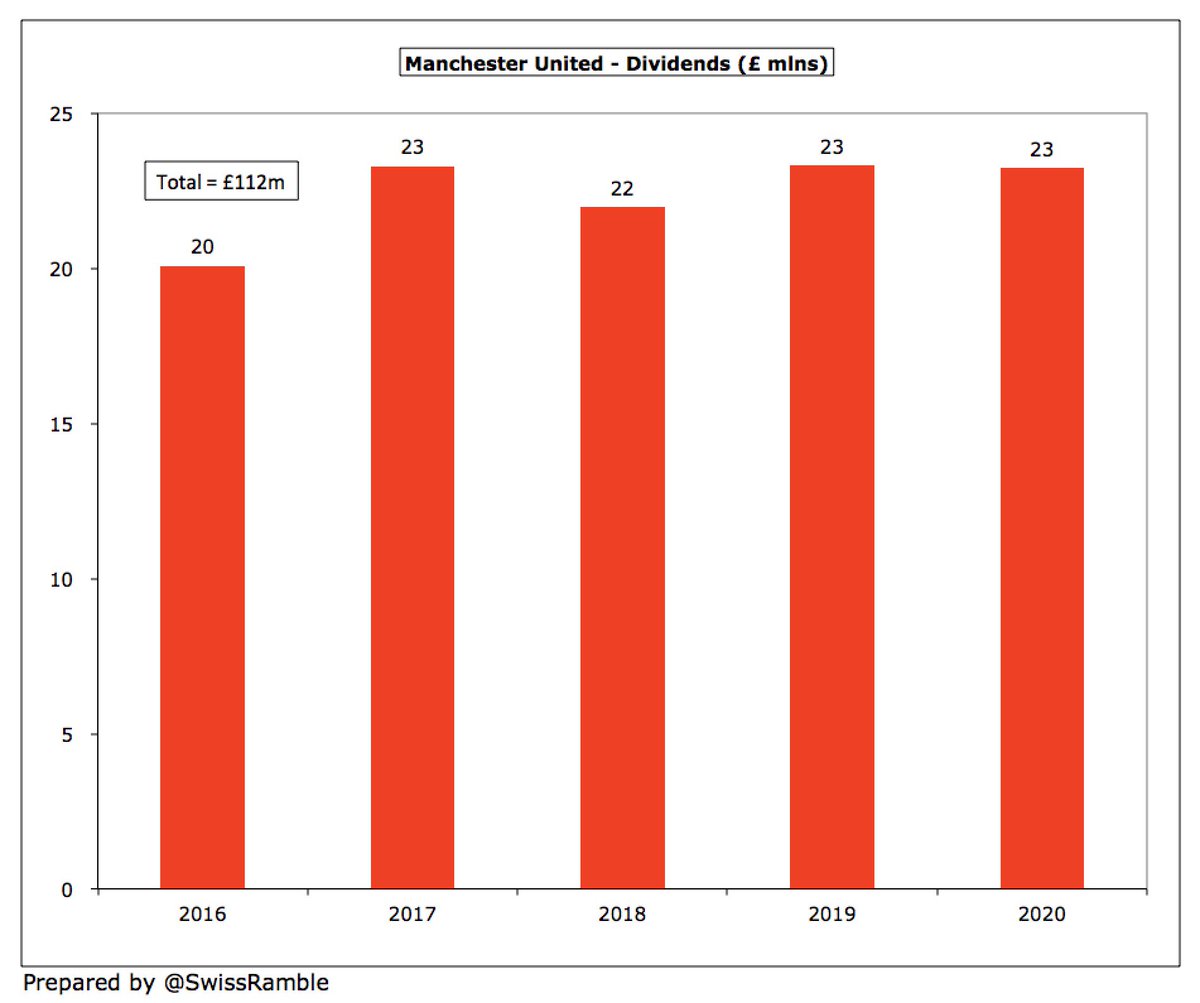

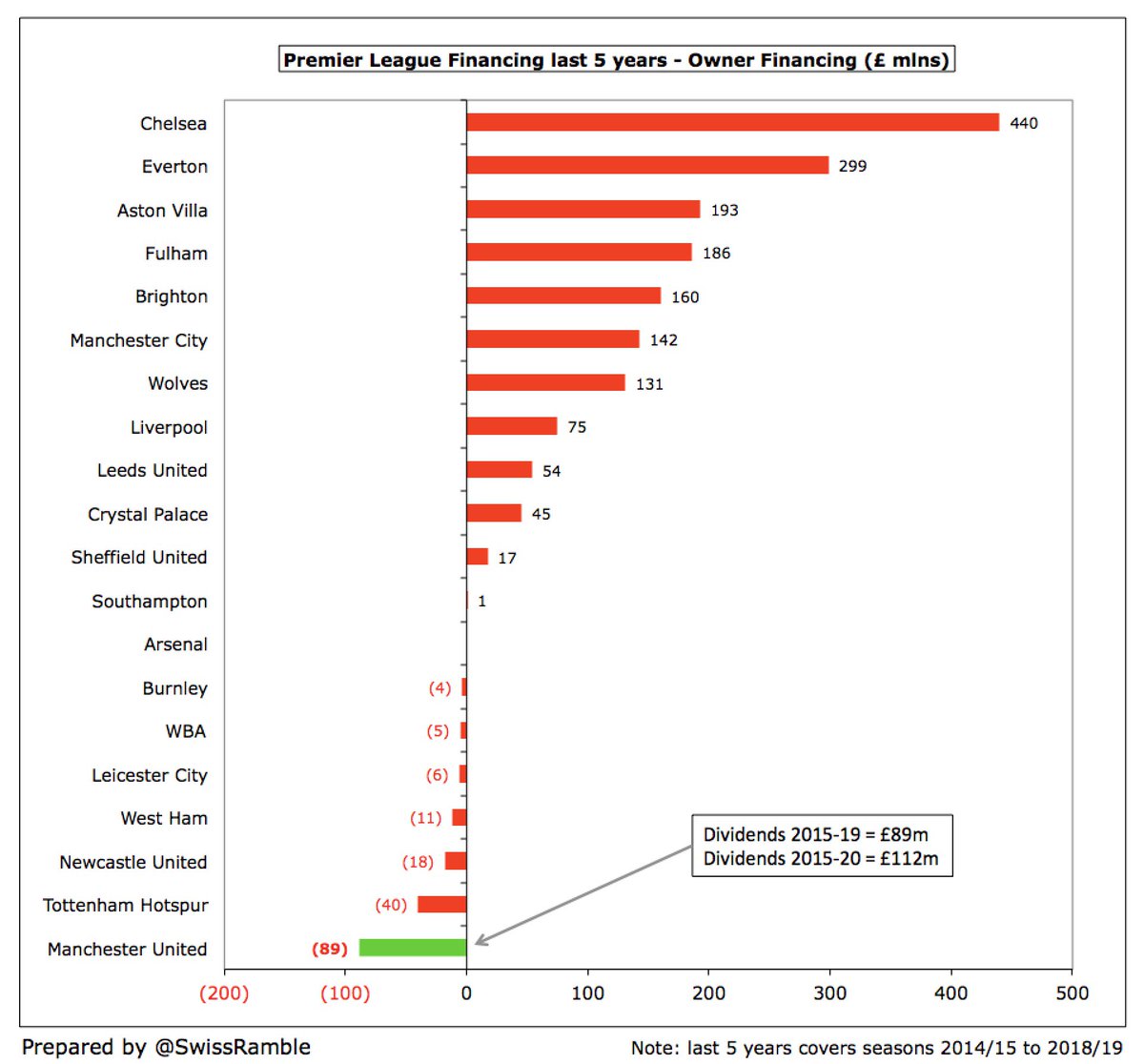

Despite the financial challenges, #MUFC have still found enough cash to pay their shareholders (mainly the Glazers) a full dividend of £23m. United were the only Premier League club to pay a dividend in 2018/19 and have paid £112m in the last 5 years.

Seven Premier League clubs benefited from more than £100m funding from their owners in the 5 years up to 2019 with #CFC leading the way with £440m, followed by #EFC £299m and #AVFC £193m. On the other hand, #MUFC paid £89m dividends to their owners.

Ed Woodward warned, “We expect the (COVID) impact to remain visible for quiet some time to come”, though #MUFC do have access to an additional £150m revolving credit facility, which provides flexibility to support the club through the disruption.

Woodward concluded, “We remain committed to our objective of winning trophies, playing entertaining, attacking football with a blend of Academy graduates and high-quality recruits, while carefully managing our resources to protect the long-term resilience of the Club.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh