#stockmarket WE update. crazy bullish euphoria is all that comes to mind. But that doesn't mean it has to end. I think we are stretched which can be resolved by time or price. >3645 tough to be overly bearish, but putting new money to work up here seems foolish....

#stockmarket #SPX correlation to USD has been strong & previous spikes this yr have seen equity dislocation. This is the most important thing to watch IMO given how lopsided this trade has become. Demark has a 13 Seq/Combo & 9 buy in place/ w/ prop down tgt of 90.15 for $DXY...

#stockmarket the $DXY has closed below the lower bound 4x since the GFC ('08 it happened many times, Jan '18, this yr in July/Aug, Nov/Dec). As illustrated this usu is short lived. why would it be different this time? ...

#stockmarket #SPX $SPY will likely post another Demark 9 sell tomorrow & a new crop of daily 13 sells this wk (earliest Seq by Fri/combo by thurs). Last Seq 13 saw a ~9% drawdown in Oct. Keep in mind propulsion up tgt still active w/ 3907 tgt....

#stockmarket resurrecting this chart from months ago, the trend line that connects the '18 lows to the Feb '20 high is around 3750-3780. Maybe we hit that tgt and record the Demark sells? Note that RSI continues to diverge negatively since '18....

#stockmarket #SPX monthly finally closed above the megaphone pattern from '08 which is clearly bullish. RSI though still diverging negatively....

#Stockmarket #SPX monthly BB has closed above the upper bound 4x since GFC. Last 3x thats happened were in Jan '18, Dec'19 and Aug '20. Nasty drawdowns occurred in each instance shortly thereafter. Clearly we are stretched here...

#stockmarket #NASDAQ also will post a Demark 9 sell tomorrow, but similar to the #SPX, its also has a propulsion up tgt active @ 13240....

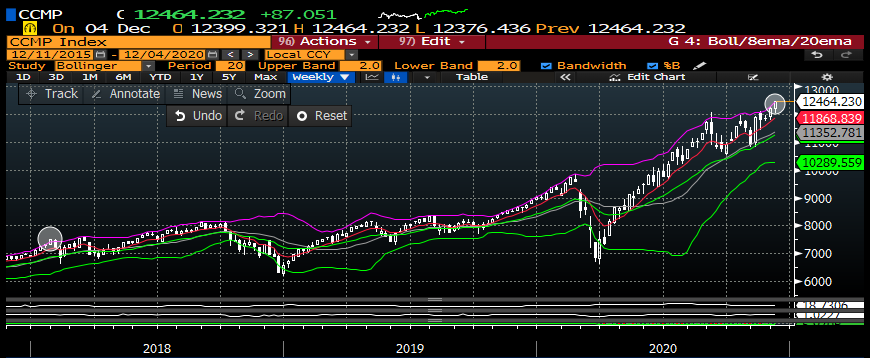

#stockmarket #NASDAQ Recall from previous updates that the Naz has weekly seq/combo 13 sells in play (signals are good for 12 price bars) unless risk lvls are qualified. The risk lvls are 13272 & 12791....

#stockmarket #NASDAQ also is stretched per it's monthly BB. While the monthly hasn't closed above the upper bound yet, the weekly has for the first time since Jan '18. Zoom in to see what happened after - yikes!....

#stockmarket $RTY has been on a tear, w/ a very mild reaction of the recent Demark 13 sells on the daily & now thru the 1st risk level and approaching the next lvl @ 1906. Weekly is about to post its 1st Combo 13 sell this wk & likely a seq 13 sell right behind it...

#stockmarket Smart Money Index hasn't really been buying into this rally which is very perplexing, although does look mildly better vs 2 wks ago as it broke above the trend line w/ a successful backtest. But still very depressed vs the index strength...

#stockmarket The McClellan Summation index w/ Demark counts will likely post a 13 seq sell this wk to go with the 13 combo sell last wk. Turning down here would be bearish...

#stockmarket Monthly put/call ratio is the lowest since the Internet bubble days. Weekly put/call has its first Demark 13 buy in 10+yrs. Turning up here would be bearish....

#stockmarket the weekly % of stocks above their 200 day, also w/ a new combo 13 sell and now clearly above previous resistance levels - the rally is obviously very strong, but is it too strong? ...

#stockmarket Zoom out a bit and the monthly chart of the % of stocks above the 200 day is into peak levels. Clearly this lvl of momentum & broadening out is NOT bearish, but if it diverges, could be a warning sign, & historically this is where it happens....

#stockmarket I also posted this a few wks back as a possibility. #SPX $VIX weekly has posted its first Demark Seq 13 since Nov '19 - 11 bars later it flipped up on its way to 85. Not saying that will repeat but not a bad idea owning cheap protection for the next 11 wks....

#stockmarket As a CMT candidate, we believe firmly in Intermarket correlations - so here's a few important Int'l indices that have recently posted Demark daily exhaustion lvls or will this wk...

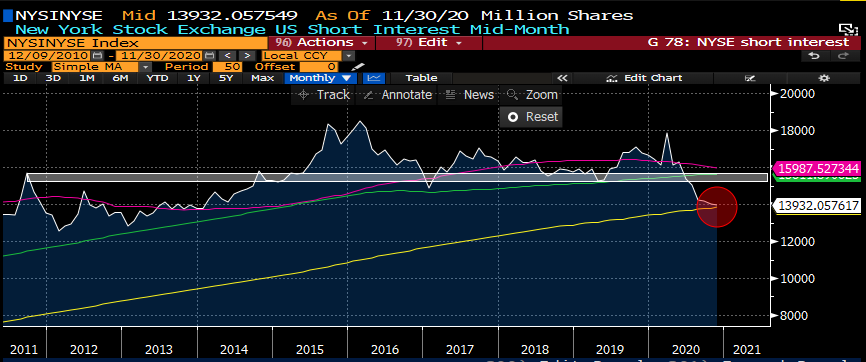

#stockmarket some more evidence exhibiting the frothy & complacent environment we are currently in...Short interest for the NYSE is at a 6 year low and currently sitting on the 200day MA....

#stockmarket but all is not lost. here is some comfort for the bulls. The ADX for the #SPX has crossed the lower bound of the DMI which is quite bullish & the last 2x this occurred the mkt still had some juice left to rally, although Jun was quite short-lived....

#stockmarket also the monthly DMI for the #SPX just crossed positive for the first time since Covid, although the ADX is still trending lower. The last time this happened w/ the ADX trending up was early '17 - mkt rallied ~25% further before correcting in Oct 18...

#stockmarket concl: price action remains bullish & seasonality is in the favor of the bulls, but everything in the aforementioned suggests we need to cool off. Can't be too bearish, but adding risk up here in the NT seems misplaced. retracements will come, rather be patient. GL

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh