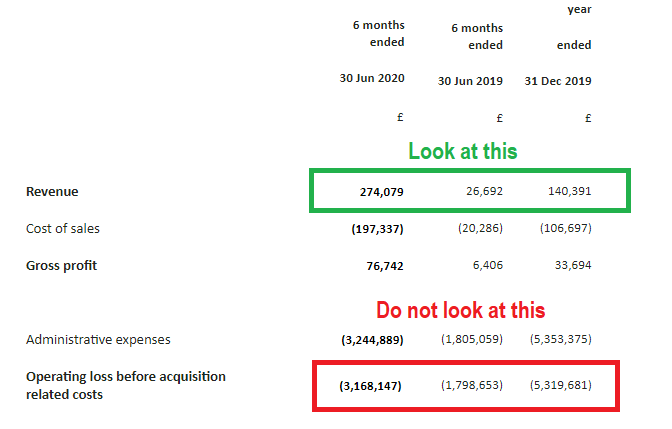

Anglo Pacific #APF is a commodity royalty company, dividend is about 7% but it doesn't look too sustainable or real.

Ultimately royalty companies are easy: receive dividends, buy more royalties and pay cash to shareholders. All works out until 2014-15 and since then, not so much

Ultimately royalty companies are easy: receive dividends, buy more royalties and pay cash to shareholders. All works out until 2014-15 and since then, not so much

The way the whole thing has been sustained since, has been by debt and printing shares. This isn't to say this won't work without a turn in commodities - it will, although there's debt here that wasn't before - otherwise the divi gets cut or shareholders will print it themselves.

• • •

Missing some Tweet in this thread? You can try to

force a refresh