Everton’s 2019/20 financial results covered a “very challenging” season when they finished 12th in the Premier League. Carlo Ancelotti replaced Marco Silva as manager in December 2019. Adversely impacted by the COVID-19 pandemic. Some thoughts in the following thread #EFC

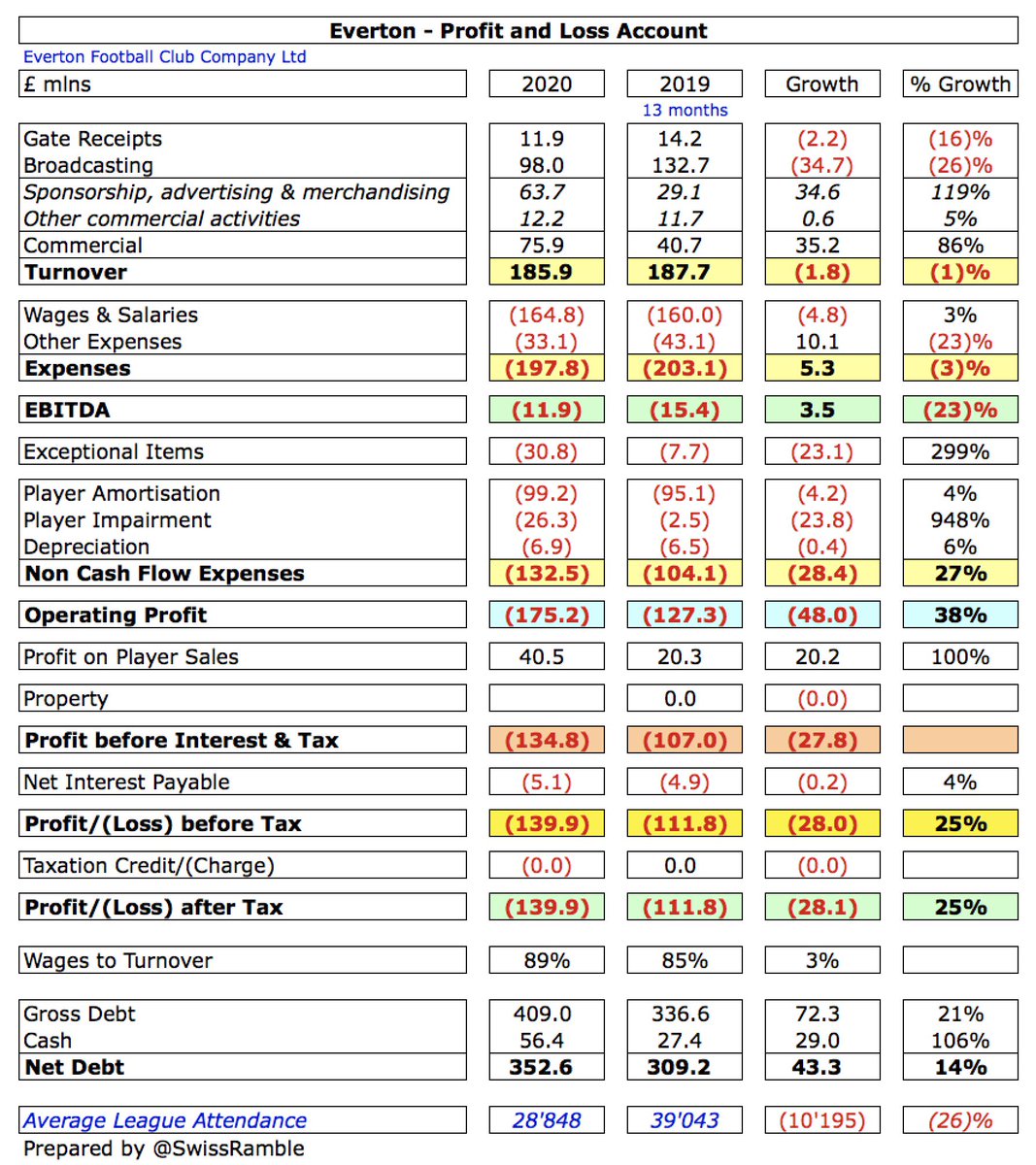

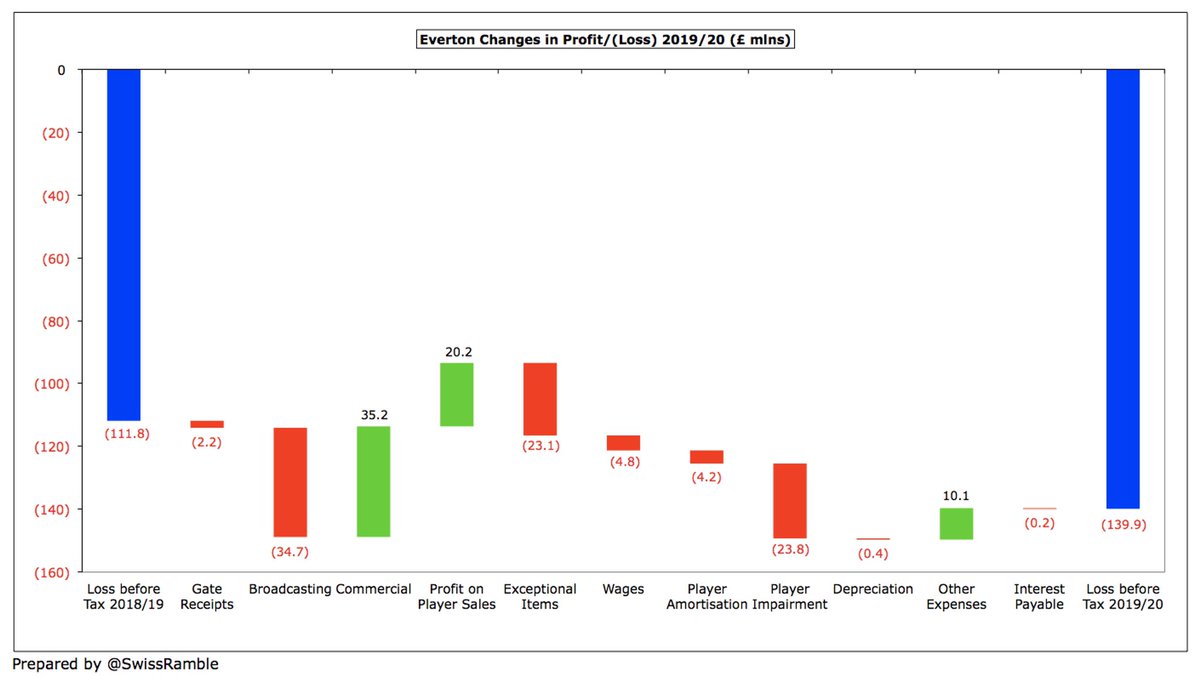

#EFC loss widened from £112m to a club record £140m, mainly due to £57m of exceptional charges (including impairment), up £47m from prior year. Revenue fell £2m (1%) to £186m, but profit on player sales doubled from £20m to £40m. Overall, operating expenses were flat.

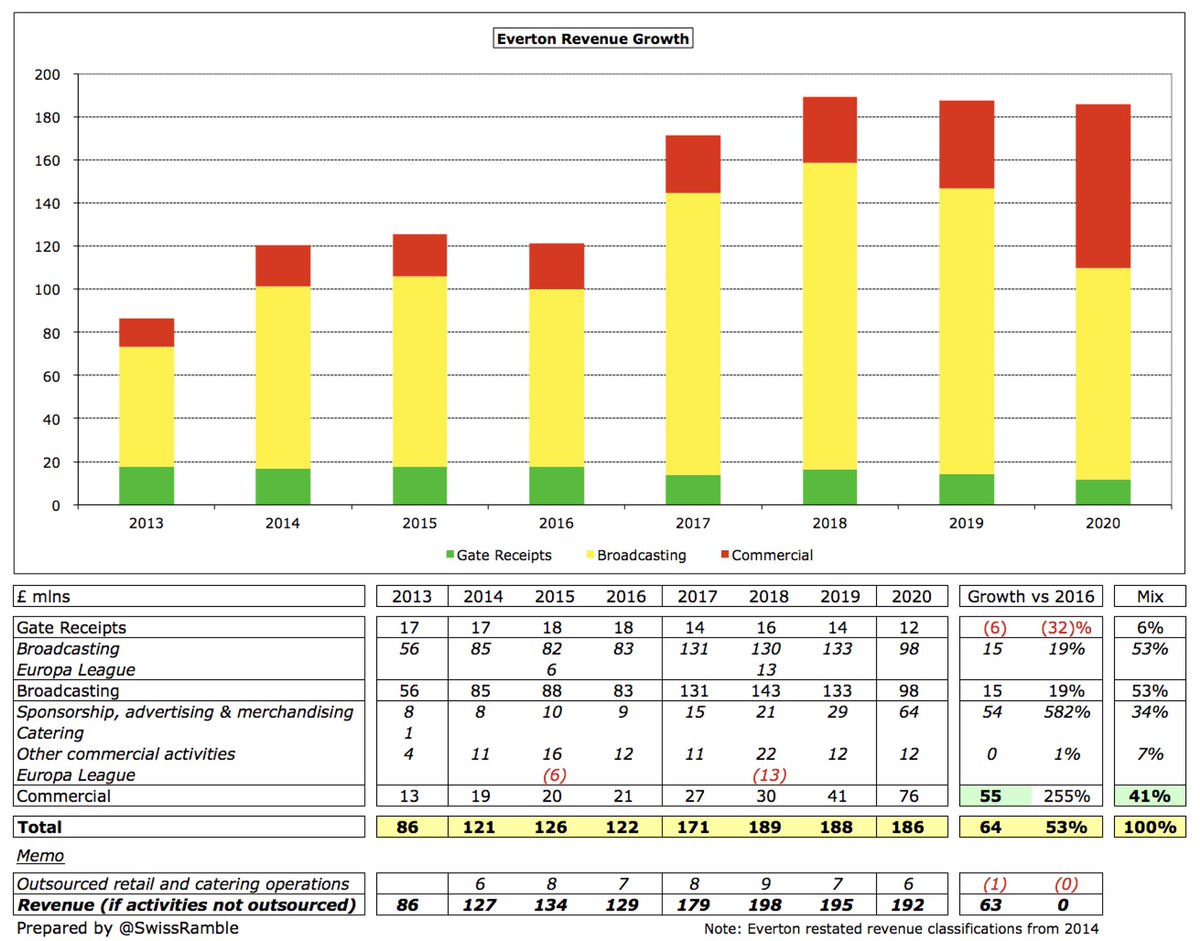

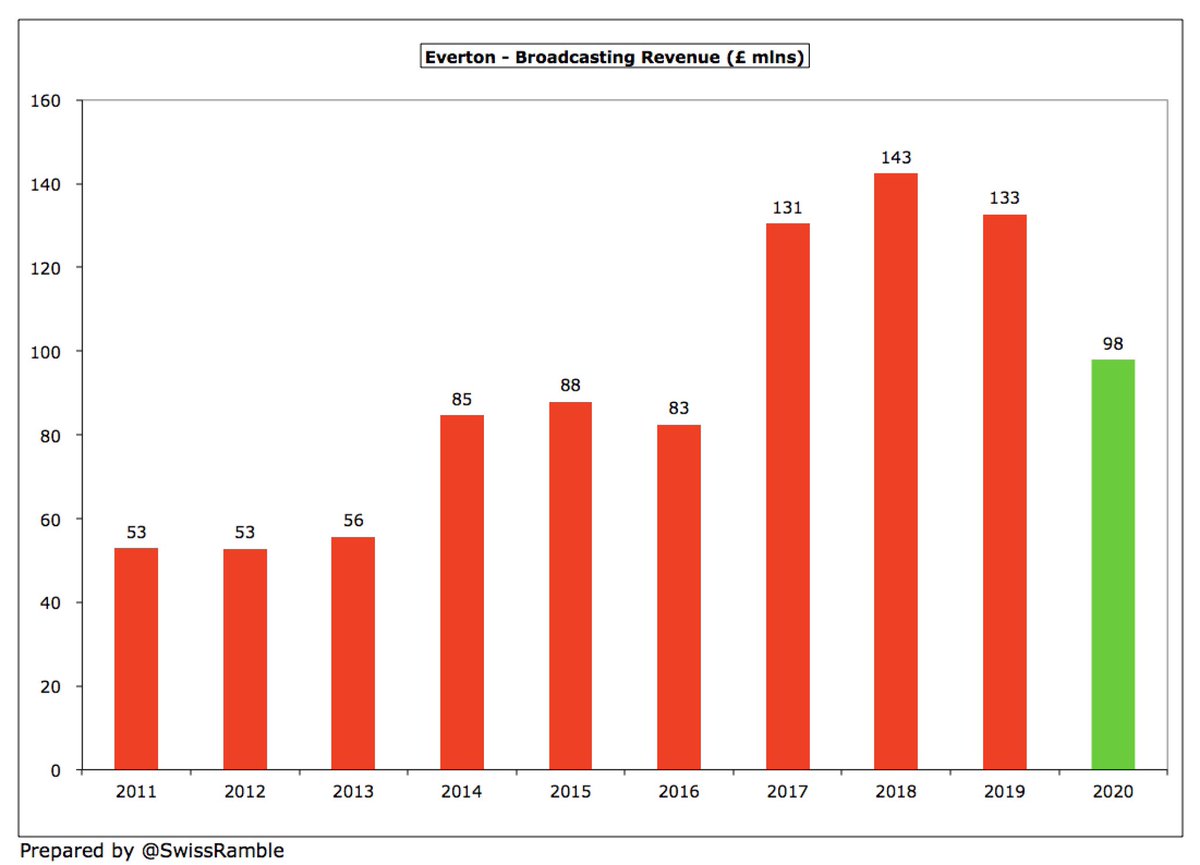

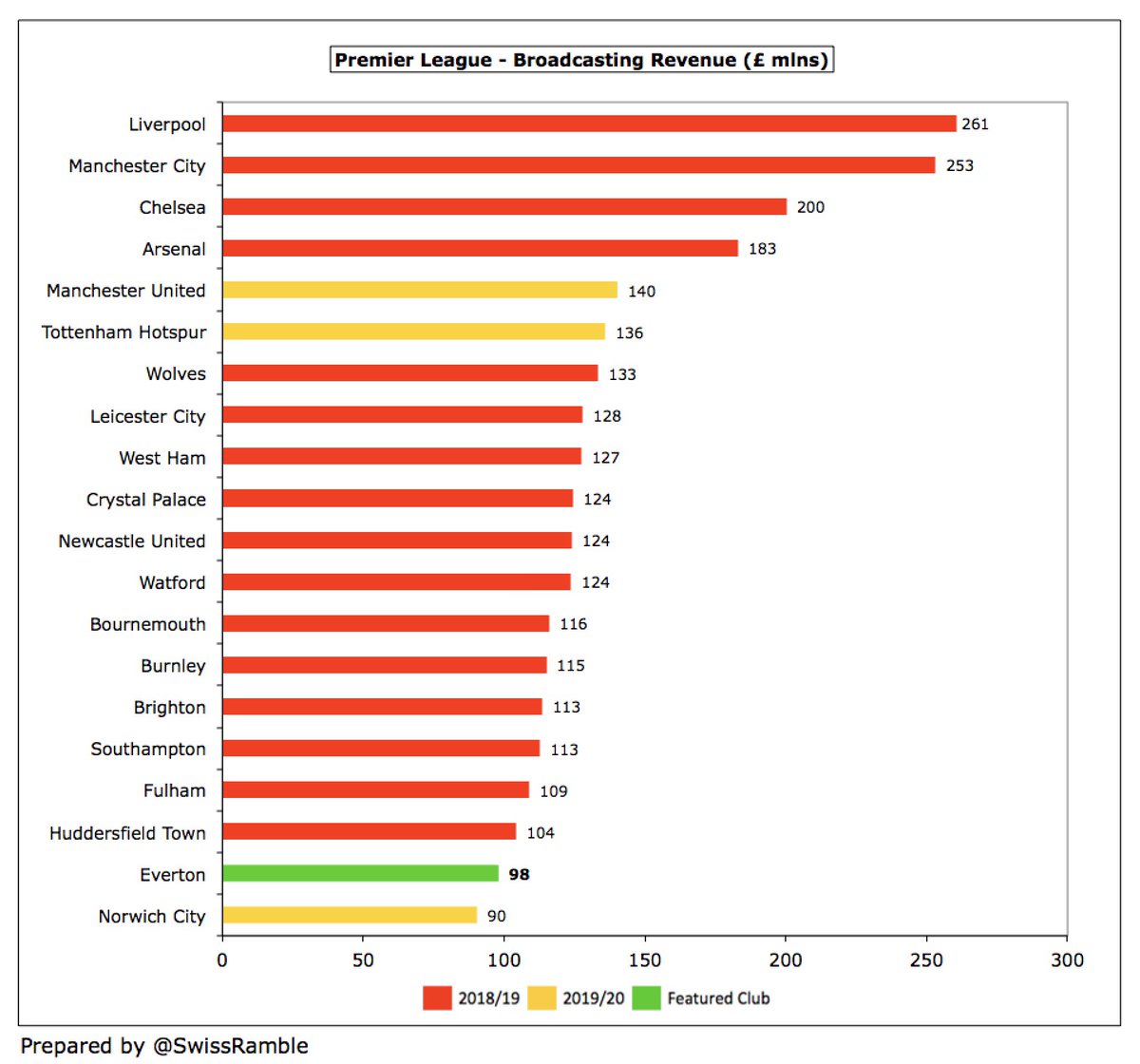

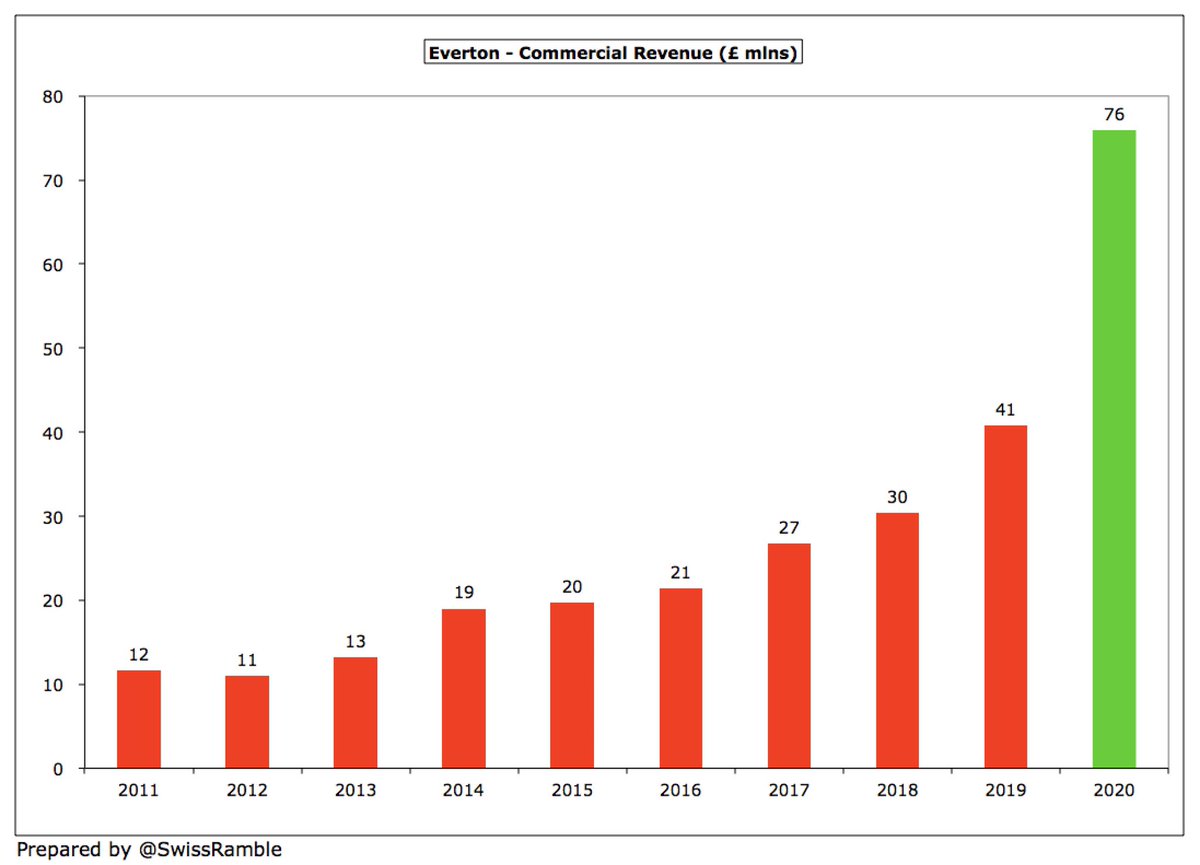

#EFC broadcasting income dropped £35m (26%) from £133m to £98m, while gate receipts fell £2m (16%) from £14m to £12m, mainly due to the delayed conclusion to the season. However, this was largely offset by commercial rising £35m (86%) from £41m to £76m.

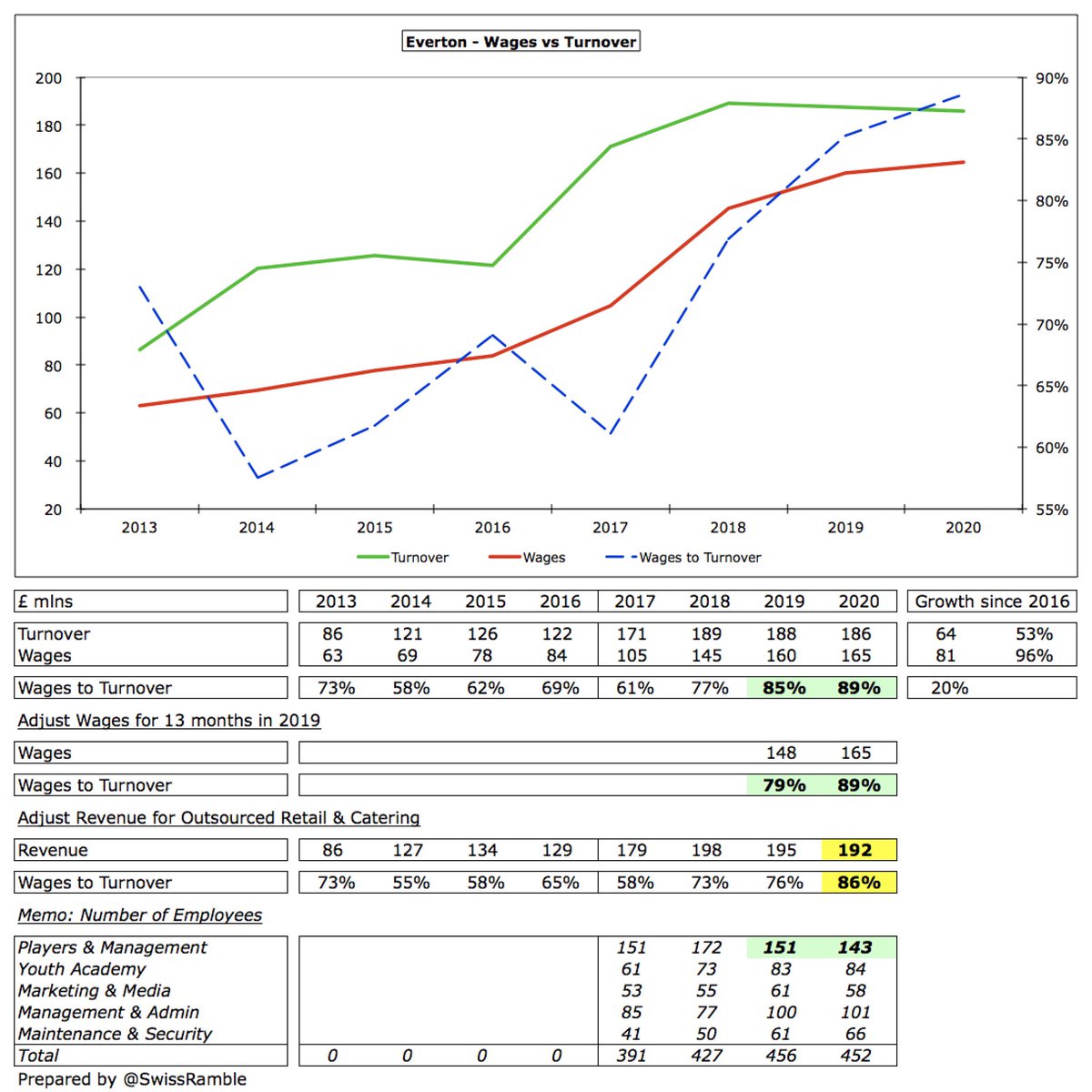

Following further investment in the squad, #EFC wage bill increased £5m (3%) to £165m and player amortisation rose £4m (4%) to £99m, but other expenses were cut £10m (23%) to £33m. On the other hand, exceptional items and player impairment were up £23m and £24m respectively.

As a technical point, it’s worth noting that #EFC changed their accounting close date from May 31st to June 30th in 2018/19, so prior year covered a 13 month period with little impact on turnover, but an additional month of expenses, which adversely impacted the bottom line.

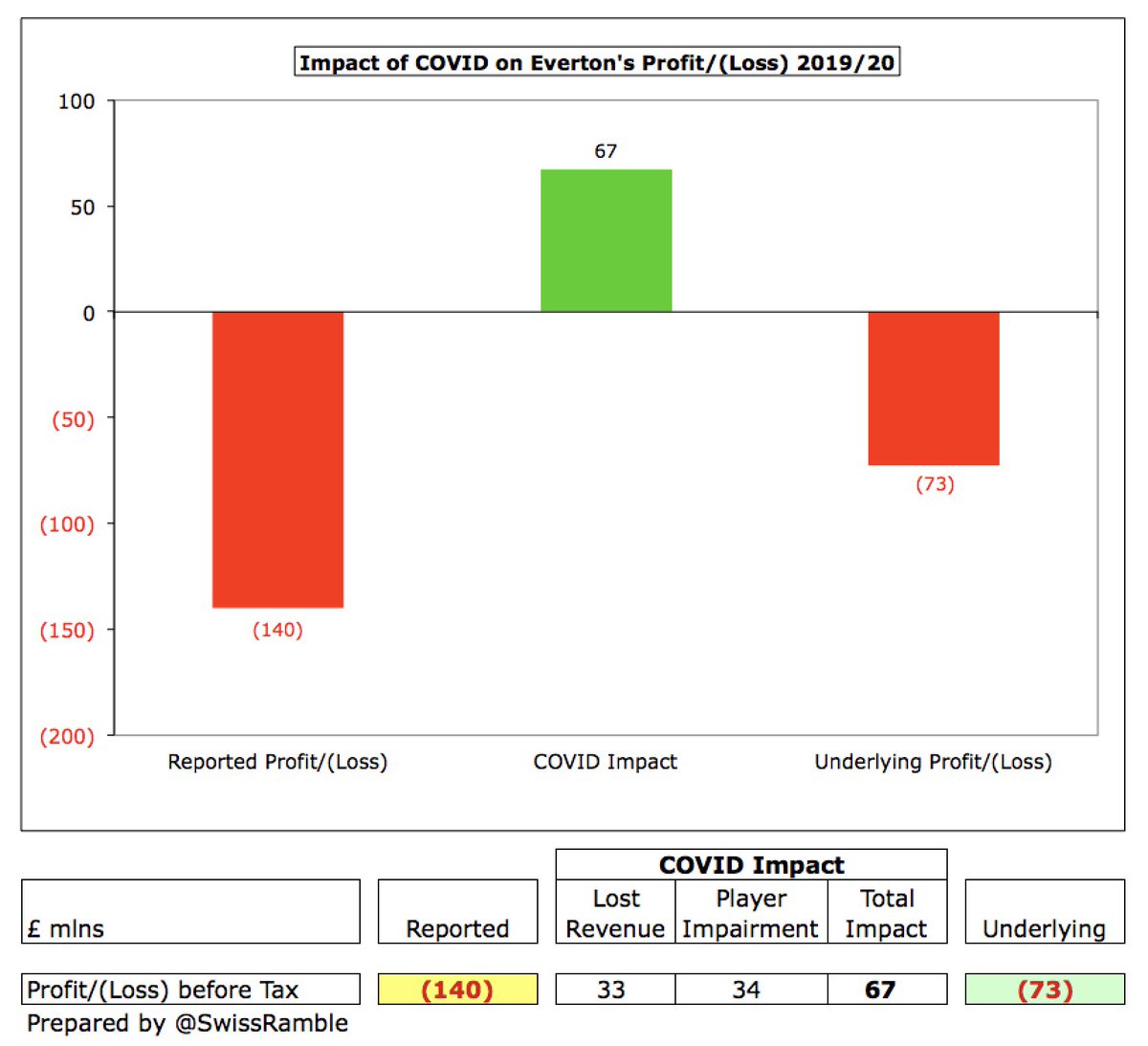

#EFC had been on course to report record revenue of £220m prior to the pandemic, so lost revenue (some deferred into 2020/21 accounts) was £33m. Adding £34m impairment, as player values hit by slump in transfer market, meant £67m total COVID impact, so underlying loss was £73m.

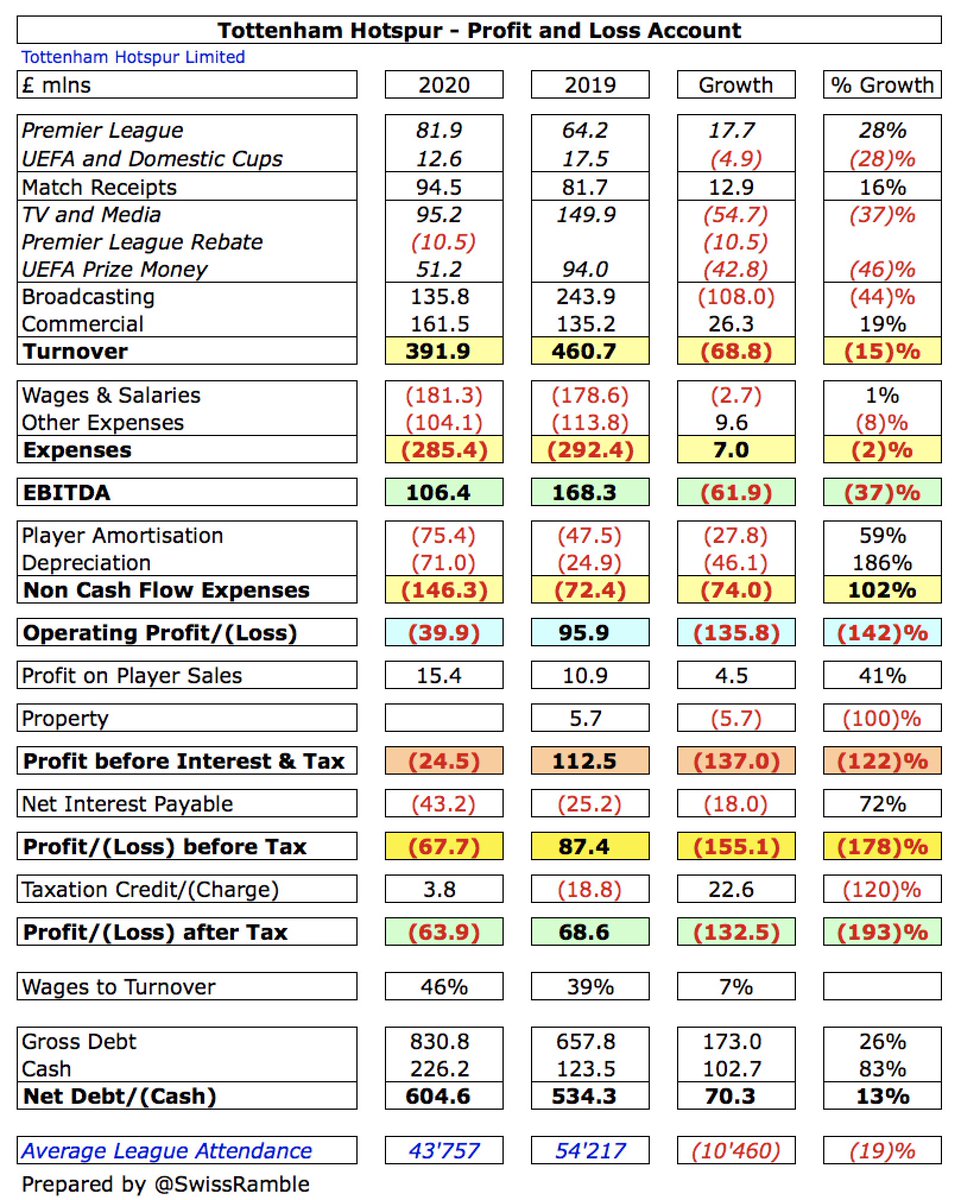

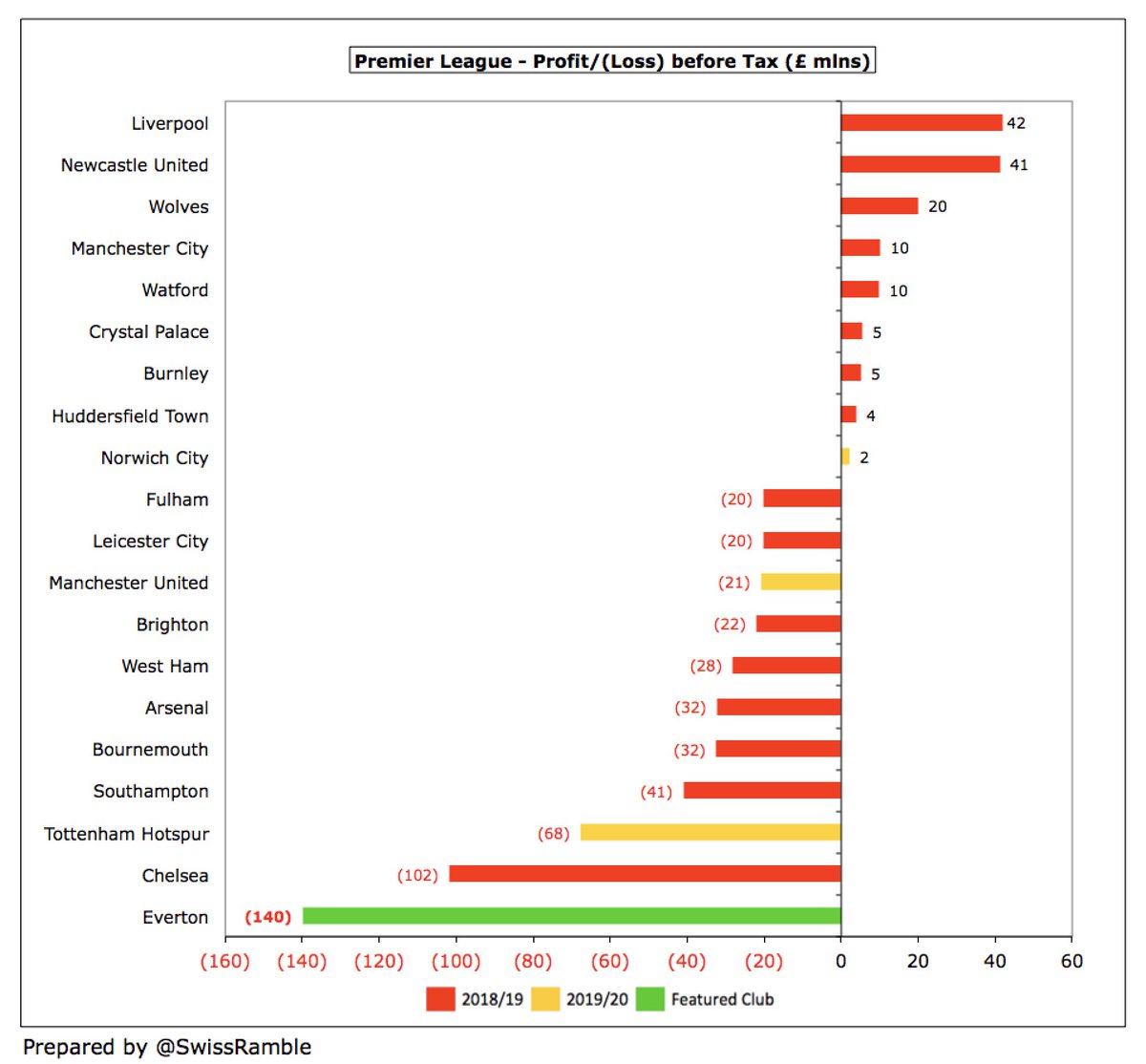

#EFC £140m loss is the highest reported to date in the 2019/20 Premier League, though all clubs are likely to report worse numbers last season, e.g. #THFC swung from £87m profit tax to £68m loss, while #MUFC went from £27m profit to £21m loss.

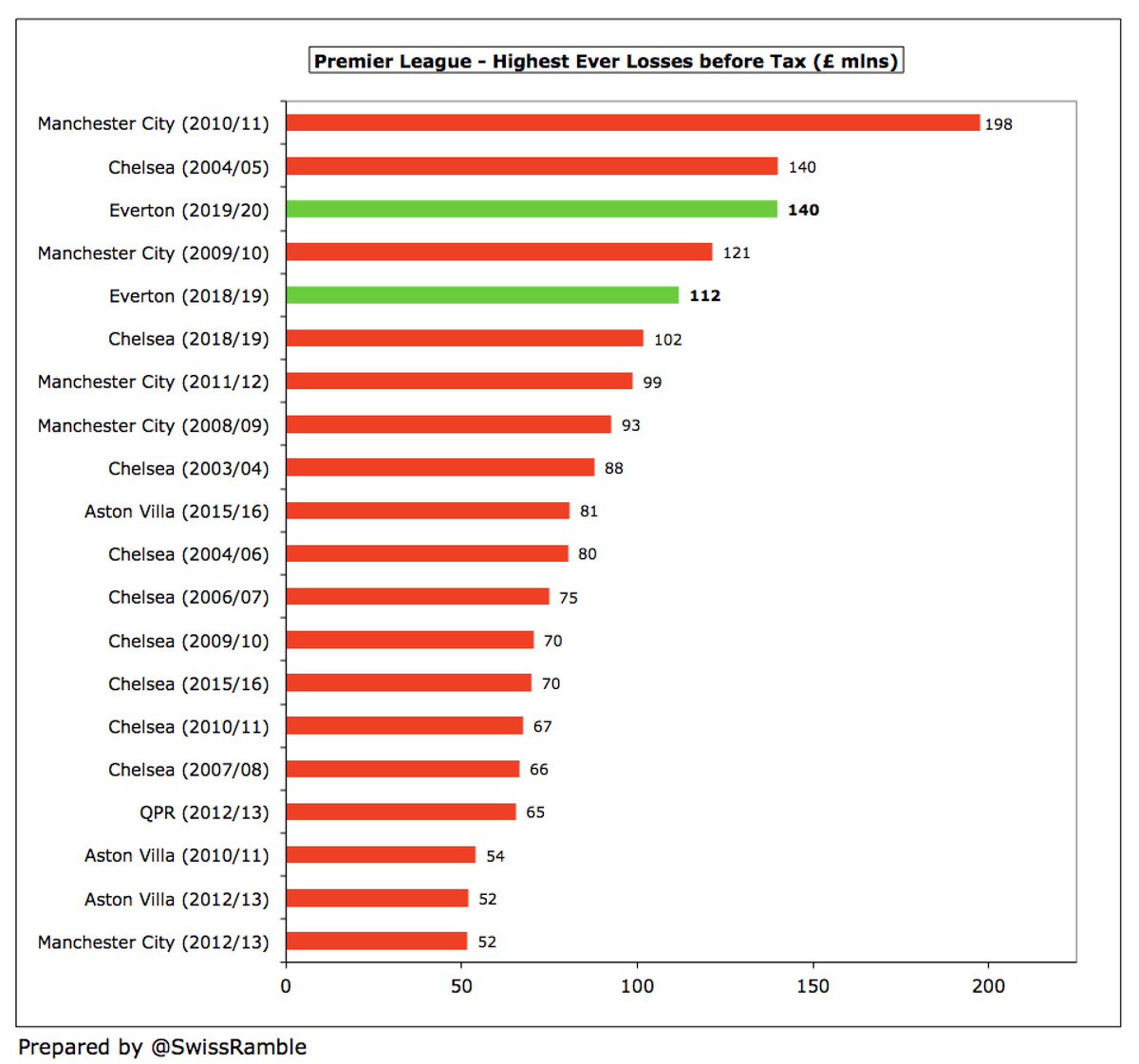

That said, #EFC £140m loss is actually the 3rd worst ever posted in the Premier League, while previous year’s £112m is 5th largest. The Everton board would argue that these results reflect the club’s position in the early stages of a long-term investment cycle.

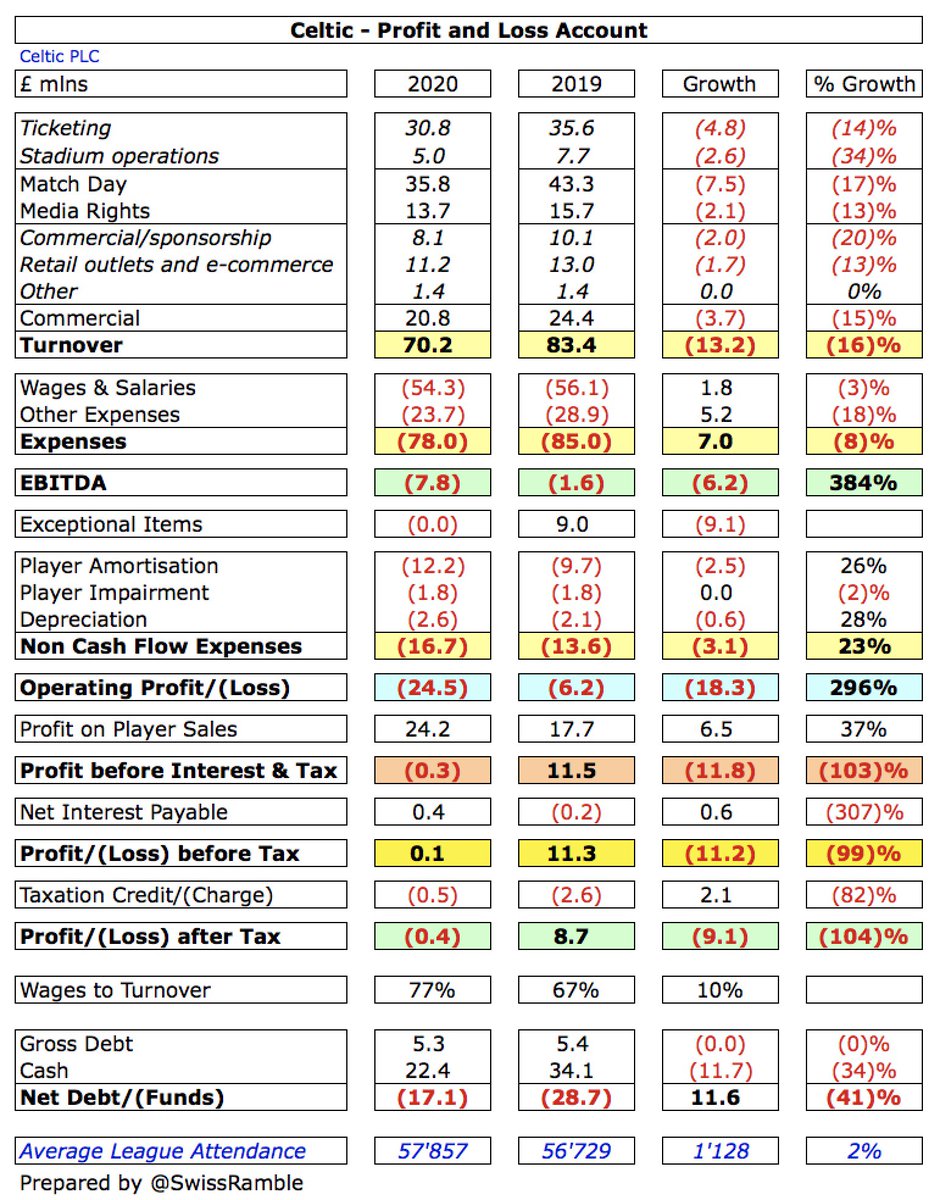

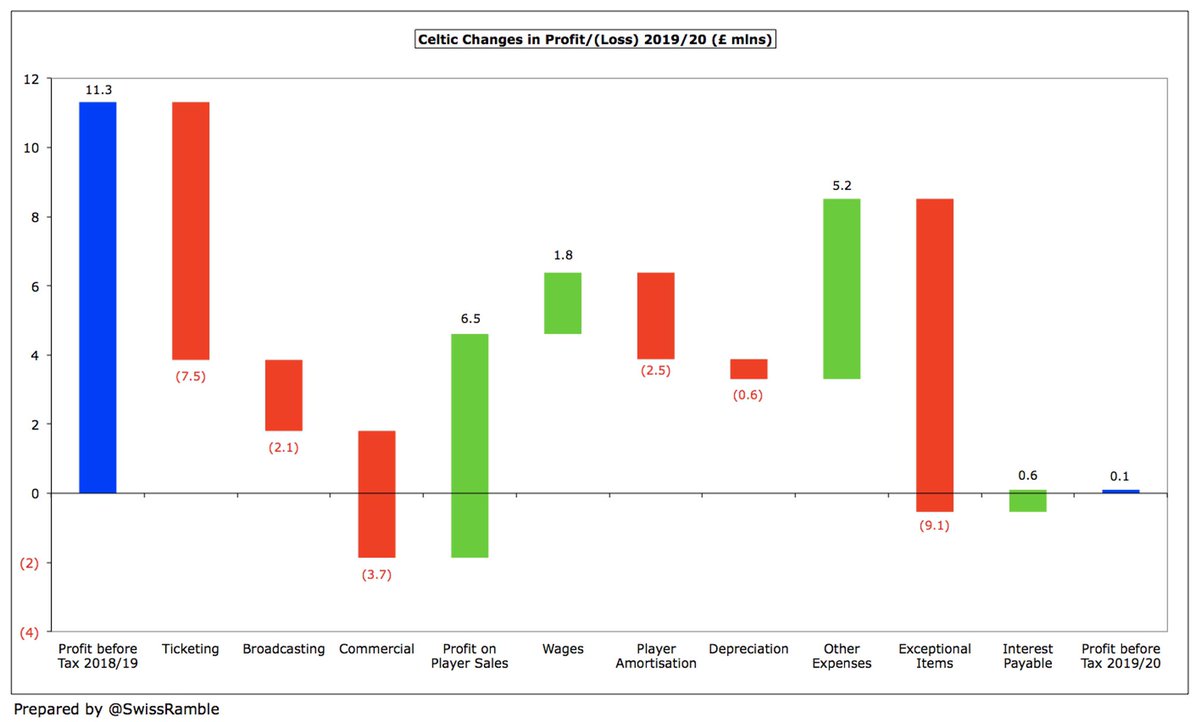

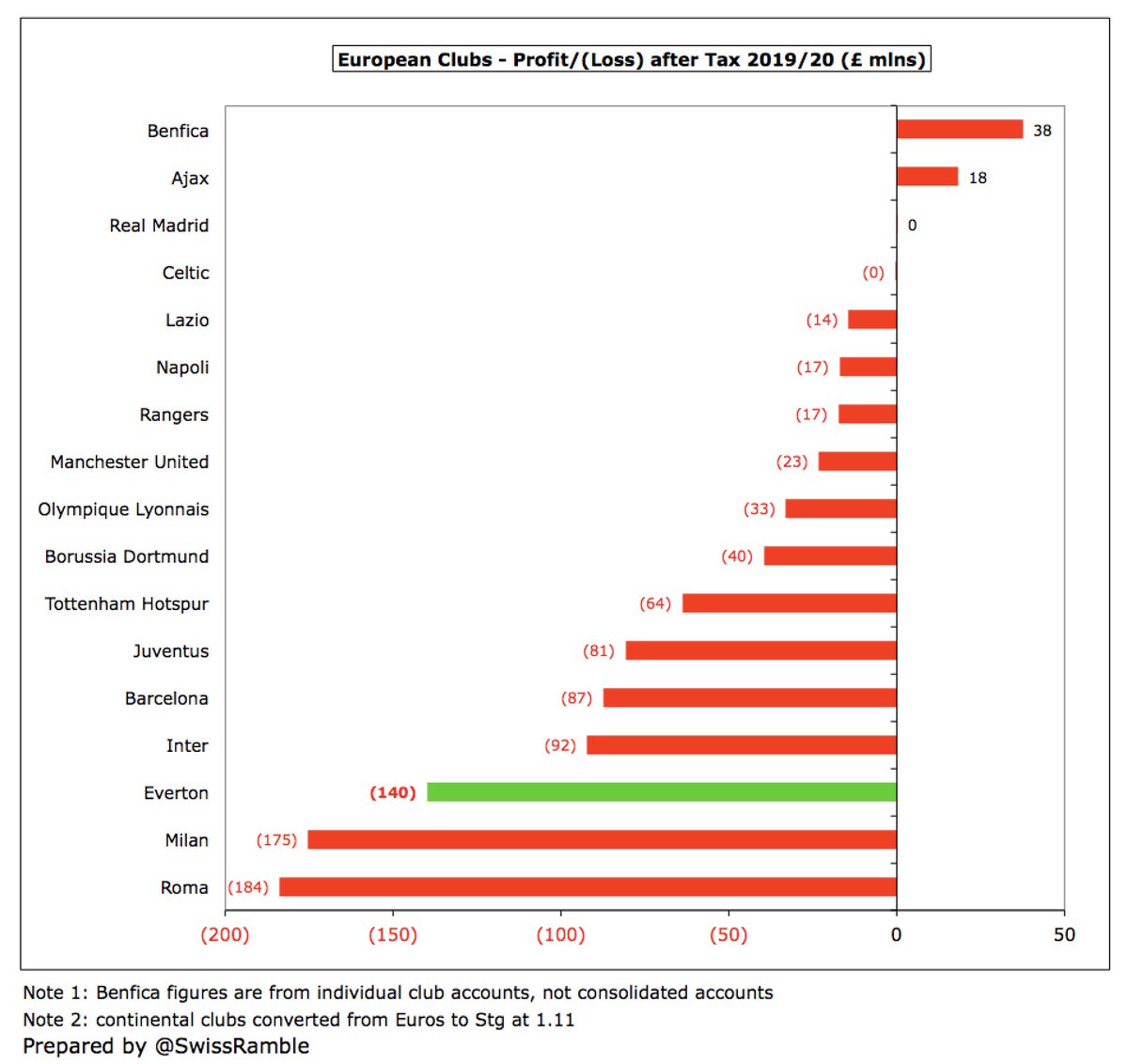

Furthermore, the pandemic has obviously significantly impacted finances in 2019/20 with many leading clubs posting horrific losses, e.g. Roma £184m, Milan £175m, Inter £92m, Barcelona £87m and Juventus £81m, so #EFC are not alone.

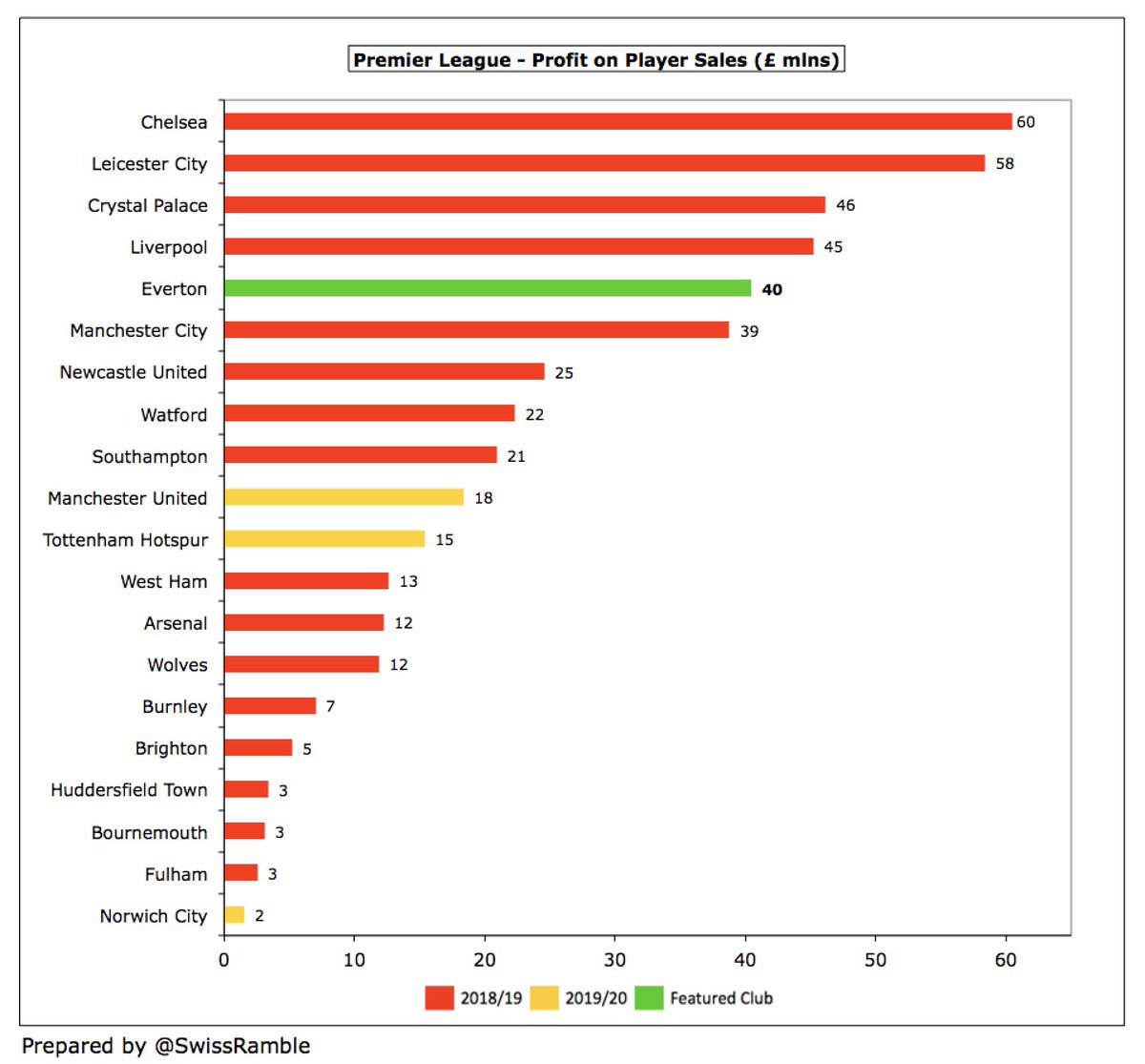

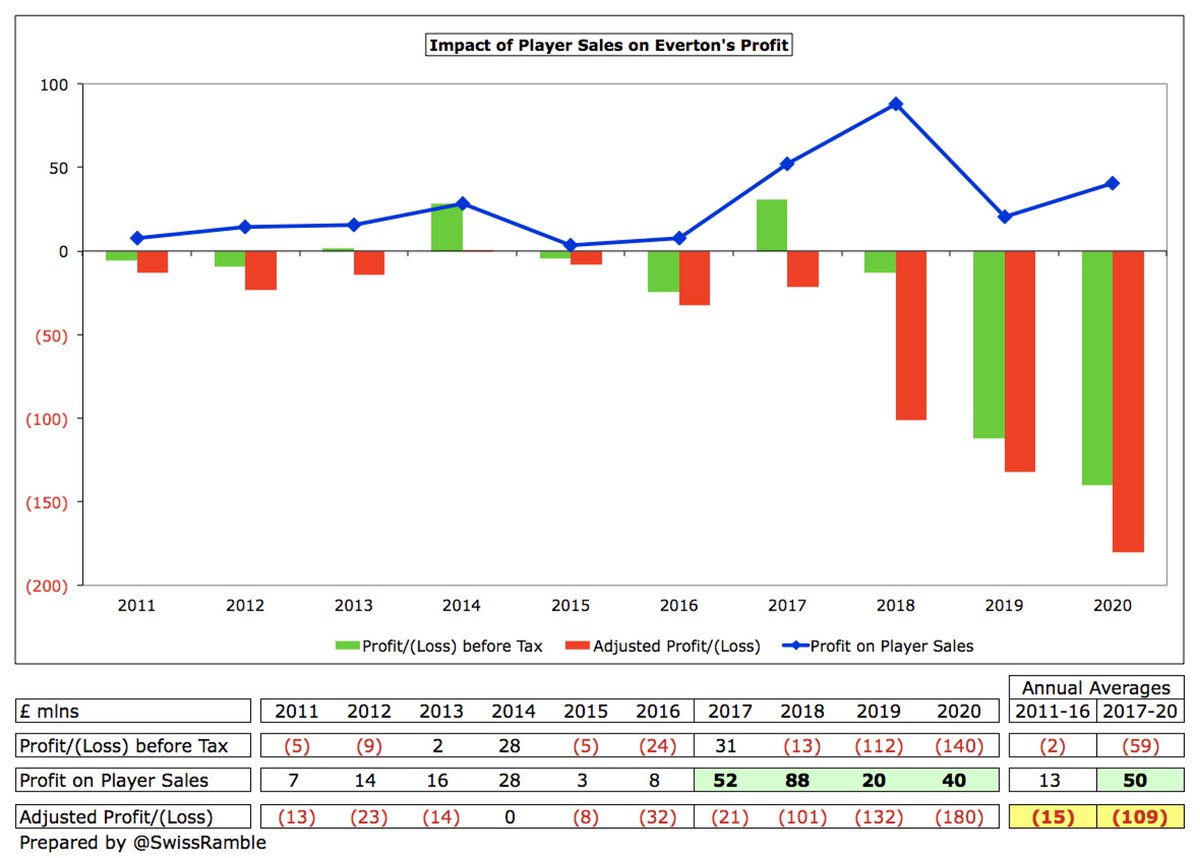

#EFC loss would have been even higher without £40m profit from player sales, £20m higher than prior year. Included Idrissa Gueye to PSG, Ademola Lookman to RB Leipzig, Nikola Vlasic to CSKA Moscow and Henry Onyekuru to Monaco. One of highest profits from this activity in the PL.

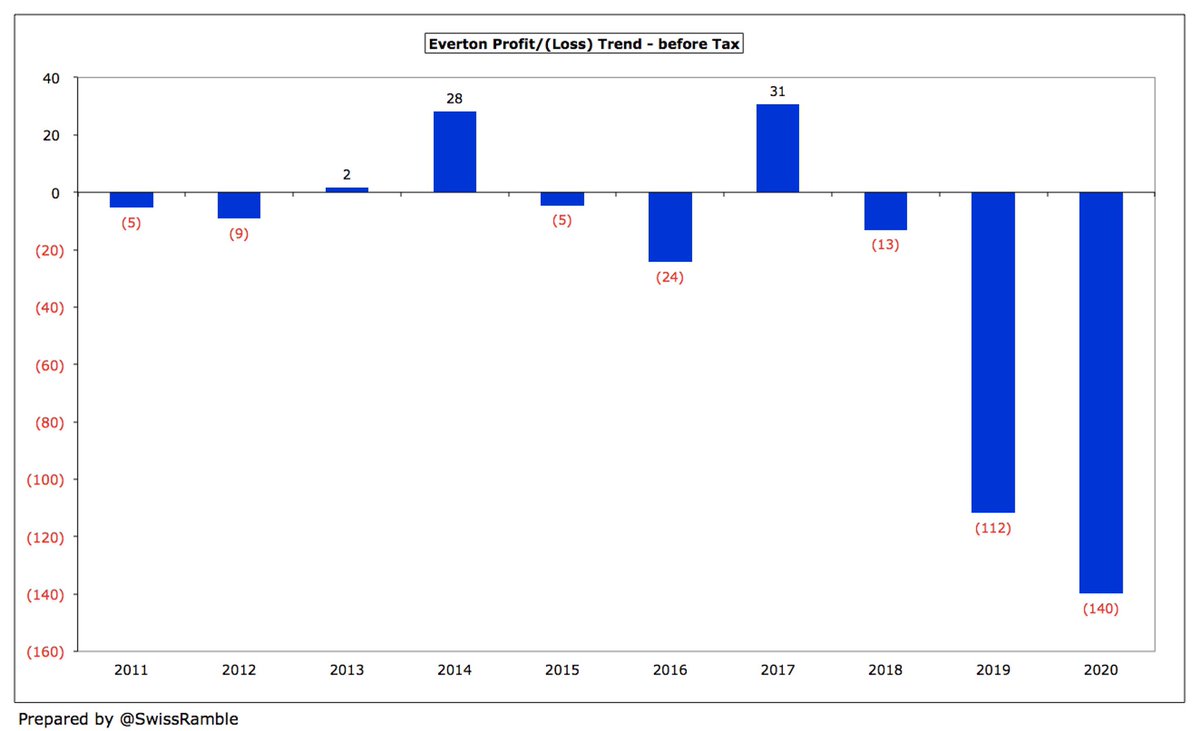

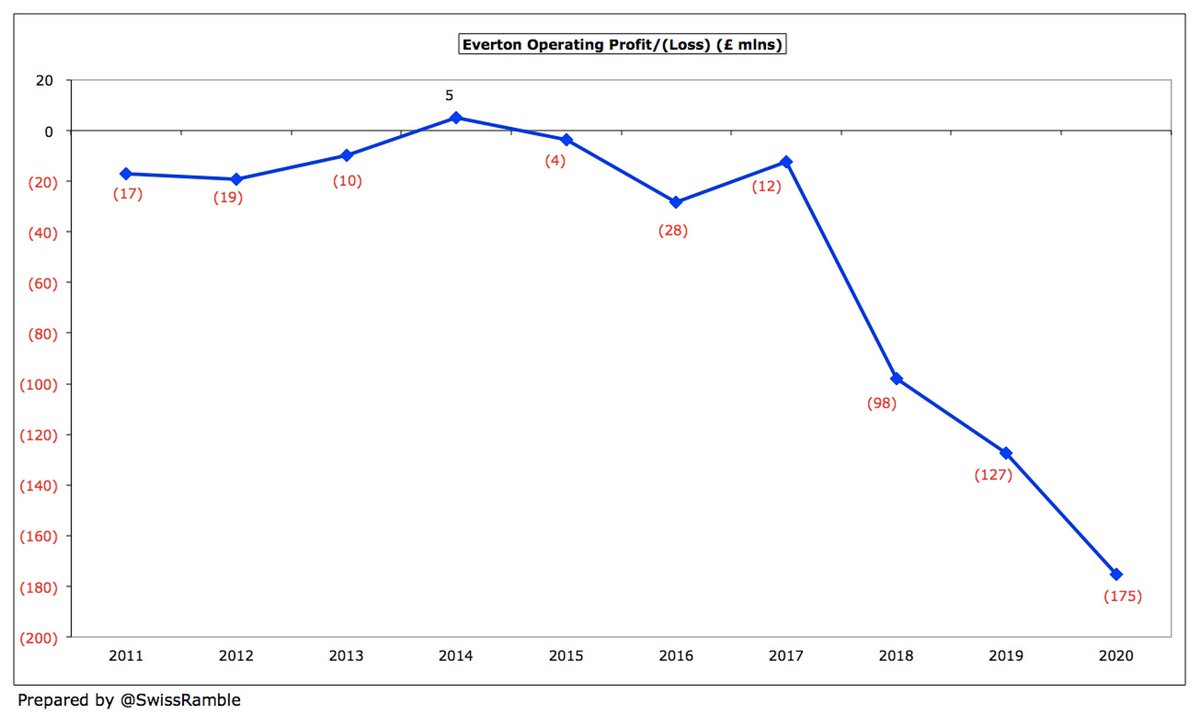

#EFC have reported losses 5 times in the last 6 seasons with the sole exception being £31m profit in 2017. That includes (growing) losses in each of the last 3 seasons with a total deficit over this period of £265m.

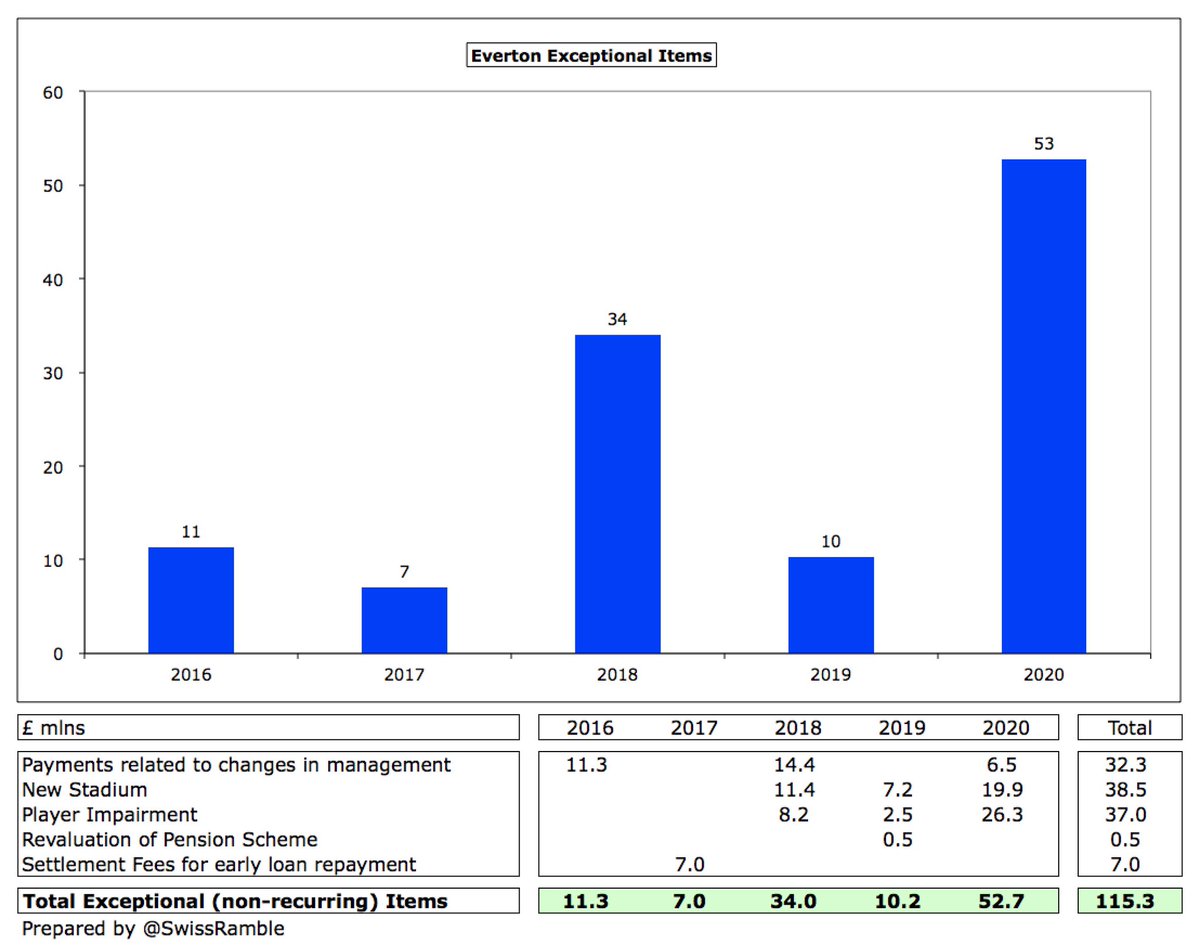

#EFC figures hit by £115m exceptional costs in last 5 seasons, including £32m payments for management changes (£6.5m for Marco Silva) and £37m player impairment (£26m in 2020). Also £39m new stadium costs (£20m in 2020), which can be capitalised once planning permission granted.

On the other hand, #EFC have increasingly relied on profit from player sales, which has averaged an impressive £50m a season over the last 4 years, compared to just £13m in the preceding 6 years.

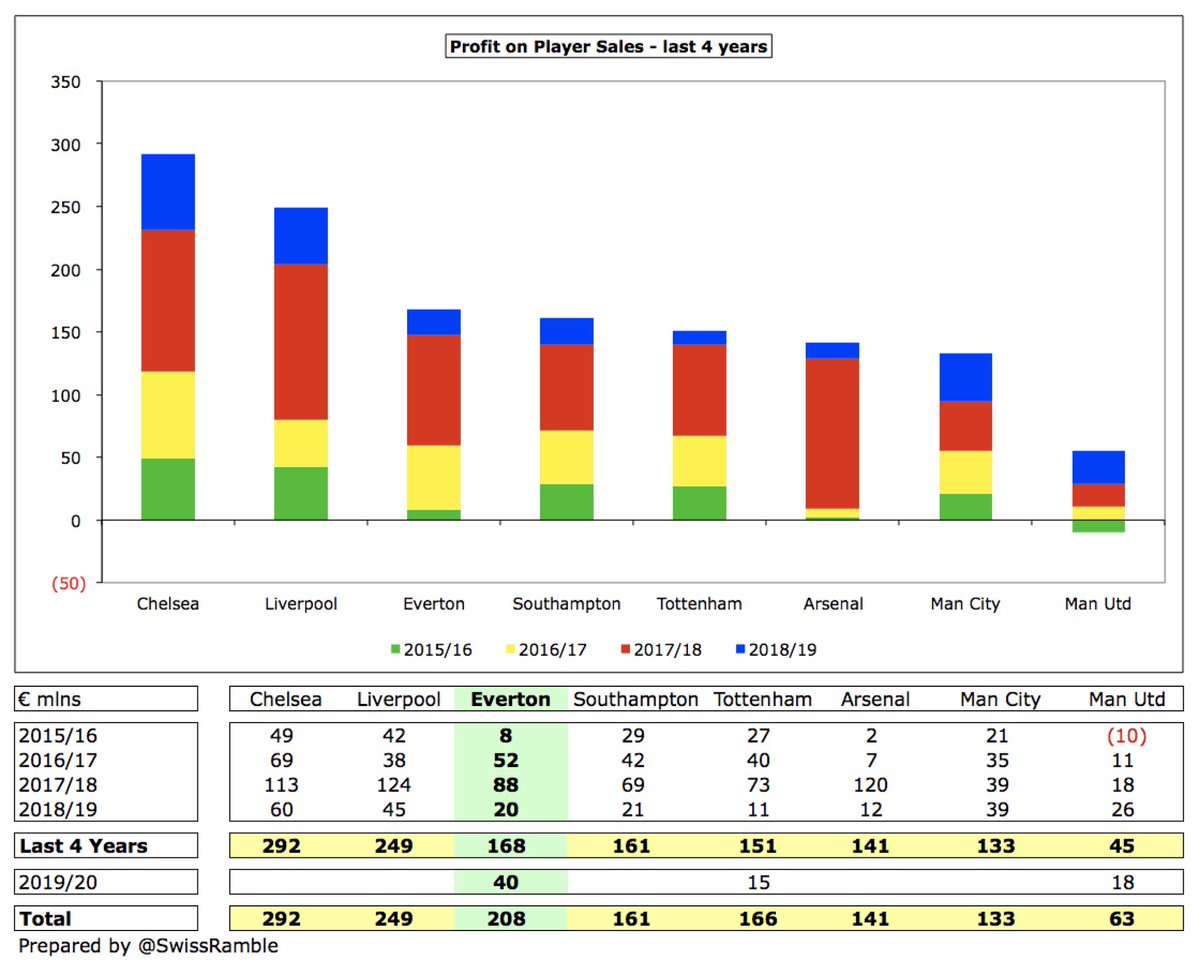

In fact, only #CFC and #LFC made more money from player sales than #EFC £168m in the four years up to 2019, though Everton did better than #THFC, #AFC, #MCFC and #MUFC. They will need to adopt this as a key part of their business model to achieve sustainability in the short-term.

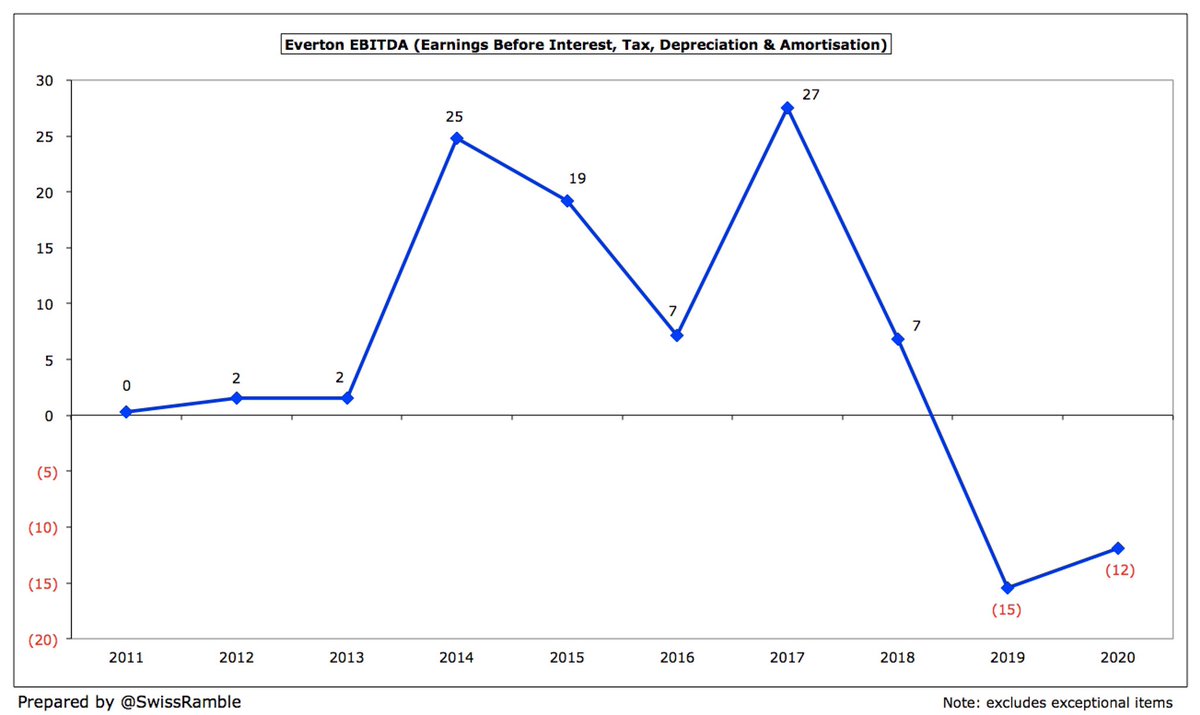

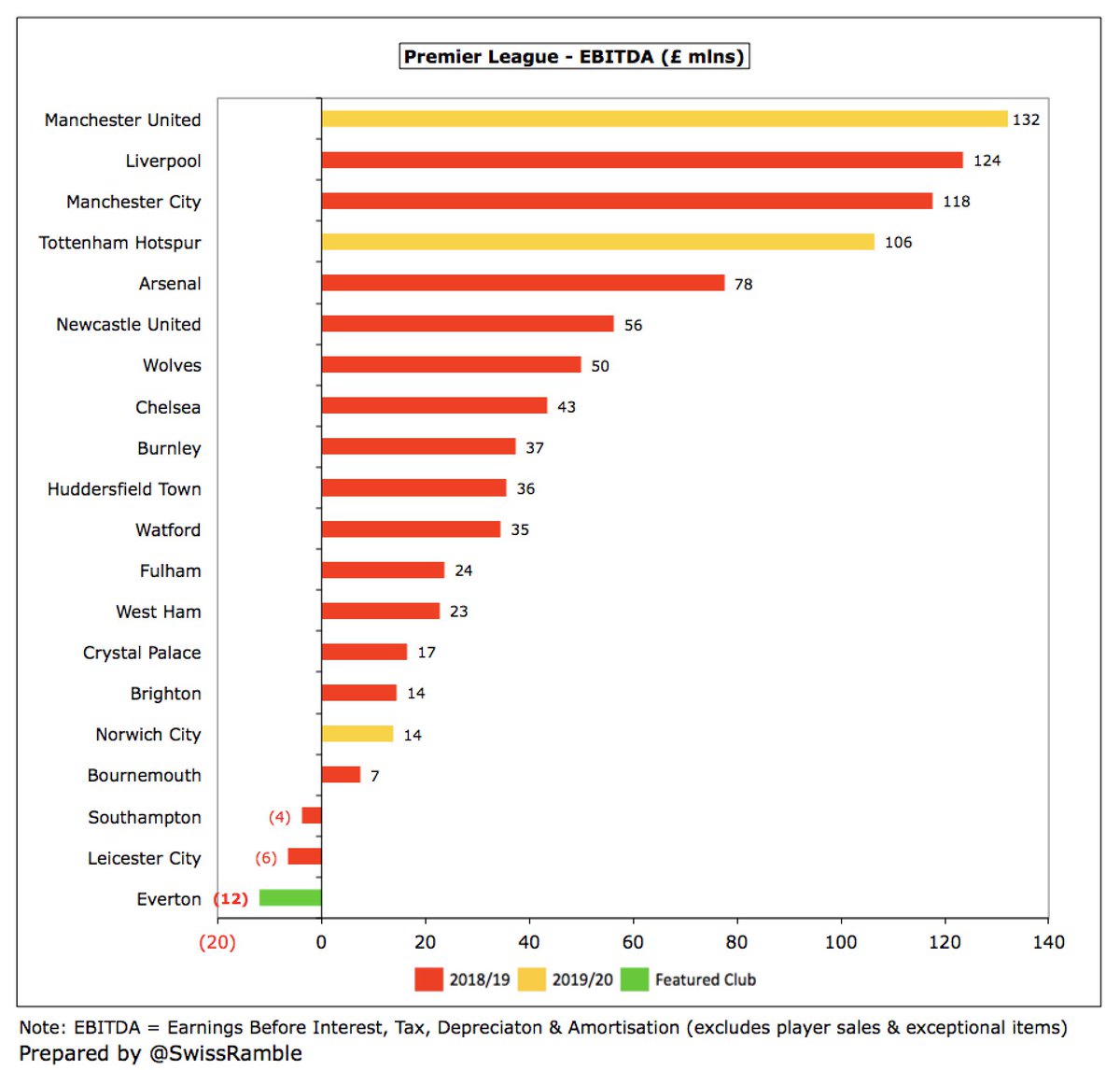

#EFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for cash operating profit, as it strips out player sales and exceptional items, improved slightly from £(15)m to £(12)m, though this was still the worst in the Premier League.

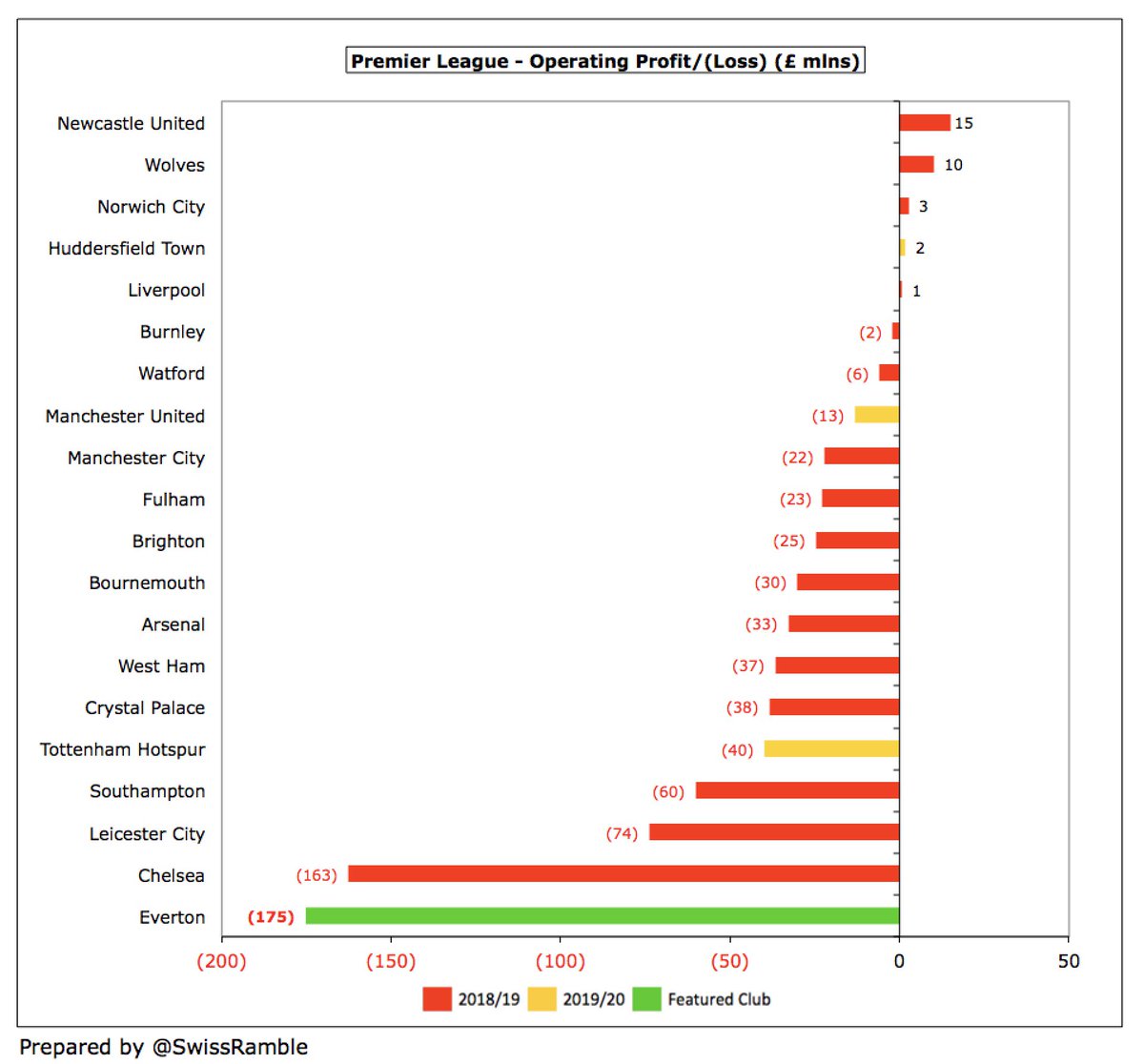

At an operating level (i.e. excluding player sales and interest), #EFC loss increased from £127m to £175m. Very few Premier League clubs post operating profits, but Everton’s loss is (currently) the highest this season and only surpassed by #MCFC 2011 £195m in PL history.

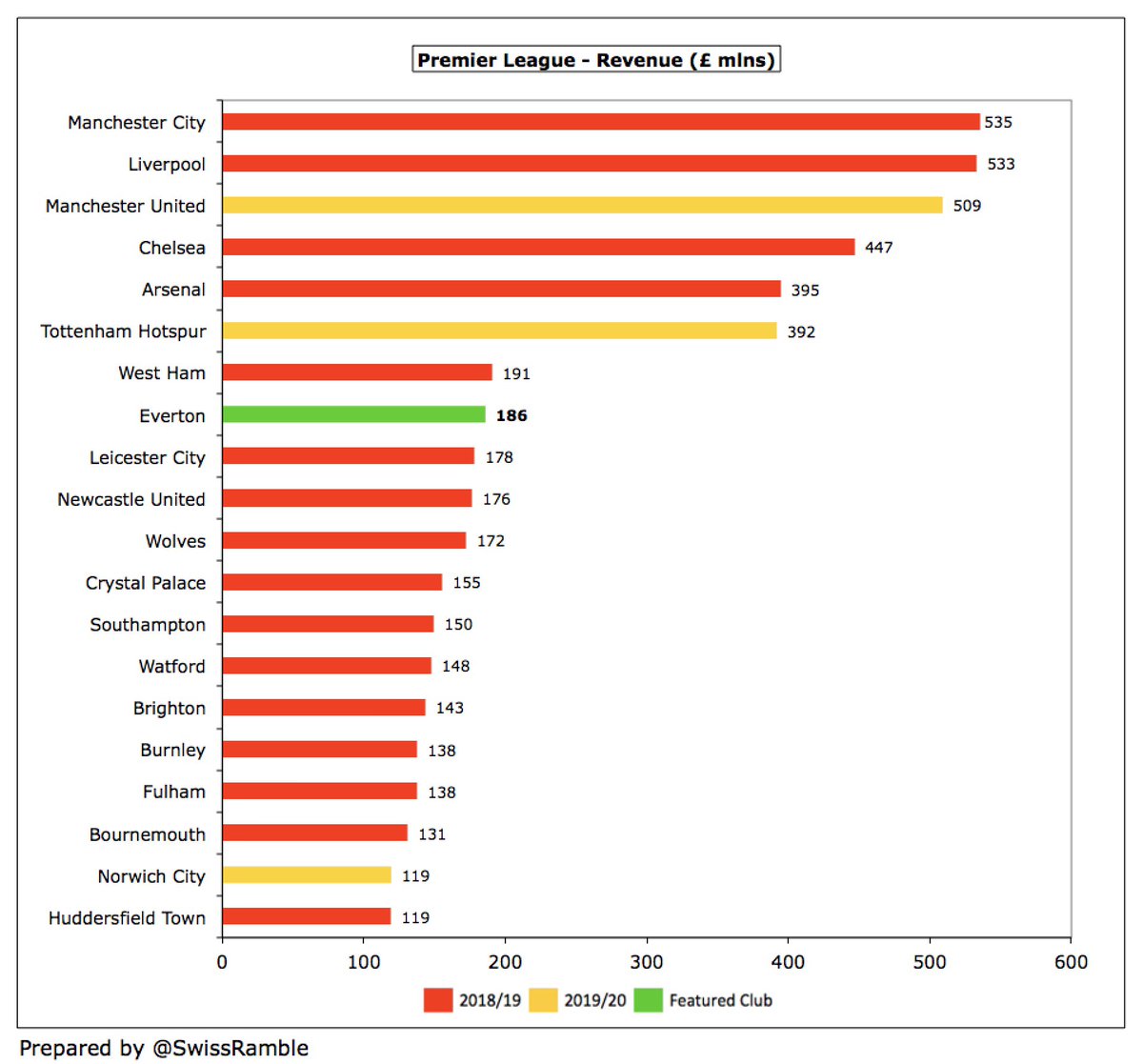

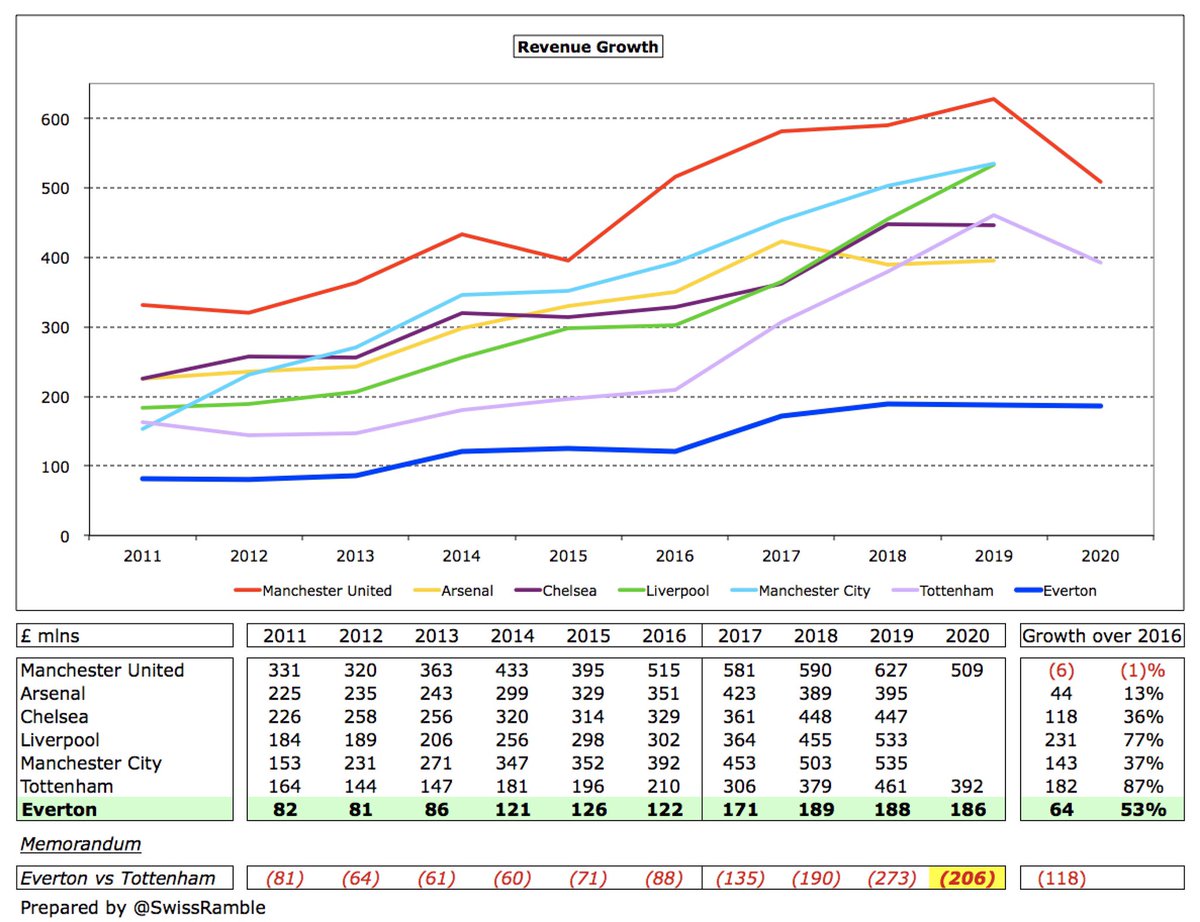

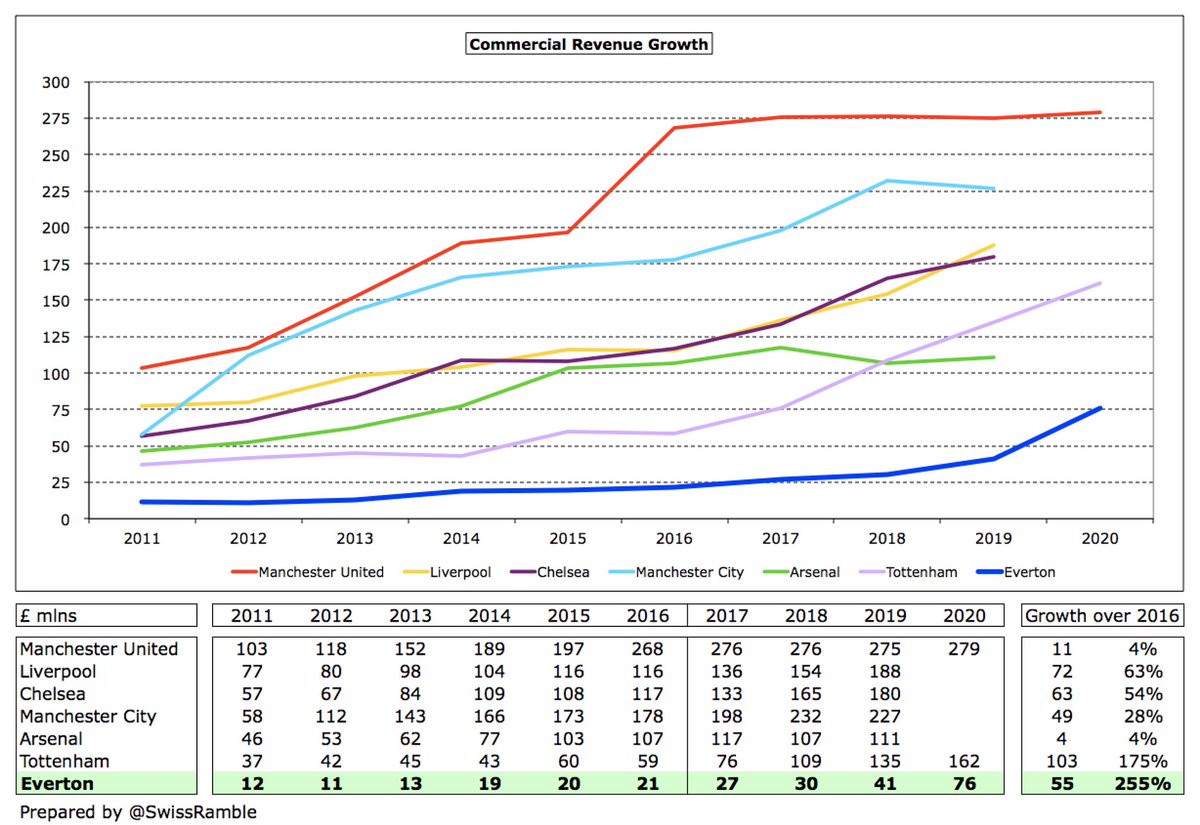

#EFC £186m revenue has grown £64m (53%) from £122m in 2016. Vast majority of the growth has come from commercial £55m, though TV revenue also up £15m, despite 2019/20 deferrals and rebates. Note: if outsourced catering/retail were included, revenue would be £6m higher at £192m.

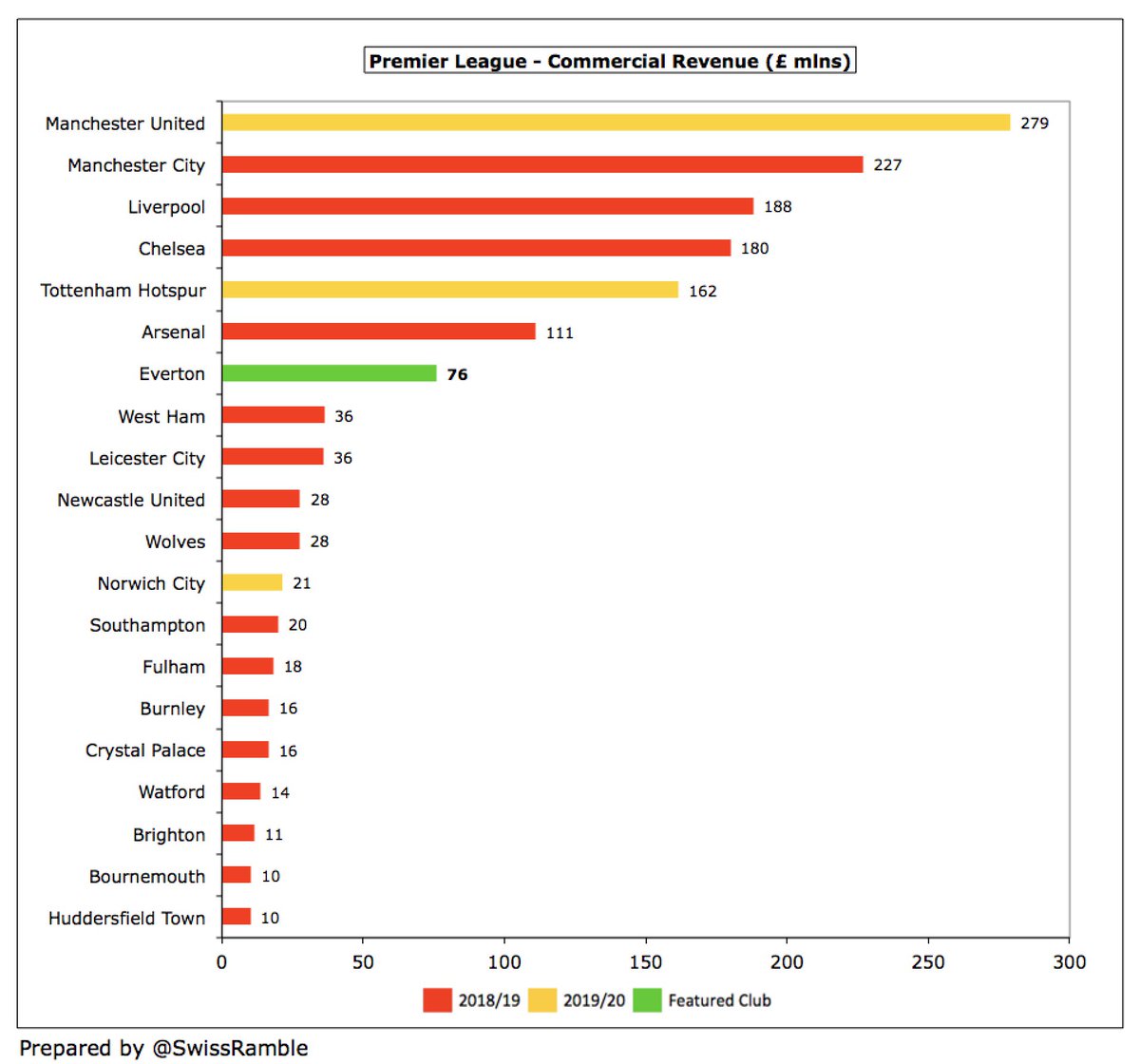

Despite #EFC revenue growth, there remains a huge disparity with the “Big Six”, where the lowest revenue (#THFC £392m) is more than twice as much. In fact, all of the leading clubs’ revenue growth in the last four years is higher than Everton, except #MUFC and #AFC.

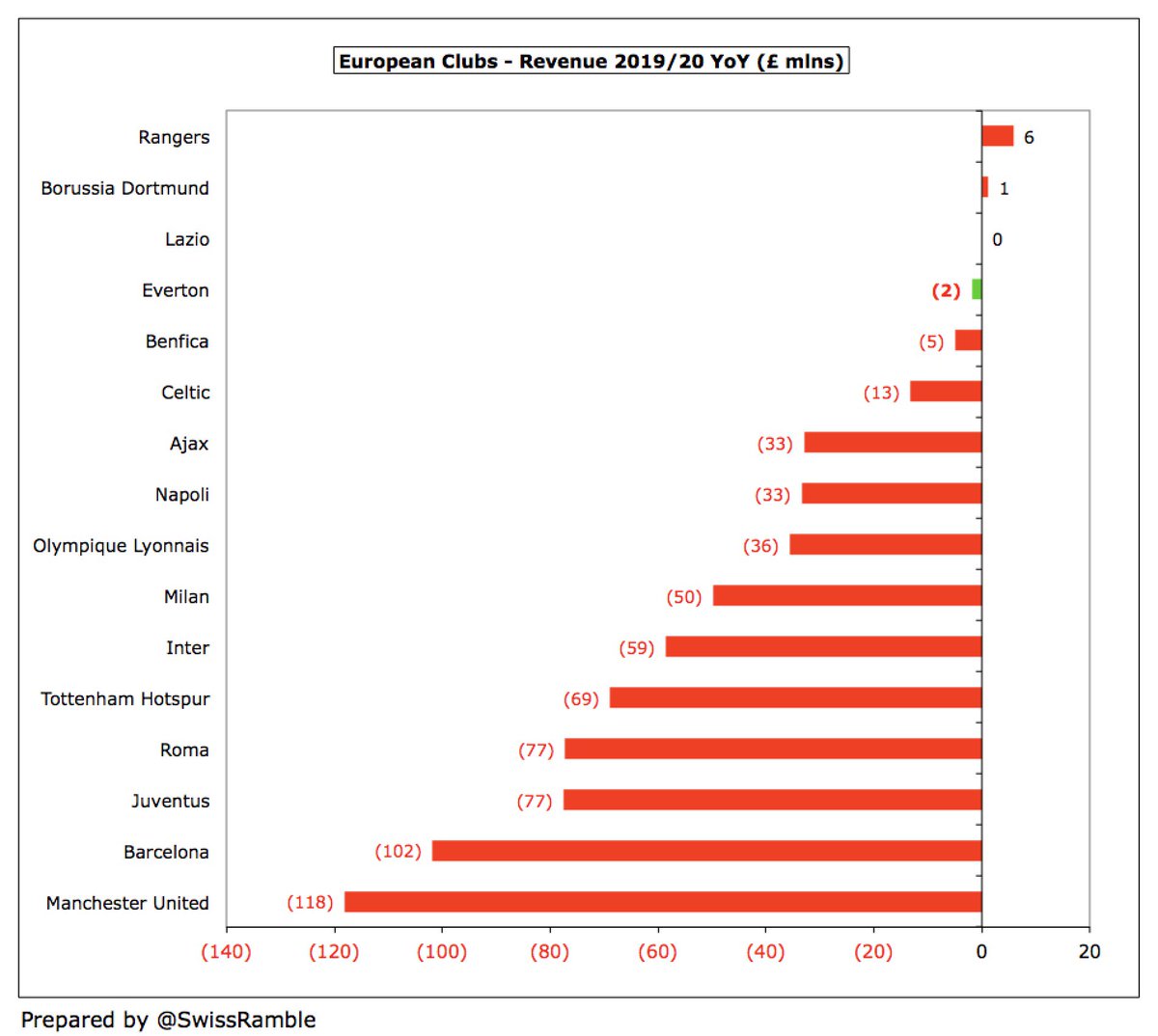

More positively, #EFC small £2m revenue decrease in 2019/20 is one of the better results of clubs that have so far published accounts with many announcing significant reductions: #MUFC £118m, Barcelona £102m, Juventus £77m, Roma £77m and #THFC £69m

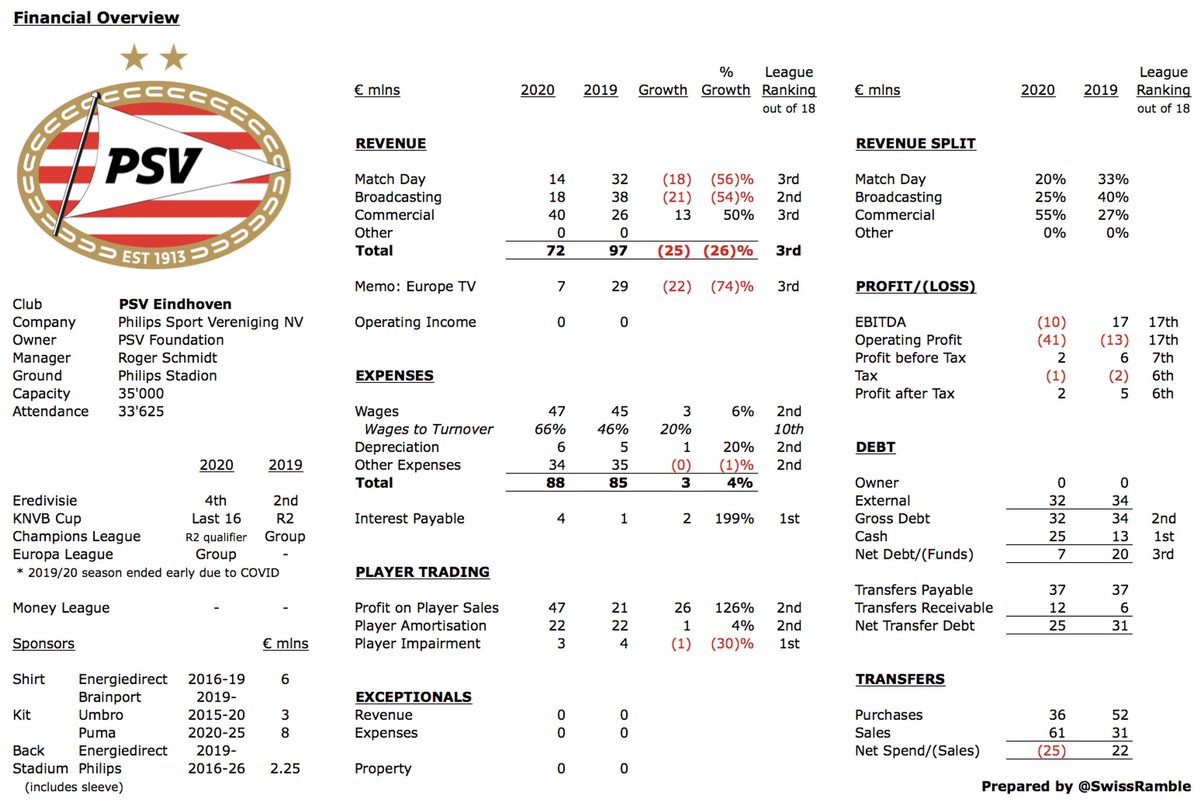

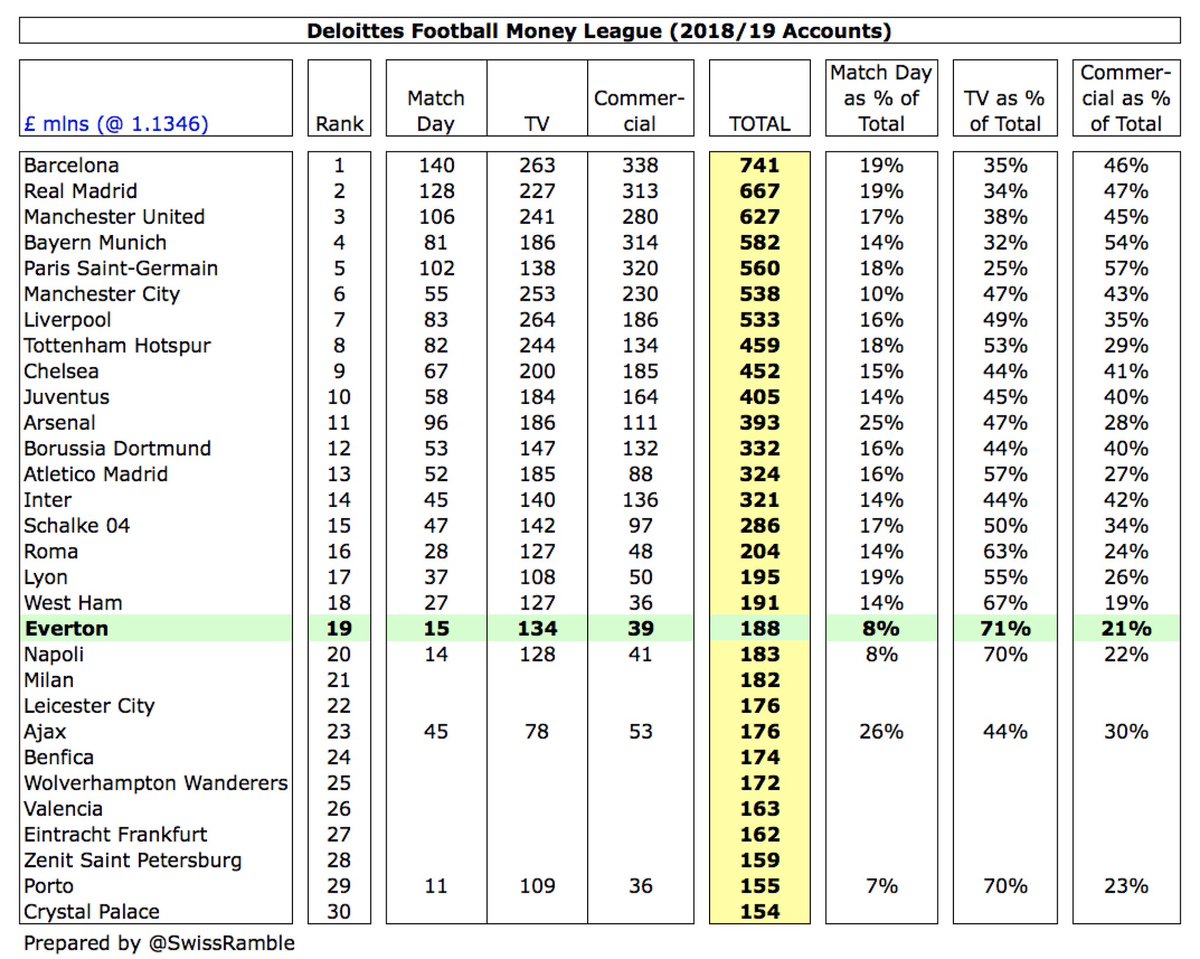

Based on 2018/19 revenue, #EFC dropped two places from 17th to 19th in the Deloitte Money League, which ranks clubs globally by revenue. Their £188m was higher than the likes of Napoli £183m, Milan £182m, Ajax £176m and Benfica £174m.

TV money has driven #EFC revenue growth in recent years, but plunged £35m (26%) from £133m to £98m, due to revenue from 7 games slipping to 2020/21 accounts (plus rebate to broadcasters) and lower Premier League finishing position. One of lowest in PL, but others will also fall.

#EFC Premier League TV money fell £28m from £124m to £96m, though £22m revenue has been deferred into 2020/21 accounts, as 2019/20 season extended beyond June. However, next season will also include a £9m rebate to broadcasters for the same reason.

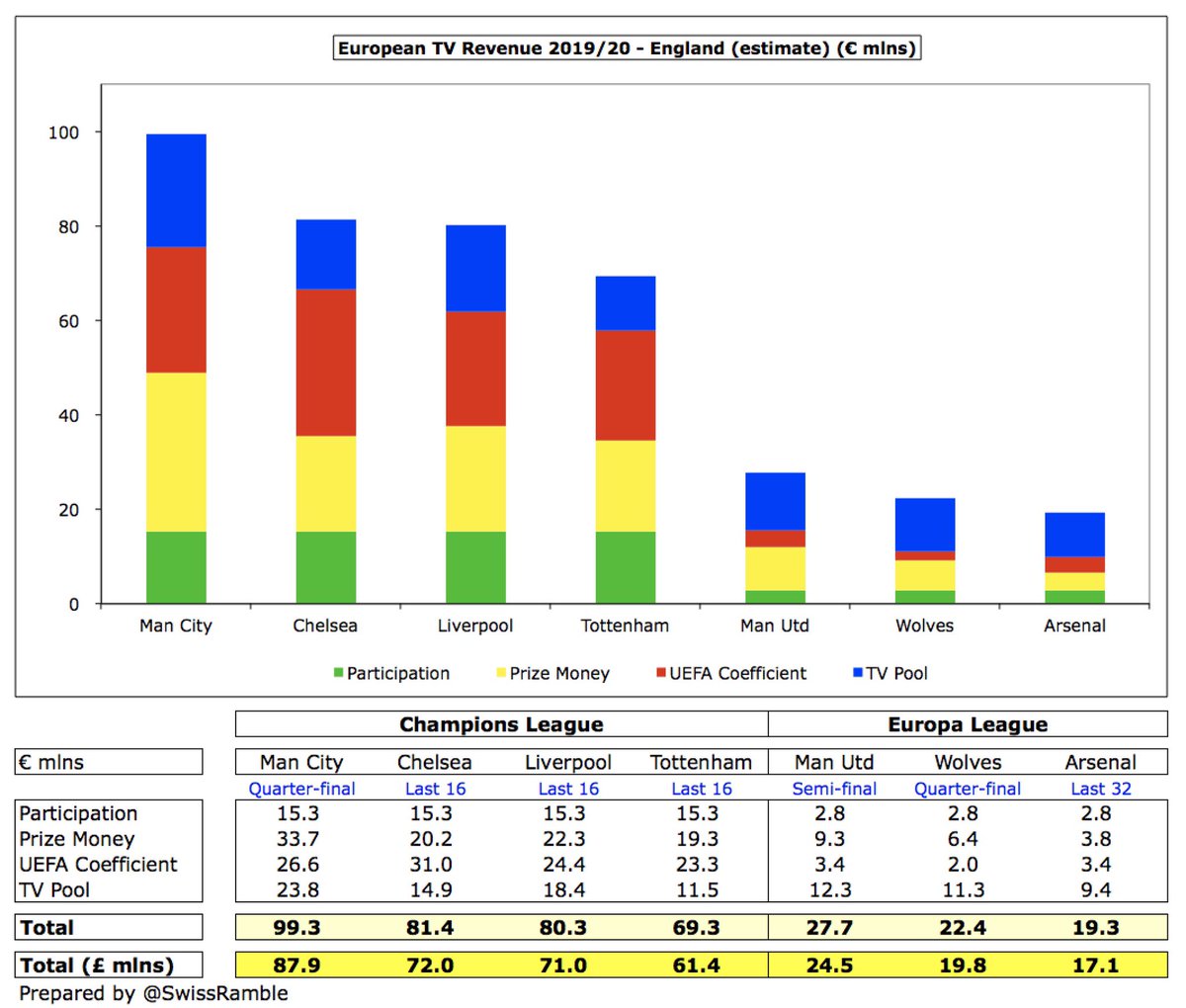

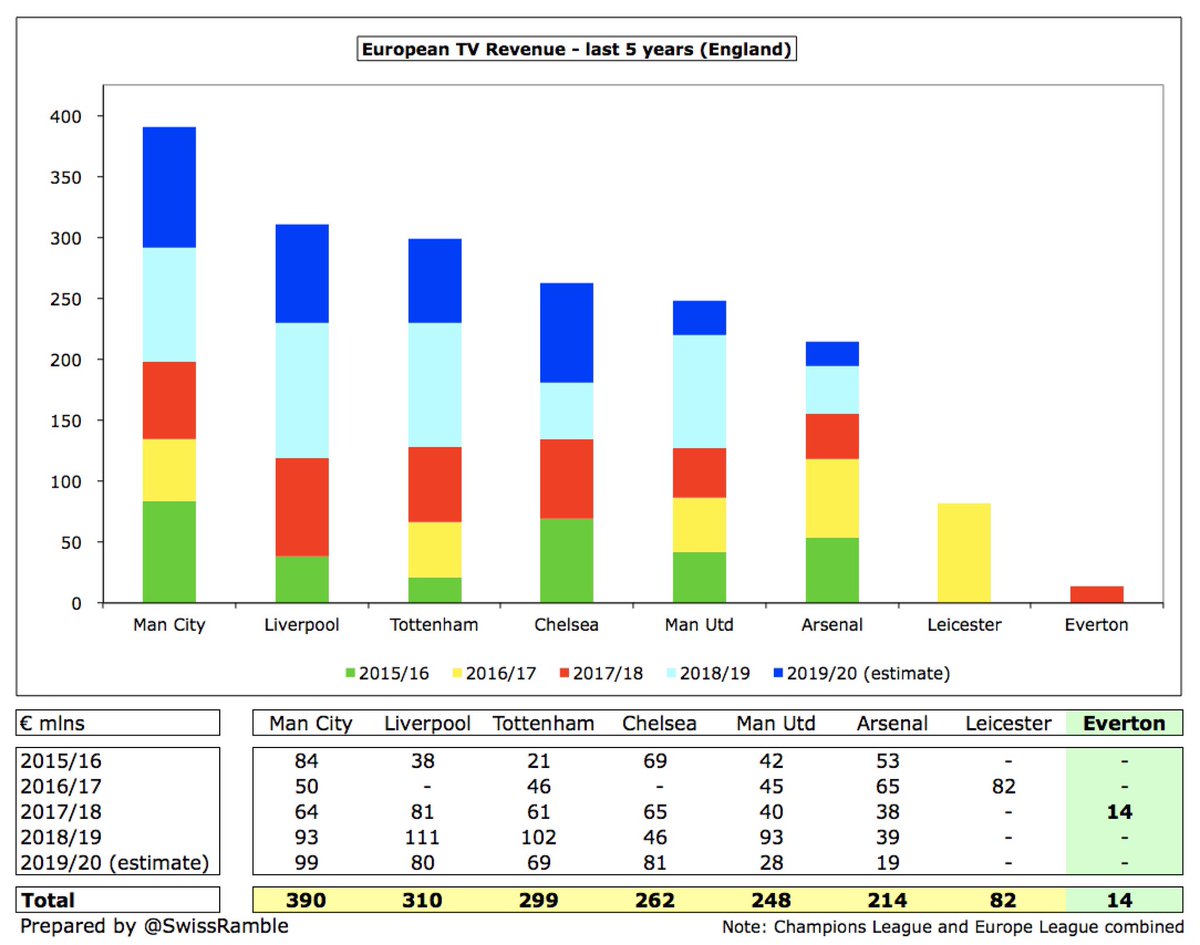

#EFC strategy is to spend big in the hope of securing regular European football, worth £60-90m in 2020 for Champions League entrants and £17-25m for the Europa League. Everton have earned €14m from Europe in last 5 years, compared to #MCFC €390m, #LFC €310m and #THFC €299m.

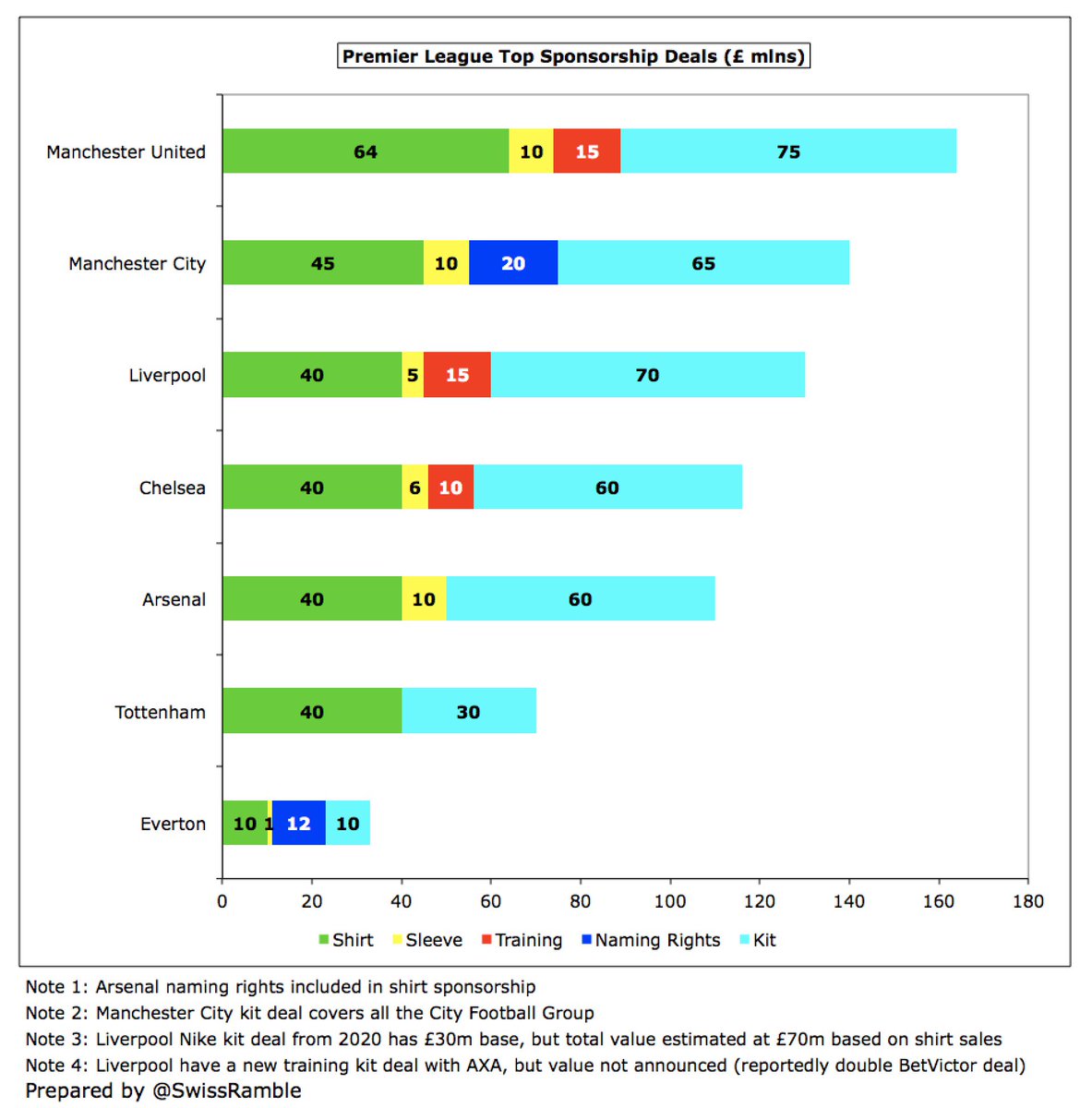

#EFC commercial revenue increased by £35m (86%) from £41m to £76m, comprising sponsorship, advertising & merchandising £64m and other commercial £12m, though this does include once-off £30m payment from USM for stadium naming rights option.

Note: #EFC “innovative” deal where USM paid for option to buy naming rights for new stadium is not for the actual naming rights, but just an option for first refusal. The Premier League will review agreement to check it is in line with FFP.

Thanks to that option, #EFC growth in commercial income since 2016 compares favourably with the Big Six, and is highest in percentage terms. Although the gap has narrowed, Everton £76m is still a long way below the likes of #MUFC £279m, #MCFC £227m and #LFC £188m.

From 2020/21 #EFC have two new 3-year sponsorships: Cazoo have replaced SportPesa (shirt) for similar amount, £10m a year, while Hummel will pay £10m for kit deal, replacing Umbro £6m. Also include £12m USM training ground naming rights deal.

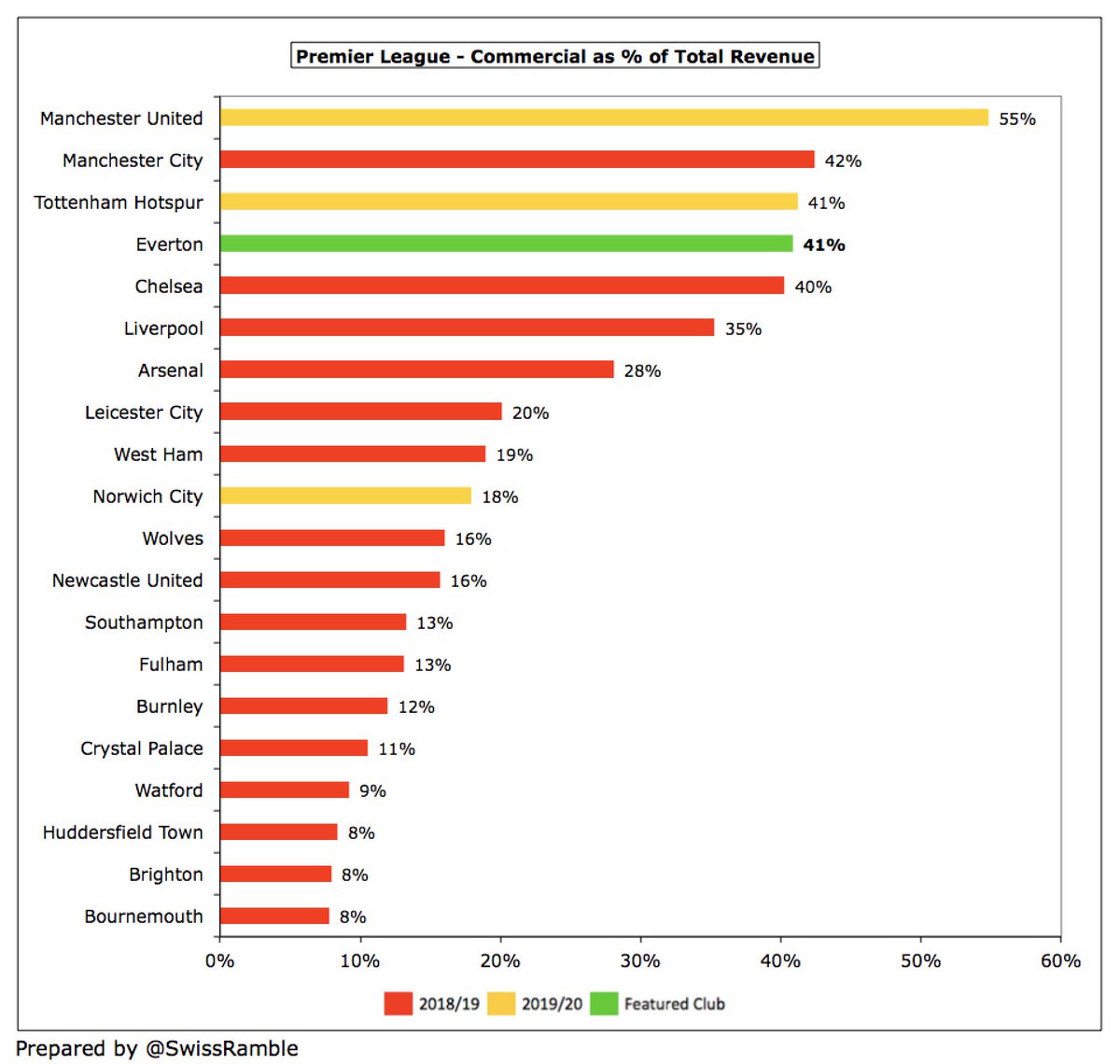

#EFC CEO Denise Barrett-Baxendale said, “It is encouraging that our commercial performance has improved markedly, and this will continue to be a priority moving forward.” Indeed, it now represents 41% of total revenue, one of the highest in the Premier League.

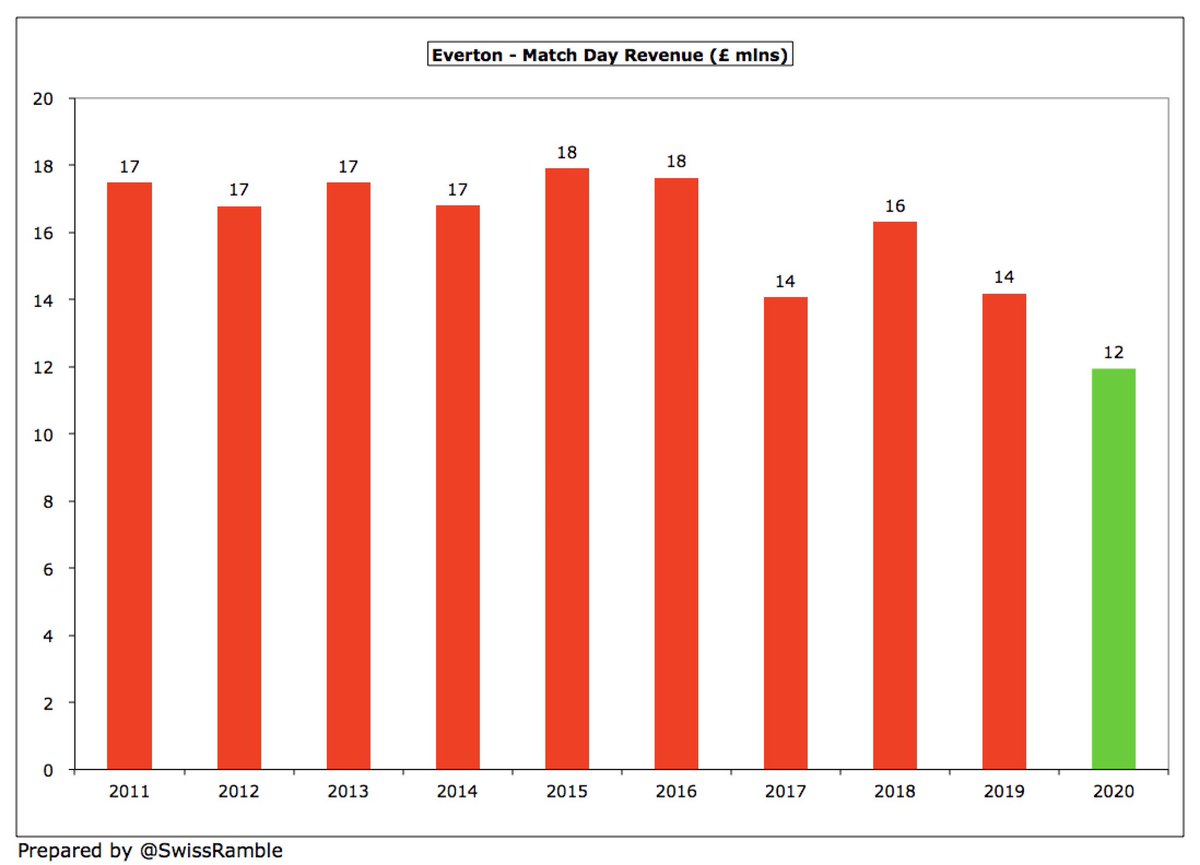

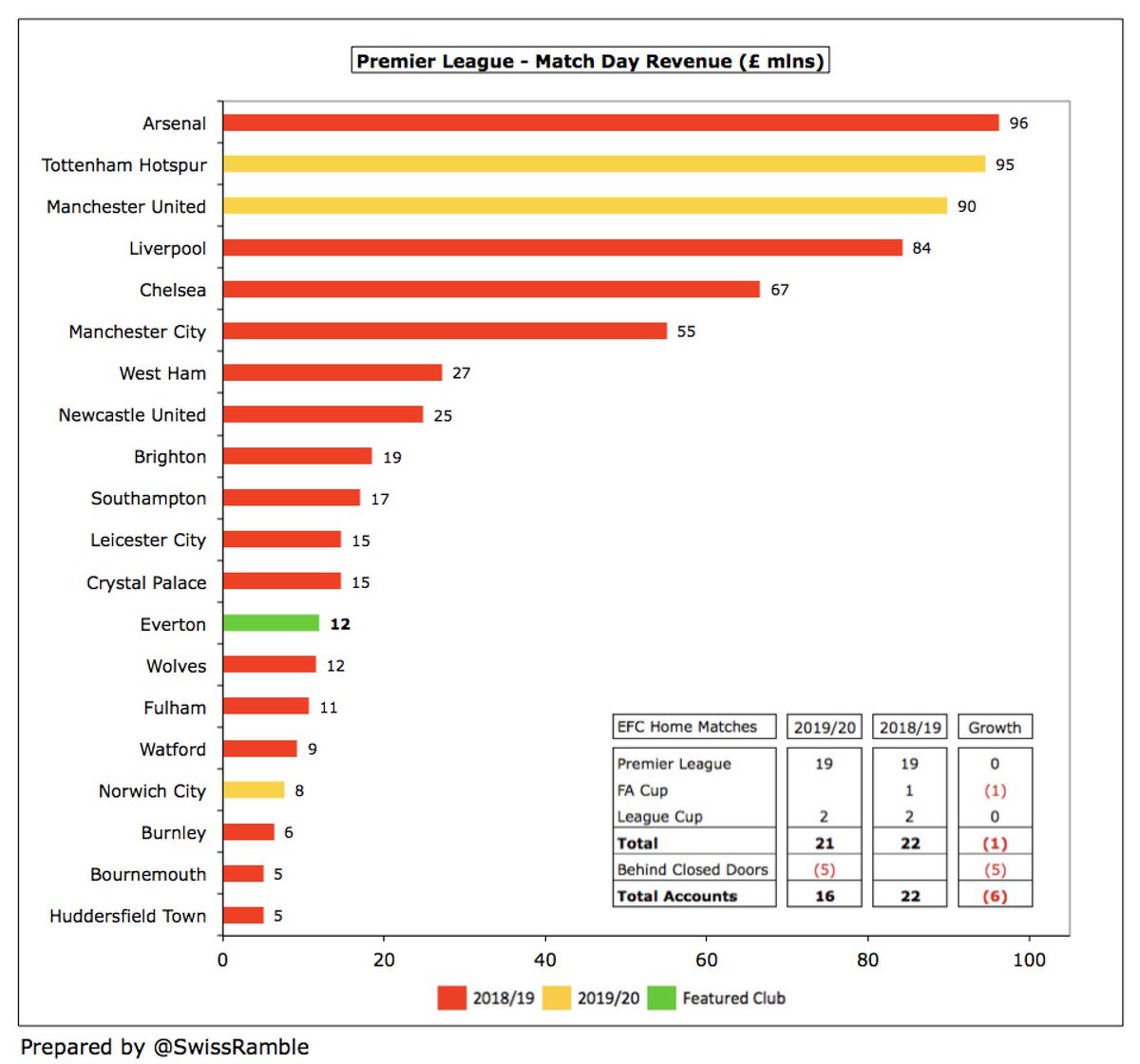

#EFC gate receipts fell £2m (16%) from £14m to £12m, due to 5 games played behind closed doors and 1 Cup game less. This is very low compared to the elite clubs, e.g. #LFC earn around 7 times as much £84m, while Everton are even below likes of #BHAFC and #CPFC.

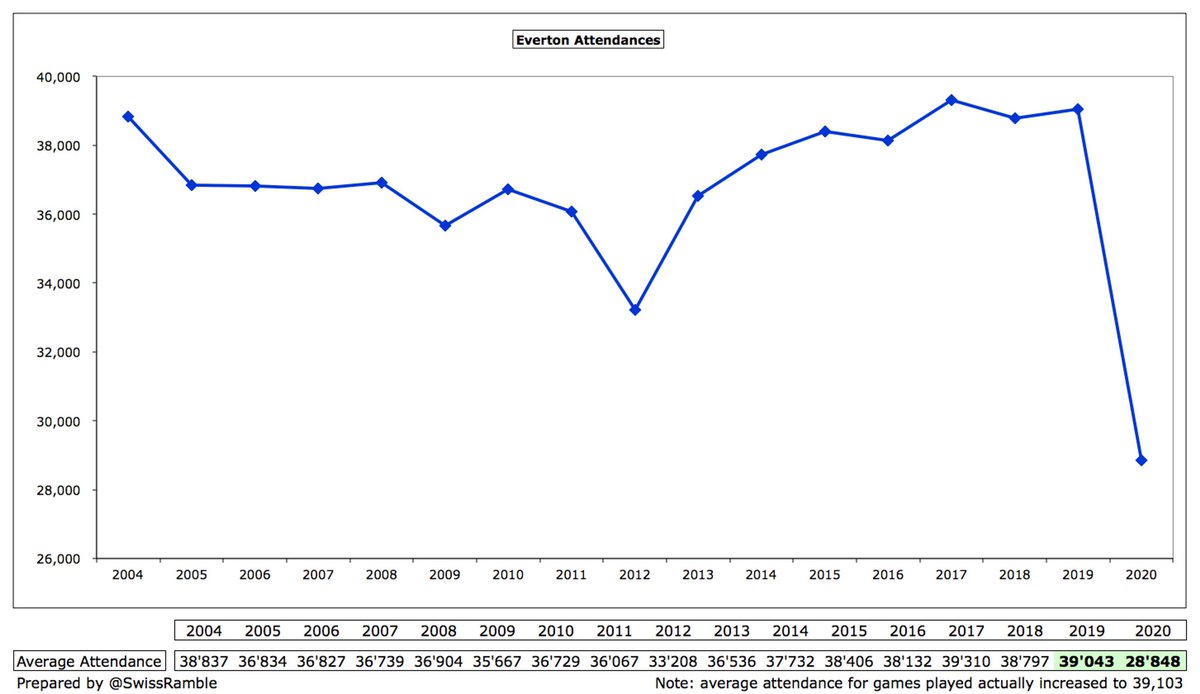

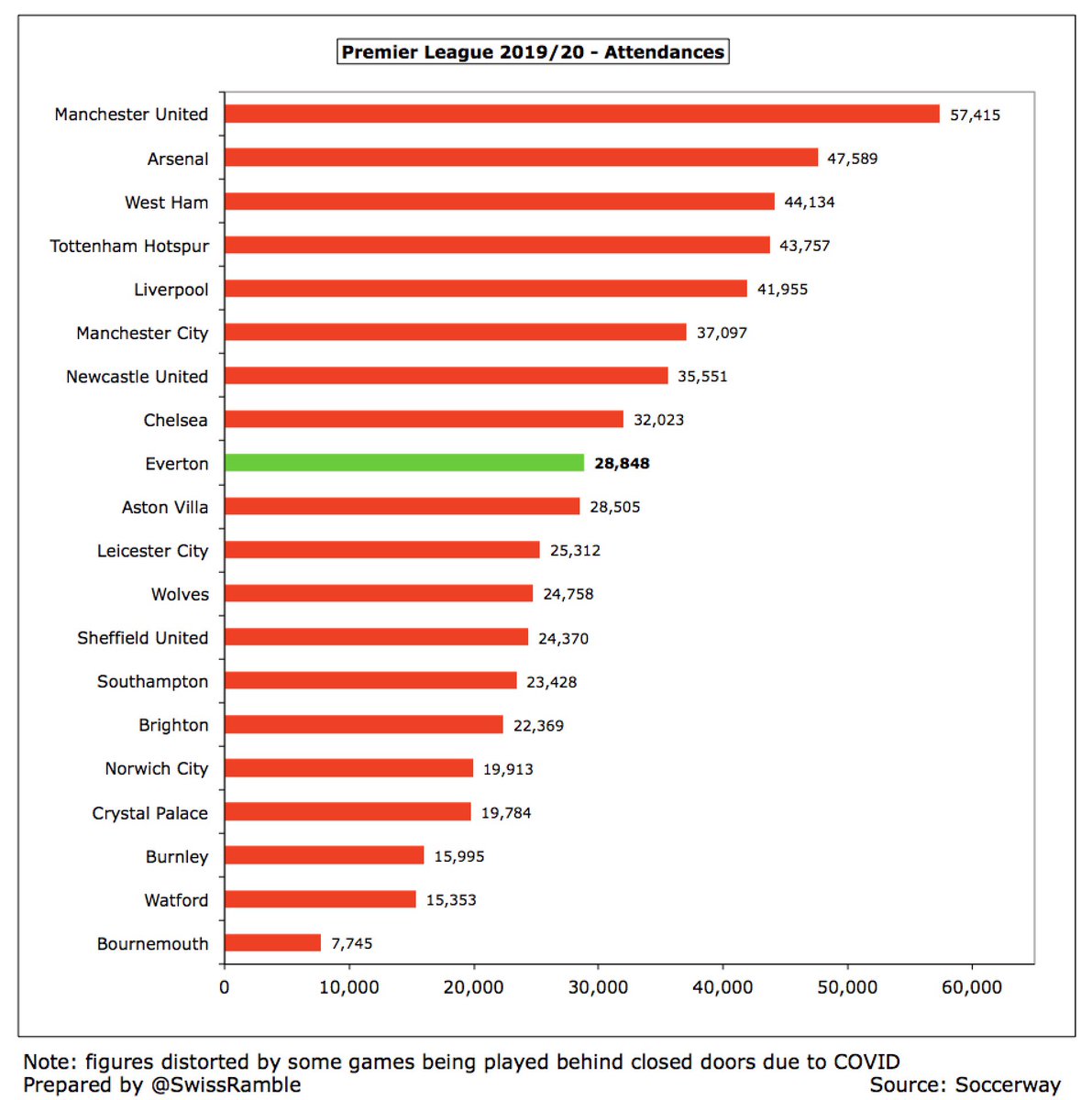

As 5 games played behind closed doors, #EFC average attendance fell from 39,043 to 28,848, though rose to 39,103 for games with fans in attendance. 9th highest in Premier League. Some of cheapest prices in top flight – most expensive season ticket less than £30 a match.

#EFC hope to start work on new 52,000 capacity stadium at Bramley-Moore Dock in 2021, if planning permission granted. Estimated cost is £500m, but could be a game-changer, as seen by #THFC match day income rising to £95m (even in COVID-impacted season) with their new stadium.

#EFC wage bill rose £5m (3%) to £165m, though the underlying growth is £17m (12%), as prior year accounts included 13 months. This means that wages have virtually doubled in just 4 years from £84m in 2016. In the same period, revenue has only grown by 53%.

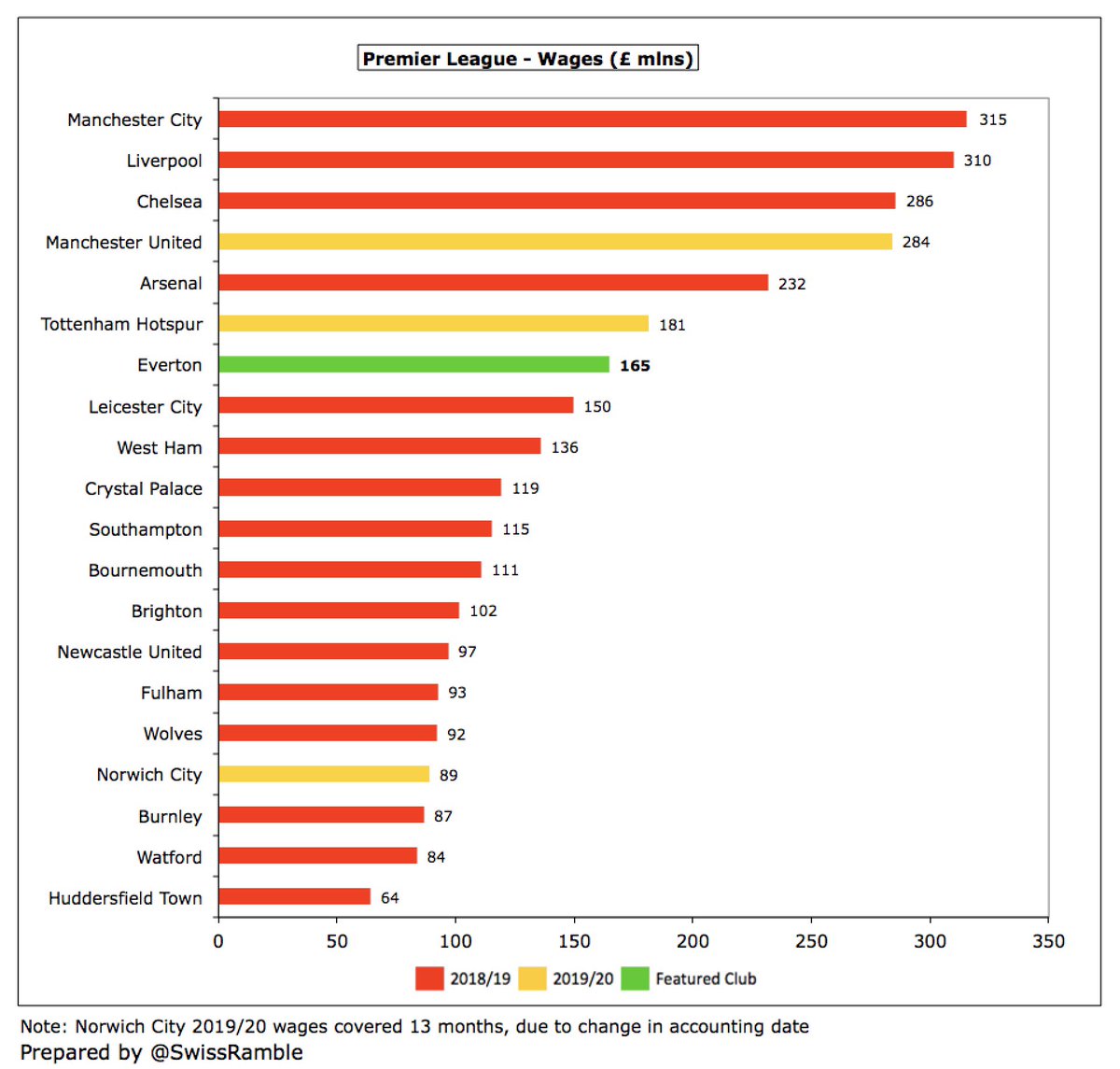

Following this growth, #EFC £165m wage bill is currently 7th highest in the Premier League, around £16m below #THFC. Despite the rise, it’s still only around half of #MCFC £315m and #LFC £310m, though these may drop when 2019/20 accounts are published.

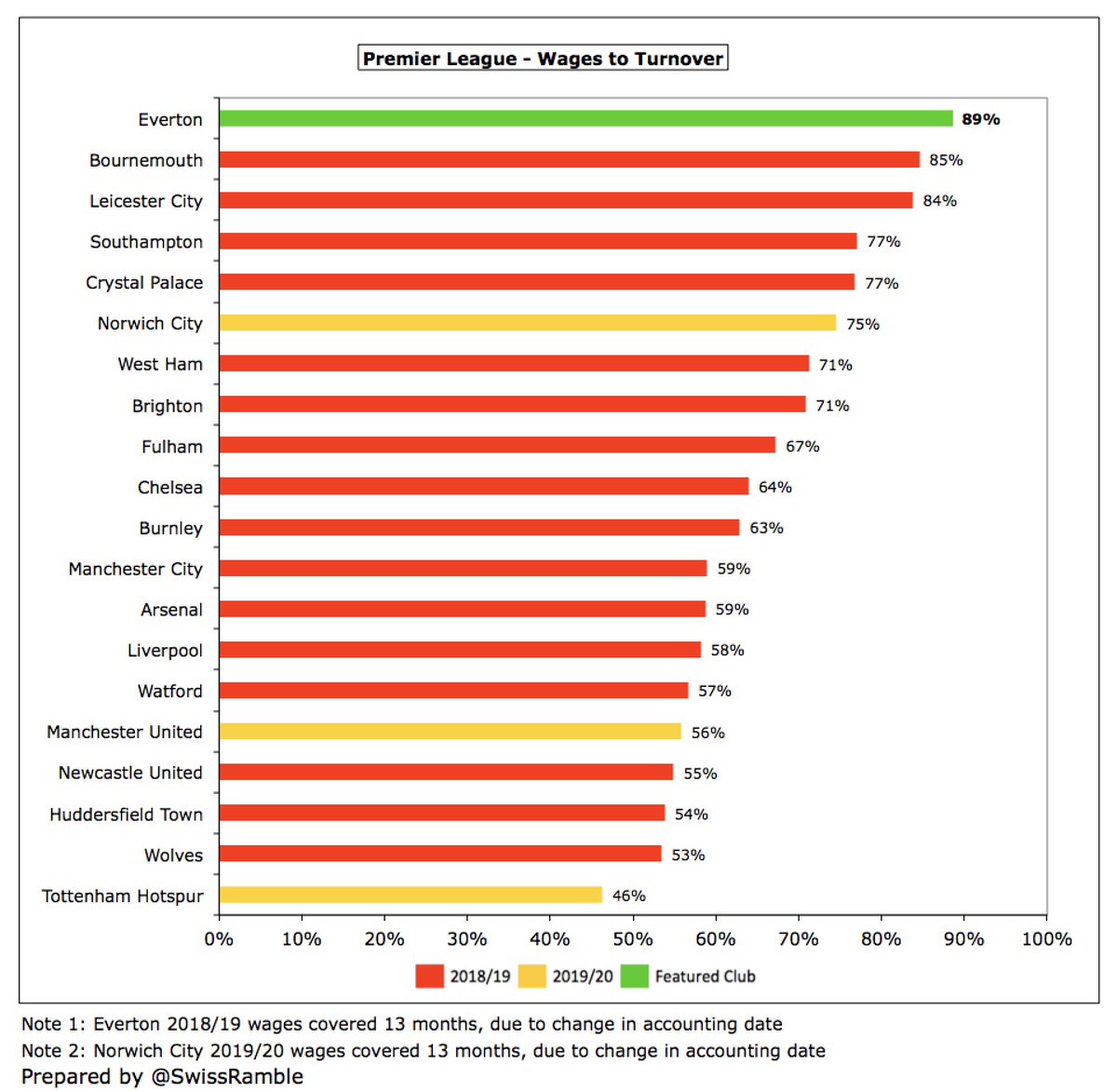

#EFC reported wages to turnover ratio increased from 85% to 89%, partly due to COVID-impacted revenue. This is the highest (worst) in the Premier League, even if we adjust for outsourced catering & retail revenue, which would reduce the ratio to 86%.

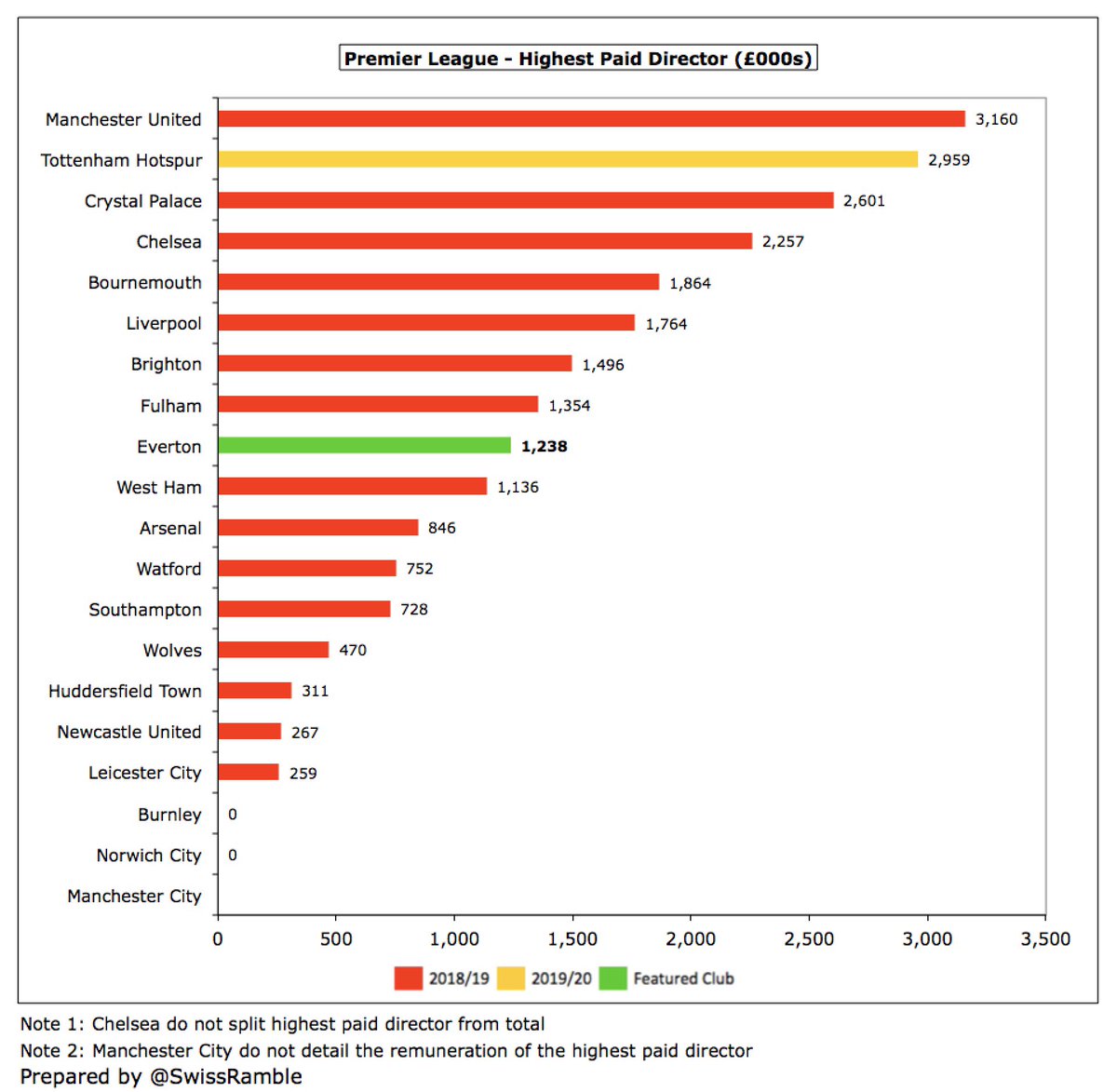

#EFC directors’ remuneration decreased from £3.6m to £3.5m, though the highest paid director rose £311k (34%) from £927k to £1,238k. This was mid-table in the Premier League, far below the likes of Ed Woodward at #MUFC and Daniel Levy at #THFC, both around £3m.

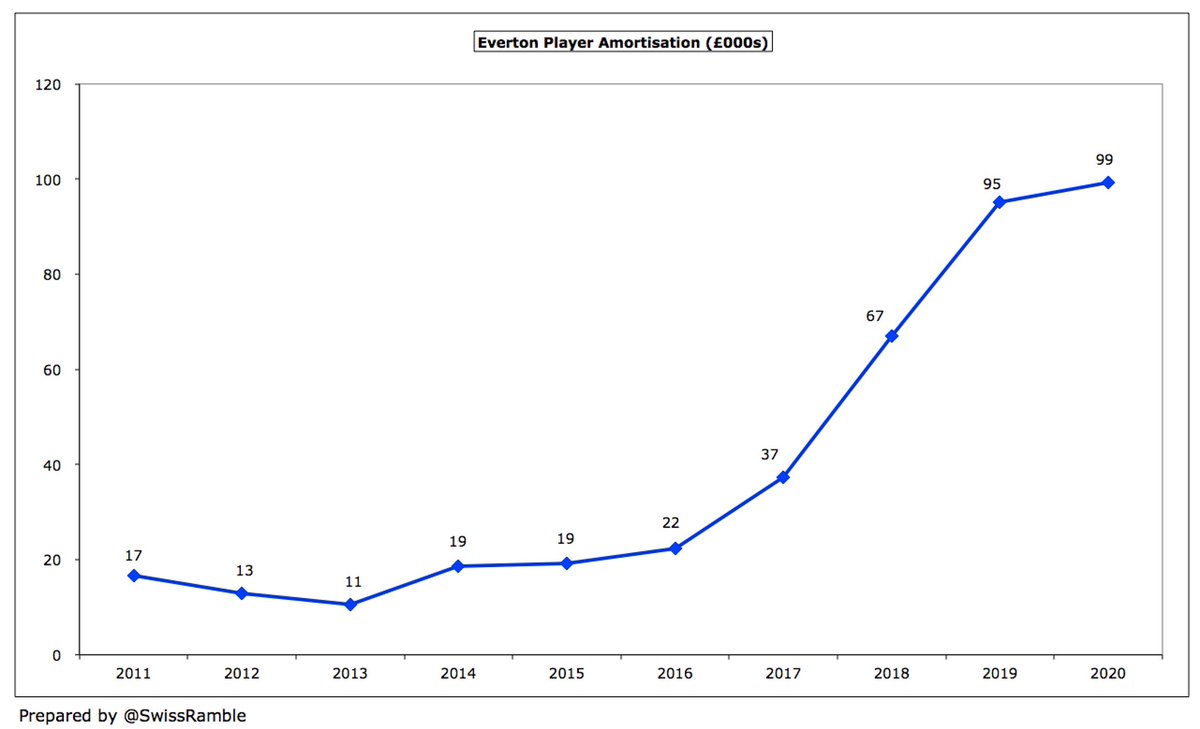

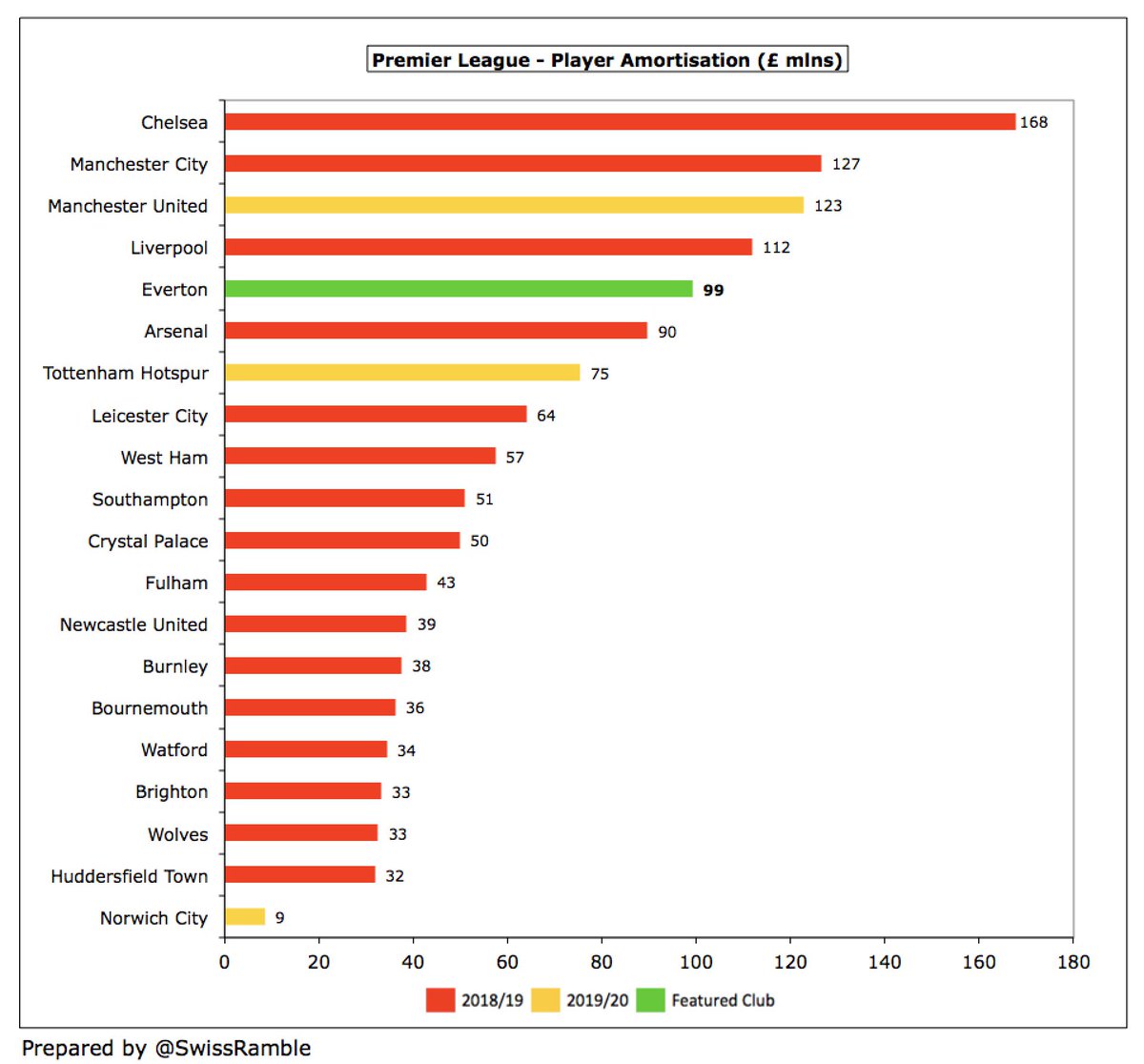

#EFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, rose £4m (4%) from £95m to £99m. This has more than quadrupled in 4 years, up from only £22m in 2016, and is now above both #AFC £90m and #THFC £75m.

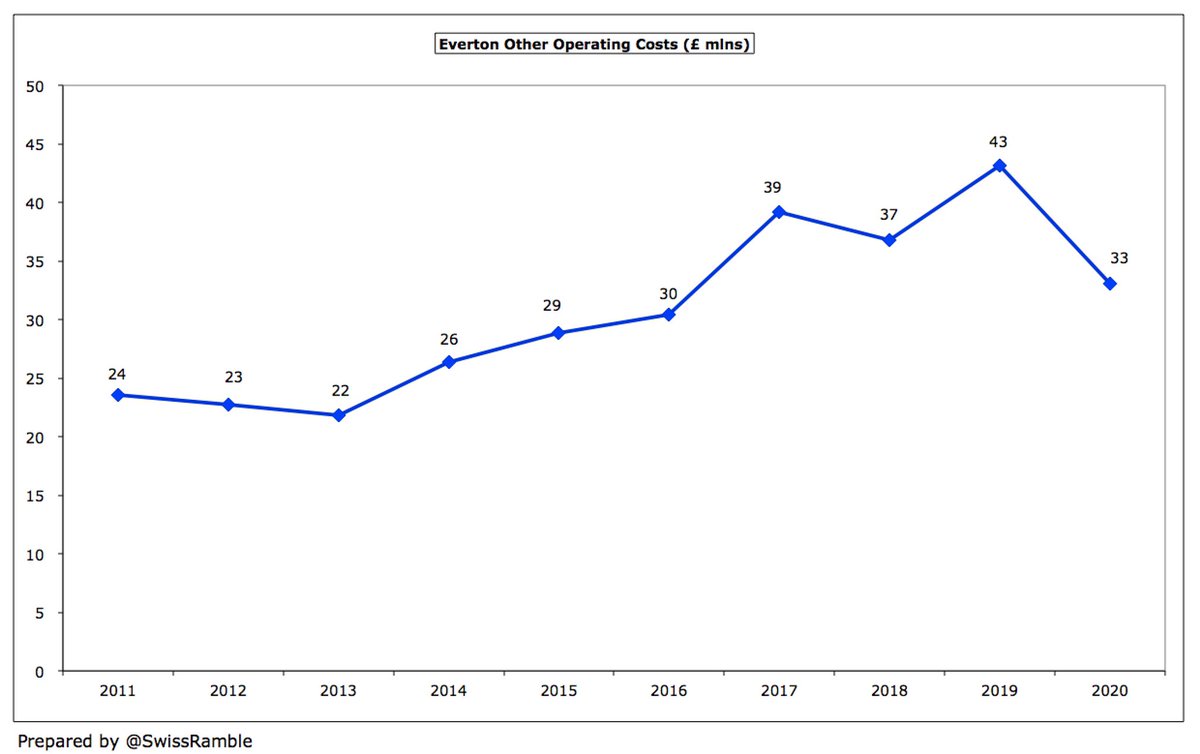

#EFC other operating costs fell £10m (23%) from £43m to £33m, partly due to “continued tight management of operational costs”, but also because prior year included an additional month after the change in year-end.

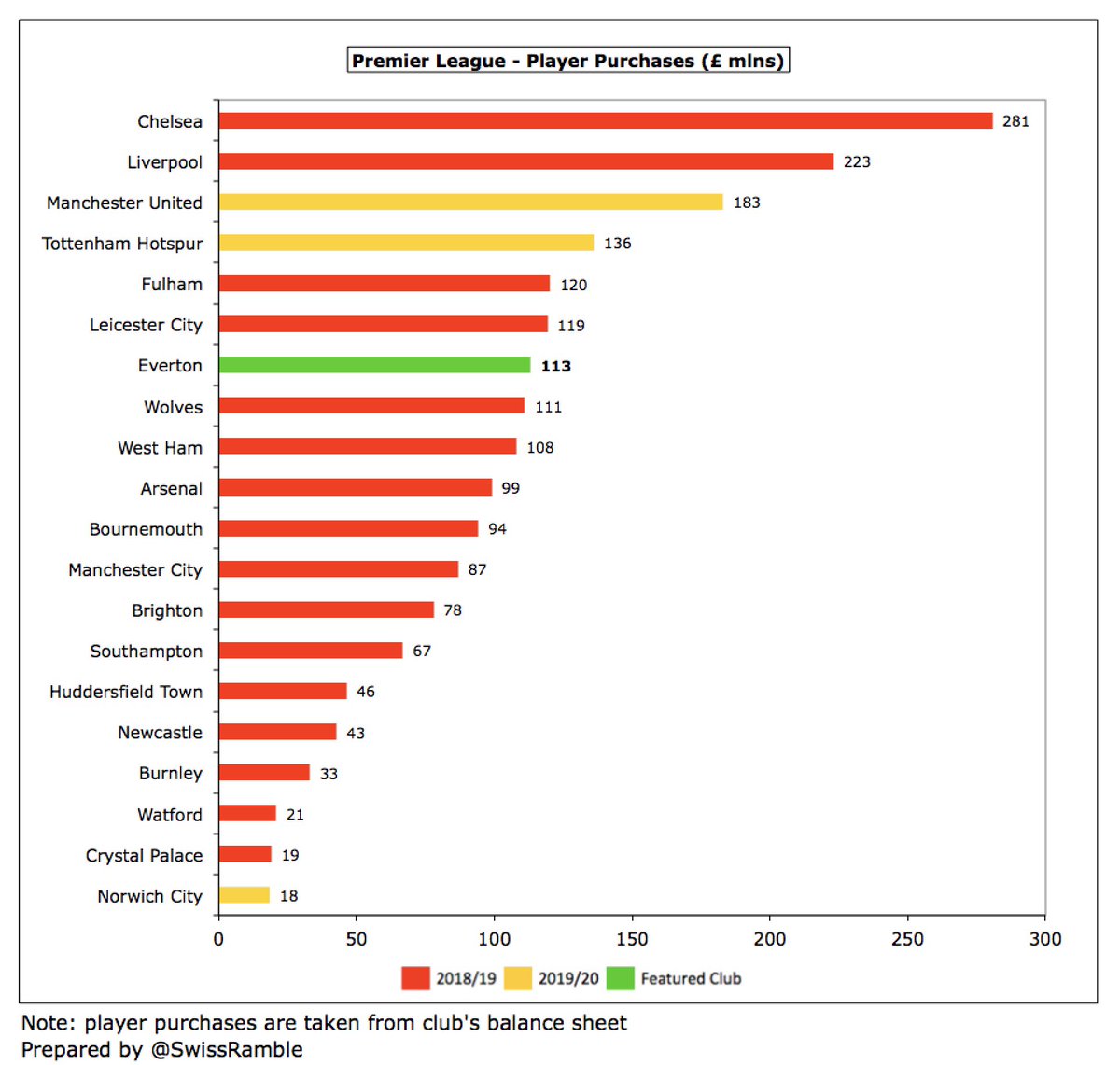

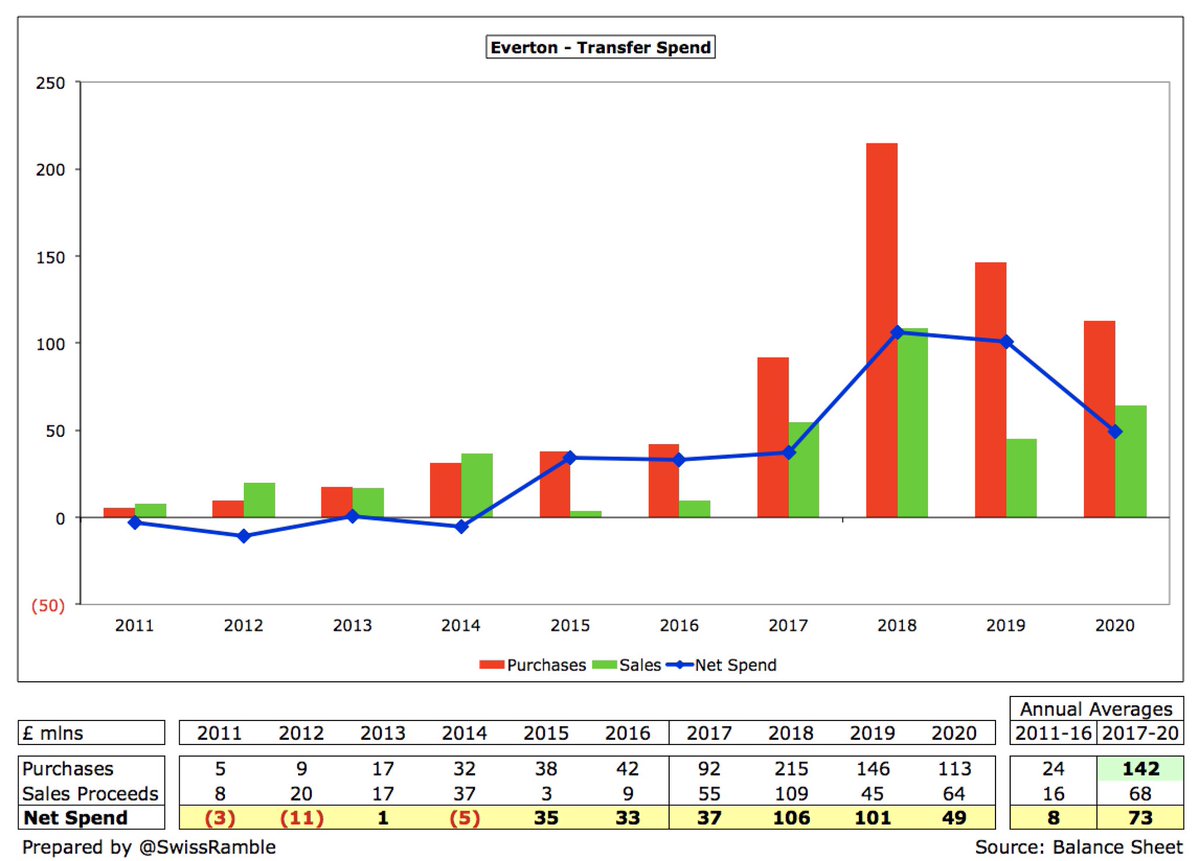

#EFC made £113m player purchases, including Moise Kean, Alex Iwobi, Fabian Delph and Jean-Philippe Gbamin, taking their expenditure in the past 4 years to an amazing £566m, thanks to Moshiri providing funds to support the squad improvements. Further £70m spent since year-end.

Since Moshiri’s arrival, #EFC have been far more active in the transfer market. In the last 4 seasons they averaged £142m gross spend, up from £24m average in the preceding 6 seasons. Over the same period, net spend has increased from £8m to £73m.

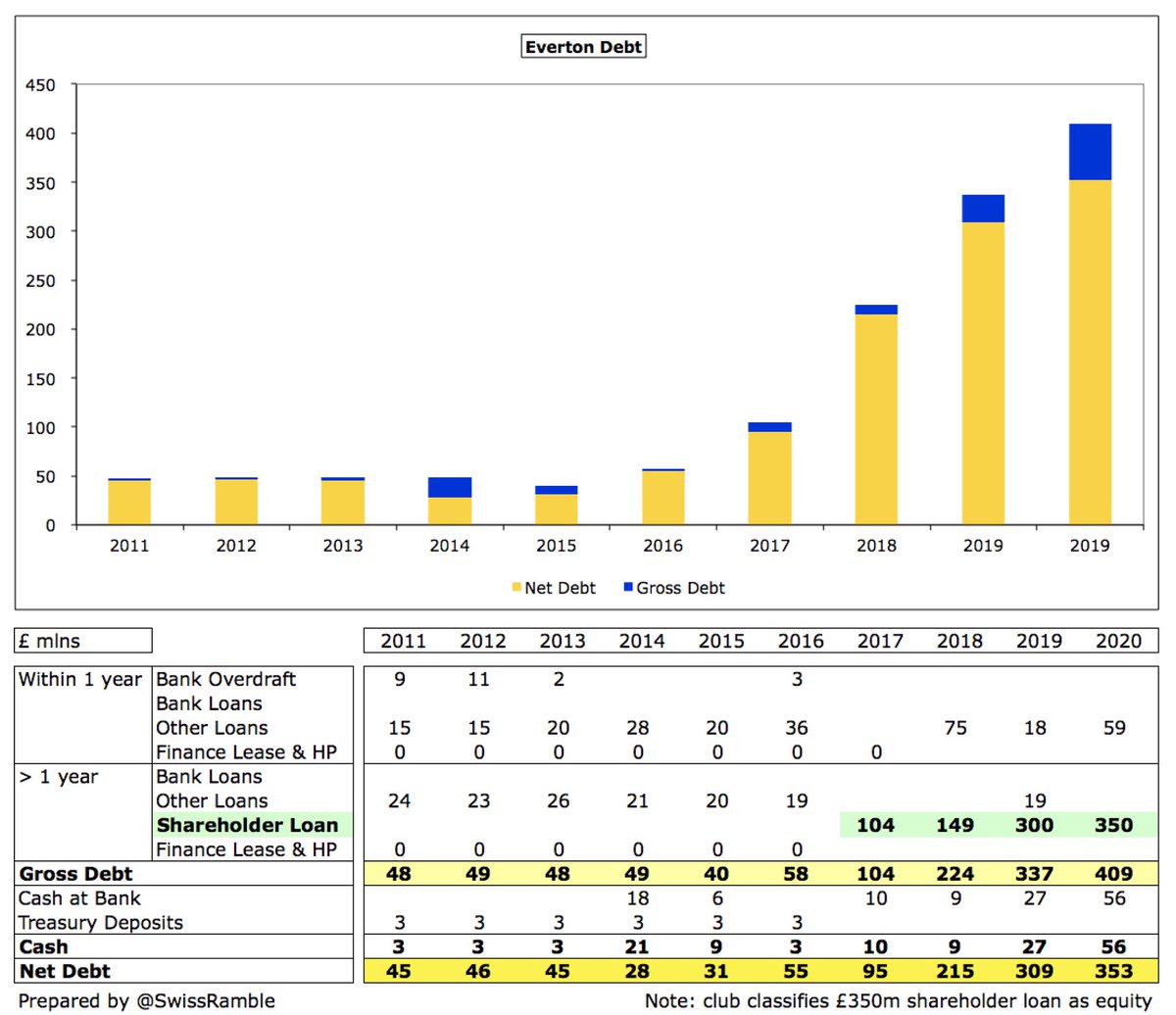

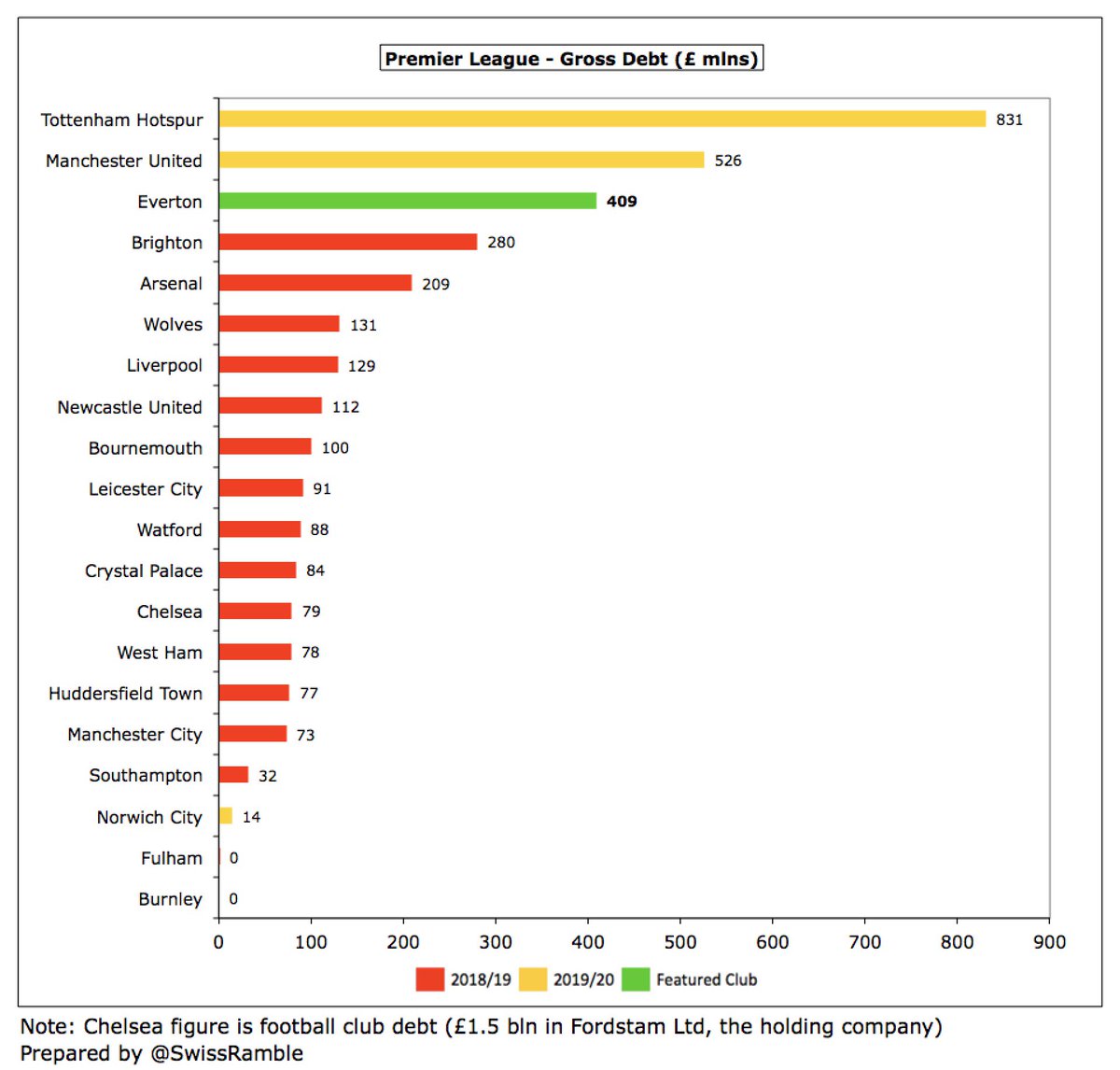

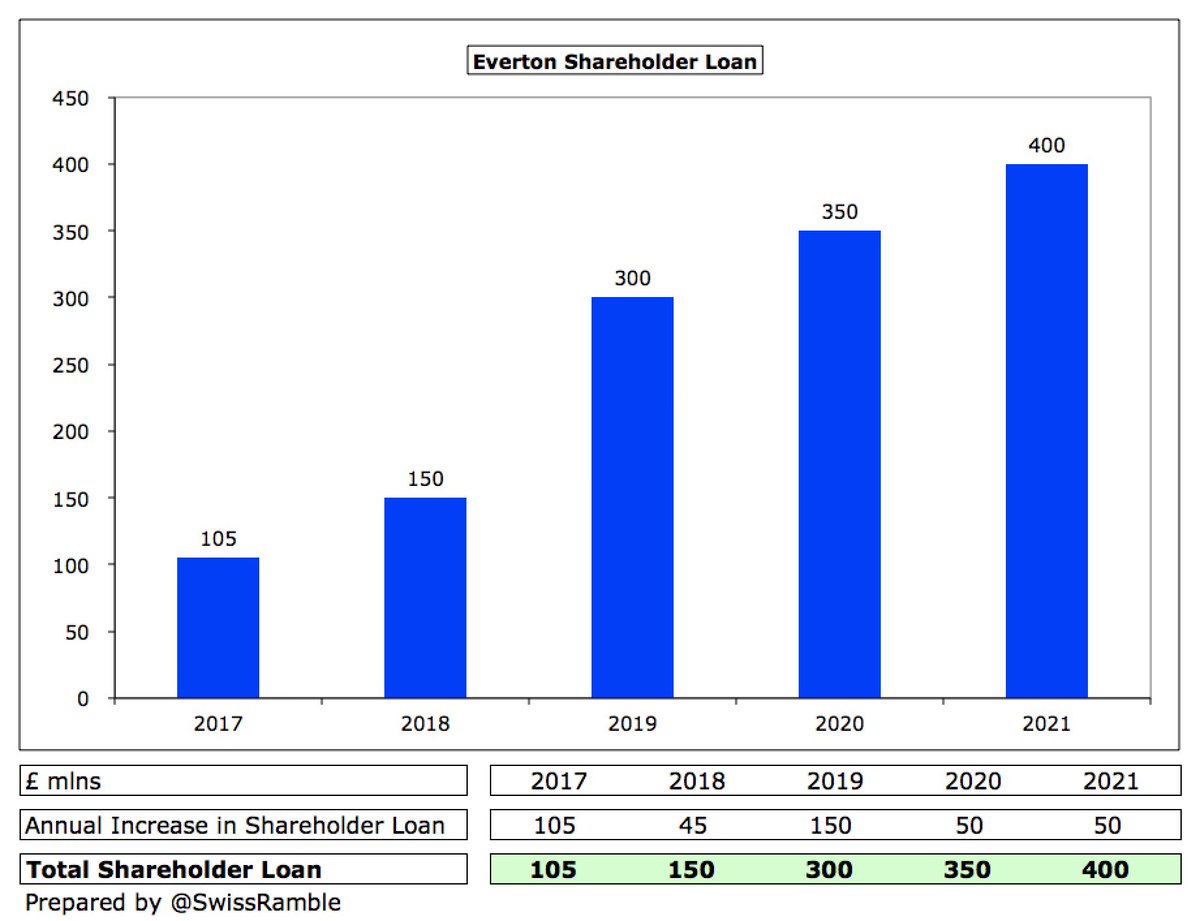

Per #EFC gross debt rose from £37m to £59m, loans from Rights and Media Funding £40m and Metro Bank £19m. In addition, Everton classify £350m interest-free loan provided by owner Moshiri as equity, as no agreed repayment date, but other clubs treat such “friendly” loans as debt.

If the Moshiri loan is considered as debt, #EFC £409m is the 3rd largest in England, only below #THFC £831m and #MUFC £526m. Club also has £54m contingent liabilities, based on things like number of appearances, plus £35m possible signing-on fees & loyalty bonuses.

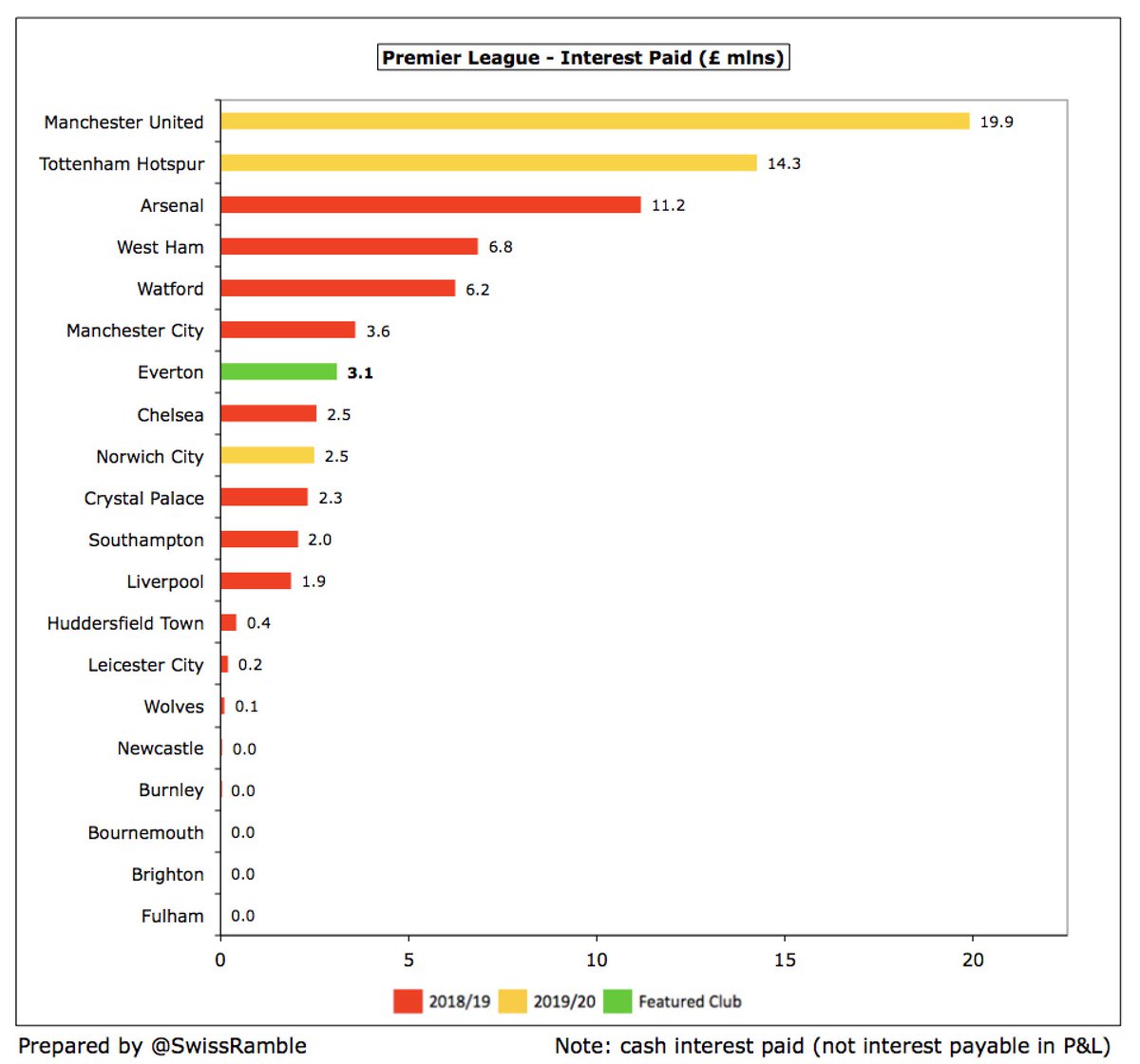

#EFC paid £3.1m interest on their loans, up from prior year £1.7m, though much lower than #MUFC £20m. The fact that Moshiri’s loans are interest-free is a big plus, but interest payments will increase due to funding for new stadium – see #THFC £14m and #AFC £11m.

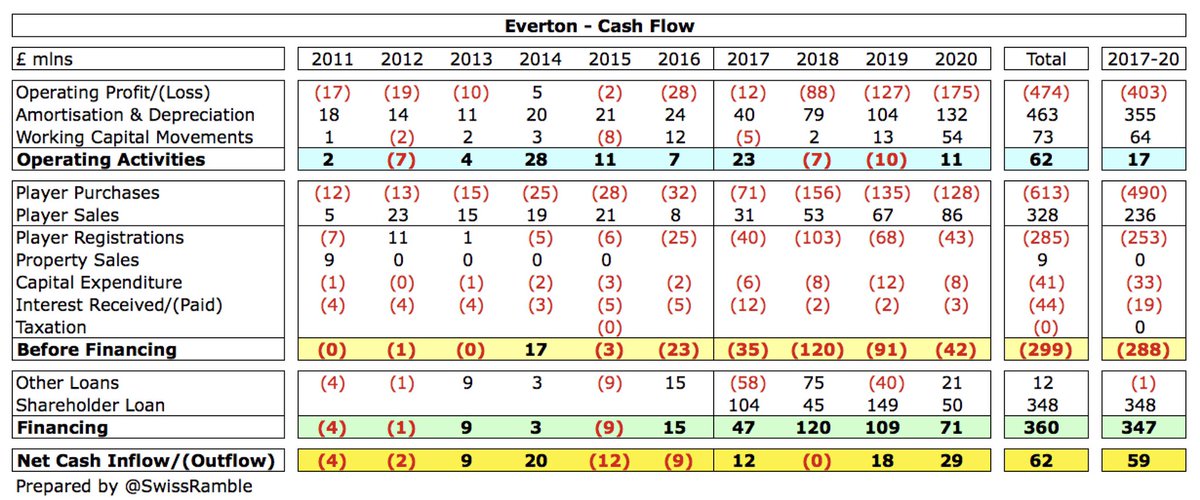

#EFC generated £11m cash from operating activities, though this was driven by £57m increase in creditors. Then spent £43m (net) on players, £8m infrastructure and £3m interest, leading to £42m cash deficit. Funded by £50m additional loan from Moshiri and £21m other loans.

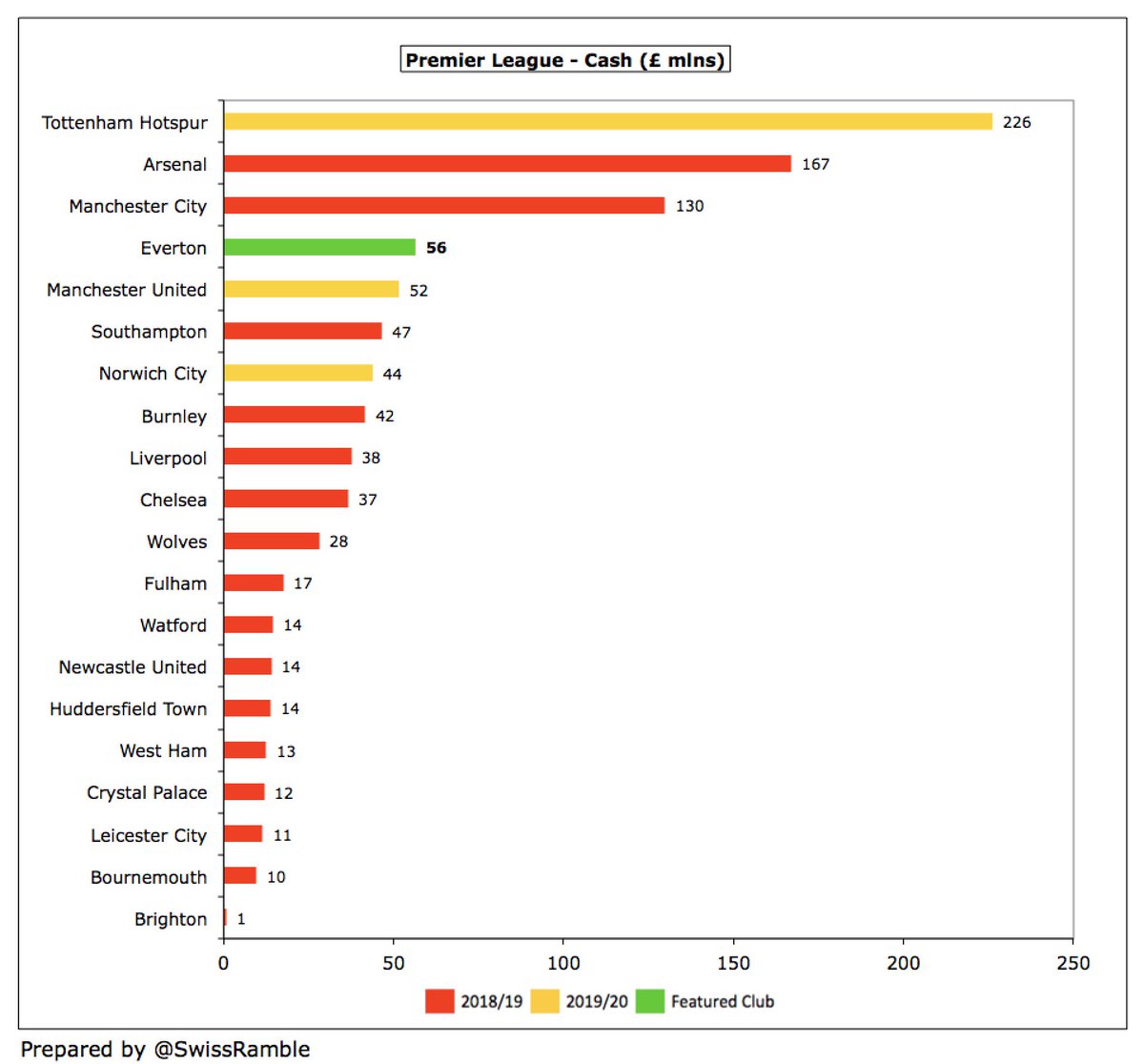

As a result, #EFC cash balance increased by £29m from £27m to £56m, the club’s highest for many years. This is actually the 4th highest in the Premier League, though it should be noted that there is a £40m short-term liability to pay for social security and other taxes.

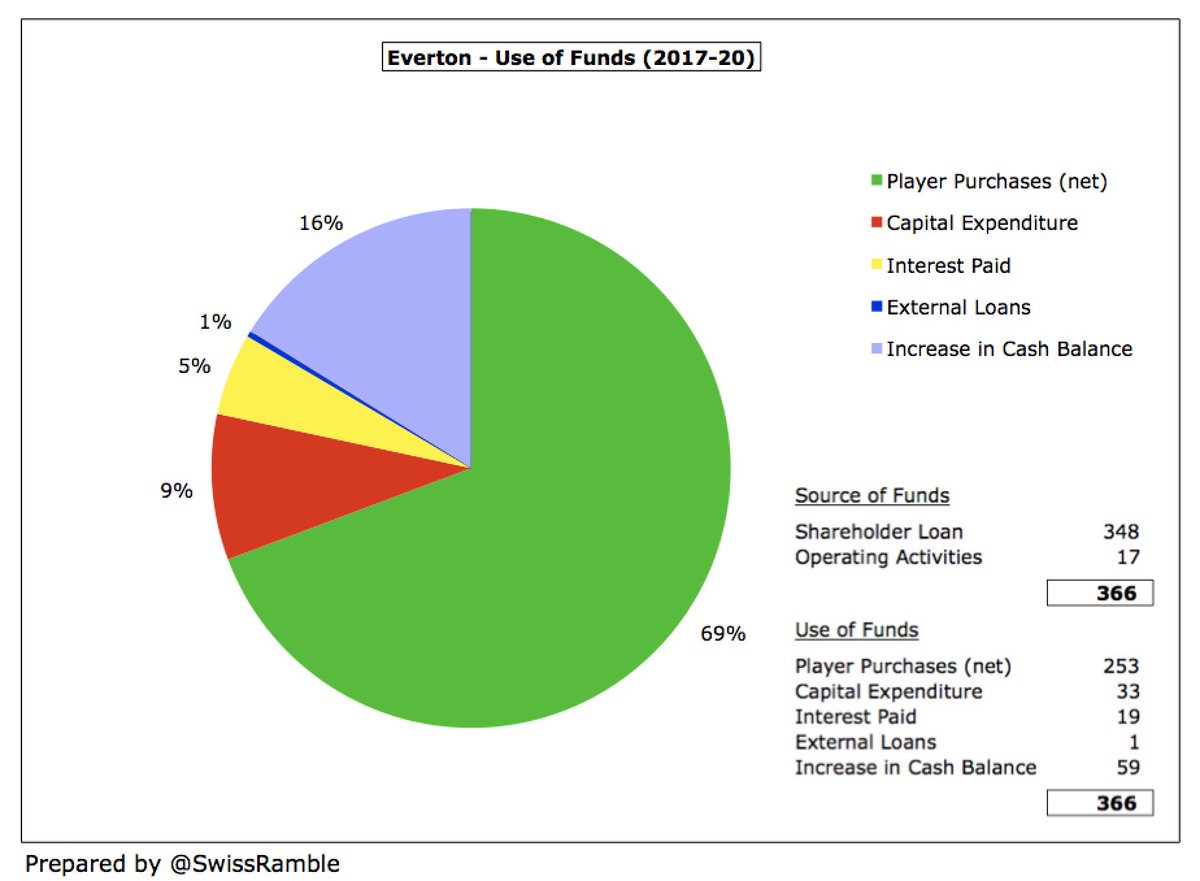

In the last 4 years #EFC available cash of £366m was almost entirely provided by £348m of loans from Moshiri. The vast majority of this (£253m) has been used to improve the squad, while £33m went on capex and £19m interest payments, with £59m increase in cash balance.

Since these accounts were finalised, the owner has added another £50m loan, which means he has provided £400m of funding to #EFC since his arrival. In addition, the club will issue £250m shares to Moshiri, including the conversion of some of his loans to equity.

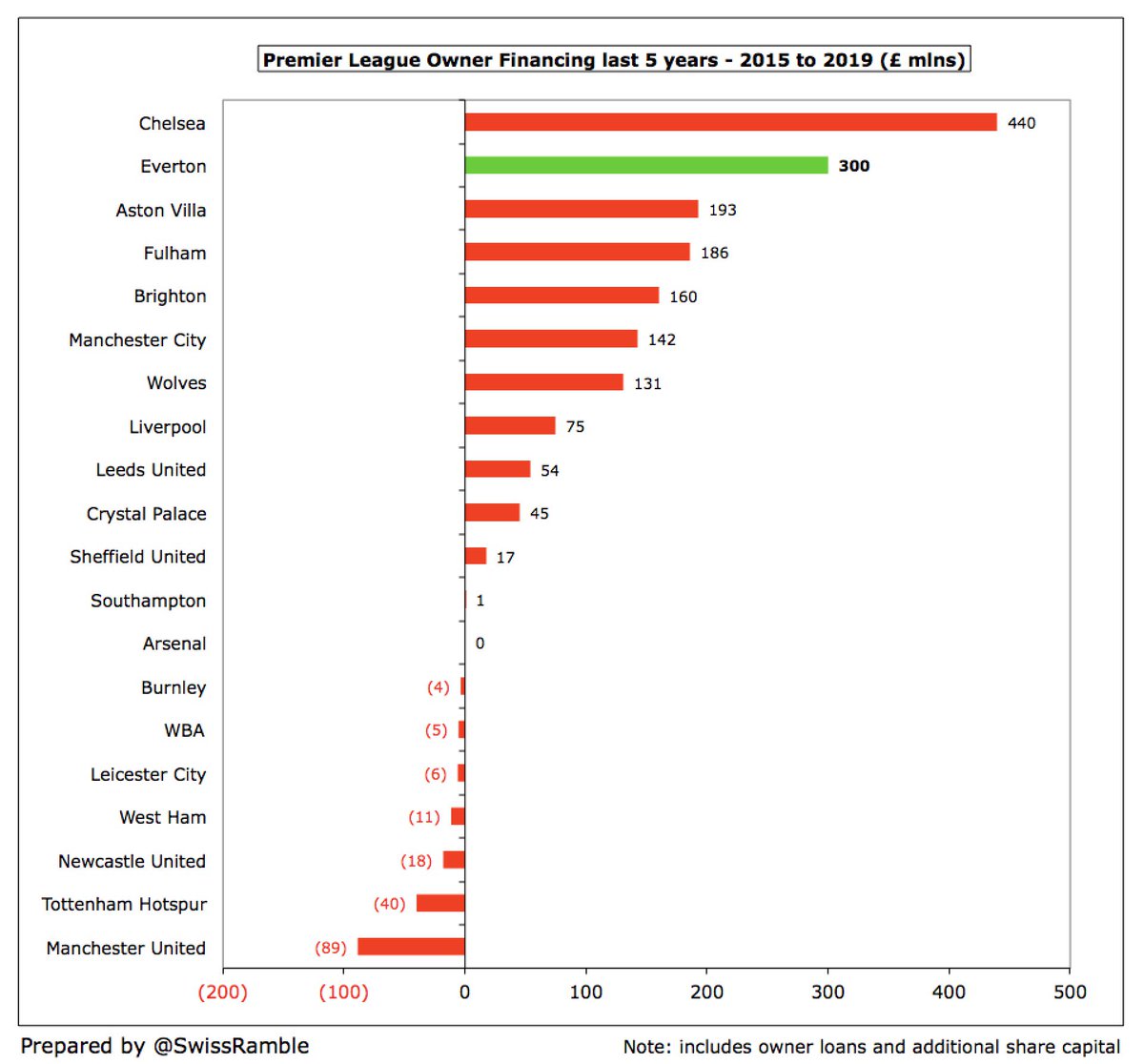

As an example of Moshiri’s commitment to #EFC, in the Premier League only Chelsea’s owner, Roman Abramovich, had provided more funding in the 5 years up to 2019: £440m vs. £300m – and the British-Iranian businessman has added £100m since then.

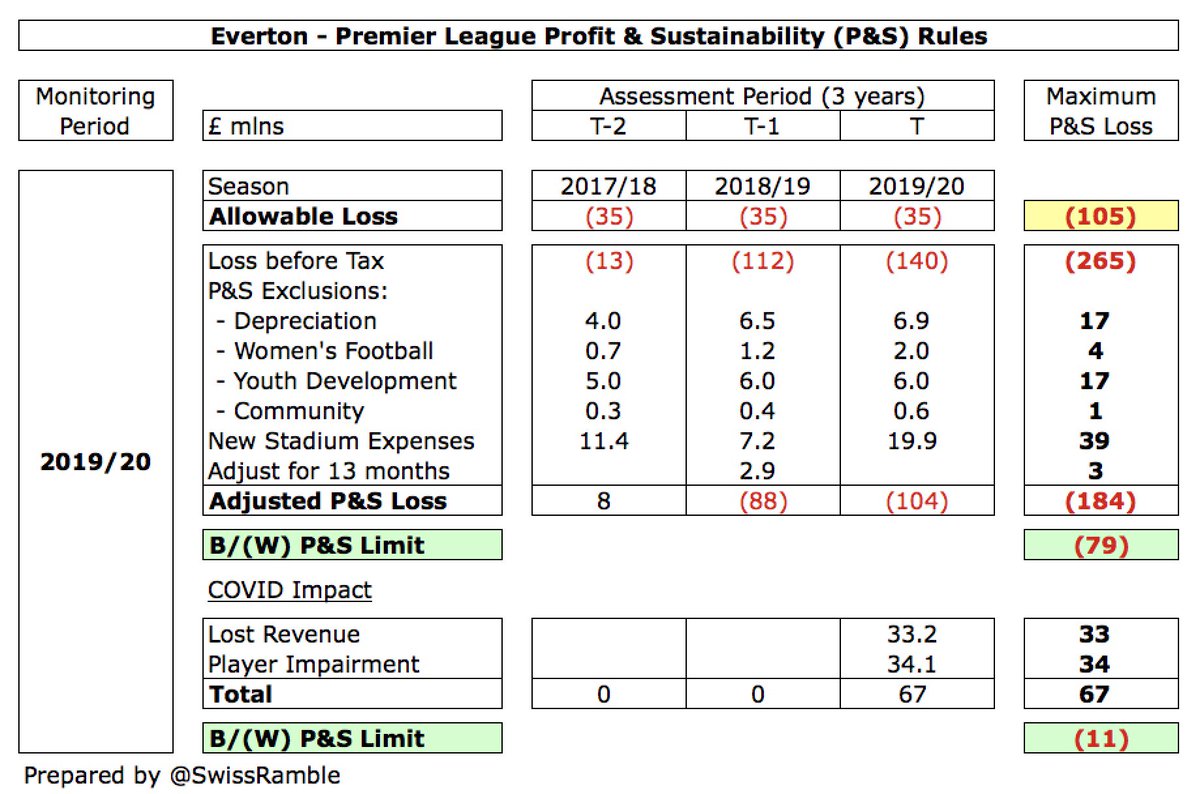

#EFC hefty losses have raised concerns over ability to meet Premier League Profitability and Sustainability rules, though they are probably closer than most might think after adjusting for depreciation, women’s football, youth & community plus stadium costs and COVID impact.

As #EFC said, “we remain in a secure financial position thanks to the unwavering support of our majority shareholder.” That said, even with the COVID impact, the losses are striking. It remains to be seen whether the significant investment delivers success – and sustainability.

• • •

Missing some Tweet in this thread? You can try to

force a refresh