#StockMarket WE update. crazy wk. Caught many offsides who were overloaded in tech. I suspect mkt leadership has shifted although it won't be linear. I am growing cautious & increasing hedges. As posted re #SPX last wk, Demark rare 9-13-9 sell printed w/ slo sto neg divergence...

#StockMarket #SPX here is another rarity & one for the bears, Demark 9-13-9 sell is also printing on the yearly chart, which has taken 40+ years to form. Not sure how to trade this but interesting nonetheless...

#stockmarket equally fascinating is that the #nasdaq is doing the same w/ a Demark 9-13-9 sell on the yearly. This in combination w/ the Demark combo & seq 13 sell on the weekly (combo printed last wk). Last time combo 13 sell printed here was the wk of Feb 20th. yikes!..

#StockMarket #nasdaq also has Demark propulsion down active on the daily w/ a tgt of 11300 which happens to coincide exactly w/ the 50day MA....

#stockmarket #NASDAQ pattern itself is interesting w/ a rising wedge into closing all time high resistance w/ massively diverging momentum (RSI)...

#stockmarket as posted last wk, the #Dow also printed a 13 combo sell, 9 sell and hit its Demark propulsions up tgt, w/ negatively diverging slo sto. Also watching if can hold this gap from last wk. also has negatively diverging RSI from Jun high...

#stockmarket Also posted last wk, $VXX has recorded a 9 buy as of Fri, but not perfected. would need to trade below 18.63 to perfect. Last 4x $VXX recorded a Demark 9 signal, there was a reaction. Is this time different?...

#StockMarket $VXX weekly chart also recorded a Demark Seq 13 buy 3 wks ago (signal good for 12 price bars or 12 wks here). Last seq 13 buy was the week of Feb 20th. $VIX weekly also on 11 count which could print a 13 seq buy the wk of thanksgiving....

#stockmarket As discussed many times on my feed, Smart Money Index continues to make new lows and now firmly below the Covid lows, broke the support band and has context for lower into 2018 lows. If bullish you need to see this turn back up....

#stockmarket #SPX $SPY On balance volume now showing a series of lower highs since Feb. $QQQ also showing a series of lower highs since the Sept peak. Not what you want to see as we probe new highs on the indexes....

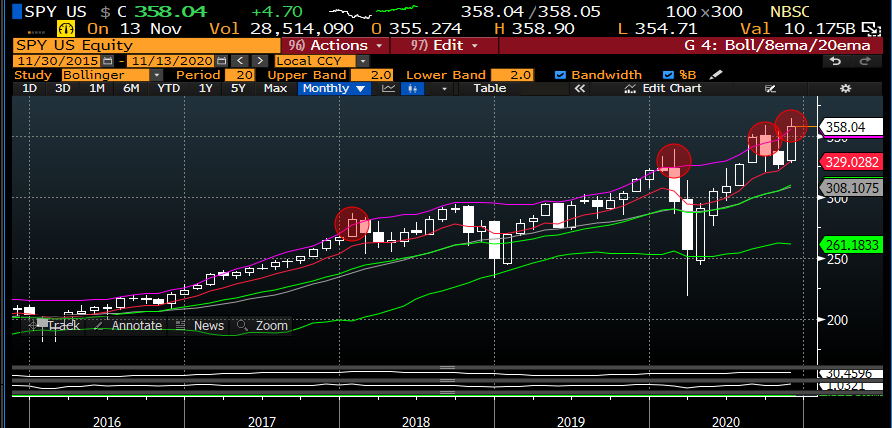

#stockmarket #SPX $SPY has pierced the upper BB. Historically this doesn't last too long until we get a major retracement back to mid BB which is a long way from here. Weekly also above the upper BB - last 2x saw decent retracements as well...

#StockMarket Net New High list w/ a Demark 13 seq sell last wk and turned down aggressively....

#stockmarket #SPX stocks above the 200 day are now back to levels where meaningful retracements have occurred since 2016. Overlay demark & see 2/3 last peaks had sell signals. Currently there is a Seq 13 sell w/ combo 13 sell likely this wk....

#stockmarket #SPX weekly put/call showing extreme complacency w/ Demark seq 13 buy at the low. turning up here could really spook the equity mkts....

#stockmarket #SPX AD/Decline making news highs is always bullish but now a new Demark combo & Seq 13 sell on the weekly - last time we saw a combo 13 sell was Feb '20 - turning down here would be bearish equities...

#StockMarket $HYG also w/ a new combo 13 sell on the daily chart last wk. Last time this signal printed was in Jan '20. Perceived credit stress always negative for equities so continuing lower here is bearish equities....

#stockmarket consumer discretionary vs staples ( $XLY vs $XLP) turned down last wk after posting a Demark seq 13 sell. Now into red support band - continuing lower would indicate risk off & bearish equities....

#stockmarket equal weight #SPX ($SPW) finally broke through the resistance band w/ a seemingly successful backtest. If sticks this could be signaling a leadership regime change away from tech...

#stockmarket Valueline Index finally breaking through resistance is also signaling regime change, but now w/ a new Demark Combo 13 sell and 9 sell set up....

#stockmarket concl: "Tremendous" confluence here w/ many of my indicators suggesting to back off equities. While we can certainly melt up from here like most strategists are suggesting, I think risk is high of the opposite. I remain heavy cash & continuing to hedge on strength.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh