#SSCNapoli 2019/20 accounts cover a season when they finished 7th in Serie A, but won the Coppa Italia and reached last 16 of the Champions League. Manager Carlo Ancelotti replaced by Gennaro Gattuso in December. Impacted by COVID-19 in the last 3 months. Some thoughts follow.

#SSCNapoli swung from €48m pre-tax profit to €20m loss, a €68m deterioration, as revenue fell €38m (17%) from €217m to €179m and expenses rose €43m (17%) to €295m, partly offset by €13m increase in profit on player sales to €96m. After tax, €29m profit to €19m loss.

All #SSCNapoli revenue streams were lower with broadcasting being the largest reduction, down €22m (15%) to €121m, though there were also falls in commercial, down €5m (11%) to €42m, and match day, down €3m (17%) to €13m. Player loans decreased €8m to €3m.

The main drivers of #SSCNapoli expenses increase were player amortisation, which rose €36m (45%) from €82m to €118m, and wages, up €6m (4%) from €135m to €141m. Other expenses were also €2m (5%) higher at €34m, though depreciation fell €1m to €2m.

#SSCNapoli post-tax €19m loss is not great, but it is much lower than huge 2019/20 losses at other Italian clubs, impacted by COVID, e.g. Roma €204m, Milan €195m, Inter €102m and Juventus €90m. Note: some clubs have 31 December year-end, so accounts do not reflect pandemic.

COVID has reduced #SSCNapoli revenue in 2019/20 by an estimated €32m: broadcasting €23m, sponsorship €7m and match day €2m. Without this loss, Napoli would have reported €306m total revenue (including €96m from player sales), i.e. higher than prior year’s €300m.

#SSCNapoli benefited from €96m profit on player sales: Diawara to Roma €19m, Inglese to Parma €17m, Rog to Cagliari €15m, Verdi to Torino €11m & Vinicius to Benfica €11m. Up on prior year €83m (Jorginho €60m and Hamsik €20m). 2nd highest in Italy, behind Juventus €167m.

#SSCNapoli have posted 4 losses in the last 6 years, though have accumulated an impressive €196m profits over the last decade, including two hefty profits in 2017 (€101m) and 2019 (€48m). Unless the COVID situation improves, club is likely to report a substantial loss in 2021.

Player sales are very important for #SSCNapoli, increasingly so, as they have averaged €65m a season in the last 5 years compared to only €24m in previous 5. The club needs to periodically sell stars to balance the books. This season will include the sale of Allan to Everton.

In fact, #SSCNapoli €325m profit from player sales in last 5 years is only beaten by Juventus €563m and Roma €372m, but is €100m more than the next highest, Inter €226m. Three largest profits ever: Higuain to Juventus €86m, Cavani to PSG €64m and Jorginho to #CFC €60m.

#SSCNapoli EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for underlying profitability, as it excludes once-off items like player sales and exceptional items, fell from €49m to €4m, though still one of the best in Italy.

Similarly, #SSCNapoli operating loss (excluding profit on player sales & interest) widened from €35m to €116m, down from €4m only 3 years ago. Again, this is much better than the traditional “Big 4” operating losses: Juventus €234m, Milan €202m, Roma €195m and Inter €133m.

#SSCNapoli revenue growth highlights importance of the Champions League, as 2020 revenue of €179m was greatly boosted by €67m from this tournament. In fact, excluding European money, revenue has actually dropped by €19m (14%) since 2016, whereas it is up €35m (24%) in total.

Nevertheless, #SSCNapoli €179m revenue is now 3rd highest in Italy, though less than half of Juventus €407m and €132m below Inter. That said, they have overtaken both Milan €172m and Roma €149m. Revenue mix: TV 68%, commercial 23%, match day 8% and player loans 1%.

Due to COVID, most clubs’ revenue has fallen dramatically in 2020, so #SSCNapoli €31m reduction (excluding player loans) is actually better than Roma €90m, Inter €63m, Juventus €58m & Milan €42m. Atalanta and Fiorentina accounts closed in December, i.e. before the pandemic.

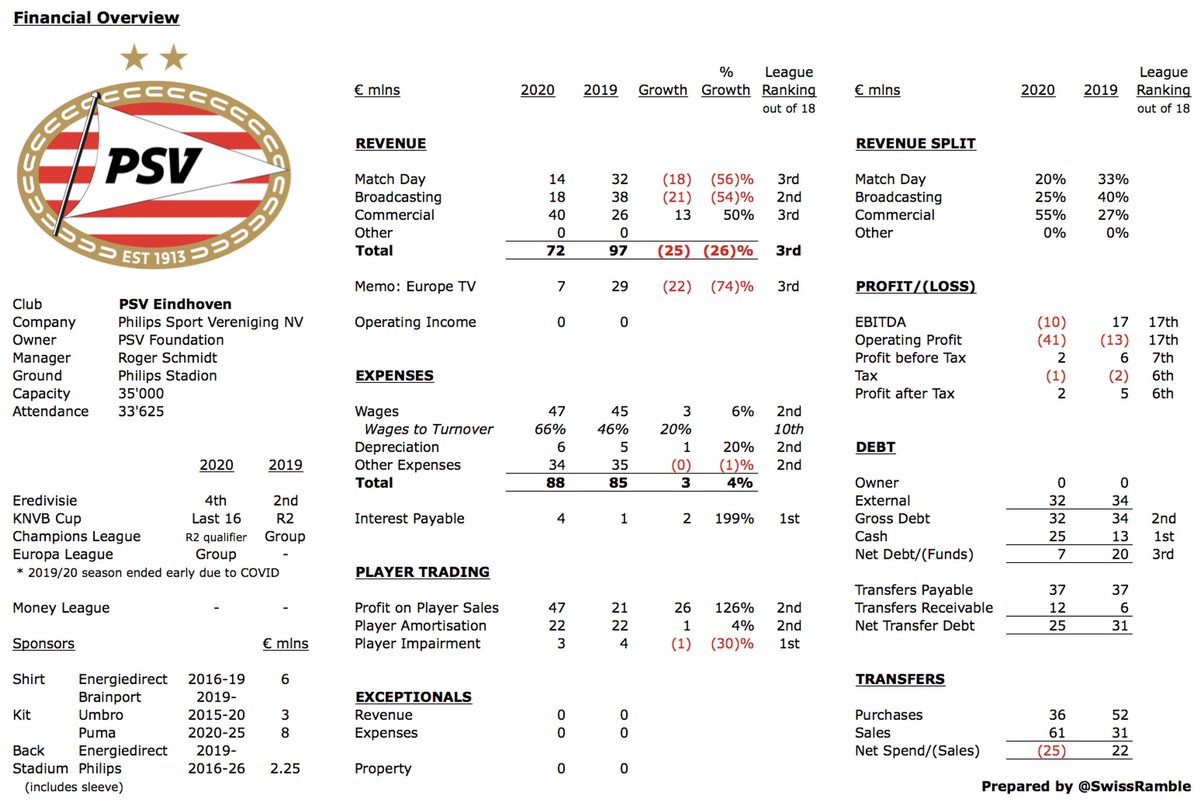

According to the Deloitte Money League, #SSCNapoli had the 20th highest revenue in the world in 2018/19 with €207m, up from 21st the prior year. This is around the same level as Everton €213m, but ahead of clubs like Ajax €199m, Benfica €198m and Valencia €185m.

#SSCNapoli broadcasting income fell €22m (15%) from €143m to €121m, mainly due to domestic TV dropping €27m (31%) from €87m to €60m, partly offset by UEFA prize money increasing €5m (9%) from €56m to €61m. Second highest in Italy, though a long way below Juventus €166m.

In 2018/19 #SSCNapoli received €77m TV money from Serie A: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); and 20% supporters. However, 2019/20 revenue was €27m lower, as some income deferred to 2020/21 as games played in July and August.

It is imperative that #SSCNapoli do well in Europe to boost their broadcasting income, as the TV rights in Serie A are relatively low. Indeed, there were big increases in England and Spain in 2019/20 and France in 2020/21, while Italy was unchanged.

#SSCNapoli earned estimated €70m for reaching the Champions League last 16, higher than prior season’s €57m (Champions League group + Europa League quarter-final). Other Italian clubs: Juventus €87m, Atalanta €58m and Inter €57m. These figures are before any COVID rebate.

The Champions League is extremely important for #SSCNapoli, who have earned an impressive €246m from Europe in last 5 seasons, only surpassed in Italy by Juventus €449m and Roma €255m, but ahead of Inter €117m, Lazio €76m, Atalanta €71m and Milan €29m.

#SSCNapoli match day income fell €3m (17%) from €16m to €13m, split domestic €7m (down €2m) & Europe €6m (down €1m), the 3rd year in a row it has decreased. Impacted by playing 7 home games behind closed doors, due to COVID. 6th highest in Italy, far below Juventus €49m.

#SSCNapoli average attendance decreased from 29,000 to 21,490, again due to 7 games being played behind closed doors. This remained the 7th highest in Italy a long way below Inter 41,558, Milan 34,078 and Juventus 28,263, who all saw similar falls to Napoli.

#SSCNapoli have a project to redevelop their stadium, described as “an ever increasing toilet” by the colourful president De Laurentiis. Recently renamed Stadio Diego Armando Maradona to honour their former star. Lowest match day revenue of top 20 European clubs.

#SSCNapoli commercial income fell €5m (11%) from €47m to €42m, as sponsorship dropped €10m from €37m to €27m, partly because of COVID deferring revenue to 2021. Now 4th highest in Serie A, though much lower than Juventus €186m, Inter €142m and Milan €68m.

#SSCNapoli long-standing shirt sponsor since 2015 is mineral water Lete, worth €9m a year, while kit supplier Kappa have extended their €8m a year deal until 2022. Also secondary sponsor MSC and back-of-shirt Kimbo. Long way behind Juventus €93m: Jeep €42m and Adidas €51m.

#SSCNapoli commercial income has hardly grown in the last decade, leading to a massive disparity with other leading European clubs. Even before last season’s decrease, their €46m in 2018/19 was miles below the likes of Barcelona €384m, PSG €363m, Bayern €357m & #MUFC €355m.

#ASRoma player loans income fell €8m from €11m to €3m, mainly Adam Ounas to Nice. Leading the way in Italy are Inter €9m, Milan €8m, Roma €7m and Atalanta €7m.

#ASRoma wage bill rose €6m (4%) from €135m to €141m, as player salaries increased €10m, while coaching staff fell €4m and bonuses were down €1m. Wages up €56m in the last 4 years, while revenue only rose €35m, increasing wages to turnover from 59% to 79%.

In fact, since 2016 #SSCNapoli wages growth of €56m has only been outpaced by Inter €74m and Juventus €63m. Over the same period, Roma wage bill was flat, while Milan actually dropped €3m. In percentage terms, only Atalanta’s growth was better than Napoli.

Despite the increase, #SSCNapoli wage bill of €141m is still 5th highest in Italy, less than half of Juventus €284m and a fair way below Inter €198m. Within striking distance of Milan €161m and Roma €155m. Worth noting over twice as much as Atalanta €69m, the next highest.

Following the 2020 increase from 62% to 79%, #ASRoma wages to turnover ratio is 6th highest (worst) in Italy, higher than Juventus 70%, Inter 64% and especially Atalanta 49%, but better than Roma 104% and Milan 93%. Above UEFA’s recommended upper limit of 70%.

Following investment in the squad, #SSCNapoli player amortisation, the annual cost of writing-off transfer fees, increased by €36m (45%) from €82m to €118m, which means that this expense has grown by an incredible €68m from €50m in 2016, i.e. more than doubling in that time.

As a result, #SSCNapoli player amortisation of €118m is the third highest in Italy, though a long way below Juventus €167m, but very close to Inter €120m. Maybe surprisingly, they are ahead of big-spending Milan €95m and Roma €94m.

#SSCNapoli have significantly increased gross transfer spend, averaging €102m in last 4 years, but sales have also increased to €71m, which means that they averaged €31m net spend. 2019/20 player purchases included Lozano, Lobotka, Petagna, Elmas, Rrahmani and Demme.

Over the last 4 seasons, #SSCNapoli have the 4th highest net spend in Serie A of €124m, only surpassed by Milan €287m, Inter €207m and Juventus €204m. Half of the clubs have had net sales, including Sampdoria €61m and Roma €27m.

It’s a similar story in gross spend with #SSCNapoli €409m being 5th highest in Italy, though €350m less than Juventus €758m. Also behind Inter €525m, Milan €515m and Roma €429m. One interesting comparative is high-flying Atalanta, who are around half as much with €216m.

#SSCNapoli have had zero financial debt for the last four years (and only had a €4m shareholder loan before that). De Laurentiis observed, “In Italy there are two or three clubs with balanced books, and I’m the only one who doesn’t have any bank debt.”

The absence of bank debt at #SSCNapoli is in stark contrast to clubs like Inter €461m (Goldman Sachs financing), Juventus €396m (mainly for new stadium) and Roma €318m (mainly bond issue).

As a consequence, #SSCNapoli paid no interest in 2019/20, which provides a major competitive advantage against the likes of Roma €32m, Inter €26m and Juventus €15m. This is testament to the club’s ability to fund itself from its own operations.

However, #SSCNapoli transfer fees debt increased from €113m to €143m, though they are themselves owed €109m by other clubs, so the net payable is only €34m, the lowest for 5 years. The gross transfer debt is 3rd highest in Italy, only behind Juventus €301m and Roma €191m.

Thanks to their sustainable approach over many years, #SSCNapoli had an incredible €124m cash balance, which is well over twice as much as the nearest Italian club, Inter €55m. Excluding these two, the other 18 Serie A clubs combined only have €119m, i.e. less than Napoli.

#SSCNapoli 2019/2 result was clearly impacted by COVID, but the loss was relatively small compared to Italian peers. However, their business model is reliant on Champions League qualification, boosted by lucrative player sales, so it would be no surprise to see Koulibaly depart.

• • •

Missing some Tweet in this thread? You can try to

force a refresh