TLDR: headlines like the below may be masking something interesting at ReNeuron - a medical platform business

As #MXCT and $CLPT show, these sell high

Direct NASDAQ comp valued 5x higher

#RENE platform has an imminent catalyst, which may be derisked.

proactiveinvestors.co.uk/companies/news…

As #MXCT and $CLPT show, these sell high

Direct NASDAQ comp valued 5x higher

#RENE platform has an imminent catalyst, which may be derisked.

proactiveinvestors.co.uk/companies/news…

Disclaimers as follows:

- I am far, far out of my lane looking at this

- The comp lives in a bubble market

- This is 100% based on crude pattern recognition

- Market appears to value #RENE for other aspects, so

- This may not work even if the idea proves correct

- I am far, far out of my lane looking at this

- The comp lives in a bubble market

- This is 100% based on crude pattern recognition

- Market appears to value #RENE for other aspects, so

- This may not work even if the idea proves correct

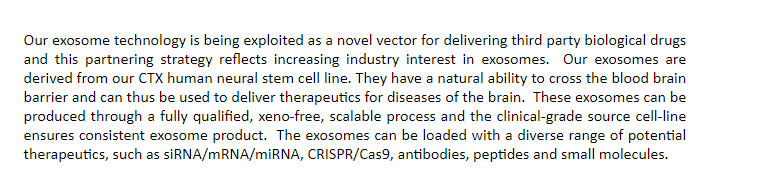

So, #RENE may have what may be one of the Next Big Things: a platform for the cutting edge of genetic medicine - the comp lives off that alone.

In English, they use "exosomes" to try to get mRNA and CRISPR molecules past the blood-brain barrier into the brain. See below

In English, they use "exosomes" to try to get mRNA and CRISPR molecules past the blood-brain barrier into the brain. See below

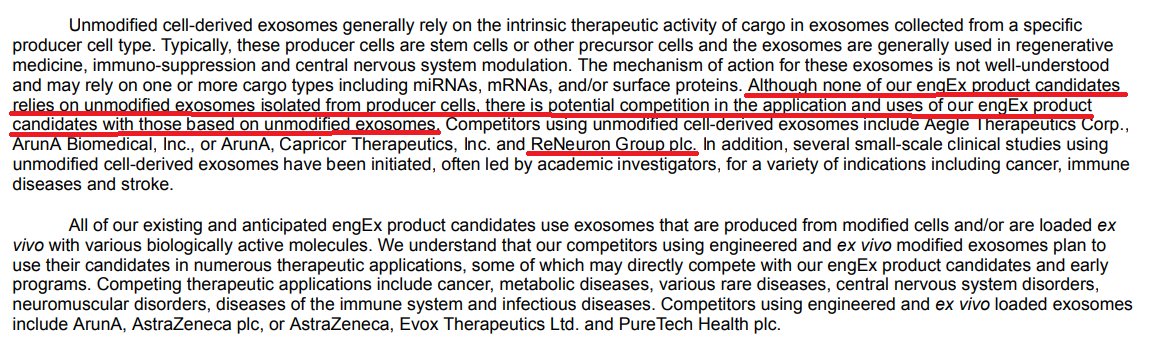

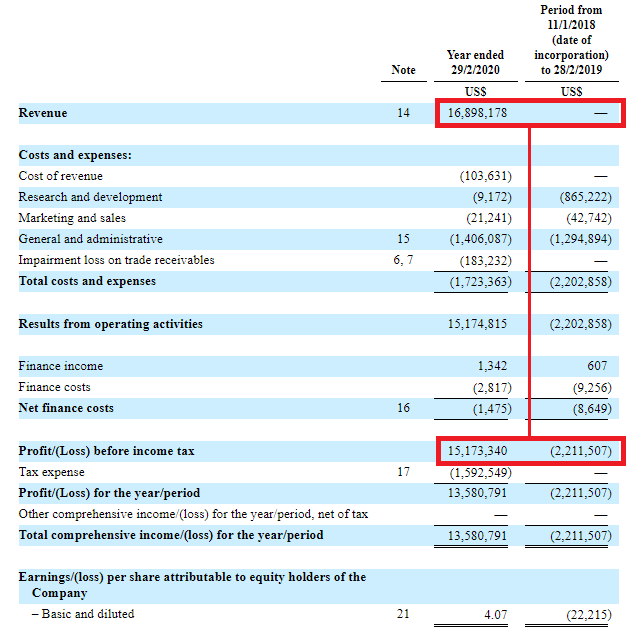

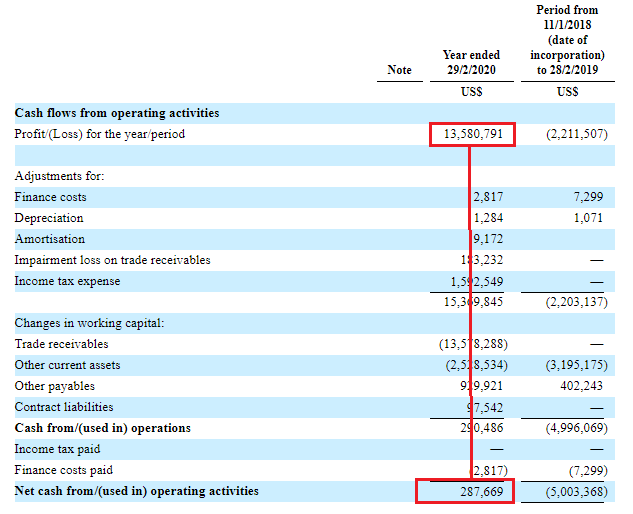

A second, more immediate reason: Codiak BioSciences $CDAK

Their only business line is a platform for using exosomes in medicine.

IPO October 20, doubled in the following months and is now more or less around a $500M cap. Ex-cash on both it's about 5x higher, #RENE is a £60M cap

Their only business line is a platform for using exosomes in medicine.

IPO October 20, doubled in the following months and is now more or less around a $500M cap. Ex-cash on both it's about 5x higher, #RENE is a £60M cap

Right.. as with the first tweet, this is *not* about molecules and pipelines - at the mention of phases or dosings, I'm out. I don't have the knowledge or the urge for biotech.

But we need to look into the weeds a little; the whole idea is more subtle.

But we need to look into the weeds a little; the whole idea is more subtle.

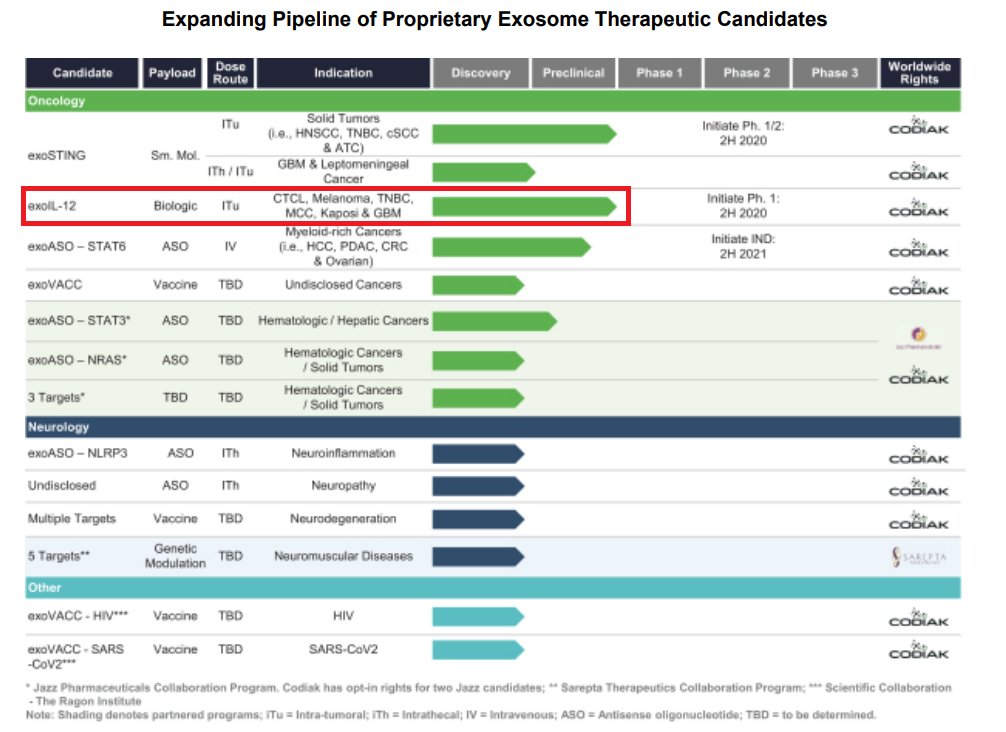

Here's CDAK's pipeline.

What CDAK are currently doing is trying to prove the exosome method works, it's called "proof of concept" - note how nearly everything is in the "discovery" stage.

What CDAK are currently doing is trying to prove the exosome method works, it's called "proof of concept" - note how nearly everything is in the "discovery" stage.

What does that mean? It means you don't know if you're even barking up the right tree (at a $500M cap..) and you need to test this approach in petri dishes or animals before you even get to Phase I - injecting something into humans.

But.. a couple *have* passed discovery

But.. a couple *have* passed discovery

And they've shot the lights out.

Is this a big deal? No, it simply shows promise, enough to go forward.

Now let's look at ReNeuron in this light

Is this a big deal? No, it simply shows promise, enough to go forward.

Now let's look at ReNeuron in this light

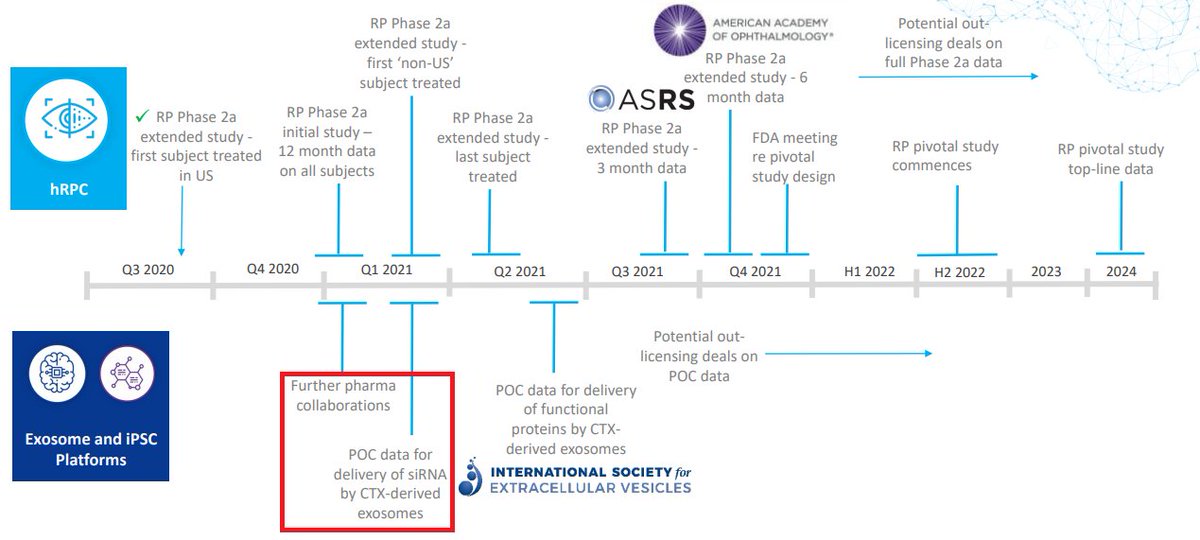

Here is #RENE's published timeline, I'm looking at the bottom half: their timeline for exosome trials.

They're going to report in Q1/21 the results of trials with "3 major pharmas". As with Codiak, it's pure proof of concept. My unqualified idea is that $CDAK just derisked it

They're going to report in Q1/21 the results of trials with "3 major pharmas". As with Codiak, it's pure proof of concept. My unqualified idea is that $CDAK just derisked it

Now here's the heart of the matter: Rene's POC trials are on animals and this isn't nice - but going by CDAK, on the surface, it looks promising. If this works out then Rene will licence this exosome method out to big pharma.

Are big pharma interested?

Are big pharma interested?

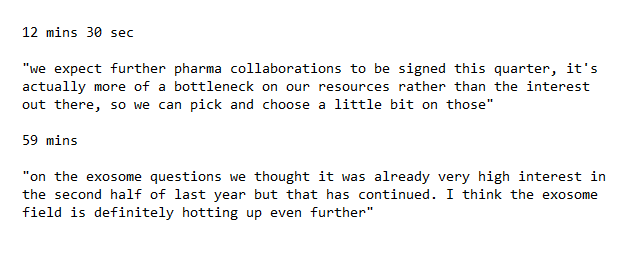

Big pharma are interested big time. You saw the graph with medical lit mentions of this idea already - here are a couple of my notes from a #RENE call last week - pharma is lining up to get into this.

Now, here's an interesting wrinkle which I'm definitely not qualified to judge.

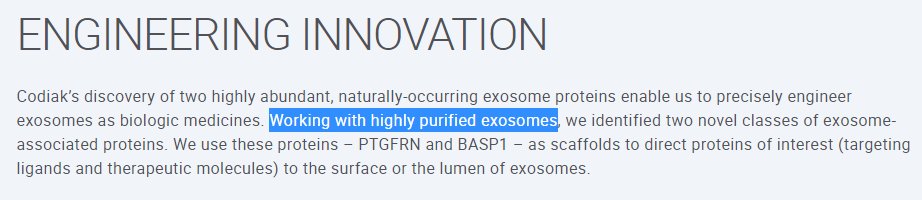

There are two types of exosomes: purified and synthetic.

Codiak do purified.

There are two types of exosomes: purified and synthetic.

Codiak do purified.

The medical literature *appears* to talk about synthetic as preferable when it comes to the holy grail of medical spending: oncology.

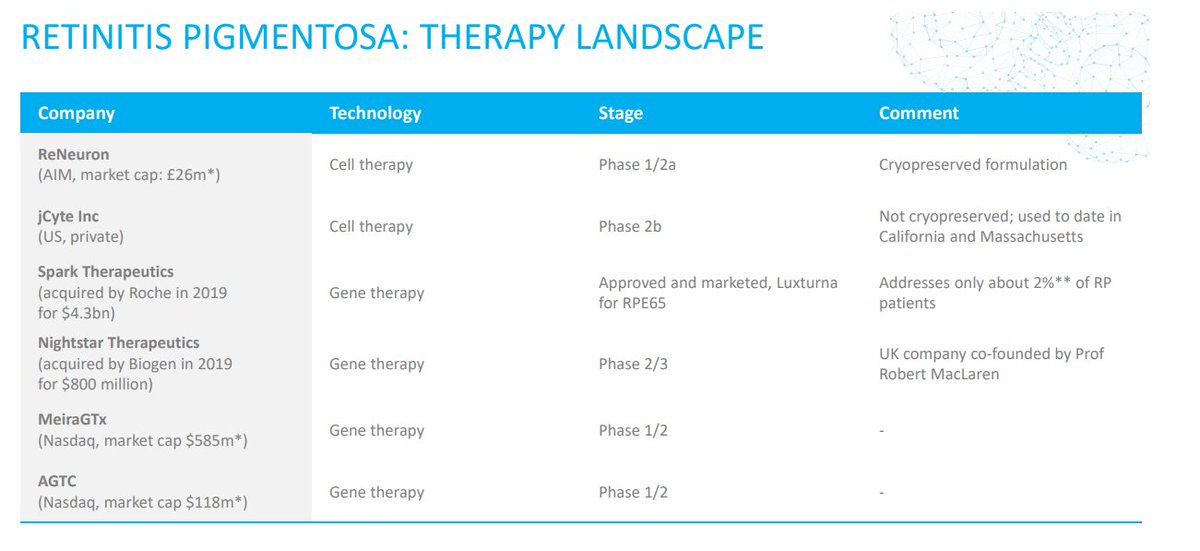

That's more or less my whole idea. However there's another part to the company (actually two more but let's just do the second quickly) - that Phase II dosing stuff from the very start.

It's not just another molecule: it's stem cells to cure a form of blindness.

It's not just another molecule: it's stem cells to cure a form of blindness.

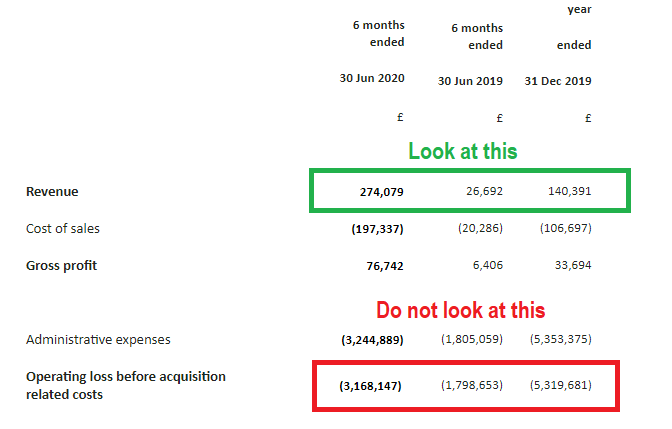

Honestly, if it wasn't already tenuous enough.. I'm not even going to deal with this. I'll just say this: my sense from questions on the call is that 99% of the attention is focused on the stem cell trial side of things. My guess is that this is what supports the valuation here.

The condition is Retinitis Pigmentosa, ReNeuron are using stem cells and from my uninformed position SCs are meant to be miracle cures. They are very enthusiastic with the progress so far - this stuff really re-grows retinal cells

M&A in that space, from RENE. Somewhat > £60M

M&A in that space, from RENE. Somewhat > £60M

Lastly, this: Nightstar was acquired by Biogen for $800M for their RP treatment. The lead in Nightstar was Prof. Robert MacLaren - he is scientific advisor at ReNeuron.

aop.org.uk/ot/science-and…

aop.org.uk/ot/science-and…

Funded until end 2021, Phase 3 for the RP is cheaper than most - apparently you don't have a placebo arm when doing retinal injections, so this makes things cheaper. They'll need to raise after the phase II to do this but at ~£15M, it's small beer by the standards of these things

I'm not here on account of stem cells for blindness, cool as that is - I'm here for the platform idea: it's about to read out, it looks to me there are grounds to expect it may work and my guess is that RENE might just look to re-rate towards other platforms, like #MXCT or $CDAK

• • •

Missing some Tweet in this thread? You can try to

force a refresh