Tiny, UK AIM co in specialty chemicals: specifically "sustainable polymers"

At best this usually means 1 client and a test batch; at worst, magic beans

But Itaconix #ITX is neither and it's rather mispriced: it sells at margins that rival the best in the world - and in size

At best this usually means 1 client and a test batch; at worst, magic beans

But Itaconix #ITX is neither and it's rather mispriced: it sells at margins that rival the best in the world - and in size

It may actually be very mispriced; estimates are clearly too low. All in part because it's off the radar.

It's another find by @dopamine_uptake who pointed it out to me after reading on IP Group - some holdings of theirs caught his eye and of them, this one really caught mine.

It's another find by @dopamine_uptake who pointed it out to me after reading on IP Group - some holdings of theirs caught his eye and of them, this one really caught mine.

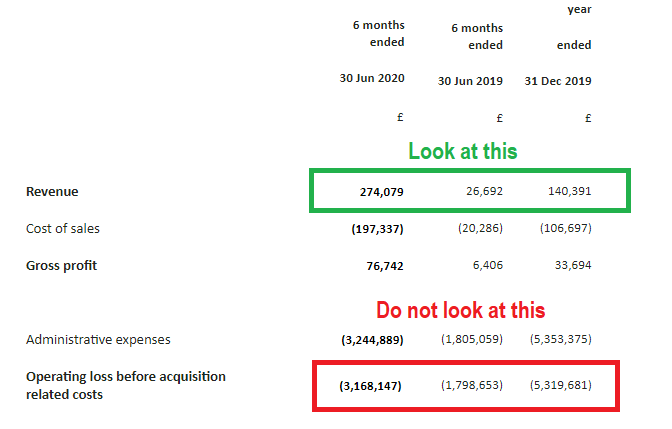

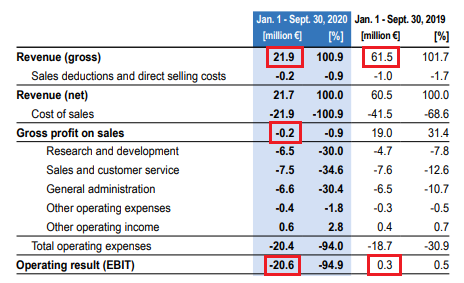

I'll get straight to it. HY20 end October.

We see revenues up +80% on the previous year's half and they're not far off equaling the whole of 2019's revenues.

Gross margin: 37% - this rings a loud bell

Loss making.

We see revenues up +80% on the previous year's half and they're not far off equaling the whole of 2019's revenues.

Gross margin: 37% - this rings a loud bell

Loss making.

It rings a bell because 37% the exact same gross margin as one of the best specialty chemical companies in the world: Croda

I have long wanted to buy it but have never been able to make the valuation work.

37% margins and their big problem is that they don't grow

I have long wanted to buy it but have never been able to make the valuation work.

37% margins and their big problem is that they don't grow

As a quick and dirty first pass when I saw this: growing chemical co, what's it worth to a Croda if they buy it, fire everyone and buy it for that 37% gross margin?

Like I never made Croda's valuation work, I didn't here either. I was off by miles - but in the good direction.

Like I never made Croda's valuation work, I didn't here either. I was off by miles - but in the good direction.

2 mins 50 secs in. Paraphrasing the CEO:

H1 was mainly a pick up in the last 4 months accelerating into the end. It's continuing into H2 and H2 > H1

H1 was mainly a pick up in the last 4 months accelerating into the end. It's continuing into H2 and H2 > H1

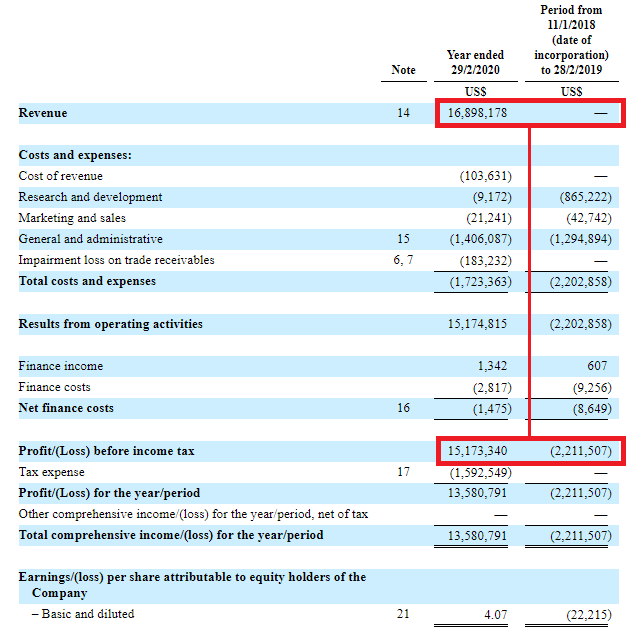

Here's the estimate.

FY $2.14M minus H1 $1.08M = H2 $1.06M

After H1 rose 59% sequentially and 80% over the previous year - and after what the CEO said we get a drop of -3%

Beyond unlikely. I'll come back later to this and what more realistic numbers mean for the company.

FY $2.14M minus H1 $1.08M = H2 $1.06M

After H1 rose 59% sequentially and 80% over the previous year - and after what the CEO said we get a drop of -3%

Beyond unlikely. I'll come back later to this and what more realistic numbers mean for the company.

Single-tweet chemistry lesson

Sustainable: not derived from petroleum. In the case of ITX, it's usually Itaconic Acid from corn and a fungus. Degrades, non-phosphate, improved characteristics. Replaces pet-chem Acrylic Acid

Polymers: for detergent & personal care products

Sustainable: not derived from petroleum. In the case of ITX, it's usually Itaconic Acid from corn and a fungus. Degrades, non-phosphate, improved characteristics. Replaces pet-chem Acrylic Acid

Polymers: for detergent & personal care products

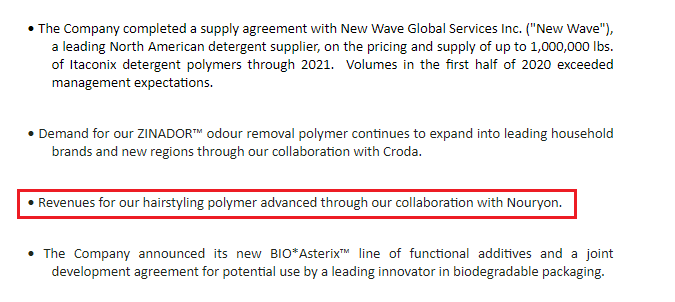

When we read down the report we see a couple of names - and the one that's immediately recognisable is Croda

Giant in the field, best of breed etc. It's a good start

Giant in the field, best of breed etc. It's a good start

New Wave Global Services.. not so much. Detergent supplier reporting volumes "exceeding management expectations" and there's something about detergent polymer into 2 North American dishwashing brands

(Note: UK based company, US management, end markets mainly US)

(Note: UK based company, US management, end markets mainly US)

Because it's chemicals, you get ingredients. Every substance has a unique identifier - called a CAS number. You find a number and you can chase it around to your heart's content all day long.

en.wikipedia.org/wiki/CAS_Regis…

en.wikipedia.org/wiki/CAS_Regis…

That number is one of ITX's - Clorox are one of the brands exceeding management's volume expectations. We have another high-quality giant.

You see what I mean. These guys aren't selling dreams and rocking-horse shit; they're not selling table salt either - they're making a 37% gross margin off specialised chemicals into some of the biggest companies in the world.

Why all the success?

There is a secular shift towards chemical ingredients that are more sustainable and natural. Jessica washes the baby in it, probably does the dishes with it and even your bleach is going to get it. ITX is right place, right time.

bbc.co.uk/news/business-…

There is a secular shift towards chemical ingredients that are more sustainable and natural. Jessica washes the baby in it, probably does the dishes with it and even your bleach is going to get it. ITX is right place, right time.

bbc.co.uk/news/business-…

They've been working on all this for years and it appears that their time may be arriving.

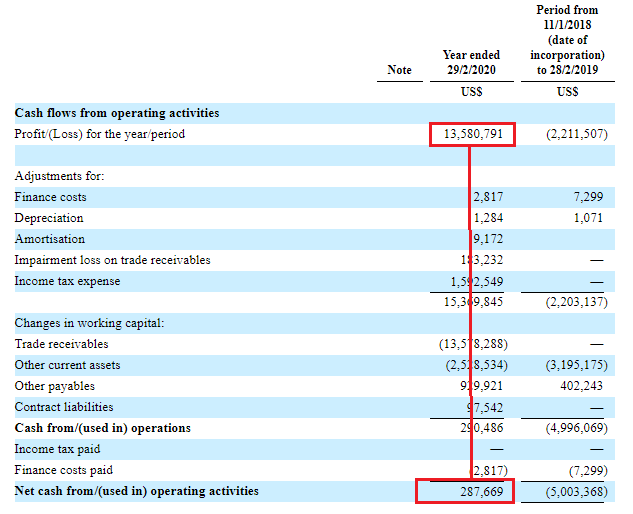

But they have spent a lot of money to get here. They were hinting at a de-listing earlier in the year. There's a meaty going concern and an equity raise.

But they have spent a lot of money to get here. They were hinting at a de-listing earlier in the year. There's a meaty going concern and an equity raise.

I think they'll be just fine.

Let's change that -3% in H2 to something else. I've gone for 20%. FY20 would then come out at $2.4M. Leave in next year's published estimates and we'd need +168% to achieve that. Punchy for sure.

Let's change that -3% in H2 to something else. I've gone for 20%. FY20 would then come out at $2.4M. Leave in next year's published estimates and we'd need +168% to achieve that. Punchy for sure.

But perhaps not impossible. Here I've barely scratched the surface of the products they have and I wouldn't rule out these things growing enough to make it - but they're already talking about packaging and paint. They mention Solvay. This might be what's next.

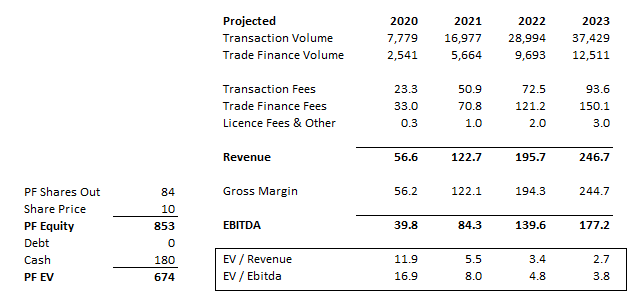

Croda is an IG credit, ITX isn't and Croda's numbers look too high to me but try some crazy: 17.8 x $2.4M

6.57 fwd at 37% margins is 17.8x fwd gross profit. Croda has limited growth, ITX can't move their needle but would you pay above your own multiple for ITX's growth? I might.

6.57 fwd at 37% margins is 17.8x fwd gross profit. Croda has limited growth, ITX can't move their needle but would you pay above your own multiple for ITX's growth? I might.

It's a volume game. Someone doesn't buy them and they make next year's numbers - annualise the expenses and they're about break even. One more raise for working cap, keep growing, ~30%+ drops to the bottom line after that. I'm not sure what it's worth but I don't think it's £13M

PS. I was going to take my time writing this but today the price went bananas. In 2019 ITX gave their full year update on January 9th, Thursday. I assume the move may be expectations for this year's release to be soon.

Other finds from the newspaper here

Other finds from the newspaper here

https://twitter.com/hareng_rouge/status/1343877318821994498?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh